Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

Income Tax Assessment Act 1936

1 Subsections 124ZM(1), (2) and (3)

Repeal the subsections, substitute:

(1) If a company pays a dividend to a shareholder at a time when the company is a PDF, so much (if any) of the dividend as has not been franked in accordance with section 160AQF is exempt from income tax.

(1A) The rest of this section applies to so much of the dividend as has been franked.

Usual case

(1B) Subsections ( 2) to (8) (inclusive) apply if the assessable income of a year of income of a taxpayer who or that is:

(a) a company or a natural person (other than a company or natural person in the capacity of a trustee); or

(b) a corporate unit trust in relation to that year of income; or

(c) a public trading trust in relation to that year of income; or

(d) an eligible entity within the meaning of Part IX in relation to that year of income;

would (apart from subsection ( 2)) include:

(e) the franked amount of the dividend; or

(f) a trust amount or partnership amount in relation to the dividend in relation to which there would be a flow - on franking amount.

This subsection does not apply to cases dealt with in subsections ( 1C) and (1D).

Taxpayers who qualify for venture capital franking rebate

(1C) If a taxpayer (other than a life assurance company) is entitled to a venture capital franking rebate in relation to the dividend under section 160ASEP, then:

(a) so much of the franked amount of the dividend as is venture capital franked is exempt income of the taxpayer; and

(b) the remaining franked amount is, subject to subsection ( 3), exempt income of the taxpayer.

(1D) If a life assurance company is entitled to a venture capital franking rebate in relation to the dividend under section 160ASEP, then:

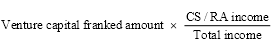

(a) the amount worked out using the following formula is exempt income of the life assurance company:

where:

CS/RA income is the amount of the life assurance company's assessable income for the year of income in which the dividend is received that is allocated to the CS/RA class of business under subsection 116CE(4).

total income is the life assurance company's assessable income for the year of income in which the dividend is paid.

venture capital franked amount has the meaning given by subsection ( 9); and

(b) the remaining franked amount is, subject to subsection ( 3), exempt income of the life assurance company.

(2) Subject to subsection ( 3), the following is exempt income of the taxpayer:

(a) if paragraph ( 1B)(e) applies--the franked amount;

(b) if paragraph ( 1B)(f) applies--so much of the trust amount or partnership amount as would constitute the flow - on franking amount.

(3) Paragraphs ( 1C)(b) and (1D)(b) and subsection ( 2) do not exempt, and are taken never to have exempted, an amount if the taxpayer's return of income of the year of income is prepared on the basis that the amount is included in the taxpayer's assessable income of that year.

2 Subsection 124ZM(9)

Insert:

"remaining franked amount" means:

(a) in a case where the taxpayer is not a life assurance company--so much of the franked amount of the dividend as exceeds the venture capital franked amount; and

(b) in a case where the taxpayer is a life assurance company--so much of the franked amount of the dividend as exceeds the amount worked out under paragraph ( 1D)(a).

3 Subsection 124ZM(9)

Insert:

"venture capital franked amount" for a dividend means so much of the dividend as has been venture capital franked in accordance with section 160ASEL.

4 Section 160APA (at the end of paragraph ( a) of the definition of applicable general company tax rate )

Add:

(iv) the calculation of a venture capital debit under section 160ASEH in relation to a year of income;

5 Section 160APA (after paragraph ( aa) of the definition of applicable general company tax rate )

Insert:

(ab) in relation to the class C franking credit that arises under section 160APVI on the payment of venture capital deficit tax by a PDF in respect of a franking year--the general company tax rate used to work out the amount of the venture capital deficit tax;

6 Section 160APA (definition of class C franking account assessment )

Repeal the definition, substitute:

"class C franking account assessment" means:

(a) the ascertainment of the class C franking account balance and of any class C franking deficit tax payable; or

(b) the ascertainment of the venture capital sub - account balance within the class C franking account and of any venture capital deficit tax payable.

7 Section 160APA (definition of estimated debit )

Repeal the definition, substitute:

"estimated debit" means:

(a) an estimated class A debit; or

(b) an estimated class B debit; or

(c) an estimated class C debit; or

(d) an estimated venture capital debit.

8 Section 160APA (definition of estimated debit determination )

Repeal the definition, substitute:

"estimated debit determination" means:

(a) an estimated class A debit determination; or

(b) an estimated class B debit determination; or

(c) an estimated class C debit determination; or

(d) an estimated venture capital debit determination.

