Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

Income Tax Assessment Act 1997

1 Paragraph 204 - 30(3)(b)

Repeal the paragraph, substitute:

(b) that a specified * exempting debit arises in the * exempting account of the entity, for a specified * distribution or other benefit to a disadvantaged member;

(c) that no * imputation benefit is to arise in respect of a distribution that is made to a favoured member and specified in the determination.

2 Subsection 204 - 30(4)

Repeal the subsection, substitute:

(4) The Commissioner may:

(a) specify the * franking debit under paragraph ( 3)(a) by specifying the * franking percentage to be used in working out the amount of the debit; and

(b) specify the * exempting debit under paragraph ( 3)(b) by specifying the * exempting percentage to be used in working out the amount of the debit.

3 Subsection 204 - 30(5)

Omit "or (b)", substitute ", (b) or (c)".

4 Paragraph 204 - 30(6)(d)

Repeal the paragraph, substitute:

(d) an * exempting credit would arise in the * exempting account of the member as a result of the distribution; or

(e) the member would not be liable to pay * withholding tax on the distribution, because of the operation of paragraph 128B(3)( ga ) of the Income Tax Assessment Act 1936 .

5 At the end of subsection 204 - 30(8)

Add:

; (f) the other member is an * exempting entity.

6 At the end of section 204 - 30

Add:

(9) A * member of an entity derives a greater benefit from franking credits than another member of the entity if any of the following circumstances exist in relation to the first member in the income year in which the * distribution giving rise to the benefit is made, and not in relation to the other member:

(a) a * franking credit arises for the first member under item 5, 6 or 7 of the table in section 208 - 130 (distributions by * exempting entities to exempting entities);

(b) a franking credit or * exempting credit arises for the first member because the distribution is * franked with an exempting credit;

(c) the first member is entitled to a * tax offset because:

(i) the distribution is a * franked distribution made by an exempting entity; or

(ii) the distribution is * franked with an exempting credit.

7 At the end of section 204 - 35

Add:

(2) If the Commissioner makes a determination giving rise to an * exempting debit in the * exempting account of an entity under paragraph 204 - 30(3)(b), the debit arises in the exempting account of the entity on the day on which the notice of determination is given to the entity in accordance with section 204 - 50.

8 After section 204 - 40

Insert:

204 - 41 Amount of the exempting debit

The amount of the * exempting debit arising because of a determination by the Commissioner under paragraph 204 - 30(3)(b) must not exceed:

(a) if the specified * distribution has been * franked with an exempting credit--the difference between the amount of the * exempting credit on the distribution and an amount worked out by multiplying the amount of the distribution by the highest * exempting percentage at which a distribution to a favoured member is franked; or

(b) if the specified distribution, although * frankable, has not been franked with an exempting credit--an amount worked out by multiplying the amount of the distribution by the highest exempting percentage at which a distribution to a favoured member is franked; or

(c) if the specified distribution is * unfrankable --an amount worked out by multiplying the amount of the distribution by the highest exempting percentage at which a distribution to a favoured member is franked; or

(d) if the specified benefit is the issue of bonus shares from a share premium account--an amount worked out by multiplying the amount debited to the share premium account in respect of the bonus shares by the highest exempting percentage at which a distribution to a favoured member is franked; or

(e) if some other benefit is specified--an amount worked out by multiplying the value of the benefit by the highest exempting percentage at which a distribution to a favoured member is franked.

9 Section 204 - 45

Omit "paragraph 204 - 30(3)(b)", substitute "paragraph 204 - 30(3)(c)".

10 Paragraph 204 - 50(2)(b)

Repeal the paragraph, substitute:

(b) in a case where the Commissioner determines that an * exempting debit is to arise in the * exempting account of an entity under paragraph 204 - 30(3)(b)--to the entity; and

(c) in a case where a favoured member is denied an * imputation benefit under paragraph 204 - 30(3)(c)--to the favoured member.

11 Subsection 204 - 50(3)

Omit "paragraph 204 - 30(3)(b)", substitute "paragraph 204 - 30(3)(c)".

12 Section 205 - 25

Omit "specified in the table in section 205 - 15 or 205 - 30", substitute "specified in a relevant table".

13 At the end of section 205 - 25

Add:

(2) The tables in sections 205 - 15 and 205 - 30 are relevant for the purposes of subsection ( 1).

14 Section 207 - 75

Omit " * franked distribution", substitute " * distribution".

15 After Division 207

Insert:

Division 208 -- Exempting entities and former exempting entities

Table of Subdivisions

Guide to Division 208

208 - A What are exempting entities and former exempting entities?

208 - B Franking with an exempting credit

208 - C Amount of the exempting credit on a distribution

208 - D Distribution statements

208 - E Distributions to be franked with exempting credits to the same extent

208 - F Exempting accounts and franking accounts of exempting entities and former exempting entities

208 - G Tax effects of distributions by exempting entities

208 - H Tax effect of a distribution franked with an exempting credit

Table of sections

208 - 5 What is an exempting entity?

208 - 10 Former exempting entities

208 - 15 Distributions by exempting entities and former exempting entities

208 - 5 What is an exempting entity?

(1) An exempting entity is a corporate tax entity that is effectively owned by entities that, either because they are not Australian residents or because they receive distributions as exempt income, would not be able to fully utilise franking credits on distributions by the corporate tax entity.

(2) In deciding whether a corporate tax entity is effectively owned by such entities, these rules:

(a) look at the membership interests in the entity that involve the holder of the interest in bearing the risks and accruing the opportunities of ownership of the entity; and

(b) ask whether at least 95% of those membership interests, and 95% of any interests in those membership interests, are held by Australian residents or entities that receive distributions as exempt income.

208 - 10 Former exempting entities

When an entity ceases to be an exempting entity, it becomes a former exempting entity.

208 - 15 Distributions by exempting entities and former exempting entities

To ensure that franking credits accumulated by an exempting entity are not the target of franking credit trading, these rules:

(a) limit the circumstances in which a distribution franked with those credits can give rise to benefits under the imputation system; and

(b) quarantine those credits by moving them into a separate account, called the exempting account, when the entity ceases to be an exempting entity; and

(c) deny a recipient of a distribution franked with a credit from that account any benefit under the imputation system as a result of that distribution, unless the recipient was a member of the entity immediately before it became a former exempting entity.

Subdivision 208 - A -- What are exempting entities and former exempting entities?

Table of sections

208 - 20 Exempting entities

208 - 25 Effective ownership of entity by prescribed persons

208 - 30 Accountable membership interests

208 - 35 Accountable partial interests

208 - 40 Prescribed persons

208 - 45 Persons who are taken to be prescribed persons

208 - 50 Former exempting companies

A * corporate tax entity is an exempting entity at a particular time if, at that time, the entity is effectively owned by prescribed persons.

Note: Prescribed persons are identified in sections 208 - 40 and 208 - 45.

