Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

A New Tax System (Goods and Services Tax) Act 1999

1 At the end of section 78 - 40

Add:

(2) Paragraph ( 1)(c) does not apply to a payment by another entity in relation to which an * increasing adjustment arises under section 80 - 30 or 80 - 70 (which are about settlement sharing arrangements).

2 Paragraph 79 - 10(2)(c)

After "the operator", insert "became or".

3 Subsection 79 - 15(4)

Repeal the subsection, substitute:

(4) The * operator may, in writing, elect that, from the start of a specified * financial year, any * decreasing adjustment in relation to all payments or supplies:

(a) that are made during the financial year; and

(b) to which paragraphs ( 1)(a), (b), (c) and (d) apply;

are to be worked out using the applicable * average input tax credit fraction.

4 After subsection 79 - 25(2)

Insert:

(2A) Subsection ( 2) does not apply if the cover under the * insurance policy commenced before 1 July 2003 (whether or not all or part of the premium on the policy was paid before that day).

5 Paragraph 79 - 50(2)(a)

After "premium", insert "to the * operator".

6 At the end of section 79 - 70

Add:

(2) Paragraph ( 1)(c) does not apply to a payment by another entity in relation to which an * increasing adjustment arises under section 80 - 30 or 80 - 70 (which are about settlement sharing arrangements).

(3) This section does not apply in relation to a payment or supply that the operator receives in settlement of a claim under an * insurance policy that the operator entered into, as the entity insured, in relation to any liability to make a * CTP compensation or ancillary payment or supply.

7 Paragraph 79 - 90(a)

Repeal the paragraph, substitute:

(a) in compliance with a judgment or order of a court relating to a claim for compensation under a * compulsory third party scheme, an entity makes a payment of * money, makes a supply, or makes both a payment of money and a supply; and

8 At the end of section 79 - 90

Add:

(2) If:

(a) in compliance with a judgment or order of a court relating to a claim by an * operator of a compulsory third party scheme exercising rights to recover from another entity in respect of a settlement made under the scheme, an entity makes a payment of * money, makes a supply, or makes both a payment of money and a supply; and

(b) had the payment or supply been made in the absence of such a judgment or order, it would have been a settlement of a claim made in exercising rights to recover from another entity in respect of a settlement made under the scheme;

the payment or supply is treated as having been made in settlement of the operator's claim made in exercising those rights.

9 Subsection 79 - 95(2) (after paragraph ( b) of the definition of applicable average input tax credit fraction )

Insert:

; or (c) if the payment or supply is a payment or supply to which section 79 - 15 applies--the accident or other incident to which the claim relates happened.

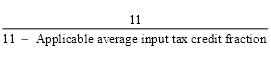

10 Subsection 79 - 95(3) (formula in step 3 of the method statement)

Repeal the formula, substitute:

11 Paragraph 80 - 5(1)(b)

Omit "owners or drivers", substitute "persons".

12 Paragraph 80 - 40(1)(b)

Omit "driver", substitute "person".

13 Subparagraph 80 - 80(1)(b)(ii)

Omit "owners or drivers", substitute "persons".

14 Application

The amendments made by this Schedule apply, and are taken to have applied, in relation to net amounts for tax periods starting on or after 1 July 2000.