Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Application of amendments

1 Application

The amendments made by this Schedule apply in relation to an income year that begins on or after 1 July 2001.

Part 2 -- Exemption of certain special purpose entities

Income Tax Assessment Act 1997

2 After section 820 - 37

Insert:

820 - 39 Exemption of certain special purpose entities

( 1 ) Subdivision 820 - B, 820 - C, 820 - D or 820 - E does not apply to disallow any * debt deduction of an entity for an income year if the entity meets the conditions in subsection (3) throughout the income year.

( 2 ) Subdivision 820 - B, 820 - C, 820 - D or 820 - E does not apply to disallow any * debt deduction of an entity for an income year that is an amount incurred by the entity during a part of that year, if the entity meets the conditions in subsection (3) throughout that part.

( 3 ) The conditions are:

( a ) the entity is one established for the purposes of managing some or all of the economic risk associated with assets, liabilities or investments (whether the entity assumes the risk from another entity or creates the risk itself); and

( b ) the total value of * debt interests in the entity is at least 50% of the total value of the entity's assets; and

( c ) the entity is an insolvency - remote special purpose entity according to criteria of an internationally recognised rating agency that are applicable to the entity's circumstances.

( 4 ) The condition in paragraph (3)(c) can be met without the rating agency determining that the entity meets those criteria.

Note 1: While an entity meets the conditions in subsection (3), it is treated for the purposes of this Division as not being:

Note 2: An entity that does not qualify for the exemption in this section may still be a securitisation vehicle under subsection 820 - 942(2), in which case the value of its securitised assets will count towards its zero - capital amount under Subdivision 820 - K.

Multi - tier special purpose entities

( 5 ) An entity is taken to meet the conditions in subsection (3) throughout a period that is all or part of an income year, if the entity is one of 2 or more entities that together satisfy the condition that, assuming:

( a ) each of the entities had been a division or part of the same entity (the notional entity ), rather than a separate entity, throughout that period; and

( b ) the notional entity had consisted only of those divisions and parts throughout that period;

the notional entity would meet the conditions in subsection (3) throughout that period.

3 After subsection 820 - 550

Insert:

820 - 552 Treatment of exempt special purpose entities

( 1 ) The fact that an entity meets the conditions in subsection 820 - 39(3) (about insolvency - remote special purpose entities established to manage economic risk) throughout a period ending at the end of an income year does not prevent the entity from being in a * resident TC group for that income year.

( 2 ) However, the entity is treated as not being in that group for the purposes of sections 820 - 550, 820 - 555, 820 - 565 and 820 - 575.

( 3 ) While an entity meets the conditions in subsection 820 - 39(3), it is treated for the purposes of this Division (except this section) as not being in a * resident TC group that it is in.

Note: This section has the effect that the circumstances of the entity are not taken into account in applying this Division to the resident TC group. The entity itself is exempt from this Division because of section 820 - 39.

4 After subsection 820 - 583

Insert:

820 - 584 Exempt special purpose entities treated as not being member of group

While an entity meets the conditions in subsection 820 - 39(3) (about insolvency - remote special purpose entities established to manage economic risk), the entity is treated for the purposes of this Division (except this section) as not being a * member of a * consolidated group or * MEC group of which it is a member.

Note: This section has the effect that the circumstances of the entity are not taken into account in applying this Division to the head company of the group. The entity itself is exempt from this Division because of section 820 - 39.

5 At the end of 820 - 942(2)

Add:

Note: An entity that does not qualify as a securitisation vehicle may be exempt from the thin capitalisation rules under section 820 - 39.

Part 3 -- Choice by some financial entities to be treated as ADIs for thin capitalisation purposes

Income Tax Assessment Act 1997

6 After Subdivision 820 - E

Insert:

Subdivision 820 - EA -- Some financial entities may choose to be treated as ADIs

Table of sections

820 - 430 When choice can be made, and what effect it has

820 - 435 Conditions

820 - 440 Revocation of choice

820 - 445 How this Subdivision interacts with Subdivisions 820 - F, 820 - FA and 820 - FB

820 - 430 When choice can be made, and what effect it has

( 1 ) An entity may choose to be treated, for the purposes of this Division (except this Subdivision), as set out in the table. However, the entity can make the choice only if subsection (5) is satisfied.

