Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Amendment of the Income Tax Assessment Act 1936

1 Subsection 73B(1AAA)

After "deduction, to", insert "encourage research and development activities in Australia and".

Note 1: The following heading to subsection 73B(1AAA) is inserted " Object of this section ".

Note 2: The following heading to subsection 73B(1AA) is inserted " Relationship with sections 73C and 73CA ".

Note 3: The following heading to subsection 73B(1AB) is inserted " What is core technology ".

2 Subsection 73B(1)

Insert:

"Australian-centred research and development activities" means:

(a) Australian research and development activities that are covered by paragraph (a) of the definition of research and development activities ; or

(b) Australian research and development activities covered by all of the following:

(i) the activities are not covered by paragraph (a) of the definition of research and development activities ;

(ii) the activities are carried on for a purpose directly related to the carrying on of other Australian research and development activities that are of the kind referred to in paragraph (a) of that definition;

(iii) that purpose is the sole or dominant purpose for which the activities are carried on.

Note: The following heading to subsection 73B(1) is inserted " Definitions ".

3 Subsection 73B(1)

Insert:

"expenditure on foreign owned R&D" by an eligible company for a year of income has the meaning given by subsections (14C) and (14D).

4 Subsection 73B(1)

Insert:

"foreign company" means a body corporate that:

(a) is incorporated under a law of a foreign country; and

(b) is a resident of a foreign country for the purposes of a double tax agreement (as defined in Part X) that relates to that foreign country.

Note 1: The following heading to subsection 73B(1A) is inserted " What is eligible feedstock expenditure ".

Note 2: The following heading to subsection 73B(1B) is inserted " Limit on what is contracted expenditure ".

5 After subsection 73B(1B)

Insert:

(1BA) Subsection (1B) does not apply to expenditure covered by subsection (14C) (ignoring paragraphs (14C)(f) and (g)).

Note 1: The following heading to subsection 73B(1C) is inserted " What use of plant counts for definition of plant expenditure ".

Note 2: The following heading to subsection 73B(2) is inserted " Disregarding transfer of property connected with security ".

Note 3: The following heading to subsection 73B(2A) is inserted " Limits on what are research and development activities ".

Note 4: The following heading to subsection 73B(3) is inserted " Expenditure by eligible company as trustee not counted ".

Note 5: The following heading to subsection 73B(3A) is inserted " Partnerships ".

Note 6: The following heading to subsection 73B(4) is inserted " Definition of qualifying plant expenditure ".

Note 7: The following heading to subsection 73B(4A) is inserted " Definitions of written - down value ".

Note 8: The following heading to subsection 73B(4C) is inserted " Definition of qualifying pilot plant expenditure ".

Note 9: The following heading to subsection 73B(4D) is inserted " Deductible amount of qualifying expenditure on post - 23 July 1996 pilot plant ".

Note 10: The following heading to subsection 73B(5) is inserted " Limit on qualifying plant expenditure ".

Note 11: The following heading to subsection 73B(5A) is inserted " Expenditure on building does not count for this section ".

Note 12: The following heading to subsection 73B(6) is inserted " Cost of plant before 19 August 1992 ".

6 Subsection 73B(9)

After "this section" (first occurring), insert "(except subsection (14C))".

Note: The following heading to subsection 73B(9) is inserted " No deduction for expenditure on activities for another person ".

7 Subsection 73B(9)

After "this section" (last occurring), insert "(except subsections (14C) and (14D))".

Note 1: The following heading to subsection 73B(10) is inserted " No deduction for unregistered company ".

Note 2: The following heading to subsection 73B(11) is inserted " Advance R and D expenditure ".

Note 3: The following heading to subsection 73B(12) is inserted " Deductions for core technology expenditure ".

Note 4: The following heading to subsection 73B(13) is inserted " Deduction for contracted expenditure ".

Note 5: The following heading to subsection 73B(14) is inserted " Deduction for research and development expenditure ".

Note 6: The following heading to subsection 73B(14AA) is inserted " Reduced rate of deduction under subsection (13) or (14) ".

Note 7: The following heading to subsection 73B(14A) is inserted " Deduction for interest expenditure ".

Note 8: The following heading to subsection 73B(14B) is inserted " Deduction for residual feedstock expenditure ".

8 After subsection 73B(14B)

Insert:

Deduction for expenditure on foreign owned R&D

(14C) An eligible company may deduct for a year of income the amount (the expenditure on foreign owned R&D by the eligible company for the year of income) worked out under subsection (14D) if:

(a) the eligible company incurs expenditure in the year of income at a time when the eligible company is grouped under section 73L with a foreign company; and

(b) the expenditure is for the purpose of the carrying on of Australian - centred research and development activities; and

(c) the activities are, are to be or were carried on wholly or primarily on behalf of the foreign company; and

(d) the activities are, are to be or were carried on directly or indirectly under a written agreement between the eligible company and the foreign company and no other parties for the activities to be performed:

(i) by the eligible company; or

(ii) by another person directly or indirectly under another agreement to which the eligible company is, or will become, a party; and

(e) the expenditure is not incurred in connection with an agreement that:

(i) is between the eligible company and another eligible company that is grouped under section 73L with the eligible company when the expenditure is incurred; and

(ii) is an agreement for the activities to be performed either by the eligible company or by a person who is not a party to the agreement and is to perform the activities directly or indirectly under another agreement to which the eligible company is, or will become, a party; and

(f) the expenditure on foreign owned R&D by the eligible company for the year of income is greater than $20,000; and

(g) the eligible company, and each other eligible company (if any) that is grouped under section 73L with that company at any time in the year of income, is registered under section 39J of the Industry Research and Development Act 1986 in relation to the year of income and all activities that meet both the following conditions:

(i) the activities are ones that, if subsection (2BA) had not been enacted, would be Australian - centred research and development activities carried on wholly or primarily on behalf of a foreign company (whether or not the activities would be such Australian - centred research and development activities taking account of that subsection);

(ii) the activities are ones in relation to which the eligible company or the other eligible company (as appropriate) incurred expenditure during the year of income.

