Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Amendments commencing on 30 June 2000

Income Tax Assessment Act 1936

1 At the end of section 148

Add:

Application to a life assurance company

(10) This section applies to a life assurance company in relation to the whole or a part of a risk if, and only if, the risk or that part of the risk:

(a) is covered by a disability policy as defined in subsection 995 - 1(1) of the Income Tax Assessment Act 1997 ; and

(b) relates to a benefit that is payable in an event mentioned in that definition.

Income Tax Assessment Act 1997

2 At the end of section 4 - 15

Add:

Note: A life insurance company can have a taxable income of the complying superannuation class and/or a taxable income of the ordinary class for the purposes of working out its income tax for an income year: see Subdivision 320 - D.

3 Section 12 - 5 (table item headed "tax losses")

After:

film losses ............................... | Subdivision 375 - G |

insert:

life insurance companies ...................... | Subdivision 320 - D |

4 Section 36 - 25 (at the end of the table headed " Tax losses of companies ")

Add:

5. | A * life insurance company | Subdivision 320 - D |

5 Section 320 - 1

Omit all the words from and including "The taxable income of life insurance companies" to and including "the company tax rate.", substitute:

Life insurance companies can have one or both of these taxable incomes for any income year for the purposes of working out their income tax for that year:

• a taxable income of the complying superannuation class, which consists of taxable income that relates to complying superannuation business and is taxed at the rate of tax that applies to complying superannuation funds;

• a taxable income of the ordinary class, which consists of taxable income that relates to other businesses and is taxed at the corporate tax rate.

Life insurance companies can also have tax losses that correspond to those 2 classes. The Division provides that tax losses of a particular class can be deducted only from incomes in respect of that class.

The Division ensures that the income tax worked out on the basis of these taxable incomes and tax losses is a single amount of income tax on one taxable income.

6 Paragraphs 320 - 5(2)(c), (d) and (e)

Repeal the paragraphs, substitute:

(c) enables a life insurance company to have taxable incomes and * tax losses of the following classes for the purposes of working out its income tax for an income year:

(i) the * complying superannuation class;

(ii) the * ordinary class; and

(d) contains other provisions necessary to enable the income tax on the taxable income of a life insurance company to be worked out.

7 Paragraph 320 - 15(b)

After " * contracts of reinsurance", insert "(except amounts that relate to a risk, or part of a risk, in relation to which subsection 148(1) of the Income Tax Assessment Act 1936 applies)".

8 Paragraph 320 - 15(c)

Omit "a * contract of reinsurance", substitute "a contract of reinsurance (except any amount that relates to a risk, or part of a risk, in relation to which subsection 148(1) of the Income Tax Assessment Act 1936 applies)".

9 After paragraph 320 - 15(d)

Insert:

(da) the * transfer values of assets transferred by the company from a * virtual PST under subsection 320 - 180(1) or 320 - 195(3); and

(db) the transfer values of assets transferred by the company to a virtual PST under subsection 320 - 180(3) or 320 - 185(1); and

10 Paragraph 320 - 15(e)

Omit " * virtual PST under subsection 320 - 180(1) or (2)", substitute "virtual PST under subsection 320 - 180(1) or (3)".

11 Paragraph 320 - 15(f)

Repeal the paragraph, substitute:

(f) the transfer values of assets transferred by the company from the company's * segregated exempt assets under subsection 320 - 235(1) or 320 - 250(2); and

12 Paragraph 320 - 15(g)

Omit "320 - 235(2)", substitute "320 - 235(3)".

13 Paragraph 320 - 15(h)

Before "if", insert "subject to subsection ( 2),".

14 After paragraph 320 - 15(j)

Insert:

(ja) amounts imposed by the company in respect of risk riders for * ordinary investment policies in an income year in which the company did not receive any life insurance premiums for those policies; and

15 Paragraph 320 - 15(k)

After "included in", insert ", or taken into account in working out,".

16 At the end of section 320 - 15

Add:

(2) Paragraph ( 1)(h) does not cover any liabilities under:

(a) a * life insurance policy that provides for * participating benefits or * discretionary benefits; or

(b) an * exempt life insurance policy; or

(c) a * funeral policy.

17 Paragraph 320 - 40(5)(b)

Repeal the paragraph, substitute:

(b) so much of the sum of:

(i) any amounts transferred to the virtual PST in the income year under subsection 320 - 180(3) or 320 - 185(1); and

(ii) any of the amounts mentioned in paragraph ( a) that are related to the company's liability to pay amounts on the death or disability of a person; and

(iii) any of the amounts mentioned in paragraph ( a) that are related to expenses incurred by the company in respect of policies that provide for * participating benefits or * discretionary benefits; and

(iv) any of the amounts mentioned in paragraph ( a) that are not covered by subparagraph ( ii) or (iii) and are covered by subsection ( 5A);

as does not exceed the sum of the amounts mentioned in paragraph ( a).

18 After subsection 320 - 40(5)

Insert:

(5A) This subsection covers amounts that:

(a) are related to expenses incurred by the company directly in respect of * virtual PST assets in relation to a period during which the assets were virtual PST assets; and

(b) were transferred from the * virtual PST in the income year (as mentioned in paragraph ( 5)(a)) because the expenses were not paid from the virtual PST as required by subsection 320 - 195(4).

Note: For example, the amounts were transferred out of the virtual PST under subsection 320 - 195(3) because fees or charges were imposed to recover those expenses (as the expenses would have been paid from assets other than virtual PST assets).

19 Paragraphs 320 - 40(6)(a) and (b)

Repeal the paragraphs, substitute:

(a) the sum of the amounts transferred from the segregated exempt assets in the income year under subsection 320 - 235(1) or 320 - 250(2);

less:

(b) so much of the sum of:

(i) any amounts transferred to the segregated exempt assets in the income year under subsection 320 - 235(3) or 320 - 240(1); and

(ii) any of the amounts mentioned in paragraph ( a) that are related to expenses incurred by the company in respect of policies that provide for * participating benefits or * discretionary benefits; and

(iii) any of the amounts mentioned in paragraph ( a) that are not covered by subparagraph ( ii) and are covered by subsection ( 6A);

as does not exceed the sum of the amounts mentioned in paragraph ( a).

20 After subsection 320 - 40(6)

Insert:

(6A) This subsection covers amounts that:

(a) are related to expenses incurred by the company directly in respect of * segregated exempt assets in relation to a period during which the assets were segregated exempt assets; and

(b) were transferred from the segregated exempt assets in the income year (as mentioned in paragraph ( 6)(a)) because the expenses were not paid from the segregated exempt assets as required by subsection 320 - 250(3).

Note: For example, the amounts were transferred out of the segregated exempt assets under subsection 320 - 250(2) because fees or charges were imposed to recover those expenses (as the expenses would have been paid from assets other than segregated exempt assets).

21 Subsection 320 - 40(7)

Repeal the subsection, substitute:

(7) The applicable amount for other policies is:

(a) the sum of:

(i) the * life insurance premiums received in respect of the policies in the income year; and

(ii) any amounts that the company includes in its assessable income in respect of the policies under paragraph 320 - 15(1)(k) for the income year;

less:

(b) so much of the sum of:

(i) the amounts that the company can deduct under section 320 - 75 in respect of the policies in the income year; and

(ii) the * risk components of claims paid under the policies in the income year;

as does not exceed the sum of the amounts mentioned in paragraph ( a).

