Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Anti - avoidance rules in relation to exempt institutions

Income Tax Assessment Act 1997

1 At the end of section 207 - 130

Add:

(7) This section has effect subject to sections 207 - 119 to 207 - 136.

2 Section 207 - 130

Renumber as section 207 - 115.

3 Section 207 - 135

Renumber as section 207 - 117.

4 At the end of Subdivision 207 - E

Add:

207 - 119 Entity not treated as exempt institution eligible for refund in certain circumstances

For the purposes of this Act:

(a) an entity must not be treated as an * exempt institution that is eligible for a refund in relation to a * franked distribution if section 207 - 120, 207 - 122 or 207 - 124 applies to the entity in relation to the distribution; and

(b) a beneficiary of a trust must not be treated as an exempt institution that is eligible for a refund in relation to a franked distribution made in an income year if section 207 - 126 applies to the beneficiary in relation to that income year.

207 - 120 Entity may be ineligible because of a distribution event

(1) This section applies to an entity (the ineligible entity ) if:

(a) a * franked distribution is made, or * flows indirectly under subsection 207 - 50(3) or (4), to the entity; and

(b) subsection (2) of this section applies because of a * distribution event in relation to the distribution.

(2) Subject to subsection (3) and to section 207 - 128, this subsection applies if, because of a * distribution event in relation to the * franked distribution:

(a) the ineligible entity or another entity:

(i) makes, becomes liable to make, or may reasonably be expected to make or to become liable to make, a payment to any entity; or

(ii) transfers, becomes liable to transfer, or may reasonably be expected to transfer or to become liable to transfer, any property to any entity; or

(iii) incurs, becomes liable to incur, or may reasonably be expected to incur or to become liable to incur, any other detriment, disadvantage, liability or obligation; or

(b) if the distribution is made to the ineligible entity--the amount or value of the benefit derived by the ineligible entity from the distribution is, will be, or may reasonably be expected to be, less than the amount or value of the distribution as at the time the distribution is made; or

(c) if the distribution * flows indirectly to the ineligible entity--the amount or value of the benefit derived by the ineligible entity from the ineligible entity's * trust share amount in relation to the distribution is, will be, or may reasonably be expected to be, less than the amount or value of the ineligible entity's trust share amount in relation to the distribution as at the time when that amount arises; or

(d) any of the following entities has obtained, will obtain or may reasonably be expected to obtain, a benefit, advantage, right or privilege:

(i) the entity making the distribution;

(ii) an entity through which the distribution flows indirectly to the ineligible entity;

(iii) an * associate of any of those entities.

Note: For when paragraph (d) is satisfied, see also subsection 207 - 132(2).

Exception to paragraph (2)(b) or (c)

(3) Paragraph (2)(b) or (c) does not apply if:

(a) that paragraph would otherwise apply only because of expenses the ineligible entity has incurred, will incur, or may reasonably be expected to incur, for the purpose of obtaining the * franked distribution or * trust share amount mentioned in that paragraph; and

(b) the Commissioner considers the expenses to be reasonable.

Trust share amount

(4) An entity's trust share amount in relation to a * franked distribution that * flows indirectly to the entity under subsection 207 - 50(3) or (4) is the entity's share amount that is mentioned in that subsection.

Distribution event

(5) A distribution event in relation to a * franked distribution is an act, transaction or circumstance that has happened, will happen, or may reasonably be expected to happen, as part of, in relation to or as a result of:

(a) the payment or receipt of the distribution; or

(b) if the distribution * flows indirectly to an entity under subsection 207 - 50(3) or (4)--the arising of, or the distribution or receipt of, the entity's * trust share amount in relation to the distribution; or

(c) an * arrangement entered into in association with a matter mentioned in paragraph (a) or (b).

207 - 122 Entity may be ineligible if distribution is in the form of property other than money

This section applies to an entity (the ineligible entity ) to whom a * franked distribution is made, or * flows indirectly under subsection 207 - 50(3) or (4), if:

(a) one of the following is in the form of property other than money:

(i) if the distribution is made to the ineligible entity--all or part of the distribution;

(ii) if the distribution flows indirectly to the ineligible entity through the trustee of a trust under subsection 207 - 50(3) or (4)--all or a part of a distribution (the trust distribution ) made by the trustee of the trust that relates to the ineligible entity's * trust share amount in relation to the franked distribution; and

(b) the terms and conditions on which the franked distribution or trust distribution is made are such that the ineligible entity:

(i) does not receive immediate custody and control of the property; or

(ii) does not have the unconditional right to retain custody and control of the property in perpetuity; or

(iii) does not obtain an immediate, indefeasible and unencumbered legal and equitable title to the property.

