Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Technical corrections and amendments commencing on Royal Assent

A New Tax System (Goods and Services Tax) Act 1999

1 Subsection 29 - 15(2)

Omit "33 - 15(b)", substitute "33 - 15(1)(b)".

2 Application

The amendment made by item 1 applies, and is taken to have applied, in relation to net amounts for tax periods starting, or that started, on or after 1 July 2000.

3 Subsection 60 - 5(1)

Omit " * in existence", substitute "in existence".

4 Paragraph 60 - 15(1)(a)

Omit " * in existence", substitute "in existence".

5 Subsection 60 - 20(1)

Omit " * in existence", substitute "in existence".

6 Paragraphs 69 - 5(3)(h) and (i)

Repeal the paragraphs, substitute:

(h) section 51AK of the * ITAA 1936 (Agreements for the provision of non - deductible non - cash business benefits).

7 Paragraph 80 - 90(a)

Omit " * nominal defendant settlement arrangement", substitute " * nominal defendant settlement sharing arrangement".

8 Paragraph 80 - 95(a)

Omit " * nominal defendant settlement arrangement", substitute " * nominal defendant settlement sharing arrangement".

9 Application

The amendments made by items 7 and 8 apply, and are taken to have applied, in relation to net amounts for tax periods starting, or that started, on or after 1 July 2000.

10 Subsection 132 - 5(1)

Omit " * decreasing adjustment", substitute " decreasing adjustment ".

11 Section 195 - 1 (table item 6 of the definition of decreasing adjustment )

Omit "Section 132 - 15", substitute "Section 132 - 5".

12 Application

The amendment made by item 11 applies, and is taken to have applied, in relation to net amounts for tax periods starting, or that started, on or after 1 July 2000.

13 Section 195 - 1 (table item 6 of the definition of increasing adjustment )

Repeal the item.

14 Section 195 - 1 (definition of in existence )

Repeal the definition.

A New Tax System (Wine Equalisation Tax) Act 1999

15 Subparagraph 5 - 15(1)(a)(ii)

Omit "associate", substitute " * associate".

Fringe Benefits Tax Assessment Act 1986

16 Subsection 58ZC(2)

Omit "For the purposes of this section, a", substitute "A".

17 Subsection 136(1)

Insert:

"remote area housing benefit" has the meaning given by subsection 58ZC(2).

18 Application

The amendments made by items 16 and 17 apply in respect of the FBT year beginning on 1 April 2000 and in respect of all later FBT years.

Income Tax Assessment Act 1936

19 Subsection 6(1) (definition of insurance funds )

Repeal the definition, substitute:

"insurance funds" , in relation to a company, means all the Australian statutory funds of the company and all other funds maintained by the company in respect of the life assurance business of the company.

20 Paragraph 23AH(12)(b)

Omit "subsections 432(2) and (3)", substitute "subsection 432(3)".

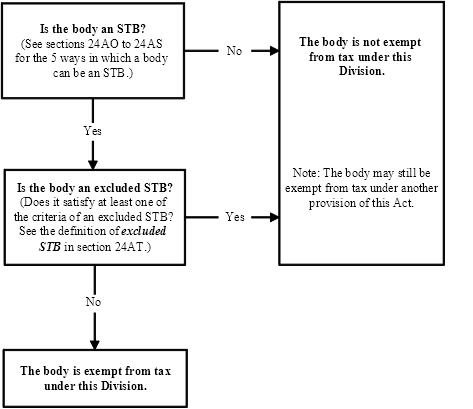

21 Section 24AL (diagram)

Repeal the diagram, substitute:

22 Paragraph 47(2B)(b)

Omit "is not dissolved", substitute "does not cease to exist".

23 Section 63CA (the section 63CA inserted by item 10 of Schedule 10 to the Taxation Laws Amendment Act (No. 2) 2000 )

Renumber as section 63CB.

24 Subsection 63CA(1) (the subsection 63CA(1) inserted by item 10 of Schedule 10 to the Taxation Laws Amendment Act (No. 2) 2000 )

Omit "section 63CB", substitute "section 63CC".

25 Section 63CB

Renumber as section 63CC.

Note: The heading to section 63CC (as renumbered) is altered by omitting " section 63CA " and substituting " section 63CB ".

26 Section 63CC (as renumbered)

Omit "63CA" (wherever occurring), substitute "63CB".

27 Sections 63CB and 63CC (as renumbered)

Relocate to after section 63CA (the section 63CA inserted by the Income Tax (Consequential Amendments) Act 1997 ).

28 Subsection 159GZZT(1)

Omit "in existence (within the meaning of that Act)", substitute "in existence".

29 Section 159S (definition of tax threshold )

Repeal the definition, substitute:

"tax threshold" means:

(a) the lower of the amounts specified in item 1 of the table in Part I of Schedule 7 to the Income Tax Rates Act 1986 ; or

(b) if, because of section 20 of the Income Tax Rates Act 1986 , that Act applies to the taxpayer as if the reference in the table in Part I of Schedule 7 to that Act to the amount referred to in paragraph (a) were a reference to a different amount--that different amount.

30 Application

The amendment made by item 29 applies to assessments for the 2000 - 2001 year of income and later years of income.

