Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPetroleum Resource Rent Tax Assessment Act 1987

1 Section 2

Insert:

"accounts" includes:

(a) ledgers; and

(b) journals; and

(c) statements of financial performance; and

(d) profit and loss accounts; and

(e) balance - sheets; and

(f) statements of financial position;

and also includes statements, reports and notes attached to, or intended to be read with, anything covered by any of the above paragraphs.

2 Section 2

Insert:

"applicable foreign currency" has the meaning given by section 58C.

3 Section 2

Insert:

"basic company group" has the meaning given by section 2B.

4 Section 2

Insert:

"designated company group" has the meaning given by section 2BA.

5 Section 2

Insert:

"excess closing-down expenditure" has the meaning given by paragraph 46(1)(a).

6 Section 2

Insert:

"foreign currency" means a currency other than Australian currency.

7 Section 2

Insert:

"group company" has the meaning given by section 2B.

8 Section 2

Insert:

"head company" of a designated company group has the meaning given by section 2BA.

9 Section 2

Insert:

"overall company group" has the meaning given by section 2B.

10 Section 2

Insert:

"subsidiary" has the meaning given by section 2B.

11 Subsection 2B(1)

Before "during so much", insert "at all times".

Note 1: The heading to section 2B is altered by adding at the end " , subsidiaries, basic company groups and overall company groups ".

Note 2: The following heading to subsection 2B(1) is inserted " Group company--period ".

12 After subsection 2B(1)

Insert:

Group company--time

(1A) For the purposes of this Act, a company is a group company in relation to another company at a particular time if, at that time:

(a) one of the companies was a subsidiary of the other company; or

(b) each of the companies was a subsidiary of the same company.

13 Subsection 2B(2)

Repeal the subsection, substitute:

Subsidiary

(2) For the purposes of this Act, a company (in this subsection called the subsidiary company ) is a subsidiary of another company (in this subsection called the holding company ) at a particular time if, at that time:

(a) all the shares in the subsidiary company are beneficially owned by:

(i) the holding company; or

(ii) a company that is, or 2 or more companies each of which is, a subsidiary of the holding company; or

(iii) the holding company and a company that is, or 2 or more companies each of which is, a subsidiary of the holding company; and

(b) there is no agreement, arrangement or understanding in force under which any person is able, or would be able after that time, to affect rights of the holding company or of a subsidiary of the holding company in relation to the subsidiary company.

14 Subsection 2B(3)

Omit "this section", substitute "this Act".

15 After subsection 2B(4)

Insert:

Basic company group

(4A) For the purposes of this Act, a basic company group is a group of companies, where each company in the group is a group company in relation to each other company in the group.

Overall company group

(4B) For the purposes of this Act, an overall company group is a basic company group that is not a subset of any other basic company group.

Note: The following heading to subsection 2B(5) is inserted " When company in existence ".

16 After section 2B

Insert:

(1) This section sets out the method for identifying a designated company group for the purposes of this Act.

(2) First, identify a particular overall company group.

(3) Second, identify all of the members of the overall company group that are entitled to derive assessable receipts in relation to a petroleum project (whether or not the same petroleum project). These members constitute a provisional designated company group .

(4) Third, if the following conditions are satisfied in relation to a company (the key company ):

(a) the key company is a member of the provisional designated company group;

(b) the key company is not a subsidiary of any other company in the provisional designated company group;

(c) each other company in the provisional designated company group is a subsidiary of the key company;

then:

(d) the provisional designated company group is a designated company group ; and

(e) the key company is the head company of that designated company group.

(5) Fourth, if:

(a) subsection (4) does not apply; and

(b) each company in the provisional designated company group is a subsidiary of another company (the key company ) that:

(i) is a member of the overall company group; and

(ii) is not a member of the provisional designated company group;

then:

(c) both:

(i) the key company; and

(ii) the members of the provisional designated company group;

constitute a designated company group ; and

(d) the key company is the head company of that designated company group.

(6) Subsection (5) has effect subject to subsection (7).

(7) If:

(a) a designated company group is covered by subsection (5); and

(b) the head company of the designated company group is a subsidiary of another company (the higher - tier company ); and

(c) the higher - tier company is a member of the overall company group; and

(d) the higher - tier company is not a member of the provisional designated company group;

there is taken not to be a designated company group of which:

(e) the higher - tier company is the head company; and

(f) any member of the provisional designated company group is a member.