208 - 25 Effective ownership of entity by prescribed persons

(1) An entity is effectively owned by prescribed persons at a particular time if:

(a) at that time:

(i) not less than 95% of the * accountable membership interests in the entity; or

(ii) not less than 95% of the * accountable partial interests in the entity;

are held by, or held indirectly for the benefit of, prescribed persons; or

(b) paragraph ( a) does not apply but it would nevertheless be reasonable to conclude that, at that time, the risks involved in, and the opportunities resulting from, holding accountable membership interests, or accountable partial interests, in the entity that are not held by, or directly or indirectly for the benefit of, prescribed persons are substantially borne by, or substantially accrue to, prescribed persons.

(2) In deciding whether it would be reasonable to conclude as mentioned in paragraph ( 1)(b):

(a) have regard to any * arrangement in respect of * membership interests (including unissued membership interests), or in respect of * partial interests, in the entity (including any derivatives held or issued in connection with those membership interests or partial interests) of which the entity is aware; but

(b) do not have regard to risks involved in the ownership of membership interests, or partial interests, in the entity that are substantially borne by any person in the person's capacity as a secured creditor.

(3) An entity has a partial interest in a * corporate tax entity if it has an interest in a * membership interest in the corporate tax entity.

208 - 30 Accountable membership interests

(1) The purpose of this section is to identify which * membership interests in an entity are relevant in determining whether the entity is effectively owned by prescribed persons.

(2) A * membership interest in an entity is an accountable membership interest if it is not an excluded membership interest.

(3) A * membership interest in an entity is an excluded membership interest if, having regard to:

(a) the purposes for which the membership interest was issued; and

(b) any special or limited rights connected with, arising from, or attached to:

(i) the membership interest; or

(ii) other membership interests in the entity held by the holder of the membership interest; or

(iii) membership interests in the entity held by persons other than the holder of the membership interest; or

(iv) interests in any of the above;

including rights that are conferred or exercisable only if the holder of the membership interest or interests concerned is, or is not, a prescribed person; and

(c) the extent to which any such special or limited rights are similar to or differ from the rights that are normally attached to the ownership of * ordinary membership interests in * corporate tax entities; and

(d) the relationship between the value of the membership interest and the value of the entity; and

(e) any relationship or connection (whether of a personal or business nature) between holders of membership interests in the entity of which the entity is aware; and

(f) any * arrangement in respect of membership interests (including unissued membership interests) in the entity, or interests in membership interests in the entity, of which the entity is aware;

it would be reasonable to conclude that the membership interest is not relevant in determining whether the entity is effectively owned by prescribed persons because holding the membership interest does not involve the holder bearing the risks, or result in the accrual to the holder of the opportunities, of ownership of the entity that ordinarily arise from, or are ordinarily attached to, the holding of ordinary membership interests in an entity.

(4) In applying subsection ( 3), the fact that a person is a trustee is to be disregarded.

(5) Without limiting subsection ( 3), a * membership interest in an entity held by a person who is not a prescribed person is an excluded membership interest if:

(a) it is a finance membership interest; or

(b) it is a distribution access membership interest; or

(c) it does not carry the right to receive distributions; or

(d) it was issued, transferred or acquired for a purpose (other than an incidental purpose) of ensuring that the entity is not effectively owned by prescribed persons.

(6) A * membership interest is a finance membership interest if:

(a) the membership interest is a * non - equity share in the entity; or

(b) having regard to the rights attached to the membership interest and to any * arrangement with respect to the membership interest of which the entity is aware, the membership interest is equivalent to a debt owed by the entity to the holder of the membership interest.

(7) A * membership interest to which subsection ( 6) does not apply is a finance membership interest if:

(a) the manner in which the * distributions payable in respect of the membership interest are calculated, and the conditions applying to the payment of such distributions, indicate that the distributions paid are equivalent to the receipt by the person to whom they are paid of interest or an amount in the nature of or similar to interest; or

(b) the capital invested by the holder of the membership interest will be redeemed or, because of an * arrangement between the holder and the entity or an * associate of the entity, it is reasonable for the holder to expect that the capital will be redeemed, for an amount that is not less than, or for property (including other membership interests in the entity) the value of which is not less than, the amount paid for the membership interest; or

(c) the membership interest is redeemable by the entity by payment of a lump sum or by the transfer of property, or the membership interest has a preferred right to a repayment of capital on a winding up, where the amount of the lump sum or the value of the property, or the amount of the capital to be repaid, as the case may be, is to be calculated by reference to an implicit interest rate.

(8) A * membership interest in an entity is a distribution access membership interest if, having regard to:

(a) the terms of the issue of the membership interest, including any guarantee of payment of distributions; and

(b) the amounts of the * distributions paid on the membership interest relative to the issue price of the membership interest; and

(c) whether there is any guaranteed rate at which * franked distributions are to be paid on the membership interest; and

(d) the duration of the period within which the membership interest was issued; and

(e) the rights attached to other membership interests in the entity; and

(f) any other relevant matters;

it could be concluded that the membership interest was issued only for the purpose of paying distributions to the holder of the membership interest.

208 - 35 Accountable partial interests

(1) The purpose of this section is to identify which * partial interests in an entity are relevant in determining whether the entity is effectively owned by prescribed persons.

(2) A * partial interest in an entity is an accountable partial interest if it is not an excluded partial interest.

(3) A * partial interest in an entity is an excluded partial interest if, having regard to:

(a) the purposes for which the interest was granted; and

(b) the nature of the interest; and

(c) any special or limited rights connected with or arising from:

(i) the interest; or

(ii) other * membership interests, or partial interests, in the entity held by the holder of the interest; or

(iii) membership interests, or partial interests, in the entity held by persons other than the holder of the interest;

including rights that are conferred or exercisable only if the holder of the membership interests or partial interests concerned is, or is not, a prescribed person; and

(d) the extent to which the interest is similar to or differs from beneficial ownership; and

(e) the relationship between the value of the interest and the value of the entity; and

(f) any relationship or connection (whether of a personal or business nature) between holders of partial interests in the entity, and the holders of membership interests in the entity, of which the entity is aware; and

(g) any * arrangement in respect of membership interests (including unissued membership interests) in the entity, or partial interests in the entity, of which the entity is aware;

it would be reasonable to conclude that the partial interest is not relevant in determining whether the entity is effectively owned by prescribed persons because holding the membership interest to which the partial interest relates does not involve the holder bearing the risks, or result in the accrual to the holder of the opportunities, of ownership of the entity that ordinarily arise from, or are ordinarily attached to, the holding of * ordinary membership interests in an entity.

(4) In applying subsection ( 3), the fact that a person is a trustee is to be disregarded.

(5) Without limiting subsection ( 3), a * partial interest in an entity is also an excluded partial interest if it was granted or otherwise created, or was transferred or acquired, for a purpose (other than an incidental purpose) of ensuring that the entity is not effectively owned by prescribed persons.

(1) A company is a prescribed person in relation to another * corporate tax entity if:

(a) the company is not an * Australian resident; or

(b) were the company to receive a * distribution made by the other corporate tax entity, the distribution would be * exempt income of the company.

