Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies to a person's asset - tested income stream if it is not a defined benefit income stream, it is not an asset - tested income stream (lifetime) and it is not a family law affected income stream.

Note: For defined benefit income streams , see section 1120. For asset - tested income streams (lifetime) , see sections 1120AA and 1120AB. For family law affected income streams , see section 1120A.

(2) The value of the income stream is, for the purposes of the assets test, worked out:

(a) if the person receives payments from the income stream 2 or more times a year--in relation to each 6 month period of the income stream's term; and

(b) if the person receives a payment from the income stream only once a year--in relation to each 12 month period of the income stream's term.

(3) If the income stream has an account balance, the value of the income stream, for the purposes of the assets test, is the value of the account balance at the beginning of the 6 month or 12 month period (as the case requires) referred to in subsection (2).

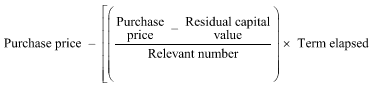

(4) If the income stream does not have an account balance, the value of the income stream is, for the purposes of the assets test, worked out as follows:

where:

"purchase price" has the meaning given by subsection 9(1).

"relevant number" has the meaning given by subsection 9(1).

"residual capital value" has the meaning given by subsection 9(1).

"term elapsed" is the number of years of the term that have elapsed since the commencement day of the income stream, rounded down:

(a) in the case of an income stream referred to in paragraph (2)(a)--to the nearest half - year; and

(b) in the case of an income stream referred to in paragraph (2)(b)--to the nearest whole year.

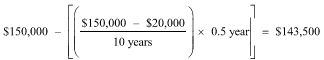

Example: Sally is 65 years old and single. She purchases a 10 year annuity for $150,000 with a residual capital value of $20,000. Her total annual annuity payment is $18,337. Monthly payments commence on 1 January. Her assessable asset for the first six months will be:

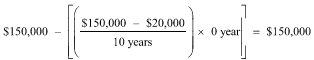

Her assessable asset after 30 June in that year will be: