Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

Income Tax Assessment Act 1936

1 Subsection 6(1)

Insert:

"non-assessable non" -exempt income has the meaning given by the Income Tax Assessment Act 1997 .

2 Subparagraph 6AB(2)(b)(iv)

Omit "23AI exempt part", substitute "23AI non - assessable part".

3 Subparagraph 6AB(2)(b)(vi)

Omit "23AK exempt part", substitute "23AK non - assessable part".

4 Paragraph 6AB(3A)(b)

Omit "23AI exempt part", substitute "23AI non - assessable part".

5 Paragraph 6AB(3A)(c)

Omit "23AK exempt part", substitute "23AK non - assessable part".

6 Paragraph 23(jd)

Repeal the paragraph.

7 Subsection 23AE(1A) (note)

Omit "51 - 25", substitute "59 - 15".

8 Subsection 23AH(2)

Repeal the subsection, substitute:

(2) If the original taxpayer in relation to the foreign branch income is a company, so much of the foreign branch income as is attributable to a period when the company was a resident is not assessable income and is not exempt income of the company.

Note: The heading to section 23AH is replaced by the heading " Foreign branch profits of Australian companies not assessable ".

9 Paragraph 23AH(3)(d)

Repeal the paragraph, substitute:

(d) so much of the foreign branch income as is attributable to a period when the actual taxpayer was a resident is not assessable income and is not exempt income of the original taxpayer; and

10 Subsection 23AH(4)

Repeal the subsection.

11 Paragraph 23AH(9)(d)

Repeal the paragraph, substitute:

(d) so much of the foreign branch capital gain as is attributable to a period when the actual taxpayer was a resident is not assessable income and is not exempt income of the original taxpayer; and

12 Paragraph 23AI(1)(c)

Repeal the paragraph, substitute:

(c) if the payment is of a kind referred to in paragraph 365(1)(a)--the payment is not assessable income, and is not exempt income, to the extent of the debit;

Note: The heading to section 23AI is replaced by the heading " Amounts paid out of attributed income not assessable ".

13 Paragraph 23AI(1)(d)

Omit "that amount is not so included, to the extent of the debit", substitute "that amount is not assessable income, and is not exempt income, to the extent of the debit".

14 Paragraph 23AI(1)(e)

Repeal the paragraph, substitute:

(e) if the payment is of a kind referred to in paragraph 365(1)(c) and, apart from this section, an amount would be included in the taxpayer's assessable income under section 97, 98A or 100 in respect of a share of the net income of the trust of the year of income referred to in that paragraph--that amount is not assessable income and is not exempt income, to the extent of the debit;

(ea) if the payment is of a kind referred to in paragraph 365(1)(c) and, apart from this section, an amount would be assessable to the trustee of the trust referred to in that paragraph under section 98 in respect of a share of the net income of the trust of the year of income referred to in that paragraph--that amount is not so assessable to the extent of the debit;

15 Paragraph 23AI(1)(g)

Omit "not so included", substitute "not assessable income, and is not exempt income,".

16 Subsection 23AJ(1)

Omit "exempt from income tax", substitute "not assessable income, and is not exempt income,".

Note: The heading to section 23AJ is replaced by the heading " Certain non - portfolio dividends from foreign countries not assessable ".

17 Paragraph 23AK(1)(c)

Omit "exempt from tax", substitute "not assessable income, and is not exempt income,".

Note: The heading to section 23AK is replaced by the heading " Amounts paid out of attributed foreign investment fund income not assessable ".

18 Paragraph 23AK(1)(d)

Omit "not so included,", substitute "not assessable income, and is not exempt income,".

19 Paragraph 23AK(1)(e)

Repeal the paragraph, substitute:

(e) if the payment is of a kind referred to in paragraph 603(1)(d) and, apart from this section, an amount would be included in the taxpayer's assessable income under section 97, 98A or 100 in respect of a share of the net income of the trust of the year of income referred to in that paragraph--that amount is not assessable income, and is not exempt income, to the extent of the debit;

(ea) if the payment is of a kind referred to in paragraph 603(1)(d) and, apart from this section, an amount would be assessable to the trustee of the trust referred to in that paragraph under section 98 in respect of a share of the net income of the trust of the year of income referred to in that paragraph--that amount is not so assessable to the extent of the debit;

20 Paragraph 23AK(1)(g)

Omit "not so included", substitute "not assessable income, and is not exempt income,".

21 Paragraph 23AK(1)(h)

Omit "exempt from tax", substitute "not assessable income, and is not exempt income,".

22 Paragraph 23AK(1)(i)

Omit "exempt from tax", substitute "not assessable income, and is not exempt income,".

23 Subsection 23E(1)

Repeal the subsection, substitute:

(1) An amount received by a person upon the redemption of a Special Bond, other than a part of that amount paid as accrued interest, is not assessable income and is not exempt income of the person.

24 Subsection 23J(1)

Repeal the subsection, substitute:

(1) An amount received by a person upon the sale or redemption of eligible securities purchased or otherwise acquired at a discount on or before 30 June 1982, other than any part of that amount received as accrued interest, is not assessable income and is not exempt income of the person.

