Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsNote: See section 3 of the National Credit Act.

This Code may be cited as the National Credit Code .

(1) Part 13 contains the principal definitions of words and expressions used in this Code.

(2) Part 14 contains other miscellaneous provisions relating to the interpretation of this Code.

3 Meaning of credit and amount of credit

(1) For the purposes of this Code, credit is provided if under a contract:

(a) payment of a debt owed by one person (the debtor ) to another (the credit provider ) is deferred; or

(b) one person (the debtor ) incurs a deferred debt to another (the credit provider ).

(2) For the purposes of this Code, the amount of credit is the amount of the debt actually deferred. The amount of credit does not include:

(a) any interest charge under the contract; or

(b) any fee or charge:

(i) that is to be or may be debited after credit is first provided under the contract; and

(ii) that is not payable in connection with the making of the contract or the making of a mortgage or guarantee related to the contract.

For the purposes of this Code, a credit contract is a contract under which credit is or may be provided, being the provision of credit to which this Code applies.

5 Provision of credit to which this Code applies

(1) This Code applies to the provision of credit (and to the credit contract and related matters) if when the credit contract is entered into or (in the case of precontractual obligations) is proposed to be entered into:

(a) the debtor is a natural person or a strata corporation; and

(b) the credit is provided or intended to be provided wholly or predominantly:

(i) for personal, domestic or household purposes; or

(ii) to purchase, renovate or improve residential property for investment purposes; or

(iii) to refinance credit that has been provided wholly or predominantly to purchase, renovate or improve residential property for investment purposes; and

(c) a charge is or may be made for providing the credit; and

(d) the credit provider provides the credit in the course of a business of providing credit carried on in this jurisdiction or as part of or incidentally to any other business of the credit provider carried on in this jurisdiction.

(2) If this Code applies to the provision of credit (and to the credit contract and related matters):

(a) this Code applies in relation to all transactions or acts under the contract whether or not they take place in this jurisdiction; and

(b) this Code continues to apply even though the credit provider ceases to carry on a business in this jurisdiction.

(3) For the purposes of this section, investment by the debtor is not a personal, domestic or household purpose.

(4) For the purposes of this section, the predominant purpose for which credit is provided is:

(a) the purpose for which more than half of the credit is intended to be used; or

(b) if the credit is intended to be used to obtain goods or services for use for different purposes, the purpose for which the goods or services are intended to be most used.

6 Provision of credit to which this Code does not apply

Short term credit

(1) This Code does not apply to the provision of credit if, under the contract:

(a) the provision of credit is limited to a total period that does not exceed 62 days; and

(b) the maximum amount of credit fees and charges that may be imposed or provided for does not exceed 5% of the amount of credit; and

(c) the maximum amount of interest charges that may be imposed or provided for does not exceed an amount (calculated as if the Code applied to the contract) equal to the amount payable if the annual percentage rate were 24% per annum.

(2) For the purposes of paragraph (1)(b), credit fees and charges imposed or provided for under the contract are taken to include the following, whether or not payable under the contract:

(a) a fee or charge payable by the debtor to any person for an introduction to the credit provider;

(b) a fee or charge payable by the debtor to any person for any service if the person has been introduced to the debtor by the credit provider;

(c) a fee or charge payable by the debtor to the credit provider for any service related to the provision of credit, other than a service mentioned in paragraph (b).

(3) For the purposes of paragraphs (2)(a) and (b), it does not matter whether or not there is an association between the person and the credit provider.

Credit without express prior agreement

(4) This Code does not apply to the provision of credit if, before the credit was provided, there was no express agreement between the credit provider and the debtor for the provision of credit. For example, when a cheque account becomes overdrawn but there is no expressly agreed overdraft facility or when a savings account falls into debit.

Credit for which only account charge payable

(5) This Code does not apply to the provision of credit under a continuing credit contract if the only charge that is or may be made for providing the credit is a periodic or other fixed charge that does not vary according to the amount of credit provided. However, this Code applies if the charge is of a nature prescribed by the regulations for the purposes of this subsection or if the charge exceeds the maximum charge (if any) so prescribed.

Joint credit and debit facilities

(6) This Code does not apply to any part of a credit contract under which both credit and debit facilities are available to the extent that the contract or any amount payable or other matter arising out of it relates only to the debit facility.

Bill facilities

(7) This Code applies to the provision of credit arising out of a bill facility, that is, a facility under which the credit provider provides credit by accepting, drawing, discounting or endorsing a bill of exchange or promissory note. However, it does not apply if:

(a) the credit is provided by an authorised deposit - taking institution (within the meaning of subsection 5(1) of the Banking Act 1959 ); or

(b) the regulations provide that the Code does not apply to the provision of all or any credit arising out of such a facility.

Insurance premiums by instalments

(8) This Code does not apply to the provision of credit by an insurer for the purpose of the payment to the insurer of an insurance premium by instalments, even though the instalments exceed the total of the premium that would be payable if the premium were paid in a lump sum, if on cancellation the insured would have no liability to make further payments under the contract.

Pawnbrokers

(9) This Code does not apply to the provision of credit on the security of pawned or pledged goods by a pawnbroker in the ordinary course of a pawnbroker's business (being a business which is being lawfully conducted by the pawnbroker) as long as it is the case that, if the debtor is in default, the pawnbroker's only recourse is against the goods provided as security for the provision of the credit. However, sections 76 to 81 (Court may reopen unjust transactions) apply to any such provision of credit.

Trustees of estates

(10) This Code does not apply to the provision of credit by the trustee of the estate of a deceased person by way of an advance to a beneficiary or prospective beneficiary of the estate. However, sections 76 to 81 (Court may reopen unjust transactions) apply to any such provision of credit.

Employee loans

(11) This Code (other than this Part, Part 4, Division 3 of Part 5, Divisions 4 and 5 of Part 7 and Parts 12, 13 and 14) does not apply to the provision of credit by an employer, or a related body corporate within the meaning of the Corporations Act 2001 of an employer, to an employee or former employee (whether or not it is provided to the employee or former employee with another person). However, for a credit provider that provides credit to which this Code applies in the course of a business of providing credit to which this Code applies to employees or former employees and to others, this subsection applies only to the provision of credit on terms that are more favourable to the debtor than the terms on which the credit provider provides credit to persons who are not employees or former employees of the credit provider or a related body corporate.

Margin loans

(12) This Code does not apply to the provision of credit by way of a margin loan (within the meaning of subsection 761EA(1) of the Corporations Act 2001 ).

Regulations may exclude credit

(13) The regulations may exclude, from the application of this Code, the provision of credit of a class specified in the regulations. In particular (but without limiting the generality of the foregoing), the regulations may so exclude the provision of credit if the amount of the credit exceeds or may exceed a specified amount or if the credit is provided by a credit provider of a specified class.

(14) ASIC may exclude, from the application of this Code, a provision of credit specified by ASIC.

(15) Without limiting subsection (14), ASIC may exclude a provision of credit if:

(a) the amount of the credit exceeds, or may exceed, a specified amount; or

(b) the credit is provided by a specified credit provider.

(16) An exemption under subsection (14) is not a legislative instrument.

(17) ASIC may, by legislative instrument, exclude from the application of this Code, the provision of credit of a class specified in the instrument.

(18) Without limiting subsection (17), ASIC may exclude a provision of credit if:

(a) the amount of the credit exceeds, or may exceed, a specified amount; or

(b) the credit is provided by a specified credit provider, or a class of credit providers.