22 Subsection 320 - 55(3)

Repeal the subsection, substitute:

(3) For the purposes of subsection ( 2) only, the amount of a * life insurance premium that relates to the company's liability to pay amounts on the death or disability of a person is:

(a) if the policy provides for * participating benefits or * discretionary benefits--nil; or

(b) if paragraph ( a) does not apply and the policy states that the whole or a specified part of the premium is payable in respect of such a liability--the whole or that part of the premium, as appropriate; or

(c) if neither paragraph ( a) nor (b) applies:

(i) if the policy is an * endowment policy--10% of the premium; or

(ii) if the policy is a * whole of life policy--30% of the premium; or

(iii) otherwise--so much of the premium as an * actuary determines to be attributable to such a liability.

23 Subsection 320 - 70(2)

Repeal the subsection, substitute:

(2) This section does not apply to:

(a) * life insurance policies that provide for * participating benefits or * discretionary benefits; or

(b) funeral policies.

24 Section 320 - 75

Repeal the section, substitute:

320 - 75 Deduction for ordinary investment policies

(1) This section applies to a * life insurance company in respect of * ordinary investment policies issued by the company.

(2) The company can deduct, in respect of * life insurance premiums received in the income year for those policies:

(a) the sum of the * net premiums;

less:

(b) so much of the net premiums as an * actuary determines to be attributable to fees and charges charged in that income year.

(3) In making a determination under subsection ( 2), an * actuary is to have regard to:

(a) the changes over the income year in the sum of the * net current termination values of the policies; and

(b) the movements in those values during the income year.

(4) In addition, if an * actuary determines that:

(a) there has been a reduction in the income year (the current year ) of exit fees that were imposed in respect of those policies in a previous income year; and

(b) the reduction (or a part of it) has not been taken into account in a determination under subsection ( 2) for the current year;

the company can deduct so much of that reduction as has not been so taken into account.

25 Subparagraph 320 - 80(2)(a)(ii)

Repeal the subparagraph, substitute:

(ii) the policy is neither an * exempt life insurance policy nor a * funeral policy; and

26 Paragraph 320 - 80(2)(b)

After "exempt life insurance policy", insert "or a funeral policy".

27 Subsection 320 - 85(2)

Repeal the subsection, substitute:

(2) Subsection ( 1) does not cover any liabilities under:

(a) a * life insurance policy that provides for * participating benefits or * discretionary benefits; or

(b) an * exempt life insurance policy; or

(c) a * funeral policy.

28 Section 320 - 87

Repeal the section, substitute:

320 - 87 Deduction for assets transferred from or to virtual PST

(1) A * life insurance company can deduct the * transfer values of assets that are transferred by the company in the income year from a * virtual PST under subsection 320 - 180(1) or 320 - 195(3).

(2) A * life insurance company can deduct the * transfer values of assets that are transferred by the company in the income year to a * virtual PST under subsection 320 - 180(3) or 320 - 185(1).

(3) If an asset (other than money) is transferred by a * life insurance company:

(a) from a * virtual PST under subsection 320 - 180(1) or 320 - 195(2) or (3); or

(b) to a virtual PST under subsection 320 - 180(3) or section 320 - 185;

the company can deduct the amount (if any) that it can deduct because of section 320 - 200.

29 Section 320 - 100

Repeal the section, substitute:

320 - 100 Deduction for life insurance premiums paid under certain contracts of reinsurance

A * life insurance company can deduct amounts that:

(a) were paid by the company in the income year as * life insurance premiums under * contracts of reinsurance; and

(b) do not relate to a risk, or part of a risk, in relation to which subsection 148(1) of the Income Tax Assessment Act 1936 applies.

30 Section 320 - 105

Omit "320 - 235(2)" (wherever occurring), substitute "320 - 235(3)".

31 At the end of section 320 - 120

Add:

Note: This section affects the amount of assessable income that is to be taken into account in working out a taxable income or tax loss of the ordinary class: see sections 320 - 139 and 320 - 143.

32 At the end of section 320 - 125

Add:

Note: This section affects the amount of assessable income that is to be taken into account in working out a taxable income or tax loss of the complying superannuation class: see sections 320 - 137 and 320 - 141.

33 Subdivisions 320 - D and 320 - E

Repeal the Subdivisions, substitute:

Subdivision 320 - D -- Income tax, taxable income and tax loss of life insurance companies

320 - 130 What this Subdivision is about

This Subdivision explains how a life insurance company's income tax is worked out.

For that purpose, this Subdivision enables a life insurance company to have taxable incomes and tax losses of the following classes:

• the complying superannuation class;

• the ordinary class.

320 - 131 Overview of Subdivision

Working out the income tax

(1) In any income year, a life insurance company can have:

(a) a taxable income of the complying superannuation class and/or a taxable income of the ordinary class; or

(b) a tax loss of the complying superannuation class and/or a tax loss of the ordinary class; or

(c) a taxable income of one class and a tax loss of the other class.

Note: The taxable incomes mentioned in paragraph ( a) are taxed at different rates: see section 23A of the Income Tax Rates Act 1986 .

(2) Taxable incomes and tax losses of both classes are taken into account in working out the amount of income tax that the company has to pay for the income year (see section 320 - 134). That amount is then taken to be the income tax on the company's taxable income for that income year.

Working out taxable income and tax loss of each class

(3) In general, the rules in this Act about working out a company's taxable income or tax loss, or deducting a company's tax loss, apply to a life insurance company in relation to:

(a) working out a taxable income or tax loss of a particular class; or

(b) deducting a tax loss of a particular class.

(4) However, that general rule is subject to the following:

(a) sections 320 - 137 to 320 - 143, which allocate amounts of incomes and deductions for the purposes of working out a taxable income or tax loss of a particular class;

(b) subsections 320 - 141(2) and 320 - 143(2), which provide that tax losses of a particular class can be deducted only from incomes in respect of that class;

(c) section 320 - 149, which sets out the provisions in this Act that have effect only in relation to a taxable income or tax loss of the ordinary class.

Table of sections

General rules

320 - 133 Object of Subdivision

320 - 134 Income tax of a life insurance company

320 - 135 Taxable income and tax loss of each of the 2 classes

Taxable income and tax loss of life insurance companies

320 - 137 Taxable income--complying superannuation class

320 - 139 Taxable income--ordinary class

320 - 141 Tax loss--complying superannuation class

320 - 143 Tax loss--ordinary class

320 - 149 Provisions that apply only in relation to the ordinary class

[This is the end of the Guide.]

320 - 133 Object of Subdivision

(1) The object of this Subdivision is to ensure that:

(a) for the purposes of working out the amount of a * life insurance company's income tax for an income year:

(i) the company's taxable income or * tax loss of one * class is worked out separately from its taxable income or tax loss of the other class; and

(ii) the company's tax losses of a particular class can be deducted only from its incomes in respect of that class; and

(b) for the purposes of this Act, that amount of income tax is treated as the company's income tax on its taxable income for that income year.

(2) In subsection ( 1), a class means the * complying superannuation class or the * ordinary class.