31 Paragraph 214A(2)(e)

Omit "or 12C", substitute ", 12AE or 12C".

32 Paragraph 262A(5)(b)

Omit "been finally dissolved", substitute "finally ceased to exist".

33 Paragraph 410(c)

After "exempt income", insert "etc.".

34 Subsection 432(2)

Repeal the subsection.

35 Subparagraph 437(2)(c)(ii)

Omit "(within the meaning of section 432)".

Income Tax Assessment Act 1997

36 Subsection 4 - 15(2) (table item 4)

Omit "not an Australian resident", substitute "a foreign resident".

37 Subsection 6 - 5(3)

Omit " not an Australian resident", substitute "a foreign resident".

38 Subsection 6 - 10(5)

Omit " not an Australian resident", substitute "a foreign resident".

39 Section 11 - 55 (at the end of the table)

Add:

withholding taxes |

|

see foreign aspects of income taxation and mining |

|

40 Section 12 - 5 (table item headed "interest")

Repeal the item, substitute:

interest |

|

convertible notes, interest on, generally ............ | 82L to 82T |

foreign residents, debt creation involving, generally .... | 159GZY to 159GZZF |

foreign residents, delayed deduction for interest paid to until withholding tax payable has been paid |

|

life assurance premiums, interest etc. on loans to finance, no deduction for | 67AAA |

superannuation contributions, interest etc. on loans to finance, no deduction for |

|

underpayment or late payment of tax, interest for ..... | 25 - 5 |

see also infrastructure borrowings |

|

41 Section 12 - 5 (table item headed "royalties")

Omit "non - resident", substitute "foreign resident".

42 Subsection 27 - 10(1)

Omit "or 132".

43 Subdivision 27 - B (heading)

Repeal the heading, substitute:

Subdivision 27 - B -- Effect of input tax credits etc. on capital allowances

44 Subsection 34 - 10(1)

Omit " * non - compulsory uniform", substitute " * non - compulsory * uniform".

45 Section 34 - 15 (heading)

Repeal the heading, substitute:

34 - 15 What is a non - compulsory uniform?

46 Subsection 34 - 25(1)

Omit " * non - compulsory uniform", substitute " * non - compulsory * uniform".

47 Subsection 36 - 20(2)

Omit " not an Australian resident", substitute "a foreign resident".

48 Subsection 40 - 430(3)

Renumber as subsection (2).

49 Subsection 102 - 5(1) (method statement, step 4, note 2)

After "roll - overs", insert "and the small business retirement exemption".

50 Section 104 - 5 (table item dealing with CGT event I1)

Omit "a resident", substitute "an Australian resident".

51 Subsection 104 - 47(5) (at the end of the example)

Add:

She reduces the cost base of the land by the part that is apportioned to the covenant:

![]()

52 Subsection 104 - 135(6)

Omit "is dissolved", substitute "ceases to exist".

53 Section 104 - 160 (heading)

Repeal the heading, substitute:

104 - 160 Individual or company stops being an Australian resident: CGT event I1

54 Subsection 104 - 160(1)

Omit " * Australian resident", substitute "Australian resident".

55 Subsection 104 - 160(5) (note 1)

Omit "resident", substitute "Australian resident".

56 Subsection 104 - 160(5) (note 2)

Omit "a resident", substitute "an Australian resident".

57 Section 104 - 165 (heading)

Repeal the heading, substitute:

104 - 165 Exception for individual who stops being an Australian resident

58 Subsection 104 - 165(1) (heading)

Repeal the heading, substitute:

Short term Australian residents

59 Subsection 104 - 165(1)

Omit " * Australian resident", substitute "Australian resident".

60 Paragraph 104 - 165(3)(b)

Omit " * Australian resident", substitute "Australian resident".

61 Paragraph 104 - 215(1)(e)

Repeal the paragraph, substitute:

(c) is a foreign resident.

62 Subsection 104 - 215(2)

Omit "not an * Australian resident", substitute "a foreign resident".

63 Paragraph 104 - 215(2)(a)

Omit " * Australian resident", substitute "Australian resident".

64 Subsection 104 - 215(5) (note)

Repeal the note, substitute:

Note: There is also an exception for certain philanthropic testamentary gifts: see section 118 - 60.

65 Subsection 104 - 230(7)

Omit "not an * Australian resident", substitute "a foreign resident".

66 Section 104 - 250 (heading)

Repeal the heading, substitute:

104 - 250 Direct value shifts: CGT event K8

67 Section 109 - 55 (table item 7)

Omit " * prospecting or mining entitlement", substitute "prospecting or mining entitlement".

68 Section 109 - 55 (table item 17)

Repeal the item, substitute:

17 | There is a roll - over under Subdivision 126 - B for a CGT event and you are the company owning the roll - over asset just after the roll - over and you stop being a 100% subsidiary of another company in the wholly - owned group | when you stop | section 104 - 175 |

69 Section 109 - 60 (after table item 2)

Insert:

2A | Lender acquires a replacement security | before 20 September 1985 | subsection 26BC(6A) |

70 Section 109 - 60 (table items 13 and 14)

Repeal the items.