17 Section 10

Repeal the section, substitute:

10 Translation of amounts into Australian currency

(1) For the purposes of this Act, an amount in a foreign currency is to be translated into Australian currency.

Examples of an amount

(2) The following are examples of an amount:

(a) an amount of an expense;

(b) an amount of an obligation;

(c) an amount of a liability;

(d) an amount of a receipt;

(e) an amount of a payment;

(f) an amount of consideration;

(g) a value.

Translation rule--assessable receipt

(3) If:

(a) a person derives an assessable receipt in relation to a petroleum project; and

(b) the receipt is in a foreign currency;

the receipt is to be translated into Australian currency at the exchange rate applicable at the time when the receipt is derived.

Translation rule--deductible expenditure

(4) If:

(a) a person incurs deductible expenditure in relation to a petroleum project; and

(b) the expenditure is in a foreign currency;

the expenditure is to be translated into Australian currency at the exchange rate applicable at the time when the expenditure is incurred.

Translation rule--transfer of entire entitlement to assessable receipts

(5) If:

(a) section 48 applies in relation to a transaction; and

(b) a person is a purchaser (within the meaning of section 48) in relation to the transaction; and

(c) the person is taken, under section 48, to have derived or incurred an amount; and

(d) the vendor (within the meaning of section 48) in relation to the transaction has made an election under section 58B (functional currency); and

(e) the election is in effect for the year of tax in which the transfer time (within the meaning of section 48) occurred; and

(f) the amount is in the vendor's applicable functional currency;

the amount is to be translated from the applicable functional currency into Australian currency at the exchange rate applicable at the transfer time (within the meaning of section 48).

Translation rule--transfer of part of entitlement to assessable receipts

(6) If:

(a) section 48A applies in relation to a transaction; and

(b) a person is a purchaser (within the meaning of section 48A) in relation to the transaction; and

(c) the person is taken, under section 48A, to have derived or incurred an amount; and

(d) the vendor (within the meaning of section 48A) in relation to the transaction has made an election under section 58B (functional currency); and

(e) the election is in effect for the year of tax in which the transfer time (within the meaning of section 48A) occurred; and

(f) the amount is in the vendor's applicable functional currency;

the amount is to be translated from the applicable functional currency into Australian currency at the exchange rate applicable at the transfer time (within the meaning of section 48A).

Operation of functional currency provisions unaffected

(7) This section does not affect the operation of Division 7 of Part V (functional currency).

18 Subsection 46(1)

Repeal the subsection, substitute:

(1) If, in relation to a petroleum project, the sum of any closing - down expenditure and any other deductible expenditure incurred by a person in a year of tax exceeds the assessable receipts derived by the person in the year of tax:

(a) so much of the excess as does not exceed the amount of the closing - down expenditure is the person's excess closing - down expenditure for the year of tax; and

(b) the person is entitled to a credit of the lesser of the following amounts:

(i) an amount equal to 40% of the excess closing - down expenditure for the year of tax;

(ii) the total amount of any tax in respect of the project (including in the case of a combined project any pre - combination project in relation to the project) paid or payable by the person in relation to previous years of tax, reduced by the total amount of any credits allowed or allowable to the person under this section in relation to the project in relation to any previous years of tax.

19 At the end of Part V

Add:

Division 7 -- Functional currency

The objects of this Division are:

(a) to allow a person whose accounts are kept solely or predominantly in a particular foreign currency (the functional currency ) to calculate:

(i) the person's taxable profits; and

(ii) certain other amounts;

by reference to the functional currency; and

(b) to allow companies that:

(i) are in a designated company group; and

(ii) whose accounts are kept solely or predominantly in a particular foreign currency (the functional currency );

to calculate:

(iii) their taxable profits; and

(iv) certain other amounts;

by reference to the functional currency.

58B Person may elect to be bound by the functional currency rules

(1) A person may elect to be bound by the functional currency rules for the purposes of this Act, with effect from the start of:

(a) if the election was made by the person within 30 days after the day on which the Tax Laws Amendment (2009 Measures No. 3) Act 2009 received the Royal Assent--the year of tax beginning on 1 July 2009; or

(b) in any other case--the year of tax following the one in which the person made the election.