320 - 134 Income tax of a life insurance company

Working out the income tax

(1) Work out a * life insurance company's income tax for an income year under section 4 - 10 as follows:

(a) apply steps 1 and 2 of the method statement in subsection 4 - 10(3) to work out separately the amount that would be the company's basic income tax liability for its taxable income of each * class for that year;

(b) treat the sum of these amounts as the company's basic income tax liability for that year and apply step 4 of the method statement to subtract its * tax offsets from that sum.

(2) For the purposes of this Act:

(a) the income tax worked out in accordance with subsection ( 1) is taken to be the company's income tax on its taxable income for the income year; and

(b) except as provided by subsection ( 1) of this section and sections 320 - 135 to 320 - 149, the company's taxable income for that year is taken to be equal to the sum of the company's taxable incomes of the 2 * classes for that year.

Note: This means that there is only one assessment in respect of the company's taxable income for the income year and that the income tax constitutes only one debt to the Commonwealth.

Working out the income tax on certain assumptions

(3) Subsection ( 1) also has effect in relation to working out an amount that would be the company's income tax if certain assumptions were made. It has that effect in the same way as it has effect in relation to working out the company's income tax under section 4 - 10 (except in regard to those assumptions).

Note: This means, for example, subsection ( 1) also has effect in relation to working out the amount of a life insurance company's income tax on the basis of the assumptions mentioned in section 67 - 30 (about getting a refund of a tax offset).

320 - 135 Taxable income and tax loss of each of the 2 classes

(1) Subject to the other provisions in this Subdivision:

(a) this Act has effect for a * life insurance company in relation to working out a taxable income of a particular * class in the same way as it has effect in relation to working out a taxable income of any other company; and

(b) this Act has effect for a life insurance company in relation to working out or deducting a * tax loss of a particular class in the same way as it has effect in relation to working out or deducting a tax loss of any other company.

(2) Sections 320 - 137 to 320 - 143 have effect in addition to other provisions in this Act that relate to working out a taxable income or * tax loss, or deducting a tax loss (as appropriate).

(3) Nothing in this Subdivision prevents a * life insurance company from:

(a) having taxable incomes, or * tax losses, of both * classes for the same income year; or

(b) having a taxable income of one class and a tax loss of the other class for the same income year.

Note: In certain circumstances, a life insurance company can have a taxable income and a tax loss of the same class in an income year (see Subdivision 165 - B as it has effect under this Subdivision).

Taxable income and tax loss of life insurance companies

320 - 137 Taxable income--complying superannuation class

(1) A * life insurance company's taxable income of the complying superannuation class is a taxable income worked out under this Act on the basis of only:

(a) assessable income of the company that is covered by subsection ( 2); and

(b) deductions of the company that are covered by subsection ( 4); and

(c) * tax losses of the company that are of the * complying superannuation class.

Note: For the usual way of working out a taxable income: see subsection 4 - 15(1). For other ways of working out a taxable income: see subsection 4 - 15(2).

Relevant assessable income

(2) This subsection covers the following assessable income of a * life insurance company:

(a) assessable income derived by the company from the investment of its * virtual PST assets in relation to the period during which those assets were virtual PST assets;

(b) so much of the amount that is included in the company's assessable income because of paragraph 320 - 15(1)(a) as is equal to the total * transfer value of assets transferred in the income year by the company to a * virtual PST under subsection 320 - 185(3);

(c) if an asset (other than money) is transferred by the company from a virtual PST under subsection 320 - 180(1) or 320 - 195(2) or (3)--amounts that are included in the company's assessable income because of section 320 - 200;

(d) amounts that are included in the company's assessable income because of paragraph 320 - 15(1)(db), (i) or (j);

(e) amounts that are included in the company's assessable income under subsection 115 - 280(4);

(f) subject to subsection ( 3), so much of the company's assessable income for the income year as is:

(i) the total amount credited during that year to the * RSAs provided by the company; less

(ii) the total amount debited during that year from the RSAs.

Amounts disregarded for RSAs

(3) In working out the amount mentioned in paragraph ( 2)(f), disregard the following amounts:

(a) contributions credited to the * RSAs that are not * taxable contributions;

(b) amounts debited from the RSAs that are benefits paid to, or in respect of, the holders of the RSAs;

(c) income tax debited from the RSAs;

(d) if an * annuity was paid from an RSA in respect of the whole of the income year, or the whole of the part of the income year in which the RSA existed, the total amount credited to the RSA during the income year;

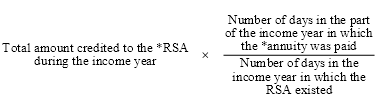

(e) if an annuity was paid from an RSA in respect of a part, but not the whole, of the portion of the income year in which the RSA existed, so much of the total amount credited to the RSA during the income year as is equal to the amount worked out using the following formula:

Relevant deductions

(4) This subsection covers the following deductions of a * life insurance company:

(a) amounts that the company can deduct under section 320 - 55;

(b) amounts that the company can deduct (other than any * tax losses) in respect of the investment of the company's * virtual PST assets in relation to the period during which those assets were virtual PST assets;

(c) amounts that the company can deduct under section 320 - 87 because of subsection ( 1) or paragraph ( 3)(a) of that section;

(d) amounts that the company can deduct under subsection 115 - 280(1);

(e) so much of the amounts that the company can deduct under subsection 115 - 215(6) as are attributable to * capital gains that:

(i) the company is taken to have under subsection 115 - 215(3); and

(ii) are in respect of the investment of the company's virtual PST assets; and

(iii) are in relation to the period during which those assets were virtual PST assets.

320 - 139 Taxable income--ordinary class

A * life insurance company's taxable income of the ordinary class is a taxable income worked out under this Act on the basis of only:

(a) assessable income of the company that is not covered by subsection 320 - 137(2); and

(b) amounts (other than * tax losses) that the company can deduct and are not covered by subsection 320 - 137(4); and

(c) tax losses of the company that are of the * ordinary class.

Note: For the usual way of working out a taxable income: see subsection 4 - 15(1). For other ways of working out a taxable income: see subsection 4 - 15(2).

320 - 141 Tax loss--complying superannuation class

Working out a tax loss of the complying superannuation class

(1) A * life insurance company's * tax loss of the complying superannuation class is a tax loss worked out under this Act on the basis of only:

(a) assessable income of the company that is covered by subsection 320 - 137(2); and

(b) deductions of the company that are covered by subsection 320 - 137(4); and

(c) * net exempt income of the company that is attributable to * exempt income derived:

(i) from the company's * virtual PST assets; and

(ii) in relation to the period during which those assets were virtual PST assets.

Note: For the usual way of working out a tax loss: see section 36 - 10. For other ways of working out a tax loss: see section 36 - 25.

Deducting a tax loss of the complying superannuation class

(2) A * life insurance company's * tax loss of the complying superannuation class can be deducted under this Act only from:

(a) * net exempt income of the company that is attributable to * exempt income derived:

(i) from the company's * virtual PST assets; and

(ii) in relation to the period during which those assets were virtual PST assets; and

(b) assessable income of the company that is covered by subsection 320 - 137(2), reduced by deductions of the company that are covered by subsection 320 - 137(4).

Note: For the usual way of deducting a tax loss: see section 36 - 15. For other ways of deducting a tax loss: see section 36 - 25.