Note 1: An example of the carrying on or performance of activities indirectly under an agreement that is a contract is the carrying on or performance of the activities under a subcontract, or one of a chain of subcontracts, under the agreement.

Note 2: One effect of paragraph (14C)(e) is that, even if the eligible company has an agreement with the foreign company for the carrying on of Australian - centred research and development activities wholly or primarily on behalf of the foreign company, the eligible company cannot deduct its expenditure:

(a) for performing the activities as a subcontractor under a subcontract with another eligible company grouped under section 73L with the eligible company; or

(b) if the eligible company is a subcontractor to another eligible company grouped under section 73L with the eligible company, for further subcontracting the performance of the activities.

Note 3: The eligible company may get an extra deduction under section 73QB if its expenditure on foreign owned R&D for the year of income is greater than the average of the amounts that would be the expenditure on foreign owned R&D by the eligible company for the 3 previous years of income if subsection (2BA) of this section had not been enacted.

(14D) The expenditure on foreign owned R&D by the eligible company for the year of income is the amount that would be the eligible company's incremental expenditure under section 73P for the year of income if:

(a) the Australian - centred research and development activities covered by subsection (14C) (ignoring paragraphs (14C)(f) and (g)) of this section were carried on on behalf of the eligible company (and not on behalf of the foreign company mentioned in paragraph (14C)(c)); and

(b) the only expenditure incurred by the eligible company in the year of income in relation to research and development activities had been the expenditure covered by subsection (14C) (ignoring paragraphs (14C)(f) and (g)) of this section; and

(c) the total group markup (if any) of the eligible company for the year of income were the amount (if any) that would be worked out under subsection (14AC) of this section if the company were working out the amount of a deduction under subsection (13) or (14) of this section on the basis described in paragraphs (a) and (b) of this subsection.

Note 1: Paragraphs (14D)(a) and (b) affect what would be the eligible company's incremental expenditure by affecting expenditure described in definitions of terms (e.g. contracted expenditure and salary expenditure ) used in the definition of research and development expenditure , on which incremental expenditure is based.

Note 2: Subsection 73P(5) excludes a company's total group markup (worked out under subsection (14AC) of this section) from the company's incremental expenditure. The markup is worked out to affect a deduction by the company under subsection (13) or (14) of this section for an amount of research and development expenditure to which subsection (14AB) of this section applies.

Note 1: The following heading to subsection 73B(15) is inserted " Deduction for qualifying plant expenditure ".

Note 2: The following heading to subsection 73B(15AA) is inserted " Deduction for qualifying expenditure on post - 23 July 1996 pilot plant ".

Note 3: The following heading to subsection 73B(15A) is inserted " Reduction of deduction under subsection (15) ".

Note 4: The following heading to subsection 73B(17A) is inserted " Limit on deduction for expenditure on overseas research and development activities ".

Note 5: The following heading to subsection 73B(18) is inserted " Choice that this section not apply to plant ".

Note 6: The following heading to subsection 73B(20) is inserted " Limit on double deductions ".

Note 7: The following heading to subsection 73B(23) is inserted " Balancing adjustments ".

Note 8: The following heading to subsection 73B(27) is inserted " Amounts included in assessable income ".

9 Paragraph 73B(31)(a)

Repeal the paragraph, substitute:

(a) an eligible company has:

(i) incurred an amount of research and development expenditure; or

(ii) incurred an amount of core technology expenditure; or

(iii) incurred an amount of expenditure covered by subsection (14C) (ignoring paragraphs (14C)(f) and (g)); or

(iv) incurred an amount of expenditure in the acquisition or construction of plant for use by the company exclusively for the purpose of the carrying on by or on behalf of the company of research and development activities; and

Note 1: The following heading to subsection 73B(31) is inserted " Amounts worked out on arm's length basis ".

Note 2: The following heading to subsection 73B(33) is inserted " Deductions denied if Board gives certificates ".

10 Subsection 73B(34)

Repeal the subsection, substitute:

Certificates from Board bind Commissioner

(34) If the Board gives to the Commissioner:

(a) a certificate that:

(i) is given under section 39L of the Industry Research and Development Act 1986 ; and

(ii) states whether particular activities were research and development activities; and

(iii) relates to activities that were carried on by or on behalf of an eligible company; or

(b) a certificate that:

(i) is given under section 39LAAA of the Industry Research and Development Act 1986 ; and

(ii) states whether particular activities were Australian - centred research and development activities; and

(iii) relates to activities in relation to which an eligible company incurred expenditure;

the certificate is binding on the Commissioner for the purpose of making an assessment of the eligible company's taxable income of any year of income in which those activities were carried on.

