Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsIncome Tax Assessment Act 1997

1 Before Subdivision 61 - G

Insert:

Subdivision 61 - A -- Dependant (invalid and carer) tax offset

61 - 1 What this Subdivision is about

You are entitled to a tax offset for an income year if you maintain certain dependants who are unable to work.

Table of sections

Object of this Subdivision

61 - 5 Object of this Subdivision

Entitlement to the dependant (invalid and carer) tax offset

61 - 10 Who is entitled to the tax offset

61 - 15 Cases involving more than one spouse

61 - 20 Exceeding the income limit for family tax benefit (Part B)

61 - 25 Eligibility for family tax benefit (Part B) without shared care

Amount of the dependant (invalid and carer) tax offset

61 - 30 Amount of the dependant (invalid and carer) tax offset

61 - 35 Families with shared care percentages

61 - 40 Reduced amounts of dependant (invalid and carer) tax offset

61 - 45 Reductions to take account of the other individual's income

61 - 5 Object of this Subdivision

The object of this Subdivision is to provide a * tax offset to assist with the maintenance of certain types of dependants who are genuinely unable to work because of invalidity, or because of their care obligations.

Entitlement to the dependant (invalid and carer) tax offset

61 - 10 Who is entitled to the tax offset

(1) You are entitled to a * tax offset for an income year if:

(a) during the year you contribute to the maintenance of another individual who:

(i) is your * spouse; or

(ii) is your * parent or your spouse's parent; or

(iii) is aged 16 years or over, and is your * child, brother or sister or a brother or sister of your spouse; and

(b) during the year, the other individual meets the requirements of one or more of subsections ( 2), (3) and (4); and

(c) during the year:

(i) the other individual is an Australian resident; or

(ii) if the other individual is your spouse or your child--you had a domicile in Australia; and

(d) you are not entitled to a rebate of tax under section 159J (rebates for dependants) of the Income Tax Assessment Act 1936 in respect of the other individual for the year; and

(e) you are not entitled to a rebate of tax under section 159L (rebates for housekeepers) of the Income Tax Assessment Act 1936 in respect of the other individual for the year.

Note: To be entitled to a rebate under section 159J or 159L of the Income Tax Assessment Act 1936 , you must also be entitled to either or both of the following:

(a) a rebate under section 23AB (service with an armed force under the control of the United Nations), section 79A (residents of isolated areas) or section 79B (members of Defence Force serving overseas) of that Act;

(b) a rebate under subsection 159J(2) of that Act in respect of a spouse born before 1 July 1952.

(2) The other individual meets the requirements of this subsection if he or she is being paid:

(a) a disability support pension or a special needs disability support pension under the Social Security Act 1991 ; or

(b) an invalidity service pension under the Veterans' Entitlements Act 1986 .

(3) The other individual meets the requirements of this subsection if he or she:

(a) is your * spouse or parent, or your spouse's parent; and

(b) is being paid a carer allowance or carer payment under the Social Security Act 1991 in relation to provision of care to a person who:

(i) is your * child, brother or sister, or the brother or sister of your spouse; and

(ii) is aged 16 years or over.

(4) The other individual meets the requirements of this subsection if he or she is your * spouse or parent, or your spouse's parent, and is wholly engaged in providing care to an individual who:

(a) is your * child, brother or sister, or the brother or sister of your spouse; and

(b) is aged 16 years or over; and

(c) is being paid:

(i) a disability support pension or a special needs disability support pension under the Social Security Act 1991 ; or

(ii) an invalidity service pension under the Veterans' Entitlements Act 1986 .

(5) You may be entitled to more than one * tax offset for the year under subsection ( 1) if:

(a) you contributed to the maintenance of more than one other individual (none of whom are your * spouse) during the year; or

(b) you had different * spouses at different times during the year.

Note 1: If paragraph ( b) applies, the amount of the tax offset in relation to each spouse would be only part of the full amount: see section 61 - 40.

Note 2: Section 960 - 255 may be relevant to determining relationships for the purposes of this section.

61 - 15 Cases involving more than one spouse

(1) Despite paragraph 61 - 10(1)(a), if, during a period comprising some or all of the year, there are 2 or more individuals who are your * spouse, you are taken, for the purposes of section 61 - 10, only to contribute to the maintenance of the spouse with whom you reside during that period.

(2) Despite paragraph 61 - 10(1)(a) and subsection ( 1) of this section, if, during a period comprising some or all of the year:

(a) you reside with 2 or more individuals who are your * spouse; or

(b) 2 or more individuals are your * spouse but you reside with none of them;

you are taken, for the purposes of section 61 - 10, only to contribute to the maintenance of whichever of those individuals in relation to whom you are entitled to the smaller, or smallest, amount (including a nil amount) of tax offset under this Subdivision in relation to that period.