(2) A trustee is a prescribed person in relation to a * corporate tax entity if:

(a) all the beneficiaries in the trust are prescribed persons under other provisions of this section; or

(b) were the trustee to receive a * distribution made by the corporate tax entity, the distribution would be * exempt income of the trust estate.

(3) A * partnership is a prescribed person in relation to a * corporate tax entity if:

(a) all the partners are prescribed persons under other provisions of this section; or

(b) were the partnership to receive a * distribution made by the corporate tax entity, the distribution would be * exempt income of the partnership.

(4) An individual (other than a trustee) is a prescribed person in relation to a * corporate tax entity if:

(a) he or she is not an * Australian resident; or

(b) were he or she to receive a * distribution made by the corporate tax entity, the distribution would be * exempt income of the individual.

(5) The Commonwealth, each of the States, the Australian Capital Territory, the Northern Territory and Norfolk Island are prescribed persons in relation to any * corporate tax entity.

208 - 45 Persons who are taken to be prescribed persons

(1) This section applies to a person that:

(a) is a * company, a trustee, or a * partnership, that holds * membership interests (whether * accountable membership interests or excluded membership interests), or * partial interests (whether * accountable partial interests or excluded partial interests), in a * corporate tax entity (the relevant entity ); and

(b) is not a prescribed person under section 208 - 40.

(2) A * company that holds * membership interests, or * partial interests, in the relevant entity is taken to be a prescribed person in relation to the relevant entity if the risks involved in, and the opportunities resulting from, holding the membership interests or partial interests are substantially borne by, or substantially accrue to, as the case may be, one or more prescribed persons.

(3) A trustee of a trust who holds * membership interests, or * partial interests, in the relevant entity is taken to be a prescribed person in relation to the relevant entity if the risks involved in, and the opportunities resulting from, holding the membership interests or partial interests are substantially borne by, or substantially accrue to, as the case may be, one or more prescribed persons.

(4) A trustee of a trust who holds * membership interests, or * partial interests, in the relevant entity is taken to be a prescribed person in relation to the relevant entity if:

(a) unless subsection ( 7) applies, the trust is controlled by one or more persons who are prescribed persons; or

(b) all the beneficiaries who are presently entitled to, or during the relevant year of income become presently entitled to, income from the trust are prescribed persons.

(5) In determining whether subsection ( 3) or (4) applies in respect of a trust that is controlled by a person, have regard to the way in which the person, or any * associate of the person, exercises powers in relation to the trust.

(6) A person controls a trust if:

(a) the person has the power, either directly, or indirectly through one or more interposed entities, to control the application of the income, or the distribution of the property, of the trust; or

(b) the person has the power, either directly, or indirectly through one or more entities, to appoint or remove the trustee of the trust; or

(c) the person has the power, either directly, or indirectly through one or more entities, to appoint or remove beneficiaries of the trust; or

(d) the trustee of the trust is accustomed or under an obligation, whether formal or informal, to act according to the directions, instructions or wishes of the person or of an * associate of the person.

(7) Paragraph ( 4)(a) does not apply in relation to a trust if some of the beneficiaries receiving income from the trust are not prescribed persons and the Commissioner considers that it is reasonable to conclude that the risks involved in, and the opportunities resulting from, holding the * membership interests or * partial interests in the relevant entity are substantially borne by, or substantially accrue to, as the case may be, one or more persons who are not prescribed persons.

(8) A * partnership that holds * membership interests, or * partial interests, in the relevant entity is taken to be a prescribed person in relation to the relevant entity if the risks involved in, and the opportunities resulting from, holding the membership interests or partial interests are substantially borne by, or substantially accrue to, as the case may be, one or more prescribed persons.

(9) If any of the prescribed persons referred to in subsection ( 2), (3), (4) or (8) is a * corporate tax entity, that subsection applies even if the risks involved in, and the opportunities resulting from, holding any of the * membership interests, or * partial interests, in that entity are substantially borne by, or substantially accrue to, as the case may be, one or more persons who are not prescribed persons.

208 - 50 Former exempting companies

(1) Subject to subsection ( 2), a * corporate tax entity is a former exempting entity if it has, at any time, ceased to be an * exempting entity and is not again an exempting entity.

(2) If an entity that, at any time, becomes effectively owned by prescribed persons ceases to be so effectively owned within 12 months after that time, the entity is not taken, by so ceasing, to become a former exempting entity.

Subdivision 208 - B -- Franking with an exempting credit

208 - 55 What this Subdivision is about

If a former exempting entity makes a distribution in circumstances where it could be franked, the entity can frank the distribution with an exempting credit.

Table of sections

Operative provisions

208 - 60 Franking with an exempting credit

[This is the end of the Guide.]

208 - 60 Franking with an exempting credit

An entity franks a * distribution with an exempting credit if:

(a) the entity is a * former exempting entity when the distribution is made; and

(b) the entity is a * franking entity that satisfies the * residency requirement when the distribution is made; and

(c) the distribution is a * frankable distribution; and

(d) the entity allocates an * exempting credit to the distribution.

Note: The residency requirement for an entity making a distribution is set out in section 202 - 20.

Subdivision 208 - C -- Amount of the exempting credit on a distribution

208 - 65 What this Subdivision is about

The amount of the exempting credit on a distribution is that stated in the distribution statement, unless the amount stated exceeds the maximum franking credit for the distribution. In that case, it is nil.

Table of sections

Operative provisions

208 - 70 Amount of the exempting credit on a distribution

[This is the end of the Guide.]

208 - 70 Amount of the exempting credit on a distribution

(1) Subject to subsection ( 2), the amount of the * exempting credit on a * distribution is that stated in the * distribution statement for the distribution.

(2) If the sum of the * franking credit and the * exempting credit stated in the * distribution statement for a * distribution exceeds the * maximum franking credit for the distribution, the amount of the exempting credit on the distribution is taken to be nil.

Note: If the franking credit stated in the distribution statement exceeds the maximum franking credit for the distribution, the amount of the franking credit on the distribution is taken to equal that maximum under section 202 - 65.

Subdivision 208 - D -- Distribution statements

208 - 75 Guide to Subdivision 208 - D

Former exempting entities and exempting entities that make certain distributions must provide additional information in the distribution statement given to the recipient.

Table of sections

Operative provisions

208 - 80 Additional information to be included by a former exempting entity or exempting entity

[This is the end of the Guide.]

208 - 80 Additional information to be included by a former exempting entity or exempting entity

(1) A * former exempting entity that makes a * distribution * franked with an exempting credit must include in the * distribution statement given to the recipient, a statement that there is an * exempting credit of a specified amount on the distribution.

(2) An * exempting entity that makes a * frankable distribution to a * member must include in the * distribution statement given to the member, a statement to the effect that members who are * Australian residents are not entitled to a * tax offset or * franking credit as a result of the distribution, except for certain * corporate tax entities, and employees who receive the distribution in connection with certain * employee share schemes.

(3) If, under subsection ( 1) or (2), a statement must be included in a * distribution statement, the distribution statement is taken not to have been given unless the statement is included.