(19) In this section:

"fee or charge" does not include a government fee, charge or duty of any kind.

"security" , of pawned or pledged goods, means security by way of bailment of the goods under which the title to the goods does not pass, conditionally or unconditionally, to the bailee.

7 Mortgages to which this Code applies

(1) This Code applies to a mortgage if:

(a) it secures obligations under a credit contract or a related guarantee; and

(b) the mortgagor is a natural person or a strata corporation.

(2) If any such mortgage also secures other obligations, this Code applies to the mortgage to the extent only that it secures obligations under the credit contract or related guarantee.

(3) The regulations may exclude, from the application of all or any provisions of this Code, a mortgage of a class specified in the regulations.

8 Guarantees to which this Code applies

(1) This Code applies to a guarantee if:

(a) it guarantees obligations under a credit contract; and

(b) the guarantor is a natural person or a strata corporation.

(2) If any such guarantee also guarantees other obligations, this Code applies to the guarantee to the extent only that it guarantees obligations under the credit contract.

(3) The regulations may exclude, from the application of all or any provisions of this Code, a guarantee of a class specified in the regulations.

9 Goods leases with option to purchase to be regarded as sale by instalments

(1) For the purposes of this Code, a contract for the hire of goods under which the hirer has a right or obligation to purchase the goods, is to be regarded as a sale of the goods by instalments if the charge that is or may be made for hiring the goods, together with any other amount payable under the contract (including an amount to purchase the goods or to exercise an option to do so) exceeds the cash price of the goods.

Note: A contract includes a series of contracts, or contracts and arrangements (see Part 13).

(2) A debt is to be regarded as having been incurred, and credit provided, in such circumstances.

(3) Accordingly, if because of subsection 5(1) the contract is a credit contract, this Code (including Part 6) applies as if the contract had always been a sale of goods by instalments, and for that purpose:

(a) the amounts payable under the contract are the instalments; and

(b) the credit provider is the person who is to receive those payments; and

(c) the debtor is the person who is to make those payments; and

(d) the property of the supplier in the goods passes under the contract to the person to whom the goods are hired on delivery of the goods or the making of the contract, whichever occurs last; and

(e) the charge for providing the credit is the amount by which the charge that is or may be made for hiring the goods, together with any other amount payable under the contract (including an amount to purchase the goods or to exercise an option to do so), exceeds the cash price of the goods; and

(f) a mortgage containing the terms and conditions set out in the regulations is taken to have been entered into in writing between the person to whom the goods are hired under the contract and the supplier as security for payment to the supplier of the amount payable to the supplier by the person to whom the goods are hired under the contract; and

(g) any provision in the contract for hiring by virtue of which the supplier is empowered to take possession, or dispose, of the goods to which the contract relates is void.

(4) For the purposes of this section, the amount payable under the contract includes any agreed or residual value of the goods at the end of the hire period or on termination of the contract, but does not include the following amounts:

(a) any amount payable in respect of services that are incidental to the hire of goods under the contract;

(b) any amount that ceases to be payable on the termination of the contract following the exercise of a right of cancellation by the hirer at the earliest opportunity.

Note: Part 11 (Consumer leases) applies to the contracts specified in that Part for the hire of goods under which the hirer does not have a right or obligation to purchase the goods.

10 Deciding application of Code to particular contracts for the sale of land by instalments

(1) This section applies to an executory contract for the sale of land if:

(a) under the contract, the purchaser:

(i) is entitled to enter into possession of the land before becoming entitled to receive a conveyance or transfer of the land; and

(ii) is bound to make a payment or payments (other than a deposit or rent payment) to, or in accordance with the instructions of, the vendor without becoming entitled to receive a conveyance or transfer of the land in exchange for the payment or payments; and

(b) the amount payable to purchase the land under the contract exceeds the cash price of the land.

Note: Cash price is defined in Part 13 in terms of goods or services. Services is defined in Part 13 to include rights in relation to, and interests in, real property.

(2) For the purpose of deciding whether the contract is a credit contract and, if it is a credit contract, of applying this Code (including Part 6) to it:

(a) a debt is to be regarded as having been incurred, and credit provided, in the circumstances mentioned in subsection (1); and

(b) the debtor is the purchaser under the contract; and

(c) the credit provider is the vendor under the contract; and

(d) the charge for providing the credit is the amount by which the amount payable to purchase the land, together with any other amount payable under the contract other than outgoings for the land, exceeds the cash price of the land.

(3) This section does not affect the application of this Code to a contract that is, apart from this section, a credit contract.

(4) In this section:

"deposit" , in relation to a contract, means an amount:

(a) not exceeding 10% of the amount payable to purchase the land under the contract; and

(b) paid or payable in one or more amounts; and

(c) liable to be forfeited and retained by the vendor in the event of a breach of contract by the purchaser.

"outgoings" includes rates, water charges and house and contents insurance.

"rent payment" , under a contract, means a payment:

(a) made by the purchaser to the vendor in exchange for possession of the land before becoming entitled to receive a conveyance or transfer of the land; and

(b) that is not deductible from the amount payable to purchase the land.

11 Deciding application of Code to particular contracts for the sale of goods by instalments

(1) This section applies to a contract for the sale of goods if the amount payable to purchase the goods under the contract:

(a) is payable by instalments; and

(b) exceeds the cash price of the goods.

(2) This section does not apply to a contract for the hire of goods even if the hirer has a right or obligation to purchase the goods.

(3) For the purpose of deciding whether the contract is a credit contract and, if it is a credit contract, of applying this Code (including Part 6) to it:

(a) a debt is to be regarded as having been incurred, and credit provided, in the circumstances mentioned in subsection (1); and

(b) the debtor is the person who is to make the payments; and

(c) the credit provider is the person who is to receive the payments; and

(d) the charge for providing the credit is the amount by which the amount payable to purchase the goods, together with any other amount payable under the contract, exceeds the cash price of the goods.

(4) This section does not affect the application of this Code to a contract that is, apart from this section, a credit contract.

(1) For the purpose of this section, a contract is a related contract to a contract for the sale of goods (the goods contract ) if:

(a) the sale of goods is financed, wholly or partly, by the provision of credit under the contract; and

(b) the credit provider under the contract is:

(i) the supplier of goods under the goods contract; or

(ii) a related body corporate within the meaning of the Corporations Act 2001 of the supplier of the goods under the goods contract; and

(c) the amount payable under the contract is payable by instalments.

(2) For the purpose of deciding whether a related contract to a goods contract is a credit contract and, if it is a credit contract, of applying this Code (including Part 6) to it, the charge for providing the credit is the amount by which the amount payable to purchase the goods, together with any other amount payable under the related contract, exceeds the cash price of the goods.

(3) This section does not affect the application of this Code to a contract that is, apart from this section, a credit contract.

13 Presumptions relating to application of Code

(1) In any proceedings (whether brought under this Code or not) in which a party claims that a credit contract, mortgage or guarantee is one to which this Code applies, it is presumed to be such unless the contrary is established.

(2) It is presumed for the purposes of this Code that credit is not provided or intended to be provided under a contract wholly or predominantly for any or all of the following purposes (a Code purpose ):

(a) for personal, domestic or household purposes;

(b) to purchase, renovate or improve residential property for investment purposes;

(c) to refinance credit that has been provided wholly or predominantly to purchase, renovate or improve residential property for investment purposes;

if the debtor declares, before entering the contract, that the credit is to be applied wholly or predominantly for a purpose that is not a Code purpose, unless the contrary is established.