(34AA) If the Board gives to the Commissioner a certificate that:

(a) is given under section 39LAAB of the Industry Research and Development Act 1986 ; and

(b) states whether particular activities were activities that would have been Australian - centred research and development activities if subsection (2BA) of this section had not been enacted; and

(c) relates to activities in relation to which an eligible company incurred expenditure;

the certificate is binding on the Commissioner for the purpose of making an assessment of the eligible company's taxable income of any year of income in which those activities were carried on and any later year of income.

Note: The following heading to subsection 73B(36) is inserted " Apportioning insurance receipts etc. ".

11 Paragraph 73BAC(1)(a)

Omit "incremental expenditure (see section 73P)", substitute "expenditure".

12 At the end of subsection 73BAC(1)

Add:

; and (c) the head company of the group had received any recoupments of, or grants in respect of, that expenditure that the joining company or a person grouped with it under section 73L received, or became entitled to receive, before the joining company became a member of the group.

13 Section 73BAC (note)

Omit "the incremental expenditure provisions", substitute "sections 73P to 73Z (inclusive) of this Act".

14 Paragraph 73BAD(1)(a)

Omit "incremental expenditure (see section 73P)", substitute "expenditure".

15 Section 73BAD (note)

Omit "the incremental expenditure provisions", substitute "sections 73P to 73Z (inclusive) of this Act".

16 Subsection 73I(1)

After "73B", insert "(except subsection 73B(14C))".

17 Subsection 73I(1)

Omit "73Y", substitute "73QA".

Note: The heading to section 73I is altered by omitting " 73Y " and substituting " 73QA ".

18 Subsection 73I(3)

After "73B", insert "(except subsection 73B(14C))".

19 Subsection 73I(3)

Omit "73Y", substitute "73QA".

20 Subsection 73I(4)

After "73B", insert "(except subsection 73B(14C))".

21 Subsection 73I(4)

Omit "73Y", substitute "73QA".

22 Paragraph 73J(1)(a)

After "73B", insert "(except subsection 73B(14C))".

23 Paragraph 73J(1)(a)

Omit "73Y", substitute "73QA".

24 Subsection 73P(1)

Omit "73Q", substitute "73QA".

25 After subsection 73P(1)

Insert:

(1A) Subsection (1) of this section and subsection 73B(9) do not prevent a deduction under section 73QA or 73QB merely because those sections require account to be taken of expenditure incurred by an eligible company in relation to activities carried on wholly or primarily on behalf of a foreign company.

(1B) Subsection (1) of this section does not cause any of section 73CA to apply in relation to expenditure in respect of which deductions are available under both subsection 73B(14C) and section 73QB.

26 Subsection 73P(2)

Omit "73Q", substitute "73QA".

27 Subsection 73P(2) (definition of incremental expenditure )

Repeal the definition, substitute:

"incremental expenditure" means expenditure that:

(a) is research and development expenditure except:

(i) expenditure to lease or hire plant; and

(ii) expenditure under a contract to the extent that it is, in substance, for the acquisition of plant and not for the receipt of services; and

(b) can be taken into account in working out the amount of a deduction under subsection 73B(13) or (14) or could be taken into account in working out the amount of a deduction under subsection 73B(14) apart from paragraph 73B(14)(b).

Note: The effects of paragraph (b) of the definition of incremental expenditure include preventing a company from counting as incremental expenditure:

(a) expenditure that the company is required by subsection 73B(9) to disregard because it was incurred by the company for the purpose of carrying on research and development activities on behalf of another person; and

(b) expenditure on overseas research and development activities that is not certified expenditure and so is expenditure for which subsection 73B(17A) denies a deduction under subsection 73B(13) or (14).

28 Subsection 73P(2) (definition of premium amount )

Repeal the definition.

29 Subsection 73P(2) (definition of R&D spend )

Repeal the definition, substitute:

"R&D spend" of an eligible company and its group members for a year of income means the sum of:

(a) the amounts worked out for the year of income under steps 1, 2 and 3 of the method statement in subsection 73RA(1) as the reduced expenditure on Australian owned R&D by each eligible company in its group membership period for the year of income; and

(b) the amounts worked out for the year of income under steps 4, 5 and 6 of the method statement in subsection 73RB(1) as the reduced notional expenditure on foreign owned R&D by each eligible company in its group membership period for the year of income.

30 Subsection 73P(2) (definition of RA 0 )

Repeal the definition.

31 Subsection 73P(2) (definition of RA - 1 )

Repeal the definition, substitute:

"RA" - 1 (short for Running Average for the Y - 1 year of income) means half the sum of the R&D spend of the eligible company and its group members for the Y - 2 and Y - 3 years of income.

32 Subsection 73P(2) (definition of running average )

Repeal the definition.

33 Subsection 73P(6)

Omit "73Q, 73R, 73S, 73T, 73U, 73V, 73W, 73X and 73Y", substitute "73QA, 73QB, 73R, 73RA, 73RB, 73T and 73V".