Subdivision 208 - E -- Distributions to be franked with exempting credits to the same extent

208 - 85 What this Subdivision is about

All frankable distributions made within a franking period must be franked to the same extent with an exempting credit.

Table of sections

Operative provisions

208 - 90 All frankable distributions made within a franking period must be franked to the same extent with an exempting credit

208 - 95 Exempting percentage

208 - 100 Consequences of breaching the rule in section 208 - 90

[This is the end of the Guide.]

(1) If an entity * franks a * distribution with an exempting credit, it must frank each other * frankable distribution made within the same * franking period with an exempting credit worked out at the same * exempting percentage.

(2) If an entity is not a * former exempting entity for the whole of a * franking period (the longer period ), then, for the purposes of subsection ( 1), each period within that longer period during which the entity is a former exempting entity is taken to be a franking period .

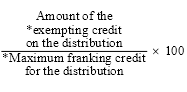

The exempting percentage for a * frankable distribution is worked out using the formula:

208 - 100 Consequences of breaching the rule in section 208 - 90

If an entity * franks a * distribution with an exempting credit in breach of section 208 - 90:

(a) that distribution is taken not to have been franked with an exempting credit; and

(b) each other * frankable distribution made by the entity within the relevant * franking period is taken not to have been franked with an exempting credit.

208 - 105 What this Subdivision is about

This Subdivision:

• creates an exempting account for each former exempting entity; and

• identifies when exempting credits and debits arise in those accounts and the amount of those credits and debits; and

• identifies when there is an exempting surplus or deficit in the account; and

• identifies when franking credits and debits arise in the franking account of an entity because it is an exempting entity, or former exempting entity.

Table of sections

Operative provisions

208 - 110 Exempting account

208 - 115 Exempting credits

208 - 120 Exempting debits

208 - 125 Exempting surplus and deficit

208 - 130 Franking credits arising because of status as exempting entity or former exempting entity

208 - 135 Relationships that will give rise to a franking credit under item 5 of the table in section 208 - 130

208 - 140 Membership of the same effectively wholly - owned group

208 - 145 Franking debits arising because of status as exempting entity or former exempting entity

208 - 150 Residency requirement

208 - 155 Eligible continuing substantial member

208 - 160 Distributions that are affected by a manipulation of the imputation system

208 - 165 Amount of the exempting credit or franking credit arising because of a distribution franked with an exempting credit

208 - 170 Where a determination under paragraph 177EA(5)(b) of the Income Tax Assessment Act 1936 affects part of the distribution

208 - 175 When does a distribution franked with an exempting credit flow indirectly to an entity?

208 - 180 What is an entity's share of the exempting credit on a distribution?

208 - 185 Minister may convert exempting surplus to franking credit of former exempting entity previously owned by the Commonwealth

[This is the end of the Guide.]

Each * former exempting entity has an exempting account .

The following table sets out when a credit arises in the * exempting account of a * former exempting entity. A credit in the former exempting entity's account is called an exempting credit .

Exempting Credits | |||

Item | If: | A credit of: | Arises: |

1 | the entity had a * franking surplus at the time it became a * former exempting entity (at the time of its transition ) | an amount equal to: (a ) in a case not covered by paragraph ( b)--the franking surplus; or (b ) if the entity has been a former exempting entity at any time within a period of 12 months before its transition--so much of the franking surplus as would have been the entity's * exempting surplus had it remained a former exempting entity throughout the period | immediately after its transition |

2 | the entity receives a * distribution * franked with an exempting credit; and the entity satisfies the * residency requirement for the income year in which the distribution is made and at the time the distribution is made; and the distribution is not wholly * exempt income of the entity; and the entity is an * eligible continuing substantial member in relation to the distribution; and the distribution is not affected by a manipulation of the imputation system mentioned in section 208 - 160 | an amount worked out under section 208 - 165 | on the day on which the distribution is made |

3 | the entity receives a * distribution * franked with an exempting credit; and the entity satisfies the * residency requirement for the income year in which the distribution is made and at the time the distribution is made; and the distribution is not wholly * exempt income of the entity; and the entity is an * eligible continuing substantial member in relation to the distribution; and the Commissioner has made a determination under paragraph 177EA(5)(b) of the Income Tax Assessment Act 1936 that no franking credit benefit (within the meaning of that section) is to arise in respect of a specified part of the distribution | an amount worked out under section 208 - 170 | on the day on which the distribution is made |

4 | a * distribution * franked with an exempting credit * flows indirectly to the entity (the ultimate recipient ); and the recipient of the distribution is an * eligible continuing substantial member in relation to the distribution; and except for the fact that the ultimate recipient is not an eligible continuing substantial member in relation to the distribution, it would have been entitled to an * exempting credit because of the distribution had the distribution been made to the ultimate recipient | an amount equal to the exempting credit that would have arisen for the ultimate recipient if: (a ) the ultimate recipient had been an eligible continuing substantial member in relation to the distribution; and (b ) the distribution had been made to the ultimate recipient; and (c ) the distribution had been franked with an exempting credit equal to the ultimate recipient's * share of the actual exempting credit | on the day on which the distribution is made |

5 | the entity * pays a * PAYG instalment; and the entity satisfies the * residency requirement for the income year in relation to which the PAYG instalment is paid; and the entity was an * exempting entity for the whole or part of the relevant * PAYG instalment period | an amount equal to that part of the payment that is attributable to the period during which the entity was an exempting entity | on the day on which the payment is made |

6 | the entity * pays income tax; and the entity satisfies the * residency requirement for the income year for which the tax is paid; and the entity was an * exempting entity for the whole or part of that income year | an amount equal to that part of the payment that is attributable to the period during which the entity was an exempting entity | on the day on which the payment is made |

7 | the * exempting account of the entity would, apart from this item, be in * deficit immediately before the end of an income year | an amount equal to the deficit | immediately before the end of the income year |

8 | the entity becomes an * exempting entity; and the entity has an * exempting deficit at the time it becomes an exempting entity | an amount equal to the exempting deficit | immediately after the entity becomes an exempting entity |

The following table sets out when a debit arises in the * exempting account of the * former exempting entity. A debit in the * former exempting entity's exempting account is called an exempting debit .