(3) If, but for this subsection, subsection ( 2) would apply in relation to more than one other individual, that paragraph is taken to apply only in relation to one of those other individuals.

61 - 20 Exceeding the income limit for family tax benefit (Part B)

(1) Despite section 61 - 10, you are not entitled to a * tax offset for an income year if the sum of:

(a) your * adjusted taxable income for offsets for the year; and

(b) if you had a * spouse for the whole or part of the year, and your spouse was not the other individual referred to in subsection 61 - 10(1)--the spouse's adjusted taxable income for offsets for the year;

is more than the amount specified in subclause 28B(1) of Schedule 1 to the A New Tax System (Family Assistance) Act 1999 , as indexed under Part 2 of Schedule 4 to that Act.

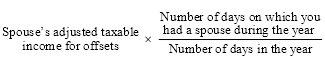

(2) However, if you had a * spouse for only part of the year, the spouse's * adjusted taxable income for offsets for the year is taken, for the purposes of paragraph ( 1)(b), to be this amount:

(3) If you had a different * spouse during different parts of the year, include the * adjusted taxable income for offsets of each spouse under paragraph ( 1)(b) and subsection ( 2).

61 - 25 Eligibility for family tax benefit (Part B) without shared care

Despite section 61 - 10, you are not entitled to a * tax offset in relation to another individual for an income year if:

(a) your entitlement to the tax offset would, apart from this section, be based on the other individual being your spouse during the year; and

(b) during the whole of the year:

(i) you, or your * spouse while being your partner (within the meaning of the A New Tax System (Family Assistance) Act 1999 ), is eligible for family tax benefit at the Part B rate (within the meaning of that Act); and

(ii) clause 31 of Schedule 1 to that Act does not apply in respect of the Part B rate.

Amount of the dependant (invalid and carer) tax offset

61 - 30 Amount of the dependant (invalid and carer) tax offset

The amount of the * tax offset to which you are entitled in relation to another individual under section 61 - 10 for an income year is $2,423. The amount is indexed annually.

Note 1: Subdivision 960 - M shows you how to index amounts.

Note 2: The amount of the tax offset may be reduced by the application, in order, of sections 61 - 35 to 61 - 45.

61 - 35 Families with shared care percentages

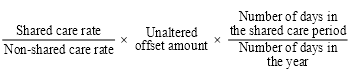

(1) The amount of the * tax offset under section 61 - 30 in relation to the other individual for the year is reduced by the amount worked out under subsection ( 2) of this section if:

(a) your entitlement to the tax offset is based on the other individual being your spouse during the year; and

(b) during a period (the shared care period ) comprising the whole or part of the year:

(i) you, or your * spouse while being your partner (within the meaning of the A New Tax System (Family Assistance) Act 1999 ), was eligible for family tax benefit at the Part B rate within the meaning of that Act; and

(ii) clause 31 of Schedule 1 to that Act applied in respect of that Part B rate because you, or your spouse, had a shared care percentage for an FTB child (within the meaning of that Act).

(2) The reduction is worked out as follows:

where:

"non-shared care rate" is the rate that would be the standard rate in relation to you or your * spouse under clause 30 of Schedule 1 to the A New Tax System (Family Assistance) Act 1999 if:

(a) clause 31 of that Schedule did not apply; and

(b) the FTB child in relation to whom the standard rate was determined under clause 31 of that Schedule was the only FTB child of you or your spouse, as the case requires.

"shared care rate" is the standard rate in relation to you or your * spouse worked out under clause 31 of Schedule 1 to the A New Tax System (Family Assistance) Act 1999 .

"unaltered offset amount" is what would, but for this section, be the amount of your * tax offset in relation to the other individual under section 61 - 10 for the year.

