Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Foreign branch income exemption

Income Tax Assessment Act 1936

1 Section 23AH

Repeal the section, substitute:

23AH Foreign branch income of Australian companies not assessable

Objects

(1) The objects of this section are:

(a) to ensure that active foreign branch income derived by a resident company, and capital gains made by a resident company in disposing of non - tainted assets used in deriving foreign branch income, are not assessable income or exempt income of the company; and

(b) to include in the assessable income of a resident company that part of its income and capital gains derived through a branch in a foreign country that is comparable to the amounts that would be included in an attributable taxpayer's assessable income for income and capital gains derived by a CFC resident in the same foreign country; and

(c) to get the same outcomes where one or more partnerships or trusts are interposed between a resident company and a foreign branch.

Foreign branch income not assessable

(2) Subject to this section, foreign income derived by a company, at a time when the company is a resident in carrying on a business, at or through a PE of the company in a listed country or unlisted country is not assessable income, and is not exempt income, of the company.

Foreign capital gains and losses disregarded

(3) Subject to this section, a capital gain from a CGT event happening to a CGT asset is disregarded for the purposes of Part 3 - 1 of the Income Tax Assessment Act 1997 if:

(a) the gain is made by a company that is a resident; and

(b) the company used the asset wholly or mainly for the purpose of producing foreign income in carrying on a business at or through a PE of the company in a listed country or unlisted country; and

(c) the asset does not have the necessary connection with Australia.

(4) Subject to this section, a capital loss from a CGT event happening to a CGT asset is disregarded for the purposes of Part 3 - 1 of the Income Tax Assessment Act 1997 if:

(a) the loss is made by a company that is a resident; and

(b) the company used the asset wholly or mainly for the purpose of producing foreign income in carrying on a business at or through a PE of the company in a listed country or unlisted country; and

(c) had the loss been a gain, it would be disregarded under subsection (3).

Exceptions: listed country PE

(5) Subsection (2) does not apply to foreign income derived by the company if:

(a) the PE is in a listed country; and

(b) the PE does not pass the active income test (see subsection (12)); and

(c) the foreign income is both:

(i) adjusted tainted income (see subsection (13)); and

(ii) eligible designated concession income in relation to a listed country.

(6) Subsection (3) or (4) does not apply to a capital gain or capital loss if:

(a) the PE is in a listed country; and

(b) for a capital gain--the gain is from a tainted asset and is eligible designated concession income in relation to a listed country; and

(c) for a capital loss--the loss is from a tainted asset and would be eligible designated concession income in relation to a listed country if it were a capital gain.

Exceptions: unlisted country PE

(7) Subsection (2) does not apply to foreign income derived by the company if:

(a) the PE is in an unlisted country; and

(b) the PE does not pass the active income test (see subsection (12)); and

(c) the foreign income is adjusted tainted income (see subsection (13)).

(8) Subsection (3) or (4) does not apply to a capital gain or capital loss if:

(a) the PE is in an unlisted country; and

(b) the gain or loss is from a tainted asset.

Income derived in disposing of a business

(9) This section applies to foreign income derived by an entity in the course of disposing, in whole or in part, of a business carried on in a listed country or unlisted country at or through a PE of the entity in the listed country or unlisted country as if the foreign income had been derived in carrying on that business.

Interposed partnerships or trusts

(10) This section applies to any indirect interest (through one or more partnerships or trust estates) of a company in foreign income derived by a partnership or trustee through a PE of the partnership or trustee in a listed country or unlisted country as if that indirect interest were foreign income derived by the company through a PE of the company in that country.

(11) This section applies to any indirect interest (through one or more partnerships or trust estates) of a company in a capital gain or capital loss made in relation to an asset of a partnership, or made by a trustee, in carrying on a business at or through a PE of the partnership or trustee in a listed country or unlisted country as if that indirect interest were a capital gain or capital loss made by the company through a PE of the company in that country.

Active income test

(12) A PE of an entity passes the active income test for a year of income if the entity would have passed the active income test in section 432 if:

(a) the assumptions in subsection (14) were made; and

(b) subsections 432(2) and (3) and 446(2) and paragraphs 432(1)(b) and (e) and 447(1)(b), (d) and (f) had not been enacted.