Exempting debits | |||

Item | If : | A debit of: | Arises: |

1 | the entity had a * franking deficit at the time it became a * former exempting entity (at the time of its transition ) | an amount equal to: (a ) in a case not covered by paragraph ( b)--the franking deficit; or (b ) if the entity has been a former exempting entity at any time within a period of 12 months before its transition--so much of the franking deficit as would have been the entity's * exempting deficit had it remained a former exempting entity throughout the period | immediately after its transition |

2 | the entity makes a * distribution * franked with an exempting credit | an amount equal to the * exempting credit on the distribution | on the day on which the distribution is made |

3 | the entity * receives a refund of income tax; and the entity was an * exempting entity during all or part of the income year to which the refund relates; and the entity satisfies the * residency requirement for the income year to which the refund relates | an amount equal to that part of the refund that is attributable to the period during which the entity is an exempting entity | on the day on which the refund is received |

4 | the Commissioner makes a determination under paragraph 204 - 30(3)(b) giving rise to an * exempting debit for the entity (streaming distributions) | the amount specified in the determination | on the day specified in section 204 - 35 |

5 | a * franking debit arises for the entity under section 204 - 15 (linked distributions), 204 - 25 (substituting tax - exempt bonus shares for franked distributions) or a determination made under paragraph 204 - 30(3)(a) (streaming distributions); and the entity was an * exempting entity for the whole or part of the period to which the franking debit relates | an amount equal to that part of the franking debit that relates to the period during which the entity was an exempting entity | when the franking debit arises |

6 | the Minister makes a determination under paragraph 208 - 185(4)(a) giving rise to an * exempting debit for the entity | the amount specified in the determination | on the day specified in the determination |

7 | the entity becomes an * exempting entity; and the entity has an * exempting surplus at the time it becomes an exempting entity | an amount equal to the exempting surplus | immediately after the entity becomes an exempting entity |

208 - 125 Exempting surplus and deficit

(1) An entity's * exempting account is in surplus at a particular time if, at that time, the sum of the * exempting credits in the account exceeds the sum of the * exempting debits in the account. The amount of the exempting surplus is the amount of the excess.

(2) An entity's * exempting account is in deficit at a particular time if, at that time, the sum of the * exempting debits in the account exceeds the sum of the * exempting credits in the account. The amount of the exempting deficit is the amount of the excess.

208 - 130 Franking credits arising because of status as exempting entity or former exempting entity

The following table sets out when a credit arises in the * franking account of an entity because of its status as an * exempting entity or * former exempting entity.

Franking credits arising because of status as an exempting entity or former exempting entity | |||

Item | If: | A credit of: | Arises: |

1 | an entity becomes a * former exempting entity; and the entity has a * franking deficit at the time it becomes a former exempting entity | an amount equal to the franking deficit | immediately after the entity becomes a former exempting entity |

2 | an entity receives a * distribution * franked with an exempting credit; and the entity is an * exempting entity at the time the distribution is made; and the entity satisfies the * residency requirement for the income year in which the distribution is made and at the time the distribution is made; and the distribution is not wholly * exempt income of the entity; and the entity is an * eligible continuing substantial member in relation to the distribution; and the distribution is not affected by a manipulation of the imputation system mentioned in section 208 - 160 | an amount worked out under section 208 - 165 | on the day on which the distribution is made |

3 | the entity receives a * distribution * franked with an exempting credit; and the entity is an * exempting entity at the time the distribution is made; and the entity satisfies the * residency requirement for the income year in which the distribution is made and at the time the distribution is made; and the distribution is not wholly * exempt income of the entity; and the entity is an * eligible continuing substantial member in relation to the distribution; and the Commissioner has made a determination under paragraph 177EA(5)(b) of the Income Tax Assessment Act 1936 that no franking credit benefit (within the meaning of that section) is to arise in respect of a specified part of the distribution | an amount worked out under section 208 - 170 | on the day on which the distribution is made |

4 | a * distribution * franked with an exempting credit * flows indirectly to the entity (the ultimate recipient ); and the recipient of the distribution is an * eligible continuing substantial member in relation to the distribution; and except for the fact that the ultimate recipient is not an eligible continuing substantial member in relation to the distribution, it would have been entitled to a * franking credit because of the distribution had the distribution been made to the ultimate recipient | an amount equal to the franking credit that would have arisen for the ultimate recipient if: (a ) the ultimate recipient had been an eligible continuing substantial member in relation to the distribution; and (b ) the distribution had been made to the ultimate recipient; and (c ) the distribution had been franked with a franking credit equal to the ultimate recipient's * share of the actual franking credit | on the day on which the distribution is made |

5 | an * exempting entity makes a * franked distribution to the entity (the recipient ); and at the time the distribution is made: (a ) the recipient is an exempting entity; and (b ) the recipient satisfies the * residency requirement; and (c ) the relationship between the entities is of the type mentioned in section 208 - 135; and the recipient satisfies the residency requirement for the income year in which the distribution is made; and the distribution is not wholly * exempt income of the recipient; and the distribution is not affected by a manipulation of the imputation system mentioned in section 208 - 160 | an amount worked out using the formula in section 208 - 165 | on the day on which the distribution is made |

6 | an * exempting entity makes a * franked distribution to the entity (the recipient ); and at the time the distribution is made: (a ) the recipient is an exempting entity; and (b ) the recipient satisfies the * residency requirement; and (c ) the relationship between the entities is of the type mentioned in section 208 - 135; and the recipient satisfies the residency requirement for the income year in which the distribution is made; and the distribution is not wholly * exempt income of the recipient; and the Commissioner has made a determination under paragraph 177EA(5)(b) of the Income Tax Assessment Act 1936 that no franking credit benefit (within the meaning of that section) is to arise in respect of a specified part of the distribution | an amount worked out using the formula in section 208 - 170 | on the day on which the distribution is made |

7 | a * distribution made by an * exempting entity * flows indirectly to the entity (the ultimate recipient ); and the recipient of the distribution is an * eligible continuing substantial member in relation to the distribution; and except for the fact that the ultimate recipient is not an eligible continuing substantial member in relation to the distribution, it would have been entitled to a * franking credit because of the distribution had the distribution been made to the ultimate recipient | an amount equal to the franking credit that would have arisen for the ultimate recipient if: (a ) the ultimate recipient had been an eligible continuing substantial member in relation to the distribution; and (b ) the distribution had been made to the ultimate recipient; and (c ) the distribution had been franked with a franking credit equal to the ultimate recipient's * share of the actual franking credit | on the day on which the distribution is made |

8 | the Minister makes a determination under paragraph 208 - 185(4)(b) giving rise to a * franking credit for the entity | the amount of the credit specified in the determination | on the day specified in the determination |

9 | an * exempting debit arises for the entity under item 3 or 5 of the table in section 208 - 120 | an amount equal to the exempting debit | when the exempting debit arises |

10 | a * former exempting entity becomes an * exempting entity; and the entity has an * exempting surplus at the time it becomes an * exempting entity | an amount equal to the * exempting surplus | immediately after it becomes an exempting entity |

Note: Item 9 is designed to reverse out franking debits that arise in relation to a period during which the entity is an exempting entity. The entity will receive an exempting debit instead.

(1) A relationship between an entity making a * franked distribution and the recipient of the distribution is of a type that gives rise to a * franking credit under item 5 or 6 of the table in section 208 - 130 if either:

(a) both entities are members of the same effectively wholly - owned group; or

(b) the recipient holds more than 5% of the * membership interests in the entity making the distribution (other than finance membership interests or distribution access membership interests within the meaning of section 208 - 30 or membership interests that do not carry the right to receive distributions) and it would be reasonable to conclude that the risks involved in, and the opportunities resulting from, holding those membership interests are substantially borne by, or substantially accrue to, the recipient.