9 Section 160APA

Insert:

"estimated venture capital debit" means an estimated venture capital debit specified in an estimated venture capital debit determination.

10 Section 160APA

Insert:

"estimated venture capital debit determination" means a determination made by the Commissioner under section 160ASEK.

11 Section 160APA (definition of franking deficit tax )

Repeal the definition, substitute:

"franking deficit tax" means:

(a) class A franking deficit tax; or

(b) class B franking deficit tax; or

(c) class C franking deficit tax; or

(d) venture capital deficit tax.

12 Section 160APA

Insert:

"qualifying SME investment" means an SME investment that is made in accordance with Division 1 of Part 4 of the Pooled Development Funds Act 1992 .

13 Section 160APA

Insert:

"section 124ZZB SME assessable income" for a PDF for a year of income is the assessable income allocated to the PDF's SME assessable income for the year of income under section 124ZZB.

14 Section 160APA

Insert:

"SME investment" has the same meaning as in section 124ZS.

15 Section 160APA

Insert:

"venture capital deficit tax" means tax payable in accordance with the Venture Capital Deficit Tax Act.

Note: See also section 160ASEN.

16 Section 160APA

Insert:

"Venture Capital Deficit Tax Act" means the New Business Tax System (Venture Capital Deficit Tax) Act 2000 .

17 Section 160APA

Insert:

"venture capital franked amount" for a dividend means so much of the dividend as has been venture capital franked in accordance with section 160ASEL .

18 Section 160APA

Insert:

"venture capital franked dividend" means a dividend the whole or a part of which has been venture capital franked in accordance with section 160ASEL.

19 Section 160APA

Insert:

"venture capital sub-account" means a venture capital sub - account that a PDF maintains within its class C franking account.

Note: See section 160ASEB .

20 Section 160APA

Insert:

"venture capital sub-account balance" , in relation to a PDF, means:

(a) if the PDF has a venture capital sub - account surplus--the amount of that surplus; and

(b) if the PDF has a venture capital sub - account deficit--the amount of that deficit; and

(c) in any other case--nil.

21 Section 160APA

Insert:

"venture capital sub-account deficit" means a deficit calculated under subsection 160ASEC(2).

22 Section 160APA

Insert:

"venture capital sub-account surplus" means a surplus calculated under subsection 160ASEC(1).

23 After section 160APVH

Insert:

160APVI Credit for PDF when it pays venture capital deficit tax

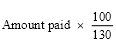

(1) There arises, on the day on which a PDF pays venture capital deficit tax for a franking year, a class C franking credit equal to the adjusted amount in relation to:

(a) the amount paid; or

(b) if the amount paid was calculated under subsection 5(2) of the Venture Capital Deficit Tax Act--the amount worked out using the formula:

(2) The credit under subsection ( 1) is reduced by the amount (if any) of the class C franking deficit at the end of the franking year.

24 After subsection 160AQCBA(2)

Insert:

(2A) This section applies to the streaming of venture capital franking rebate benefits as if:

(a) references to a franking debit include references to a venture capital debit; and

(b) references to the franked amount of the dividend include references to the venture capital franked amount of the dividend.

25 Paragraph 160AQCBA(16)(c)

Omit "or 160AQY", substitute ", 160AQY or 160ASEP".

26 Subparagraph 160AQCBA(17)(a)(ii)

Omit "or 160AQY", substitute ", 160AQY or 160ASEP".

27 At the end of subsection 160AQCBA(17)

Add:

; (c) if the relevant franking benefit is a franking rebate under section 160ASEP--the first shareholder qualifies for franking rebates under Subdivision G of Division 12A in relation to the year of income and the other shareholder does not.

28 Subparagraph 160AQH(1)(b)(i)

Omit "and the class C franked amount of the dividend (if any)", substitute ", the class C franked amount of the dividend (if any) and, if the company is a PDF, the venture capital franked amount of the dividend (if any)".