Adjusted tainted income

(13) For the purposes of this section, the adjusted tainted income of a PE of an entity is income or other amounts that would be adjusted tainted income of the entity for the purposes of Part X if:

(a) the assumptions in subsection (14) were made; and

(b) subsection 446(2) and paragraphs 447(1)(b), (d) and (f) had not been enacted.

Assumptions for subsections (12) and (13)

(14) The assumptions referred to in paragraphs (12)(a) and (13)(a) are:

(a) except in applying paragraphs 447(1)(a), (c) and (e) and 450(6)(c), (7)(d) and (8)(b), the only income or other amounts derived by the entity were the income derived in carrying on business at or through the PE; and

(b) the entity's statutory accounting periods were the same as the entity's years of income; and

(c) in applying paragraphs 447(1)(a), (c) and (e) and 450(6)(c), (7)(d) and (8)(b):

(i) the part of the entity's operations that consists of the business carried on at or through the PE were a company (the PE company ); and

(ii) the remaining part of the entity's operations were a separate company (the HQ company ); and

(iii) the PE company and the HQ company had carried out the transactions that they would have carried out if the PE company were engaged in the same or similar activities as the PE under the same or similar conditions as the PE and were dealing wholly independently with the HQ company; and

(iv) any income derived by the HQ company were disregarded; and

(d) if the entity is an AFI entity (within the meaning of subsection 326(2))--the entity were an AFI subsidiary; and

(e) in applying paragraphs 447(1)(a), (c) and (e), the HQ company were an associate of the PE company.

Definitions

(15) In this section:

"company" does not include a company in the capacity of a trustee.

"double tax agreement" has the same meaning as in Part X.

"eligible designated concession income" has the same meaning as in Part X.

"foreign income" includes an amount that:

(a) apart from this section, would be included in assessable income under a provision of this Act other than Part 3 - 1 or 3 - 3 of the Income Tax Assessment Act 1997 (CGT); and

(b) is derived from sources in a listed country or unlisted country.

"listed country" has the same meaning as in Part X.

"permanent establishment" , or PE , in relation to a listed country or unlisted country:

(a) if there is a double tax agreement in relation to that country--has the same meaning as in the double tax agreement; or

(b) in any other case--has the meaning given by subsection 6(1).

"statutory accounting period" has the same meaning as in Part X.

"tainted asset" has the same meaning as in Part X.

"unlisted country" has the same meaning as in Part X.

2 Subsection 63D(1)

Repeal the subsection, substitute:

(1) Subject to section 63F, if:

(a) apart from this section and section 63F, a deduction would be allowable to a taxpayer:

(i) under section 8 - 1 or 25 - 35 of the Income Tax Assessment Act 1997 in respect of the writing off of a debt as bad; or

(ii) under section 63E of this Act in respect of a debt/equity swap in relation to a debt; and

(b) the debt was created or acquired in the ordinary course of a money - lending business of the taxpayer who carries on that business; and

(c) during any part or parts (the foreign country branch period ) of the period since the debt was so created or acquired (the debt holding period ), it is the case that, if income had been derived by the taxpayer in respect of the debt, the income would not, because of section 23AH of this Act, have been included in the assessable income of the taxpayer;

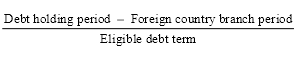

then only a proportion of the deduction is allowable, being the proportion calculated using the formula:

where:

"debt holding period" means the number of days in the debt holding period.

"eligible debt term" means:

(a) where the debt was acquired from a person other than an associate, within the meaning of section 318 of this Act--the number of days in the debt holding period; or

(b) in any other case--the number of days in the period beginning on the day on which the debt was created (whether by the taxpayer or another person) and ending at the end of the day on which it was written off.

"foreign country branch period" means the number of days in the foreign country branch period.

Note: The heading to section 63D is replaced by the heading " Bad debts etc. of money - lenders not allowable deductions where attributable to listed country or unlisted country branches ".

3 Subsection 63D(2)

Omit "paragraph (1)(e)", substitute "paragraph (b) of the definition of eligible debt term in subsection (1).

Part 2 -- Non - portfolio dividend exemption: main amendments

Income Tax Assessment Act 1936

4 Section 23AJ

Repeal the section, substitute:

23AJ Certain non - portfolio dividends from foreign countries not assessable

A non - portfolio dividend (as defined in section 317) paid to a company is not assessable income, and is not exempt income, of the company if:

(a) the company is an Australian resident and does not receive the dividend in the capacity of a trustee; and

(b) the company that paid the dividend is not a Part X Australian resident (as defined in that section).

