Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies if:

(a) at the operative time, standard allowance or annuity is not payable in respect of the original interest; and

(b) after the operative time, a retiring allowance (the affected benefit ) becomes payable to the member spouse in respect of the original interest.

Note: If the member spouse dies before becoming entitled to a retiring allowance, then subsection (1) will nevertheless result in an indirect reduction of any annuity under paragraph 19(1)(a) to a surviving spouse. This happens because the amount of that annuity is based on the amount of retiring allowance that would have become payable to the member spouse if he or she had not died.

Reduction of basic percentage

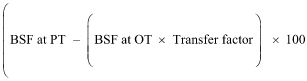

(2) In calculating the annual rate of the affected benefit, the applicable basic percentage is replaced by the percentage calculated using the formula:

where:

"BSF at OT" means the basic service factor at the operative time.

"BSF at PT" means the basic service factor at the payment time.

Reduction of additional percentage

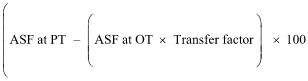

(3) In calculating the annual rate of the affected benefit, each applicable additional percentage is replaced by the percentage calculated using the formula:

where:

"ASF at OT" means the additional service factor at the operative time for the office concerned.

"ASF at PT" means the additional service factor at the payment time for the office concerned.

(4) Subsection (3) does not apply to an applicable additional percentage for an office if:

(a) the period of service in the office began after the operative time; and

(b) paragraph 18(10B)(b) does not apply.

Multiple interest splits for same original interest

(5) If, before the affected benefit becomes payable, the original interest has been split more than once (that is to say, section 22CD has applied more than once), then the calculations under subsections (2) and (3) are modified as set out in subsections (6) and (7).

Note: If the same superannuation interest is subject to 2 or more payment splits, then section 22CD applies separately in relation to each of those splits.

(6) In applying the formula in subsection (2), the component (BSF at OT ï‚´ Transfer factor) is to be replaced by the number calculated using the following steps, based on the chronological order of the operative times (starting with the earliest):

(a) calculate a factor (the interim factor ) for the first split using the formula:

![]()

(b) calculate a factor (the interim factor ) for the next split (the current split ), using the formula:

![]()

(c) calculate a factor for each remaining split (if any), using the formula in paragraph (b);

(d) add together the factors calculated under paragraphs (a) to (c).

Example: Assume 2 splits, with the first split having a basic service factor (BSF) of 0.4 and a transfer factor of 0.5 and the second split having a basic service factor of 0.6 and a transfer factor of 0.5. Applying the above steps, the replacement number for the formula is 0.4, that is:

![]()

(7) In applying the formula in subsection (3), the component (ASF at OT ï‚´ Transfer factor) is to be replaced by the number calculated using the following steps, based on the chronological order of the operative times (starting with the earliest):

(a) calculate a factor (the interim factor ) for the first split using the formula:

![]()

(b) calculate a factor (the interim factor ) for the next split (the current split ), using the formula:

![]()

(c) calculate a factor for each remaining split (if any), using the formula in paragraph (b);

(d) add together the factors calculated under paragraphs (a) to (c).

Reduction not to affect later non - standard annuity

(8) A reduction under this section is to be disregarded in calculating the amount of any non - standard annuity that later becomes payable.

Note: For example, the reduction will be disregarded in calculating the amount of annuity payable under section 19AA in respect of a child of the member spouse after the member spouse's death.