Choice by financial entity to be treated as an ADI | ||

| Column 1 | Column 2 |

Item | For a period that the choice covers, and for which the entity would, apart from this Subdivision, have been: | The entity is treated as if it had instead been: |

1 | an * outward investor (financial) | an * outward investing entity (ADI) |

2 | an * inward investor (financial) | an * inward investing entity (ADI) |

3 | an * inward investment vehicle (financial) | an * outward investing entity (ADI) |

( 2 ) The choice:

( a ) has effect accordingly, except as provided in subsection (4); and

( b ) ceases to have effect only as provided in this Subdivision; and

( c ) covers each period:

( i ) that started on or after a day specified in the choice (or on the day the choice is made if no day is specified); and

( ii ) that is all or part of an income year.

( 3 ) Subdivision 820 - E applies to the entity, in relation to a period for which this section treats it as an * inward investing entity (ADI), as if all the entity's * business were banking business of the entity.

( 4 ) The choice does not have effect for the purposes of determining whether the entity is covered by paragraph 820 - 910(2)(a) (about working out the associate entity debt of another entity).

Conditions for making the choice

( 5 ) For the income year that is or includes the first period for which the entity would be treated in accordance with the choice, the entity must satisfy:

( a ) subsection 820 - 435(1); or

( b ) subsections 820 - 435(2) and (3).

Also, the entity must not have made a previous choice under this section that has ceased to have effect.

Conditions are retested every 3 years

( 6 ) The choice ceases to have effect, or is taken to have ceased to have effect, as appropriate, at the end of an income year covered by subsection (7) of this section, unless the entity:

( a ) satisfies subsection 820 - 435(1) for that income year; or

( b ) satisfies subsections 820 - 435(2) and (3) for that income year.

( 7 ) This subsection covers every third income year after the one referred to in subsection (5).

( 1 ) An entity satisfies this subsection for an income year if the average value, for that income year, of the entity's * on - lent amount is at least 80% of the average value, for that income year, of all the entity's assets.

( 2 ) An entity satisfies this subsection for an income year if the first period that is all or part of that income year, and for which the entity would be treated in accordance with a choice under section 820 - 430, consists of one or more periods, each of which is either or both of these:

( a ) a period throughout which the entity is a * financial entity because of paragraph (d) of the definition of financial entity in subsection 995 - 1(1) (which covers licensed (or exempt) dealers in derivatives);

( b ) a period throughout which:

( i ) the entity is the * head company of a * consolidated group or * MEC group; and

( ii ) at least one * member of the group is a financial entity because of that paragraph.

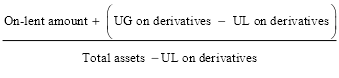

( 3 ) An entity satisfies this subsection for an income year if it satisfies subsection (2) and the amount worked out using this formula is greater than or equal to 0.8:

where:

"on-lent amount" means the average value, for that income year, of the entity's * on - lent amount.

"total assets" means the average value, for that income year, of all the entity's assets.

"UG on derivatives" means the average value, for that income year, of the entity's assets consisting of unrealised gains on trading derivatives within the meaning of the Corporations Act 2001 .

"UL on derivatives" means the lesser of:

(a) the average value, for that income year, of the entity's liabilities consisting of unrealised losses on trading derivatives within the meaning of the Corporations Act 2001 ; and

(b) the average value, for that income year, of the entity's assets consisting of unrealised gains on trading derivatives within the meaning of that Act.

On - lent amount increased for financial entity whose assets include precious metals

( 4 ) In working out whether an entity satisfies subsection (1) or (3) for an income year, the average value, for that income year, of the entity's * on - lent amount is increased by the average value, for that income year, of the entity's assets that consist of * precious metals, but only if the entity satisfies subsection (5) for that income year.

( 5 ) An entity satisfies this subsection for an income year if the first period that is all or part of that income year, and for which the entity would be treated in accordance with a choice under section 820 - 430, consists of one or more periods, each of which is either or both of these:

( a ) a period throughout which the entity is a * financial entity;

( b ) a period throughout which:

( i ) the entity is the * head company of a * consolidated group or * MEC group; and

( ii ) at least one * member of the group is a financial entity.

820 - 440 Revocation of choice

( 1 ) A choice under section 820 - 430 can be revoked only with the written approval of the Commissioner. The Commissioner may approve a revocation only if satisfied that the entity's circumstances have changed significantly since the choice was made.

