Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsFor the purposes of the method statement in section 123AB, work out the annualised maintenance income free area for a parent of the person for the income year using this method statement.

Method statement

Step 1. Using Submodule 4 of Module GA of the Youth Allowance Rate Calculator in section 1067G of the 1991 Act, work out whether the maintenance income free area (the MIFA ) for the parent was the same on all days in the income year. If it was, then that MIFA is the annualised maintenance income free area for the parent for the income year.

Step 2. If the MIFA for the parent was not the same on all days in the income year, work out for how many days in the income year each MIFA applied.

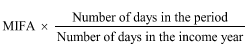

Step 3. Work out the MIFA share for each such period by using this formula:

Step 4. Add up the MIFA share for each such period in the income year. The result is the annualised maintenance income free area for the parent for the income year.