Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) Subject to subsection ( 2), the amount of levy payable by a trustee of a superannuation entity for a financial year is the sum of the restricted levy component and the unrestricted levy component for the financial year.

Note: For restricted levy component , see subsection ( 1A). For unrestricted levy component , see subsection ( 1B).

(1A) The restricted levy component for the financial year is:

(a) unless paragraph ( b) or (c) applies--the amount that, for the financial year, is the restricted levy percentage of:

(i) except where the superannuation entity was an unregulated entity on 30 June of the previous financial year--the superannuation entity's levy base on that day; or

(ii) if the superannuation entity was an unregulated entity, or was not in existence, on 30 June of the previous financial year--the entity's levy base on the day when the entity became a superannuation entity; or

(b) if the amount worked out under paragraph ( a) exceeds the maximum restricted levy amount for the financial year--the maximum restricted levy amount; or

(c) if the amount worked out under paragraph ( a) is less than the minimum restricted levy amount for the financial year--the minimum restricted levy amount.

Note: The restricted levy percentage, maximum restricted levy amount, minimum restricted levy amount and the method of working out the superannuation entity's levy base are as determined under subsection ( 3).

(1B) The unrestricted levy component for the financial year is the amount that, for the financial year, is the unrestricted levy percentage of:

(a) if the superannuation entity was an unregulated entity, or was not in existence, on 30 June of the previous financial year--the entity's levy base on the day when the entity became a superannuation entity; or

(b) otherwise--the superannuation entity's levy base on 30 June of the previous financial year.

Note: The unrestricted levy percentage is as determined under subsection ( 3).

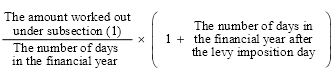

(2) If the levy imposition day for the trustee of a superannuation entity for the financial year is later than 1 July in the financial year, the amount of levy payable by the trustee for the financial year is the amount worked out using the following formula:

(3) The Treasurer is, by legislative instrument , to determine:

(a) the maximum restricted levy amount for each financial year; and

(b) the minimum restricted levy amount for each financial year; and

(c) the restricted levy percentage for each financial year; and

(ca) the unrestricted levy percentage for each financial year; and

(d) how a superannuation entity's levy base is to be worked out.

(4) An amount determined under subsection ( 3) as the maximum restricted levy amount for a financial year must not exceed the statutory upper limit for the financial year .

(4A) A determination under subsection ( 3) may make different provision for different classes of superannuation entity.

(5) Without limiting subsection ( 3), the Treasurer may make more than one determination, for a financial year, about any or all of the matters referred to in that subsection.