320 - 143 Tax loss--ordinary class

Working out a tax loss of the ordinary class

(1) A * life insurance company's * tax loss of the ordinary class is a tax loss worked out under this Act on the basis of only:

(a) assessable income of the company that is not covered by subsection 320 - 137(2); and

(b) amounts (other than tax losses) that the company can deduct and are not covered by subsection 320 - 137(4); and

(c) * net exempt income of the company that is not attributable to * exempt income derived:

(i) from the company's * virtual PST assets; and

(ii) in relation to the period during which those assets were virtual PST assets.

Note: For the usual way of working out a tax loss: see section 36 - 10. For other ways of working out a tax loss: see section 36 - 25.

Deducting a tax loss of the ordinary class

(2) A * life insurance company's * tax loss of the ordinary class can be deducted under this Act only from:

(a) * net exempt income of the company that is not attributable to * exempt income derived:

(i) from the company's * virtual PST assets; and

(ii) in relation to the period during which those assets were virtual PST assets; and

(b) assessable income of the company that is not covered by subsection 320 - 137(2), reduced by amounts (other than tax losses) that the company can deduct and are not covered by subsection 320 - 137(4).

Note: For the usual way of deducting a tax loss: see section 36 - 15. For other ways of deducting a tax loss: see section 36 - 25.

320 - 149 Provisions that apply only in relation to the ordinary class

(1) The provisions covered by subsection ( 2):

(a) have effect as provided by section 320 - 135 in relation to a * life insurance company's taxable income, or * tax loss, of the * ordinary class; but

(b) have no effect in relation to the company's taxable income, or tax loss, of the * complying superannuation class.

(2) This subsection covers these provisions:

(a) section 36 - 55;

(b) Division 165 (except Subdivision 165 - CD).

Example 1: A life insurance company that has an amount of excess franking offsets will need to recalculate its tax loss of the ordinary class under section 36 - 55. But its tax loss of the complying superannuation class is unaffected by that section.

Example 2: A life insurance company that fails to meet the relevant tests of Division 165 will need to recalculate the ordinary class of its taxable income and tax loss under Subdivision 165 - B. But the complying superannuation class of its taxable income and tax loss are unaffected by that Subdivision.

34 Subdivision 320 - F (heading)

Repeal the heading, substitute:

Subdivision 320 - F -- Virtual PST

35 Section 320 - 165

Repeal the section, substitute:

320 - 165 What this Subdivision is about

This Subdivision explains how a life insurance company can segregate assets (to be known as a virtual PST ) to be used for the sole purpose of discharging its complying superannuation liabilities.

36 Subsection 320 - 170(3)

Repeal the subsection, substitute:

(3) The assets segregated must have, as at the time of the segregation, a total * transfer value that does not exceed the sum of:

(a) the company's * virtual PST liabilities as at that time; and

(b) any reasonable provision made by the company at that time in its accounts for liability for income tax in respect of the assets segregated.

37 Section 320 - 175

Repeal the section, substitute:

320 - 175 Valuations of virtual PST assets and virtual PST liabilities for each valuation time

(1) A * life insurance company that has established a * virtual PST must cause the following amounts to be calculated within the period of 60 days starting immediately after each * valuation time:

(a) the total * transfer value of the company's * virtual PST assets as at the valuation time;

(b) the company's * virtual PST liabilities as at the valuation time.

(2) These are the valuation times :

(a) the end of the income year in which the * virtual PST was established;

(b) the end of each later income year.

Note: A life insurance company that fails to comply with this section is liable to an administrative penalty: see section 288 - 70 in Schedule 1 to the Taxation Administration Act 1953 .

38 Section 320 - 180

Repeal the section, substitute:

320 - 180 Consequences of a valuation under section 320 - 175

Transfer from the virtual PST

(1) If the total * transfer value of the company's * virtual PST assets as at a * valuation time exceeds the sum of:

(a) the company's * virtual PST liabilities as at that time; and

(b) any reasonable provision made by the company at that time in its accounts for liability for income tax in respect of those assets;

the company must transfer, from the * virtual PST, assets of any kind having a total transfer value equal to the excess.

(2) A transfer under subsection ( 1) must be made within the period of 30 days starting immediately after:

(a) the day on which the total * transfer value and the * virtual PST liabilities (as at the * valuation time) were calculated; or

(b) if those amounts were calculated on different days--the later of those days.

The transfer, once made, is taken to have been made at the valuation time (whether or not the transfer is made within those 30 days).

Note: A life insurance company that fails to comply with subsections ( 1) and (2) is liable to an administrative penalty: see section 288 - 70 in Schedule 1 to the Taxation Administration Act 1953 .

Transfer to the virtual PST

(3) If the total * transfer value of the company's * virtual PST assets as at a * valuation time is less than the sum of:

(a) the company's * virtual PST liabilities as at that time; and

(b) any reasonable provision made by the company at that time in its accounts for liability for income tax in respect of those assets;

the company can transfer, to the * virtual PST, assets of any kind having a total transfer value not exceeding the difference.

(4) A transfer under subsection ( 3) is taken to have been made at the * valuation time if it is made within the period of 30 days starting immediately after:

(a) the day on which the total * transfer value and the * virtual PST liabilities (as at the valuation time) were calculated; or

(b) if those amounts were calculated on different days--the later of those days.

39 Section 320 - 185 (heading)

Repeal the heading, substitute:

40 Subsection 320 - 185(1)

Repeal the subsection, substitute:

(1) If a * life insurance company determines, at a time other than a * valuation time, that the total * transfer value of the company's * virtual PST assets as at that time is less than the sum of:

(a) the company's * virtual PST liabilities as at that time; and

(b) any reasonable provision made by the company at that time in its accounts for liability for income tax in respect of those assets;

the company can transfer, to the * virtual PST, assets of any kind having a total transfer value not exceeding the difference.

41 Subsection 320 - 185(4)

Omit "320 - 180(2)", substitute "320 - 180(3)".

42 Section 320 - 195 (heading)

Repeal the heading, substitute:

43 Paragraph 320 - 195(3)(c)

Repeal the paragraph, substitute:

(c) determines, at a time other than a * valuation time, that the total * transfer value of the company's virtual PST assets as at that time exceeds the sum of:

(i) the company's * virtual PST liabilities at that time; and

(ii) any reasonable provision made by the company at that time in its accounts for liability for income tax in respect of those assets;

44 Subsection 320 - 195(4)

Repeal paragraph ( c) and omit all the words after it, substitute:

(c) any liabilities to pay * PAYG instalments, or income tax, that are attributable to the company's * virtual PST assets;

the life insurance company must pay, from the virtual PST, any amounts required to discharge the liabilities, or amounts equal to the expenses (as appropriate).

45 Subsection 320 - 200(1)

Omit "320 - 180(2)", substitute "320 - 180(3)".

46 After subsection 320 - 200(2)

Insert:

(2A) Without limiting subsection ( 2), where the asset transferred is a unit of * plant, Division 42 has effect for the company as if:

(a) in relation to the sale of the asset that is taken to have occurred under paragraph ( 2)(c):

(i) the sale were a * balancing adjustment event; and

(ii) the * termination value of the asset for that event were equal to the consideration for the sale under that paragraph; and

(iii) the company had ceased to be the owner or * quasi - owner of the asset at the time of the sale; and

(b) in relation to the purchase of the asset that is taken to have occurred under paragraph ( 2)(d):

(i) the company had only become the owner or quasi - owner of the asset after the purchase; and

(ii) the asset's cost were equal to the consideration for the purchase under that paragraph; and

(iii) the company had acquired the asset from an * associate of the company.