207 - 124 Entity may be ineligible if other money or property also acquired

Subject to section 207 - 128, this section applies to an entity (the ineligible entity ) to whom a * franked distribution is made, or * flows indirectly under subsection 207 - 50(3) or (4), if:

(a) the ineligible entity or another entity has entered into an * arrangement as part of, or in association with:

(i) the distribution; or

(ii) if the distribution flows indirectly to the ineligible entity--the ineligible entity's * trust share amount in relation to the distribution; and

(b) because of the arrangement, the ineligible entity or another entity has acquired or will acquire (whether directly or indirectly) money or property, other than money or property comprising the distribution or the ineligible entity's trust share amount, from:

(i) the entity making the distribution; or

(ii) an entity through which the distribution flows indirectly to the ineligible entity; or

(iii) an * associate of any of those entities (other than the ineligible entity).

207 - 126 Entity may be ineligible if distributions do not match trust share amounts

(1) This section applies to a beneficiary of a trust in relation to an income year if:

(a) the sum of the distributions:

(i) made to the beneficiary during the income year by the trustee of the trust; and

(ii) that relate to the beneficiary's * trust share amount in relation to a * franked distribution made during the income year;

is less than:

(b) that trust share amount.

Commissioner's power to treat trust share amount as having been distributed during the income year

(2) Subsection (1) does not apply if the Commissioner, having regard to all the circumstances, considers that it would be reasonable to treat the * trust share amount as having been distributed to the beneficiary in the income year.

(1) If, apart from this section, paragraph 207 - 120(2)(a) or (d) or section 207 - 124 would apply to an entity (the receiving entity ) to whom a * franked distribution is made or * flows indirectly, that paragraph or section is taken not to apply to the receiving entity if:

(a) instead of receiving the distribution, or the * trust share amount concerned, by a payment of money, the receiving entity chooses to be issued with:

(i) if the distribution is made to the receiving entity-- * shares in the * corporate tax entity making the distribution; or

(ii) if the distribution flows indirectly to the receiving entity--a fixed interest in the trust in relation to which the trust share amount arises; and

(b) the choice is genuine and furthers the purpose for which the entity was established; and

(c) the choice is not made for the purpose, or purposes that include the purpose, of benefiting the corporate tax entity, trust or any of their * associates (other than the receiving entity); and

(d) any benefit derived by the corporate tax entity, trust or any of their associates (other than the receiving entity) because of that choice is one which is an ordinary incident of issuing the shares or interests to the receiving entity or of the receiving entity's holding of those shares or interests; and

(e) the parties that were involved in the * distribution event or * arrangement concerned deal with one another on an arm's length basis in relation to the event or arrangement.

A vested and indefeasible interest constitutes a fixed interest

(2) The receiving entity's interest in a trust is a fixed interest if the interest is a vested and indefeasible interest in the trust's capital.

Special rule about whether interests in unit trusts are defeasible

(3) If:

(a) the trust is a unit trust and the receiving entity holds units in the unit trust; and

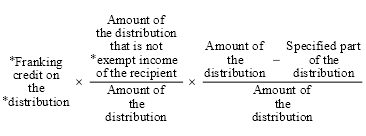

(b) the units are redeemable or further units are able to be issued; and

(c) the units held by the receiving entity will be redeemed, or any further units will be issued:

(i) if units in the unit trust are listed for quotation in the official list of an * approved stock exchange--for the price at which other units of the same kind in the unit trust are offered for sale on the exchange at the time of the redemption or issue; or

(ii) if the units are not listed as mentioned in subparagraph (i)--for their market value at the time of the redemption or issue;

then the mere fact that the units are redeemable, or that the further units are able to be issued, does not mean that the receiving entity's interest, as a unit holder, in the trust's capital is defeasible.

Commissioner's power to treat an interest in a trust as being a fixed interest

(4) If:

(a) the receiving entity has an interest in the trust's capital; and

(b) apart from this subsection, the interest would not be a vested or indefeasible interest; and

(c) the Commissioner considers that the interest should be treated as being vested and indefeasible, having regard to:

(i) the circumstances in which the interest is capable of not vesting, or the defeasance can happen; and

(ii) the likelihood of the interest not vesting or the defeasance happening; and

(iii) the nature of the trust; and

(iv) any other matter the Commissioner thinks relevant;

the Commissioner may determine that the interest is to be taken to be vested and indefeasible.

(5) A determination made under subsection (4) has effect according to its terms.

207 - 130 Controller's liability

(1) A * controller (for imputation purposes) of an entity (the controlled entity ) is liable to pay an amount under this section in respect of a refund paid to the controlled entity under Division 67 if:

(a) the controlled entity claimed the refund wholly or partly on the basis that:

(i) the controlled entity was entitled to a * tax offset under section 207 - 20, 207 - 45 or 207 - 110 in relation to a * franked distribution; and

(ii) the controlled entity was an * exempt institution that is eligible for a refund; and

(b) because of the operation of section 207 - 120, 207 - 122, 207 - 124 or 207 - 126 in respect of a * distribution event or an * arrangement in relation to the distribution, the controlled entity is not entitled to the tax offset; and

(c) the controller or an * associate of the controller benefited from that event or arrangement; and

(d) some or all of the amount that the controlled entity is liable to pay in respect of the refund remains unpaid after the day on which the amount becomes due and payable; and

(e) the Commissioner gives the controller written notice:

(i) stating that the controller is liable to pay an amount under this section; and

(ii) specifying that amount.

