Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

Income Tax Assessment Act 1936

1 Subsection 6(1)

Insert:

"corporate limited partnership" has the meaning given by section 94D.

2 Subsection 6(1)

Insert:

"dwelling" has the meaning given by the Income Tax Assessment Act 1997 .

3 Subsection 6(1)

Insert:

"foreign tax" has the meaning given by section 6AB.

4 Subsection 6(1)

Insert:

"once-only deduction" : a deduction in a year of income in respect of a percentage of expenditure is a once-only deduction , in relation to the expenditure, if no deduction is allowable in respect of a percentage of the expenditure in any other year of income.

5 Subsection 21A(5) (definition of once - only deduction )

Repeal the definition.

6 Subsection 26AJ(11) (definition of once - only deduction )

Repeal the definition.

7 Section 94B (definition of corporate limited partnership )

Repeal the definition.

8 At the end of section 94N

Add:

Note: Division 7A (Distributions to entities connected with a private company) applies to certain corporate limited partnerships in the same way as it applies to private companies: see section 109BB.

9 Section 109B

After:

An amount may be treated as a dividend even if it is paid or lent by the company to the shareholder or associate through one or more interposed entities. (See Subdivision E.)

Insert:

An amount may also be included in the assessable income of a shareholder or shareholder's associate if:

(a) a company has an unpaid present entitlement to income of a trust; and

(b) the trustee makes a payment or loan to, or forgives a debt of, the shareholder or associate.

(See Subdivisions EA and EB.)

10 Subdivision AA of Division 7A of Part III (heading)

Repeal the heading, substitute:

Subdivision AA -- Application of Division

11 At the end of Subdivision AA of Division 7A of Part III

Add:

109BB Application of Division to closely - held corporate limited partnerships

This Division applies to a corporate limited partnership in relation to a year of income in the same way as it applies to a private company in relation to a year of income, if, any time during the year of income:

(a) the partnership has fewer than 50 members; or

(b) any entity has, directly or indirectly, and for the entity's own benefit, an entitlement to a 75% or greater share of the income or capital of the partnership.

Example: Michael has an entitlement to an 80% share of the income of 2 fixed trusts. The 2 fixed trusts have, between them, an entitlement to 100% of the income of a corporate limited partnership. For the purposes of paragraph ( b), Michael has, indirectly, and for his own benefit, an entitlement to a 75% or greater share of the income of the partnership.

109BC Application of Division to non - resident companies

(1) This Division applies, in relation to a payment, loan or debt forgiveness, in relation to a private company that is a non - resident as if:

(a) references in this Division to a year of income of the company were references to a tax accounting period in relation to the company in relation to a foreign tax imposed by a tax law of:

(i) if the company is a resident of only one foreign country--that foreign country; or

(ii) otherwise--the foreign country to which subsection ( 2) applies; and

(b) references in this Division to the lodgment day for the year of income were references to the due date for lodgment of the company's return of income for the tax accounting period under that tax law.

(2) For the purposes of subparagraph ( 1)(a)(ii), this subsection applies to a foreign country (the relevant country ) if:

(a) the company is a resident of the relevant country; and

(b) of all the tax accounting periods:

(i) in relation to the company in relation to the foreign taxes imposed by the tax laws of the foreign countries of which the company is resident; and

(ii) during which the payment, loan or debt forgiveness is made;

the tax accounting period under the tax law of the relevant country ends first; and

(c) if more than one of the tax accounting periods mentioned in paragraph ( b) end first--the due date for lodgment of the company's return of income for the tax accounting period under the tax law of the relevant country is not later than the due date for lodgment for any of the other tax accounting periods that end first.

(3) In this section:

"tax accounting period" has the meaning given by section 317.

"tax law" has the meaning given by section 317.

Note: Section 109L prevents amounts from being included in assessable income under this Division if the amounts are included in, or excluded from, assessable income under another provision of this Act, such as the rules relating to CFCs and FIFs.