Note: This means that, amongst other things, as a result of the transfer:

47 At the end of section 320 - 200

Add:

(4) Subsection ( 3) does not apply in relation to an amount that the company can deduct under a provision in Division 42.

48 Section 320 - 205

Repeal the section.

49 Subdivision 320 - G

Repeal the Subdivision.

50 Subsection 320 - 225(3)

Repeal the subsection, substitute:

(3) The assets segregated must have, as at the time of the segregation, a total * transfer value that does not exceed the amount of the company's * exempt life insurance policy liabilities as at that time.

51 Section 320 - 230

Repeal the section, substitute:

(1) A * life insurance company that has segregated any of its assets in accordance with section 320 - 225 must cause the following amounts to be calculated within the period of 60 days starting immediately after each * valuation time:

(a) the total * transfer value of the company's * segregated exempt assets as at the valuation time;

(b) the amount of the company's * exempt life insurance policy liabilities as at the valuation time.

(2) These are the valuation times :

(a) the end of the income year in which the segregation occurred;

(b) the end of each later income year.

Note: A life insurance company that fails to comply with this section is liable to an administrative penalty: see section 288 - 70 in Schedule 1 to the Taxation Administration Act 1953 .

52 Section 320 - 235

Repeal the section, substitute:

320 - 235 Consequences of a valuation under section 320 - 230

Transfer from the segregated exempt assets

(1) If:

(a) the total * transfer value of the company's * segregated exempt assets as at a * valuation time;

exceeds

(b) the amount of the company's * exempt life insurance policy liabilities as at that time;

the company must transfer, from the segregated exempt assets, assets of any kind having a total transfer value equal to the excess.

(2) A transfer under subsection ( 1) must be made within the period of 30 days starting immediately after:

(a) the day on which the total * transfer value and the * exempt life insurance policy liabilities (as at the * valuation time) were calculated; or

(b) if those amounts were calculated on different days--the later of those days.

The transfer, once made, is taken to have been made at the valuation time (whether or not the transfer is made within those 30 days).

Note: A life insurance company that fails to comply with subsections ( 1) and (2) is liable to an administrative penalty: see section 288 - 70 in Schedule 1 to the Taxation Administration Act 1953 .

Transfer to the segregated exempt assets

(3) If:

(a) the total * transfer value of the company's * segregated exempt assets as at a * valuation time;

is less than

(b) the amount of the company's * exempt life insurance policy liabilities as at that time;

the company can transfer, to the segregated exempt assets, assets of any kind having a total transfer value not exceeding the difference.

(4) A transfer under subsection ( 3) is taken to have been made at the * valuation time if it is made within the period of 30 days starting immediately after:

(a) the day on which the total * transfer value and the * exempt life insurance policy liabilities (as at the valuation time) were calculated; or

(b) if those amounts were calculated on different days--the later of those days.

53 Section 320 - 240 (heading)

Repeal the heading, substitute:

54 Subsection 320 - 240(1)

Repeal the subsection, substitute:

(1) If a * life insurance company determines, at a time other than a * valuation time, that:

(a) the total * transfer value of the company's * segregated exempt assets as at that time;

is less than

(b) the company's * exempt life insurance policy liabilities as at that time;

the company can transfer, to the segregated exempt assets, assets of any kind having a total transfer value not exceeding the difference.

55 Subsection 320 - 240(4)

Omit "320 - 235(2)", substitute "320 - 235(3)".

56 Subparagraph 320 - 245(3)(a)(ii)

Repeal the subparagraph.

57 After section 320 - 245

Insert:

320 - 246 Exempt life insurance policy

(1) An exempt life insurance policy is a * life insurance policy (other than an * RSA):

(a) that is held by the trustee of a * complying superannuation fund and provides solely for the discharge of the current pension liabilities (within the meaning of Part IX of the Income Tax Assessment Act 1936 ) of the fund; or

(b) that is held by the trustee of a * pooled superannuation trust, where:

(i) the policy provides solely for the discharge of the current pension liabilities (within the meaning of Part IX of the Income Tax Assessment Act 1936 ) of complying superannuation funds; and

(ii) the funds are unit holders of the trust; or

(c) that is held by another * life insurance company and is a * segregated exempt asset of that other company; or

(d) that is held by the trustee of a * constitutionally protected fund; or

(e) that provides for an * immediate annuity that:

(i) was purchased on or before 9 December 1987 and was not purchased wholly or partly with a rolled - over amount; or

(ii) satisfies the conditions in subsections ( 3), (4) and (5) and was purchased on or before 9 December 1987 wholly or partly with a rolled - over amount; or

(iii) satisfies the conditions in subsections ( 3), (4) and (5) and was purchased after 9 December 1987.

Note: A part of a life insurance policy may be taken to be an exempt life insurance policy under section 320 - 247.

(2) In subsection ( 1), a rolled - over amount has the same meaning as it has under section 27A of the Income Tax Assessment Act 1936 .

(3) An * immediate annuity satisfies the conditions in this subsection if it is payable until the later of:

(a) the death of a person (or the death of the last to die of 2 or more persons); or

(b) the end of a fixed term.

(4) An * immediate annuity satisfies the conditions in this subsection if the contract under which it is payable does not permit:

(a) the total amount payable for its commutation to exceed its reduced purchase price (within the meaning of section 27A of the Income Tax Assessment Act 1936 ); and

(b) any payment of its residual capital value (within the meaning of that section) to exceed its purchase price (within the meaning of that section).

(5) An * immediate annuity satisfies the conditions in this subsection if there is no unreasonable deferral of the payments of the annuity, having regard to:

(a) to the extent to which the payments depend on the returns of the investment of the assets of the * life insurance company paying the annuity--when the payments are made and when those returns are derived; and

(b) to the extent to which the payments do not depend on those returns--the relative sizes of the payments from year to year; and

(c) any other relevant factors.

320 - 247 Policy split into an exempt life insurance policy and another life insurance policy

When is a part of a policy taken to be an exempt life insurance policy?

(1) A part of a * life insurance policy (the original policy ) is taken to be an * exempt life insurance policy for the purposes of this Act if:

(a) the part provides solely for the discharge of the current pension liabilities (within the meaning of Part IX of the Income Tax Assessment Act 1936 ) of a * complying superannuation fund; and

(b) the trustee of the fund holds the original policy.

(2) A part of a * life insurance policy (the original policy ) is taken to be an * exempt life insurance policy for the purposes of this Act if:

(a) the part provides solely for the discharge of liabilities that are attributable to the current pension liabilities (within the meaning of Part IX of the Income Tax Assessment Act 1936 ) of * complying superannuation funds; and

(b) the trustee of a * pooled superannuation trust holds the original policy; and

(c) the funds are unit holders of the trust.

What happens to the rest of the policy?

(3) If a part of a policy (the original policy ) is taken to be an * exempt life insurance policy under subsection ( 1) or (2), the rest of the original policy is taken to be another * life insurance policy for the purposes of this Act.

58 Section 320 - 250 (heading)

Repeal the heading, substitute:

59 Paragraph 320 - 250(2)(c)

Repeal the paragraph, substitute:

(c) determines, at a time other than a * valuation time, that the total * transfer value of the company's segregated exempt assets as at that time exceeds the amount of the company's * exempt life insurance policy liabilities as at that time;

60 Subsection 320 - 250(4)

Repeal the subsection.