25 Subsection 23L(1)

Repeal the subsection, substitute:

(1) Income derived by a taxpayer by way of the provision of a fringe benefit within the meaning of the Fringe Benefits Tax Assessment Act 1986 is not assessable income and is not exempt income of the taxpayer.

(1A) Income derived by a taxpayer by way of the provision of a benefit (other than a benefit to which paragraph 26(eaa) of this Act applies) that, but for paragraph (g) of the definition of fringe benefit in subsection 136(1) of the Fringe Benefits Tax Assessment Act 1986 , would be a fringe benefit within the meaning of that Act is exempt income of the taxpayer.

Note: The heading to section 23L is replaced by the heading " Certain benefits in the nature of income not assessable ".

26 Subparagraph 47A(7)(b)(i)

Repeal the subparagraph, substitute:

(i) non - assessable non - exempt exempt income under section 23AJ (in whole or in part); or

27 Subsection 59(2AAA)

Repeal the subsection, substitute:

(2AAA) For the purposes of the application of subsection (2), any amount by which consideration receivable under firearms surrender arrangements exceeds the depreciated value of a surrendered item of property is not assessable income and not exempt income of the taxpayer.

Note: Firearms surrender arrangements has the meaning given by subsection 6(1).

28 Section 90

Insert:

"non-assessable non" -exempt income , in relation to a partnership, means the non - assessable non - exempt income of the partnership calculated as if the partnership were a taxpayer who was a resident.

29 At the end of section 92

Add:

(4) The non - assessable non - exempt income of a partner in a partnership shall include:

(a) so much of the individual interest of the partner in the non - assessable non - exempt income of the partnership of the year of income as is attributable to a period when the partner was a resident; and

(b) so much of the individual interest of the partner in the non - assessable non - exempt income of the partnership of the year of income as is attributable to a period when the partner was not a resident and is also attributable to sources in Australia.

30 Subsection 95(1)

Insert:

"non-assessable non" -exempt income , in relation to a trust estate, means the non - assessable non - exempt income of the trust estate calculated as if the trustee were a taxpayer who was a resident.

31 At the end of subsection 97(1) (before the note)

Add:

; and (c) the non - assessable non - exempt income of the beneficiary shall include:

(i) so much of the individual interest of the beneficiary in the non - assessable non - exempt income of the trust estate as is attributable to a period when the beneficiary was a resident; and

(ii) so much of the individual interest of the beneficiary in the non - assessable non - exempt income of the trust estate as is attributable to a period when the beneficiary was not a resident and is also attributable to sources in Australia.

32 After subsection 99B(2)

Insert:

(2A) An amount that is not included in a beneficiary's assessable income because of paragraph (2)(d) or (e) is not assessable income and is not exempt income.

33 Paragraph 102AAZB(a)

Omit "exempt income", substitute "non - assessable income".

34 Subsection 109ZC(3)

Repeal the subsection, substitute:

(3) An amount that is taken not to be a dividend under subsection (2) is not assessable income and is not exempt income.

35 Section 128D

Omit "shall not be included in the assessable income of a person", substitute "is not assessable income and is not exempt income of a person".

Note: The heading to section 128D is replaced by the heading " Certain income not assessable ".

36 Paragraph 128TA(1)(a)

Omit "exempt from income tax", substitute "non - assessable non - exempt income".

37 Paragraph 128TA(2)(a)

Omit "exempt", substitute "non - assessable non - exempt income".

38 Paragraph 128TA(2)(b)

Omit "exempt from income tax", substitute "non - assessable non - exempt income".

39 Section 160AFCD

Repeal the section, substitute:

(1) If an attribution account payment made to a resident taxpayer by an attribution account entity in a year of income is, in whole or in part (the section 23AI non - assessable part ), not assessable income and not exempt income under section 23AI, these provisions have effect:

(a) the section 23AI non - assessable part is taken, for the purposes of paragraph 160AF(1)(a) but not (d), to be included in the assessable income of the taxpayer of the year of income;

(b) the taxpayer is taken for the purposes of this Division to have paid, and to have been personally liable for, in respect of the section 23AI non - assessable part, in the year of income, an amount of foreign tax calculated using the formula:

![]()

(2) In this section:

"AEP" or adjusted exempt percentage means the percentage that would be the exempt percentage if the attribution account payment were reduced by any part of that payment that is non - assessable non - exempt income under section 23AJ.

"AT" or attributed tax means the amount of any attributed tax account debit arising for the attribution account entity in relation to the taxpayer on the making of the attribution account payment, to the extent that the amount of the debit does not exceed the multiple of the adjusted exempt percentage and the underlying tax.

"DT" or direct tax means any foreign tax that, disregarding this section and section 160AFC, the taxpayer is taken for the purposes of this Division to have paid, and to have been personally liable for, in respect of the attribution account payment.

"EP" or exempt percentage means the percentage of the attribution account payment represented by the section 23AI non - assessable part.