12 At the end of subsection 109C(3)

Add:

Note: See also section 109CA ( Payment includes provision of asset).

13 After section 109C

Insert:

109CA Payment includes provision of asset

(1) In this Division, payment to an entity includes the provision of an asset for use by the entity.

Note: This includes provision under a lease or licence.

Example: Yacht builder Mainbrace Enterprises Pty Ltd owns a yacht for the purpose of sales demonstrations. With the private company's permission, one of its shareholders uses the yacht on weekends. The company has made a payment to the shareholder, unless one of the exceptions to subsection ( 1) applies.

(2) The time the payment is made is the time the entity first:

(a) uses the asset with the permission of the provider of the asset; or

(b) has a right to use the asset (whether alone or together with other entities), at a time when the provider of the asset does not have a right:

(i) to use the asset; or

(ii) to provide the asset for use by another entity.

Example: Paragraph ( a) could apply if a shareholder were driving a company car with the company's permission. Paragraph ( b) could apply if the shareholder had the car parked at his or her house or at another place of his or her choosing.

(3) However, if the use or right continues into another income year of the entity, treat the provision of the asset for use in the other income year as being a separate payment made at the start of that year.

Exceptions

(4) Subsection ( 1) does not apply if the provision of the asset would, if done in respect of the employment of an employee, be a minor benefit under section 58P of the Fringe Benefits Tax Assessment Act 1986 .

(5) Subsection ( 1) does not apply to the extent that, if the entity had incurred and paid expenditure in respect of the provision of the asset, a once - only deduction would have been allowable to the entity in respect of the expenditure, ignoring:

(a) section 82A (Deductions for expenses of self - education); and

(b) Divisions 28 (Car expenses) and 900 (Substantiation rules) of the Income Tax Assessment Act 1997 .

(6) Subsection ( 1) does not apply to the provision of a dwelling, if:

(a) the entity, or an associate of the entity, carries on a business; and

(b) the entity or associate:

(i) uses; or

(ii) is granted or has a lease, licence or other right to use;

land, water or a building for the purpose of carrying on the business; and

(c) the provision of the dwelling to the entity is connected with that use or with that lease, licence or other right.

Note: For the meaning of land , see paragraph 22(1)(c) of the Acts Interpretation Act 1901 .

(7) Subsection ( 1) does not apply to the provision of a dwelling, if:

(a) the dwelling is the main residence of the entity; and

(b) the provider of the dwelling is a private company; and

(c) the private company acquired the dwelling before 1 July 2009; and

(d) the private company would meet the conditions in section 165 - 12 of the Income Tax Assessment Act 1997 (which is about the company maintaining the same owners) if, despite subsection 165 - 12(1), the ownership test period were the period:

(i) starting when the company acquired the dwelling; and

(ii) ending at the time of payment, worked out under subsection ( 2) of this section.

(7A) Subsection (1) does not apply to the provision of a dwelling to the entity if:

(a) the dwelling is a flat or home unit that is part of a complex of 2 or more flats or home units; and

(b) the provider of the dwelling is a company that owns a legal or equitable interest in the land on which the complex is erected; and

(c) there is more than one share in the company, and each share (whether singly or as part of a parcel of shares) gives the relevant shareholder the right to occupy a flat or home unit in the complex; and

(d) each flat or home unit in the complex is covered by a share, or a parcel of shares, in the company; and

(e) the dwelling is provided to the entity because a shareholder holds such a share, or parcel of shares; and

(f) the company does not have legal or equitable interests in any assets other than legal or equitable interests in:

(i) the complex, and the land on which it is erected; and

(ii) any related land and buildings; and

(iii) any related plant, machinery, equipment, furniture or fittings; and

(iv) any assets relating to the matters mentioned in paragraph (g); and

(g) the assessable income of the company is derived predominantly from:

(i) managing and maintaining the complex (including the assets mentioned in subparagraphs (f)(i), (ii) and (iii)); and

(ii) interest and dividends relating to income derived from managing and maintaining the complex (including the assets mentioned in those subparagraphs).