61 Subsection 320 - 255(1)

Omit "320 - 235(2)", substitute "320 - 235(3)".

62 After subsection 320 - 255(3)

Insert:

(3A) Subsection ( 3) does not apply in relation to an amount that the company can deduct under a provision in Division 42.

63 Subsection 320 - 255(7)

Omit " * notional undeducted cost", substitute " * undeducted cost".

64 Subsection 320 - 255(7)

Omit "notional undeducted cost" (wherever occurring), substitute "undeducted cost".

65 At the end of section 320 - 255

Add:

(9) Division 42 has effect in relation to an asset covered by subsection ( 6), (7) or (8) as if:

(a) in relation to the sale of the asset that is taken to have occurred under that subsection:

(i) the sale were a * balancing adjustment event; and

(ii) the * termination value of the asset for that event were equal to the consideration for the sale; and

(iii) the company had ceased to be the owner or * quasi - owner of the asset at the time of the sale; and

(b) in relation to the purchase of the asset that is taken to have occurred under that subsection:

(i) the company had only become the owner or quasi - owner of the asset after the purchase; and

(ii) the asset's cost were equal to the consideration for the purchase under that subsection; and

(iii) the company had acquired the asset from an * associate of the company.

Note: This means that, amongst other things, as a result of the transfer:

66 Subsection 995 - 1(1)

Insert:

"class" of a taxable income or a * tax loss of a * life insurance company has the meaning given by section 320 - 133.

67 Subsection 995 - 1(1) (definition of complying superannuation class )

Repeal the definition, substitute:

"complying superannuation class" for a taxable income of a * life insurance company has the meaning given by section 320 - 137.

68 Subsection 995 - 1(1)

Insert:

"complying superannuation class" for a * tax loss of a * life insurance company has the meaning given by section 320 - 141.

69 Subsection 995 - 1(1) (definition of exempt life insurance policy )

Repeal the definition, substitute:

"exempt life insurance policy" has the meaning given by section 320 - 246.

Note: This definition is affected by section 320 - 247.

70 Subsection 995 - 1(1) (definition of net risk component )

Repeal the definition, substitute:

"net risk component" of a * life insurance policy means so much of the policy's risk component as:

(a) is not reinsured under a * contract of reinsurance; or

(b) is reinsured under a contract of reinsurance to which subsection 148(1) of the Income Tax Assessment Act 1936 applies.

71 Subsection 995 - 1(1) (definition of ordinary class )

Repeal the definition, substitute:

"ordinary class" for a taxable income of a * life insurance company has the meaning given by section 320 - 139.

72 Subsection 995 - 1(1)

Insert:

"ordinary class" for a * tax loss of a * life insurance company has the meaning given by section 320 - 143.

73 Subsection 995 - 1(1)

Insert:

"ordinary investment policy" means a * life insurance policy that is not:

(a) a * virtual PST life insurance policy; or

(b) an * exempt life insurance policy; or

(c) a policy that provides for * participating benefits or * discretionary benefits; or

(d) a policy (other than a * funeral policy) under which amounts are to be paid only on the death or disability of a person.

74 Subsection 995 - 1(1) (definition of RSA component )

Repeal the definition.

75 Subsection 995 - 1(1)

Insert:

"sickness policy" means a * life insurance policy issued by a * friendly society for the sole purpose of providing:

(a) benefits in respect of a sickness of the insured person; or

(b) benefits covered by paragraph ( a) and benefits to pay for the funeral of the insured person.

76 Subsection 995 - 1(1) (definition of specified roll - over component )

Repeal the definition.

77 Subsection 995 - 1(1) (at the end of paragraph ( a) of the definition of tax loss , after the notes)

Add:

Note 3: A life insurance company can have a tax loss of the complying superannuation class and/or a tax loss of the ordinary class for the purposes of working out its income tax for an income year: see Subdivision 320 - D.

78 Subsection 995 - 1(1)

Insert:

"valuation time" for a * life insurance company has the meaning given by sections 320 - 175 and 320 - 230.

Note: This definition is affected by section 713 - 525.

79 Subsection 995 - 1(1) (definition of virtual PST component )

Repeal the definition.

Income Tax (Transitional Provisions) Act 1997

80 After section 320 - 85

Insert:

Subdivision 320 - D -- Taxable income and tax loss of life insurance companies

320 - 100 Savings--tax losses of previous income years

If:

(a) a life insurance company has a tax loss for an income year ending before 1 July 2000; and

(b) all or a part of that tax loss is carried forward to the income year that includes that date;

so much of that tax loss as is so carried forward has effect as if it were a tax loss of the ordinary class.

81 Subdivision 320 - F (heading)

Repeal the heading, substitute:

Subdivision 320 - F -- Virtual PST

82 Subsection 320 - 175(1)

Repeal the subsection, substitute:

(1) If:

(a) a life insurance company had a liability before 1 July 2000 under a life insurance policy; and

(b) the liability or a part of the liability is to be discharged out of the company's virtual PST assets; and

(c) there is a transfer of the company's assets to the virtual PST to meet that liability or that part of the liability;

then, to the extent to which the assets are transferred to meet that liability or that part of the liability:

(d) if the transfer occurs before 1 October 2000--the transfer is to be disregarded for the purposes of the Income Tax Assessment Act 1997 ; or

(e) if the transfer occurs on or after 1 October 2000--the transfer is to be disregarded for the purposes of that Act, except:

(i) section 320 - 200 of that Act; and

(ii) any other provisions that rely on the operation of that section (for example, paragraph 320 - 15(1)(e) of that Act).

Note: This means, amongst other things, that a life insurance company to which this subsection applies will not be able to claim a deduction in respect of the transfer under subsection 320 - 87(2) of that Act.

(1A) If subsection ( 1) has applied to a life insurance company in respect of a transfer of assets to meet a liability or a part of a liability, that subsection does not apply again in respect of another transfer of assets to meet that liability or that part of the liability.

83 Subsection 320 - 230(1)

Repeal the subsection, substitute:

(1) If:

(a) a life insurance company had a liability before 1 July 2000 under a life insurance policy where the income of the company attributable to the liability was exempt from tax before that date; and

(b) the liability or a part of the liability is to be discharged out of the company's segregated exempt assets; and

(c) there is a transfer of the company's assets to the segregated exempt assets to meet that liability or that part of the liability;

then, to the extent to which the assets are transferred to meet that liability or that part of the liability:

(d) if the transfer occurs before 1 October 2000--the transfer is to be disregarded for the purposes of the Income Tax Assessment Act 1997 ; or

(e) if the transfer occurs on or after 1 October 2000--the transfer is to be disregarded for the purposes of that Act, except:

(i) section 320 - 255 of that Act; and

(ii) any other provisions that rely on the operation of that section (for example, paragraph 320 - 15(1)(g) of that Act).

Note: This means, amongst other things, that a life insurance company to which this subsection applies will not be able to claim a deduction in respect of the transfer under subsection 320 - 105(1) of that Act.

(1A) If subsection ( 1) has applied to a life insurance company in respect of a transfer of assets to meet a liability or a part of a liability, that subsection does not apply again in respect of another transfer of assets to meet that liability or that part of the liability.