5 Paragraph 389(a)

Omit ", 23AJ".

6 Paragraphs 402(2)(c), (d) and (da)

Repeal the paragraphs.

7 Section 403

Repeal the section, substitute:

403 Additional notional exempt income--unlisted country CFC

If the eligible CFC is a resident of an unlisted country at the end of the eligible period, the notional exempt income of the eligible CFC in relation to the eligible period includes income or profits derived by the eligible CFC in the eligible period in or in connection with carrying on business in a listed country at or through a permanent establishment of the eligible CFC in that listed country, where the income or profits are not eligible designated concession income in relation to any listed country in relation to the eligible period.

8 Sections 458 and 459

Repeal the sections.

Part 3 -- Non - portfolio dividend exemption: consequential amendments

Income Tax Assessment Act 1936

9 Subsection 6AB(1)

Omit "458, 459,".

10 Subparagraph 6AB(2)(a)(iii)

Repeal the subparagraph.

11 Subparagraph 6AB(2)(b)(iii)

Repeal the subparagraph.

12 Subsection 6AB(3A)

Omit "160AFCC,".

13 Paragraph 6AB(3A)(a)

Omit "458, 459,".

14 Subsection 6AC(2)

Repeal the subsection.

15 Subsection 6AC(5)

Repeal the subsection.

16 Subparagraphs 47A(2)(a)(ii), (iii) and (iv)

Repeal the subparagraphs, substitute:

(ii) by virtue of subsection (1), the whole or a part of the distribution payment would, apart from section 23AI or 23AJ, be included in the assessable income of a taxpayer of the year of income in which the distribution time occurred under section 44; and

17 Subsection 47A(2)

Omit ", section 365 and Division 6 of Part X", substitute "and section 365".

18 Paragraph 47A(7)(b)

Repeal the paragraph, substitute:

(b) the purpose, or one of the purposes, of the making of the loan was to facilitate, directly or indirectly (through one or more interposed companies, partnerships or trusts), the payment of a dividend that is, or would be, non - assessable non - exempt income under section 23AJ (in whole or in part); or

19 Paragraphs 47A(16)(b), (17)(b) and (18)(b)

Omit ", 458 or 459".

20 Subparagraph 102AAU(1)(c)(vi)

Repeal the subparagraph.

21 Subsection 102AAW(1)

Omit "458, 459".

22 Section 102AAZF

Omit ", 457, 458 or 459", substitute "or 457".

23 Subsection 103(1) (subparagraph (b)(iii) of the definition of the distributable income )

Omit "(including taxes deemed by section 160AFC to have been paid)".

24 Section 128SA

Repeal the section, substitute:

For the purposes of this Subdivision, in determining the amount of a dividend paid to a resident company, any foreign tax paid or payable by the company in respect of the dividend, where the company was or is personally liable for the tax, is to be deducted.

25 Subsections 128TA(1) and (2)

Repeal the subsections, substitute:

Conditions for credit

(1) A foreign dividend account credit or FDA credit arises for a resident company if a dividend that is non - assessable non - exempt income under section 23AJ is paid to the company.

Amount of credit

(2) The amount of credit is so much of the dividend as is non - assessable non - exempt income under section 23AJ.

26 Subparagraph 128TB(1)(b)(ii)

Omit "disregarded; or", substitute "disregarded.".

27 Paragraphs 128TB(1)(c) and (d)

Repeal the paragraphs.

28 Subsection 128TB(2)

Repeal the subsection.

29 Paragraph 128TB(3)(b)

Omit "disregarded; or", substitute "disregarded.".

30 Paragraphs 128TB(3)(c) and (d)

Repeal the paragraphs.

31 Paragraphs 128TB(4)(b) and (c)

Repeal the paragraphs, substitute:

(b) in a paragraph (1)(b) case--when the expenditure is incurred.

32 Subsection 160AE(1) (definition of exempting profits )

Repeal the definition.

33 Subsection 160AE(1) (definition of exempting profits percentage )

Repeal the definition.

34 Subsection 160AE(1) (definition of exempting receipt )

Repeal the definition.

