Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) An income stream provided to a person is also an asset - test exempt income stream for the purposes of this Act if:

(a) the following criteria are satisfied:

(i) the income stream's commencement day happens before 20 September 2007;

(ii) subsection (1A) applies; or

(b) subsection (1B) applies.

(1A) This subsection applies if:

(aa) the person to whom the income stream is being provided is:

(i) the primary beneficiary; or

(ii) the primary beneficiary's reversionary partner (if any) on the day of the primary beneficiary's death; and

(a) the income stream is an income stream arising under a contract, or governing rules, that meet the requirements of subsection (2) and the Secretary has not made a determination under subsection (3) in respect of the income stream; and

(b) subject to subsections (1C), (1D) and (1E), the Secretary is satisfied that, in relation to an income stream provided by a class of provider specified by the Secretary for the purposes of this paragraph, there is in force a current actuarial certificate that states that the actuary is of the opinion that, for the financial year in which the certificate is given, there is a high probability that the provider of the income stream will be able to pay the income stream as required under the contract or governing rules; and

(c) the Secretary is satisfied that the requirements of subsection (2) have been given effect to from the day the income stream commenced to be paid; and

(d) in the case of an income stream acquired before 20 September 2004 that is provided to a primary beneficiary's reversionary beneficiary--the remaining term (in years) of the income stream is equal to the life expectancy (in years) of the primary beneficiary's reversionary beneficiary.

Note: For paragraph (b), financial year means a period of 12 months commencing on 1 July: see the Acts Interpretation Act 1901 .

(1B) This subsection applies if the Secretary has made a determination under subsection (4) in respect of the income stream.

Exception to paragraph (1A)(b)

(1C) If, on 30 June in a financial year, an actuarial certificate referred to in paragraph (1A)(b) is in force in relation to an income stream, then paragraph (1A)(b) does not apply in relation to the next financial year (the later year ) for the period:

(a) beginning on 1 July of the later year; and

(b) ending at the earlier of the following:

(i) the start of the first day in the later year on which any actuarial certificate is given to the Secretary in relation to that income stream;

(ii) the end of the period of 26 weeks beginning on 1 July of the later year.

Guidelines relating to actuarial certificates

(1D) The Secretary may determine, in writing, guidelines to be complied with when determining whether an actuarial certificate is in force and what constitutes a high probability that the provider of the income stream will be able to pay the income stream as required under the contract or governing rules.

One certificate a financial year

(1E) For the purposes of paragraph (1A)(b), if an actuarial certificate is given to the Secretary in a financial year in relation to an income stream, then any actuarial certificate given to the Secretary later in that financial year in relation to that income stream has no effect.

Requirements of contract/governing rules for provision of income stream

(2) A contract, or the governing rules, for the provision of an income stream to a person meets the requirements of this subsection if the contract or governing rules specify:

(a) the income stream's term, which must comply with subsection (2B), (2C) or (2E); and

(aa) that payments under the income stream are to be made at least annually during the income stream's term; and

(b) the total amount of the payments that may be made under the income stream in the first year after the commencement day of the income stream (not taking commuted amounts into account); and

(c) that the total amount of the payments that may be made under the income stream in any other year (not taking commuted amounts into account) may not fall below the total amount of the payments made under the income stream in the immediately preceding year (the previous total ), and may not exceed the previous total:

(i) if subparagraph (ii) does not apply--by more than 5% of the previous total; or

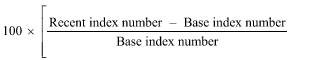

(ii) if the index number for the second last quarter before the day on which the first of those payments is to be made ( recent index number ) exceeds the index number for the same quarter in the immediately preceding year ( base index number ) by more than 4% of the base index number--by more than such percentage of the previous total as is worked out under the formula:

(d) if the income stream is purchased by or for the primary beneficiary--that the first payment under the income stream relates to the period commencing on the day of that purchase; and

(e) if the income stream is not purchased, but acquired, by or for the primary beneficiary--that the first payment under the income stream relates to the period commencing on the day of that acquisition; and

(f) if the income stream is not a defined benefit income stream--that the amount paid as the purchase price for the income stream is wholly converted into income; and

(g) that the income stream has no residual capital value; and

(h) that the income stream cannot be commuted except:

(i) if the income stream is a non - commutation funded income stream and the commutation is made within 6 months after the commencement day of the income stream; or

(ii) if the payment resulting from the commutation is transferred directly to the purchase of another income stream that is an asset - test exempt income stream; or

(iii) if the primary beneficiary's reversionary partner (if any) on the day of the primary beneficiary's death survives the primary beneficiary--on or after the partner's death; or

(iiia) if subparagraph (iii) does not apply--on or after the primary beneficiary's death; or

(iv) to the extent necessary to cover any superannuation contributions surcharge relating to the income stream; or

(iva) to the extent necessary to give effect to an entitlement of the person's partner or former partner under a payment split under Part VIIIB or VIIIC of the Family Law Act 1975 ; or

(ivb) to the extent necessary to give effect to an order under Part VIIIAA of the Family Law Act 1975 ; or

(ivc) to the extent necessary in order to comply with section 136 - 80 in Schedule 1 to the Taxation Administration Act 1953 ; or

(v) to the extent necessary to pay a hardship amount; and

(i) that the income stream cannot be transferred except on death; and

(j) that neither the capital value of the income stream, nor the income from it, can be used as security for a borrowing; and

(k) that, if the income stream reverts, it must not have a reversionary component greater than the benefit that was payable immediately before the reversion; and

(l) that, if the income stream is commuted, the commuted amount must not be greater than the benefit that was payable immediately before the commutation.