71 Section 112 - 45 (after table item dealing with CGT event E1)

Insert:

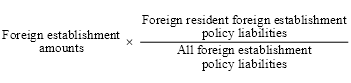

E2 | A CGT asset is transferred to a trust | First element of cost base and reduced cost base | 104 - 60 |

72 Section 112 - 97 (after table item 2)

Insert:

2A | Lender acquires a replacement security | First element of cost base and reduced cost base | subsection 26BC(6B) |

73 Section 112 - 97 (table items 23 and 24)

Repeal the items.

74 Subparagraph 116 - 30(3)(a)(ii)

Omit "statutory licence", substitute " * statutory licence".

75 Paragraph 118 - 37(4)(a)

Omit " * Australian resident", substitute "Australian resident".

76 Paragraph 118 - 415(2)(a)

Omit " * tax - exempt non - resident", substitute " * tax - exempt foreign resident".

77 Paragraph 118 - 420(1)(a)

Omit " * tax - exempt non - resident", substitute " * tax - exempt foreign resident".

78 Subsection 118 - 420(3)

Omit " tax - exempt non - resident ", substitute " tax - exempt foreign resident ".

79 Subparagraph 118 - 420(6)(b)(ii)

Omit " * tax - exempt non - resident", substitute " * tax - exempt foreign resident".

80 Section 118 - 435 (heading)

Repeal the heading, substitute:

118 - 435 Special rule relating to investment in foreign resident holding companies

81 Section 118 - 500

Omit "non - resident", substitute "foreign resident".

82 Paragraph 118 - 515(1)(a)

Omit "not an Australian resident", substitute "a foreign resident".

83 Paragraph 121 - 25(4)(b)

Omit "that has been finally dissolved", substitute "that has finally ceased to exist".

84 Subsection 122 - 25(6) (table items 2 and 3)

Omit "Not an Australian resident", substitute "A foreign resident".

85 Subsection 122 - 25(7) (table item 3)

Omit "Not an Australian resident", substitute "A foreign resident".

86 Subsection 122 - 135(6) (table items 2 and 3)

Omit "Not an Australian resident", substitute "A foreign resident".

87 Subsection 122 - 135(7) (table item 3)

Omit "Not an Australian resident", substitute "A foreign resident".

88 Subsection 122 - 140(1) (note)

Omit "section 122 - 45", substitute "section 122 - 145".

89 Paragraph 124 - 70(3)(a)

Omit "not an Australian resident", substitute "a foreign resident".

90 Subsection 124 - 85(2) (table item 3)

After "your * net capital", insert "gain".

91 Subparagraph 124 - 240(f)(ii)

Omit "not an Australian resident", substitute "a foreign resident".

92 Subparagraph 124 - 245(e)(ii)

Omit "not an Australian resident", substitute "a foreign resident".

93 Paragraph 124 - 295(7)(b)

Omit "not an Australian resident", substitute "a foreign resident".

94 Paragraph 124 - 300(7)(b)

Omit "not an Australian resident", substitute "a foreign resident".

95 Paragraph 124 - 365(4)(b)

Omit "not an Australian resident", substitute "a foreign resident".

96 Paragraph 124 - 375(4)(b)

Omit "not an Australian resident", substitute "a foreign resident".

97 Paragraph 124 - 450(4)(b)

Omit "not an Australian resident", substitute "a foreign resident".

98 Paragraph 124 - 460(4)(b)

Omit "not an Australian resident", substitute "a foreign resident".

99 Paragraph 124 - 520(1)(a)

Omit "other than * company law", substitute "(other than the Corporations Act 2001 or a similar * foreign law relating to companies)".

100 Paragraph 124 - 520(1)(b)

Omit "company law", substitute "the Corporations Act 2001 or a similar foreign law relating to companies".

101 Subparagraph 124 - 520(1)(e)(ii)

Omit "not an Australian resident", substitute "a foreign resident".

102 Subsection 124 - 520(2)

Repeal the subsection.

103 Subsection 124 - 520(3)

Renumber as subsection (2).

104 Paragraphs 124 - 710(1)(a) and (2)(a)

Omit "foreign law", substitute " * foreign law".

105 Subsection 124 - 795(1)

Omit "not an Australian resident", substitute "a foreign resident".

106 Subsection 124 - 795(1) (note)

Repeal the note, substitute:

Note: If you are a foreign resident and the replacement entity is an Australian resident, the replacement interest has the necessary connection with Australia: see Division 136.

107 Subsection 124 - 795(4)

Omit "not an Australian resident" (wherever occurring), substitute "a foreign resident".

108 Subparagraph 124 - 795(5)(b)(ii)

Omit "not an Australian resident", substitute "a foreign resident".

109 Subsection 124 - 870(3)

Omit "not an Australian resident", substitute "a foreign resident".

110 Subsection 125 - 80(7)

Omit "proportion, but not all of,", substitute "proportion, but not all, of".

111 Subsection 125 - 80(7) (note)

Omit "dispose your interests", substitute "dispose of your interests".

112 Section 128 - 10 (note 1)

Omit "not an Australian resident", substitute "a foreign resident".

113 Subsection 128 - 15(1) (note)

Omit "not an Australian resident", substitute "a foreign resident".