Except as provided for in subsection (5), this subsection does not affect any liability the controlled entity has in relation to the refund.

Note 1: Section 207 - 134 also provides that the controlled entity's present entitlement to a trust share amount is disregarded for the purposes of Division 6 of Part III of the Income Tax Assessment Act 1936 .

Note 2: For when paragraph (c) is satisfied, see also subsection 207 - 132(3).

(2) The amount that the * controller (for imputation purposes) is liable to pay under subsection (1):

(a) is the amount specified under subparagraph (1)(e)(ii); and

(b) becomes due and payable at the end of the period of 14 days that starts on the day on which the notice mentioned in paragraph (1)(e) is given.

(3) The amount that the * controller (for imputation purposes) is liable to pay under subsection (1) must not exceed the total amount or value of the benefit that the controller and its * associates obtained from the * distribution event or * arrangement.

(4) The total of:

(a) the amounts that the Commissioner recovers under subsection (1) in relation to the refund from all of the controlled entity's * controllers (for imputation purposes); and

(b) the amounts that the Commissioner recovers in relation to the refund from the controlled entity;

must not exceed the amount that the controlled entity was liable to pay as mentioned in paragraph (1)(d).

Controller of a company

(5) An entity is a controller (for imputation purposes) of a company if the entity is a * controller of the company (for CGT purposes).

Controller of an entity other than a company--basic meaning

(6) Subject to subsections (7) and (8), an entity is a controller (for imputation purposes) of an entity other than a company (the controlled entity ) if:

(a) a group in relation to the entity has the power, by means of the exercise of a power of appointment or revocation or otherwise, to obtain beneficial enjoyment (directly or indirectly) of the capital or income of the controlled entity; or

(b) a group in relation to the entity is able (directly or indirectly) to control the application of the capital or income of the controlled entity; or

(c) a group in relation to the entity is capable, under a * scheme, of gaining the beneficial enjoyment mentioned in paragraph (a) or the control mentioned in paragraph (b); or

(d) the controlled entity or, if the controlled entity is a trust, the trustee of the trust:

(i) is accustomed; or

(ii) is under an obligation; or

(iii) might reasonably be expected;

to act in accordance with the directions, instructions or wishes of a group in relation to the entity; or

(e) if the controlled entity is a trust--a group in relation to the entity is able (directly or indirectly) to remove or appoint the trustee of the trust; or

(f) a group in relation to the entity has more than a 50% stake in the income or capital of the controlled entity; or

(g) entities in a group in relation to the entity are the only entities that, under the terms of:

(i) the constitution of the controlled entity or the terms on which the controlled entity is established; or

(ii) if the controlled entity is a trust--the terms of the trust;

can obtain the beneficial enjoyment of the income or capital of the controlled entity.

Group in relation to an entity

(7) For the purposes of subsection (6), each of the following constitutes a group in relation to an entity:

(a) the entity acting alone;

(b) an * associate of the entity acting alone;

(c) the entity and one or more associates of the entity acting together;

(d) 2 or more associates of the entity acting together.

Commissioner's power to take an entity not to be a controller (for imputation purposes)

(8) If:

(a) at a particular time, an entity (the first entity ) would, but for this subsection, be a * controller (for imputation purposes) of an entity other than a company (the second entity ); and

(b) the Commissioner, having regard to all relevant circumstances, considers that it is reasonable that the first entity be taken not to be such a controller of the second entity at the particular time;

the first entity is taken not to be a controller (for imputation purposes) of the second entity at the particular time.

(9) Without limiting paragraph (8)(b), if the second entity is a trust, the Commissioner may have regard under that paragraph to the identity of the beneficiaries of the trust at any time (whether before or after the first entity began to be a * controller (for imputation purposes) of the second entity).

207 - 132 Treatment of benefits provided by an entity to a controller

(1) This section applies in relation to a benefit (the relevant benefit ) given by an entity to a * controller (for imputation purposes) of the entity, or to an * associate of such a controller, if:

(a) the controller or associate:

(i) makes a * franked distribution to the entity; or

(ii) is the trustee of the trust in relation to which a * trust share amount of the entity arises in relation to a franked distribution that * flows indirectly to the entity; and

(b) the benefit is, or was, given to the controller or associate at any time during the period that starts 3 years before, and ends 3 years after, the distribution is made or the trust share amount arises (as appropriate).

(2) For the purposes of paragraph 207 - 120(2)(d), the controller or * associate is taken to have obtained the relevant benefit because of a * distribution event in relation to the * franked distribution or * trust share amount.