29 At the end of paragraph 160AQH(1)(b)

Add:

(vii) if the dividend is a venture capital franked dividend--a statement to the effect that the venture capital franking is only relevant for a taxpayer who is:

(A) the trustee of a fund that is a complying superannuation fund for the purposes of Part IX in relation to the year of income; or

(B) the trustee of a fund that is a complying ADF for the purposes of Part IX in relation to the year of income; or

(C) the trustee of a unit trust that is a pooled superannuation trust for the purposes of Part IX in relation to the year of income; or

(D) a life assurance company; or

(E) a registered organisation; and

30 After subsection 160AQJ(1B)

Insert:

(1C) The amount of tax that a PDF would otherwise be liable to pay under subsection ( 1B) in relation to a franking year is reduced by the amount (if any) of the venture capital deficit tax the PDF is liable to pay in relation to that franking year under section 160ASEN.

31 After subsection 160AQJC(2)

Insert:

(2A) If the company is a PDF, the class C deficit deferral amount is reduced by the extent (if any) to which the refund gives rise to, or increases, a liability of the PDF to venture capital deficit tax because of the operation of subsection 4(2) of the Venture Capital Deficit Tax Act. The reduction under this subsection is reduced by the extent (if any) to which the refunds produced a reduction in the PDF's class C franking deficit tax under subsection 160AQJ(1C).

32 At the end of section 160AQT

Add:

(6) For the purposes of this section, if:

(a) because of subsection 124ZM(3), an amount of a dividend paid to a shareholder by a company is not exempt income of the shareholder under paragraph 124ZM(1C)(b) or 124ZM(1D)(b); and

(b) the dividend is not otherwise exempt income of the shareholder;

then:

(c) the dividend is taken not to be exempt income of the shareholder; and

(d) subsections ( 1AB) and (1C) apply to the dividend as if references to the franked amount of the dividend in those subsections were references to the remaining franked amount as defined in section 124ZM.

33 Subsection 160ARXA(1) ( subparagraph ( a)(iii) of the definition of franking tax shortfall )

Repeal the subparagraph, substitute:

(iii) the class C franking tax shortfall in relation to the company and the franking year; or

(iv) the venture capital franking tax shortfall in relation to the company and the franking year; and

34 Subsection 160ARXA(1) (at the end of the definition of statement franking tax )

Add:

; or (d) the venture capital statement franking tax in relation to the company, the franking year and the time.

35 Subsection 160ARXA(1)

Insert:

"venture capital franking tax shortfall" , in relation to a PDF and a franking year, means the amount (if any) by which the PDF's venture capital statement franking tax for that year at the time at which it was lowest is less than the PDF's venture capital proper franking tax for that year.

36 Subsection 160ARXA(1)

Insert:

"venture capital proper franking tax" , in relation to a PDF and a franking year, means the venture capital deficit tax properly payable by the PDF in respect of that year.

37 Subsection 160ARXA(1)

Insert:

"venture capital statement franking tax" , in relation to a PDF, a franking year and a time, means the venture capital deficit tax that would have been payable by the PDF in respect of that year if the tax were assessed at that time taking into account taxation statements by the PDF.

38 Subparagraph 160ARY(1)(a)(ii)

After "160AQU", insert "or 160ASEP".

39 Paragraph 160ARY(1)(b))

After "160AQU" (twice occurring), insert "or 160ASEP".

40 At the end of subsection 160ARZ(1)

Add:

; and (d) the venture capital deficit tax (if any) payable by the company for the franking year.

41 After sub - subparagraph 160ARZD(1)(c)(ii)(BA)

Insert:

(BB) if the shortfall is a venture capital franking tax shortfall--the venture capital deficit tax that would have been payable by the company for that year if the tax were assessed on the basis of the company's return under subsection 160ARE(1) or 160ARF(1) in relation to that year;

42 Paragraph 160ASC(b)

Repeal the paragraph, substitute:

(b) a reference to income and expenditure were a reference to matters relevant to ascertaining:

(i) the class A franking account balance; or

(ii) the class B franking account balance; or

(iii) the class C franking account balance; or

(iv) the venture capital sub - account balance;

and, if the company is a former exempting company, includes a reference to matters relevant to working out the class A exempting account balance or the class C exempting account balance; and

43 At the end of section 160ASC

Add:

(2) A PDF does not need to maintain records under this section in relation to a venture capital sub - account if the PDF does not establish a venture capital sub - account.

44 After Division 12 of Part IIIAA

Insert:

Division 12A -- Venture capital franking

Subdivision A -- Establishing a venture capital sub - account within the class C franking account

160ASEB PDF may establish a venture capital sub - account within its class C franking account

A PDF may establish a venture capital sub - account within its class C franking account.