( 2 ) If revoked, the choice does not have effect for a period that starts on or after the day on which the Commissioner's approval is given, unless the revocation is expressed to take effect on an earlier day. In that case, it does not have effect for a period that starts on or after the earlier day.

820 - 445 How this Subdivision interacts with Subdivisions 820 - F, 820 - FA and 820 - FB

Subdivision 820 - F

( 1 ) A choice under section 820 - 430 does not affect how section 820 - 550 (Classification of the resident TC group) applies to a * resident TC group for an income year unless the group could have made a choice under section 820 - 430 covering the whole of that income year if:

(a) the group had been a company throughout the income year; and

(b) each entity in the group had been a division or part of that company, rather than a separate entity, at all times during the income year when the entity was in the group.

Note: To work out the times during the income year when an entity was in the group, see section 820 - 530.

( 2 ) A choice under section 820 - 430 does not have effect for so much of a period as happens while the entity is in a * resident TC group for an income year if, apart from the choice, section 820 - 575 would apply Subdivision 820 - E to the group for that income year as if the group were an * inward investing entity (ADI).

Subdivision 820 - FA

( 3 ) A choice under section 820 - 430 does not have effect for so much of a period as happens while the entity is a * subsidiary member of a * consolidated group or * MEC group.

Note: If the head company of the group makes a choice under that section, that choice will have effect instead.

Subdivision 820 - FB

( 4 ) A choice under section 820 - 430 does not have effect for so much of a period as happens during the grouping period for a choice by the entity under section 820 - 597 or 820 - 599 (about treating foreign bank branches as part of the entity).

Note: Instead, the choice under section 820 - 597 or 820 - 599 will result in the entity being an outward investing entity (ADI) or an inward investing entity (ADI) for the grouping period: see section 820 - 609.

7 Subsection 995 - 1(1) (at the end of the definition of inward investing entity (ADI) )

Add:

Note: Section 820 - 430 allows an inward investor (financial) to be treated as an inward investing entity (ADI) in certain cases.

8 Subsection 995 - 1(1) (at the end of the definition of inward investment vehicle (financial) )

Add:

Note: Section 820 - 430 allows an inward investment vehicle (financial) to be treated as an outward investing entity (ADI) in certain cases.

9 Subsection 995 - 1(1) (at the end of the definition of inward investor (financial) )

Add:

Note: Section 820 - 430 allows an inward investor (financial) to be treated as an inward investing entity (ADI) in certain cases.

10 Subsection 995 - 1(1) (at the end of the definition of outward investing entity (ADI) )

Add:

Note: Section 820 - 430:

11 Subsection 995 - 1(1) (at the end of the definition of outward investor (financial) )

Add:

Note: Section 820 - 430 allows an outward investor (financial) to be treated as an outward investing entity (ADI) in certain cases.

12 Subsection 995 - 1(1)

Insert:

"precious metal" has the same meaning as in the A New Tax System (Goods and Services Tax) Act 1999 .

Part 4 -- Revaluing assets for thin capitalisation purposes

Income Tax Assessment Act 1997

13 At the end of subsection 820 - 680(2)

Add:

Note: The entity must also keep records in accordance with section 820 - 985 about the revaluation, unless the exception in subsection (2A) of this section applies.

14 After subsection 820 - 680(2)

Insert:

Revaluation reflected in statutory financial statements for the same period

(2A) A revaluation of an asset need not comply with subsection (2) if:

( a ) the revaluation is for the purpose of the entity calculating the value of its assets for the purposes of this Division as applying to the entity for a particular period; and

( b ) the entity is required by an Australian law to prepare financial statements for a period that is or includes all or part of that period; and

( c ) those financial statements reflect the revaluation.

External validation of a revaluation made internally

(2B) A revaluation of assets mentioned in paragraph (1)(a) may be made by a person (the internal expert ) if:

( a ) apart from this subsection, paragraph (2)(b) would prevent the internal expert from making the revaluation, but only because, in making it, he or she would be:

( i ) performing duties as an employee of the entity; or

( ii ) providing services under an * arrangement with the entity that is substantially similar to a contract of employment; and

( b ) another person (the external expert ):

( i ) is not prevented by subsection (2) from making the revaluation; and

( ii ) has reviewed the methodology for making it (including the validity of any assumptions to be made, and the accuracy and reliability of the data and other information to be used); and

( iii ) has agreed that that methodology is suitable for making it; and

( c ) the internal expert makes the revaluation in accordance with that methodology.

