Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) If:

(a) a release authority lump sum is paid in relation to a release authority issued to a person; and

(b) the person is entitled to a retiring allowance in accordance with section 18;

the person's rate of retiring allowance is the applicable percentage of the rate of retiring allowance that would, apart from this section (but having regard to any other provisions of this Act that affect that rate), be worked out under section 18.

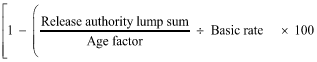

(2) For the purposes of subsection (1), the applicable percentage is worked out using this formula:

where:

"age factor" means the age factor for the person on the day on which the retiring allowance becomes payable (see subsection (4)).

"basic rate" means the rate of the retiring allowance that would, apart from this subsection (but having regard to any other provisions of this Act that affect that rate), be worked out under section 18 for the person at the time the retiring allowance becomes payable.

(3) The applicable percentage mentioned in subsection (1) is to be calculated to 3 decimal places (rounding up if the fourth decimal place is 5 or more).

(4) The Secretary of the Finance Department may, by legislative instrument, determine the age factor, or the method for working out the age factor, for the purposes of subsection (2).