Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsNo change in couple status during overall qualifying period

(1) If:

(a) a person was a member of a couple throughout the person's overall qualifying period; or

(b) a person was not a member of a couple at any time during the person's overall qualifying period;

the amount of the person's pension bonus is worked out using the following formula (for rounding up, see subsection (7)):

![]()

Change in couple status during overall qualifying period

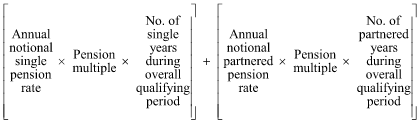

(2) If subsection (1) does not apply to a person, the amount of the person's pension bonus is worked out using the following formula (for rounding up, see subsection (7)):

(3) For the purposes of this section, a person's annual notional single pension rate is equal to:

(a) if the person is not permanently blind--the adjusted percentage of the sum of:

(i) the person's maximum basic rate under Table B in point 1064 - B1; and

(ii) the amount worked out for the person using the table in subsection 93H(4);

calculated in each case as at the start day for the age pension and assuming that the person was not a member of a couple at that day; or

(b) if the person is permanently blind--the sum of:

(i) the person's maximum basic rate under Table B in point 1065 - B1; and

(ii) the amount worked out for the person using the table in subsection 93H(4);

calculated in each case as at the start day for the age pension and assuming that the person was not a member of a couple at that day.

(4) For the purposes of this section, a person's annual notional partnered pension rate is equal to:

(a) if the person is not permanently blind--the adjusted percentage of the sum of:

(i) the person's maximum basic rate under Table B in point 1064 - B1; and

(ii) the amount worked out for the person using the table in subsection 93H(4);

calculated in each case as at the start day for the age pension and assuming that the person was a member of a couple at that day; or

(b) if the person is permanently blind--the sum of:

(i) the person's maximum basic rate under Table B in point 1065 - B1; and

(ii) the amount worked out for the person using the table in subsection 93H(4);

calculated in each case as at the start day for the age pension and assuming that the person was a member of a couple at that day.

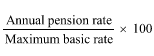

(5) For the purposes of this section, a person's adjusted percentage is the percentage worked out using the following formula (for rounding up, see subsection (8)):

where:

"maximum basic rate" is the sum of the person's maximum basic rate worked out using Module B of Pension Rate Calculator A in section 1064 and the amount worked out for the person using the table in subsection 93H(4).

(6) For the purposes of this section:

(a) the number of single years during the overall qualifying period is the number of years during the overall qualifying period when the person was not a member of a couple; and

(b) the number of partnered years during the overall qualifying period is the number of years during the overall qualifying period when the person was a member of a couple.

Rounding up

(7) An amount calculated under subsection (1) or (2) is to be rounded to the nearest 10 cents (with 5 cents being rounded up).

(8) A percentage worked out under subsection (5) is to be calculated to 3 decimal places. However, if a percentage worked out under subsection (5) would, if it were calculated to 4 decimal places, end in a digit that is greater than 4, the percentage is to be increased by 0.001.