(3) For the purposes of paragraph 207 - 130(1)(c), and at least to the extent of the relevant benefit, the controller or * associate is taken to have benefited from a * distribution event or * arrangement that caused section 207 - 120 to apply in relation to the * franked distribution or * trust share amount.

Commissioner's power not to apply subsection (2) or (3)

(4) Subsection (2) or (3) does not apply in relation to a benefit if the Commissioner is satisfied, having regard to all the circumstances, that it would be unreasonable to apply that subsection.

207 - 134 Entity's present entitlement disregarded in certain circumstances

The present entitlement of a beneficiary of a trust to a share of trust income is disregarded for the purposes of Division 6 of Part III of the Income Tax Assessment Act 1936 if:

(a) the beneficiary has claimed a * tax offset under section 207 - 45 or 207 - 110 of this Act on the basis that the beneficiary was an * exempt institution that was eligible for a refund in relation to a * trust share amount that is that share of trust income; but

(b) the beneficiary was not entitled to that tax offset because of the operation of section 207 - 120, 207 - 122, 207 - 124 or 207 - 126 in respect of a * distribution event, or an * arrangement, to which the trust share amount is related.

Note: This means that the trustee of the trust is liable to pay income tax on that share of the trust income.

207 - 136 Review of certain decisions

An entity that is dissatisfied with a decision of the Commissioner under any of the following provisions may object against it in the manner set out in Part IVC of the Taxation Administration Act 1953 :

(a) paragraph 207 - 120(3)(b);

(b) subsection 207 - 126(2);

(c) subsection 207 - 128(4);

(d) paragraph 207 - 130(1)(e);

(e) paragraph 207 - 130(8)(b);

(f) subsection 207 - 132(4).

5 At the end of Subdivision 975 - A

Add:

975 - 155 When is an entity a controller (for CGT purposes) of a company?

An entity (the first entity ) is a controller (for CGT purposes) of a company if:

(a) the first entity has an * associate - inclusive control interest in the company of at least 50%; or

(b) the first entity has an associate - inclusive control interest in the company of at least 40% and entities other than the first entity or associates of the first entity do not control the company; or

(c) the first entity controls the company (alone or with an * associate).

975 - 160 When an entity has an associate - inclusive control interest

(1) An entity has an associate - inclusive control interest in a company in the circumstances set out in Subdivision A of Division 3 of Part X of the Income Tax Assessment Act 1936 .

(2) However, in working out whether an entity has an associate - inclusive control interest of a particular percentage for the purposes of section 975 - 155, there are these modifications to the way Part X of that Act operates:

(a) that Part is applied to any company, including one acting as a trustee; and

(b) subsection 349(4) applies in all cases in working out which entity holds a direct control interest or a control tracing interest equal to 100%; and

(c) subsections 350(6) and (7) and 355(1) are ignored; and

(d) despite subsection 352(2), an interposed entity may be taken into account in calculating an indirect control interest if the interposed entity is:

(i) a company of which the first entity or an * associate is a controller; or

(ii) a partnership or a trust; and

(e) section 354 applies as if it referred to partnerships rather than CFP's; and

(f) section 355 applies as if it referred to trusts rather than CFT's.

Note 1: Part X of the Income Tax Assessment Act 1936 defines company to exclude a company in the capacity of a trustee.

Note 2: The terms direct control interest and control tracing interest are relevant to working out associate - inclusive control interests in a company: see sections 350, 351, 353, 354 and 355 of that Act.

Note 3: Under subsection 349(4) of that Act, if 2 or more entities would have a direct control interest or a control tracing interest in a company or trust equal to 100%, only one of them holds the interest.

Note 4: Subsections 350(6) and (7) of that Act deal with direct control interests in a company. They deal with interests held by Australian entities. Under subsection 355(1), certain entities are taken to hold a control tracing interest in a trust equal to 100%.

Note 5: Paragraphs (2)(d), (e) and (f) of this section are necessary because Part X of the Income Tax Assessment Act 1936 applies only to CFE's (which comprise CFC's, CFP's and CFT's).

6 Subsection 995 - 1(1)

Insert:

"associate-inclusive control interest" in a company has the meaning given by section 975 - 160.

7 Subsection 995 - 1(1) (definition of controller (for CGT purposes) )

Omit "140 - 20", substitute "975 - 155".

8 Subsection 995 - 1(1)

Insert:

"controller (for imputation purposes)" has the meaning given by subsections 207 - 130(5) and (6).

9 Subsection 995 - 1(1)

Insert:

"distribution event" has the meaning given by subsection 207 - 120(5).

10 Subsection 995 - 1(1) (definition of exempt institution that is eligible for a refund )

Omit "207 - 130", substitute "207 - 115".

11 Subsection 995 - 1(1) (at the end of the definition of exempt institution that is eligible for a refund )

Add:

Note: This definition is affected by sections 207 - 119 to 207 - 136.