(2) An election under subsection (1) must be in writing.

(3) An election under subsection (1) continues in effect until a withdrawal of the election takes effect (see section 58L).

Designated company group--deemed election etc.

(4) If:

(a) a person has made an election under subsection (1); and

(b) at the time when the person made the election, the person was the head company of a designated company group; and

(c) the election is in effect for a year of tax; and

(d) when the election took effect, the person was the head company of a designated company group; and

(e) immediately before the end of the year of tax, the person is the head company of a designated company group (the current designated company group );

then:

(f) each other company that was in the current designated company group immediately before the end of the year of tax is taken to have made an election under subsection (1); and

(g) an election covered by paragraph (f):

(i) is taken to have been in effect for the year of tax; and

(ii) supersedes any previous election made by the other company that was in effect for the year of tax.

(5) If:

(a) a person has made an election under subsection (1); and

(b) at the time when the person made the election, the person was the head company of a designated company group; and

(c) the election is in effect for a year of tax; and

(d) during the year of tax, the person ceased to be the head company of the designated company group; and

(e) immediately before the end of the year of tax, another company is the head company of the designated company group;

then:

(f) the company covered by paragraph (e) is taken to have made an election under subsection (1); and

(g) an election covered by paragraph (f):

(i) is taken to have been in effect for the year of tax; and

(ii) supersedes any previous election made by the company that was in effect for the year of tax; and

(h) each other company that was in the designated company group immediately before the end of the year of tax is taken to have made an election under subsection (1); and

(i) an election covered by paragraph (h):

(i) is taken to have been in effect for the year of tax; and

(ii) supersedes any previous election made by the other company that was in effect for the year of tax.

(6) If:

(a) immediately before the end of a year of tax, a person is the head company of a designated company group; and

(b) the person is not taken, under subsection (5), to have made an election under subsection (1) that is in effect for the year of tax; and

(c) the person has not made an election under subsection (1) that:

(i) is in effect for the year of tax; and

(ii) under subsection (4), results in each other company that was in the designated company group immediately before the end of the year of tax being taken to have made an election under subsection (1); and

(d) a company that was in the designated company group immediately before the end of the year of tax has made an election under subsection (1); and

(e) the election covered by paragraph (d) is in effect for the year of tax;

the company covered by paragraph (d) is taken to have withdrawn the election covered by paragraph (d) with effect from the start of the year of tax.

58C Applicable foreign currency

(1) For the purposes of this Act, if:

(a) a person has made an election under section 58B (other than an election taken to have been made as a result of the application of subsection 58B(4) or paragraph 58B(5)(h) to a designated company group); and

(b) the election is in effect for a year of tax;

the person's applicable functional currency for the year of tax is the sole or predominant foreign currency in which:

(c) if the person is the head company of a designated company group--the person kept the person's accounts immediately before the end of the year of tax; or

(d) otherwise--the person kept the person's accounts at the time when the person made the election.

Designated company group

(2) For the purposes of this Act, if:

(a) a person is taken to have made an election under section 58B as a result of the application of subsection 58B(4) or paragraph 58B(5)(h) to a designated company group; and

(b) the election is in effect for a year of tax;

the person's applicable functional currency for the year of tax is the sole or predominant currency in which the head company of the designated company group kept its accounts immediately before the end of the year of tax.

(1) If:

(a) a person has made an election under section 58B; and

(b) that election is in effect for a year of tax;

the following rules apply:

(c) first, for the purpose of working out the taxable profit of the person of the year of tax in relation to a petroleum project:

(i) an amount that is not in the applicable functional currency is to be translated into the applicable functional currency; and

(ii) the definition of foreign currency in section 2 does not apply; and

(iii) the applicable functional currency is taken not to be a foreign currency; and

(iv) Australian currency and any other currency (except the applicable functional currency) are taken to be foreign currencies;

(d) second, the taxable profit of the person of the year of tax in relation to the petroleum project is to be translated into Australian currency;

(e) third, for the purpose of working out a credit to which the person is entitled under section 46 in relation to the year of tax, an amount of excess closing - down expenditure is to be translated into Australian currency.