35 Subsection 160AE(1) (definition of non - exempting profits )

Repeal the definition.

36 Subsection 160AEA(1) (paragraph (n) of the definition of passive income )

Omit "458, 459,".

37 Section 160AFC

Repeal the section.

38 Section 160AFCB

Repeal the section, substitute:

160AFCB Foreign tax in respect of amounts assessable under section 457

If:

(a) an amount (the section 457 amount ) is included in the assessable income of a taxpayer, being a company, of a year of income under section 457 as a result of a change of residence at a particular time (the residence - change time ) by a CFC; and

(b) at the residence - change time, the CFC was related to the taxpayer;

the taxpayer is taken, for the purposes of this Division, to have paid, and to have been personally liable for, in respect of the section 457 amount, in the year of income, an amount of foreign tax equal to the total foreign tax and Australian tax paid by the CFC that is attributable to the section 457 amount.

39 Section 160AFCC

Repeal the section.

40 Subsection 160AFCD(2) (definition of DT or direct tax )

Omit "and section 160AFC".

41 Subsection 160AFCD(2) (definition of UT or underlying tax )

Repeal the definition, substitute:

"UT" or underlying tax , where the taxpayer is a company and the attribution account payment is a non - portfolio dividend, means the amount by which the section 23AI non - assessable part would have been greater if:

(a) the attribution account entity had not paid any foreign tax on its profits; and

(b) any other attribution account entity, in relation to which the taxpayer has an attribution debit for an attribution account payment that is a non - portfolio dividend, had not paid any foreign tax on its profits; and

(c) each of those attribution account entities had distributed the same percentage of its distributable profits as was actually distributed.

42 Subsection 160AFCJ(4) (definition of DT or direct tax )

Omit "and section 160AFC".

43 Subsection 160AFCJ(4) (definition of UT or underlying tax )

Repeal the definition, substitute:

"UT" or underlying tax means:

(a) any foreign tax that, disregarding this section, the taxpayer is taken, for the purposes of this Division, to have paid, and to have been personally liable for, under subparagraph 6AB(3)(a)(ii); or

(b) where the taxpayer is a company and the FIF attribution account payment is a non - portfolio dividend, the amount by which the section 23AK non - assessable part would have been greater if:

(i) the FIF attribution account entity had not paid any foreign tax on its profits; and

(ii) any other FIF attribution account entity, in relation to which the taxpayer has a FIF attribution debit for a FIF attribution account payment that is a non - portfolio dividend, had not paid any foreign tax on its profits; and

(iii) each of those FIF attribution account entities had distributed the same percentage of its distributable profits as was actually distributed.

44 Subsection 160AO(4)

Repeal the subsection.

45 Paragraphs 316(1)(b) and (c)

Repeal the paragraphs, substitute:

(b) certain changes of residence by a CFC (section 457).

46 Paragraph 316(2)(f)

Repeal the paragraph.

47 Section 317 (definition of exempting profits )

Repeal the definition.

48 Section 317 (definition of exempting profits percentage )

Repeal the definition.

49 Section 317 (definition of exempting receipt )

Repeal the definition.

50 Subsection 356(4A)

Omit "(except in so far as that subsection has effect for the purposes of section 459)".

51 Paragraph 371(1)(c)

Repeal the paragraph.

52 Subsection 371(3)

Repeal the subsection.

53 Paragraph 371(5)(c)

Repeal the paragraph.

54 Subsection 371(6)

Omit ", 457 or 458", substitute "or 457".

55 Subsection 372(3)

Repeal the subsection.

56 Paragraphs 375(1)(c) and (d)

Repeal the paragraphs.

57 Division 6 of Part X

Repeal the Division.

58 Paragraph 384(2)(aa)

Repeal the paragraph.

59 Subparagraph 384(2)(d)(ia)

Repeal the subparagraph.

60 Subsection 386(1)

Omit "and 385", substitute ", 385 and 457".

61 Paragraph 387(1)(c)

Repeal the paragraph.

62 Paragraph 387(1)(d)

Omit ", or of the grossed - up 458 component of the dividend, as the case requires,".

63 Subsection 387(1)

Omit ", or of the grossed - up 458 component of the dividend, as the case requires" (last occurring).

64 Subsection 387(2) (definition of grossed - up 458 component )

Repeal the definition.

