Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsIncome Tax Assessment Act 1997

1 At the end of subsection 87 - 20(1)

Add:

Note: Sections 87 - 35 and 87 - 40 affect the operation of paragraph ( 1)(a) in relation to Australian government agencies and certain agents.

2 After section 87 - 35

Insert:

87 - 40 Application of this Division to certain agents

Object of this section

(1) The object of this section is to modify the operation of this Division for agents who bear entrepreneurial risk in the way they provide services.

Agents covered by this section

(2) Subsection 87 - 15(3) and section 87 - 20 apply, in the manner specified in this section, to an individual or * personal services entity if:

(a) the individual or personal services entity is an agent of another entity (the principal ) but not the principal's employee; and

(b) the agent receives income from the principal that is for services that the agent provides to other entities ( customers ) on the principal's behalf; and

(c) at least 75% of that income is commissions, or fees, based on the agent's performance in providing services to the customers on the principal's behalf; and

(d) the agent actively seeks other entities to whom the agent could provide services on the principal's behalf; and

(e) the agent does not provide any services to the customers, on the principal's behalf, using premises:

(i) that the principal or an * associate of the principal owns; or

(ii) in which the principal or an associate of the principal has a leasehold interest;

unless the agent uses the premises under an arrangement entered into at arm's length.

Whether personal services income is from one source

(3) If the agent is an individual, in applying subsection 87 - 15(3) to the * personal services income of the agent during an income year, any part of the agent's personal services income from the principal that:

(a) the agent gains or produces during the income year; and

(b) is for services that the agent provided to a customer on the principal's behalf in the income year or an earlier income year;

is treated as if it were personal services income from the customer, and not personal services income from the principal.

(4) If the agent is a * personal services entity, in applying subsection 87 - 15(3) to an individual's * personal services income that is included in the entity's * ordinary income or * statutory income during an income year, any part of the individual's personal services income from the principal that:

(a) the agent gains or produces during the income year; and

(b) is for services that the individual or the agent provided to a customer on the principal's behalf in the income year or an earlier income year;

is treated as if it were personal services income from the customer, and not personal services income from the principal.

The unrelated clients test for a personal services business

(5) In determining whether, during an income year, the agent meets the unrelated clients test under section 87 - 20, any services the agent provided in the income year or an earlier income year:

(a) for which the agent gains or produces, during the income year, personal services income from the principal; and

(b) that were provided to a customer on the principal's behalf;

are treated for the purposes of paragraph 87 - 20(1)(a) as if the agent, and not the principal, provided them to the customer.

3 Subsection 995 - 1(1) (definition of agent )

After "(the principal )", insert ", except in section 87 - 40,".

Part 2 -- Personal services business tests

Income Tax Assessment Act 1997

4 Section 87 - 15

Repeal the section, substitute:

87 - 15 What is a personal services business?

(1) An individual or * personal services entity conducts a personal services business if:

(a) for an individual--a * personal services business determination is in force relating to the individual's * personal services income; or

(b) for a personal services entity--a personal services business determination is in force relating to an individual whose personal services income is included in the entity's * ordinary income or * statutory income; or

(c) in any case--the individual or entity meets at least one of the 4 * personal services business tests in the income year for which the question whether the individual or entity is conducting a personal services business is in issue.

Note 1: For personal services business determinations, see Subdivision 87 - B.

Note 2: Under subsection ( 3), the personal services business tests, apart from the results test under section 87 - 18, do not apply if 80% or more of your personal services income is from one source (but they can still be used in deciding whether to make a personal services business determination).

(2) The 4 personal services business tests are:

(a) the results test under section 87 - 18; and

(b) the unrelated clients test under section 87 - 20; and

(c) the employment test under section 87 - 25; and

(d) the business premises test under section 87 - 30.

(3) However, if 80% or more of an individual's * personal services income during an income year is income from the same entity (or one entity and its * associates), and:

(a) the individual's personal services income is not included in a * personal services entity's * ordinary income or * statutory income during an income year, and the individual does not meet the results test under section 87 - 18 in that income year; or

(b) the individual's personal services income is included in a personal services entity's ordinary income or statutory income during an income year, and the entity does not, in relation to the individual, meet the results test under section 87 - 18 in that income year;

the individual's personal services income is not taken to be from conducting a * personal services business unless:

(c) when the personal services income is gained or produced, a * personal services business determination is in force relating to the individual's personal services income; and

(d) if the determination was made on the application of a personal services entity-- the individual's personal services income is income from the entity conducting the personal services business .

Note: Sections 87 - 35 and 87 - 40 affect the operation of subsection ( 3) in relation to Australian government agencies and certain agents.

87 - 18 The results test for a personal services business

(1) An individual meets the results test in an income year if, in relation to at least 75% of the individual's * personal services income (not including income referred to in subsection ( 2)) during the income year:

(a) the income is for producing a result; and

(b) the individual is required to supply the * plant and equipment, or tools of trade, needed to perform the work from which the individual produces the result; and

(c) the individual is, or would be, liable for the cost of rectifying any defect in the work performed.

(2) Paragraph ( 1)(a) does not apply to income:

(a) that the individual receives as an employee; or

(b) that the individual receives as an individual referred to in paragraph 12 - 45(1)(a), (b), (c), (d) or (e) (payments to office holders) in Schedule 1 to the Taxation Administration Act 1953 .

(3) A * personal services entity meets the results test in an income year if, in relation to at least 75% of the * personal services income of one or more individuals that is included in the personal services entity's * ordinary income or * statutory income during the income year:

(a) the income is for producing a result; and

(b) the personal services entity is required to supply the * plant and equipment, or tools of trade, needed to perform the work from which the personal services entity produces the result; and

(c) the personal services entity is, or would be, liable for the cost of rectifying any defect in the work performed.