(3) However, the declaration is ineffective if, when the declaration was made, the credit provider or a person (the prescribed person ) of a kind prescribed by the regulations:

(a) knew, or had reason to believe; or

(b) would have known, or had reason to believe, if the credit provider or prescribed person had made reasonable inquiries about the purpose for which the credit was provided, or intended to be provided, under the contract;

that the credit was in fact to be applied wholly or predominantly for a Code purpose.

(4) If the declaration is ineffective under subsection (3), paragraph 5(1)(b) is taken to be satisfied in relation to the contract.

(5) A declaration under this section is to be substantially in the form (if any) required by the regulations and is ineffective for the purposes of this section if it is not.

(6) A person commits an offence if:

(a) the person engages in conduct; and

(b) the conduct induces a debtor to make a declaration under this section that is false or misleading in a material particular; and

(c) the declaration is false or misleading in a material particular.

Criminal penalty: 2 years imprisonment.

(7) Strict liability applies to paragraph (6)(c).

Note: For strict liability, see section 6.1 of the Criminal Code .

(1) For the purposes of this Code, an arrangement is a reverse mortgage if the arrangement involves a credit contract, except a bridging finance contract, and a mortgage over a dwelling or land securing a debtor's obligations under the contract and either:

(a) the conditions in subsections (2) and (3) are met; or

(b) the arrangement is of a kind declared by ASIC under subsection (4) and is made on or after the commencement of that declaration.

Conditions

(2) The first condition is that the debtor's total liability under the credit contract or mortgage may exceed (to a limited or unlimited extent) the maximum amount of credit that may be provided under the contract without the debtor being obliged to reduce that liability to or below that maximum amount.

Note: The debtor's total liability can exceed the maximum amount of credit because interest and some other fees and charges are not included in an amount of credit: see subsection 3(2).

(3) The second condition is that, if the regulations prescribe any prerequisites for the arrangement to be a reverse mortgage, those prerequisites are met.

Declarations by ASIC

(4) ASIC may by legislative instrument declare specified kinds of arrangements involving a credit contract and a mortgage over a dwelling or land securing a debtor's obligations under the contract to be reverse mortgages.

Division 1 -- Negotiating and making credit contracts

14 Credit contract to be in form of written contract document

(1) A credit contract must be in the form of:

(a) a written contract document signed by the debtor and the credit provider; or

(b) a written contract document signed by the credit provider and constituting an offer to the debtor that is accepted by the debtor in accordance with the terms of the offer.

(2) An offer may be accepted by the debtor for the purposes of paragraph (1)(b):

(a) by the debtor or a person authorised by the debtor accessing or drawing down credit to incur a liability; or

(b) by any other act of the debtor or of any such authorised person that satisfies the conditions of the offer and constitutes an acceptance of the offer at law.

(3) The credit provider, or a person associated with the credit provider, may not be authorised by the debtor for the purposes of subsection (2). However, this subsection does not prevent the debtor authorising the credit provider to debit the debtor's account.

(4) In the case of a contract document consisting of more than one document, it is sufficient compliance with this section if one of the documents is duly signed and the other documents are referred to in the signed document.

(1) The regulations may authorise other ways of making a credit contract that do not involve a written document.

(2) In that case, the provisions of this Division apply with such modifications as are prescribed by the regulations.

(1) A credit provider must not enter into a credit contract unless the credit provider has given the debtor:

(a) a precontractual statement setting out the matters required by section 17 to be included in the contract document; and

(b) an information statement in the form required by the regulations of the debtor's statutory rights and statutory obligations.

(2) Those statements must be given:

(a) before the contract is entered into; or

(b) before the debtor makes an offer to enter into the contract;

whichever first occurs.

(3) Before entering into a credit contract, the credit provider may inform the debtor of the comparison rate. If the credit provider does so, the comparison rate must be calculated as prescribed by the regulations and be accompanied by the warnings set out in the regulations.

(4) The precontractual statement must contain the financial information specified by the regulations in the form prescribed by the regulations.

(5) The precontractual statement may be the proposed contract document or be a separate document or documents.

(6) A document forming part of a precontractual statement consisting of more than one document when the precontractual statement is first given must indicate that it does not contain all of the required precontractual information.

(7) A precontractual statement may be varied, within the time referred to in subsection (2), by written notice containing particulars of the variation given to the debtor.

Alternative ways of giving statements to debtors

(8) The regulations may specify ways in which a credit provider may give a document to a debtor for the purposes of this section (without limiting the ways in which the credit provider may give the document to the debtor).

Mandatory requirements relating to giving statements to debtors

(9) The regulations may specify:

(a) the way in which a credit provider must give a document to a debtor for the purposes of this section; or

(b) a way in which a credit provider must not give a document to a debtor for the purposes of this section; or

(c) other requirements relating to a credit provider giving a document to a debtor for the purposes of this section.

(10) The giving of a document by a credit provider to a debtor for the purposes of this section is to be disregarded if:

(a) the giving of the document is not in the way (if any) specified for the purposes of paragraph (9)(a); or

(b) the giving of the document is in a way (if any) specified for the purposes of paragraph (9)(b); or

(c) any requirements specified for the purposes of paragraph (9)(c) in relation to the giving of the document are not satisfied.

(11) To avoid doubt, subsections (9) and (10) have effect despite section 187 (electronic transactions and documents).

17 Matters that must be in contract document

(1) The contract document must contain the following matters.

Credit provider's name

(2) The contract document must contain the credit provider's name.

Amount of credit

(3) The contract document must contain:

(a) if the amount of credit to be provided is ascertainable:

(i) that amount; and

(ii) the persons, bodies or agents (including the credit provider) to whom it is to be paid and the amounts payable to each of them, but only if both the person, body or agent and the amount are ascertainable; and

(b) if the amount of the credit to be provided is not ascertainable--the maximum amount of credit agreed to be provided, or the credit limit under the contract, if any; and

(c) if the credit is provided by the supplier for a sale of land or goods by instalments--a description of the land and its cash price or of the goods and their cash price.

The requirement under paragraph (c) is in addition to, and does not limit, the requirement under paragraph (a) or (b).

Note: A penalty may be imposed for contravention of a key requirement in this subsection: see Part 6.

Annual percentage rate or rates

(4) In the case of a credit contract other than a small amount credit contract, the contract document must contain:

(a) the annual percentage rate or rates under the contract; and

(b) if there is more than one rate, how each rate applies; and

(c) if an annual percentage rate under the contract is determined by referring to a reference rate:

(i) the name of the rate or a description of it; and

(ii) the margin or margins (if any) above or below the reference rate to be applied to determine the annual percentage rate or rates; and

(iii) where and when the reference rate is published or, if it is not published, how the debtor may ascertain the rate; and

(iv) the current annual percentage rate or rates.

Note: A penalty may be imposed for contravention of a key requirement in this subsection: see Part 6.

Calculation of interest charges

(5) In the case of a credit contract other than a small amount credit contract, the contract document must contain the method of calculation of the interest charges payable under the contract and the frequency with which interest charges are to be debited under the contract.

Note: A penalty may be imposed for contravention of a key requirement in this subsection: see Part 6.

