Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

Income Tax Assessment Act 1997

1 Section 205 - 15 (table item 4)

Omit "at the end of the income year of the last partnership or trust interposed between the entity and the corporate tax entity that made the distribution", substitute "at the time specified in subsection (2)".

2 At the end of section 205 - 15

Add:

(2) A * franking credit covered by item 4 of the table arises at the end of the income year:

(a) that is an income year of the last * partnership or trust interposed between:

(i) the entity; and

(ii) the * corporate tax entity that made the distribution; and

(b) during which the * franked distribution * flows indirectly to the entity.

3 Subsection 205 - 25(1)

Repeal the subsection, substitute:

(1) An entity satisfies the residency requirement for an income year in which, or in relation to which, an event specified in a relevant table occurs if:

(a) the entity is a * company, or a * corporate limited partnership, to which at least one of the following subparagraphs applies:

(i) the entity is an * Australian resident for more than one half of the 12 months immediately preceding the event if the event occurs before the end of the income year;

(ii) the entity is an Australian resident at all times during the income year when the entity exists if the event occurs at or after the end of the income year;

(iii) the entity is an Australian resident for more than one half of the income year (whether or not the event occurs before the end of the income year); or

(b) the entity is a * corporate unit trust for the income year; or

(c) the entity is a * public trading trust for the income year.

4 Link note before Division 220

Repeal the link note, substitute:

Division 219 -- Imputation for life insurance companies

Table of Subdivisions

Guide to Division 219

219 - A Application of imputation rules to life insurance companies

219 - B Franking accounts of life insurance companies

219 - 1 What this Division is about

This Division sets out how the imputation rules are applied to a life insurance company.

Subdivision 219 - A -- Application of imputation rules to life insurance companies

Table of sections

219 - 10 Application of imputation rules to life insurance companies

219 - 10 Application of imputation rules to life insurance companies

(1) This Part (except this Division) applies to a * life insurance company in the same way as it applies to any other company.

(2) However, that application is subject to the modifications set out in this Division.

Subdivision 219 - B -- Franking accounts of life insurance companies

Table of sections

219 - 15 Franking credits

219 - 30 Franking debits

219 - 40 Residency requirement

219 - 45 Assessment day

219 - 50 Amount attributable to shareholders' share of income tax liability

219 - 55 Adjustment resulting from an amended assessment

(1) The table in section 205 - 15 does not apply to a * life insurance company.

(2) The following table sets out when a * franking credit arises under this section in the * franking account of a * life insurance company.

Franking credits in the franking account | |||

Item | If: | A credit of: | Arises: |

1 | the company * pays a PAYG instalment; and the company satisfies the * residency requirement for the income year in relation to which the PAYG instalment is paid; and the payment is made before the company's * assessment day for that income year; and the company is a * franking entity for the whole or part of the relevant * PAYG instalment period | that part of the payment that: (a) the company estimates will be attributable to the * shareholders' share of the income tax liability of the company for that income year; and (b) is attributable to the period during which the company was a franking entity | on the day on which the payment is made (see note 1 to this subsection) |

2 | the company * paid a PAYG instalment; and the company satisfied the * residency requirement for the income year in relation to which the PAYG instalment was paid; and the payment was made before the company's * assessment day for that income year; and the company was a * franking entity for the whole or part of the relevant * PAYG instalment period | that part of the payment that is attributable to: (a) the * shareholders' share of the income tax liability of the company for that income year; and (b) the period during which the company was a franking entity | on the company's assessment day for that income year (see note 1 to this subsection) |

3 | the company * pays a PAYG instalment; and the company satisfies the * residency requirement for the income year in relation to which the PAYG instalment is paid; and the payment is made on or after the company's * assessment day for that income year; and the company is a * franking entity for the whole or part of the relevant * PAYG instalment period | that part of the payment that is attributable to: (a) the * shareholders' share of the income tax liability of the company for that income year; and (b) the period during which the company was a franking entity | on the day on which the payment is made |

4 | the company * pays income tax; and the company satisfies the * residency requirement for the income year for which the tax is paid; and the company is a * franking entity for the whole or part of that income year | that part of the payment that is attributable to: (a) the * shareholders' share of the income tax liability of the company for that income year; and (b) the period during which the company was a franking entity | on the day on which the payment is made |

5 | a * franked distribution is made to the company; and the company satisfies the * residency requirement for the income year in which the distribution is made; and the company is a * franking entity when it receives the distribution; and the company is entitled to a * tax offset under Division 207 because of the distribution; and the tax offset is not subject to the refundable tax offset rules in Division 67 | the amount of the tax offset | on the day on which the distribution is made |