114 Subsection 128 - 25(2) (note 2)

Repeal the note, substitute:

Note 2: If the beneficiary is a foreign resident, Subdivision 136 - B sets out what happens if the beneficiary becomes an Australian resident. The beneficiary is taken to have acquired each asset owned just before becoming an Australian resident for the market value of the asset at that time.

115 Division 136 (heading)

Repeal the heading, substitute:

Division 136 -- Foreign residents

116 Section 136 - 1

Omit "non - resident" (wherever occurring), substitute "foreign resident".

117 Section 136 - 1

Omit "becomes a resident", substitute "becomes an Australian resident".

118 Section 136 - 5 (heading)

Repeal the heading, substitute:

136 - 5 What if you are a foreign resident just before a CGT event

119 Paragraph 136 - 5(a)

Omit "not an Australian resident", substitute "a foreign resident".

120 Section 136 - 10 (table heading)

Omit " Non - resident ", substitute " Foreign resident capital ".

121 Section 136 - 20 (table item dealing with CGT event I1)

Omit "resident", substitute "an Australian resident".

122 Section 136 - 25 (table items 8 and 9)

Omit "not an Australian resident", substitute "a foreign resident".

123 Section 136 - 25 (note)

Omit "non - resident", substitute "foreign resident".

124 Subdivision 136 - B (heading)

Repeal the heading, substitute:

Subdivision 136 - B -- Becoming an Australian resident

125 Section 136 - 40 (heading)

Repeal the heading, substitute:

136 - 40 Individual or company becomes an Australian resident

126 Section 152 - 5

After "apart from small business roll - overs", insert "and the small business retirement exemption".

127 Paragraph 152 - 25(1)(a)

Omit "spouse or child", substitute " * spouse or * child".

128 Subdivision 152 - C (heading)

Repeal the heading, substitute:

Subdivision 152 - C -- Small business 50% reduction

129 Section 152 - 215

Repeal the section, substitute:

152 - 215 15 - year rule has priority

This Subdivision does not apply to a * capital gain to which Subdivision 152 - B (15 - year exemption) applies.

Note: Under that Subdivision, such a gain is entirely disregarded, so there is no need for any further concession to apply.

130 At the end of Subdivision 152 - D

Add:

152 - 330 15 - year rule has priority

This Subdivision does not apply to a * capital gain to which Subdivision 152 - B (15 - year exemption) applies.

Note: Under that Subdivision, such a gain is entirely disregarded, so there is no need for any further concession to apply.

131 At the end of Subdivision 152 - E

Add:

152 - 430 15 - year rule has priority

This Subdivision does not apply to a * capital gain to which Subdivision 152 - B (15 - year exemption) applies.

Note: Under that Subdivision, such a gain is entirely disregarded, so there is no need for any further concession to apply.

132 Subsection 165 - 115ZC(3)

Repeal the subsection, substitute:

Foreign resident controlling entity to be disregarded in certain circumstances

(3) If:

(a) apart from this subsection, an entity that is a foreign resident would be a controlling entity of a * loss company; and

(b) there is an entity that is an Australian resident and would be a controlling entity of the loss company if all the foreign residents that held direct or indirect interests in the Australian resident were individuals;

then, for the purposes of this section, the entity referred to in paragraph (a) is taken not to be a controlling entity of the company but the Australian resident is taken to be a controlling entity of the company.

133 Subsection 165 - 235(1) (heading)

Repeal the heading, substitute:

Notice about foreign resident non - fixed trust

134 Subsection 165 - 235(4) (heading)

Repeal the heading, substitute:

Foreign resident trust

135 Paragraph 165 - 235(4)(a)

Omit "non - resident", substitute "foreign resident".

136 Subsections 170 - 30(1) and (2)

Omit " * in existence", substitute "in existence".

137 Subsection 170 - 30(4) (table items 1, 2 and 3)

Omit " * in existence", substitute "in existence".

138 Subsections 170 - 32(4) and (5)

Omit " * in existence", substitute "in existence".

139 Subsection 170 - 115(1) (at the end of the note)

Add "or 102 - 10".

140 Subsections 170 - 130(1) and (2)

Omit " * in existence", substitute "in existence".

141 Subsection 170 - 130(4) (table items 1, 2 and 3)

Omit " * in existence", substitute "in existence".

142 Subsections 170 - 132(4) and (5)

Omit " * in existence", substitute "in existence".

143 Subsections 170 - 133(2) and (3)

Omit " * in existence", substitute "in existence".

144 Subsection 170 - 140(2) (at the end of note 2)

Add "or 102 - 10".

145 Paragraphs 170 - 210(1)(e) and (2)(f)

Omit " * in existence", substitute "in existence".

146 Paragraphs 170 - 215(1)(e) and (2)(f)

Omit " * in existence", substitute "in existence".

147 Paragraphs 170 - 220(1)(e) and (2)(f)

Omit " * in existence", substitute "in existence".

148 Paragraphs 170 - 225(1)(e) and (2)(f)

Omit " * in existence", substitute "in existence".

149 Subparagraph 170 - 255(1)(d)(i)

Omit "a resident", substitute "an Australian resident".

150 Subparagraph 170 - 255(1)(d)(v)

Omit "non - resident", substitute "foreign resident".