34 Section 73Q

Repeal the section, substitute:

73QA Extra deduction for increase in expenditure on Australian owned research and development

Prerequisites for deduction

(1) An eligible company may deduct an amount for the Y 0 year of income if:

(a) the company can deduct an amount for that year under subsection 73B(13) or (14) for incremental expenditure incurred in the company's group membership period; and

(b) for each of the Y - 1 , Y - 2 and Y - 3 years of income, any of the following conditions is met:

(i) the eligible company could deduct for the year of income an amount under subsection 73B(13) or (14) for expenditure incurred in its group membership period;

(ii) one of the eligible company's other group members could deduct for the year of income an amount under subsection 73B(13) or (14) for expenditure incurred in its group membership period;

(iii) the eligible company received a start grant or commercial ready grant in respect of the year of income;

(iv) one of the eligible company's other group members received a start grant or commercial ready grant in respect of the year of income;

(whether or not the same condition is met for 2 or more of those years, and whether or not a condition is met by the same company for 2 or more of those years); and

(c) the amount (the eligible company's share of the Australian owned part of the adjusted increase in expenditure on R&D by the group ) worked out under subsection (3) is more than zero.

Amount of deduction

(2) The amount of the eligible company's deduction for the Y 0 year of income is 50% of the eligible company's share of the Australian owned part of the adjusted increase in expenditure on R&D by the group.

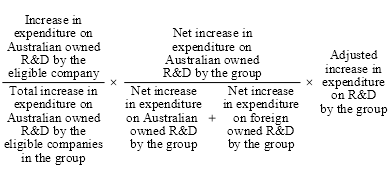

(3) The eligible company's share of the Australian owned part of the adjusted increase in expenditure on R&D by the group is the amount worked out using the formula:

where:

"adjusted increase in expenditure on R&D by the group" means the amount worked out under section 73RE.

"increase in expenditure on Australian owned R&D by the eligible company" means the amount worked out under subsection 73RA(1).

"net increase in expenditure on Australian owned R&D by the group" means the amount worked out under section 73RC.

"net increase in expenditure on foreign owned R&D by the group" means the amount worked out under section 73RD.

"total increase in expenditure on Australian owned R&D by the eligible companies in the group" means the amount worked out under subsection 73RA(2).

Note: The amount worked out using the formula will not be more than zero if at least one of the following is zero:

(a) the increase in expenditure on Australian owned R&D by the eligible company;

(b) the net increase in expenditure on Australian owned R&D by the group;

(c) the adjusted increase in expenditure on R&D by the group.

Solitary company may be able to deduct under subsection (1)

(4) To avoid doubt, an eligible company for which there are no other group members may be able to deduct an amount under subsection (1).

Note: For an eligible company for which there are no other group members, the values of the following components of the formula in subsection (3) will all be the same:

(a) the increase in expenditure on Australian owned R&D by the eligible company;

(b) the total increase in expenditure on Australian owned R&D by the eligible companies in the group;

(c) the net increase in expenditure on Australian owned R&D by the group.

73QB Extra deduction for increase in expenditure on foreign owned research and development

Prerequisites for deduction

(1) An eligible company may deduct an amount for the Y 0 year of income if:

(a) the company can deduct an amount for that year under subsection 73B(14C) for expenditure incurred in the company's group membership period; and

(b) for each of the Y - 1 , Y - 2 and Y - 3 years of income, any of the following conditions is met:

(i) the eligible company could deduct for the year of income an amount under subsection 73B(14C) for expenditure in its group membership period;

(ii) one of the eligible company's other group members could deduct for the year of income an amount under subsection 73B(14C) for expenditure in its group membership period;

(iii) the year of income is one (a nil expenditure year ) for which both the conditions in subsection (2) are met;

(whether or not the same condition in this paragraph is met for 2 or more of those years, and whether or not such a condition is met by the same company for 2 or more of those years); and

(c) the amount (the eligible company's share of the foreign owned part of the adjusted increase in expenditure on R&D by the group ) worked out under subsection (4) is more than zero.

(2) For the purposes of subparagraph (1)(b)(iii), the conditions for a nil expenditure year are as follows:

(a) neither the eligible company nor any other group member (determined under section 73R) of the eligible company existed at any time in the nil expenditure year or the 10 immediately preceding years of income;

(b) at no time in the nil expenditure year or the 10 immediately preceding years of income did any of the following carry on business in Australia:

(i) a foreign company that was grouped under section 73L with the eligible company at any time in the Y 0 , Y - 1 , Y - 2 or Y - 3 year of income;

(ii) a foreign company that was grouped under section 73L with another group member (under section 73R) of the eligible company at any time during the other group member's group membership period (under section 73R);

(iii) a person who was grouped under section 73L with a foreign company described in subparagraph (i) or (ii) at any time in the nil expenditure year or the 10 immediately preceding years of income.

Note: Section 73R provides for:

(a) primary group members to be determined on the basis of the relationship between companies at the end of the Y 0 year of income; and

(b) secondary group members to be determined on the basis of the relationship between a company and a primary group member during the primary group member's group membership period (which ends at the end of the Y 0 year of income and starts at or after the start of the Y - 3 year of income).

Amount of deduction

(3) The eligible company may deduct an amount for the Y 0 year of income equal to 75% of the eligible company's share of the foreign owned part of the adjusted increase in expenditure on R&D by the group.