160ASEC Ascertainment of surplus or deficit

(1) The surplus in a PDF's venture capital sub - account at a particular time in a franking year is the excess calculated using the formula:

![]()

where:

"venture capital credits at that time" has the meaning given by subsection ( 4).

"venture capital debits at that time" has the meaning given by subsection ( 4).

(2) The deficit in a PDF's venture capital sub - account at a particular time in a franking year is the excess calculated using the formula:

![]()

where:

"venture capital credits at that time" has the meaning given by subsection ( 4).

"venture capital debits at that time" has the meaning given by subsection ( 4).

(3) The venture capital sub - account may be in deficit even though the class C franking account as a whole is in surplus. Similarly, the venture capital sub - account may be in surplus even though the class C franking account as a whole is in deficit.

Note: This can happen because:

(a) only amounts coming from particular sources can be credited or debited to the venture capital sub - account; and

(b) the PDF may anticipate future venture capital credits to a greater or lesser extent than it anticipates future class C franking credits generally; and

(c) the venture capital credits and debits do not necessarily arise at the same time as the relevant class C franking credits and debits (see subsections 160ASED(4) and (9)).

(4) In this section:

"venture capital credits" at a particular time in a franking year is the total of the PDF's venture capital credits arising in the franking year and before that time.

"venture capital debits" at a particular time in a franking year is the total of the PDF's venture capital debits arising in the franking year and before that time.

Subdivision C -- Venture capital credits and debits

160ASED Venture capital credits and debits

Venture capital credits

(1) A class C franking credit of a PDF is a venture capital credit of the PDF to the extent to which it is reasonably attributable to a payment of tax by the PDF in relation to a CGT event in relation to a qualifying SME investment of the PDF. This subsection does not apply to a class C franking credit that arises under subsection 160APL(3).

Note 1: Venture capital credits also arise under:

(a) section 160ASEE (carry - forward of surplus from previous franking year); and

(b) section 160ASEF (lapsing of estimated venture capital debit determinations); and

(c) subsection 160ASEN(3) (receipt of refund that creates or increases venture capital sub - account deficit).

Note 2: Subsection 160APL(3) exclusion--the venture capital sub - account has its own provision for the carrying forward of end of franking year surpluses (see section 160ASEE).

(2) In determining the extent to which the class C franking credit is reasonably attributable to a payment of tax by the PDF in relation to the CGT event, have regard to:

(a) the extent to which the credit can reasonably be attributed to a payment of tax by the PDF in relation to its section 124ZZB SME assessable income for a year of income; and

(b) the extent to which the section 124ZZB SME assessable income can reasonably be attributed to the CGT event.

(3) Subject to subsection ( 4), the venture capital credit arises at the same time as the class C franking credit arises.

(4) Before a PDF's assessment day (the assessment day ) for a year of income, the PDF may elect to have the venture capital credits that would otherwise arise under subsection ( 1) during that year of income arise on the assessment day. If the PDF makes this election, the venture capital credits:

(a) are taken not to have arisen on the day on which the relevant class C franking credits arose; and

(b) are taken to arise on the assessment day.

(5) The PDF's assessment day for a year of income is the earlier of:

(a) the day on which the PDF furnishes its return of income for the year of income; or

(b) the day on which the Commissioner makes an assessment of the amount of the PDF's taxable income for that year of income under section 166.

Venture capital debits

(6) A class C franking debit of a PDF is a venture capital debit of the PDF to the extent to which it is reasonably attributable to a reduction amount in relation to a venture capital credit of the PDF.

Note: Venture capital debits also arise under:

(a) section 160ASEG (declaration is made attaching venture capital credits to a dividend); and

(b) section 160ASEI (estimated venture capital debit determinations); and

(c) subsection 160ASEM(2) (failure to empty the sub - account in certain circumstances); and

(d) section 160AQCBA (streaming venture capital franking rebate benefits) (see section 160ASEJ); and

(e) section 160ASEH (PDF's total venture capital credits for the franking year exceeding the PDF's CGT limit for the relevant year of income).

(7) A reduction amount in relation to a venture capital credit of the PDF is:

(a) an amount received as a refund of a payment of tax; or

(b) an amount, in respect of a credit under paragraph 221AZM(1)(b) or (c), applied by the Commissioner against a liability of the PDF; or

(c) an amount applied by the Commissioner against a liability of the PDF; or

(d) a reduction mentioned in section 160APZ;

to the extent to which the amount or reduction is attributable to a payment of tax that gives rise to a venture capital credit of the PDF.