(7B) Subsection (7A) does not apply in a case to which Subdivision E (about interposed entities) applies, if the company mentioned in that subsection is interposed between:

(a) a private company; and

(b) a shareholder, or an associate of a shareholder, of the private company.

(8) Section 118 - 120 of the Income Tax Assessment Act 1997 (Extension to adjacent land) applies in relation to subsections (6) to (7A) of this section in the same way as it applies in relation to Subdivision 118 - B of that Act.

(9) Subsection ( 1) does not apply if the provision of the asset to the entity is a transfer of property to the entity.

Note: For transfers of property, see paragraph 109C(3)(c).

Value of payment

(10) Subject to subsection ( 11), the amount of the payment is:

(a) the amount that would have been paid for the provision of the asset by the parties dealing at arm's length; less

(b) any consideration given for the provision of the asset by the entity.

(11) The amount of the payment is nil if the consideration given by the entity equals or exceeds the amount that would have been paid at arm's length for the provision of the asset.

14 At the end of subsection 109D(6)

Add:

Note: For the lodgment day for a private company that is a non - resident, see section 109BC.

15 Subsection 109R(2)

Repeal the subsection, substitute:

(2) A payment must not be taken into account if:

(a) a reasonable person would conclude (having regard to all the circumstances) that, when the payment was made, the entity intended to obtain a loan or loans from the private company of a total amount similar to, or larger than, the payment; or

(b) both of the following subparagraphs apply:

(i) the entity obtained, before the payment was made, a loan or loans from the private company of a total amount similar to, or larger than, the amount of the payment;

(ii) a reasonable person would conclude (having regard to all the circumstances) that the entity obtained the loan or loans in order to make the payment.

16 Paragraph 109XA(1)(a)

After "a payment", insert "(including a payment through an interposed entity as described in section 109XF)".

17 At the end of paragraph 109XA(1)(c)

Add:

Note: For entitlements through interposed trusts, see section 109XI.

18 After subsection 109XA(1)

Insert:

Loan repayments

(1A) Disregard paragraph ( 1)(b) if:

(a) subsection ( 1) has previously applied because the trustee made a payment (the original transaction ) to the shareholder, or to an associate of the shareholder, during a previous year of income; and

(b) the shareholder, or an associate of the shareholder, makes a loan or loans to the trustee on or after 1 July 2009; and

(c) either:

(i) a reasonable person would conclude (having regard to all the circumstances) that at the time the original transaction took place the shareholder, or an associate of the shareholder, intended to make the loan or loans to the trustee; or

(ii) the shareholder, or an associate of the shareholder, made the loan or loans to the trustee before the time the original transaction took place and a reasonable person would conclude (having regard to all the circumstances) that the trustee obtained the loan or loans in order to make the payment; and

(d) the actual transaction is applied to repay all or a part of the loan or loans.

(1B) For the purposes of applying section 109XB in a case covered by subsections ( 1) and (1A) of this section, disregard section 109J (Payments discharging pecuniary obligations not treated as dividends).

19 Paragraph 109XA(2)(a)

After "a loan", insert "(including a loan through an interposed entity as described in section 109XG)".

20 At the end of paragraph 109XA(2)(b)

Add:

Note: For entitlements through interposed trusts, see section 109XI.

21 At the end of paragraph 109XA(3)(b)

Add:

Note: For entitlements through interposed trusts, see section 109XI.

22 Subsection 109XB(1)

After "dividend", insert "paid by the company at the end of the year of income of the company in which the actual transaction took place".

23 Subsection 109XC(8)

Omit "paragraphs 109R(3)(a), (b) and (ba)", substitute "paragraph 109R(3)(a)".