151 Section 180 - 1

Repeal the section, substitute:

180 - 1 What this Division is about

If a company would only avoid the tax consequences of Division 165 or 175 because of interests held by a foreign resident family trust, the Commissioner may require the company to give certain information about the family trust. If it is not given, the company does not avoid the tax consequences of that Division.

152 Subsection 180 - 5(4) (heading)

Repeal the heading, substitute:

Foreign resident trust

153 Paragraph 180 - 5(4)(a)

Omit "non - resident", substitute "foreign resident".

154 Subsection 180 - 15(4) (heading)

Repeal the heading, substitute:

Foreign resident trust

155 Paragraph 180 - 15(4)(a)

Omit "non - resident", substitute "foreign resident".

156 Section 202 - 10

Omit "resident", substitute "an Australian resident".

157 Paragraph 202 - 15(c)

Omit " * company", substitute "company".

158 Paragraph 202 - 20(a)

Repeal the paragraph, substitute:

(a) in the case of a company--the company is an Australian resident at that time; and

159 Subsections 204 - 25(4), (5) and (6)

Omit " * company", substitute "company".

160 Paragraph 204 - 30(8)(a)

Omit "not an Australian resident", substitute "a foreign resident".

161 Paragraph 205 - 25(1)(a)

Omit " * company", substitute "company".

162 Subparagraph 205 - 25(1)(a)(i)

Omit " * Australian resident", substitute "Australian resident".

163 Section 205 - 30 (table item 9)

Omit " * company", substitute "company".

164 Paragraph 207 - 75(a)

Omit " * Australian resident", substitute "Australian resident".

165 Paragraph 207 - 75(b)

Repeal the paragraph, substitute:

(b) in the case of a company--the company is an Australian resident at that time; and

166 Subsection 207 - 95(4) (example)

Omit "non - resident individual", substitute "foreign resident individual".

167 Paragraph 208 - 40(1)(a)

Omit "not an * Australian resident", substitute "a foreign resident".

168 Paragraph 208 - 40(4)(a)

Omit "not an * Australian resident", substitute "a foreign resident".

169 Paragraph 208 - 45(1)(a)

Omit " * company", substitute "company".

170 Subsection 208 - 45(2)

Omit " * company", substitute "company".

171 Subsection 208 - 80(2)

Omit " * Australian residents", substitute "Australian residents".

172 Paragraph 208 - 155(2)(a)

Omit " * company", substitute "company".

173 Paragraph 208 - 155(3)(a)

Omit "not an * Australian resident", substitute "a foreign resident".

174 Subsection 208 - 155(4)

Omit "if not an * Australian resident", substitute "if a foreign resident".

175 Paragraph 208 - 205(a)

Omit " * company", substitute "company".

176 Section 208 - 215

Omit " * company", substitute "company".

177 Paragraph 208 - 235(a)

Omit " * company", substitute "company".

178 Paragraph 208 - 240(b)

Omit " * Australian residents", substitute "Australian residents".

179 Paragraph 215 - 10(1)(a)

Omit " * Australian resident", substitute "Australian resident".

180 Subparagraph 215 - 10(2)(a)(ii)

Omit " * Australian resident", substitute "Australian resident".

181 Division 218

Relocate the Division so it appears immediately after Division 216.

182 Paragraph 220 - 215(1)(c)

Omit "not an Australian resident", substitute "a foreign resident".

183 Subparagraph 220 - 605(1)(c)(i)

Omit "not an Australian resident", substitute "a foreign resident".

184 Paragraph 320 - 37(1)(c)

Omit "non - resident proportion", substitute "foreign resident proportion".

185 Subsection 320 - 37(2)

Repeal the subsection, substitute:

(2) For the purposes of paragraph (1)(c), the foreign resident proportion of the * foreign establishment amounts is the amount worked out using the formula:

where:

"all foreign establishment policy liabilities" means the average value for the income year (as calculated by an * actuary) of the policy liabilities (as defined in the * Valuation Standard) for all * life insurance policies that:

(a) were included in the class of * life insurance business to which the company's * Australian/overseas fund or * overseas fund relates; and

(b) were issued by the company at or through the * permanent establishment to which the foreign establishment amounts relate.

"foreign resident foreign establishment policy liabilities" means the average value for the income year (as calculated by an * actuary) of the policy liabilities (as defined in the * Valuation Standard) for all * life insurance policies that:

(a) are * foreign resident life insurance policies; and

(b) were issued by the company at or through the * permanent establishment to which the foreign establishment amounts relate.

186 Paragraph 328 - 375(1)(a)

Omit "business supplies", substitute " * business * supplies".

187 Subsections 328 - 375(2) and (3)

Omit "business supplies", substitute " * business * supplies".

188 Subsection 328 - 380(1)

Omit "business supplies", substitute " * business * supplies".

189 Subparagraph 376 - 5(1)(d)(ii)

Omit "is not an Australian resident", substitute "is a foreign resident".

190 Subparagraph 376 - 15(1)(a)(ii)

Omit "is not an Australian resident", substitute "is a foreign resident".

191 Subparagraph 376 - 50(a)(i)

Omit "is not an Australian resident", substitute "is a foreign resident".

192 Subsection 396 - 75(2) (example)

Omit "is not an Australian resident", substitute "is a foreign resident".