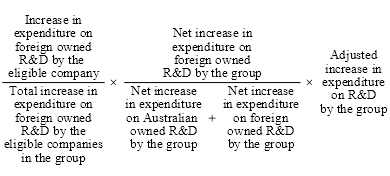

(4) The eligible company's share of the foreign owned part of the adjusted increase in expenditure on R&D by the group is the amount worked out using the formula:

where:

"adjusted increase in expenditure on R&D by the group" means the amount worked out under section 73RE.

"increase in expenditure on foreign owned R&D by the eligible company" means the amount worked out under subsection 73RB(1).

"net increase in expenditure on Australian owned R&D by the group" means the amount worked out under section 73RC.

"net increase in expenditure on foreign owned R&D by the group" means the amount worked out under section 73RD.

"total increase in expenditure on foreign owned R&D by the eligible companies in the group" means the amount worked out under subsection 73RB(2).

Note: The amount worked out using the formula will not be more than zero if at least one of the following is zero:

(a) the increase in expenditure on foreign owned R&D by the eligible company;

(b) the net increase in expenditure on foreign owned R&D by the group;

(c) the adjusted increase in expenditure on R&D by the group.

Solitary company may be able to deduct under subsection (1)

(5) To avoid doubt, an eligible company for which there are no other group members may be able to deduct an amount under subsection (1).

Note: For an eligible company for which there are no other group members, the values of the following components of the formula in subsection (4) will all be the same:

(a) the increase in expenditure on foreign owned R&D by the eligible company;

(b) the total increase in expenditure on foreign owned R&D by the eligible companies in the group;

(c) the net increase in expenditure on foreign owned R&D by the group.

35 Subsection 73R(1) (first sentence)

Repeal the sentence, substitute:

This section sets out rules for determining which eligible companies that have deducted or can deduct an amount under subsection 73B(13), (14) or (14C), or that received a start grant or commercial ready grant, are group members.

36 Paragraph 73R(5)(c)

Repeal the paragraph, substitute:

(c) the person or persons that disposed of control of the company provide written details of the following needed to enable the making of calculations required by sections 73QA, 73QB, 73RA, 73RB, 73RC, 73RD, 73RE, 73T and 73V:

(i) expenditure incurred by the company during the period (its history period ) it was a group member of its former group;

(ii) receipts of grants and recoupments relating to that expenditure;

(iii) entitlements to receive grants and recoupments relating to that expenditure.

37 After section 73R

Insert:

73RA Increases in expenditure on Australian owned R&D by eligible companies

(1) For the purposes of section 73QA, work out the increase in expenditure on Australian owned R&D by the eligible company as follows:

Method statement

Step 1. For each of the Y 0 , Y - 1 , Y - 2 and Y - 3 years of income, work out the eligible company's incremental expenditure incurred in its group membership period.

Step 2. For each of the Y 0 , Y - 1 , Y - 2 and Y - 3 years of income, work out how much (if any) of the initial clawback amount (if any) under section 73C relating to expenditure incurred by the eligible company is attributable to incremental expenditure incurred in the eligible company's group membership period.

Step 3. For each of those years of income, reduce (but not below zero) the result of step 1 for the year of income by the result of step 2 for the year of income. The result is the reduced expenditure on Australian owned R&D by the eligible company in its group membership period for the year of income.

Step 4. Add up:

(a) the reduced expenditure on Australian owned R&D by the eligible company in its group membership period for the Y - 1 year of income; and

(b) the reduced expenditure on Australian owned R&D by the eligible company in its group membership period for the Y - 2 year of income; and

(c) the reduced expenditure on Australian owned R&D by the eligible company in its group membership period for the Y - 3 year of income.

Step 5. Divide the result of step 4 by 3.

Step 6. Subtract the result of step 5 from the reduced expenditure on Australian owned R&D by the eligible company in its group membership period for the Y 0 year of income (see step 3). The result is the change in expenditure on Australian owned R&D by the eligible company .

Note: The change in expenditure on Australian owned R&D by the eligible company may be a positive or negative number or zero.

Step 7. The increase in expenditure on Australian owned R&D by the eligible company is:

(a) the change in expenditure on Australian owned R&D by the eligible company; or

(b) zero, if the change in expenditure on Australian owned R&D by the eligible company is a negative number.

(2) For the purposes of section 73QA, work out the total increase in expenditure on Australian owned R&D by the eligible companies in the group as follows:

Method statement

Step 1. For each group member that is an eligible company, work out the increase in expenditure on Australian owned R&D by the eligible company under subsection (1) of this section.

Step 2. Total the results of step 1.

73RB Increases in expenditure on foreign owned R&D by eligible companies

(1) For the purposes of section 73QB, work out the increase in expenditure on foreign owned R&D by the eligible company as follows:

Method statement

Step 1. For the Y 0 year of income, work out the amount of the expenditure on foreign owned R&D by the eligible company for the year of income (see subsections 73B(14C) and (14D)) that was incurred by the company in its group membership period. The result is the expenditure on foreign owned R&D by the eligible company in its group membership period for the year of income.

Step 2. For the Y 0 year of income, work out how much (if any) of the initial clawback amount (if any) under section 73C relating to expenditure incurred by the eligible company is attributable to the expenditure on foreign owned R&D by the eligible company in its group membership period for the year of income.

Step 3. Reduce (but not below zero) the result of step 1 for the year of income by the result of step 2 for the year of income. The result is the reduced expenditure on foreign owned R&D by the eligible company in its group membership period for the Y 0 year of income.

