Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) The maximum contribution base for a quarter in the 2001 - 02 year is $27,510.

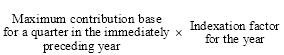

(3) The maximum contribution base for a quarter in any later year is the amount worked out using the formula:

(4) Amounts calculated under subsection ( 3) must be rounded to the nearest 10 dollar multiple (rounding 5 dollars upwards).

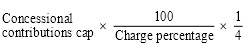

(5) Despite subsections ( 3) and (4), the maximum contribution base for a quarter in the 2017 - 18 year or any later year is the amount worked out using the following formula, if that amount is less than the amount worked out under those subsections:

where:

"charge percentage" is the number specified in subsection 19(2) for the quarter.

"concessional contributions cap" is the basic concessional contributions cap, within the meaning of the Income Tax Assessment Act 1997 , for the financial year in which the quarter occurs.

(6) Amounts calculated under subsection ( 5) must be rounded down to the nearest 10 dollar multiple.