Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Income Tax Assessment Act 1936

1 Subsection 6BA(2)

After "be a dividend", insert "(including as a result of section 45C)".

2 Subsection 6BA(4)

Omit " subsection ( 1)", substitute " subsection ( 3)".

3 Paragraph 6BA(5)(c)

Omit " subsection ( 2)", substitute " subsections ( 2) and (3)".

4 Paragraph 45A(3)(b)

After "share capital", insert "or share premium".

5 Paragraph 45B(4)(b)

After "share capital", insert "or share premium".

6 Paragraph 45B(5)(b)

After "of capital", insert "or share premium".

7 Paragraph 45B(5)(h)

After "of share capital" (wherever occurring), insert "or share premium".

8 Paragraph 45C(4)(c)

After "of share capital", insert "or share premium".

9 Paragraph 45C(4)(c)

After "share capital account", insert "or share premium account".

10 Subsection 45D(2)

Omit "under", substitute "referred to in".

11 Subsection 45D(2)

Omit "relevant taxpayer", substitute "advantaged shareholder".

12 Paragraph 159GZG(6)(e)

Omit "or (iii)" (wherever occurring).

13 Paragraph 159GZG(6)(f)

Repeal the paragraph, substitute:

(f) where subparagraph ( b)(ii) applies in relation to subparagraph ( a)(iii)--the difference between:

(i) the greatest amount unpaid on the eligible share at any time during the year of income; and

(ii) the amount unpaid on the eligible share at the end of the year of income.

14 Section 160APA ( paragraph ( a) of the definition of frankable dividend ) (the paragraph ( a) inserted by item 4 of Schedule 4 to the Taxation Laws Amendment (Company Law Review) Act 1998 )

Renumber as paragraph ( aa).

15 Paragraph 160ARDW(2)(a)

Omit "160ARDX(2)(a)", substitute "160ARDX(a)".

16 Paragraph 160ARDW(2)(b)

Omit "160ARDX(2)(b)", substitute "160ARDX(b)".

17 At the end of Division 7B of Part IIIAA

Add:

Subdivision D -- Payment etc. of untainting tax

160ARDZ Payment of untainting tax

Due date

(1) Untainting tax is due and payable at the end of:

(a) 21 days after an election to untaint is made under section 160ARDR; or

(b) such later day as the Commissioner, in special circumstances, allows.

Debt due

(2) Untainting tax, when it becomes due and payable, is a debt due to the Commonwealth and payable to the Commissioner.

160ARDZA Late payment of untainting tax

(1) Subject to subsection ( 2), if any untainting tax remains unpaid 60 days after the day by which it is due to be paid, additional tax, by way of penalty, is due and payable at the rate of 16% per annum on the amount unpaid, calculated from the end of that period.

Remission of additional tax

(2) Where additional tax is due and payable by a company under subsection ( 1) in relation to an amount of untainting tax, the Commissioner may remit the additional tax or a part of it if he or she is satisfied that there are special circumstances by reason of which it would be fair and reasonable to do so.

Effect of court judgment

(3) Where judgment is given by, or entered in, a court for the payment of:

(a) an amount of tainting tax; or

(b) an amount that includes an amount of tainting tax;

then:

(c) the untainting tax is not taken, for the purposes of subsection ( 1), to have ceased to be due and payable by reason only of the giving or entering of the judgment; and

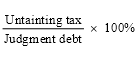

(d) if the judgment debt carries interest, the additional tax that would, but for this paragraph, be payable under this section in relation to the untainting tax is reduced by:

(i) in a case to which paragraph ( a) applies--the amount of the interest; or

(ii) in a case to which paragraph ( b) applies--the percentage of the interest worked out using the formula:

Any unpaid untainting tax, and any unpaid additional tax payable under section 160ARDZA, may be sued for and recovered in a court of competent jurisdiction by the Commissioner suing in his or her official name.

(1) The Commissioner may give a company, by post or otherwise, a notice specifying:

(a) the amount of any untainting tax that the Commissioner has ascertained is payable by the company; and

(b) the day on which that tax became or will become due and payable.

Effect of notice on liability etc.

(2) The amount of the liability of a person or persons to untainting tax, and the due date for payment of the tax, are not dependent on, or in any way affected by, the giving of a notice.

Amendment of notice

(3) The Commissioner may at any time amend a notice. An amended notice is a notice for the purposes of this section.

Inconsistency between notices

(4) If there is an inconsistency between notices that relate to the same subject matter, the later notice prevails to the extent of the inconsistency.

Objections

(5) A company that is dissatisfied with a notice made in relation to the company may object against it in the manner set out in Part IVC of the Taxation Administration Act 1953 .

160ARDZD Evidentiary effect of notice of liability

(1) The production of:

(a) a notice given under section 160ARDZC; or

(b) a document that is signed by the Commissioner and appears to be a copy of such a notice;

is conclusive evidence that:

(c) the notice was duly given; and

(d) the amount of untainting tax specified in the notice became due and payable by the company to which it was given on the day specified.

(2) Subsection ( 1) does not apply in proceedings under Part IVC of the Taxation Administration Act 1953 on a review or appeal relating to the review.

18 Sections 160ARDZA and 160ARDZB

Repeal the sections, substitute:

160ARDZA Late payment of untainting tax

If any of the untainting tax which a person is liable to pay remains unpaid 60 days after the day by which it is due to be paid, the person is liable to pay the general interest charge on the unpaid amount for each day in the period that:

(a) started at the beginning of the 60th day after the day by which the untainting tax was due to be paid; and

(b) finishes at the end of the last day on which, at the end of the day, any of the following remains unpaid:

(i) the untainting tax;

(ii) general interest charge on any of the untainting tax.

Note: The general interest charge is worked out under Division 1 of Part IIA of the Taxation Administration Act 1953 .

Any unpaid untainting tax may be sued for and recovered in a court of competent jurisdiction by the Commissioner suing in his or her official name.

Part 2 -- Income Tax Assessment Act 1997

19 Subsection 109 - 55(1) (table item 9)

Omit "not".

Part 3 -- Taxation Administration Act 1953

20 Subsection 8AAB(4) (after table item 1)

Insert:

1A | 160ARDZA | payment of untainting tax |

Part 4 -- Application of amendments

21 Application

The amendments made by items 4 to 9 apply to the provision of bonus shares or capital benefits on or after 30 June 1999.