Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

Income Tax Assessment Act 1997

1 Section 10 - 5 (table item headed "dividends")

Insert:

benefit of LIC capital gain through a trust or partnership . | 115 - 280 |

2 Section 12 - 5 (table item headed "dividends")

Insert:

dividends including LIC capital gain component ...... | 115 - 280 |

3 At the end of subsection 102 - 3(2)

Add:

Note: Shareholders in a listed investment company can also receive a concession equivalent to a discount capital gain: see Subdivision 115 - D.

4 Subsection 104 - 70(7) (heading)

Omit " Exception ", substitute " Exceptions ".

5 At the end of section 104 - 70

Add:

(8) CGT event E4 does not happen to the extent that the payment is reasonably attributable to a * LIC capital gain.

6 Subsection 110 - 25(8) (after table item 3)

Insert:

4 | A listed investment company | The company |

7 Subsection 114 - 5(2) (after table item 3)

Insert:

4 | A listed investment company | The company |

8 At the end of section 115 - 1

Add:

Special rules apply to certain capital gains made by listed investment companies to enable shareholders receiving dividends that include these gains to obtain benefits similar to those conferred by the CGT discount.

9 At the end of subsection 115 - 20(1)

Add:

Note: A listed investment company must also calculate capital gains without reference to indexation in order to allow its shareholders to access the concessions in Subdivision 115 - D.

10 At the end of Division 115

Add:

Subdivision 115 - D -- Tax relief for shareholders in listed investment companies

115 - 275 What this Subdivision is about

This Subdivision allows shareholders of certain listed companies to obtain benefits similar to those conferred by discount capital gains.

The benefits accrue where dividends paid by those companies represent capital gains that would be discount capital gains had they been made by an individual, a trust or a complying superannuation entity.

Table of sections

Operative provisions

115 - 280 Deduction for certain dividends

115 - 285 Meaning of LIC capital gain

115 - 290 Meaning of listed investment company

115 - 295 Maintaining records

[This is the end of the Guide.]

115 - 280 Deduction for certain dividends

(1) You can deduct an amount for a * dividend paid to you by a company (the payment company ) if:

(a) you are:

(i) an individual, a * complying superannuation entity, a trust or a partnership; or

(ii) a * life insurance company where the dividend is in respect of * shares that are * virtual PST assets; and

(b) you are an Australian resident when the dividend is paid; and

(c) all or some part of the dividend is reasonably attributable to a * LIC capital gain made by a * listed investment company; and

(d) in a case where the LIC capital gain was made by a company other than the payment company--the payment company was a listed investment company when it received a dividend part of which is attributable to the LIC capital gain.

Note: The concession is available for LIC capital gains made directly by a listed investment company, and for LIC capital gains that company receives as a dividend through one or more other listed investment companies.

(2) The amount you can deduct is:

(a) 50% of your share of the amount (the attributable part ) worked out under subsection ( 3) if you are an individual, a trust (except a trust that is a * complying superannuation entity) or a partnership; or

(b) 33 1 / 3 % of your share of the attributable part if you are a complying superannuation entity or a * life insurance company.

Note 1: The listed investment company will advise you of your share of the attributable part.

Note 2: If a shareholder in a listed investment company is a trust or partnership, a beneficiary of the trust or a partner in the partnership has no share of the attributable part.

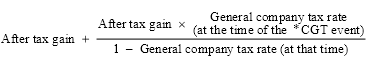

(3) The attributable part is worked out using this formula:

where:

"after tax gain" is the after tax * LIC capital gain.

Example: A listed investment company disposes of a CGT asset for $30,000. The asset had a cost base of $10,000. The capital gain is therefore $20,000. The company applies a capital loss of $10,000 against the gain. Its net capital gain is $10,000.

The net capital gain is subject to tax at 30%. The after tax gain is therefore $7,000.

The company pays a fully franked dividend to Daryl, one of its shareholders. It advises Daryl that his share of the attributable part of the dividend is:

![]()

Daryl, being an individual, can deduct 50% of $10, which is $5.

(4) An amount is included in your assessable income if:

(a) a deduction is allowed under subsection ( 1) to a trust or a partnership; and

(b) you are a beneficiary of the trust or a partner in the partnership and you are not an individual; and

(c) the income of the trust or partnership is reduced by an amount because of that deduction; and

(d) a part of the deduction (the reduction amount ) is reflected in your share of the net income of the trust or partnership.

(5) The amount included is:

(a) the reduction amount if you are a company, a trust (except a trust that is a * complying superannuation entity) or a partnership; or

(b) one - third of the reduction amount if you are a complying superannuation entity or a * life insurance company.

Example: The Burnett Partnership received a dividend from a listed investment company. The dividend statement advised that the dividend included a $100 attributable part. The partnership deducted $50 under this section in calculating its net income.

The partnership has 2 equal partners, Amy Burnett and Burnett Consulting Pty Ltd.