Examples of an amount

(2) The following are examples of an amount:

(a) an amount of an expense;

(b) an amount of an obligation;

(c) an amount of a liability;

(d) an amount of a receipt;

(e) an amount of a payment;

(f) an amount of consideration;

(g) a value.

58E Translation rule--assessable receipt

If:

(a) a person derives an assessable receipt in relation to a petroleum project; and

(b) the receipt is not in the applicable functional currency; and

(c) the receipt was derived when an election made by the person under section 58B was in effect;

the receipt is to be translated into the applicable functional currency at the exchange rate applicable at the time when the receipt was derived.

58F Translation rule--deductible expenditure

If:

(a) a person incurs deductible expenditure in relation to a petroleum project; and

(b) the expenditure is not in the applicable functional currency; and

(c) the expenditure was incurred when an election made by the person under section 58B was in effect;

the expenditure is to be translated into the applicable functional currency at the exchange rate applicable at the time the expenditure was incurred.

58G Translation rule--transfer of entire entitlement to assessable receipts

If:

(a) section 48 applies in relation to a transaction; and

(b) a person is a purchaser (within the meaning of section 48) in relation to the transaction; and

(c) the person is taken, under section 48, to have derived or incurred an amount; and

(d) the transfer time (within the meaning of section 48) occurred when an election made by the person under section 58B was in effect; and

(e) the amount is not in the applicable functional currency;

the amount is to be translated into the applicable functional currency at the exchange rate applicable at the transfer time (within the meaning of section 48).

58H Translation rule--transfer of part of entitlement to assessable receipts

If:

(a) section 48A applies in relation to a transaction; and

(b) a person is a purchaser (within the meaning of section 48A) in relation to the transaction; and

(c) the person is taken, under section 48A, to have derived or incurred an amount; and

(d) the transfer time (within the meaning of section 48A) occurred when an election made by the person under section 58B was in effect; and

(e) the amount is not in the applicable functional currency;

the amount is to be translated into the applicable functional currency at the exchange rate applicable at the transfer time (within the meaning of section 48A).

58J Translation of taxable profit, or excess closing - down expenditure, into Australian currency

(1) If:

(a) paragraph 58D(1)(d) requires the translation of the taxable profit of a person of a year of tax in relation to a petroleum project; or

(b) paragraph 58D(1)(e) requires the translation of an amount of excess closing - down expenditure for the purpose of working out a credit to which a person is entitled under section 46 in relation to a year of tax;

that taxable profit or excess closing - down expenditure, as the case may be, is to be translated using:

(c) if the person elects to use an exchange rate that is an average of all the exchange rates during the year of tax--that exchange rate; or

(d) if the person elects to use the exchange rate applicable on the last day of the year of tax--that exchange rate.

(2) An election under paragraph (1)(c) or (d):

(a) must be in writing; and

(b) is irrevocable.

Default election

(3) If:

(a) either:

(i) paragraph 58D(1)(d) requires the translation of the taxable profit of a person of a year of tax in relation to a petroleum project; or

(ii) paragraph 58D(1)(e) requires the translation of an amount of excess closing - down expenditure for the purpose of working out a credit to which a person is entitled under section 46 in relation to a year of tax; and

(b) the person does not make an election under paragraph (1)(c) or (d) of this section in relation to the year of tax;

the person is taken to have made an election under paragraph (1)(c) of this section in relation to the year of tax.

Continuity of election

(4) If:

(a) a person has made an election under section 58B; and

(b) that election is in effect for 2 or more consecutive years of tax; and

(c) the person made an election under paragraph (1)(c) of this section in relation to the first of those years of tax;

the person is taken to have made an election under paragraph (1)(c) of this section in relation to each remaining year of tax.

(5) If:

(a) a person has made an election under section 58B; and

(b) that election is in effect for 2 or more consecutive years of tax; and

(c) the person made an election under paragraph (1)(d) of this section in relation to the first of those years of tax;

the person is taken to have made an election under paragraph (1)(d) of this section in relation to each remaining year of tax.

Designated company group--deemed election under paragraph (1)(c) etc.