(8) Subject to subsection ( 9), the venture capital debit arises at the same time as the relevant class C franking debit arises.

(9) If the venture capital credit referred to in subsection ( 7) does not arise until after the relevant class C franking debit arises, the venture capital debit arises when the venture capital credit arises.

Note: This subsection deals with the situation in which the PDF elects under subsection ( 4) to have its venture capital credits arise on its assessment day. It brings the related intervening venture capital debits to account on the same day.

160ASEE Venture capital credit--carry forward of venture capital sub - account surplus

If a PDF has a venture capital sub - account surplus at the end of a franking year, there arises at the beginning of the next franking year a venture capital credit of the PDF equal to that venture capital sub - account surplus.

160ASEF Venture capital credit--lapsing of estimated venture capital debit determination

(1) On the day on which the termination time in relation to an estimated venture capital debit of a PDF occurs, there arises a venture capital credit of the PDF equal to the estimated venture capital debit.

(2) If, on a particular day, the Commissioner serves on a PDF a notice of an estimated venture capital debit determination that is in substitution for an earlier determination, there arises on that day a venture capital credit of the PDF equal to the amount of the venture capital debit that arose because of the earlier determination.

160ASEG Venture capital debit--declaration made under section 160ASEL

A venture capital debit of a PDF arises when the PDF makes a declaration under section 160ASEL that a dividend is a venture capital franked dividend to a specified extent. The amount of the debit is the venture capital franked amount of the dividend.

Note: The debit occurs as soon as the declaration is made (and not when the dividend is later paid). By way of contrast, the debit made to the class C franking account under section 160AQB only occurs when the dividend is paid.

160ASEH Venture capital debit--CGT limit for year of income exceeded

(1) A venture capital debit of a PDF arises on the last day of a year of income if the PDF's net venture capital credits for the year of income exceeds whichever is the lesser of:

(a) the adjusted amount of the PDF's CGT limit for that year of income; and

(b) the adjusted amount of the tax paid by the PDF on its SME income component for that year of income.

The amount of the debit is equal to the excess.

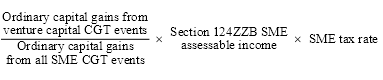

![]() (2) The PDF's net venture capital credits for the

year of income is:

(2) The PDF's net venture capital credits for the

year of income is:

![]()

where:

"venture capital credits" is the total venture capital credits of the PDF that arise under subsection 160ASED(1) and relate to tax in relation to taxable income of that year of income.

"venture capital debits" is the total venture capital debits of the PDF that relate to tax in relation to taxable income of that year of income.

Note: The venture capital credits that are counted for the purposes of this subsection do not include the credit that carries over the surplus in the venture capital sub - account from one franking year to the next. This arises under section 160ASEE and not under subsection 160ASED(1).

(3) The PDF's CGT limit for the year of income is worked out using the formula:

where:

"ordinary capital gains from all SME CGT events" means the total of the ordinary capital gains for the year of income for CGT events in relation to SME investments of the PDF.

"ordinary capital gains from venture capital CGT events" means the total of ordinary capital gains for the year of income for CGT events in relation to shares in companies that are qualifying SME investments.

"SME tax rate" is the tax rate applicable to the SME income component of the PDF for the year of income.

Note: Section 124ZZB SME assessable income is defined in section 160APA.

(4) The tax paid by the PDF on its SME income component for the year of income is the tax paid by the PDF on its SME income component after allowing tax offsets referred to in section 4 - 10 of the Income Tax Assessment Act 1997.

(5) In this section:

"ordinary capital gain" has the meaning given by section 124ZW.

"SME income component" has the same meaning as in section 124ZU.

"SME investment" has the meaning given by section 124ZW.

160ASEI Venture capital debit--estimated venture capital debit determination

If, on a particular day, the Commissioner serves on a PDF notice of an estimated venture capital debit determination, there arises on that day a venture capital debit of the PDF equal to the estimated venture capital debit specified in the notice.

160ASEJ Venture capital debit--PDF that streams dividends or other benefits

Under section 160AQCBA, a venture capital debit of a PDF arises if:

(a) the PDF streams the payment of dividends, or the payment of dividends and the giving of other benefits, to its shareholders in a way mentioned in subsection 160AQCBA(2); and

(b) the Commissioner makes a determination under paragraph 160AQCBA(3)(a) in respect of a dividend paid or other benefit given by the PDF; and

(c) the franking credit benefit obtained relates to rebates allowable under section 160ASEP.