"UT" or underlying tax means any foreign tax (other than CFC - type foreign tax) that, disregarding this section, the taxpayer is taken, for the purposes of this Division, to have paid, and to have been personally liable for, under section 160AFC in respect of the attribution account payment.

40 Section 160AFCJ

Repeal the section, substitute:

(1) If a FIF attribution account payment made to a resident taxpayer by a FIF attribution account entity in a year of income is, in whole or in part (the section 23AK non - assessable part ), not assessable income and not exempt income under section 23AK, these provisions have effect.

(2) The section 23AK non - assessable part is taken, for the purposes of paragraph 160AF(1)(a) but not (d), to be included in the taxpayer's assessable income of the year of income.

(3) The taxpayer is taken for the purposes of this Division to have paid, and to have been personally liable for, in respect of the section 23AK non - assessable part, in the year of income, an amount of foreign tax worked out using the formula:

![]()

(4) In this section:

"AEP" or adjusted exempt percentage means the percentage that would be the exempt percentage if the FIF attribution account payment were reduced by any part of that payment that is non - assessable non - exempt income under section 23AJ.

"AT" or attributed tax means the amount of any FIF attributed tax account debit arising for the FIF attribution account entity in relation to the taxpayer on the making of the FIF attribution account payment, to the extent that the amount of the debit does not exceed the multiple of the adjusted exempt percentage and the underlying tax.

"DT" or direct tax means any foreign tax that, disregarding this section and section 160AFC, the taxpayer is taken for the purposes of this Division to have paid, and to have been personally liable for, in respect of the FIF attribution account payment.

"EP" or exempt percentage means the percentage of the FIF attribution account payment represented by the section 23AK non - assessable part.

"UT" or underlying tax means any foreign tax that, disregarding this section, the taxpayer is taken, for the purposes of this Division, to have paid, and to have been personally liable for, under subparagraph 6AB(3)(a)(ii) or under section 160AFC in respect of the FIF attribution account payment.

41 Paragraph 160AQT(4)(b)

Repeal the paragraph, substitute:

(b) paragraphs 320 - 37(1)(a) and (d) of the Income Tax Assessment Act 1997 .

42 Paragraph 160AQU(2)(b)

Repeal the paragraph, substitute:

(b) paragraphs 320 - 37(1)(a) and (d) of the Income Tax Assessment Act 1997 .

43 Paragraph 160AQWA(1)(b)

Repeal the paragraph, substitute:

(b) paragraphs 320 - 37(1)(a) and (d) of the Income Tax Assessment Act 1997 ;

44 Subparagraph 160AQZB(1)(c)(ii)

Repeal the subparagraph, substitute:

(ii) would have been included in the assessable income of the holder of the interest if paragraphs 320 - 37(1)(a) and (d) of the Income Tax Assessment Act 1997 had not been enacted;

45 Subparagraph 160AQZC(1)(c)(ii)

Repeal the subparagraph, substitute:

(ii) would have been included in the assessable income of the holder of the interest if paragraphs 320 - 37(1)(a) and (d) of the Income Tax Assessment Act 1997 had not been enacted;

46 Subsection 170(10AB)

Omit "Division 22", substitute "section 59 - 30".

46A Paragraph 177EA(15)(b)

Repeal the paragraph, substitute:

(b) paragraph 320 - 37(1)(a) of the Income Tax Assessment Act 1997 (segregated exempt assets) or paragraph 320 - 37(1)(d) of that Act (income bonds, funeral policies and scholarship plans).

47 Subparagraph 530(1)(d)(i)

Omit "exempt from income tax", substitute "non - assessable non - exempt income".

48 At the end of section 271 - 105 in Schedule 2F

Add:

(3) The amount of the reduction is not assessable income and is not exempt income.

Note: The heading to section 271 - 105 in Schedule 2F is replaced by the heading " Amounts subject to family trust distribution tax not assessable ".

Income Tax Assessment Act 1997

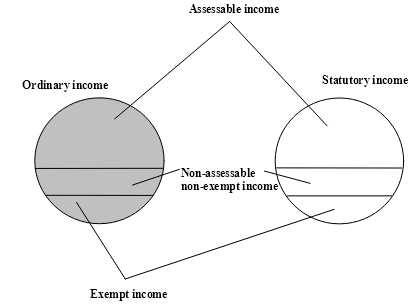

49 Section 6 - 1

Repeal the section, substitute:

6 - 1 Diagram showing relationships among concepts in this Division

(1) Assessable income consists of ordinary income and statutory income.

(2) Some ordinary income, and some statutory income, is exempt income.

(3) Exempt income is not assessable income.

(4) Some ordinary income, and some statutory income, is neither assessable income nor exempt income.

For the effect of the GST in working out assessable income, see Division 17.

(5) An amount of ordinary income or statutory income can have only one status (that is, assessable income, exempt income or non - assessable non - exempt income) in the hands of a particular entity.

[This is the end of the Guide.]

