Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

Income Tax Assessment Act 1997

1 At the end of subsection 701 - 30(3)

Add:

; and (c) so that each relevant item is either:

(i) allocated to only one of the non - membership periods or to a period that is all or part of the rest of the income year; or

(ii) apportioned among such periods (for example, by Subdivision 716 - A (see note to this subsection)).

2 Subsection 701 - 30(3) (note)

Repeal the note, substitute:

Note: Other provisions of this Part are to be applied in working out the taxable income or loss, for example:

Subdivision 716 also affects the tax position of the head company of a group of which the entity has been a subsidiary member for some but not all of the income year.

3 Before Division 717

Insert:

Division 716 -- Miscellaneous special rules

Table of Subdivisions

716 - A Assessable income and deductions spread over several membership or non - membership periods

716 - Z Other

716 - 1 What this Division is about

Some items of assessable income, and some deductions, are in effect spread over 2 or more income years. This Division apportions the assessable income or deduction for each of those income years among periods within the income year when an entity is, or is not, a subsidiary member of a consolidated group.

This Division also apportions in a similar way some items of assessable income, and some deductions, for a single income year.

Table of sections

Operative provisions

716 - 15 Assessable income spread over 2 or more income years

716 - 25 Deductions spread over 2 or more income years

716 - 70 Capital expenditure that is fully deductible in one income year

Assessable income and deductions arising from share of net income of a partnership or trust, or from share of partnership loss

716 - 75 Application

716 - 80 Head company's assessable income and deductions

716 - 85 Entity's assessable income and deductions for a non - membership period

716 - 90 Entity's share of assessable income or deductions of partnership or trust

716 - 95 Special rule if not all partnership or trust's assessable income or deductions taken into account in working out amount

716 - 100 Spreading period

[This is the end of the Guide.]

716 - 15 Assessable income spread over 2 or more income years

(1) This section applies if, apart from this Part, a provision of this Act would spread an amount (the original amount ) over 2 or more income years (whether or not because of a choice) by including part of the original amount in the same entity's assessable income for each of those income years.

Head company's assessable income

(2) If:

(a) for some but not all of an income year, an entity is a * subsidiary member of a * consolidated group; and

(b) a part of the original amount:

(i) would have been included in the assessable income of the * head company of the group for that income year if the entity had been a subsidiary member of the group throughout that income year; but

(ii) would have been included in the entity's assessable income for that income year if throughout that income year the entity had not been a subsidiary member of any * consolidated group;

the head company's assessable income for that income year includes a proportion of that part.

Note 1: Examples of when paragraph ( 2)(b) could be satisfied are:

Note 2: If the entity is a subsidiary member of the group throughout the income year, the part of the original amount will be included in the head company's assessable income for the income year, either:

(3) The proportion is worked out by multiplying that part of the original amount by:

• the number of days that are in both the income year and the * spreading period, and on which the entity was a * subsidiary member of the group;

divided by:

• the number of days that are in both the income year and the spreading period.

Entity's assessable income for a non - membership period

(4) If:

(a) for some but not all of an income year, an entity is a * subsidiary member of a * consolidated group; and

(b) a part of the original amount would have been included in the entity's assessable income for that income year if throughout that income year the entity had not been a subsidiary member of any * consolidated group;

the assessable income of the entity for a part of the income year that is a non - membership period for the purposes of section 701 - 30 includes a proportion of that part.

Note 1: Section 701 - 30 is about working out an entity's tax position for a period when it is not a subsidiary member of any consolidated group.

Note 2: If throughout the income year the entity is not a subsidiary member of any consolidated group, this section does not affect the part of the original amount that is assessable income of the entity for the income year either:

(5) The proportion is worked out by multiplying that part of the original amount by:

• the number of days that are in both the non - membership period and the * spreading period;

divided by:

• the number of days that are in both the income year and the spreading period.

Spreading period

(6) The spreading period for the original amount is the period by reference to which the respective parts of the original amount that, apart from this Part, would be included in an entity's assessable income for the 2 or more income years are worked out.