12 Subsection 995 - 1(1) (paragraph (d) of the definition of residency requirement )

Omit "207 - 135", substitute "207 - 117".

13 Subsection 995 - 1(1)

Insert:

"trust share amount" has the meaning given by subsection 207 - 120(4).

Part 2 -- Miscellaneous consequential and technical amendments

Income Tax Assessment Act 1936

14 Subsection 6(1)

Insert:

"corporate tax entity" has the same meaning as in the Income Tax Assessment Act 1997 .

15 Subsection 6(1)

Insert:

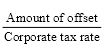

"corporate tax rate" has the same meaning as in the Income Tax Assessment Act 1997 .

16 Subsection 6(1)

Insert:

"distribution" , when used in a franking context, has the same meaning as in the Income Tax Assessment Act 1997 .

17 Subsection 6(1)

Insert:

"frankable distribution" has the same meaning as in the Income Tax Assessment Act 1997 .

18 Subsection 6(1)

Insert:

"franking credit" has the same meaning as in the Income Tax Assessment Act 1997 .

19 Subsection 6(1)

Insert:

"franking debit" has the same meaning as in the Income Tax Assessment Act 1997 .

20 Subsection 6(1)

Insert:

"franking deficit tax" has the same meaning as in the Income Tax Assessment Act 1997 .

21 Subsection 6(1)

Insert:

"franking surplus" has the same meaning as in the Income Tax Assessment Act 1997 .

22 Subsection 6(1)

Insert:

"franks with an exempting credit" has the same meaning as in the Income Tax Assessment Act 1997 .

23 Subsection 6(1)

Insert:

"over-franking tax" has the same meaning as in the Income Tax Assessment Act 1997 .

24 Subsection 6(1)

Insert:

"venture capital deficit tax" has the same meaning as in the Income Tax Assessment Act 1997 .

25 Section 43A

Repeal the section, substitute:

43A Subdivision has effect subject to provisions of Division 216 of the Income Tax Assessment Act 1997

This Subdivision has effect subject to the provisions of Division 216 of the Income Tax Assessment Act 1997 (which describes cum dividend sales in which a distribution to a member of a corporate tax entity is treated as having been made to someone else).

26 Paragraph 46FB(4)(c)

After "but for", insert "subsection 46AB(1) or 46AC(2) or".

27 Paragraph 102AAM(10)(a)

Omit "general company tax rate (within the meaning of Part IIIAA)", substitute "corporate tax rate".

28 Subparagraph 102AAU(1)(c)(iii)

Omit "so much of a frankable dividend (within the meaning of Part IIIAA) as has been franked in accordance with section 160AQF or 160AQFA", substitute "the franked part of a distribution, or the part of a distribution that has been franked with an exempting credit".

29 Subparagraph 102AAU(1)(c)(iv)

Omit "section 160AQT", substitute "subsection 207 - 35(1) or (3) of the Income Tax Assessment Act 1997 ".

30 Subsection 105A(4AA)

Omit "to the extent that the whole, or a part, of the dividend has been franked in accordance with section 160AQF", substitute "to the extent of the franked part of the dividend".

31 Paragraph 108(2)(c)

Omit "other than Part IIIAA", substitute ", other than Part 3 - 6 of the Income Tax Assessment Act 1997 ".

32 Paragraph 108(2)(d)

Omit "sections 160APP and 160AQT", substitute "Part 3 - 6 of the Income Tax Assessment Act 1997 ".

33 At the end of paragraph 108(3)(a)

Add "and".

34 Paragraph 108(3)(b)

Repeal the paragraph.

35 Section 109B

Omit "for reducing the company's franking account credit (under section 160AQCNC)", substitute "for a debit arising in the company's franking account (under item 8 of the table in section 205 - 30 of the Income Tax Assessment Act 1997 )".

36 Subsection 109Y(2) (subparagraph (b)(i) of the definition of repayments of non - commercial loans )

Omit "to the extent that the dividend has not been franked under section 160AQF", substitute "to the extent of the unfranked part of the dividend".

37 Subsection 109ZC(2)

Omit "except Part IIIAA (which deals with franking of dividends)", substitute ", except Part 3 - 6 of the Income Tax Assessment Act 1997 (which deals with franking of distributions)".

38 Subsection 109ZC(2)

Omit "that has not been franked under section 160AQF or 160AQFA", substitute "that is not either the franked part of that dividend, or the part of that dividend that has been franked with an exempting credit".

39 Section 121AT (table item 12, column headed "Event")

Omit "a class A franking surplus, a class B franking surplus or a class C franking surplus (all within the meaning of Part IIIAA)", substitute "a franking surplus".

40 Section 121AT (table item 12, column headed "Modifications")

Omit "class A franking surplus, class B franking surplus or class C franking surplus (all within the meaning of Part IIIAA)", substitute "franking surplus".

41 Section 121AT (table item 13, column headed "Modifications")

Omit "(within the meaning of Part IIIAA)".