50 Subsection 6 - 15(2) (note)

Repeal the note, substitute:

Note: If an amount is exempt income, there are other consequences besides it being exempt from income tax. For example:

51 At the end of section 6 - 15

Add:

(3) If an amount is * non - assessable non - exempt income, it is not assessable income .

Note 1: You cannot deduct as a general deduction a loss or outgoing incurred in deriving an amount of non - assessable non - exempt income (see Division 8).

Note 2: Capital gains and losses on assets used to produce some types of non - assessable non - exempt income are disregarded (see section 118 - 12).

52 Subsection 6 - 20(1)

Omit "Commonwealth law", substitute " * Commonwealth law".

53 Subsection 6 - 20(2) (note)

Repeal the note.

54 Subsection 6 - 20(3)

Omit "Commonwealth law", substitute " * Commonwealth law".

55 At the end of section 6 - 20

Add:

(4) If an amount of * ordinary income or * statutory income is * non - assessable non - exempt income, it is not exempt income .

Note: An amount of non - assessable non - exempt income is not taken into account in working out the amount of a tax loss.

56 After section 6 - 20

Insert:

6 - 23 Non - assessable non - exempt income

An amount of * ordinary income or * statutory income is non - assessable non - exempt income if a provision of this Act or of another * Commonwealth law states that it is not assessable income and is not * exempt income.

Note: Capital gains and losses on assets used to produce some types of non - assessable non - exempt income are disregarded (see section 118 - 12).

For a summary list of provisions about non - assessable non - exempt income, see Subdivision 11 - B.

57 Paragraph 8 - 1(2)(c)

After " * exempt income", insert "or your * non - assessable non - exempt income".

58 Section 10 - 5 (table item headed "repayments")

Repeal the item.

59 Division 11 (heading)

Repeal the heading, substitute:

Division 11 -- Particular kinds of non - assessable income

Table of Subdivisions

11 - A Lists of classes of exempt income

11 - B Particular kinds of non - assessable non - exempt income

60 Before section 11 - 1A

Insert:

Subdivision 11 - A -- Lists of classes of exempt income

Table of sections

11 - 1A Effect of this Subdivision

11 - 1 Overview

11 - 5 Entities that are exempt, no matter what kind of ordinary or statutory income they have

11 - 10 Ordinary or statutory income which is exempt, no matter whose it is

11 - 15 Ordinary or statutory income which is exempt only if it is derived by certain entities

61 Section 11 - 1A

Repeal the section, substitute:

11 - 1A Effect of this Subdivision

This Subdivision is a * Guide.

62 Section 11 - 10 (table item dealing with Commonwealth places windfall tax)

Repeal the item.

63 Section 11 - 10 (table item dealing with foreign aspects of income taxation)

Repeal the item, substitute:

foreign aspects of income taxation |

|

Australian - American Education Foundation, grant from | 51 - 10 |

64 Section 11 - 10 (table item dealing with franchise fees windfall tax)

Repeal the item.

65 Section 11 - 10 (table item dealing with non - cash benefits)

Repeal the item, substitute:

non - cash benefits |

|

business benefit ............................ | 23L(2) |

exempt fringe benefit ........................ | 23L(1A) |

66 Section 11 - 15 (table item dealing with foreign aspects of income taxation)

Omit:

dividend from a foreign country, non - portfolio . | 23AJ |

67 Section 11 - 15 (table item dealing with foreign aspects of income taxation)

Omit:

foreign branch profits by an Australian company ...... | 23AH |

68 Section 11 - 15 (table item dealing with mining)

Repeal the item.

69 Section 11 - 15 (table item dealing with social security or like payments)

Omit:

bonus payments made to certain older Australians ..... | Subdivision 52 - E |

70 At the end of Division 11

Add:

Subdivision 11 - B -- Particular kinds of non - assessable non - exempt income

Table of sections

11 - 50 Effect of this Subdivision

11 - 55 List of non - assessable non - exempt income provisions

11 - 50 Effect of this Subdivision

This Subdivision is a * Guide.

11 - 55 List of non - assessable non - exempt income provisions

The provisions set out in the list make amounts non - assessable non - exempt income.

Provisions of the Income Tax Assessment Act 1997 are identified in normal text. The other provisions, in bold , are provisions of the Income Tax Assessment Act 1936 .

alienated personal services income |

|

associate, non - deductible payment or obligation to | 85 - 20(3) |

entitlements to a share of net income that is personal services income already assessable to an individual |

86 - 35(2) |

payments by personal services entity or associate of personal services income already assessable to an individual |

86 - 35(1) |

personal services entity, amounts of personal services income assessable to an individual |