Revaluation of individual assets

(2C) Subsection (1) does not prevent the entity from revaluing one or more assets in a class of assets (as distinct from revaluing all the assets in the class) if the value of no asset in that class has fallen since the entity last calculated the total value of all the assets in that class in accordance with the * accounting standards.

When further revaluation of assets required

(2D) If:

( a ) the entity revalues one or more assets (whether constituting a class of assets or not) for the purpose of calculating the value of its assets for the purposes of this Division as applying to the entity for a particular period (the first period ); and

( b ) the revaluation is not required by the * accounting standards; and

( c ) if the revaluation had been required by the accounting standards, the entity could have relied on it in preparing financial statements that the entity is required by an Australian law to prepare for a period (the later period ) that ends after the first period;

the entity may also rely on the revaluation in calculating the value of its assets for the purposes of this Division as applying to the entity for a period that is or includes all or part of the later period.

(2E) If subsection (2D) does not permit the entity to rely on the revaluation in calculating the value of its assets for the purposes of this Division as applying to the entity for a period that is later than the first period, the revaluation is disregarded in determining whether subsection (1) requires the entity to revalue the one or more assets in calculating the value of its assets for those purposes.

Note: As a result, the entity may not be required to make a further revaluation of the one or more assets. However, if the entity does not, it must use the value of the one or more assets that is reflected in financial statements for the relevant period that comply with the accounting standards.

Accounting standards need not otherwise apply to the entity

15 After section 820 - 980

Insert:

Records about asset revaluations

820 - 985 Methodology of revaluation and independence of valuer

(1) An entity must keep records under this section for a revaluation of assets mentioned in subsection 820 - 680(2) (except a revaluation that need not comply with that subsection because of subsection 820 - 680(2A)).

(2) The records must contain particulars about:

( a ) the methodology used in making the revaluation (including any assumptions made); and

( b ) how that methodology was applied (including the data and other information used); and

( c ) who made the revaluation; and

( d ) that person's qualifications and experience as an expert in valuing assets of the relevant kind; and

( e ) the remuneration and expenses paid to that person.

(3) If the revaluation was made in accordance with subsection 820 - 680(2B) (about external validation of a revaluation made internally), the records must also contain particulars of:

( a ) who was the external expert referred to in that subsection; and

( b ) his or her qualifications and experience as an expert in valuing assets of the relevant kind; and

( c ) the remuneration and expenses paid to him or her; and

( d ) his or her review of the methodology for making the revaluation (as required by subparagraph 820 - 680(2B)(b)(ii)); and

( e ) his or her agreement that the methodology is suitable for making it (as required by subparagraph 820 - 680(2B)(b)(iii)).

(4) The entity must prepare the records before the time by which the entity must lodge its * income tax return for the income year in relation to all or a part of which the revaluation is made.

Note: A person must comply with the requirements in section 262A of the Income Tax Assessment Act 1936 about the keeping of these records (see subsections (2AA) and (3) of that section) .

Income Tax Assessment Act 1936

16 Subsection 262A(2AA)

Omit "or 820 - 980", substitute ", 820 - 980 or 820 - 985".

17 At the end of subsection 262A(3)

Add:

; and (e) for records required to be kept under section 820 - 985 of that Act--comply with subsections (2) and (3) of that section.

Part 5 -- Arrangements for borrowing securities

Income Tax Assessment Act 1997

18 Subsection 820 - 85(3) (step 4 of the method statement)

Repeal the step, substitute:

Step 4. If the entity is a * financial entity throughout the relevant year, add to the result of step 3 the average value, for the relevant year, of the entity's * borrowed securities amount.

19 Subsection 820 - 120(2) (step 4 of the method statement)

Repeal the step, substitute:

Step 4. If the entity is a * financial entity throughout that period, add to the result of step 3 the average value, for that period, of the entity's * borrowed securities amount.

20 Subsection 820 - 185(3) (step 3 of the method statement)

Repeal the step, substitute:

Step 3. If the entity is a * financial entity throughout the relevant year, add to the result of step 2 the average value, for the relevant year, of the entity's * borrowed securities amount.

21 Subsection 820 - 225(2) (step 3 of the method statement)

Repeal the step, substitute:

Step 3. If the entity is a * financial entity throughout that period, add to the result of step 2 the average value, for that period, of the entity's * borrowed securities amount.