Total amount of interest charges payable

(6) In the case of a credit contract other than a small amount credit contract, the contract document must contain the total amount of interest charges payable under the contract, if ascertainable (but only if the contract would, on the assumptions under sections 180 and 182, be paid out within 7 years of the date on which credit is first provided under the contract).

Note: A penalty may be imposed for contravention of a key requirement in this subsection: see Part 6.

Repayments

(7) The contract document must contain:

(a) if more than one repayment is to be made:

(i) the amount of the repayments or the method of calculating the amount; and

(ii) if ascertainable, the number of the repayments; and

(iii) if ascertainable, the total amount of the repayments, but only if the contract would, on the assumptions under sections 180 and 182, be paid out within 7 years of the date on which credit is first provided under the contract; and

(iv) when the first repayment is to be paid, if ascertainable, and the frequency of payment of repayments; and

(b) if the contract provides for a minimum repayment, the amount of that repayment, if ascertainable, but, if not, the method of calculation of the minimum repayment.

Paragraph (a) does not apply to minimum repayments under a continuing credit contract.

Credit fees and charges

(8) The contract document must contain:

(a) a statement of the credit fees and charges that are, or may become, payable under the contract, and when each such fee or charge is payable, if ascertainable; and

(b) the amount of any such fee or charge if ascertainable, but, if not, the method of calculation of the fee or charge, if ascertainable; and

(c) the total amount of credit fees and charges payable under the contract to the extent that it is ascertainable.

Note: A penalty may be imposed for contravention of a key requirement in paragraph (a) or (b), but only in respect of retained credit fees and charges: see Part 6.

Changes affecting interest and credit fees and charges

(9) If the annual percentage rate or rates or the amount or frequency of payment of a credit fee or charge or instalment payable under the contract may be changed, or a new credit fee or charge may be imposed, the contract document must contain a statement or statements to that effect and of the means by which the debtor will be informed of the change or the new fee or charge.

Note: A penalty may be imposed for contravention of a key requirement in this subsection: see Part 6.

Statements of account

(10) The contract document must contain the frequency with which statements of account are to be provided to the debtor (except in the case of a credit contract for which the annual percentage rate is fixed for the whole term of the contract and under which there is no provision for varying the rate).

Default rate

(11) The contract document must contain:

(a) if the contract is a contract under which a default rate of interest may be charged when payments are in default--a statement to that effect and the default rate and how it is to be applied; and

(b) if the default rate under the contract is determined by referring to a reference rate:

(i) the name of the rate or a description of it; and

(ii) the margin or margins (if any) above or below the reference rate to be applied to determine the default rate; and

(iii) when and where the reference rate is published or, if it is not published, how the debtor may ascertain the rate; and

(iv) the current default rate.

Note: A penalty may be imposed for contravention of a key requirement in this subsection: see Part 6.

Enforcement expenses

(12) The contract document must contain a statement that enforcement expenses may become payable under the credit contract or mortgage (if any) in the event of a breach.

(13) The contract document must contain:

(a) if any mortgage or guarantee is to be or has been taken by the credit provider--a statement to that effect; and

(b) in the case of a mortgage--a description of the property subject to, or proposed to be subject to, the mortgage, to the extent to which it is ascertainable.

(14) If a commission is to be paid by or to the credit provider for the introduction of credit business or business financed by the contract, the contract document must contain:

(a) a statement of that fact; and

(b) the person by whom the commission is payable; and

(c) the person to whom the commission is payable; and

(d) the amount if ascertainable.

Commission does not include fees payable by a supplier under a merchant service agreement with a credit provider, an amount payable in connection with a credit - related insurance contract or commission paid to employees of the credit provider.

Insurance financed by contract

(15) If the credit provider knows that the debtor is to enter into a credit - related insurance contract and that the insurance is to be financed under the credit contract, the contract document must contain:

(a) the name of the insurer; and

(b) the amount payable to the insurer or, if it is not ascertainable, how it is calculated; and

(c) the kind of insurance and any other particulars that may be prescribed by the regulations; and

(d) if the credit provider knows of any commission to be paid by the insurer for the introduction of the insurance business--a statement that it is to be paid and, if ascertainable, the amount of the commission expressed either as a monetary amount or as a proportion of the premium.

In the case of consumer credit insurance that includes a contract of general insurance within the meaning of the Insurance Contracts Act 1984 :

(e) it is sufficient compliance with paragraphs (a) and (b) if the contract document contains the name of the general insurer and the total amount payable to the insurers (or, if it is not ascertainable, how it is calculated); and

(f) it is sufficient compliance with paragraph (d) relating to the amount of commission if the contract document contains the total amount of commission (expressed as a monetary amount or as a proportion of the premium) to be paid by the insurers.

Note: A penalty may be imposed for contravention of a key requirement in paragraph (a) or (b): see Part 6.

Provisions for person other than debtor to occupy reverse mortgaged property

(15A) If the credit contract for a reverse mortgage is to make provision for a person other than the debtor to occupy the reverse mortgaged property, the contract document must contain provisions that have the following effect (whether or not the document also contains other provisions relating to such occupation by such a person):

(a) the debtor may at any time (before, when or after the contract is made):

(i) nominate to the credit provider a person who is to be allowed to occupy the property (whether alone or with other persons); and

(ii) revoke such a nomination by notice given to the credit provider;

(b) while a nomination described in paragraph (a) is in force, the nominated person has the same rights (against the credit provider) to occupy the property as the debtor has or would have apart from the death of the debtor or vacation of the property by the debtor.

Note: Other provisions contained in the contract document may, for example, limit the kinds of persons whom the debtor may nominate to the credit provider as persons who are to be allowed to occupy the property.

Other information

(16) The contract document must contain any information or warning required by the regulations.

Note: Sections 180 to 182 set out the tolerances and assumptions applicable to matters required to be disclosed.

18 Form and expression of contract document

The contract document must conform to the requirements of the regulations as to its form and the way it is expressed and, subject to any such requirements, may consist of one or more separate documents.

18A Provisions that must not be included in credit contract for reverse mortgage

(1) A credit provider must not enter into a credit contract for a reverse mortgage that provides a basis for beginning enforcement proceedings relating to the contract for an event described in subsection (3).

(2) A credit provider must not agree to change, or unilaterally change, a credit contract for a reverse mortgage so that it provides a basis for beginning enforcement proceedings relating to the contract for an event described in subsection (3).

(3) For the purposes of subsections (1) and (2), the events are as follows:

(a) the debtor failing to inform the credit provider that another person occupies the reverse mortgaged property;

(b) the debtor failing, when the debtor occupies the reverse mortgaged property, to give the credit provider evidence that the debtor, or another person nominated by the debtor to the credit provider, occupies or occupied the reverse mortgaged property;

(c) the debtor leaving the reverse mortgaged property unoccupied while it is the debtor's principal place of residence;

(d) the debtor failing to pay a cost to a person other than the credit provider within 3 years after the payment became due;

(e) the debtor failing to comply with a provision of the credit contract if the contract does not make it clear how the debtor is to comply with the provision;

(f) the debtor breaching another credit contract with the credit provider;

(g) an event that involves an act or omission by the debtor and is prescribed by the regulations.

18B Disclosure if credit contract for reverse mortgage does not protect tenancy of person other than debtor

(1) This section applies if a proposed credit contract for a reverse mortgage does not include a provision (a tenancy protection provision ) for a person other than the debtor to have a right against the credit provider to occupy the reverse mortgaged property.