193 Subsection 405 - 50(5) (table heading)

Omit " not an Australian resident ", substitute " a foreign resident ".

194 Subsection 405 - 50(5) (note)

Omit "not an Australian resident", substitute "a foreign resident".

195 Section 703 - 25 (table item 3)

Omit "resident unit trust (as defined in whichever one of sections 102H and 102Q of the Income Tax Assessment Act 1936 is relevant)", substitute " * resident unit trust".

196 Subsection 721 - 15(2)

Omit "Australian law", substitute " * Australian law".

197 Subsection 960 - 60(1) (table items 1 and 2)

Omit " * Australian resident", substitute "Australian resident".

198 Subsection 960 - 60(1) (table item 2)

Omit " * foreign resident", substitute "foreign resident".

199 Subsection 960 - 80(1) (table items 1 and 2)

Omit " * Australian resident", substitute "Australian resident".

200 Subsection 960 - 80(1) (table item 2)

Omit " * foreign resident", substitute "foreign resident".

201 Subsection 960 - 90(1) (table items 1 and 2)

Omit " * Australian resident", substitute "Australian resident".

202 Subsection 960 - 90(1) (table item 2)

Omit " * foreign resident", substitute "foreign resident".

203 Paragraph 960 - 140(a)

Omit " * company", substitute "company".

204 Paragraph 960 - 345(1)(a)

Omit "business supplies", substitute " * business * supplies".

205 Subsection 960 - 345(2)

Repeal the subsection, substitute:

(2) The value of the * business * supplies an entity makes in an income year is the sum of:

(a) for * taxable supplies (if any) the entity made during the year in the ordinary course of carrying on a business--the value (as defined by section 9 - 75 of the * GST Act) of the supplies; and

(b) for other supplies the entity made during the year in the ordinary course of carrying on a business--the prices (as defined by section 9 - 75 of the GST Act) of the supplies.

206 Section 975 - 100

Repeal the section.

207 Subsection 995 - 1(1) (definition of company law )

Repeal the definition.

208 Subsection 995 - 1(1)

Insert:

"foreign resident life insurance policy" means a * life insurance policy that:

(a) was issued by a company in the course of * carrying on a * business at or through the * permanent establishment of the company in a foreign country; and

(b) is held by an entity that is neither an * associate of the company nor a Part X Australian resident (within the meaning of Part X of the Income Tax Assessment Act 1936 ).

209 Subsection 995 - 1(1) (definition of group turnover ) (the definition inserted by item 2 of Schedule 6 to the New Business Tax System (Capital Allowances) Act 1999 )

Omit "section 960 - 345", substitute "subsection 960 - 345(1)".

Note: This was the first insertion of a definition of group turnover .

210 Subsection 995 - 1(1) (definition of group turnover ) (the definition inserted by item 9 of Schedule 5 to the A New Tax System (Indirect Tax and Consequential Amendments) Act (No. 2) 1999 )

Repeal the definition.

Note: This was the second insertion of a definition of group turnover .

211 Subsection 995 - 1(1) (definition of in existence )

Repeal the definition.

212 Subsection 995 - 1(1) (all of the definitions of member )

Repeal the definitions.

213 Subsection 995 - 1(1)

Insert:

"member" :

(a) in relation to a * GST group--has the meaning given by section 195 - 1 of the * GST Act; and

(b) in relation to a * consolidated group or * consolidatable group--has the meaning given by section 703 - 15; and

(c) in relation to an entity--has the meaning given by section 960 - 130; and

(d) in relation to a * copyright collecting society, means:

(i) any person who has been admitted as a member under the society's * constitution; or

(ii) any person who has authorised the society to license the use of his or her copyright material.

214 Subsection 995 - 1(1) (definition of non - compulsory uniform )

Repeal the definition.

215 Subsection 995 - 1(1) (definition of non - resident life insurance policy )

Repeal the definition.

216 Subsection 995 - 1(1) (definition of taxable supply ) (the definition inserted by item 7 of Schedule 6 to the New Business Tax System (Capital Allowances) Act 1999 )

Repeal the definition.

Note: This was the first insertion of a definition of taxable supply .

217 Subsection 995 - 1(1)

Insert:

"tax-exempt foreign resident" has the meaning given by subsection 118 - 420(3).

218 Subsection 995 - 1(1) (definition of tax - exempt non - resident )

Repeal the definition.

219 Subsection 995 - 1(1) (the 2 definitions of value )

Repeal the definitions.

220 Subsection 995 - 1(1)

Insert:

"value" :

(a) the value of the liabilities of a * life insurance company under the * risk components of * life insurance policies means the value worked out under section 320 - 85; and

(b) the value of an item of * trading stock has the meaning given by Subdivision 70 - C; and

Note 1: For the value of trading stock at the start of the 1997 - 98 income year, see section 70 - 40 of the Income Tax (Transitional Provisions) Act 1997 .

Note 2: For the value of oysters acquired by using the traditional stick farming method and held as trading stock at the start of the 2001 - 2002 income year, see section 70 - 41 of the Income Tax (Transitional Provisions) Act 1997 .

(c) the value of the * business * supplies of an entity has the meaning given by subsection 960 - 345(2).

221 Subsection 995 - 1(1) (the 2 definitions of value of the business supplies )

Repeal the definitions.