65 Paragraph 389(a)

Omit "458, 459,".

66 Subsection 392(2)

Repeal the subsection.

67 Subsections 393(2) and (3)

Repeal the subsections.

68 Subsection 399(2) (definition of excluded modifications )

Omit "paragraphs 402(2)(c) and 403(b) and".

69 Paragraph 423(2)(d)

Omit "section 458 or 459", substitute "section 456".

70 Paragraphs 436(1)(e) and (f)

Repeal the paragraphs, substitute:

(e) a non - portfolio dividend paid to the company by a company that is a resident of a listed country or unlisted country;

71 Subsection 457(2) (formula)

Repeal the formula, substitute:

![]()

72 Subsection 457(2) (definition of Adjusted distributable profits )

Repeal the definition, substitute:

"Adjusted distributable profits" means:

(a) if paragraph (1)(c) applies--the amount that would be the CFC's distributable profits at the residence - change time if:

(i) the CFC's only income were its adjusted tainted income (excluding any non - portfolio dividends) if all the CFC's tainted assets were disposed of at that time for a consideration equal to their market value; and

(ii) the CFC's only expenses were expenses related to income covered by subparagraph (i); or

(b) if paragraph (1)(d) applies--the amount that would be the CFC's distributable profits at the residence - change time if:

(i) the CFC's only income were its adjusted tainted income (excluding any non - portfolio dividends); and

(ii) the CFC's only expenses were expenses related to income covered by subparagraph (i).

73 Subsection 457(2) (definition of Attribution surplus )

Repeal the definition.

74 Paragraph 459A(1)(a)

Omit ", 457, 458 or 459", substitute "or 457".

75 Subparagraphs 459A(1)(c)(iii) and (iv)

Repeal the subparagraphs.

76 Subsection 460(1)

Omit "458, 459".

77 Sections 463 and 464

Repeal the sections.

78 Subsections 465(1) and (2)

Omit "463, 464".

79 Paragraphs 467(a) and (b)

Omit "or 462A, subsection 463(1), (2), (3) or (4) or 464(1), (2) or (3) or section 464A", substitute ", 462A or 464A".

80 Subparagraph 530(1)(d)(ii)

Omit "paragraph 402(2)(c) or 403(b) or section 404", substitute "section 23AJ or 404".

Income Tax Assessment Act 1997

81 Subsection 116 - 85(1) (table item 3)

Repeal the item, substitute:

3 | The company or * CFC is taken, under section 47A of the Income Tax Assessment Act 1936 , to have paid you a dividend in relation to that event and some or all of the dividend is included in your assessable income under section 44 of that Act |

82 Subsection 116 - 85(3)

Repeal the subsection.

83 Subsection 717 - 510(4)

Repeal the subsection (including the note).

84 Subsection 719 - 903(5)

Repeal the subsection (including the note).

Part 4 -- Listed countries: main amendments

Income Tax Assessment Act 1936

85 Subsection 320(1) (definition of broad - exemption listed country )

Repeal the definition.

86 Subsection 320(1) (definition of limited - exemption listed country )

Repeal the definition.

87 Subsection 320(1) (definition of listed country )

Repeal the definition, substitute:

"listed country" means a foreign country, or a part of a foreign country, that is declared by the regulations to be a listed country for the purposes of this Part.

88 Subsection 320(1) (definition of non - broad exemption listed country )

Repeal the definition.

89 Subsection 320(1)

Insert:

"section 404 country" means a foreign country, or a part of a foreign country, that is declared by the regulations to be a section 404 country for the purposes of this Part.

90 Section 404

After "listed country" (wherever occurring), insert "or a section 404 country".

Note: The heading to section 404 is replaced by the heading " Additional notional exempt income--listed or section 404 country CFC ".

Part 5 -- Listed countries: consequential amendments

Income Tax Assessment Act 1936

91 Section 102AAB (definition of Broad - exemption listed country )

Repeal the definition.

92 Section 102AAB (definition of broad - exemption listed country trust estate )

Repeal the definition.

93 Section 102AAB

Insert:

"listed country" has the same meaning as in Part X.

94 Section 102AAB

Insert:

"listed country trust estate" has the same meaning as in Part X.

95 Section 102AAB (definition of non - broad - exemption listed country )

Repeal the definition.