(2) A person must not provide a credit service relating to the contract unless the person has told the debtor, in writing in the form (if any) prescribed by the regulations, that the contract does not include a tenancy protection provision.

Criminal penalty: 50 penalty units.

(3) Subsection (2) does not apply if the person is or will be the credit provider under the contract.

(4) The credit provider must not enter into the contract unless the credit provider has told the debtor, in writing in the form (if any) prescribed by the regulations, that the contract does not include a tenancy protection provision.

Criminal penalty: 50 penalty units.

(5) An offence against subsection (2) or (4) is an offence of strict liability.

Note: For strict liability, see section 6.1 of the Criminal Code .

18C Independent legal advice before entry into credit contract for reverse mortgage

(1) The regulations may regulate or prohibit the entry by a credit provider into a credit contract for a reverse mortgage if the debtor has not obtained legal advice, in accordance with the regulations, about the contract or reverse mortgage.

(2) The regulations may provide for offences and civil penalties for contraventions of regulations made for the purposes of subsection (1).

(3) The penalties for offences described in subsection (2) must not be more than 50 penalty units for an individual or 500 penalty units for a body corporate.

(4) The civil penalty for a contravention of a regulation made for the purposes of subsection (1) by an individual is 5,000 penalty units. However, section 167B of the National Credit Act applies in the same way as it would apply if the regulation contravened were a civil penalty provision under that Act.

19 Alteration of contract document

(1) An alteration of (including an addition to) a new contract document by the credit provider after it is signed by the debtor is ineffective unless the debtor has agreed in writing to the alteration.

(2) This section does not apply to an alteration having the effect of reducing the debtor's liabilities under the credit contract.

20 Copy of contract for debtor

(1) If a contract document is to be signed by the debtor and returned to the credit provider, the credit provider must give the debtor a copy to keep.

(2) A credit provider must, not later than 14 days after a credit contract is made, give a copy of the contract in the form in which it was made to the debtor.

(3) Subsection (2) does not apply if the credit provider has previously given the debtor a copy of the contract document to keep.

21 When debtor may terminate contract

(1) Although a credit contract has been made, the debtor may nevertheless, by written notice to the credit provider, terminate the contract unless:

(a) any credit has been obtained under the contract; or

(b) a card or other means of obtaining credit provided to the debtor by the credit provider has been used to acquire goods or services for which credit is to be advanced under the contract.

(2) Nothing in this section prevents the credit provider from retaining or requiring payment of fees or charges incurred before the termination and which would have been payable under the credit contract.

(1) A credit provider must not:

(a) enter into a credit contract that contravenes a requirement of this Division; or

(b) otherwise contravene a requirement of this Division.

Criminal penalty: 100 penalty units.

(2) Subsection (1) is an offence of strict liability.

Note: For strict liability, see section 6.1 of the Criminal Code .

(3) Subsection (1) does not apply to a contravention of a requirement of section 18B.

Division 2 -- Debtor's monetary obligations

23 Prohibited monetary obligations--general

(1) A credit contract (other than a small amount credit contract) must not impose a monetary liability on the debtor:

(a) in respect of a credit fee or charge prohibited by this Code; or

(b) in respect of an amount of a fee or charge exceeding the amount that may be charged consistently with this Code; or

(c) in respect of an interest charge under the contract exceeding the amount that may be charged consistently with this Code.

Note 1: A penalty may be imposed for contravention of a key requirement in this subsection, but only at the time the credit contract is entered into: see Part 6.

Note 2: This subsection also applies to liabilities imposed contrary to section 133BI of the National Credit Act: see subsection (7) of that section.

Civil effect

(2) Any provision of a credit contract that imposes a monetary liability prohibited by subsection (1) is void to the extent that it does so. If an amount that is prohibited by subsection (1) is paid, it may be recovered.

(3) A credit fee or charge cannot be charged in respect of a credit contract unless the contract authorises it to be charged.

Civil effect

(4) If an amount that is prohibited by subsection (3) is paid, it may be recovered.

23A Prohibited monetary obligations--small amount credit contracts

(1) A small amount credit contract must not impose a monetary liability on the debtor:

(a) in respect of an interest charge (including a default rate of interest) under the contract; or

(b) in respect of a fee or charge prohibited by this Code; or

(c) in respect of an amount of a fee or charge exceeding the amount that may be charged consistently with this Code.

(2) If a provision of a small amount credit contract imposes a monetary liability prohibited by subsection (1) then:

(a) each provision (the void provisions ) of the contract that imposes a monetary liability of a kind referred to in that subsection (whether or not the liability is imposed consistently with this Code) is void to the extent that the provision relates to the liability; and

(b) the debtor may recover as a debt due to the debtor any amount paid to the credit provider under the void provisions to the extent that the amount relates to the liability.

24 Offences related to prohibited monetary obligations--credit providers

(1) A credit provider must not:

(a) enter into a credit contract on terms imposing a monetary liability prohibited by subsection 23(1); or

(b) require or accept payment of an amount in respect of a monetary liability that cannot be imposed consistently with this Code.

Civil penalty: 5,000 penalty units.

(1A) A credit provider must not:

(a) enter into a small amount credit contract on terms imposing a monetary liability prohibited by subsection 23A(1); or

(b) require or accept payment of an amount in respect of a monetary liability that cannot be imposed consistently with this Code.

Civil penalty: 5,000 penalty units.

Offence

(2) A person commits an offence of strict liability if:

(a) the person is subject to a requirement under subsection (1) or (1A); and

(b) the person engages in conduct; and

(c) the conduct contravenes the requirement.

Criminal penalty: 100 penalty units.

24A Offences related to prohibited monetary obligations--credit assistance providers

(1) A person must not provide credit assistance to a consumer by:

(a) suggesting that the consumer apply for a particular small amount credit contract with a particular credit provider; or

(b) assisting the consumer to apply for a particular small amount credit contract with a particular credit provider;

if the person knows, or is reckless as to whether, the contract will contravene subsection 23A(1).

Criminal penalty: 50 penalty units.

(2) If a person provides credit assistance to a consumer that is prohibited by subsection (1):

(a) the consumer is not liable (and is taken never to have been liable) to pay any fees or charges to the person in relation to:

(i) the credit assistance; or

(ii) any other services provided by the person in connection with the credit assistance; and

(b) the consumer may recover as a debt due to the consumer the amount of any such fees or charges paid by the consumer to the person.

25 Loan to be in money or equivalent

(1) A credit provider must not under a credit contract pay an amount to or in accordance with the instructions of the debtor unless the payment is in cash or money's worth and is made in full without deducting an amount for interest charges under the contract.

Criminal penalty: 100 penalty units.

(2) Subsection (1) is an offence of strict liability.

Note: For strict liability, see section 6.1 of the Criminal Code .

(3) The regulations may provide that subsection (1) does not apply to the deduction of an amount for the first payment of interest charges under the contract.

26 Early payments and crediting of payments

(1) A credit provider must accept any payment under a credit contract that is made before it is payable under the contract unless the contract prohibits its early payment.

Criminal penalty: 100 penalty units.

(2) A credit provider must credit each payment made under a credit contract to the debtor as soon as practicable after receipt of the payment.

Criminal penalty: 100 penalty units.

(3) Subsections (1) and (2) are offences of strict liability.

