Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) For the purposes of this Act, current apportionment percentage means the percentage applying from time to time under the definition of current apportionment percentage in subsection 286(4) of the Offshore Petroleum and Greenhouse Gas Storage Act 2006 .

(2) For the purposes of this Act, apportionment percentage figure , in relation to a year of tax, means:

(a) if the current apportionment percentage did not change during the year of tax--the numerator of the fraction with a denominator of 100 that represents the current apportionment percentage that applied during that year; or

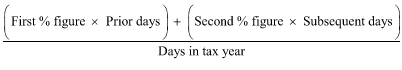

(b) if the current apportionment percentage changed during the year of tax--means the amount worked out using the following formula:

where:

days in tax year means the number of days in the year of tax.

first % figure , in relation to a year of tax in which the current apportionment percentage changed, means the numerator of the fraction with a denominator of 100 that represents the current apportionment percentage applying before the change.

prior days , in relation to a year of tax in which the current apportionment percentage changed, means the number of days in that year before the current apportionment percentage changed.

second % figure , in relation to a year of tax in which the current apportionment percentage changed, means the numerator of the fraction with a denominator of 100 that represents the current apportionment percentage applying after the change.

subsequent days , in relation to a year of tax in which the current apportionment percentage changed, means the number of days in that year from and including the day on which the current apportionment percentage changed.

(3) For the purposes of this Act, apportionment percentage figure , in relation to a period of days that is not a year of tax, means the amount worked out under subsection (2) as if the period were a year of tax.