716 - 25 Deductions spread over 2 or more income years

(1) This section applies if, apart from this Part, a provision of this Act would spread an amount (the original amount ) over 2 or more income years (whether or not because of a choice) by entitling the same entity to deduct part of the original amount for each of those income years.

(2) However, this section does not apply if the deductions would be for the decline in value of a * depreciating asset.

Note: Such deductions arise under Division 40 (Capital allowances) and Division 328 (Simplified tax system).

Head company's deduction

(3) If for some but not all of an income year an entity is a * subsidiary member of a * consolidated group, and:

(a) the * head company of the group could have deducted for that income year a part of the original amount if the entity had been a subsidiary member of the group throughout that income year; but

(b) the entity could have deducted that part for that income year if throughout that income year the entity had not been a subsidiary member of any * consolidated group;

the head company can deduct for that income year a proportion of that part.

Note 1: Examples of when paragraphs ( 3)(a) and (b) could be satisfied are set out in note 1 to subsection 716 - 15(2).

Note 2: If the entity is a subsidiary member of the group throughout the income year, the head company can deduct that part for the income year, either:

(4) The proportion is worked out by multiplying that part of the original amount by:

• the number of days that are in both the income year and the * spreading period, and on which the entity was a * subsidiary member of the group;

divided by:

• the number of days that are in both the income year and the spreading period.

Entity's deduction for a non - membership period

(5) If:

(a) for some but not all of an income year, an entity is a * subsidiary member of a * consolidated group; and

(b) the entity could have deducted for that income year a part of the original amount if throughout that income year the entity had not been a subsidiary member of any * consolidated group;

the entity can deduct a proportion of that part for a part of the income year that is a non - membership period for the purposes of section 701 - 30.

Note 1: Section 701 - 30 is about working out an entity's tax position for a period when it is not a subsidiary member of any consolidated group.

Note 2: If throughout the income year the entity is not a subsidiary member of any consolidated group or MEC group, this section does not affect the part of the original amount that the entity can deduct for the income year either:

(6) The proportion is worked out by multiplying that part of the original amount by:

• the number of days that are in both the non - membership period and the * spreading period;

divided by:

• the number of days that are in both the income year and the spreading period.

Spreading period

(7) The spreading period for the original amount is the period by reference to which the respective parts of the original amount that, apart from this Part, an entity could deduct for the 2 or more income years are worked out.

Note: For example, under section 82KZMD of the Income Tax Assessment Act 1936 an item of expenditure on something is spread over the period over which that thing is to be provided, which is called the eligible service period. Deductions for the item for a sequence of income years are worked out by reference to how much of that period falls within each of those income years.

[The next section is section 716 - 70]

716 - 70 Capital expenditure that is fully deductible in one income year

(1) This section applies if, apart from this Part, an entity could deduct for a single income year the whole of an amount (the original amount ) of capital expenditure by the entity.

(2) If for some but not all of an income year an entity is a * subsidiary member of a * consolidated group or * MEC group, and:

(a) the * head company of the group could have deducted the original amount for that income year if the entity had been a subsidiary member of the group throughout that income year; but

(b) the entity could have deducted the original amount for that income year if throughout that income year the entity had not been a subsidiary member of any consolidated group or MEC group;

the head company can deduct for that income year a proportion of the original amount.

Note 1: Examples of when paragraphs ( 2)(a) and (b) could be satisfied are set out in note 1 to subsection 716 - 15(2).

Note 2: If the entity is a subsidiary member of the group throughout the income year, the head company can deduct the original amount for the income year, either:

(3) The proportion is worked out by multiplying the original amount by:

• the number of days that are in the * spreading period, and on which the entity was a * subsidiary member of the group;

divided by:

• the number of days that are in the spreading period.

Entity's deduction for a non - membership period

(4) If:

(a) for some but not all of an income year, an entity is a * subsidiary member of a * consolidated group or * MEC group; and

(b) the entity could have deducted the original amount for that income year if throughout that income year the entity had not been a subsidiary member of any consolidated group or MEC group;

the entity can deduct a proportion of the original amount for a part of the income year that is a non - membership period for the purposes of section 701 - 30.

Note 1: Section 701 - 30 is about working out an entity's tax position for a period when it is not a subsidiary member of any consolidated group.