24 At the end of Subdivision EA of Division 7A of Part III

Add:

An amount is not included in the assessable income for a year of income of the shareholder or associate referred to in subsection 109XA(3) because of the forgiveness of an amount of a debt resulting from a loan if, because of the loan, an amount was included in the assessable income of the shareholder or associate under section 109XB (or former section 109UB) in that or an earlier year of income.

25 After Subdivision EA of Division 7A of Part III

Insert:

Subdivision EB--Unpaid present entitlements --interposed entities

109XE Simplified outline of this Subdivision

The following is a simplified outline of this Subdivision:

Payments and loans

This Subdivision allows an amount to be included in an entity's (the target entity's ) assessable income under Subdivision EA if an entity interposed between a trustee and the target entity makes a payment or loan to the target entity under an arrangement involving the trustee.

This result is achieved by treating the trustee as making a payment or loan of an amount determined by the Commissioner to the target entity.

The arrangement must involve the trustee and one or more interposed entities in making payments or loans for the purpose of the target entity receiving a payment or loan from an interposed entity.

If the target entity repays a fraction of the loan made by the interposed entity, the target entity is treated as repaying the same fraction of the loan taken to have been made by the trustee.

Some provisions that prevent payments or loans from giving rise to assessable income do not apply to payments or loans this Subdivision treats a trustee as making.

Present entitlements

This Subdivision similarly allows an amount to be included in an entity's assessable income under Subdivision EA if a private company is or becomes presently entitled to an amount from the net income of a trust estate interposed between the private company and another trust estate (the target trust ) under an arrangement involving the target trust.

109XF Payments through interposed entities

(1) For the purposes of paragraphs 109XA(1)(a) and (1A)(a), a trustee is taken to have made a payment to a shareholder, or to an associate of a shareholder, (the target entity ) of a private company if:

(a) the trustee makes a payment or loan to another entity (the first interposed entity ) that is interposed between:

(i) the trustee; and

(ii) the target entity; and

(b) a reasonable person would conclude (having regard to all the circumstances) that the trustee made the payment or loan solely or mainly as part of an arrangement involving a payment to the target entity; and

(c) either:

(i) the first interposed entity makes a payment to the target entity; or

(ii) another entity interposed between the trustee and the target entity makes a payment to the target entity.

(2) For the purposes of this section, it does not matter:

(a) whether the interposed entity made the payment to the target entity before, after or at the same time as the first interposed entity received the payment or loan from the trustee; or

(b) whether or not the interposed entity paid the target entity the same amount as the trustee paid or lent the first interposed entity.

(3) Treat the reference in paragraph 109XA(1)(b) to a payment as being a reference to the payment to the target entity mentioned in paragraph ( 1)(c) of this section.

109XG Loans through interposed entities

Loans by a trustee through interposed entities

(1) For the purposes of paragraph 109XA(2)(a), a trustee is taken to have made a loan (the notional loan ) to a shareholder, or to an associate of a shareholder, (the target entity ) of a private company if:

(a) the trustee makes a payment or loan to another entity (the first interposed entity ) that is interposed between:

(i) the trustee; and

(ii) the target entity; and

(b) a reasonable person would conclude (having regard to all the circumstances) that the trustee made the payment or loan solely or mainly as part of an arrangement involving a loan to the target entity; and

(c) either:

(i) the first interposed entity makes a loan to the target entity; or

(ii) another entity interposed between the trustee and the target entity makes a loan to the target entity.

(2) For the purposes of this section, it does not matter:

(a) whether the interposed entity made the loan to the target entity before, after or at the same time as the first interposed entity received the payment or loan from the trustee; or

(b) whether or not the interposed entity lent the target entity the same amount as the trustee paid or lent the first interposed entity.