Step 4. For each of the Y - 1 , Y - 2 and Y - 3 years of income, work out the amount (the notional expenditure on foreign owned R&D by the eligible company in its group membership period for the year of income) of expenditure that:

(a) was incurred by the company in its group membership period; and

(b) would have been expenditure on foreign owned R&D by the eligible company for the year of income (see subsections 73B(14C) and (14D)) if subsection 73B(2BA) had not been enacted.

Note 1: This requires counting of expenditure relating to all activities that would have been research and development activities had they been carried on in accordance with a plan described in subsection 73B(2BA) (whether or not they were carried on in that way).

Note 2: If all relevant activities were carried on in accordance with such a plan, and the eligible company's group membership period includes the whole of the year of income, the notional expenditure on foreign owned R&D by the eligible company in its group membership period for the year of income is the same as the expenditure on foreign owned R&D by the company for the year of income.

Step 5. For each of the Y - 1 , Y - 2 and Y - 3 years of income, work out what would have been the amount of the eligible company's initial clawback amount (if any) under section 73C attributable to the notional expenditure on foreign owned R&D by the eligible company in its group membership period for the year of income if subsection 73B(2BA) had not been enacted.

Note: This requires counting of grants and recoupments described in section 73C relating to expenditure on projects involving activities that would have been research and development activities had they been carried on in accordance with a plan described in subsection 73B(2BA) (whether or not they were carried on in that way).

Step 6. For each of the Y - 1 , Y - 2 and Y - 3 years of income, reduce (but not below zero) the result of step 4 for the year of income by the result of step 5 for the year of income. The result is the reduced notional expenditure on foreign owned R&D by the eligible company in its group membership period for the year of income.

Step 7. Add up:

(a) the reduced notional expenditure on foreign owned R&D by the eligible company in its group membership period for the Y - 1 year of income; and

(b) the reduced notional expenditure on foreign owned R&D by the eligible company in its group membership period for the Y - 2 year of income; and

(c) the reduced notional expenditure on foreign owned R&D by the eligible company in its group membership period for the Y - 3 year of income.

Step 8. Divide the result of step 7 by 3.

Step 9. Subtract the result of step 8 from the reduced expenditure on foreign owned R&D by the eligible company for the Y 0 year of income (see step 3). The result is the change in expenditure on foreign owned R&D by the eligible company .

Note: The change in expenditure on foreign owned R&D by the eligible company may be a positive or negative number or zero.

Step 10. The increase in expenditure on foreign owned R&D by the eligible company is:

(a) the change in expenditure on foreign owned R&D by the eligible company; or

(b) zero, if the change in expenditure on foreign owned R&D by the eligible company is a negative number.

(2) For the purposes of section 73QB, work out the total increase in expenditure on foreign owned R&D by the eligible companies in the group as follows:

Method statement

Step 1. For each group member that is an eligible company, work out the increase in expenditure on foreign owned R&D by the eligible company under subsection (1) of this section.

Step 2. Total the results of step 1.

73RC Net increase in expenditure on Australian owned R&D by the group

For the purposes of sections 73QA and 73QB, work out the net increase in expenditure on Australian owned R&D by the group as follows:

Method statement

Step 1. For each eligible company that was a group member, work out under steps 1 to 6 (inclusive) of the method statement in subsection 73RA(1) the change in expenditure on Australian owned R&D by the eligible company.

Step 2. Total the results of step 1. If the result is a negative number, the net increase in expenditure on Australian owned R&D by the group is zero instead.

73RD Net increase in expenditure on foreign owned R&D by the group

For the purposes of sections 73QA and 73QB, work out the net increase in expenditure on foreign owned R&D by the group as follows:

Method statement

Step 1. For each eligible company that was a group member, work out under steps 1 to 9 (inclusive) of the method statement in subsection 73RB(1) the change in expenditure on foreign owned R&D by the eligible company.

Step 2. Total the results of step 1. If the result is a negative number, the net increase in expenditure on foreign owned R&D by the group is zero instead.

73RE Adjusted increase in expenditure on R&D by the group

Work out the adjusted increase in expenditure on R&D by the group as follows:

Method statement

Step 1. For each eligible company that was a group member, work out under steps 1 to 6 (inclusive) of the method statement in subsection 73RA(1) the change in expenditure on Australian owned R&D by the eligible company.

Step 2. For each eligible company that was a group member, work out under steps 1 to 9 (inclusive) of the method statement in subsection 73RB(1) the change in expenditure on foreign owned R&D by the eligible company.

Step 3. Add up all the results of steps 1 and 2.

Note: If the sum is a negative number, the adjusted increase in expenditure on R&D by the group will be zero.

Step 4. Subtract the adjustment balance worked out under section 73V from the result of step 3. If the result is a negative number, the adjusted increase in expenditure on R&D by the group is zero instead.

38 Section 73S

Omit ", 73V or 73W", substitute "or 73V".

39 Paragraphs 73T(3)(a) and (4)(a)

Omit "was eligible to claim an additional deduction under section 73Y", substitute "could deduct an amount under section 73QA or 73QB".

40 Section 73U

Repeal the section.

41 Paragraph 73V(3)(a)

Omit "was eligible to claim an additional deduction under section 73Y", substitute "met the conditions either in paragraphs 73QA(1)(a) and (b) or in paragraphs 73QB(1)(a) and (b)".