6 | a * franked distribution * flows indirectly to the company through a * partnership or trust; and the company is a * franking entity when the franked distribution is made; and the company is entitled to a * tax offset under Division 207 because of the distribution; and the tax offset is not subject to the refundable tax offset rules in Division 67 | the amount of the tax offset | at the time specified in subsection (3) |

7 | the company incurs a liability to pay * franking deficit tax under section 205 - 45 or 205 - 50 | the amount of the liability | immediately after the liability is incurred |

Note 1: On the assessment day, a franking credit that arose under item 1 of the table:

Note 2: Section 219 - 50 tells you how to work out the part of an amount that is attributable to the shareholders' share of the income tax liability of the company for the income year.

Note 3: To find out whether a tax offset under Division 207 is subject to the refundable tax offset rules: see section 67 - 25.

(3) A * franking credit covered by item 6 of the table arises at the end of the income year:

(a) that is an income year of the last * partnership or trust interposed between:

(i) the * life insurance company; and

(ii) the * corporate tax entity that made the distribution; and

(b) during which the * franked distribution * flows indirectly to the life insurance company.

(1) The table in section 205 - 30 (except item 2) applies to a * life insurance company in the same way as it applies to any other company.

(2) The following table sets out when a * franking debit arises under this section in the * franking account of a * life insurance company.

Franking debits in the franking account | |||

Item | If: | A debit of: | Arises: |

1 | a * franking credit arises for the company under item 1 of the table in section 219 - 15 ( * payment of a PAYG instalment) | the amount of the franking credit | on the company's * assessment day for the income year mentioned in that item |

2 | the company * receives a refund of income tax; and the company satisfies the * residency requirement for the income year to which the refund relates; and the company was a * franking entity for the whole or part of that income year | that part of the refund that is attributable to: (a) the * shareholders' share of the income tax liability of the company for that income year; and (b) the period during which the company was a franking entity | on the day on which the refund is received |

Note 1: On the assessment day, a franking debit that arises under item 1 of this table reverses the effect of a franking credit that arose under item 1 of the table in section 219 - 15.

Note 2: Section 219 - 50 tells you how to work out the part of an amount that is attributable to the shareholders' share of the income tax liability of the company for the income year.

219 - 40 Residency requirement

The tables in sections 219 - 15 and 219 - 30 are relevant for the purposes of subsection 205 - 25(1) (about the residency requirement).

A * life insurance company's assessment day for an income year is the earlier of:

(a) the day on which the company furnishes its * income tax return for that income year; or

(b) the day on which the Commissioner makes an assessment of the amount of the company's taxable income for that income year under section 166 of the Income Tax Assessment Act 1936 .

219 - 50 Amount attributable to shareholders' share of income tax liability

(1) Subsection (2) applies to a * life insurance company in relation to the payment or refund mentioned in an item of a table in this Subdivision (except item 1 of the table in section 219 - 15).

(2) For the purposes of this Part, the part of the payment or refund that is attributable to the * shareholders' share of the income tax liability of the company for an income year must be worked out as follows:

Method statement

Step 1. Work out the part of the company's total income tax liability for the income year that is attributable to the company's shareholders.

The result of this step is the shareholders' share of the income tax liability of the company for the income year.

Step 2. Divide the step 1 result by that total income tax liability.

The result of this step is the shareholders' ratio for the income year.

Step 3. Multiply the amount of the payment or refund by the * shareholders' ratio.

The result of this step is the part of the payment or refund that is attributable to the * shareholders' share of the income tax liability of the company for the income year.

(3) For the purposes of this Part, the estimate mentioned in item 1 of the table in section 219 - 15 (the part of a payment estimated to be attributable to the * shareholders' share of a company's income tax liability for an income year) must be worked out on the basis of:

(a) subject to paragraph (b), the method statement in subsection (2); and

(b) the company's reasonable estimate of the amounts that, on the company's * assessment day for the income year, will be:

(i) its total income tax liability for the income year; and

(ii) the part of that total income tax liability that is attributable to its shareholders.

(4) In working out the part of the income tax liability of a * life insurance company that is attributable to the shareholders of the company for the purposes of this section, regard is to be had to the accounting records of the company.