(6) If:

(a) a person has made an election under paragraph (1)(c) in relation to a year of tax; and

(b) at the time when the person made the election, the person was the head company of a designated company group; and

(c) immediately before the end of the year of tax, the person is the head company of a designated company group (the current designated company group );

then:

(d) each other company that was in the current designated company group immediately before the end of the year of tax is taken to have made an election under paragraph (1)(c) in relation to the year of tax; and

(e) an election covered by paragraph (d):

(i) is taken to have been in effect for the year of tax; and

(ii) supersedes any previous election made by the other company that was in effect for the year of tax.

(7) If:

(a) a person has made an election under paragraph (1)(c); and

(b) at the time when the person made the election, the person was the head company of a designated company group; and

(c) the election is in effect for a year of tax; and

(d) during the year of tax, the person ceased to be the head company of the designated company group; and

(e) immediately before the end of the year of tax, another company is the head company of the designated company group;

then:

(f) the company covered by paragraph (e) of this subsection is taken to have made an election under paragraph (1)(c); and

(g) an election covered by paragraph (f) of this subsection:

(i) is taken to have been in effect for the year of tax; and

(ii) supersedes any previous election made by the company that was in effect for the year of tax; and

(h) each other company that was in the designated company group immediately before the end of the year of tax is taken to have made an election under paragraph (1)(c); and

(i) an election covered by paragraph (h) of this subsection:

(i) is taken to have been in effect for the year of tax; and

(ii) supersedes any previous election made by the other company that was in effect for the year of tax.

(8) If:

(a) immediately before the end of a year of tax, a person is the head company of a designated company group; and

(b) the person is not taken, under subsection (7), to have made an election under paragraph (1)(c) that is in effect for the year of tax; and

(c) the person has not made an election under paragraph (1)(c) that:

(i) relates to the year of tax; and

(ii) under subsection (6), results in each other company that was in the designated company group immediately before the end of the year of tax being taken to have made an election under paragraph (1)(c); and

(d) a company that was in the designated company group immediately before the end of the year of tax has made an election under paragraph (1)(c) in relation to the year of tax;

the election covered by paragraph (c) of this subsection is taken not to have been in effect for the year of tax.

Designated company group--deemed election under paragraph (1)(d) etc.

(9) If:

(a) a person has made an election under paragraph (1)(d) in relation to a year of tax; and

(b) at the time when the person made the election, the person was the head company of a designated company group; and

(c) immediately before the end of the year of tax, the person is the head company of a designated company group (the current designated company group );

then:

(d) each other company that was in the current designated company group immediately before the end of the year of tax is taken to have made an election under paragraph (1)(d) in relation to the year of tax; and

(e) an election covered by paragraph (d):

(i) is taken to have been in effect for the year of tax; and

(ii) supersedes any previous election made by the other company that was in effect for the year of tax.

(10) If:

(a) a person has made an election under paragraph (1)(d); and

(b) at the time when the person made the election, the person was the head company of a designated company group; and

(c) the election is in effect for a year of tax; and

(d) during the year of tax, the person ceased to be the head company of the designated company group; and

(e) immediately before the end of the year of tax, another company is the head company of the designated company group;

then:

(f) the company covered by paragraph (e) of this subsection is taken to have made an election under paragraph (1)(d); and

(g) an election covered by paragraph (f) of this subsection:

(i) is taken to have been in effect for the year of tax; and

(ii) supersedes any previous election made by the company that was in effect for the year of tax; and

(h) each other company that was in the designated company group immediately before the end of the year of tax is taken to have made an election under paragraph (1)(d); and

(i) an election covered by paragraph (h) of this subsection:

(i) is taken to have been in effect for the year of tax; and

(ii) supersedes any previous election made by the other company that was in effect for the year of tax.

(11) If:

(a) immediately before the end of a year of tax, a person is the head company of a designated company group; and

(b) the person is not taken, under subsection (10), to have made an election under paragraph (1)(d) that is in effect for the year of tax; and

(c) the person has not made an election under paragraph (1)(d) that:

(i) relates to the year of tax; and

(ii) under subsection (9), results in each other company that was in the designated company group immediately before the end of the year of tax being taken to have made an election under paragraph (1)(d); and

(d) a company that was in the designated company group immediately before the end of the year of tax has made an election under paragraph (1)(d) in relation to the year of tax;

the election covered by paragraph (c) of this subsection is taken not to have been in effect for the year of tax.

