Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies if:

(a) a person is receiving a social security pension; and

(b) the person's rate of payment of the pension is worked out with regard to the income test module of a rate calculator in this Chapter; and

(c) an amount (the initial amount ) of employment income, in respect of a period of 1 month, is paid on a day in a calendar month (the initial calendar month ) to or for the benefit of the person by the person's employer; and

(d) the Secretary is satisfied that, for the reasonably foreseeable future, an amount of employment income, in respect of a period of 1 month, equal to the initial amount will be paid to or for the benefit of the person by that employer on the following:

(i) the corresponding day in each calendar month (a later calendar month ) after the initial calendar month;

(ii) if there is no such day in a later calendar month month--the last day of the later calendar month.

Note: If the person has multiple employers, this section applies separately in relation to each employer.

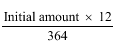

(2) Subject to this section, for the day on which the initial amount is paid and for each day after that day, the person is taken to have received an amount of employment income worked out as follows:

(3) If, after the day on which the initial amount is paid, the Secretary ceases to be satisfied as mentioned in paragraph (1)(d) in relation to the person and the person's employer, then subsection (2) ceases to apply in relation to the person and the person's employer at the end of the period of 1 month beginning on the last payment day.

(4) For the purposes of this section, a payment day is:

(a) the day in the calendar month on which the initial amount is paid by the person's employer; or

(b) the following on which an amount of employment income equal to the initial amount is paid to or for the benefit of the person by that employer:

(i) a corresponding day in a later calendar month;

(ii) if there is no such day in a later calendar month--the last day of the later calendar month.

(5) If the person is taken, under this section, to have received employment income (the attributed employment income ) during a part, but not the whole, of a particular instalment period, the person is taken to receive on each day in that instalment period an amount of employment income worked out by dividing the total amount of the attributed employment income by the number of days in the instalment period.

(6) Section 1073A does not apply to an amount of employment income covered by paragraph (4)(a) or (b).

Interpretation

(7) This section applies in relation to an amount of employment income paid on a day in a calendar month, whether or not the amount is received on that day.

(8) Subsection (3) does not prevent a later application of this section in relation to the person, whether in connection with the same employer or another employer.