Note 2: If throughout the income year the entity is not a subsidiary member of any consolidated group or MEC group, this section does not affect the entity's ability to deduct the original amount for the income year either:

(5) The proportion is worked out by multiplying the original amount by:

• the number of days that are in both the non - membership period and the * spreading period;

divided by:

• the number of days that are in the spreading period.

Spreading period

(6) The spreading period for the original amount:

(a) starts when, apart from this Part, an entity would become entitled to deduct the amount for an income year; and

(b) ends at the end of the income year.

Sections 716 - 80 to 716 - 100 apply if, apart from this Part:

(a) an amount would be included in an entity's assessable income for an income year under section 92 (about income and deductions of partner) of the Income Tax Assessment Act 1936 in respect of a partnership; or

(b) an entity could deduct an amount for an income year under section 92 of that Act in respect of a partnership; or

(c) an amount would be included in an entity's assessable income for an income year under section 97 (Beneficiary of a trust estate who is not under a legal disability) of that Act in respect of a trust; or

(d) an amount would be included in an entity's assessable income for an income year under section 98A (Non - resident beneficiaries assessable in respect of certain income) of that Act in respect of a trust.

716 - 80 Head company's assessable income and deductions

(1) If for some but not all of the income year the entity is a * subsidiary member of a * consolidated group or * MEC group:

(a) the assessable income for that income year of the head company of the group includes the entity's share (worked out under section 716 - 90) of each of these:

(i) the total assessable income of the partnership or trust for the income year so far as it is reasonably attributable to a period, during the income year, throughout which the entity was a * subsidiary member of the group but the partnership or trust was not ;

(ii) a proportion (worked under subsection ( 2) of this section) of the total assessable income of the partnership or trust for the income year so far as it is not reasonably attributable to a particular period within the income year; and

(b) the head company of the group can deduct for that income year the entity's share (worked out under section 716 - 90) of each of these:

(i) the total deductions of the partnership or trust for the income year so far as they are reasonably attributable to a period covered by subparagraph ( a)(i) of this subsection;

(ii) a proportion (worked under subsection ( 2) of this section) of the total deductions of the partnership or trust for the income year so far as they are not reasonably attributable to a particular period within the income year.

Note 1: If the entity is a subsidiary member of the group throughout the income year, the amount referred to in section 716 - 75 will be included in the head company's assessable income, or the head company can deduct that amount, for the income year because of section 701 - 1 (Single entity rule).

Note 2: While the entity, and the partnership or trust, are both subsidiary members of the group, section 701 - 1 (Single entity rule) attributes to the head company all assessable income and deductions giving rise to the amount referred to in section 716 - 75.

(2) The proportion is worked out by multiplying the amount concerned by:

• the number of days that are in the * spreading period, and on which the entity was a * subsidiary member of the group but the partnership or trust was not ;

divided by:

• the number of days that are in the spreading period.

716 - 85 Entity's assessable income and deductions for a non - membership period

(1) The assessable income of the entity for a part of the income year that is a non - membership period for the purposes of section 701 - 30 includes the entity's share (worked out under section 716 - 90) of each of these:

(a) the total assessable income of the partnership or trust for the income year so far as it is reasonably attributable to the non - membership period;

(b) a proportion (worked under subsection ( 3) of this section) of the total assessable income of the partnership or trust for the income year so far as it is not reasonably attributable to a particular period within the income year.

Note 1: Section 701 - 30 is about working out an entity's tax position for a period when it is not a subsidiary member of any consolidated group.

Note 2: If throughout the income year the entity is not a subsidiary member of any consolidated group or MEC group, this section does not affect the amount referred to in section 716 - 75 being assessable income of the entity for the income year.

(2) For a part of the income year that is a non - membership period for the purposes of section 701 - 30, the entity can deduct the entity's share (worked out under section 716 - 90) of each of these:

(a) the total deductions of the partnership or trust for the income year so far as they are reasonably attributable to the non - membership period;

(b) a proportion (worked under subsection ( 3) of this section) of the total deductions of the partnership or trust for the income year so far as they are not reasonably attributable to a particular period within the income year.