58K Special translation rules--events that happened before the current election took effect

Class 1 augmented bond rate general expenditure, class 1 augmented bond rate exploration expenditure and class 2 augmented bond rate general expenditure

(1) If:

(a) a person has made an election under section 58B (the current election ) with effect from the start of a particular year of tax; and

(b) any of the following subparagraphs applies:

(i) under subsection 33(3), an amount is taken to be class 1 augmented bond rate general expenditure incurred by the person in relation to a petroleum project on the first day of the year of tax;

(ii) under subsection 34(3), an amount is taken to be class 1 augmented bond rate exploration expenditure incurred by the person in relation to a petroleum project on the first day of the year of tax;

(iii) under subsection 34A(4), an amount is taken to be class 2 augmented bond rate general expenditure incurred by the person on the first day of the year of tax; and

(c) as a result of the current election, section 58D requires that the amount be translated into the applicable functional currency;

the amount is to be translated into the applicable functional currency at the exchange rate applicable when the current election took effect.

Class 2 augmented bond rate exploration expenditure, class 2 GDP factor expenditure and transferable exploration expenditure

(2) For the purpose of working out:

(a) the class 2 augmented bond rate exploration expenditure; or

(b) the class 2 GDP factor expenditure; or

(c) the transferable exploration expenditure;

that a person is taken to have incurred in a year of tax in relation to a petroleum project, if:

(d) the person has made an election (the current election ) under section 58B; and

(e) the current election is in effect for the year of tax; and

(f) section 58D requires that an amount of expenditure be translated into the applicable functional currency; and

(g) the expenditure was actually incurred before the current election took effect;

the expenditure is to be translated into the applicable functional currency at the exchange rate applicable when the current election took effect.

(1) If:

(a) a person has made an election under section 58B (other than an election taken to have been made as a result of the application of subsection 58B(4) or paragraph 58B(5)(h) to a designated company group); and

(b) the person's applicable functional currency has ceased to be the sole or predominant currency in which the person keeps the person's accounts;

the person may withdraw the election with effect from immediately after the end of the year of tax in which the person withdraws the election.

(2) A withdrawal must be in writing.

(3) Withdrawing an election does not prevent the person from making a fresh election under section 58B.

Designated company groups--deemed withdrawal of election etc

(4) If:

(a) a person withdraws an election under section 58B with effect from immediately after the end of the year of tax in which the person withdraws the election; and

(b) at the time when the withdrawal is made, the person is the head company of a designated company group;

each other company in the designated company group is taken to have withdrawn the other company's section 58B election with effect from immediately after the end of the year of tax.

58M Special translation rules--events that happened before the withdrawal of an election took effect

Class 1 augmented bond rate general expenditure, class 1 augmented bond rate exploration expenditure and class 2 augmented bond rate general expenditure

(1) If:

(a) a person withdraws an election under section 58B with effect from immediately after the end of a year of tax; and

(b) the person does not make a fresh election under section 58B with effect from the start of the next year of tax; and

(c) any of the following subparagraphs applies:

(i) under subsection 33(3), an amount is taken to be class 1 augmented bond rate general expenditure incurred by the person in relation to a petroleum project on the first day of the next year of tax;

(ii) under subsection 34(3), an amount is taken to be class 1 augmented bond rate exploration expenditure incurred by the person in relation to a petroleum project on the first day of the next year of tax;

(iii) under subsection 34A(4), an amount is taken to be class 2 augmented bond rate general expenditure incurred by the person on the first day of the next year of tax; and

(d) section 10 requires that the amount be translated into Australian currency;

the amount is to be translated into Australian currency at the exchange rate applicable at the start of the next year of tax.

Class 2 augmented bond rate exploration expenditure, class 2 GDP factor expenditure and transferable exploration expenditure

(2) For the purpose of working out:

(a) the class 2 augmented bond rate exploration expenditure; or

(b) the class 2 GDP factor expenditure; or

(c) the transferable exploration expenditure;

that a person is taken to have incurred in a year of tax in relation to a petroleum project, if:

(d) a person withdraws an election under section 58B with effect from immediately after the end of an earlier year of tax; and

(e) the person has not made an election under section 58B with effect from the start of an intervening year of tax; and

(f) section 10 requires that an amount of expenditure be translated into Australian currency; and

(g) the expenditure was actually incurred before the withdrawal of the election took effect;

the expenditure is to be translated into Australian currency at the exchange rate applicable at the start of the next year of tax after that earlier year of tax.