Burnett Consulting's assessable income includes its share of the net income of the partnership plus $25 (being that part of the $50 deduction allowed to the partnership that is reflected in the company's share of the partnership net income).

Subsections ( 4) and (5) do not apply to Amy because she is an individual.

115 - 285 Meaning of LIC capital gain

(1) A LIC capital gain is a * capital gain:

(a) from a * CGT event that happens on or after 1 July 2001; and

(b) that is made by a company that is a * listed investment company from a * CGT asset that is an investment to which paragraph 115 - 290(1)(c) applies; and

(c) that meets the requirements of sections 115 - 20 and 115 - 25; and

(d) that is not a capital gain that could not be a * discount capital gain had it been made by an individual because of section 115 - 40 or 115 - 45; and

(e) that is included in the * net capital gain of the company; and

(f) that is reflected in the taxable income of the company for the income year in which the company had the net capital gain.

Note 1: The listed investment company must be able to demonstrate that at least some part of the LIC capital gain, whether made by the company itself or by another listed investment company, remains after claiming deductions and losses against that income for the income year.

Note 2: Section 115 - 30 may affect the date of acquisition of a CGT asset for the purposes of sections 115 - 25, 115 - 40 and 115 - 45.

(2) However, a * capital gain made by a company is not a LIC capital gain if the company:

(a) became a * listed investment company after 1 July 2001; and

(b) * acquired the * CGT asset concerned before the day on which it became a listed investment company.

(3) In applying subsection ( 2), a * CGT asset is treated as if it had been * acquired by the company before it became a * listed investment company if the asset would otherwise be treated as being acquired after that time because of one of these provisions:

(a) section 70 - 110 (about trading stock);

(b) Subdivision 124 - E or 124 - F (replacement asset roll - overs for exchange of * shares, units, rights or options);

(c) Subdivision 126 - B (same - asset roll - over for transfers within a wholly - owned group).

115 - 290 Meaning of listed investment company

(1) A listed investment company is a company:

(a) that is an Australian resident; and

(b) * shares in which are listed for quotation on the official list of the Australian Stock Exchange Limited or of a body corporate that is approved as a stock exchange under section 769 of the Corporations Act 2001 ; and

(c) at least 90% of the * market value of whose * CGT assets consists of investments permitted by subsection ( 4).

(2) A company is also a listed investment company if:

(a) it is a 100% subsidiary of a company that is a * listed investment company because of subsection ( 1); and

(b) the subsidiary would be a listed investment company because of subsection ( 1) if it were able to comply with paragraph ( 1)(b).

(3) This Subdivision applies to a company that does not comply with paragraph ( 1)(c) as if it did comply if the failure:

(a) was of a temporary nature only; and

(b) was caused by circumstances outside its control.

(4) The permitted investments are:

(a) * shares, units, options, rights or similar interests to the extent permitted by subsections ( 5), (6), (7) and (8); or

(b) financial instruments (such as loans, debts, debentures, bonds, promissory notes, futures contracts, forward contracts, currency swap contracts and a right or option in respect of a share, security, loan or contract); or

(c) an asset whose main use by the company in the course of carrying on its * business is to derive interest, an annuity, rent, royalties or foreign exchange gains unless:

(i) the asset is an intangible asset and has been substantially developed, altered or improved by the company so that its market value has been substantially enhanced; or

(ii) its main use for deriving rent was only temporary; or

(d) goodwill.

(5) The company can own a * 100% subsidiary if the subsidiary is a listed investment company because of subsection ( 2).

(6) The company can own (directly or indirectly) any percentage of another * listed investment company that is not the company's * 100% subsidiary.

(7) Otherwise, the company cannot own (directly or indirectly) more than 10% of another company or trust.

(8) In working out whether a company indirectly owns any part of another company or trust:

(a) disregard any ownership it has indirectly through a * listed public company or a * publicly traded unit trust; and

(b) if the company owns not more than 50% of another * listed investment company--disregard any ownership it has indirectly through the other company.

A * listed investment company must maintain records showing the balance of its * LIC capital gains available for distribution.

11 At the end of subsection 320 - 205(3)

Add:

; and (f) amounts included in the company's assessable income for the income year under subsection 115 - 280(4).

12 At the end of subsection 320 - 205(4)

Add:

; and (f) the proportion of the amount that the company can deduct for the income year under subsection 115 - 280(1) that is attributable to a * dividend paid to the company by a * listed investment company in respect of virtual PST assets that are * shares in the listed investment company.

13 Subsection 995 - 1(1)

Insert:

"LIC capital gain" has the meaning given by section 115 - 285.

14 Subsection 995 - 1(1)

Insert:

"listed investment company" has the meaning given by section 115 - 290.

15 Application

The amendments made by this Schedule apply to LIC capital gains made by listed investment companies on or after 1 July 2001.