(2) In deciding whether it would be reasonable to make the conclusion mentioned in paragraph ( 1)(b):

(a) have regard to any * arrangement in respect of the * membership interests (including unissued membership interests) in the entity making the distribution (including derivatives held or issued in connection with those membership interests); and

(b) do not have regard to risks involved in the ownership of membership interests in the entity making the distribution that are substantially borne by any person in the person's capacity as a secured creditor.

208 - 140 Membership of the same effectively wholly - owned group

(1) Two * corporate tax entities are members of the same effectively wholly - owned group of entities on a particular day if:

(a) throughout that day, not less than 95% of the * accountable membership interests in each of the entities, and not less than 95% of the * accountable partial interests in each of the entities, are held by, or are held indirectly for the benefit of, the same persons; or

(b) paragraph ( a) does not apply but it would nevertheless be reasonable to conclude, having regard to the matters mentioned in subsection ( 2), that, throughout that day, the risks involved in, and the opportunities resulting from, holding accountable membership interests, or accountable partial interests, in each of the entities are substantially borne by, or substantially accrue to, the same persons.

(2) The matters to which regard is to be had as mentioned in paragraph ( 1)(b) are:

(a) any special or limited rights attaching to * accountable membership interests, or * accountable partial interests, in each of the entities held by persons other than the persons mentioned in paragraph ( 1)(b) or their * associates; and

(b) any special rights attaching only to accountable membership interests, or accountable partial interests, in each of the entities held by the persons mentioned in paragraph ( 1)(b) or their associates; and

(c) the respective proportions:

(i) that accountable membership interests in each of the entities held by the persons mentioned in paragraph ( 1)(b) or their associates, and other accountable membership interests in the entity concerned, bear to all the accountable membership interests in that entity; and

(ii) that accountable partial interests in each of the entities held by the persons mentioned in paragraph ( 1)(b) or their associates, and other accountable partial interests in the entity concerned, bear to all the accountable partial interests in that entity; and

(d) the respective proportions that:

(i) the total value of accountable membership interests in each of the entities held by the persons mentioned in paragraph ( 1)(b) or their associates, and the total value of other accountable membership interests in the entity concerned, bear to the total value of all the accountable membership interests in that entity; and

(ii) the total value of accountable partial interests in each of the entities held by the persons mentioned in paragraph ( 1)(b) or their associates, and the total value of other accountable partial interests in the entity concerned, bear to the total value of all the accountable partial interests in that entity; and

(e) the purposes for which accountable membership interests, or accountable partial interests, in each of the entities were issued or granted to persons other than the persons mentioned in paragraph ( 1)(b) or their associates; and

(f) any * arrangement in respect of accountable membership interests, or accountable partial interests, in each of the entities held by persons other than the persons mentioned in paragraph ( 1)(b) or their associates (including any derivatives held or issued in connection with those membership interests or interests) of which the entity concerned is aware.

208 - 145 Franking debits arising because of status as exempting entity or former exempting entity

The following table sets out when a debit arises in the * franking account of an entity because of its status as an * exempting entity or * former exempting entity.

Franking debits arising because of status as an exempting entity or former exempting entity | |||

Item | If: | A debit of: | Arises: |

1 | an entity becomes a * former exempting entity; and the entity has a * franking surplus at the time it becomes a former exempting entity | the amount of the franking surplus | immediately after the entity becomes a former exempting entity |

2 | the * exempting account of a * former exempting entity would, apart from this item, be in * deficit immediately before the end of an income year | an amount equal to the deficit | immediately before the end of the income year |

3 | an * exempting credit arises in the * exempting account of the entity under item 5 or 6 of the table in section 208 - 115 | an amount equal to the exempting credit | when the exempting credit arises |

4 | a * former exempting entity becomes an * exempting entity; and the entity has an * exempting deficit at the time it becomes an * exempting entity | an amount equal to the exempting deficit | immediately after it becomes an exempting entity |

5 | a * franking credit arises in the * franking account of an entity under item 3 or 4 of the table in section 205 - 15 because a * distribution is made by an * exempting entity to the entity, or a distribution made by an exempting entity * flows indirectly to the entity | an amount equal to the amount of the franking credit | when the franking credit arises |

Note 1: Item 3 of the table is designed to reverse out franking credits that arise in relation to a period during which the entity is an exempting entity. The entity will receive an exempting credit instead.

Note 2: Item 5 of the table is designed to reverse out franking credits that arise under the core rules because an entity receives a franked distribution from an exempting entity. Only a recipient who is itself an exempting entity is entitled to a franking credit in these circumstances.

208 - 150 Residency requirement

The tables in sections 208 - 115, 208 - 120, 208 - 130 and 208 - 145 are relevant for the purposes of subsection 205 - 25(1).

Note 1: Subsection 205 - 25(1) sets out the residency requirement for an income year in which, or in relation to which, an event specified in one of the tables occurs.

Note 2: Section 207 - 75 sets out the residency requirement that must be satisfied by the entity receiving a distribution when the distribution is made.

208 - 155 Eligible continuing substantial member

(1) A * member of a * former exempting entity is an eligible continuing substantial member in relation to a * distribution made by the entity if the following provisions apply.

(2) At both the time when the * distribution was made, and the time immediately before the entity ceased to be an * exempting entity, the * member was entitled to not less than 5% of:

(a) where the entity is a * company:

(i) if the voting shares (as defined in the Corporations Act 2001 ) in the relevant former exempting entity are not divided into classes--those voting shares; or

(ii) if the voting shares (as so defined) in the relevant former exempting entity are divided into 2 or more classes--the shares in one of those classes; and

(b) where the entity is a * corporate unit trust or * public trading trust--the units in the trust; and

(c) where the entity is a * corporate limited partnership--the income of the partnership.

(3) At both the time when the * distribution was made, and the time immediately before the entity ceased to be an * exempting entity, the * member was a person referred to in one or more of the following paragraphs:

(a) a person who is not an * Australian resident;

(b) a * life insurance company;

(c) an exempting entity;

(d) a * former exempting entity;

(e) a trustee of a trust in which an interest was held by a person referred to in any of paragraphs ( a) to (d);

(f) a * partnership in which an interest was held by a person referred to in any of paragraphs ( a) to (d).

(4) If the assumptions set out in subsection ( 5) are made:

(a) if the * member was a person referred to in any of paragraphs ( 3)(a) to (d)--the member; or

(b) if the member was a trustee of a trust or a * partnership, being a trust or partnership in which a person referred to in any of those paragraphs held an interest--the holder of the interest;

would (if not an * Australian resident) be exempt from * withholding tax on the distribution or (if an Australian resident) be entitled to a * franking credit or a * tax offset in respect of the distribution.

(5) The assumptions referred to in subsection ( 4) are that:

(a) the relevant former exempting entity was an * exempting entity at the time it made the * distribution; and

(b) the distribution was a * franked distribution made to the member; and

(c) if the * member was a * former exempting entity--the member was an exempting entity; and

(d) if the member was a trustee of a trust or * partnership in which a former exempting entity had an interest--the former exempting entity was an exempting entity.