96 Section 102AAB (definition of tax law )

Omit "a broad - exemption listed country or a non - broad - exemption listed country", substitute "a listed country or an unlisted country".

97 Section 102AAB

Insert:

"unlisted country" has the same meaning as in Part X.

98 Section 102AAC

Repeal the section, substitute:

102AAC Each listed country and unlisted country to be treated as a separate foreign country

For the purposes of the application of section 6AB to this Division, each listed country and each unlisted country is to be treated as a separate foreign country.

99 Section 102AAE

Omit "broad - exemption listed country" (wherever occurring), substitute "listed country".

100 Sub - subparagraph 102AAE(1)(b)(ii)(A)

Omit "broad - exemption listed countries", substitute "listed countries".

Note: The heading to section 102AAE is replaced by the heading " Listed country trust estates ".

101 Section 102AAM

Omit "broad - exemption listed country" (wherever occurring), substitute "listed country".

102 Subsections 102AAU(1), (3) and (4)

Omit "broad - exemption listed country" (wherever occurring), substitute "listed country".

103 Subsection 102AAU(6)

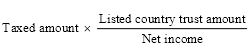

Omit " broad - exemption listed country trust amount " (first occurring), substitute " listed country trust amount ".

104 Subsection 102AAU(6) (formula)

Repeal the formula, substitute:

105 Subsection 102AAU(6) (definition of Broad - exemption listed country trust amount )

Repeal the definition.

106 Subsection 102AAU(6)

Insert:

"Listed country trust amount" means the number of dollars in the listed country trust amount.

107 Section 102AAZE

Omit "broad - exemption listed country trust estate", substitute "listed country trust estate".

108 Section 317 (definition of accruals tax law )

Omit "broad - exemption listed country" (wherever occurring), substitute "listed country".

109 Section 317 (definition of broad - exemption listed country )

Repeal the definition.

110 Section 317 (definition of designated concession income )

Omit "broad - exemption listed country", substitute "listed country".

111 Section 317 (definition of eligible designated concession income )

Omit "broad - exemption listed country" (wherever occurring), substitute "listed country".

112 Section 317 (definition of limited - exemption listed country )

Repeal the definition.

113 Section 317 (definition of non - broad - exemption listed country )

Repeal the definition.

114 Section 317 (paragraphs (c) and (d) of the definition of tainted rental income )

Repeal the paragraphs, substitute:

(c) a lease of land, except where the following conditions are satisfied:

(i) the land is situated in a listed country or in an unlisted country;

(ii) at all times during the period when the income accrued, the company was a resident of that country;

(d) a lease of land where the following conditions are satisfied:

(i) the land is situated in a listed country or in an unlisted country;

(ii) at all times during the period when the income accrued, the company was a resident of that country;

(iii) it is not the case that a substantial part of the income is attributable to the provision of labour - intensive property management services in connection with the land, being services provided by directors or employees of the company;

115 Section 332

Omit "broad - exemption listed country" (wherever occurring), substitute "listed country".

Note: The heading to section 332 is replaced by the heading " Companies that are residents of listed countries ".

116 Section 332A

Omit "limited - exemption listed country" (wherever occurring), substitute "section 404 country".

Note: The heading to section 332A is replaced by the heading " Companies that are residents of section 404 countries ".

117 Paragraph 332A(2)(c)

Omit "broad - exemption listed country" (wherever occurring), substitute "listed country".

118 Subsection 384(1)

Omit "a non - broad - exemption listed country", substitute "an unlisted country".

Note: The heading to section 384 is replaced by the heading " Additional assumption for unlisted country CFC ".

119 Subsections 385(1) and (2)

Omit "broad - exemption listed country" (wherever occurring), substitute "listed country".

Note: The heading to section 385 is replaced by the heading " Additional assumption for listed country CFC ".

120 Subsection 385(2A)

Repeal the subsection, substitute:

(2A) For the purposes of sub-subparagraphs (2)(a)(ii)(C) and (2)(d)(ii)(C), income or other amounts pass the test set out in this subsection if both:

(a) the income or other amounts are adjusted tainted income (within the meaning of section 386); and

(b) the income or other amounts are not subject to tax in the listed country or in any other listed country in a tax accounting period ending before the end of the eligible period or commencing during the eligible period.

121 Paragraph 400(aa)

Omit "broad - exemption listed country", substitute "listed country".