22 Subsection 820 - 942(1) (step 1 of the method statement)

Repeal the step, substitute:

Step 1. Work out the total value, as at that particular time, of all the assets of the entity that represent * debt interests that:

(a) are of a kind commonly dealt in by entities that carry on a * business of dealing in securities; and

(b) the entity has sold under a reciprocal purchase agreement (otherwise known as a repurchase agreement), sell - buyback arrangement or securities loan arrangement; and

(c) the entity has not yet repurchased under the agreement or arrangement.

23 Subsection 820 - 942(1) (after step 3 of the method statement)

Insert:

Step 3A. Add to the result of step 3 the total value, as at that time, of all the assets of the entity, to the extent that they:

(a) consist of rights to the return of assets covered by subsection (2A); and

(b) are covered by none of steps 1, 2 and 3.

24 Subsection 820 - 942(1) (step 4 of the method statement)

Omit "step 3", substitute "step 3A".

25 After subsection 820 - 942(1)

Insert:

(2A) This subsection covers an asset that:

( a ) the entity provided as security for the performance of its obligations in relation to securities it acquired under a reciprocal purchase agreement (otherwise known as a repurchase agreement), sell - buyback arrangement or securities loan arrangement; and

( b ) does not consist of * shares.

26 Subsection 995 - 1(1)

Insert:

"borrowed securities amount" of an entity at a particular time means the total of the liabilities of the entity, to the extent that they meet these conditions:

( a ) the value of the liability at that time is worked out by reference to the value at that time of securities that the entity has short sold;

( b ) as at that time, the entity has settled the sale using securities it acquired under one or more of these * arrangements:

( i ) a reciprocal purchase agreement (otherwise known as a repurchase agreement);

( ii ) a sell - buyback arrangement;

( iii ) a securities loan arrangement.

27 Subsection 995 - 1(1) (at the end of the definition of non - debt liabilities )

Add:

; or (e) a liability of the entity, to the extent that it meets the conditions for being taken into account in working out the * borrowed securities amount of the entity as at that time.

28 Subsection 995 - 1(1) (at the end of the definition of on - lent amount )

Add:

; and (d) if the entity:

(i) carries on a * business of dealing in securities; and

(ii) does not carry on that business predominantly for the purposes of dealing in securities with, or on behalf of, the entity's * associates;

all * shares that:

(iii) the entity holds at that time; and

(iv) are listed at that time for quotation in the official list of an * approved stock exchange; and

(v) are not shares in an * associate entity at that time of the entity.

Part 6 -- Definition of financial entity

Income Tax Assessment Act 1997

29 Subsection 995 - 1(1) (paragraph (c) of the definition of financial entity )

Repeal the paragraph, substitute:

(c) an entity that:

( i ) is a financial services licensee within the meaning of the Corporations Act 2001 whose licence covers dealings in at least one of the financial products mentioned in paragraphs 764A(1)(a), (b) and (j) of that Act; or

( ii ) under paragraph 911A(2)(h) or (l) of the Corporations Act 2001 , is exempt from the requirement to hold an Australian financial services licence for dealings in at least one of those financial products;

and carries on a * business of dealing in securities, but not predominantly for the purposes of dealing in securities with, or on behalf of, the entity's * associates;

Note 1: Paragraphs 764A(1)(a), (b) and (j) of the Corporations Act 2001 deal respectively with securities, managed investment products and government debentures, stocks and bonds.

Note 2: Paragraph 911A(2)(h) of that Act exempts financial services provided to wholesale clients in the course of a business that is regulated by an overseas regulatory authority approved by the Australian Securities and Investments Commission (ASIC).

Note 3: Paragraph 911A(2)(l) of that Act empowers ASIC to exempt financial services.

(d) an entity that:

( i ) is a financial services licensee within the meaning of the Corporations Act 2001 whose licence covers dealings in derivatives within the meaning of that Act; or

( ii ) under paragraph 911A(2)(h) or (l) of the Corporations Act 2001 , is exempt from the requirement to hold an Australian financial services licence for dealings in such derivatives;

and carries on a business of dealing in such derivatives, but not predominantly for the purposes of dealing in such derivatives with, or on behalf of, the entity's associates.