61 - 40 Reduced amounts of dependant (invalid and carer) tax offset

(1) The amount of the * tax offset under sections 61 - 30 and 61 - 35 in relation to the other individual for the year is reduced by the amount in accordance with subsection ( 2) of this section if one or more of the following applies:

(a) you contribute to the maintenance of the other individual during part only of the year;

(b) during the whole or part of the year, 2 or more individuals contribute to the maintenance of the other individual;

(c) the other individual is an individual of a kind referred to in subparagraph 61 - 10(1)(a)(i), (ii) or (iii) during part only of the year;

(d) paragraph 61 - 10(1)(b) applies to the other individual during part only of the year;

(e) paragraph 61 - 10(1)(c) applies during part only of the year;

(f) during part of the year:

(i) you, or your * spouse while being your partner (within the meaning of the A New Tax System (Family Assistance) Act 1999 ), is eligible for family tax benefit at the Part B rate (within the meaning of that Act); and

(ii) clause 31 of Schedule 1 to that Act does not apply in respect of the Part B rate;

(g) the other individual is your spouse, and, during part of the year, parental leave pay is payable under the Paid Parental Leave Act 2010 to you, or to your spouse while being your partner (within the meaning of that Act).

(2) The amount of the tax offset under sections 61 - 30 and 61 - 35 is reduced to an amount that, in the Commissioner's opinion, is reasonable in the circumstances, having regard to the applicable matters referred to in paragraphs ( 1)(a) to (g).

(3) If paragraph ( 1)(f) or (g) applies, the Commissioner is not to consider the part of the year covered by that paragraph.

61 - 45 Reductions to take account of the other individual's income

The amount of the * tax offset under sections 61 - 30 to 61 - 40 in relation to the other individual for the year is reduced by $1 for every $4 by which the following exceeds $282:

(a) if you contribute to the maintenance of the other individual for the whole of the year--the other individual's * adjusted taxable income for offsets for the year;

(b) if paragraph ( a) does not apply--the other individual's * adjusted taxable income for offsets for that part of the year during which you contribute to the maintenance of the other individual.

Income Tax Assessment Act 1936

2 After subsection 159J(1E)

Insert:

(1F) A taxpayer is not entitled, in his or her assessment in respect of a year of income, to a rebate under this section in respect of a dependant included in class 2, 3, 4, 5 or 6 in the table in subsection ( 2) unless the taxpayer is entitled, in his or her assessment in respect of that year of income, to a rebate under:

(a) section 23AB (certain persons serving with an armed force under the control of the United Nations); or

(b) section 79A (residents of isolated areas); or

(c) section 79B (members of Defence Force serving overseas).

(1G) Subsection ( 1F) does not affect a taxpayer's entitlement to a rebate in respect of a dependant who is also a dependant included in class 1 in the table in subsection ( 2).

3 Subsection 159J(6) (definition of invalid relative )

Repeal the definition, substitute:

"invalid relative" means a person who:

(a) is not less than 16 years of age and is a child, brother or sister of the taxpayer or of the taxpayer's spouse; and

(b) is being paid a disability support pension or a special needs disability support pension under the Social Security Act 1991 .

Note: Section 960 - 255 of the Income Tax Assessment Act 1997 may be relevant to determining relationships for the purposes of this definition.

4 Subsection 159J(6) (definition of invalid spouse )

Repeal the definition, substitute:

"invalid spouse" means a person who:

(a) is a spouse of the taxpayer; and

(b) is being paid a disability support pension or a special needs disability support pension under the Social Security Act 1991 .

5 After subsection 159L(3B)

Insert:

(3C) A taxpayer is not entitled, in his or her assessment in respect of a year of income, to a rebate under this section unless the taxpayer is entitled, in his or her assessment in respect of that year of income, to a rebate under:

(a) section 23AB (certain persons serving with an armed force under the control of the United Nations); or

(b) section 79A (residents of isolated areas); or

(c) section 79B (members of Defence Force serving overseas).

6 Subsection 159P(4) (at the end of the definition of dependant )

Add:

; or (e) a person in respect of whom the taxpayer is entitled to a tax offset under Subdivision 61 - A of the Income Tax Assessment Act 1997 ; or

(f) a person in respect of whom the taxpayer would be entitled to a tax offset under Subdivision 61 - A of the Income Tax Assessment Act 1997 but for section 61 - 20 of that Act.

Income Tax Assessment Act 1997

7 Section 13 - 1 (table item headed "dependants")

Omit:

invalid relative, invalid spouse or carer spouse ....... | 159J |

substitute:

invalid relative, invalid spouse or carer in receipt of carer benefit ....................... | 159J , Subdivision 61 - A |

8 After section 960 - 265 (table item 3)

Insert:

3A | Dependant (invalid and carer) tax offset | section 61 - 30 |

9 Subsection 995 - 1(1)

Insert:

"adjusted taxable income for offsets" means adjusted taxable income for rebates within the meaning of subsection 6(1) of the Income Tax Assessment Act 1936 .

Part 3 -- Application of amendments

10 Application of amendments

The amendments made by this Schedule apply to assessments for the 2012 - 13 income year and later income years.