Subdivision D -- Determination of estimated venture capital debit

160ASEK Determination of estimated venture capital debit

(1) If a PDF:

(a) has taken liability reduction action in relation to a payment of tax for which a venture capital credit arises under subsection 160ASED(1); or

(b) has paid a company tax instalment for which a venture capital credit arises under subsection 160ASED(1);

the PDF may lodge an application with the Commissioner for:

(c) the determination of an estimated venture capital debit in relation to the liability reduction action or the company tax instalment; or

(d) the determination of such an estimated venture capital debit in substitution for an earlier determination.

(2) An estimated venture capital debit in relation to a company tax instalment must relate to the refund of that instalment under section 221AZL or 221AZQ.

(3) The application must:

(a) be made before the termination time; and

(b) be in the approved form; and

(c) specify the amount of the estimated venture capital debit applied for.

(4) The Commissioner:

(a) may determine an estimated venture capital debit not greater than the amount specified in the application; and

(b) must serve notice of any such determination on the PDF.

(5) If:

(a) a PDF lodges an application with the Commissioner on a particular day (the application day ); and

(b) at the end of the 21st day after the application day, the Commissioner has neither:

(i) served notice of an estimated venture capital debit determination on the PDF; nor

(ii) refused to make an estimated venture capital debit determination;

the Commissioner is taken, on the 22nd day after the application day, to have:

(c) determined an estimated venture capital debit in accordance with the application; and

(d) served notice of the determination on the PDF.

(6) A notice of an estimated venture capital debit determination has no effect if it is served after the termination time.

Subdivision E -- Venture capital franking declaration

(1) A PDF that has a venture capital sub - account may frank a dividend paid by the PDF as a venture capital franked dividend in accordance with this section if:

(a) the dividend is a class C franked dividend; and

(b) the dividend is paid under a resolution under which:

(i) dividends are to be paid to all shareholders in the PDF; and

(ii) the amount of the dividend per share is the same for each of those dividends.

(2) The dividend is venture capital franked to the extent of the amount worked out using the formula in subsection ( 3) if:

(a) the PDF declares the dividend to be a venture capital franked dividend to a specified extent in the declaration that it makes under subsection 160AQF(1AAA) in relation to the dividend; and

(b) the extent to which the dividend is declared to be a venture capital franked dividend is the same for all dividends to be paid under the resolution.

Note 1: Section 160ASEM requires the PDF to declare the dividend to be a venture capital franked dividend if the venture capital sub - account is in surplus when the subsection 160AQF(1AAA) declaration is made.

Note 2: The PDF may anticipate future credits to the sub - account by making a declaration under this subsection even though the sub - account is in deficit or by making a declaration under this subsection that will put the sub - account into deficit.

Note 3: If this subsection is not satisfied, the dividend is not a venture capital franked dividend.

(3) Subject to subsection ( 4), the extent to which the dividend is venture capital franked is worked out using the formula:

![]()

(4) If the amount worked out under subsection ( 3) exceeds the class C franked amount of the dividend, the extent to which the dividend is venture capital franked is reduced by the amount of the excess.

(1) If a PDF:

(a) pays dividends under a resolution under which the dividends are to be paid to all shareholders in the PDF; and

(b) makes a declaration under subsection 160AQF(1AAA) in relation to the dividends; and

(c) has a surplus in its venture capital sub - account immediately before it makes the declaration;

the PDF must make a declaration under section 160ASEL so that:

(d) the dividend is venture capital franked to the same extent to which it is class C franked; or

(e) there is a nil surplus, or a deficit, in the sub - account immediately after the declaration is made.

(2) A venture capital debit of the PDF arises when a dividend is paid if the PDF does not venture capital frank the dividend to the extent required by subsection ( 1). The amount of the debit is:

![]()

where:

"actual franked amount" is the venture capital franked amount of the dividend.

"subsection (1) franked amount" is the amount that would have been the venture capital franked amount of the dividend if it had been franked in accordance with subsection ( 1).

Subdivision F -- Venture capital deficit tax

160ASEN Liability to venture capital deficit tax

(1) A PDF is liable to pay venture capital deficit tax if it has a venture capital sub - account deficit at the end of a franking year.

