Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies to a brand of a pharmaceutical item on the catch - up price reduction day if:

(a) the 15th anniversary of the drug in the pharmaceutical item being a listed drug was on or before 1 April 2022; and

(b) the pharmaceutical item is not an exempt item; and

(c) on the catch - up price reduction day, the percentage worked out using the formula in subsection (2) is greater than zero.

Note: See also section 99ACG.

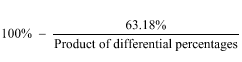

(2) The formula mentioned in paragraph (1)(c) is:

where:

"product of differential percentages" means:

(a) if there has been only one previous price reduction under this Division--the differential percentage for that price reduction; or

(b) if there have been 2 or more previous price reductions under this Division--the product of the differential percentages for those previous price reductions; or

(c) if there have not been any previous price reductions under this Division--100%.

Note 1: The effect of the formula is that, following the application of the price reduction which applies as a result of this section and item 8 of the table in section 99ACF(1), the cumulative impact of price reductions under this Division, applied successively, will be 36.82%. For example, if the brand of the pharmaceutical item has been subject to a 5% previous price reduction under this Division followed by a 16% previous price reduction under this Division, the product of the differential percentages will be (100% - 5%) x (100% - 16%) = 79.80%, and the percentage worked out using the formula will be 100% - 63.18%/79.80% = 20.83%.

Note 2: For rounding of the percentage worked out using the formula, see subsection (5).

(3) For the purposes of this section, previous price reduction under this Division has the meaning given by section 99ACNA.

(4) For the purposes of this section, the differential percentage for a previous price reduction under this Division means the difference between 100% and the previous price reduction under this Division.

(5) The percentage worked out using the formula in subsection (2) is to be calculated to 2 decimal places (rounding up if the third decimal place is 5 or more).

(6) In this section, the catch - up price reduction day is 1 April 2023.