Taxation Administration Act 1953

84 Subsection 45 - 330(3) in Schedule 1 (method statement)

Repeal the method statement, substitute:

Method statement

Step 1. Recalculate the taxable income of the * ordinary class for the * base assessment on the basis that it did not include any * net capital gain.

Step 2. Add to the step 1 result the deductions for * tax losses of the * ordinary class that were used in making the * base assessment.

Step 3. Reduce the step 2 result by the amount of any * tax losses of the * ordinary class, to the extent that the company can carry them forward to the next income year.

Step 4. Add to the step 3 result the taxable income of the * complying superannuation class for the * base assessment.

Step 5. Add to the step 4 result the deductions for * tax losses of the * complying superannuation class that were used in making the * base assessment.

Step 6. Reduce the step 5 result by the amount of any * tax losses of the * complying superannuation class, to the extent that the company can carry them forward to the next income year.

The result of this step is the adjusted taxable income of the company for the * base year.

Part 2 -- Amendments commencing on 30 June 2001

Income Tax Assessment Act 1997

85 Section 40 - 15 (note)

Renumber the note as Note 1.

86 At the end of section 40 - 15

Add:

Note 2: The application of this Division to a life insurance company is affected by sections 320 - 200 and 320 - 255.

87 Subsection 320 - 200(2A)

Repeal the subsection, substitute:

(2A) Without limiting subsection ( 2), where the asset transferred is a * depreciating asset, Division 40 has effect for the company as if:

(a) in relation to the sale of the asset that is taken to have occurred under paragraph ( 2)(c):

(i) the sale were a * balancing adjustment event; and

(ii) the * termination value of the asset for that event were equal to the consideration for the sale under that paragraph; and

(iii) the company had stopped * holding the asset at the time of the sale; and

(b) in relation to the purchase of the asset that is taken to have occurred under paragraph ( 2)(d):

(i) the company had only begun to hold the asset after the purchase; and

(ii) the first element of the asset's * cost were equal to the consideration for the purchase under that paragraph; and

(iii) the company had acquired the asset from an * associate of the company.

Note: This means that, amongst other things, as a result of the transfer:

88 Subsection 320 - 200(4)

Repeal the subsection, substitute:

(4) Subsection ( 3) does not apply in relation to an amount that the company can deduct under a provision in Division 40.

89 Subsection 320 - 255(3A)

Repeal the subsection, substitute:

(3A) Subsection ( 3) does not apply in relation to an amount that the company can deduct under a provision in Division 40.

90 Subsection 320 - 255(5)

Repeal the subsection.

91 Subsection 320 - 255(7)

Omit " * notional adjustable value", substitute " * adjustable value".

92 Subsection 320 - 255(7)

Omit "notional adjustable value" (wherever occurring), substitute "adjustable value".

93 Subsection 320 - 255(9)

Repeal the subsection, substitute:

(9) Division 40 has effect in relation to an asset covered by subsection ( 6), (7) or (8) as if:

(a) in relation to the sale of the asset that is taken to have occurred under that subsection:

(i) the sale were a * balancing adjustment event; and

(ii) the * termination value of the asset for that event were equal to the consideration for the sale under that subsection; and

(iii) the company had stopped * holding the asset at the time of the sale; and

(b) in relation to the purchase of the asset that is taken to have occurred under that subsection:

(i) the company had only begun to hold the asset after the purchase; and

(ii) the first element of the asset's * cost were equal to the consideration for the purchase under that subsection; and

(iii) the company had acquired the asset from an * associate of the company.

Note: This means that, amongst other things, as a result of the transfer:

94 Subsection 995 - 1(1) (definition of notional adjustable value )

Repeal the definition.

Part 3 -- Amendments commencing on 24 October 2002

Income Tax Assessment Act 1997

95 At the end of subsection 320 - 175(2)

Add:

Note: The time when a life insurance company joins or leaves a consolidated group is also a valuation time: see section 713 - 525.

96 At the end of subsection 320 - 230(2)

Add:

Note: The time when a life insurance company joins or leaves a consolidated group is also a valuation time: see section 713 - 525.

97 Section 713 - 525

Repeal the section, substitute:

713 - 525 Obligation to value certain assets and liabilities

Division 320 has effect as if:

(a) the joining time when a * life insurance company becomes a * subsidiary member of a * consolidated group; and

(b) the time (the leaving time ) when a life insurance company ceases to be a subsidiary member of a consolidated group;

were a * valuation time for the purposes of sections 320 - 175 and 320 - 230.

Note: This means that:

98 Subparagraph 713 - 530(1)(c)(ii)

Repeal the subparagraph, substitute:

(ii) the head company has a * tax loss of the * complying superannuation class.

99 Subsection 713 - 530(2)

Omit "or the difference", substitute "or the * tax loss".

Part 4 -- Amendment commencing on 19 December 2002

Income Tax Assessment Act 1997

100 At the end of subsection 320 - 246(1)

Add:

; or (f) that provides for either or both of the following:

(i) a * personal injury annuity, payments of which are exempt from income tax under Division 54;

(ii) a * personal injury lump sum, payment of which is exempt from income tax under Division 54.

Part 5 -- Amendments commencing on 30 June 2003

Income Tax Assessment Act 1997

101 Paragraph 320 - 35(b)

Repeal the paragraph, substitute:

(b) if the company is an * RSA provider--any amounts that are disregarded because of paragraph 320 - 137(3)(d) or (e) in working out the company's taxable income of the * complying superannuation class.

102 Subparagraph 320 - 37(1)(d)(ii)

Omit "or * funeral policies", substitute ", * funeral policies or * sickness policies".

103 Subparagraph 320 - 37(1)(d)(iv)

Omit "or funeral policies", substitute ", funeral policies or * sickness policies, that were".

104 Section 320 - 40 (heading)

Repeal the heading, substitute:

Part 6 -- Amendments commencing on 17 December 2003

Income Tax Assessment Act 1997

105 Subsection 320 - 141(2) (note)

Omit "section 36 - 15", substitute "section 36 - 17".

106 Subsection 320 - 143(2) (note)

Omit "section 36 - 15", substitute "section 36 - 17".

Taxation Administration Act 1953

107 Subsection 45 - 330(3) in Schedule 1 (method statement)

Repeal the method statement, substitute:

Method statement

Step 1. Recalculate the taxable income of the * ordinary class for the * base assessment on the basis that it did not include any * net capital gain.

Step 2. Add to the step 1 result the deductions for * tax losses of the * ordinary class that were used in making the * base assessment.

Step 3. Reduce the step 2 result by the lesser of the following amounts:

(a) the amount of any * tax losses of the * ordinary class, to the extent that the company can carry them forward to the next income year;

(b) deductions for tax losses of the ordinary class that were used in making the * base assessment.

Step 4. Add to the step 3 result the taxable income of the * complying superannuation class for the * base assessment.

Step 5. Add to the step 4 result the deductions for * tax losses of the * complying superannuation class that were used in making the * base assessment.

Step 6. Reduce the step 5 result by the lesser of the following amounts:

(a) the amount of any * tax losses of the * complying superannuation class, to the extent that the company can carry them forward to the next income year;

(b) deductions for tax losses of the complying superannuation class that were used in making the * base assessment.

The result of this step is the adjusted taxable income of the company for the * base year.

Part 7 -- Amendments commencing on Royal Assent

Income Tax Assessment Act 1936

108 Subsection 6(1) ( paragraph ( f) of the definition of dividend )

Omit "a policy of life - assurance", substitute "a life assurance policy".