Part 7 -- Cost - free debt capital

Income Tax Assessment Act 1997

30 Paragraph 820 - 946(1)(c)

Repeal the paragraph, substitute:

(c) neither section 820 - 35 ($250,000 debt deductions threshold) nor section 820 - 37 (exemption for entity with 90% Australian assets) prevents Subdivision 820 - B, 820 - C, 820 - D or 820 - E from disallowing any * debt deduction of the entity for the income year;

(da) for some or all of that period, the entity does not meet the conditions in subsection 820 - 39(3) (about exemption of certain special purpose entities);

31 At the end of subsection 820 - 946(4)

Add:

However, if the total period for which the interest remains on issue is 180 days or more, this subsection is taken not to have covered the interest at that time.

Part 8 -- Associate entity debt

Income Tax Assessment Act 1997

32 Subsection 820 - 910(2)

Repeal the subsection, substitute:

(2) This section also applies, for the relevant entity, to an * associate entity (a relevant associate entity ) of the relevant entity, if:

( a ) either:

(i) the associate entity is an * outward investing entity (non - ADI), an * inward investment vehicle (general), or an * inward investment vehicle (financial), for the relevant period; or

(ii) the associate entity is an * inward investor (general) or an * inward investor (financial) for the relevant period, and the condition in subsection (2A) of this section is satisfied; and

( b ) neither section 820 - 35 ($250,000 debt deductions threshold) nor section 820 - 37 (exemption for entity with 90% Australian assets) prevents Subdivision 820 - B, 820 - C, 820 - D or 820 - E from disallowing any * debt deduction of the relevant associate entity for the income year; and

( c ) for some or all of the relevant period, the relevant associate entity does not meet the conditions in subsection 820 - 39(3) (about exemption of certain special purpose entities); and

( d ) the relevant associate entity is not an * exempt entity for the income year.

(2A) The condition referred to in subparagraph (2)(a)(ii) is that the relevant period consists of one or more periods each of which is either or both of these:

( a ) a period throughout which the * associate entity carries on its * business in Australia at or through one or more of its * Australian permanent establishments;

( b ) a period throughout which the associate entity holds any of the following assets:

(i) assets that are attributable to the associate entity's Australian permanent establishments;

(ii) other assets that are held for the purposes of producing the associate entity's assessable income.

Part 9 -- Debt deductions for borrowing expenses

Income Tax Assessment Act 1997

33 Paragraph 820 - 40(1)(c)

Repeal the paragraph, substitute:

(c) the cost is not incurred before 1 July 2001 if the entity can deduct it under section 25 - 25 of this Act or section 67 of the Income Tax Assessment Act 1936 .

Note: The sections referred to in paragraph (c) spread deductions for borrowing expenses over up to 5 years in most cases.

Part 10 -- Foreign controlled Australian partnerships

Income Tax Assessment Act 1997

34 Paragraph 820 - 795(2)(a)

Repeal the paragraph, substitute:

(a) at least one of the partners is an * Australian entity; and

Part 11 -- Arm's length debt amount

Income Tax Assessment Act 1997

35 Paragraph 820 - 105(2)(d)

Omit "paragraph (e)", substitute "paragraphs (e), (f) and (g)".

36 At the end of subsection 820 - 105(2)

Add:

; (f) the entity's only activities during that year were the Australian business;

(g) the entity's only assets and liabilities during that year were those referred to in paragraph (c) of this subsection.

However, the assumptions set out in paragraphs (f) and (g) of this subsection are not to be made in taking into account the relevant factors mentioned in subsection (3).

37 Paragraph 820 - 215(2)(d)

Omit "paragraph (e)", substitute "paragraphs (e), (f) and (g)".

38 At the end of subsection 820 - 215(2)

Add:

; (f) the entity's only activities during that year were the Australian business;

(g) the entity's only assets and liabilities during that year were those referred to in paragraph (c) of this subsection.

However, the assumptions set out in paragraphs (f) and (g) of this subsection are not to be made in taking into account the relevant factors mentioned in subsection (3).

Part 12 -- Maximum allowable debt

Income Tax Assessment Act 1997

39 Paragraph 820 - 90(1)(c)

Before "the", insert "unless the entity has * worldwide equity of a negative amount--".

Part 13 -- Non - debt liabilities

Income Tax Assessment Act 1997

40 Subsection 995 - 1(1) (paragraph (c) of the definition of non - debt liabilities )

Repeal the paragraph, substitute:

(c) if the entity is a * corporate tax entity--a provision for a * distribution of profit; or

(ca) if paragraph (c) does not apply--a provision for a distribution to the entity's * members; or