(6) A person is taken to hold an interest in a trust, for the purposes of paragraph ( 3)(e), if:

(a) the person is a beneficiary under the trust; or

(b) the person derives, or will derive, income indirectly, through interposed trusts or * partnerships, from * distributions received by the trustee.

(7) A person is taken to hold an interest in a * partnership, for the purposes of paragraph ( 3)(f), if:

(a) the person is a partner in the partnership; or

(b) the person derives, or will derive, income indirectly, through interposed trusts or partnerships, from * distributions received by the partnership.

208 - 160 Distributions that are affected by a manipulation of the imputation system

For the purposes of item 2 of the table in section 208 - 115 and items 2 and 5 of the table in section 208 - 130, a * distribution to an entity is affected by a manipulation of the imputation system if:

(a) the Commissioner has made a determination under paragraph 204 - 30(3)(c) that no * imputation benefit is to arise for the entity in respect of the distribution; or

(b) the Commissioner has made a determination under paragraph 177EA(5)(b) of the Income Tax Assessment Act 1936 that no franking credit benefit (within the meaning of that section) is to arise in respect of the distribution to the entity; or

(c) the distribution is part of a * dividend stripping operation.

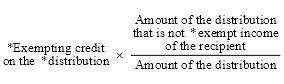

Use the following formula to work out:

(a) the amount of an * exempting credit arising under item 2 of the table in section 208 - 115 because a * former exempting entity receives a * distribution * franked with an exempting credit; or

(b) the amount of a * franking credit arising under item 2 or 5 of the table in section 208 - 130 because an * exempting entity receives a distribution franked with an exempting credit;

208 - 170 Where a determination under paragraph 177EA(5)(b) of the Income Tax Assessment Act 1936 affects part of the distribution

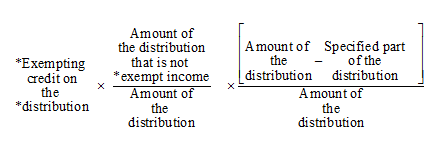

Use the following formula to work out:

(a) the amount of an * exempting credit arising under item 3 of the table in section 208 - 115 because a * former exempting entity receives a * distribution * franked with an exempting credit; or

(b) the amount of a * franking credit arising under item 3 or 6 of the table in section 208 - 130 because an * exempting entity receives a distribution franked with an exempting credit;

208 - 175 When does a distribution franked with an exempting credit flow indirectly to an entity?

A * distribution * franked with an exempting credit is taken to flow indirectly to an entity if, had it been a * franked distribution, it would have been taken to have flowed indirectly to the entity under section 207 - 35.

208 - 180 What is an entity's share of the exempting credit on a distribution?

To work out an entity's share of the * exempting credit on a * distribution * franked with that credit, use section 207 - 55 to work out what the entity's share of the credit would be it if were a * franking credit on a * franked distribution. The entity's share of the exempting credit is equal to that amount.

(1) The Minister may make a determination or determinations under this section if:

(a) at a particular time, a * corporate tax entity is an * exempting entity; and

(b) at that time all of the * membership interests in the entity are owned by the Commonwealth; and

(c) the Commonwealth has offered for sale or sold, or proposes to offer for sale, some or all of the membership interests; and

(d) the Minister is satisfied, having regard to the matters mentioned in subsection ( 2), that it is desirable to make a determination or determinations under this section in relation to the entity.

(2) The matters to which the Minister must have regard under paragraph ( 1)(d) are:

(a) whether the making of the determination or determinations is necessary to enable the entity to make * distributions * franked at a * franking percentage of 100% after the sale; and

(b) the extent to which the success of the sale or proposed sale depended or will depend upon the ability of the entity to make * franked distributions; and

(c) the extent to which the reduction in receipts of income tax resulting from the making of the determination or determinations would be offset by the receipt of increased proceeds from the sale; and

(d) any other matters that the Minister thinks relevant.

(3) The following provisions of this section apply after the * exempting entity becomes a * former exempting entity.

(4) If the * former exempting entity would, apart from this section, have an * exempting surplus at the end of an income year, the Minister may, in writing, determine that:

(a) an * exempting debit of the entity (not exceeding the exempting surplus) specified in the determination is taken to have arisen immediately before the end of that income year; and

(b) a * franking credit of the entity equal to the amount of the exempting debit is taken to have arisen immediately before the end of that income year.

(5) A determination under this section may be expressed to be subject to compliance by the * former exempting entity with such conditions as are specified in the determination.

(6) If a condition specified in a determination is not complied with, the Minister may revoke the determination and, if the Minister thinks it appropriate, make a further determination under subsection ( 4).

(7) A determination, unless it is revoked, has effect according to its terms.

Subdivision 208 - G -- Tax effects of distributions by exempting entities

208 - 190 What this Subdivision is about

Generally, a franked distribution from an exempting entity will only generate a tax effect for the recipient under Division 207 if the recipient is also an exempting entity.

A concession is made to employees of the entity who receive a franked distribution because they hold shares under an eligible employee share scheme.

Table of sections

Operative provisions

208 - 195 Division 207 does not generally apply

208 - 200 Distributions to exempting entities

208 - 205 Distributions to employees acquiring shares under an eligible employee share scheme

208 - 210 Subsidiaries

208 - 215 Eligible employee share scheme

[This is the end of the Guide.]

208 - 195 Division 207 does not generally apply

Division 207 does not apply to a * distribution by an * exempting entity, unless expressly applied under this Subdivision.

208 - 200 Distributions to exempting entities

(1) Division 207 applies to a * franked distribution made by an * exempting entity to another exempting entity if the distribution gives rise to a * franking credit for the other exempting entity under item 5 or 6 of the table in section 208 - 130.

(2) Division 207 applies to a * franked distribution that is made by an * exempting entity and * flows indirectly to another exempting entity if the distribution gives rise to a * franking credit for that other entity under item 7 of the table in section 208 - 130.

208 - 205 Distributions to employees acquiring shares under an eligible employee share scheme

Division 207 also applies to a * franked distribution made by an * exempting entity if:

(a) the distribution is made to a person who is an employee of the exempting entity, or of a * company that is a * subsidiary of the exempting entity, at the time the distribution is made; and

(b) the recipient acquired the * share on which the distribution is made under an * employee share scheme in circumstances specified as relevant in section 208 - 215; and

(c) the recipient does not hold that share as a trustee.

The question whether a company is a subsidiary of another company is to be determined in the same way as the question whether a corporation is a subsidiary of another corporation is determined under the Corporations Act 2001 .

208 - 215 Eligible employee share scheme

A * share in a * company is acquired by a person under an * employee share scheme in circumstances that are relevant for the purposes of paragraph 208 - 205(b) and 208 - 235(b) if:

(a) the share is acquired by the person in respect of, or for or in relation directly or indirectly to, any employment of the person by the entity or by an entity that is a * subsidiary of the company; and

(b) all the shares available for acquisition under the scheme are ordinary shares or are preference shares to which are attached substantially the same rights as are attached to ordinary shares; and

(c) immediately after the acquisition of the shares:

(i) the person does not hold a legal or beneficial interest in more than 5% of the shares in the company; and

(ii) the person is not in a position to control, or control the casting of, more than 5% of the maximum number of votes that might be cast at a general meeting of the company; and

(d) the share is not a * non - equity share.