Notional loans

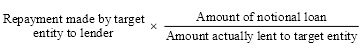

(3) When working out whether an amount is included in the assessable income of the target entity under section 109XB as a result of the notional loan under subsection ( 1) of this section, and the amount included in assessable income, assume that the target entity repays an amount of the notional loan equal to the amount worked out using the formula:

where:

"amount actually lent to target entity" is the amount the interposed entity lent to the target entity.

"repayment made by target entity to lender" is the amount of any repayment made by the target entity of the loan the interposed entity made to the target entity.

(4) For the purposes of section 109E (Amalgamated loan from a previous year treated as dividend if minimum repayment not made):

(a) treat the notional loan as an amalgamated loan from the private company to the target entity; and

(b) treat the amount of the notional loan worked out under section 109XH as the amount of the amalgamated loan; and

(c) treat the agreement under which the actual loan was made as the agreement under which the amalgamated loan was made; and

(d) treat repayments by the target entity of the amount of the notional loan worked out under subsection ( 3) of this section as payments by the target entity to the private company in relation to the amalgamated loan.

(5) For the purposes of section 109N (about certain loans not being treated as dividends), treat the agreement under which the actual loan was made as the agreement under which the notional loan was made.

109XH Amount and timing of payment or loan through interposed entities

Amount of payment or loan

(1) The amount the trustee is taken under section 109XF or 109XG to have paid or lent the target entity is the amount (if any) determined by the Commissioner.

(2) In determining the amount of the payment or loan, the Commissioner must take account of:

(a) the amount the interposed entity paid or lent the target entity; and

(b) how much (if any) of that amount the Commissioner believes represented consideration payable to the target entity by:

(i) the trustee; or

(ii) any of the interposed entities;

for anything (assuming that the consideration payable equals that for similar transactions at arm's length).

(3) The total of the amounts determined under subsection ( 1) for payments and loans in relation to which section 109XB applies because of the same present entitlement mentioned in paragraph 109XA(1)(c), (2)(b) or (3)(b) must not exceed the unpaid present entitlement mentioned in subsection 109XA(4).

Timing of payment or loan

(4) The trustee is taken under section 109XF or 109XG to have made the payment or loan at the time the interposed entity made the payment or loan mentioned in paragraph 109XF(1)(c) or 109XG(1)(c) to the target entity.

109XI Entitlements to trust income through interposed trusts

Entitlements through interposed trusts

(1) For the purposes of paragraphs 109XA(1)(c), (2)(b) and (3)(b), a private company is taken to be or to become entitled to an amount from the net income of a trust estate (the target trust ) if:

(a) the company is or becomes presently entitled to an amount from the net income of another trust estate (the first interposed trust ) that is interposed between the target trust and the company; and

(b) a reasonable person would conclude (having regard to all the circumstances) that the company is or becomes so entitled solely or mainly as part of an arrangement involving an entitlement to an amount from the target trust; and

(c) either:

(i) the first interposed trust is or becomes presently entitled to an amount from the net income of the target trust; or

(ii) another trust interposed between the target trust and the company is or becomes presently entitled to an amount from the net income of the target trust.

This section operates regardless of certain factors

(2) For the purposes of this section, it does not matter:

(a) whether the company became or becomes entitled to the amount from the net income of the first interposed trust before, after or at the same time as the interposed trust became or becomes presently entitled to an amount from the net income of the target trust; or

(b) whether or not the company became presently entitled to the same amount as the amount to which the interposed trust become entitled.

This section does not operate to the extent Subdivision EA would otherwise apply

(3) Subsection ( 1) does not apply to the extent that an amount is included in the assessable income of a shareholder, or an associate of a shareholder, of the company under Subdivision EA (as it applies apart from this section) as a result of the present entitlement of any interposed trust.

Amount of entitlement

(4) The amount the private company is taken to be or to become entitled to from the net income of the target trust is the amount (if any) determined by the Commissioner.

(5) The total amount determined under subsection ( 4) for present entitlements to which that subsection applies because of the same present entitlement to an amount from the net income of the target trust mentioned in paragraph ( 1)(c) must not exceed that amount.