109 Paragraph 26(i)

Omit "a policy of life assurance", substitute "a life assurance policy".

110 Subsection 26AH(1) (definition of eligible policy )

Omit "a policy of life assurance", substitute "a life assurance policy".

111 Subsection 26AH(2)

Omit "paid - up policy of life assurance", substitute "paid - up life assurance policy".

112 Subparagraph 102AE(2)(b)(iv)

Omit "a policy of life assurance", substitute "a life assurance policy".

113 Section 282A

Omit "a policy of life assurance", substitute "a life assurance policy".

Note: The heading to section 282A is altered by omitting " policies of life assurance " and substituting " life assurance policies ".

114 Section 291A

Omit "a policy of life assurance", substitute "a life assurance policy".

Note: The heading to section 291A is altered by omitting " policies of life assurance " and substituting " life assurance policies ".

115 Section 297A

Omit "a policy of life assurance", substitute "a life assurance policy".

Note: The heading to section 297A is altered by omitting " policies of life assurance " and substituting " life assurance policies ".

Income Tax Assessment Act 1997

116 After paragraph 320 - 15(c)

Insert:

(ca) any reinsurance commission received or recovered by the company in respect of a contract of reinsurance (except any commission that relates to a risk, or part of a risk, in relation to which subsection 148(1) of the Income Tax Assessment Act 1936 applies); and

117 Paragraph 320 - 37(1)(c)

Omit " * foreign establishment amounts", substitute "foreign establishment amounts".

118 After subsection 320 - 37(1)

Insert:

(1A) For the purposes of paragraph ( 1)(c), foreign establishment amounts for the * life insurance company means the total amount of assessable income that was derived in the income year:

(a) in the course of the carrying on by the company of a business in a foreign country at or through a * permanent establishment of the company in that country; and

(b) from sources in that or any other foreign country; and

(c) from assets that:

(i) are attributable to the permanent establishment; and

(ii) are held to meet the liabilities under the * life insurance policies issued by the company at or through the permanent establishment.

119 Subsection 320 - 37(2)

Omit " * foreign establishment amounts", substitute "foreign establishment amounts".

120 Subsection 320 - 37(2) (definition of all foreign establishment policy liabilities )

Repeal the definition, substitute:

"all foreign establishment policy liabilities" means the average value for the income year (as calculated by an * actuary) of the policy liabilities (as defined in the * Valuation Standard) for all * life insurance policies that:

(a) were included in the class of * life insurance business to which the company's * Australian/overseas fund or * overseas fund relates; and

(b) were issued by the company at or through the * permanent establishment to which the foreign establishment amounts relate.

121 Subsection 320 - 37(2) (definition of non - resident foreign establishment policy liabilities )

Repeal the definition, substitute:

"non-resident foreign establishment policy liabilities" means the average value for the income year (as calculated by an * actuary) of the policy liabilities (as defined in the * Valuation Standard) for all * life insurance policies that:

(a) are * non - resident life insurance policies; and

(b) were issued by the company at or through the * permanent establishment to which the foreign establishment amounts relate.

122 Subsection 995 - 1(1) (definition of foreign establishment amounts )

Repeal the definition.

123 Subsection 995 - 1(1) (definition of Solvency Standard )

Repeal the definition, substitute:

"Solvency Standard" means the solvency standard mentioned in section 65 of the Life Insurance Act 1995 .

124 Subsection 995 - 1(1) (definition of Valuation Standard )

Repeal the definition, substitute:

"Valuation Standard" means any actuarial standard that:

(a) provides for a valuation of the policy liabilities mentioned in subsection 114(2) of the Life Insurance Act 1995 ; and

(b) is in force under that Act.

Taxation Administration Act 1953

125 At the end of Division 288 in Schedule 1 (before the link note)

Add:

288 - 70 Administrative penalties for life insurance companies

Virtual PST--calculation of an amount

(1) A * life insurance company is liable to an administrative penalty if the company:

(a) is required to calculate a particular amount under section 320 - 175 of the Income Tax Assessment Act 1997 ; but

(b) fails to do so within the period of 60 days that is required by that section.

Virtual PST--transfer following valuation

(2) A * life insurance company is liable to an administrative penalty if the company:

(a) is required to transfer assets having a particular * transfer value from its * virtual PST assets under subsection 320 - 180(1) of the Income Tax Assessment Act 1997 ; but

(b) fails to do so within the period of 30 days that is required by subsection 320 - 180(2) of that Act.

Segregated exempt assets--calculation of an amount

(3) A * life insurance company is liable to an administrative penalty if the company:

(a) is required to calculate a particular amount under section 320 - 230 of the Income Tax Assessment Act 1997 ; but

(b) fails to do so within the period of 60 days that is required by that section.

Segregated exempt assets--transfer following valuation

(4) A * life insurance company is liable to an administrative penalty if the company:

(a) is required to transfer assets having a particular * transfer value from its * segregated exempt assets under subsection 320 - 235(1) of the Income Tax Assessment Act 1997 ; but

(b) fails to do so within the period of 30 days that is required by subsection 320 - 235(2) of that Act.

How to work out the administrative penalty

(5) The administrative penalty under subsection ( 1), (2), (3) or (4) for a failure to make a calculation or transfer is equal to 5 penalty units for each period of 28 days or part of a period of 28 days:

(a) starting immediately after the end of the period mentioned in paragraph ( b) of that subsection; and

(b) ending at the end of the day on which the calculation or transfer is made.

However, the maximum penalty for that failure must not exceed 25 penalty units.

Note 1: See section 4AA of the Crimes Act 1914 for the current value of a penalty unit.

Note 2: Division 298 contains machinery provisions for the penalties provided by this section.

Part 8 -- Application of the amendments

126 Application

(1) The amendment made by item 84 applies to a base year that is an income year including 1 July 2000 or is a later income year.

(2) The amendments made by items 85 to 94 apply in relation to depreciating assets that, apart from the effect of any of those amendments, a life insurance company:

(a) started to hold under a contract entered into after 30 June 2001; or

(b) started to construct after that day; or

(c) started to hold in some other way after that day.

(3) The amendments made by items 95 to 99 apply in relation to a consolidated group that comes into existence on or after 1 July 2002.

(4) The amendment made by item 100 applies to assessments for the 2001 - 2002 income year and later income years, where the date of the settlement or order (within the meaning of Division 54 of the Income Tax Assessment Act 1997 ) is 26 September 2001 or a later date.

(5) The amendments made by items 101 to 104 apply to amounts derived by a life insurance company on or after 1 July 2000.

(6) The amendment made by item 107 applies to a base year that is an income year including 1 July 2002 or is a later income year.

(7) The amendments made by items 108 to 115 apply in relation to amounts received or derived by a taxpayer under or in relation to a life assurance policy after the day on which this Act receives the Royal Assent.

(8) The amendment made by item 116 applies to any reinsurance commission received or recovered by a life insurance company at any time after the day on which this Act receives the Royal Assent.

(9) The amendments made by items 117 to 122 apply to the 2003 - 2004 income year and later income years.

(10) The amendments made by items 123 and 124 apply to the income year in which 30 June 2002 occurs and later income years.

(11) The amendment made by item 125 applies in relation to a valuation time that occurs after the day on which this Act receives the Royal Assent.