Subdivision 208 - H -- Tax effect of a distribution franked with an exempting credit

208 - 220 What this Subdivision is about

Generally, a distribution franked with an exempting credit will only generate a tax effect for the recipient under Division 207 if a tax effect would have been generated for the recipient had the recipient received a franked distribution when the distributing entity was an exempting entity.

Table of sections

Operative provisions

208 - 225 Division 207 does not generally apply

208 - 230 Distributions to exempting entities and former exempting entities

208 - 235 Distributions to employees acquiring shares under an eligible employee share scheme

208 - 240 Distributions to certain individuals

[This is the end of the Guide.]

208 - 225 Division 207 does not generally apply

Division 207 does not apply to a * distribution * franked with an exempting credit, unless the Division is expressly applied to the distribution under this Subdivision.

208 - 230 Distributions to exempting entities and former exempting entities

Division 207 applies to a * distribution * franked with an exempting credit by a * former exempting entity as if it were a * franked distribution if:

(a) the recipient of the distribution is a former exempting entity and the distribution gives rise to an * exempting credit for the recipient; or

(b) the recipient of the distribution is an * exempting entity and the distribution gives rise to a * franking credit for the recipient; or

(c) the distribution * flows indirectly to a former exempting entity and gives rise to an exempting credit for that entity; or

(d) the distribution flows indirectly to an exempting entity and gives rise to a franking credit for that entity.

208 - 235 Distributions to employees acquiring shares under an eligible employee share scheme

Division 207 also applies to a * distribution * franked with an exempting credit made by a * former exempting entity as if it were a * franked distribution if:

(a) the distribution is made to a person who is an employee of the former exempting entity, or of a * company that is a * subsidiary of the former exempting entity, at the time the distribution is made; and

(b) the recipient acquired the * share on which the distribution is made under an * employee share scheme in circumstances specified as relevant in section 208 - 215; and

(c) the recipient does not hold that share as a trustee.

208 - 240 Distributions to certain individuals

Division 207 also applies to a * distribution * franked with an exempting credit made by a * former exempting entity as if it were a * franked distribution if:

(a) a * corporate tax entity other than a former exempting entity became an * exempting entity; and

(b) immediately before the entity became an exempting entity all the accountable membership interests and accountable partial interests were beneficially owned (whether directly or indirectly) by natural persons who were * Australian residents; and

(c) the entity became an exempting entity because some or all of the persons mentioned in paragraph ( b) ceased to be Australian residents; and

(d) the entity becomes a former exempting entity because all of the persons mentioned in paragraph ( b) are or have become Australian residents; and

(e) an amount attributable to a distribution * franked with an exempting credit made by the entity is included in the assessable income of such a person; and

(f) all the accountable membership interests or accountable partial interests in the entity were, throughout the period beginning when the entity became an exempting entity and ending when the amount was received by the person, beneficially owned (directly or indirectly) by the person mentioned in paragraph ( b); and

(g) the person is an eligible continuing substantial member in relation to the distribution.

16 After section 960 - 135

Insert:

960 - 140 Ordinary membership interest

A * membership interest in a * corporate tax entity is an ordinary membership interest if:

(a) in the case of a membership interest in a * company--it is an ordinary share; and

(b) in the case of a membership interest in a * corporate limited partnership--it is an interest in the income of the partnership; and

(c) in the case of a membership interest in a * corporate unit trust or * public trading trust--it is a unit in the trust.

17 Subsection 995 - 1(1)

Insert:

"accountable membership interest" has the meaning given by section 208 - 30.

18 Subsection 995 - 1(1)

Insert:

"accountable partial interest" has the meaning given by section 208 - 35.

19 Subsection 995 - 1(1) (definition of deficit)

Repeal the definition, substitute:

"deficit" :

(a) section 205 - 40 sets out when a * franking account is in deficit; and

(b) section 208 - 125 sets out when an * exempting account is in deficit.

20 Subsection 995 - 1(1)

Insert:

"eligible continuing substantial member" of a * former exempting entity has the meaning given by section 208 - 155.

21 Subsection 995 - 1(1)

Insert:

"exempting account" means an account that arises under section 208 - 110.

22 Subsection 995 - 1(1)

Insert:

"exempting credit" has the meaning given by section 208 - 115.

23 Subsection 995 - 1(1)

Insert:

"exempting debit" has the meaning given by section 208 - 120.

24 Subsection 995 - 1(1)

Insert:

"exempting deficit" has the meaning given by subsection 208 - 125(2).

25 Subsection 995 - 1(1)

Insert:

"exempting entity" has the meaning given by section 208 - 20.

26 Subsection 995 - 1(1)

"exempting percentage" has the meaning given by section 208 - 95.

27 Subsection 995 - 1(1)

"exempting surplus" has the meaning given by subsection 208 - 125(1).

28 Subsection 995 - 1(1) (at the end of the definition of flows indirectly)

Add:

; and (c) section 208 - 175 sets out the circumstances in which a * distribution * franked with an exempting credit flows indirectly to an entity.

29 Subsection 995 - 1(1)

Insert:

"former exempting entity" has the meaning given by section 208 - 50.

30 Subsection 995 - 1(1)

Insert:

"franks with an exempting credit" has the meaning given by section 208 - 60.

31 Subsection 995 - 1(1)

Insert:

"partial interest" in a * corporate tax entity has the meaning given by subsection 208 - 25(3).

32 Subsection 995 - 1(1) ( paragraphs ( a), (b) and (c) of the definition of residency requirement )

Repeal the paragraphs, substitute:

(a) for an entity making a * distribution--has the meaning given by section 202 - 20; and

(b) for an income year in which, or in relation to which, an event specified in a table in one of the following sections occurs:

(i) section 205 - 15 (general table of * franking credits);

(ii) section 205 - 30 (general table of * franking debits);

(iii) section 208 - 115 (table of * exempting credits);

(iv) section 208 - 120 (table of * exempting debits);

(v) section 208 - 130 (table of franking credits that arise because of an entity's status as a * former exempting entity or * exempting entity);

(vi) section 208 - 145 (table of franking debits that arise because of an entity's status as a former exempting entity or exempting entity); and

(c) for an entity receiving a distribution--has the meaning given by section 207 - 75; and

33 Subsection 995 - 1(1) (definition of share of a franking credit)

Repeal the definition, substitute:

"share" :

(a) of a * franking credit--has the meaning given by section 207 - 55; and

(b) of an * exempting credit--has the meaning given by section 208 - 180.

34 Subsection 995 - 1(1)

Insert:

"surplus" :

(a) section 205 - 40 sets out when a * franking account is in surplus; and

(b) section 208 - 125 sets out when an * exempting account is in surplus.