Note: For strict liability, see section 6.1 of the Criminal Code .

(4) Despite subsection (2), a credit provider is not required to credit a payment under a credit contract before it is payable under the contract if the contract prohibits its early payment and:

(a) the credit provider informs the debtor, as soon as practicable after the credit provider becomes aware of the payment, that it will not be credited to the debtor (or that any credit will be reversed) until it becomes payable under the contract, and the debtor elects to leave the payment with the credit provider; or

(b) the credit provider informs the debtor, before accepting the payment, that it will not be credited to the debtor until it becomes payable under the contract; or

(c) the credit provider refunds the payment to the debtor.

(5) A credit contract may not, under this section, prohibit the paying out of the contract at any time under section 82.

(6) A credit contract for a reverse mortgage may not prohibit an early payment that:

(a) is made in the circumstances described in paragraph 86A(1)(a); and

(b) is of the amount described in paragraph 86A(1)(b).

26A Regulations about residential investment property

The regulations may provide that section 25 or 26 applies in relation to a provision of credit covered by subparagraph 5(1)(b)(ii) or (iii) as if specified provisions were omitted, modified or varied as specified in the regulations.

Division 3 -- Interest charges

27 Definitions relating to interest

(1) In this Code:

"annual percentage rate" under a credit contract means a rate specified in the contract as an annual percentage rate.

"daily percentage rate" means the rate determined by dividing the annual percentage rate by 365.

"default rate" means a higher annual percentage rate permitted by section 30.

"unpaid balance" under a credit contract at any time means the difference between all amounts credited and all amounts debited to the debtor under the contract at that time.

"unpaid daily balance" for a day under a credit contract means the unpaid balance under the contract at the end of that day.

(2) A credit contract may specify, for the purposes of payments or any other purposes under the contract, when a day ends. Different times of the day may be specified for different purposes.

27A Application of this Division

This Division does not apply to a small amount credit contract.

(1) The maximum amount of an interest charge that may be imposed or provided for under a credit contract is:

(a) where only one annual percentage rate applies to the unpaid balances under the contract--the amount determined by applying the daily percentage rate to the unpaid daily balances; or

(b) in any other case--the sum of each of the amounts determined by applying each daily percentage rate to that part of the unpaid daily balances to which it applies under the contract.

(2) However, an interest charge under a credit contract for a month, a quarter or half a year may be determined by applying the annual percentage rate or rates, divided by 12 (for a month), by 4 (for a quarter) or by 2 (for half a year), to the whole or that part of the average unpaid daily balances to which it applies. The regulations may provide for the calculation of unpaid daily balances in these circumstances.

(3) This section does not prevent the imposition of a default rate of interest permitted by section 30.

29 Early debit or payment of interest charges prohibited

(1) A credit provider must not, at any time before the end of a day to which an interest charge applies, require payment of or debit the interest charge.

(2) A credit contract may provide for an interest charge to become payable or be debited at any time after the day to which it applies.

(3) The regulations may provide that subsection (1) does not apply to the first payment of interest charges under a credit contract.

(4) This section does not apply to the debit of an interest charge under a credit contract before the end of the period to which the charge applies if:

(a) the charge is debited on the last day of the period; and

(b) the amount debited is not treated by the credit provider as part of the unpaid daily balance for that day for the purpose of calculating interest charges under the contract.

(1) A credit contract may not provide that an annual percentage rate applicable under a credit contract to any part of the unpaid balance will differ according to whether the debtor is in default under the contract.

(2) However, a credit contract may provide for such a differential rate if the higher rate is imposed only in the event of default in payment, in respect of the amount in default and while the default continues.

30A Regulations about residential investment property

The regulations may provide that this Division applies in relation to a provision of credit covered by subparagraph 5(1)(b)(ii) or (iii) as if specified provisions were omitted, modified or varied as specified in the regulations.

30B Regulations about credit card contracts

(1) The regulations may make provision in relation to any of the following matters relating to interest charges under credit card contracts:

(a) the day from which a daily percentage rate may be applied, and the balance (or the part of a balance) to which it may be applied;

(b) how matters relating to interest charges may be described in:

(i) credit card contracts; and

(ii) other documents or advertisements published or broadcast by or on behalf of licensees who are credit providers under credit card contracts.

(2) Regulations made for the purpose of subsection (1) may:

(a) provide for offences against the regulations; and

(b) provide for civil penalties for contraventions of the regulations.

(3) The penalties for offences referred to in paragraph (2)(a) must not be more than 50 penalty units for an individual or 500 penalty units for a body corporate.

(4) The civil penalty for a contravention of a regulation made for the purposes of subsection (1) by an individual is 5,000 penalty units. However, section 167B of the National Credit Act applies in the same way as it would apply if the regulation contravened were a civil penalty provision under that Act.

(5) This Division has effect subject to regulations made for the purpose of subsection (1).

Division 4 -- Fees and charges

31 Prohibited credit fees or charges

(1) The regulations may specify credit fees or charges or classes of credit fees or charges that are prohibited for the purposes of this Code.

(2) Subsection (1) does not apply to a small amount credit contract.

31A Restrictions on fees and charges for small amount credit contracts

(1) A small amount credit contract must not impose or provide for fees and charges if the fees and charges are not of the following kind:

(a) a permitted establishment fee;

(b) a fee or charge (a permitted monthly fee ) that is payable on a monthly basis starting on the day the contract is entered into;

(c) a fee or charge that is payable in the event of a default in payment under the contract;

(d) a government fee, charge or duty payable in relation to the contract.

Note: See section 39B for the maximum amount that may be recovered by the credit provider if there is a default in payment under the contract.

(1A) Despite subsection (1), a small amount credit contract must not impose or provide for a permitted establishment fee if any of the amount of credit to be provided under the contract is to refinance any of the amount of credit provided to the debtor under another small amount credit contract.

Permitted establishment fee

(2) A permitted establishment fee is a fee or charge the amount of which must not exceed 20% of the adjusted credit amount in relation to the small amount credit contract.

Maximum amount of permitted monthly fee

(3) The amount of a permitted monthly fee that may be imposed or provided for under a small amount credit contract must not exceed 4% of the adjusted credit amount in relation to the contract.

31B Credit provider or prescribed person must not require or accept payment of a fee or charge in relation to a small amount credit contract etc.

(1) A credit provider, or a person prescribed by the regulations, must not require or accept payment by the debtor of a fee or charge in relation to:

(a) a small amount credit contract; or

(b) the provision of the amount of credit under a small amount credit contract; or

(c) a thing that is connected with a small amount credit contract or the provision of the amount of credit under such a contract.

Criminal penalty: 100 penalty units.

(2) Subsection (1) does not apply if the fee or charge is:

(a) a fee or charge that may be imposed or provided for by the small amount credit contract under section 31A; or

(b) a fee or charge prescribed by the regulations.

(3) If a credit provider or person contravenes subsection (1):

(a) the debtor is not liable (and is taken never to have been liable) to make the payment to the credit provider or person; and

(b) the debtor may recover as a debt due to the debtor the amount of any payment made by the debtor to the credit provider or person.

31C Prohibition on unexpired monthly fees in relation to small amount credit contracts

Requirement

(1) A credit provider must not require or accept payment by the debtor under a small amount credit contract of an unexpired monthly fee.

Note: A penalty may be imposed for contravention of a key requirement in this subsection: see Part 6.