20 Application of amendments

The amendments made by this Part apply in relation to instalments and assessments of tax under the Petroleum Resource Rent Tax Assessment Act 1987 for years of tax that start on or after 1 July 2009.

Part 2 -- Exploration expenditure etc.

Petroleum Resource Rent Tax Assessment Act 1987

21 Section 2

Insert:

"post-30 June 2008 petroleum project" means a petroleum project, where the production licence, or each production licence, in relation to the project came into force after 30 June 2008.

22 Section 2

Insert:

"pre-1 July 2008 petroleum project" means a petroleum project other than a post - 30 June 2008 petroleum project.

23 Subsection 5(1)

Omit "this Act (including this section)", substitute "the application of this Act (including this section) to a pre - 1 July 2008 petroleum project,".

Note: The following heading to subsection 5(1) is inserted " Pre - 1 July 2008 petroleum project ".

24 Subsection 5(2)

Omit "this Act,", substitute "the application of this Act to a pre - 1 July 2008 petroleum project,".

25 At the end of section 5

Add:

Post - 30 June 2008 petroleum project

(5) For the purposes of the application of this Act (including this section) to a post - 30 June 2008 petroleum project, a reference to exploration for petroleum in, or recovery of petroleum from, a production licence area, an exploration permit area or a retention lease area is a reference to exploration for petroleum in, or recovery of petroleum from, the production licence area, the exploration permit area or the retention lease area while the production licence, exploration permit or retention lease concerned is or was in force.

(6) For the purposes of the application of this Act to a post - 30 June 2008 petroleum project, a reference to exploration for petroleum in, or recovery of petroleum from, the eligible exploration or recovery area in relation to a petroleum project is a reference to:

(a) if the production licence, or any production licence, in relation to the project is a production licence (in this paragraph called the current production licence ) derived from an exploration permit (in this paragraph called the prior exploration permit )--exploration for petroleum in, or recovery of petroleum from, the exploration permit area of the prior exploration permit, where the exploration or recovery occurred:

(i) before the current production licence came into force; and

(ii) if, before the current production licence came into force, there came into force one or more retention leases, or one or more other production licences, derived from the prior exploration permit--after whichever of those retention leases or other production licences last came into force before the current production licence came into force; and

(b) if the production licence, or any production licence, in relation to the project is a production licence (in this paragraph called the current production licence ) derived from a retention lease (in this paragraph called the prior retention lease )--exploration for petroleum in, or recovery of petroleum from, the retention lease area of the prior retention lease, where the exploration or recovery occurred before the current production licence came into force; and

(c) if:

(i) the production licence, or any production licence, in relation to the project is a production licence (in this paragraph called the current production licence ) derived from a retention lease (in this paragraph called the prior retention lease ); and

(ii) the prior retention lease was derived from an exploration permit (in this paragraph called the prior exploration permit );

exploration for petroleum in, or recovery of petroleum from, the exploration permit area of the prior exploration permit, where the exploration or recovery occurred:

(iii) before the prior retention lease came into force; and

(iv) if, before the prior retention lease came into force, there came into force one or more other production licences, or one or more other retention leases, derived from the prior exploration permit--after whichever of those other retention leases or other production licences last came into force before the prior retention lease came into force; and

(d) exploration for petroleum in, or recovery of petroleum from, the production licence area of the production licence, or the production licence areas of the production licences, in respect of the project.