42 Sections 73W, 73X and 73Y

Repeal the sections.

43 Paragraph 73Z(1)(b)

Omit "73Y", substitute "73QA or 73QB".

44 At the end of subsection 73Z(2)

Add "or the notional expenditure on foreign owned R&D by the eligible company in its group membership period for any year of income (see step 4 of the method statement in subsection 73RB(1))".

45 Paragraphs 82KZM(1)(c), 82KZMA(1)(a), 82KZME(1)(a) and 82KZMF(2)(a)

Omit "or 73Y", substitute ", 73QA, 73QB or former section 73Y".

46 Subsection 170(10A)

Omit "or 73Y", substitute ", 73QA or 73QB".

47 Subsection 245 - 140(1) in Schedule 2C (definition of table of deductible expenditure , table item 8, column 2)

Omit "and 73Y", substitute ", 73QA and 73QB".

48 Subsection 57 - 85(3) in Schedule 2D (table item 13, column 3)

Omit " and 73Y ", substitute " , 73QA and 73QB ".

Part 2 -- Amendment of the Industry Research and Development Act 1986

49 Subsections 39AA(1) and (2)

Omit "and 73Y", substitute ", 73QA and 73QB".

50 Subsection 39AA(2)

After "deduction, to", insert "encourage research and development activities in Australia and".

51 Section 39D

Repeal the section, substitute:

39D Research and development activities for the benefit of the Australian economy

(1) Australian research and development activities are taken to be for the benefit of the Australian economy.

(2) Overseas research and development activities are taken to be for the benefit of the Australian economy if the Board has given a provisional certificate in respect of the activities.

52 Subparagraph 39EB(3)(c)(ii)

Omit "73Y", substitute "73QA".

53 Subsection 39EC(1)

Omit "73Y", substitute "73QA".

54 Subparagraph 39EC(2)(d)(iii)

Omit "73Y", substitute "73QA".

55 Paragraphs 39EE(1)(c) and (2)(b) and 39EF(2)(b)

Omit "73Y", substitute "73QA".

56 At the end of subsection 39F(1)

Add "or foreign companies".

57 Subsection 39HG(1)

Omit "its".

58 Paragraph 39HG(2)(c)

Omit "its", substitute "the".

59 At the end of subsection 39HG(2)

Add:

; and (g) specify each company on behalf of which the activities will be undertaken.

Note: A company on behalf of which the activities will be undertaken may be the applicant or a foreign company with which the applicant is grouped under section 73L of the Income Tax Assessment Act 1936 .

60 Paragraph 39HH(1)(b)

Omit "its proposed research and development activities", substitute "the research and development activities proposed in the application".

61 Section 39HH (note)

Omit "or 73Y", substitute ", 73QA or 73QB".

62 Paragraph 39J(1)(a)

Repeal the paragraph, substitute:

(a) an eligible company applies to the Board for registration in relation to activities of either or both of the following kinds in respect of a year of income:

(i) the eligible company's research and development activities;

(ii) activities described in paragraph 73B(14C)(g) of the Income Tax Assessment Act 1936 in relation to the eligible company; and

63 Paragraph 39J(1)(b)

Omit "its research and development activities", substitute "the activities covered by the application".

64 Subsection 39J(1A)

Omit "the company's research and development".

65 Paragraph 39JD(1)(b)

Omit "research and development".

66 Paragraph 39JD(1)(ba)

Omit "carrying on the activities, maintained records that substantiate the company's carrying on of the activities", substitute "the activities were carried on, maintained records that substantiate the carrying on of the activities".

67 After paragraph 39JD(1)(ba)

Insert:

(bb) specify each company on behalf of which each of the activities was undertaken; and

68 Subsection 39JD(1) (note)

Omit "Note", substitute "Note 1".

69 At the end of subsection 39JD(1)

Add:

Note 2: A company on behalf of which an activity was undertaken might be the eligible company applying for registration or a foreign company with which the applicant is grouped under section 73L of the Income Tax Assessment Act 1936 .

70 After subsection 39K(1A)

Insert:

(1B) The Board is entitled to refuse to register an eligible company, in relation to activities described in paragraph 73B(14C)(g) of the Income Tax Assessment Act 1936 in relation to the company in respect of a year of income, on the ground that the activities are not activities that would be Australian - centred research and development activities if subsection 73B(2BA) of that Act had not been enacted.

71 At the end of section 39L

Add:

(3) If the activities were or are carried on on behalf of a foreign company grouped under section 73L of the Income Tax Assessment Act 1936 with an eligible company that was or is incurring expenditure in relation to the carrying on of the activities, the Board must give a copy of the notice to the eligible company.

72 After section 39L

Insert:

39LAAA Certificate as to Australian - centred research and development activities

(1) The Board may give to the Commissioner a certificate stating whether particular activities were Australian - centred research and development activities.

(2) The Board must give to the Commissioner a certificate described in subsection (1) if the Commissioner gives the Board a written request to do so.

(3) If:

(a) the activities covered by a certificate given under this section were or are carried on on behalf of a foreign company grouped under section 73L of the Income Tax Assessment Act 1936 with an eligible company that incurred expenditure in relation to the carrying on of the activities; and

(b) the certificate states that the activities were not Australian - centred research and development activities;

the Board must give notice in writing to the eligible company, stating the reasons for giving the certificate.