42 Subsection 121EG(4) (definition of eligible fraction )

Omit "general company tax rate (within the meaning of section 160APA)", substitute "corporate tax rate".

43 Paragraph 128B(3)(ga)

Repeal the paragraph, substitute:

(ga) income that consists of:

(i) the franked part of a dividend; or

(ii) in relation to a dividend that is paid by a former exempting entity (within the meaning of the Income Tax Assessment Act 1997 ) on a share acquired under an employee share scheme (within the meaning of that Act)--the part of the dividend that is franked with an exempting credit; or

(iii) in relation to a dividend that is paid by a former exempting entity (within the meaning of the Income Tax Assessment Act 1997 ) to an eligible continuing substantial member (within the meaning of that Act)--the part of the dividend that is franked with an exempting credit;

other than a dividend in respect of which a determination is made under paragraph 204 - 30(3)(c) of the Income Tax Assessment Act 1997 or a dividend or a part of a dividend in respect of which a determination is made under paragraph 177EA(5)(b) of this Act; or

44 Subsection 128TD(2)

Omit "section 160AQH", substitute "section 202 - 75 of the Income Tax Assessment Act 1997 ".

45 Subsection 128TD(3)

Omit "section 160AQH", substitute "subsection 202 - 80(2) of the Income Tax Assessment Act 1997 ".

46 Subsection 128TE(1)

Omit "section 160AQH", substitute "section 202 - 75 of the Income Tax Assessment Act 1997 ".

47 Subsection 128TE(2)

Repeal the subsection.

48 Before paragraph 159GZZZQ(8)(a)

Insert:

(aa) the seller is a corporate tax entity; and

49 Paragraph 159GZZZQ(8)(b)

Omit "a rebatable amount", substitute "an offsetable amount".

Note: The heading to subsection 159GZZZQ(8) is replaced by the heading " Offsetable amount excluded from reduction where loss ".

50 Paragraph 159GZZZQ(8)(e)

Omit "rebatable amount", substitute "offsetable amount".

51 Subsection 159GZZZQ(9)

Repeal the subsection, substitute:

Meaning of offsetable amount

(9) For the purposes of subsection (8), if the seller is entitled to a tax offset under Division 207 of the Income Tax Assessment Act 1997 in the seller's assessment for a year of income in respect of the dividend, the dividend consists of an offsetable amount worked out using the formula:

52 Subsection 160AN(3A)

Omit "Division 2 of Part IIIAA (which deals with franking credits and debits)", substitute "Division 205 of the Income Tax Assessment Act 1997 (which deals with franking accounts)".

53 Subsection 170BA(1) (paragraph (b) of the definition of ruling affected tax )

Repeal the paragraph, substitute:

(b) franking deficit tax; or

(ba) venture capital deficit tax; or

(bb) over - franking tax; or

54 Paragraph 276(4)(b)

Repeal the paragraph, substitute:

(b) the amount of the tax offsets (if any) to which the trustee of the fund, or the RSA provider, is entitled under Part 3 - 6 of the Income Tax Assessment Act 1997 in relation to the notice year; and

55 Paragraph 365(3)(b)

Omit "frankable dividend, within the meaning of Part IIIAA, that has been franked in accordance with section 160AQF or 160AQFA", substitute "frankable distribution that has been franked in accordance with section 202 - 5 of the Income Tax Assessment Act 1997 , or that has been franked with an exempting credit in accordance with section 208 - 60 of that Act".

56 Paragraph 389(b)

Omit "Part IIIAA", substitute "Part 3 - 6 of the Income Tax Assessment Act 1997 ".

57 Paragraph 402(2)(b)

Repeal the paragraph, substitute:

(b) so much of a frankable distribution, paid to the eligible CFC in the eligible period, as is either the franked part of the distribution, or the part of the distribution that has been franked with an exempting credit;

58 Paragraph 436(1)(d)

Repeal the paragraph, substitute:

(d) so much of a frankable distribution as is either the franked part of the distribution, or the part of the distribution that has been franked with an exempting credit;

59 Subsection 57 - 120(1) in Schedule 2D

Omit "class A franking surplus, a class B franking surplus or a class C franking surplus", substitute "franking surplus".

60 Paragraph 57 - 120(3)(a) in Schedule 2D

Omit "class A franking debits, class B franking debits or class C franking debits", substitute "franking debits".

61 Subparagraph 57 - 120(3)(c)(i) in Schedule 2D

Repeal the subparagraph, substitute:

(i) there was a franking surplus of the transition taxpayer that was less than the total of the pre - transition time components of all of the debits; or

62 Subparagraph 57 - 120(3)(c)(ii) in Schedule 2D

Omit "class A franking surplus, there was no class B franking surplus or there was no class C franking surplus", substitute "franking surplus".

63 Paragraph 57 - 120(3)(d) in Schedule 2D

Omit "or surpluses concerned".

64 Paragraph 57 - 120(3)(e) in Schedule 2D

Omit "of the class or classes concerned".