219 - 55 Adjustment resulting from an amended assessment

(1) This section applies in relation to the * franking account of a * life insurance company if:

(a) the assessment of the company's income tax liability for an income year is amended on a particular day (the adjustment day ); and

(b) the * shareholders' ratio (the new ratio ) based on the amended assessment is different from the shareholders' ratio used previously in relation to that income year to work out a * franking credit or * franking debit for the company; and

(c) the franking account would have a different balance on the adjustment day if the new ratio had been used to work out all the franking credits and franking debits covered by paragraph (b).

(2) On the adjustment day, a * franking credit or * franking debit (as appropriate) of the amount worked out under subsection (3) arises in the * franking account.

(3) The amount is an adjustment that will bring the * franking account to the balance that it would have on the adjustment day if the new ratio had been used to work out all the * franking credits and * franking debits covered by paragraph (1)(b).

Example: On the basis of a shareholders' ratio of 60% for the income year, franking credits of the amounts of $6,000, $6,000, $6,000 and $6,000 arose under item 2 of the table in section 219 - 15 for Company X.

An amended assessment results in a new shareholders' ratio of 70%. Under this section, a franking credit of $4,000 arises on the day of the amended assessment to bring the balance of the franking account from $24,000 to $28,000, which would be the account's balance if the new shareholders' ratio had been used.

5 Subsection 995 - 1(1)

Insert:

"assessment day" for an income year of a * life insurance company has the meaning given by section 219 - 45.

6 Subsection 995 - 1(1)

Insert:

"shareholders' ratio" for an income year of a * life insurance company has the meaning given by section 219 - 50.

7 Subsection 995 - 1(1)

Insert:

"shareholders' share" of the income tax liability of a * life insurance company for an income year has the meaning given by section 219 - 50.

8 Application

Subject to the rules on the application of Part 3 - 6 of the Income Tax Assessment Act 1997 set out in the Income Tax (Transitional Provisions) Act 1997, the amendments made by items 1 to 7 apply to events that occur on or after 1 July 2002.

Income Tax (Transitional Provisions) Act 1997

9 Before Division 220

Insert:

Division 219 -- Imputation for life insurance companies

Table of sections

219 - 40 Reversing and replacing (on tax paid basis) certain franking credits that arose before 1 July 2002

219 - 45 Reversing (on tax paid basis) certain franking debits that arose before 1 July 2002

(1) This section applies if:

(a) a franking credit arose before 1 July 2002 in the franking account of a life insurance company under section 160APVJ of the Income Tax Assessment Act 1936 in relation to a PAYG instalment in respect of an income year; and

(b) the company's assessment day (the assessment day) for that income year occurs on or after 1 July 2002; and

(c) the company has a franking account (the new franking account ) under section 205 - 10 of the Income Tax Assessment Act 1997 .

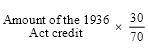

(2) A franking debit of the amount worked out in accordance with the following formula is taken to have arisen in the new franking account on the assessment day:

where:

"amount of the 1936 Act credit" means the amount of the franking credit mentioned in paragraph (1)(a).

(3) On the assessment day, a franking credit of the amount mentioned in item 2 of the table in section 219 - 15 of the Income Tax Assessment Act 1997 arises in the new franking account in relation to a payment of the PAYG instalment mentioned in paragraph (1)(a) of this section that was made before 1 July 2002.

Note: On the assessment day, the franking credit mentioned in paragraph (1)(a) is therefore:

219 - 45 Reversing (on tax paid basis) certain franking debits that arose before 1 July 2002

(1) This section applies if:

(a) a franking debit arose before 1 July 2002 in the franking account of a life insurance company under section 160AQCNCE of the Income Tax Assessment Act 1936 in relation to a PAYG instalment variation credit in respect of an income year; and

(b) the company's assessment day (the assessment day ) for that income year occurs on or after 1 July 2002; and

(c) the company has a franking account (the new franking account ) under section 205 - 10 of the Income Tax Assessment Act 1997 .

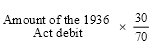

(2) A franking credit of the amount worked out in accordance with the following formula is taken to have arisen in the new franking account on 1 July 2002:

where:

"amount of the 1936 Act debit" means the amount of the franking debit mentioned in paragraph (1)(a).

Note: As the effects of sections 160AQCNCE and 160APVN of the Income Tax Assessment Act 1936 are not duplicated in the Income Tax Assessment Act 1997 , this section ensures that a debit arising under section 160AQCNCE before 1 July 2002 is reversed on a tax paid basis on that date if it has not been reversed under section 160APVN before that date.