(1) The Board may give to the Commissioner a certificate stating whether particular activities were activities that would have been Australian - centred research and development activities if subsection 73B(2BA) of the Income Tax Assessment Act 1936 had not been enacted.

Note 1: Subsection 73B(2BA) of the Income Tax Assessment Act 1936 says activities are not research and development activities unless they are carried on in accordance with a plan that complies with any guidelines formulated by the Board under section 39KA of this Act that are in force at the time.

Note 2: Activities may be ones that would have been Australian - centred research and development activities if subsection 73B(2BA) of the Income Tax Assessment Act 1936 had not been enacted, whether or not the activities were carried on in accordance with such a plan.

(2) The Board must give to the Commissioner a certificate described in subsection (1) if the Commissioner gives the Board a written request to do so.

(3) If:

(a) the activities covered by a certificate given under this section were or are carried on on behalf of a foreign company grouped under section 73L of the Income Tax Assessment Act 1936 with an eligible company that incurred expenditure in relation to the carrying on of the activities; and

(b) the certificate states that the activities were activities that would have been Australian - centred research and development activities if subsection 73B(2BA) of the Income Tax Assessment Act 1936 had not been enacted;

the Board must give notice in writing to the eligible company, stating the reasons for giving the certificate.

73 Subparagraph 39M(1)(b)(i)

Repeal the subparagraph, substitute:

(i) any of the results of those research and development activities have been exploited otherwise than on normal commercial terms; or

(ia) those research and development activities are not for the benefit of the Australian economy; or

74 Paragraph 39N(1)(a)

Omit "registered".

75 Paragraph 39N(1)(a)

After "on behalf of the company,", insert "or activities in relation to which the company incurred expenditure,".

76 At the end of section 39N

Add:

(4) To avoid doubt, a notice under subsection (1) has effect whether the particular information that is the subject of the notice and the Board's request is identified in the notice or request wholly or partly:

(a) by reference to the functions to be performed or the powers to be exercised; or

(b) by another means.

77 Subsection 39S(1)

After "39L,", insert "39LAAA, 39LAAB,".

Part 3 -- Application and transitional provisions

78 Application

(1) The amendments made by this Schedule apply in relation to:

(a) assessments for years of income starting after 30 June 2007; and

(b) registrations under section 39J of the Industry Research and Development Act 1986 for those years of income.

(2) A term that is used in this item and has a meaning given by the Income Tax Assessment Act 1936 has the same meaning in this item.

79 Transitional provisions--deductions under former section 73Y of the Income Tax Assessment Act 1936

(1) This item modifies paragraphs 73T(3)(a) and (4)(a) and 73V(3)(a) of the Income Tax Assessment Act 1936 as amended by this Schedule for the Y 0 year of income that is the first year of income starting after 30 June 2007.

(2) Those paragraphs have effect for that year of income as if an eligible company or one of its group members could deduct an amount under section 73QA for the Y - 1 year of income if the company or group member had been eligible to claim an additional deduction under section 73Y of that Act (as in force before the commencement of this Schedule) for that Y - 1 year of income.

(3) A term that is used in this item and had a meaning given by any of sections 73P to 73Z of the Income Tax Assessment Act 1936 immediately before the commencement of this Schedule has the same meaning in this item.

80 Transitional provisions--reduced notional expenditure on foreign owned R&D

(1) This item has effect for the purposes of the application of sections 73P to 73Z (inclusive) of the Income Tax Assessment Act 1936 as amended by this Schedule, if:

(a) in its group membership period including all or part of the year of income (the initial year ) starting after 30 June 2007 and before 1 July 2008, an eligible company has incurred an amount of expenditure that is expenditure on foreign owned R&D by the eligible company in its group membership period for the year of income; and

(b) any of the 3 immediately preceding years of income were not nil expenditure years.

(2) For the purposes of paragraph 73QB(1)(b) of the Income Tax Assessment Act 1936 , the eligible company is taken to have been able to deduct an amount under subsection 73B(14C) of that Act for each of the following years of income:

(a) the year of income before the initial year;

(b) the year of income 2 years before the initial year;

(c) the year of income 3 years before the initial year.

(3) The reduced notional expenditure on foreign owned R&D by the eligible company in its group membership period for an earlier year of income described in the second column of an item of the table is taken to be the amount set out in the third column of that item.

Reduced notional expenditure on foreign owned R&D | ||

Item | Earlier year of income | Amount of reduced notional expenditure on foreign owned R&D |

1 | The year of income before the initial year | 90% of the amount described in paragraph (1)(a) |

2 | The year of income 2 years before the initial year | 80% of the amount described in paragraph (1)(a) |

3 | The year of income 3 years before the initial year | 70% of the amount described in paragraph (1)(a) |

(4) To avoid doubt, this item has effect for the purposes of the application of sections 73P to 73Z (inclusive) of the Income Tax Assessment Act 1936 as amended by this Schedule not only for the initial year but also for the next 2 years of income.

Note: This item will be relevant only to years of income assessments for which can be affected by the amount of reduced notional expenditure on foreign owned R&D for years of income before the initial year.

(5) A term that is used in this item and has a meaning given by section 73B, or any of sections 73P to 73Z (inclusive), of the Income Tax Assessment Act 1936 as amended by this Schedule has the same meaning in this item.