Income Tax (Transitional Provisions) Act 1997

222 Subdivision 104 - J (heading)

Repeal the heading, substitute:

Subdivision 104 - J -- CGT events relating to roll - overs

223 Subdivision 175 - C

Repeal the Subdivision, substitute:

Subdivision 175 - C -- Tax benefits from unused bad debt deductions

Table of sections

175 - 78 Application of Subdivision 175 - C of the Income Tax Assessment Act 1997

175 - 78 Application of Subdivision 175 - C of the Income Tax Assessment Act 1997

Subdivision 175 - C of the Income Tax Assessment Act 1997 (about companies obtaining tax benefits from unused bad debt deductions) applies to assessments for the 1998 - 99 income year and later income years.

New Business Tax System (Consolidation and Other Measures) Act 2003

224 Item 3 of Schedule 7

The item is taken never to have had effect.

Petroleum Resource Rent Tax Assessment Act 1987

225 Section 2

Insert:

"approved form" has the meaning given by section 388 - 50 in Schedule 1 to the Taxation Administration Act 1953 .

Note: Forms previously approved by the Commissioner under this Act continue in effect : see item 230 of Schedule 10 to the Tax Laws Amendment (2004 Measures No. 7) Act 2005 .

226 Subsection 45A(6) (definition of transfer notice )

Omit "form approved by the Commissioner for the purposes of this section", substitute "approved form".

227 Subsection 45B(6) (definition of transfer notice )

Omit "form approved by the Commissioner for the purposes of this section", substitute "approved form".

228 Paragraph 59(2)(a)

Omit "form provided or authorised by the Commissioner for the purposes of this section", substitute "approved form".

229 Subsection 98(1)

Omit "a form approved by the Commissioner", substitute "the approved form".

230 Transitional

An approval of a form for the purposes of the Petroleum Resource Rent Tax Assessment Act 1987 that was in force immediately before the commencement of this item has effect after that commencement as if it had been done under section 388 - 50 in Schedule 1 to the Taxation Administration Act 1953 .

Product Grants and Benefits Administration Act 2000

231 Paragraph 35(1)(b)

Omit "section 36", substitute "subsection 284 - 75(1) in Schedule 1 to the Taxation Administration Act 1953 ".

Superannuation Guarantee (Administration) Act 1992

232 Subsection 19(3)

Omit "subsection (2)", substitute "subsection (1)".

Taxation Administration Act 1953

233 Paragraph 12 - 47(c) in Schedule 1

Omit "enterprise that the entity carries on", substitute " * enterprise that the entity * carries on".

234 Subsection 12 - 60(1) in Schedule 1

Omit "carries on", substitute " * carries on".

235 Paragraph 12 - 155(a) in Schedule 1

Omit "carried on", substitute " * carried on".

236 Subsection 12 - 315(1) in Schedule 1

Omit "carries on", substitute " * carries on".

237 Subsection 18 - 75(3) in Schedule 1

Renumber as subsection (2).

238 Subsection 18 - 75(4) in Schedule 1

Renumber as subsection (3).

239 Subdivision 260 - D in Schedule 1 (heading)

Repeal the heading, substitute:

Subdivision 260 - D -- From agent winding up business for foreign resident principal

240 Section 260 - 105 in Schedule 1 (heading)

Repeal the heading, substitute:

260 - 105 Obligation of agent winding up business for foreign resident principal

241 Paragraph 260 - 105(1)(a) in Schedule 1

Omit "is not an Australian resident", substitute "is a foreign resident".

Taxation Laws Amendment Act (No. 5) 2002

242 Items 6 and 7 of Schedule 1

The items are taken never to have had effect.

243 Paragraph 21 - 5(3)(b)

Omit " * tax - exempt non - resident", substitute " * tax - exempt foreign resident".

Part 2 -- Technical corrections and amendments commencing otherwise than on Royal Assent

A New Tax System (Pay As You Go) Act 1999

244 Item 85 of Schedule 2

Repeal the item, substitute:

85 Subparagraph 12A(1)(a)(i)

After "under" (last occurring), insert "section 163AA, section 170AA,".

Energy Grants (Credits) Scheme (Consequential Amendments) Act 2003

245 Item 16 of Schedule 4

Omit "definition" (last occurring), substitute "paragraph".

Fringe Benefits Tax Assessment Act 1986

246 Subsection 136(1) (definition of approved form ) (the definition inserted by item 136 of Schedule 2 to the A New Tax System (Pay As You Go) Act 1999 )

Repeal the definition.

Note: This was the first insertion of a definition of approved form .

Income Tax Assessment Act 1997

247 Section 118 - 315 (the section 118 - 315 inserted by item 18 of Schedule 1 to the Family Law Legislation Amendment (Superannuation) (Consequential Provisions) Act 2001 )

Renumber as section 118 - 313.

248 Subsection 165 - 115BB(2) (definition of previous capital losses, deductions or trading stock losses )

Repeal the definition, substitute:

"previous capital losses, deductions or trading stock losses" means the total of the following:

(a) capital losses that the company made, deductions to which the company became entitled, or trading stock losses that the company made, as a result of events earlier than the relevant event in respect of assets that the company owned at the * changeover time;

(b) each reduction that section 715 - 105 (as applying to the company as the * head company of a * consolidated group or * MEC group) makes in respect of such an asset because an entity ceased before the time of the relevant event to be a * subsidiary member of the group (but counting only the greater or greatest such reduction if 2 or more are made for the same asset);

or nil if there are none.