122 Paragraph 418A(1)(a)

Omit "broad - exemption listed or a non - broad - exemption listed country", substitute "listed country or an unlisted country".

Note: The heading to section 418A is replaced by the heading " Effect of change of residence from Australia to listed or unlisted country ".

123 Subsection 419(1) (table)

Repeal the table, substitute:

Additional requirements | |||

Item | The originating CFC's residency status | The recipient company's residency status | This requirement must be satisfied |

1 | A resident of a listed country at the time of the trigger event | Either: (a) a resident of that listed country at that time; or (b) an Australian resident at that time | It does not matter what the roll - over asset is |

2 | A resident of a listed country at the time of the trigger event | A resident of a particular unlisted country at that time | The asset must have been used (just before that time) in connection with a permanent establishment of the originating CFC in any unlisted country at or through which the originating CFC carried on business just before that time |

3 | A resident of an unlisted country at the time of the trigger event | Either: (a) a resident of an unlisted country at that time; or (b) an Australian resident at that time | It does not matter what the roll - over asset is |

124 Subsection 431(4)

Omit "broad - exemption listed country" (wherever occurring), substitute "listed country".

125 Paragraph 431(4)(b)

Omit "a non - broad - exemption listed country", substitute "an unlisted country".

126 Paragraph 431(4A)(a)

Omit "broad - exemption listed country", substitute "listed country".

127 Subparagraph 431(4A)(c)(i)

Omit "a non - broad - exemption listed country", substitute "an unlisted country".

128 Paragraph 431(4B)(a)

Omit "a non - broad - exemption listed country", substitute "an unlisted country".

129 Subparagraph 431(4B)(e)(i)

Omit "broad - exemption listed country", substitute "listed country".

130 Paragraph 431(4C)(a)

Omit "a non - broad - exemption listed country", substitute "an unlisted country".

131 Paragraph 431(4C)(c)

Omit "broad - exemption listed country", substitute "listed country".

132 Paragraph 432(1)(b)

Omit "broad - exemption listed country nor", substitute "listed country nor".

133 Paragraph 432(1)(b)

Omit "non - broad - exemption listed country", substitute "unlisted country".

134 Paragraph 432(1)(e)

Omit "broad - exemption listed country, or of a particular non - broad - exemption listed country", substitute "listed country, or of a particular unlisted country".

135 Paragraph 436(1)(b)

Omit "broad - exemption listed country" (wherever occurring), substitute "listed country".

136 Subparagraph 437(1)(c)(iii)

Omit "broad - exemption listed country or particular non - broad - exemption listed country", substitute "listed country or particular unlisted country".

137 Subparagraph 437(2)(c)(ii)

Omit "broad - exemption listed country, or of a particular non - broad - exemption listed country", substitute "listed country, or of a particular unlisted country".

138 Paragraph 456A(1)(c)

Omit "broad - exemption listed country" (wherever occurring), substitute "listed country".

Income Tax Assessment Act 1997

139 Paragraph 215 - 10(1)(c)

Omit "broad - exemption listed country (within the meaning of Part X of the Income Tax Assessment Act 1936 )", substitute " * listed country".

Part 6 -- Application of amendments

140 Application of amendments

(1) The amendments made by Part 1 of this Schedule apply to income years starting on or after 1 July 2004.

(2) Subject to subitem ( 2A), the amendments made by Parts 2 and 3 of this Schedule apply to things happening after 30 June 2004.

(2A) The amendments made by items 7, 58 and 59 of this Schedule apply to statutory accounting periods starting on or after 1 July 2004.

(3) The amendments made by Parts 4 and 5 of this Schedule apply to income years and statutory accounting periods starting on or after 1 July 2004.

141 Transitional

From 1 July 2004 until regulations are made after the commencement of this item declaring foreign countries or parts of foreign countries to be listed countries or section 404 countries for the purposes of Part X of the Income Tax Assessment Act 1936 , that Act has effect as if:

(a) each foreign country or part of a foreign country that, immediately before the commencement of this item, was a broad - exemption listed country for the purposes of that Part of that Act were a listed country for the purposes of that Part of that Act; and

(b) each foreign country or part of a foreign country that, immediately before the commencement of this item, was a limited - exemption listed country for the purposes of that Part of that Act were a section 404 country for the purposes of that Part of that Act.