86 - 30 |

bonds |

|

see securities |

|

dividends |

|

demerger dividends ......................... | 44(4) |

later dividend set off against amount taken to be dividend | 109ZC(3) |

firearms surrender arrangements |

|

compensation under ......................... | 59 - 10 |

depreciated value, consideration exceeds ........... | 59(2AAA) |

foreign aspects of income taxation |

|

attributed controlled foreign company income ........ | 23AI |

attributed foreign investment fund income .......... | 23AK |

dividend from a foreign country, non - portfolio . | 23AJ |

branch profits of Australian companies ............ | 23AH |

withholding tax, dividend royalty or interest subject to .. | 128D |

GST |

|

GST payable on a taxable supply ................ | 17 - 5(a) |

increasing adjustments ....................... | 17 - 5(b) and (c) |

life insurance companies .......................... | Subdivision 320 - B |

mining |

|

withholding tax, payments to Aboriginals and distributing bodies subject to |

59 - 15 |

non - cash benefits |

|

fringe benefits ............................. | 23L(1) |

notional sale and loan |

|

arrangement payments a notional seller receives or is entitled to receive |

240 - 40 |

luxury car leases, lease payments that the lessor receives or is entitled to receive | 42A - 40 in Schedule 2E |

offshore banking units |

|

assessable OB income other than eligible fraction ..... | 121EG |

related entities |

|

amounts from, where deduction reduced for ......... | 26 - 35(4) |

repayable amounts |

|

previously assessable amounts .................. | 59 - 30 |

securities |

|

securities acquired at a discount on or before 30 June 1982, amount received on sale or redemption of |

23J |

special bond, amount received on redemption of ...... | 23E |

small business assets |

|

income arising from CGT event, company or trust owned asset continuously for 15 years |

152 - 110(2) |

social security or like payments |

|

older Australians, bonus payments made to .......... | 59 - 5 |

tax loss transfers |

|

consideration received by loss company from income company, generally |

170 - 25(1) |

consideration received by loss company from income company, net capital loss |

170 - 125(1) |

trading stock |

|

disposal outside ordinary course of business, amounts received upon |

70 - 90(2) |

trusts |

|

attributable income, amounts representing .......... | 99B(2A) |

family trust distribution tax, amounts subject to ....... | 271 - 105(3) in Schedule 2F |

windfall amounts |

|

business franchise fees, refund of when invalid ....... | 59 - 20 |

State tax on Commonwealth place, refund of when invalid | 59 - 25 |

70A Paragraph 15 - 60(3)(b)

Omit " * exempt income of the company under paragraph 320 - 35(1)(f)", substitute " * non - assessable non - exempt income of the company under paragraph 320 - 37(1)(d)".

71 Subparagraph 17 - 5(c)(ii)

Omit "an * assessable recoupment", substitute "a * recoupment that is included in assessable income".

72 Section 20 - 160 (link note)

Repeal the link note, substitute:

[The next Division is Division 25.]

73 Division 22

Repeal the Division.

74 Section 25 - 90 (heading)

Repeal the heading, substitute:

25 - 90 Deduction relating to foreign non - assessable non - exempt income

75 Paragraph 25 - 90(b)

Omit "exempt income", substitute " * non - assessable non - exempt income".

76 Subsection 36 - 20(1)

Omit "(except * excluded exempt income)".

77 Paragraphs 36 - 20(2)(a) and (b)

Repeal the paragraphs, substitute:

(a) your * exempt income * derived from sources in Australia; and

(b) your exempt income to which section 26AG (Certain film proceeds included in assessable income) of the Income Tax Assessment Act 1936 applies;

78 Subsections 36 - 20(3), (3A) and (4)

Repeal the subsections.

79 Subsection 40 - 100(4)

After " * exempt income", insert "or * non - assessable non - exempt income".

80 Subsection 40 - 105(1)

After " * exempt income", insert "or * non - assessable non - exempt income".

81 Part 2 - 15 (heading)

Repeal the heading, substitute:

Part 2 - 15 -- Non - assessable income

82 Section 51 - 15 (link note)

Omit " 51 - 25 ", substitute " 51 - 30 ".

83 Section 51 - 25

Repeal the section.

84 Section 51 - 45

Repeal the section.

85 Section 51 - 48

Repeal the section.

86 Section 51 - 49

Repeal the section.

87 Subdivision 52 - E

Repeal the Subdivision.

88 Section 58 - 90 (link note)

Repeal the link note.

89 At the end of Part 2 - 15

Add:

Division 59 -- Particular amounts of non - assessable non - exempt income

59 - 1 What this Division is about

This Division details particular amounts that are non - assessable non - exempt income.

Table of sections

Operative provisions

59 - 5 Bonus payments made to certain older Australians

59 - 10 Compensation under firearms surrender arrangements

59 - 15 Mining payments

59 - 20 Taxable amounts relating to franchise fees windfall tax

59 - 25 Taxable amounts relating to Commonwealth places windfall tax

[This is the end of the Guide.]

59 - 5 Bonus payments made to certain older Australians

A payment made to you under the A New Tax System (Bonuses for Older Australians) Act 1999 is not assessable income and is not * exempt income.

59 - 10 Compensation under firearms surrender arrangements

A payment made to you by way of compensation under * firearms surrender arrangements for any loss of business is not assessable income and is not * exempt income.

(1) These are not assessable income and are not * exempt income:

(a) a * mining payment made to a * distributing body;

(b) a mining payment made to one or more * Aboriginals, or applied for their benefit.