(7) If:

(a) paragraph (6)(c) applies to a post - 30 June 2008 petroleum project; and

(b) the prior retention lease mentioned in that paragraph is one of a set of 2 or more retention leases that:

(i) came into force at the same time; and

(ii) were derived from the prior exploration permit mentioned in that paragraph; and

(c) the production licence, or the production licences, in relation to one or more other post - 30 June 2008 petroleum projects were derived from one or more of the retention leases included in the set mentioned in paragraph (b) of this subsection; and

(d) exploration expenditure incurred in relation to the petroleum project mentioned in paragraph (a) of this subsection is attributable to exploration for petroleum in, or recovery of petroleum from, the exploration permit area of the prior exploration permit;

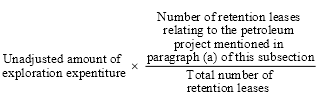

then, for the purposes of the application of this Act to the petroleum project mentioned in paragraph (a) of this subsection, the amount of the exploration expenditure mentioned in paragraph (d) of this subsection is taken to be the amount worked out using the following formula:

where:

"number of retention leases relating to the petroleum project mentioned in paragraph (a) of this subsection" means the number of retention leases:

(a) from which the production licence, or the production licences, in relation to the petroleum project mentioned in paragraph (a) of this subsection were derived; and

(b) that are included in the set mentioned in paragraph (b) of this subsection.

"total number of retention leases" means the number of retention leases that are included in the set mentioned in paragraph (b) of this subsection.

"unadjusted amount of exploration expenditure" means the amount that, apart from this subsection, is the amount of the exploration expenditure mentioned in paragraph (d) of this subsection.

Part 3 -- Processing of internal petroleum

Petroleum Resource Rent Tax Assessment Act 1987

26 Section 2

Insert:

"internal petroleum" , in relation to a petroleum project, means petroleum, or constituents of petroleum, recovered from the production licence area or production licence areas in relation to the project, where:

(a) the petroleum, or the constituents of petroleum, is, or is to be, recovered or processed:

(i) by a person entitled to derive assessable receipts in relation to the project; and

(ii) for or on behalf of another person who is entitled to derive assessable receipts in relation to the project; or

(b) the petroleum, or the constituents of petroleum, is, or is to be, sold:

(i) by a person entitled to derive assessable receipts in relation to the project; and

(ii) to another person who is entitled to derive assessable receipts in relation to the project.

27 Section 2 (at the end of the definition of petroleum project or project )

Add "or (2C)".

28 Section 2

Insert:

"processing of internal petroleum" , in relation to a petroleum project, includes the stabilisation, transportation, storage or recovery of internal petroleum in relation to the project.

29 After subsection 19(2B)

Insert:

(2C) For the purposes of this Act, there is taken to be included, as part of any petroleum project within the meaning of subsection (1) or (2), the carrying on of any processing of internal petroleum wholly or partly using the operations, facilities and other things comprising the project:

(a) in the case of an eligible production licence referred to in subsection (1)--while that licence is in force; or

(b) in the case of 2 or more eligible production licences referred to in subsection (2)--while any of those licences are in force.

30 Section 24A

After "external petroleum", insert ", or internal petroleum,".

31 Paragraph 37(1)(c)

Repeal the paragraph, substitute:

(c) in procuring another person to stabilise, transport, store, recover or process petroleum recovered from the eligible exploration or recovery area (other than any production licence area) in relation to the project, if that stabilisation, transportation, storage, recovery or processing constitutes:

(i) the processing of internal petroleum in relation to the project; or

(ii) the processing of external petroleum in relation to another petroleum project;

32 Paragraph 38(1)(c)

After "external petroleum", insert ", or internal petroleum,".

33 Paragraph 38(1)(d)

Repeal the paragraph, substitute:

(d) in procuring another person to stabilise, transport, store, recover or process petroleum recovered from the production licence area or areas in relation to the project, if that stabilisation, transportation, storage, recovery or processing constitutes:

(i) the processing of internal petroleum in relation to the project; or

(ii) the processing of external petroleum in relation to another petroleum project;

34 Subsection 38(2)

After "external petroleum", insert ", or internal petroleum,".

35 Subsection 41(2)

After "external petroleum", insert ", or internal petroleum,".

36 Application of amendments

The amendments made by this Part apply in relation to instalments and assessments of tax under the Petroleum Resource Rent Tax Assessment Act 1987 for years of tax that start on or after 1 July 2008.

Part 4 -- Designated frontier areas

Petroleum Resource Rent Tax Assessment Act 1987

37 Subsection 36B(2)

Omit "2008", substitute "2009".

Note: The heading to section 36B is altered by omitting " 2008 " and substituting " 2009 ".