Note: If throughout the income year the entity is not a subsidiary member of any consolidated group or MEC group, this section does not affect the entity's ability to deduct for the income year the amount referred to in section 716 - 75.

(3) The proportion is worked out by multiplying the amount concerned by:

• the number of days that are in both the non - membership period and the * spreading period;

divided by:

• the number of days that are in the spreading period.

716 - 90 Entity's share of assessable income or deductions of partnership or trust

(1) If paragraph 716 - 75(a) or (b) applies, the entity's share is worked out by dividing:

• the entity's individual interest as a partner in the net income of the partnership or in the partnership loss;

by:

• the amount of that net income or partnership loss;

and expressing the result as a percentage.

(2) If paragraph 716 - 75(c) or (d) applies, the entity's share is worked out by dividing:

• the share of the income of the trust to which the entity is presently entitled;

by:

• the amount of that income;

and expressing the result as a percentage.

(1) To the extent that the assessable income of the partnership or trust for the income year was not taken into account in working out the amount referred to in section 716 - 75, it is disregarded in applying paragraph 716 - 80(1)(a) or subsection 716 - 85(1).

Note: For example, if a trust's net income for an income year must be worked out under section 268 - 45 in Schedule 2F to the Income Tax Assessment Act 1936 , the trust's assessable income attributed to a period (in the income year) for which it has a notional loss under section 268 - 30 of that Act is not taken into account.

(2) To the extent that the deductions of the partnership or trust for the income year were not taken into account in working out the amount referred to in section 716 - 75, they are disregarded in applying paragraph 716 - 80(1)(b) or subsection 716 - 85(2).

Note: For example, in the case described in the note to subsection ( 1) of this section, the trust's deductions attributed to that period are not taken into account in working out the trust's net income for the income year.

The spreading period for the amount referred to in section 716 - 75 is made up of each period:

(a) that is all or part of the income year; and

(b) throughout which the entity is a partner in the partnership or a beneficiary of the trust, as appropriate.

[The next Subdivision is Subdivision 716 - Z]

Table of sections

716 - 800 Allocating amounts to periods if head company and subsidiary member have different income years

716 - 850 Grossing up threshold amounts for periods of less than 365 days

(1) The principles in this section apply if:

(a) an entity becomes, or stops being, a * subsidiary member of a * consolidated group; and

(b) the entity has an income year that starts and ends at a different time from when the income year of the * head company of the group starts and ends.

(2) Items are to be allocated to, or apportioned among, periods (whether consisting of all or part of an income year of the entity or * head company):

(a) in the most appropriate way having regard to the objects of this Part, and of particular provisions of this Part; and

(b) in particular, so as to ensure that what is in substance the same item is recognised only once for what is in substance the same purpose.

716 - 850 Grossing up threshold amounts for periods of less than 365 days

(1) Under some provisions of this Act, something that is relevant to working out:

(a) an entity's taxable income (if any); or

(b) the income tax (if any) payable on an entity's taxable income; or

(c) an entity's loss (if any) of a particular * sort;

is determined on the basis of a comparison between an amount worked out for an income year, or an amount derived from 2 or more such amounts, and another amount.

Note: The other amount assumes an income year of 365 days.

(2) This section affects how such a provision (the threshold provision ) operates for the purposes of subsection 701 - 30(3), which requires each thing covered by paragraph ( 1)(a), (b) or (c) of this section to be worked out for an entity for a non - membership period (under section 701 - 30) during an income year.

Note: A non - membership period is a period (of less than an income year) when the entity is not a subsidiary member of any consolidated group.

(3) An amount that would otherwise be worked out for the non - membership period, for the purposes of the comparison under the threshold provision, is instead:

(a) to be worked out by reference to the period (the reference period ) starting at the start of the income year and ending at the end of the non - membership period; and

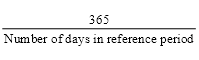

(b) then to be grossed up by multiplying it by this fraction:

4 Subsection 995 - 1(1)

Insert:

"spreading period" for an amount has the meaning given by sections 716 - 15, 716 - 25, 716 - 70 and 716 - 100.

Note: Those sections deal with assessable income and deductions spread over several periods of membership or non - membership of a consolidated group or MEC group.