(2) A payment:

(a) made to a * distributing body; or

(b) made to one or more * Aboriginals, or applied for their benefit;

is not assessable income and is not * exempt income if the payment is made by a * distributing body out of a * mining payment that it has received.

(3) A payment made to a * distributing body by another distributing body, out of a * mining payment received by the other distributing body, is taken to be a mining payment for the purposes of:

(a) any further applications of subsection (2); and

(b) any further applications of this subsection.

(4) Subsection (2) does not apply to a payment by a * distributing body for the purposes of meeting its administrative costs.

(5) This section does not apply to an amount paid to or applied for the benefit of a person if it is remuneration or consideration for goods or services provided by that person.

59 - 20 Taxable amounts relating to franchise fees windfall tax

Taxable amounts on which tax is imposed by the Franchise Fees Windfall Tax (Imposition) Act 1997 are not assessable income and are not * exempt income.

59 - 25 Taxable amounts relating to Commonwealth places windfall tax

Taxable amounts on which tax is imposed by the Commonwealth Places Windfall Tax (Imposition) Act 1998 are not assessable income and are not * exempt income.

90 At the end of Division 59

Add:

59 - 30 Amounts you must repay

(1) An amount you receive is not assessable income and is not * exempt income for an income year if:

(a) you must repay it; and

(b) you repay it in a later income year; and

(c) you cannot deduct the repayment for any income year.

(2) It does not matter if:

(a) you received the amount as part of a larger amount; or

(b) the obligation to repay existed when you received the amount or it came into existence later.

(3) This section does not apply to an amount you must repay because you received a lump sum as compensation or damages for a wrong or injury you suffered in your occupation.

[The next Division is Division 61.]

91 Section 65 - 30

Omit " 0.34 ", substitute " 0.3 ".

92 Subsection 65 - 35(3)

Omit " * exempt income", substitute " * net exempt income".

93 Subsection 65 - 35(3)

Omit "reducing exempt income", substitute "reducing net exempt income".

94 Subsection 65 - 35(3)

Omit "34 cents", substitute "30 cents".

95 Subsection 65 - 35(3)

Omit "the exempt income", substitute "the net exempt income".

96 Paragraphs 104 - 71(1)(a) and (b)

Repeal the paragraphs, substitute:

(a) * non - assessable non - exempt income; or

97 Paragraph 104 - 185(1)(e)

After " * exempt income", insert "or * non - assessable non - exempt income".

98 Section 118 - 12

Repeal the section, substitute:

118 - 12 Assets used to produce exempt income etc.

(1) A * capital gain or * capital loss you make from a * CGT asset that you used solely to produce your * exempt income or * non - assessable non - exempt income is disregarded.

(2) However, the exemption does not apply if the asset was used to gain or produce an amount that is * non - assessable non - exempt income because of:

(a) any of these provisions of this Act:

(i) section 59 - 15 (mining payments);

(ii) subsection 70 - 90(2) (disposing of trading stock outside the ordinary course of business);

(iii) section 86 - 30 (income of a personal services entity);

(iv) subsection 86 - 35(1) (payment by a personal services entity);

(v) subsection 86 - 35(2) (share of personal services entity's net income);

(vi) section 240 - 40 (treatment of arrangement payments); or

(b) any of these provisions of the Income Tax Assessment Act 1936 :

(i) section 23AH (foreign branch profits of Australian companies);

(ii) section 23AI (amounts paid out of attributed income);

(iii) section 23AJ (foreign non - portfolio dividends);

(iv) section 23AK (attributed foreign investment fund income);

(v) subsection 23L(1) (fringe benefits);

(vi) subsection 99B(2A) (attributed trust income);

(vii) section 128D (dividends, royalties and interest subject to withholding tax);

(viii) section 42A - 40 in Schedule 2E (luxury car lease payments);

(ix) subsection 271 - 105(3) in Schedule 2F (amounts subject to family trust distribution tax).

Note: These provisions make amounts non - assessable non - exempt income to prevent them being double taxed rather than to remove them entirely from the taxation system. Therefore, the policy reason for disregarding gains and losses does not apply to assets used to produce those amounts.

99 Paragraphs 118 - 20(4)(a) and (b)

Repeal the paragraphs, substitute:

(a) an amount of your * ordinary income or * statutory income from the event as being * non - assessable non - exempt income; or

(b) if you are a partner, your share of the ordinary income or * statutory income of the partnership from the event (calculated according to your entitlement to share in the partnership net income or loss) as being non - assessable non - exempt income of the partnership.

100 Subsection 118 - 20(6)

Omit " * exempt income", substitute " * non - assessable non - exempt income".

101 Subsection 152 - 110(2)

Omit "Any income", substitute "Any * ordinary income or * statutory income".

102 Subsection 207 - 15(3) (note 2)

After "exempt income", insert "or non - assessable non - exempt income".

103 Section 207 - 30 (note 2)

After "exempt income", insert "or non - assessable non - exempt income".