249 Subsection 205 - 50(2)

Omit "A * refund of income tax for an income year is taken to have been paid to an entity immediately before the end of that year, for the purposes of subsection 205 - 45(2), if:", substitute "An entity is taken to have * received a refund of income tax for an income year immediately before the end of that year for the purposes of subsection 205 - 45(2) if:".

250 Subsection 205 - 50(3)

Omit "If an entity ceases to be a * franking entity during an income year, a * refund of income tax is taken to have been paid to it immediately before it ceased to be a franking entity, for the purposes of subsection 205 - 45(3), if:", substitute "If an entity ceases to be a * franking entity during an income year, the entity is taken to have * received a refund of income tax immediately before it ceased to be a franking entity for the purposes of subsection 205 - 45(3) if:".

251 Section 210 - 120 (table item 2)

Omit "a * refund of income tax", substitute " * receiving a refund of income tax".

252 Subsection 210 - 150(2)

Omit "A * refund of income tax for an income year is taken to have been paid to an entity immediately before the end of that year for the purposes of subsection 210 - 135(2), if:", substitute "An entity is taken to have * received a refund of income tax for an income year immediately before the end of that year for the purposes of subsection 210 - 135(2) if:".

253 Subsection 210 - 150(3)

Omit "If an entity ceases to be a * PDF during an income year, a * refund of income tax is taken to have been paid to it immediately before it ceased to be a PDF, for the purposes of subsection 210 - 135(3), if:", substitute "If an entity ceases to be a * PDF during an income year, it is taken to have * received a refund of income tax immediately before it ceased to be a PDF for the purposes of subsection 210 - 135(3) if:".

254 Paragraph 214 - 45(1)(a)

Omit "receives a * refund of income tax", substitute " * receives a refund of income tax".

255 Paragraph 214 - 45(2)(a)

Omit "receives a * refund of income tax", substitute " * receives a refund of income tax".

256 Paragraph 214 - 105(1)(b)

Omit "received a * refund of income tax", substitute " * received a refund of income tax".

257 Paragraph 214 - 150(4)(a)

Omit "receives a * refund of income tax", substitute " * receives a refund of income tax".

258 Subsection 320 - 195(1)

Omit all the words after "does not exceed", substitute "the company's liabilities in respect of the policy".

259 Paragraphs 705 - 90(4)(a) and (9)(a)

Omit " * refund of income tax", substitute "refund of income tax".

260 Subsection 820 - 617(1)

Omit "section 820 - A515", substitute "section 820 - 599".

261 Subsection 995 - 1(1) (definition of government entity ) (the definition inserted by item 16 of Schedule 18 to the A New Tax System (Tax Administration) Act 1999 )

Repeal the definition.

Note: This was the first insertion of a definition of government entity .

262 Subsection 995 - 1(1) (definition of participant ) (the definition inserted by item 46 of Schedule 3 to the A New Tax System (Pay As You Go) Act 1999 )

Repeal the definition.

Note: This was the first insertion of a definition of participant .

263 Subsection 995 - 1(1)

Insert:

"receives a refund of income tax" has the meaning given by section 205 - 35.

264 Subsection 995 - 1(1) (definition of refund of income tax )

Repeal the definition.

New Business Tax System (Consolidation) Act (No. 1) 2002

265 Paragraph (2)(a) of item 23 of Schedule 3

After "originating company", insert "or the recipient company".

New Business Tax System (Consolidation and Other Measures) Act 2003

266 Item 6 of Schedule 21

Omit "705 - 35", substitute "705 - 35(1)".

Taxation Laws Amendment (Company Law Review) Act 1998

267 Subsection 2(2)

Repeal the subsection, substitute:

(2) Items 23, 24, 54, 55, 56 and 57 of Schedule 5 commence on 1 July 1998.

Taxation Laws Amendment (Research and Development) Act 2001

268 Item 2 of Schedule 4

Omit "73(3)(b)", substitute "73C(3)(b)".

Tax Laws Amendment (2004 Measures No. 2) Act 2004

269 Subsection 2(1) (table item 9)

Omit " New Business Tax System (Miscellaneous) Act (No. 4) 2003 ", substitute " Taxation Laws Amendment Act (No. 4) 2003 ".

Part 3 -- Removal of link notes

Note: A link note is a note included at the end of one group of units to indicate the number of the next unit, or a note indicating the end of a Guide.

Income Tax Assessment Act 1936

270 Link notes

Repeal the link notes.

Income Tax Assessment Act 1997

271 Section 2 - 30

Repeal the section, substitute:

There are gaps in the numbering system to allow for the insertion of new Divisions and sections.

272 Subsection 995 - 1(1) (definition of link note )

Repeal the definition.

273 Link notes

Repeal the link notes.

Income Tax (Transitional Provisions) Act 1997

274 Link notes

Repeal the link notes.

Taxation Administration Act 1953

275 Link notes

Repeal the link notes.

276 Link notes

Repeal the link notes.