Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

Income Tax Assessment Act 1997

1 Section 61 - 500

Omit:

Your entitlement to the offset varies depending on what kind of entity you are. The amount of your offset varies depending on whether your aggregated turnover is $50,000 or less or is more than $50,000.

Substitute:

Your entitlement to the offset varies depending on what kind of entity you are. The amount of your offset varies depending on:

(a) whether your aggregated turnover is $50,000 or less or is more than $50,000; and

(b) if you are an individual--whether you (and your spouse, if you have a spouse) have significant income from sources other than your small business.

2 Subsection 61 - 505(2) (at the end of step 4 of the method statement)

Add:

Note: If you are an individual, section 61 - 523 may reduce the amount of the tax offset.

3 Subsection 61 - 505(2) (at the end of step 5 of the method statement)

Add:

Note: If you are an individual, section 61 - 523 may reduce the amount of the tax offset.

4 Subsection 61 - 510(2) (at the end of step 4 of the method statement)

Add:

Note: If you are an individual, section 61 - 523 may reduce the amount of the tax offset.

5 Subsection 61 - 510(2) (at the end of step 5 of the method statement)

Add:

Note: If you are an individual, section 61 - 523 may reduce the amount of the tax offset.

6 Subsection 61 - 520(2) (at the end of step 4 of the method statement)

Add:

Note: If you are an individual, section 61 - 523 may reduce the amount of the tax offset.

7 Subsection 61 - 520(2) (at the end of step 5 of the method statement)

Add:

Note: If you are an individual, section 61 - 523 may reduce the amount of the tax offset.

8 After section 61 - 520

Insert:

61 - 523 25% entrepreneurs' tax offset--reduction for non - small business income

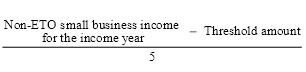

Reduce the amount of your * tax offset worked out under subsection 61 - 505(2), 61 - 510(2) or 61 - 520(2) by the amount worked out using the following formula (but not below nil), if:

(a) you are an individual; and

(b) the amount worked out using the formula is greater than nil:

where:

"non-ETO small business income" for the income year is worked out by:

(a) adding up the following:

(i) your taxable income for the year;

(ii) your * reportable fringe benefits total for the year;

(iii) your * reportable superannuation contributions (if any) for the year;

(iv) your * total net investment loss for the year; and

(b) subtracting:

(i) in a case covered by subsection 61 - 505(2)--your * net small business income for the year; or

(ii) in a case covered by subsection 61 - 510(2) or 61 - 520(2)--your net small business income share for the year (within the meaning of paragraph 61 - 510(1)(e) or 61 - 520(1)(e), whichever is applicable); and

(c) adding the following in relation to each individual (if any) who, on the last day of the year, is your * spouse:

(i) your spouse's taxable income for the year;

(ii) your spouse's reportable fringe benefits total for the year;

(iii) your spouse's reportable superannuation contributions (if any) for the year;

(iv) your spouse's total net investment loss for the year.

Note: ETO is short for 25% entrepreneurs' tax offset.

"threshold amount" means:

(a) $120,000 if:

(i) on any day during the income year, you have a dependant (within the meaning of the definition of dependant in subsection 159P(4) of the Income Tax Assessment Act 1936 , disregarding paragraph (a) (spouse) of that definition); or

(ii) on the last day of the income year, you have a * spouse; or

(b) otherwise--$70,000.

9 Application provision

The amendments made by this Schedule apply in relation to assessments for income years that commence on or after 1 July 2009.