(2) An unexpired monthly fee in relation to a small amount credit contract is each permitted monthly fee that is in respect of a month that commences after the date on which the contract is paid out.

(3) If a credit provider contravenes subsection (1) in relation to a small amount credit contract:

(a) the debtor is not liable (and is taken never to have been liable) to make the payment of the unexpired monthly fee to the credit provider; and

(b) the debtor may recover as a debt due to the debtor the amount of any payment of the unexpired monthly fee made by the debtor to the credit provider.

Offence

(4) A person commits an offence if:

(a) the person is subject to a requirement under subsection (1); and

(b) the person engages in conduct; and

(c) the conduct contravenes the requirement.

Criminal penalty: 100 penalty units.

Strict liability offence

(5) A person commits an offence if:

(a) the person is subject to a requirement under subsection (1); and

(b) the person engages in conduct; and

(c) the conduct contravenes the requirement.

Criminal penalty: 10 penalty units.

(6) Subsection (5) is an offence of strict liability.

32 Fees or charges in relation to third parties

When this section applies

(1) This section applies if a fee or charge is payable by a debtor to the credit provider for an amount (the third party amount ) payable or paid by the credit provider to another person, body or agency.

Third party amount ascertainable at time of debtor payment

(2) If, when the fee or charge is paid by the debtor to the credit provider, the third party amount is ascertainable, then the amount of the fee or charge must not exceed the third party amount.

Third party amount not ascertainable at time of debtor payment

(3) If:

(a) when the fee or charge is paid by the debtor to the credit provider, the third party amount is not ascertainable; and

(b) after the fee or charge is paid, the credit provider ascertains the third party amount; and

(c) the third party amount is less than the amount of the fee or charge paid;

then the credit provider must refund or credit the difference to the debtor.

Determining third party amount

(4) The third party amount is to be determined by:

(a) taking into account any discount, rebate or other allowance that is received or receivable by the credit provider or a related body corporate (within the meaning of the Corporations Act 2001 ); and

(b) disregarding any rebate on tax payable by the credit provider or a related body corporate (within the meaning of that Act).

Division 4A -- Annual cost rate of certain credit contracts

32A Prohibitions relating to credit contracts if the annual cost rate exceeds 48%

Entering into a credit contract

(1) A credit provider must not enter into a credit contract if the annual cost rate of the contract exceeds 48%.

Criminal penalty: 50 penalty units.

Provision of credit assistance

(2) A person must not provide credit assistance to a consumer by suggesting that the consumer apply, or assisting the consumer to apply, for a particular credit contract with a particular credit provider if the person knows, or is reckless as to whether, the annual cost rate of the contract exceeds 48%.

Criminal penalty: 50 penalty units.

(3) If a person provides credit assistance to a consumer that is prohibited by subsection (2):

(a) the consumer is not liable (and is taken never to have been liable) to pay any fees or charges to the person in relation to:

(i) the credit assistance; or

(ii) any other services provided by the person in connection with the credit assistance; and

(b) the consumer may recover as a debt due to the consumer the amount of any such fees or charges paid by the consumer to the person.

Application

(4) This section does not apply if:

(a) the credit provider is an ADI; or

(b) the credit contract is a small amount credit contract or bridging finance contract.

32AA Prohibition relating to the annual cost rate of credit contracts--later increases of the annual percentage rate etc.

(1) If:

(a) a credit provider is a party to a credit contract (other than a small amount credit contract or bridging finance contract); and

(b) the credit provider is not an ADI; and

(c) either or both of the following things (the varied matters ) occur after the contract is entered into:

(i) the annual percentage rate under the contract increases;

(ii) an amount referred to in subsection 32B(3) that is prescribed by the regulations increases;

the credit provider contravenes this subsection if the annual cost rate of the contract would have exceeded 48% at the time the contract was entered into if that or those varied matters had been taken into account at that time for the purposes of calculating the annual cost rate of the contract.

(2) A credit provider must not contravene subsection (1).

Criminal penalty: 50 penalty units.

32B Calculation of annual cost rate

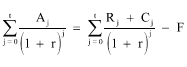

(1) The annual cost rate of a credit contract must be calculated as a nominal rate per annum, together with the compounding frequency, using the formula:

![]()

where:

"n" is the number of repayments per annum to be made under the credit contract (annualised if the term of the contract is less than 12 months), except that:

(a) if repayments are to be made weekly-- n is 52.18; and

(b) if repayments are to be made fortnightly-- n is 26.09; and

(c) if the contract does not provide for a constant interval between repayments-- n is to be derived from the interval selected for the purposes of the definition of j in subsection (2).

"r" is the solution of the equation specified in subsection (2).

(2) The equation for the purposes of the definition of r in subsection (1) is:

where:

"A" j is the amount of credit to be provided under the credit contract at time j (the value of j for the provision of the first amount of credit is taken to be zero).

"C" j is the credit cost amount (if any) for the credit contract that is payable by the debtor at time j in addition to the repayments R j .

"F" is:

(a) if the credit contract is a medium amount credit contract--$400 (or such other amount as is prescribed by the regulations); or

(b) if the credit contract is not a medium amount credit contract and an amount is prescribed by the regulations in relation to the contract--that amount; or

(c) otherwise--$0.

"j" is the time, measured as a multiple (not necessarily integral) of:

(a) if the credit contract does not provide for a constant interval between contractual repayments--an interval of any kind selected by the credit provider as the unit of time; or

(b) otherwise--the interval between contractual repayments that will have elapsed since the first amount of credit is provided under the credit contract.

"R" j is the repayment to be made at time j .

"t" is the time, measured as a multiple of the interval between contractual repayments (or other interval so selected), that will elapse between:

(a) the time when the first amount of credit is provided under the credit contract; and

(b) the time when the last repayment is to be made under the contract.

Credit cost amount

(3) The credit cost amount for the credit contract is the sum of the following amounts if they are ascertainable:

(a) the amount of credit fees and charges payable in relation to the contract;

(b) the amount of a fee or charge payable by the debtor (whether or not payable under the contract) to:

(i) any person (whether or not associated with the credit provider) for an introduction to the credit provider; or

(ii) any person (whether or not associated with the credit provider) for any service if the person has been introduced to the debtor by the credit provider; or

(iii) the credit provider for any service relating to the provision of credit, other than a service referred to in subparagraph (ii);

(c) any other amount prescribed by the regulations.

(4) For the purposes of subsection (3), the amounts referred to in that subsection:

(a) include an amount that is payable even if the credit is not provided; but

(b) do not include an amount of a government fee, charge or duty payable in relation to the credit contract.

(4A) Despite subsection (3), the regulations may provide that a specified amount, or an amount included in a specified class, is not an amount referred to in paragraph (3)(a) or (b).

Tolerances and assumptions etc.

(5) The annual cost rate must be correct to at least the nearest one hundredth of 1% per annum.

(6) In calculating the annual cost rate, reasonable approximations may be made if it would be impractical or unreasonably onerous to make a precise calculation.

Example: If repayments are to be made on a fixed day each month, it may be assumed that repayments will be made on that day each month even though the credit contract provides for payment on the preceding or succeeding business day when the due date is not a business day.

(7) The tolerances and assumptions under sections 180 to 182 apply to the calculation of the annual cost rate .