104 Section 207 - 110 (heading)

Repeal the heading, substitute:

207 - 110 Effect of non - assessable income on gross up and tax offset

105 Paragraph 207 - 110(1)(c)

After " * exempt income", insert "or * non - assessable non - exempt income".

106 Paragraph 207 - 110(2)(c)

After " * exempt income", insert "or * non - assessable non - exempt income".

107 Paragraph 207 - 110(3)(c)

After " * exempt income", insert "or * non - assessable non - exempt income".

108 Paragraph 207 - 110(4)(c)

After " * exempt income", insert "or * non - assessable non - exempt income".

109 Paragraph 207 - 120(1)(b)

Repeal the paragraph, substitute:

(b) the distribution is:

(i) * exempt income of the recipient under section 282B, 283 or 297B of the Income Tax Assessment Act 1936 (certain income derived by an eligible entity within the meaning of Part IX of that Act); or

(ii) * non - assessable non - exempt income of the recipient under paragraph 320 - 37(1)(a) (segregated exempt assets) or paragraph 320 - 37(1)(d) (certain amounts received by a friendly society) of this Act;

110 Paragraph 207 - 120(2)(b)

Repeal the paragraph, substitute:

(b) the distribution is:

(i) * exempt income of the entity under section 282B, 283 or 297B of the Income Tax Assessment Act 1936 (certain income derived by an eligible entity within the meaning of Part IX of that Act); or

(ii) * non - assessable non - exempt income of the entity under paragraph 320 - 37(1)(a) (segregated exempt assets) or paragraph 320 - 37(1)(d) (certain amounts received by a friendly society) of this Act;

111 Subsection 208 - 5(1)

After "exempt income", insert "or non - assessable non - exempt income".

112 Paragraph 208 - 5(2)(b)

After "exempt income", insert "or non - assessable non - exempt income".

113 Paragraph 208 - 40(1)(b)

After " * exempt income", insert "or * non - assessable non - exempt income".

114 Paragraph 208 - 40(2)(b)

After " * exempt income", insert "or * non - assessable non - exempt income".

115 Paragraph 208 - 40(3)(b)

After " * exempt income", insert "or * non - assessable non - exempt income".

116 Paragraph 208 - 40(4)(b)

After " * exempt income", insert "or * non - assessable non - exempt income".

117 Section 208 - 115 (table item 2)

Omit "the distribution is not wholly * exempt income of the entity", substitute "some part of the distribution is neither * exempt income nor * non - assessable non - exempt income of the entity".

118 Section 208 - 115 (table item 3)

Omit "the distribution is not wholly * exempt income of the entity", substitute "some part of the distribution is neither * exempt income nor * non - assessable non - exempt income of the entity".

119 Section 208 - 130 (table item 2)

Omit "the distribution is not wholly * exempt income of the entity", substitute "some part of the distribution is neither * exempt income nor * non - assessable non - exempt income of the entity".

120 Section 208 - 130 (table item 3)

Omit "the distribution is not wholly * exempt income of the entity", substitute "some part of the distribution is neither * exempt income nor * non - assessable non - exempt income of the entity".

121 Section 208 - 130 (table item 5)

Omit "the distribution is not wholly * exempt income of the recipient", substitute "some part of the distribution is neither * exempt income nor * non - assessable non - exempt income of the recipient".

122 Section 208 - 130 (table item 6)

Omit "the distribution is not wholly * exempt income of the recipient", substitute "some part of the distribution is neither * exempt income nor * non - assessable non - exempt income of the recipient".

123 Section 320 - 1

After "amounts of exempt income", insert "and non - assessable non - exempt income".

124 Paragraph 320 - 5(2)(a)

Omit "are exempt income", substitute "are * exempt income or * non - assessable non - exempt income".

125 Section 320 - 10

After "exempt income", insert "or non - assessable non - exempt income".

126 Section 320 - 35

Repeal the section, substitute:

These amounts derived by a * life insurance company are exempt from income tax:

(a) amounts of * ordinary income and * statutory income accrued before 1 July 1988 that were derived from assets that have become * virtual PST assets;

(b) if the company is an * RSA provider--any amounts that, except for the operation of subsections 320 - 155(3) and (4), would have been taken into account under subsection 320 - 155(1) in calculating the * RSA component of the * complying superannuation class of the company's taxable income.

320 - 37 Non - assessable non - exempt income

(1) These amounts derived by a * life insurance company are not assessable income and are not * exempt income:

(a) amounts of ordinary income and statutory income derived from * segregated exempt assets, being income that relates to the period during which the assets were segregated exempt assets;

(b) amounts of ordinary income and statutory income derived from the * disposal of units in a * pooled superannuation trust;

(c) if an * Australian/overseas fund or an * overseas fund established by the company derived * foreign establishment amounts--the non - resident proportion of the foreign establishment amounts;

(d) if the company is a * friendly society:

(i) amounts derived before 1 July 2001 that are exempt from income tax under section 50 - 1; and

(ii) amounts derived on or after 1 July 2001 but before 1 January 2003, that are attributable to * income bonds or * funeral policies; and

(iii) amounts derived on or after 1 July 2001 but before 1 January 2003, that are attributable to * scholarship plans and would have been exempt from income tax under section 50 - 1 if they had been received before 1 July 2001; and

(iv) amounts derived on or after 1 January 2003 that are attributable to income bonds or funeral policies issued before 1 January 2003; and

(v) amounts derived on or after 1 January 2003 that are attributable to scholarship plans issued before 1 January 2003 and that would have been exempt from income tax if they had been received before 1 July 2001.