Note 1: Venture capital deficit tax is imposed by the Venture Capital Deficit Tax Act.

Note 2: Under subsection 4(2) of that Act, for the purposes of working out the PDF's liability for venture capital deficit tax, a refund of income tax in relation to the PDF's taxable income for a year of income that is received within 6 months after the end of the franking year that ends in or at the same time as the year of income is taken to have been received on the last day of the franking year.

(2) The Commissioner may, in the Commissioner's discretion, remit part of the venture capital deficit tax if the amount of the venture capital deficit tax is worked out under subsection 5(2) of the Venture Capital Deficit Tax Act. The amount remitted must not exceed the difference between:

(a) the amount of the venture capital deficit tax; and

(b) the amount that would have been the amount of that tax if it had been calculated under subsection 5(1) of the Venture Capital Deficit Tax Act.

(3) If:

(a) a PDF receives a refund of income tax in relation to the PDF's taxable income for a year of income; and

(b) the receipt of the refund creates or increases a deficit in the PDF's venture capital sub - account under subsection 4(2) of the Venture Capital Deficit Tax Act;

a venture capital credit of the PDF arises equal to the extent to which the receipt of the refund creates or increases that deficit. The credit arises when the refund is received.

Subdivision G -- Venture capital franking rebates for certain taxpayers

160ASEO Taxpayers who qualify for venture capital franking rebates

(1) To qualify for franking rebates under this Subdivision in relation to dividends that a PDF pays in a year of income, a taxpayer must be:

(a) the trustee of a fund that is a complying superannuation fund for the purposes of Part IX in relation to the year of income; or

(b) the trustee of a fund that is a complying ADF for the purposes of Part IX in relation to the year of income; or

(c) the trustee of a unit trust that is a pooled superannuation trust for the purposes of Part IX in relation to the year of income; or

(d) a life assurance company; or

(e) a registered organisation.

(2) A trustee of a fund does not qualify under paragraph ( 1)(a) or (b) if the fund is a self managed superannuation fund (within the meaning of the Superannuation Industry Supervision Act 1993 ).

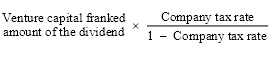

160ASEP Venture capital franking rebate

General rule for rebate

(1) Subject to subsections ( 2) and (3), if:

(a) a PDF pays a dividend to a shareholder in a year of income; and

(b) the dividend is a venture capital franked dividend to a particular extent; and

(c) the dividend is not exempt income of the shareholder (disregarding section 124ZM); and

(d) the dividend is not paid as part of a dividend stripping operation; and

(e) the shareholder is a resident at the time the dividend is paid; and

(f) the shareholder qualifies for franking rebates under this Subdivision in relation to the dividends paid by the PDF in that year of income; and

(g) the shareholder is not:

(i) a partnership; or

(ii) a trustee (other than the trustee of an eligible entity within the meaning of Part IX); and

(h) the shareholder is a qualified person in relation to the dividend for the purposes of Division 1A; and

(i) if the shareholder is a life assurance company--the assets of the shareholder from which the dividend was derived were included in the insurance funds of the shareholder at any time during the period:

(i) starting at the beginning of the year of income of the shareholder in which the dividend was paid; and

(ii) ending at the time when the dividend was paid;

the shareholder is entitled to a rebate of tax in the shareholder's assessment in respect of income of the year of income equal to the amount worked out using the following formula:

where:

"company tax rate" means the applicable general company tax rate.

Amount of the rebate for life assurance companies

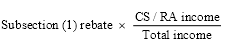

(2) If the shareholder is a life assurance company, the rebate the shareholder is entitled to is worked out using the formula:

where:

"CS/RA income" is the amount of the shareholder's assessable income for the year of income that is allocated to the CS/RA class of business under subsection 116CE(4).

"subsection (1) rebate" is the rebate that the shareholder would otherwise be entitled to under subsection ( 1).

"total income" is the shareholder's assessable income for the year of income.

Rebate for registered organisations

(3) If the shareholder is a registered organisation within the meaning of section 116E, the shareholder is entitled to the rebate under subsection ( 1) in relation to a dividend only if the dividend is income derived from the shareholder's CS/RA business.

45 Application of amendments

The amendments made by this Schedule apply to CGT events in relation to a qualifying SME investment of a PDF that happen on or after the day on which Schedule 3 to the New Business Tax System (Capital Gains Tax) Act 1999 commences.