65 Paragraph 57 - 120(4)(a) in Schedule 2D

Omit "class A franking debits, class B franking debits or class C franking debits", substitute "franking debits".

66 Subparagraph 57 - 120(4)(c)(i) in Schedule 2D

Repeal the subparagraph, substitute:

(i) there was a franking surplus of the subsidiary that was less than the total of the pre - transition time components of all of the debits; or

67 Subparagraph 57 - 120(4)(c)(ii) in Schedule 2D

Omit "class A franking surplus, there was no class B franking surplus or there was no class C franking surplus", substitute "franking surplus".

68 Paragraph 57 - 120(4)(d) in Schedule 2D

Omit "or surpluses concerned".

69 Paragraph 57 - 120(4)(e) in Schedule 2D

Omit "of the class or classes concerned".

70 Subsection 57 - 120(5) in Schedule 2D

Repeal the subsection.

71 Subsection 326 - 120(1) in Schedule 2H

Omit "class C".

72 Subsection 326 - 130(2) in Schedule 2H (definition of value of franking surplus )

Omit "class C".

73 Subsection 326 - 170(4) in Schedule 2H

Omit "class C".

74 Subsection 326 - 170(5) in Schedule 2H

Omit "class C".

Income Tax Assessment Act 1997

75 Section 10 - 5 (table item headed "dividends")

Omit:

franked dividends, credits on ................... | 160AQT |

substitute:

franked dividends, credits on ................... | 207 - 20(1), 207 - 35(1), 207 - 35(3) |

76 Section 12 - 5 (table item headed "dividends")

Omit:

franking credits, companies and non - residents .. | 160AR, 160ARD |

substitute:

franking credits, companies and non - residents .. | 207 - 95(2), 207 - 95(3), 220 - 405(3) |

77 Section 12 - 5 (table item headed "tax avoidance schemes")

Omit:

dividend stripping .......................... | 46A, 177E |

substitute:

dividend stripping .......................... | 177E |

78 Section 12 - 5 (table item headed "tax avoidance schemes")

After:

gifts ................................... | 78A |

insert:

imputation, manipulation of .................... | 207 - 150(2), 207 - 150(3) |

79 Section 13 - 1 (table item headed "dividends")

Repeal the item, substitute:

dividends |

|

general ................................. | 207 - 20(2), 207 - 45, 207 - 110(2)(c), 210 - 170(1) |

80 Section 67 - 30

After "got those tax offsets", insert "and any tax offset under section 205 - 70".

81 Subsection 70 - 45(2) (table item 1)

Repeal the item.

82 Before paragraph 110 - 55(7)(a)

Insert:

(aa) you are a * corporate tax entity; and

83 Paragraph 110 - 55(7)(c)

Repeal the paragraph, substitute:

(c) you are entitled to a * tax offset under Division 207 on the part of the distribution that is a * dividend (the dividend amount ); and

84 Subsection 110 - 55(8)

Repeal the subsection, substitute:

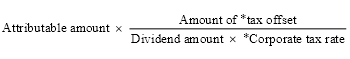

(8) The amount of the reduction is:

85 Subsections 110 - 60(5) and (6)

Repeal the subsections.

86 Paragraph 118 - 20(1B)(b)

Omit "section 160AQT of that Act (which relates to franked dividends)", substitute "subsection 207 - 20(1), 207 - 35(1) or 207 - 35(3) of this Act (which relate to franked distributions)".

87 Section 208 - 115 (table item 2, column headed "A credit of:")

Omit "section 208 - 165", substitute "subsection 208 - 165(1)".

88 Section 208 - 115 (table item 3, column headed "A credit of:")

Omit "section 208 - 170", substitute "subsection 208 - 170(1)".

89 Section 208 - 130 (table item 2, column headed "A credit of:")

Omit "section 208 - 165", substitute "subsection 208 - 165(1)".

90 Section 208 - 130 (table item 3, column headed "A credit of:")

Omit "section 208 - 170", substitute "subsection 208 - 170(1)".

91 Section 208 - 130 (table item 5, column headed "A credit of:")

Omit "section 208 - 165", substitute "subsection 208 - 165(2)".

92 Section 208 - 130 (table item 6, column headed "A credit of:")

Omit "section 208 - 170", substitute "subsection 208 - 170(2)".

93 Paragraph 208 - 165(b)

Omit "or 5".

94 At the end of section 208 - 165

Add:

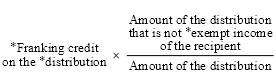

(2) Use the following formula to work out the amount of a * franking credit arising under item 5 of the table in section 208 - 130 because an * exempting entity receives a * distribution * franked with an exempting credit:

95 Paragraph 208 - 170(b)

Omit "or 6".