(8) If the credit contract is a continuing credit contract, the following assumptions also apply to the calculation of the annual cost rate of the contract:

(a) that the debtor has drawn down the maximum amount of credit that the credit provider has agreed to provide under the contract;

(b) that the debtor will pay the minimum repayments specified in the contract;

(c) if credit is provided in respect of payment by the credit provider to a third person in relation to goods or services or cash supplied by that third person to the debtor from time to time--that the debtor will not be supplied with any further goods or services or cash;

(d) if credit is provided in respect of cash supplied by the credit provider to the debtor from time to time--that the debtor will not be supplied with any further cash.

Division 5 -- Credit provider's obligation to account

(1) A credit provider that provides credit must give to the debtor, or arrange for the debtor to be given, periodic statements of account in accordance with this Division.

Criminal penalty: 100 penalty units.

(2) The maximum period for a statement of account is:

(a) in the case of a credit card contract--40 days; or

(aa) in the case of a continuing credit contract for a reverse mortgage--12 months; or

(b) in the case of any other continuing credit contract--40 days or such longer period, not exceeding 3 months, as is agreed by the credit provider and the debtor; or

(ba) in the case of a reverse mortgage not involving a continuing credit contract--12 months; or

(c) in any other case--6 months.

(3) A statement of account need not be given if:

(a) the credit is provided under a credit contract for which the annual percentage rate is fixed for the whole term of the contract and under which there is no provision for varying the rate; or

(b) no amount has been debited or credited to the account during the statement period (other than debits for government charges, or duties, on receipts or withdrawals) and the amount outstanding is zero or below a level fixed by the regulations; or

(c) the credit provider wrote off the debt of the debtor under the credit contract during the statement period and no further amount has been debited or credited to the account during the statement period; or

(d) the debtor was in default under the credit contract (not being a continuing credit contract) during the statement period and the credit provider has commenced enforcement proceedings; or

(e) the debtor was in default under a continuing credit contract during the preceding 120 days, or during the statement period and the 2 immediately preceding statement periods, whichever is the shorter time, and the credit provider has, before the commencement of the statement period, exercised a right not to provide further credit under the contract and has not provided further credit during the period; or

(f) the debtor has died or is insolvent and the debtor's personal representative or trustee in bankruptcy has not requested a statement of account.

(4) A separate statement of account may, but need not, be given in respect of each or any number of the credit facilities provided under a credit contract.

(5) Subsection (1) is an offence of strict liability.

Note: For strict liability, see section 6.1 of the Criminal Code .

34 Information to be contained in statements of account

(1) A statement of account must contain the following matters.

Statement period

(2) A statement of account must contain the dates on which the statement period begins and ends.

Balances

(3) A statement of account must contain the opening and closing balances (indicating the amount owed by the debtor at the beginning and at the end of the statement period).

Credit provided

(4) A statement of account must contain particulars of each amount of credit provided by the credit provider to the debtor during the statement period.

Identity of supplier

(5) In the case of a credit card contract, a statement of account must contain the identity of the supplier if the credit was provided for any cash, goods or services supplied by another person.

Interest charges

(6) In the case of a credit contract other than a small amount credit contract, a statement of account must contain:

(a) the amount of the interest charge debited to the debtor's account during the statement period and when the interest was debited; and

(b) the annual percentage rate or rates and, if required by Part 4, details of any change since the last statement period.

Note: A penalty may be imposed for contravention of a key requirement in this subsection: see Part 6.

Fees and charges

(7) A statement of account must contain particulars of any fees and charges debited to the debtor's account during the statement period.

Payments to or from account

(8) A statement of account must contain:

(a) particulars of each amount paid by the debtor to the credit provider, or credited to the debtor, during the statement period; and

(b) particulars of any amount transferred to or from the account to which the statement relates or to or from any other account maintained under or for the purposes of the credit contract.

Amounts payable by debtor

(9) If a minimum amount is payable by the debtor under a continuing credit contract, a statement of account must contain a statement of the amount and the date by which it is due.

Insurance payments

(10) If payment to an insurer is made during the statement period under a credit - related insurance contract that is agreed to be financed under the credit contract, a statement of account must contain:

(a) the name of the insurer, the amount paid to the insurer and the kind of insurance; and

(b) if the credit provider is aware of any commission to be paid by the insurer in relation to the insurance contract--the amount of the commission expressed either as a monetary amount or as a proportion of the premium, if ascertainable when the statement is given;

(if not previously disclosed in accordance with this Code).

In the case of consumer credit insurance that includes a contract of general insurance within the meaning of the Insurance Contracts Act 1984 :

(c) it is sufficient compliance with paragraph (a) if the statement of account contains the name of the general insurer, the total amount payable to the insurers and the kind of insurance; and

(d) it is sufficient compliance with paragraph (b) if the statement of account contains the total amount of commission (expressed as a monetary amount or as a proportion of the premium) to be paid by the insurers.

Alterations

(11) A statement of account must contain any correction of information in a previous statement of account.

Other

(12) A statement of account must contain any other information required by the regulations.

Note: Sections 180 to 182 set out the tolerances and assumptions applicable to matters required to be included in statements of accounts.

35 Opening balance must not exceed closing balance of previous statement

(1) The opening balance shown in each successive statement of account must not exceed the closing balance shown in the last statement of account.

Note: A penalty may be imposed for contravention of a key requirement in this section: see Part 6.

(2) However, if no statement of account was given for the previous period, the next statement of account required to be given by this Code may have an opening balance that exceeds the closing balance for the previous statement and must provide the particulars referred to in subsections 34(4) to (12) in relation to any immediately preceding periods for which statements were not given.

36 Statement of amount owing and other matters

(1) A credit provider must, at the request of a debtor or guarantor and within the time specified by this section, provide a statement of all or any of the following:

(a) the current balance of the debtor's account;

(b) any amounts credited or debited during a period specified in the request;

(c) any amounts currently overdue and the dates they became due;

(d) any amount currently payable and the date it becomes due.

Criminal penalty: 100 penalty units.

(2) The statement must be given:

(a) within 14 days, if all information requested relates to a period 1 year or less before the request is given; or

(b) within 30 days, if any information requested relates to a period more than 1 year before the request is given.

(3) A statement under this section may be given orally but if the request for the statement is made in writing the statement must be given in writing.

(4) In the case of joint debtors or guarantors, the statement under this section need only be given to a debtor or guarantor who requests the statement and not, despite section 194, to each joint debtor or guarantor.

(5) A credit provider is not required to provide a further written statement under this section if it has, within the 3 months before the request is given, given such a statement to the person requesting it.

(6) Except where otherwise ordered by the court on the application of the debtor or guarantor, a credit provider is not required to provide information in a statement under this section about amounts credited or debited, or which were overdue or payable, more than 7 years before the request is given unless those amounts are currently overdue and payable.

(7) Subsection (1) is an offence of strict liability.

Note: For strict liability, see section 6.1 of the Criminal Code .

37 Court may order statement to be provided

If a statement is not provided within the time required by this Division, the court may, on the application of the debtor or guarantor, order the credit provider to provide the statement or itself determine the amounts in relation to which the statement was sought.

(1) If a debtor, by written notice to a credit provider, disputes a particular liability entered against the debtor under a credit contract, the credit provider must give the debtor a written notice explaining in reasonable detail how the liability arises.

(2) A written notice need not be given if the credit provider agrees with the debtor as to the disputed amount and gives the debtor a written notice advising of the agreed liability.