(6) In determining the amount of the entitlement, the Commissioner must take account of:

(a) the amount the private company is or becomes entitled to from the net income of the first interposed trust; and

(b) how much (if any) of that amount the Commissioner believes represented consideration payable to the private company by:

(i) the target trust; or

(ii) any of the interposed trusts;

for anything (assuming that the consideration payable equals that for similar transactions at arm's length).

Timing of entitlement

(7) The company is taken to be or to become entitled to the amount from the net income of the target trust at the time the company is or becomes entitled to the amount from the net income of the first interposed trust mentioned in paragraph ( 1)(a).

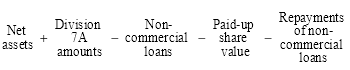

26 Subsection 109Y(2) (formula)

Repeal the formula, substitute:

27 Subsection 109Y(2)

Insert:

"Division 7A amounts" is the total of any amounts the company is taken under section 109C or 109F to have paid as dividends in the year of income apart from this section.

28 Subsection 109Y(2) (definition of non - commercial loans )

Repeal the definition, substitute:

"non-commercial loans" means the total of:

(a) any amounts that:

(i) the company is taken under former section 108, or section 109D or 109E, to have paid as dividends in earlier years of income; and

(ii) are shown as assets in the company's accounting records at the end of year of income; and

(b) any amounts that are included in the assessable income of shareholders, or associates of shareholders, of the company under section 109XB as if the amounts were dividends paid by the company in earlier years of income.

Note: The total amount worked out under paragraph ( b) might be reduced under subsection ( 2A).

29 Subsection 109Y(2) ( paragraphs ( a) and (b) of the definition of repayments of non - commercial loans )

Omit "109E", substitute "109E,".

30 After subsection 109Y(2)

Insert:

(2A) Reduce the total of the amounts worked out under paragraph ( b) of the definition of non - commercial loans in subsection ( 2) by the total of the unfranked parts of any dividends:

(a) that are distributed by the company; and

(b) to which section 109ZCA applies.

31 At the end of Subdivision F of Division 7A of Part III

Add:

(1) This section sets out special rules for dealing with a dividend (the later dividend ) distributed by a private company if:

(a) an amount is included in the assessable income of a shareholder, or an associate of a shareholder, of the company under section 109XB because of a loan made to the shareholder or associate by a trustee in relation to a present entitlement of the company to an amount from the net income of the trust estate; and

(b) subsection 109XA(2) applied to the loan; and

(c) some or all of the later dividend is applied to repay all or a part of the loan.

(2) The amount of the later dividend applied is taken not to be a dividend for the purposes of this Act, except Part 3 - 6 of the Income Tax Assessment Act 1997 (which deals with franking of distributions).

(3) However, if the amount set off or applied exceeds the amount of the later dividend that is neither:

(a) the franked part of that dividend; nor

(b) the part of that dividend that has been franked with an exempting credit;

the excess is still a dividend.

Note: This prevents double taxation by ensuring that the entity's assessable income does not include the amount of the later dividend that is not paid to the entity (except to the extent that that amount is franked).

(4) An amount that is taken not to be a dividend under subsection ( 2) is not assessable income and is not exempt income.

32 Section 109ZD (at the end of the definition of payment )

Add "and section 109CA".

33 Subparagraph 485AA(1)(a)(i)

Omit "for the purposes of Division 5A of Part III".

Income Tax Assessment Act 1997

34 Section 11 - 55 (table item headed "dividends")

Omit:

later dividend set off against amount taken to be dividend | 109ZC(3) |

Substitute:

later dividend set off against amount taken to be dividend | 109ZC(3), 109ZCA(4) |

35 Application provision

The amendments made by this Schedule apply in relation to:

(a) payments made; and

(b) loans made; and

(c) debts forgiven;

on or after 1 July 2009.