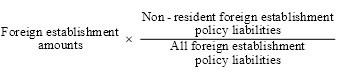

(2) For the purposes of paragraph (1)(c), the non - resident proportion of the * foreign establishment amounts is the amount worked out using the formula:

where:

"all foreign establishment policy liabilities" means the total of the policy liabilities (as defined in the * Valuation Standard), calculated by an * actuary, for all * life insurance policies included in the class of * life insurance business to which the company's * Australian/overseas fund or * overseas fund relates that were issued by the permanent establishment of the company in the foreign country.

"non-resident foreign establishment policy liabilities" means the total of the company's policy liabilities (as defined in the Valuation Standard), calculated by an actuary, for * non - resident life insurance policies.

127 Subsection 320 - 40(1)

Omit "exempt from income tax", substitute "not assessable income and are not * exempt income".

128 Subsection 320 - 40(8)

Omit "exempt from income tax", substitute "not assessable income and is not * exempt income".

128A Paragraph 320 - 112(3)(b)

Omit " * exempt income of the company under paragraph 320 - 35(1)(f)", substitute " * non - assessable non - exempt income of the company under paragraph 320 - 37(1)(d)".

129 Subsection 995 - 1(1) (definition of excluded exempt income )

Repeal the definition.

130 Subsection 995 - 1(1) (definition of exempt income subject to withholding tax )

Repeal the definition.

131 Subsection 995 - 1(1)

Insert:

"non-assessable non" -exempt income has the meaning given by section 6 - 23.

Income Tax (Transitional Provisions) Act 1997

132 Section 20 - 115 (link note)

Omit " Division 22 ", substitute " Division 25 ".

133 Division 22

Repeal the Division.

Taxation Administration Act 1953

134 After paragraph 360 - 65(1)(d) in Schedule 1

Insert:

(da) your * non - assessable non - exempt income (if any) for the inquiry period consisted only of one or more items covered by section 365 - 77; and

135 Paragraph 360 - 75(a) in Schedule 1

Repeal the paragraph, substitute:

(a) subsection 23L(1A) of the Income Tax Assessment Act 1936 (about exempt fringe benefits); or

136 Section 360 - 75 in Schedule 1 (table item 45)

Repeal the item.

137 After section 360 - 75 in Schedule 1

Insert:

360 - 77 Basic categories of non - assessable non - exempt income

This section covers * ordinary income, or * statutory income, to the extent that it is * non - assessable non - exempt income because of:

(a) subsection 23L(1) of the Income Tax Assessment Act 1936 (about fringe benefits); or

(b) section 59 - 5 of the Income Tax Assessment Act 1997 (about bonus payments made to certain older Australians).

138 After paragraph 360 - 100(1)(e) in Schedule 1

Insert:

(ea) he or she is satisfied that your * non - assessable non - exempt income (if any) for the inquiry period consisted only of one or more items covered by section 365 - 77; and

139 Paragraph 360 - 140(2)(a) in Schedule 1

Omit "or * exempt income", substitute ", * exempt income or * non - assessable non - exempt income".

140 Application

(1) Subject to this item, the amendments made by this Schedule apply to assessments for the 2003 - 04 income year and later income years.

(2) The amendment made by item 71 applies to things done on or after 1 July 2000.

(3) The amendments made by items 92, 93 and 95 apply to assessments for the 1997 - 98 income year and later income years.

(4) The amendments made by items 91 and 94 apply to assessments for the 2000 - 01 income year and later income years.

(5) The amendments made by items 41, 42, 43, 44, 45, 126, 127 and 128 apply to amounts derived on or after 1 July 2000.

(6) The amendments made by items 109 and 110 apply to events that occur on or after 1 July 2002.

(7) The amendment made by item 46A applies to distributions that are made or that flow indirectly after 30 June 2002.

(8) The amendments made by items 70A and 128A apply to an assessment for the income year including 1 January 2003 or a later income year.

141 Transitional

(1) Subparagraphs 207 - 120(1)(b)(ii) and 207 - 120(2)(b)(ii) of the Income Tax Assessment Act 1997 have effect during the period starting on 1 July 2002 and ending just before the start of the 2003 - 04 income year as if references in those subparagraphs to an amount being non - assessable non - exempt income were references to the amount being neither assessable income nor exempt income.

(2) Paragraphs 15 - 60(3)(b) and 320 - 112(3)(b) of the Income Tax Assessment Act 1997 have effect during any period starting before the start of the 2003 - 04 income year as if references in those paragraphs to an amount being non - assessable non - exempt income were references to the amount being neither assessable income nor exempt income.