96 Section 208 - 170 (formula)

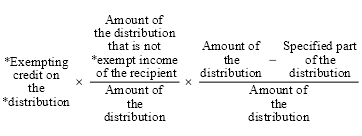

Omit the formula, substitute:

97 At the end of section 208 - 170

Add:

(2) Use the following formula to work out the amount of a * franking credit arising under item 6 of the table in section 208 - 130 because an * exempting entity receives * a distribution * franked with an exempting credit:

98 Paragraph 210 - 170(1)(e)

Omit "not".

99 Subsection 995 - 1(1)

Insert:

"franked part" of a * distribution has the meaning given by section 976 - 1.

100 Subsection 995 - 1(1)

Insert:

"part of a distribution that is franked with an exempting credit" has the meaning given by section 976 - 10.

101 Subsection 995 - 1(1)

Insert:

"part of a distribution that is franked with a venture capital credit" has the meaning given by section 976 - 15.

102 Subsection 995 - 1(1)

Insert:

"unfranked part" of a * distribution has the meaning given by section 976 - 5.

Taxation Administration Act 1953

103 Section 14ZAAA (paragraph (b) of the definition of income tax law )

Repeal the paragraph, substitute:

(b) franking deficit tax, venture capital deficit tax, or over - franking tax, within the meaning of the Income Tax Assessment Act 1997 .

104 Paragraph 14ZW(1)(aa)

Omit "or section 160AL, 160AQQ, 160ART or 175A of the Income Tax Assessment Act 1936 ", substitute ", section 160AL or 175A of the Income Tax Assessment Act 1936 or subsection 202 - 85(6) of the Income Tax Assessment Act 1997 ".

105 Paragraphs 12 - 165(b) and (c) in Schedule 1

Repeal the paragraphs, substitute:

(b) the payment is a * distribution that has been franked in accordance with section 202 - 5 of the Income Tax Assessment Act 1997 ; and

(c) the * franking percentage for the distribution is 100%.

106 After paragraph 360 - 85(a) in Schedule 1

Insert:

(aa) subsection 207 - 20(2) of the Income Tax Assessment Act 1997 ; or

107 Section 360 - 85 in Schedule 1 (table item 15)

Repeal the item.

108 Section 360 - 115 in Schedule 1

Omit "This section covers a * tax offset to which you are entitled because of a provision of the Income Tax Assessment Act 1936 listed in the table.", substitute:

This section covers a * tax offset to which you are entitled because of:

(a) section 207 - 45 of the Income Tax Assessment Act 1997 , but only so far as it applies in relation to a person as a beneficiary of a trust; or

(b) a provision of the Income Tax Assessment Act 1936 listed in the table.

109 Section 360 - 115 in Schedule 1 (table item 5)

Repeal the item.

Taxation Laws Amendment Act (No. 8) 2003

110 Item 16 of Schedule 7

Repeal the item.

Part 3 -- Application provisions

111 Application of amendments

(1) Subject to the rules on the application of Part 3 - 6 of the Income Tax Assessment Act 1997 set out in the Income Tax (Transitional Provisions) Act 1997 , the amendments made by Part 1 of this Schedule (other than items 5, 6 and 7) apply to events that occur on or after 1 July 2002.

(2) The amendments made by items 5, 6 and 7 of this Schedule apply to assessments for the 2002 - 03 year of income and later years of income.

(3) The amendments made by Part 2 of this Schedule, other than items 26 and 110, apply in relation to events that occur on or after 1 July 2002.

(4) Subject to subitem (5), the amendment made by item 26 of this Schedule applies to dividends paid on or after 1 July 2003.

(5) For a taxpayer to which section 46AC of the Income Tax Assessment Act 1936 applies, the amendment made by item 26 of this Schedule applies to dividends paid on or after the consolidation day referred to in that section.

112 Modified application of section 109ZC in 2002 - 03

Section 109ZC of the Income Tax Assessment Act 1936 , as it applies in relation to assessments for the 2002 - 03 income year, has effect as if subsection 109ZC(3) were replaced by the following subsection:

(3) Subsection (2) does not cause the amount taken not to be a dividend to be exempt income for the purposes of Part 3 - 6 of the Income Tax Assessment Act 1997 .

113 Modified application of section 128TB in 2002 - 03 and 2003 - 04

Section 128TB of the Income Tax Assessment Act 1936 , as it applies in relation to dividends paid in the period starting on 1 July 2002 and ending on 30 June 2004, has effect as if the definition of Co. tax rate in subsection 128TB(2) were amended by omitting "general company tax rate, within the meaning of section 160APA," and substituting "corporate tax rate".

114 Modified application of section 377 in 2002 - 03 and 2003 - 04

Section 377 of the Income Tax Assessment Act 1936 , as it applies in relation to dividends paid in the period starting on 1 July 2002 and ending on 30 June 2004, has effect as if paragraph 377(1)(e) were replaced by the following paragraph:

(e) so much of a frankable distribution, paid to the company in the qualifying period, as is either the franked part of the distribution, or the part of the distribution that has been franked with an exempting credit;