(2A) A contract, or the governing rules, for the provision to a person of an income stream that meets all of the requirements of subsection (2), except the requirement of paragraph (2)(c), are taken to meet the requirements of subsection (2) if the contract or governing rules specify that any provision included in the contract or governing rules in accordance with paragraph (2)(c) does not apply in any year in which:

(a) the person ceases to receive income under an income stream jointly and begins to receive income under a single income stream; and

(b) the total amount received in the year under the single income stream is less than the total amount received by the person in the previous year but is not nil.

Term of the income stream

(2B) If, on an income stream's commencement day, there is only one primary beneficiary, the income stream's term complies with this subsection if it is a period of whole years that:

(a) starts on the income stream's commencement day; and

(b) is at least as long as the primary beneficiary's life expectancy (rounded up, if not consisting of a whole number of years, to the next whole number) on the commencement day; and

(c) is at most as long as the greater of:

(i) what would be the primary beneficiary's life expectancy (rounded up, if not consisting of a whole number of years, to the next whole number) on the commencement day if the primary beneficiary were 5 years younger; and

(ii) the period (rounded up, if not consisting of a whole number of years, to the next whole number) starting on the commencement day and ending on the day on which the primary beneficiary reaches age 100 (assuming that the primary beneficiary lives until then).

(2C) If, on an income stream's commencement day, there is only one primary beneficiary, the income stream's term complies with this subsection if it is a period of whole years that:

(a) starts on the income stream's commencement day; and

(b) is at least as long as the greater of the life expectancies (rounded up, if not consisting of a whole number of years, to the next whole number), on the commencement day, of:

(i) the primary beneficiary; and

(ii) the primary beneficiary's reversionary partner on that day; and

(c) is at most as long as the period worked out under subsection (2D).

(2D) For the purposes of paragraph (2C)(c), the period is the greater of:

(a) the greater of what would be the life expectancies (rounded up, if not consisting of a whole number of years, to the next whole number), on the commencement day, of:

(i) the primary beneficiary, if the primary beneficiary were 5 years younger; and

(ii) the primary beneficiary's reversionary partner on that day, if the partner were 5 years younger; and

(b) the greater of:

(i) the period (rounded up, if not consisting of a whole number of years, to the next whole number) starting on the commencement day and ending on the day on which the primary beneficiary reaches age 100 (assuming that the primary beneficiary lives until then); and

(ii) the period (rounded up, if not consisting of a whole number of years, to the next whole number) starting on the commencement day and ending on the day on which the primary beneficiary's reversionary partner on the commencement day reaches age 100 (assuming that the partner lives until then).

(2E) If, on an income stream's commencement day, there are 2 primary beneficiaries (the first primary beneficiary and the second primary beneficiary ), the income stream's term complies with this subsection if it is a period of whole years that:

(a) starts on the income stream's commencement day; and

(b) is at least as long as the lesser of the life expectancies (rounded up, if not consisting of a whole number of years, to the next whole number), on the commencement day, of:

(i) the first primary beneficiary; and

(ii) the second primary beneficiary; and

(c) is at most as long as the period worked out under subsection (2F).

(2F) For the purposes of paragraph (2E)(c), the period is the greater of:

(a) the greater of what would be the life expectancies (rounded up, if not consisting of a whole number of years, to the next whole number), on the commencement day, of:

(i) the first primary beneficiary, if the first primary beneficiary were 5 years younger; and

(ii) the second primary beneficiary, if the second primary beneficiary were 5 years younger; and

(b) the greater of:

(i) the period (rounded up, if not consisting of a whole number of years, to the next whole number) starting on the commencement day and ending on the day on which the first primary beneficiary reaches age 100 (assuming that the first primary beneficiary lives until then); and

(ii) the period (rounded up, if not consisting of a whole number of years, to the next whole number) starting on the commencement day and ending on the day on which the second primary beneficiary reaches age 100 (assuming that the second primary beneficiary lives until then).

Determination that income stream not asset - test exempt

(3) The Secretary may determine that an income stream that meets the requirements of subsection (2) is not an asset - test exempt income stream if the Secretary is satisfied that the person who has purchased the income stream has commuted an asset - test exempt income stream within 6 months after its commencement day on at least 3 occasions since the person first received a social security payment.

Determination that income stream is asset - test exempt

(4) The Secretary may determine, in writing, that an income stream is an asset - test exempt income stream for the purposes of this Act. In making the determination, the Secretary is to have regard to the guidelines (if any) determined under subsection (5).

(4A) To avoid doubt, a determination under subsection (4) may be made in respect of an income stream regardless of the income stream's commencement day.

(4B) A determination under subsection (4) is not a legislative instrument.

Guidelines to be complied with in making determination

(5) The Secretary may, by legislative instrument, determine guidelines to be complied with when making a determination under subsection (4).

(6) In this section:

"hardship amount" has the same meaning as in section 9A.

"non-commutation funded income stream" means an income stream that has not been purchased by transferring directly to the purchase of the income stream a payment resulting from the commutation of another asset - test exempt income stream.

"reversionary partner" , in relation to the primary beneficiary of an income stream and a particular day, means another person who, on that day:

(a) is a member of a couple with the primary beneficiary; and

(b) is the person to whom the income stream will revert on the primary beneficiary's death.