(4) For the purposes of paragraph ( 1)(a), (b) or (c) or (3)(a), (b) or (c), regard is to be had to whether it is the custom or practice, when work of the kind in question is performed by an entity other than an employee:

(a) for the * personal services income from the work to be for producing a result; and

(b) for the entity to be required to supply the * plant and equipment, or tools of trade, needed to perform the work; and

(c) for the entity to be liable for the cost of rectifying any defect in the work performed;

as the case requires.

4A Subsection 87 - 15(3)

After "income" (first occurring), insert "(not including income referred to in subsection ( 4))".

4B At the end of section 87 - 15

Add:

(4) Subsection ( 3) does not apply to income:

(a) that the individual receives as an employee; or

(b) that the individual receives as an individual referred to in paragraph 12 - 45(1)(a), (b), (c), (d) or (e) (payments to office holders) in Schedule 1 to the Taxation Administration Act 1953 .

4C At the end of subsection 87 - 15(4)

Add:

; or (c) to the extent that it is a payment referred to in section 12 - 47 (payments to * religious practitioners) in that Schedule.

5 At the end of subsection 87 - 18(2)

Add:

; or (c) to the extent that it is a payment referred to in section 12 - 47 (payments to * religious practitioners) in that Schedule.

5A After subsection 87 - 25(2)

Insert:

(2A) If the * personal services entity is a partnership, work that a partner performs is taken, for the purposes of subsection ( 2), to be work that the personal services entity engages another entity to perform.

6 Section 87 - 55

Repeal the section.

Part 3 -- Personal services business determinations

Income Tax Assessment Act 1997

7 Subparagraph 87 - 60(3)(a)(i)

Repeal the subparagraph, substitute:

(i) could reasonably be expected to meet, or met, the results test under section 87 - 18, the employment test under section 87 - 25, the business premises test under section 87 - 30 or more than one of those tests; or

8 Subparagraph 87 - 60(3)(a)(ii)

Omit "3", substitute "4".

9 Subparagraphs 87 - 60(3)(b)(i) and (ii)

Repeal the subparagraphs, substitute:

(i) if subparagraph ( a)(i) applies--the results test under section 87 - 18, the employment test under section 87 - 25, the business premises test under section 87 - 30 or more than one of those tests; or

(ii) if subparagraph ( a)(ii) applies--at least one of the 4 personal services business tests.

10 Paragraph 87 - 60(3)(c)

Repeal the paragraph.

11 Subsections 87 - 60(5), (6) and (7)

Repeal the subsections.

12 Subparagraph 87 - 65(3)(a)(i)

Repeal the subparagraph, substitute:

(i) could reasonably be expected to meet, or met, the results test under section 87 - 18, the employment test under section 87 - 25, the business premises test under section 87 - 30 or more than one of those tests; or

13 Subparagraph 87 - 65(3)(a)(ii)

Omit "3", substitute "4".

14 Subparagraphs 87 - 65(3)(b)(i) and (ii)

Repeal the subparagraphs, substitute:

(i) if subparagraph ( a)(i) applies--the results test under section 87 - 18, the employment test under section 87 - 25, the business premises test under section 87 - 30 or more than one of those tests; or

(ii) if subparagraph ( a)(ii) applies--at least one of the 4 personal services business tests.

15 Paragraph 87 - 65(3)(c)

Repeal the paragraph.

16 Subsections 87 - 65(5), (6) and (7)

Repeal the subsections.

Income Tax Assessment Act 1936

16A Section 202A (definition of payer )

Repeal the definition, substitute:

"payer" means:

(a) a person who makes an eligible PAYG payment (other than an alienated personal services payment), or is likely to make such a payment; or

(b) a person who receives an alienated personal services payment, or is likely to receive such a payment.

16B Section 202A (definition of recipient )

Repeal the definition, substitute:

"recipient" means:

(a) a person who receives an eligible PAYG payment (other than an alienated personal services payment), or is likely to receive such a payment; or

(b) a person in relation to whose personal services income (within the meaning of the Income Tax Assessment Act 1997 ) a payer receives an alienated personal services payment, or is likely to receive such a payment.

16C After section 222AOB

Insert:

(1) The persons who are directors of the company on the payment day in relation to the payment or payments (referred to in paragraph 222AOA(1)(ba)) must cause the company to do at least one of the following before the end of the payment day:

(a) comply with section 13 - 5 and Subdivision 16 - B in Schedule 1 to the Taxation Administration Act 1953 in relation to each payment relating to the payment day;

(b) make an agreement with the Commissioner under section 222ALA in relation to the company's liability under that Subdivision in respect of each such payment;

(c) appoint an administrator of the company under section 436A of the Corporations Act 2001 ;

(d) begin to be wound up within the meaning of that Act.

(2) The payment day is the day on which the company must pay an amount under section 13 - 5 in Schedule 1 to the Taxation Administration Act 1953 to the Commissioner in relation to the payment or payments (referred to in paragraph 222AOA(1)(ba)).

(3) This section is complied with when:

(a) the company complies as mentioned in paragraph ( 1)(a); or

(b) the company makes an agreement as mentioned in paragraph ( 1)(b); or

(c) an administrator of the company is appointed under section 436A, 436B or 436C of the Corporations Act 2001 ; or

(d) the company begins to be wound up within the meaning of that Act;

whichever first happens, even if the directors did not cause the event to happen.

(4) If this section is not complied with before the end of the payment day, the persons who are directors of the company on that day continue to be under the obligation imposed by subsection ( 1) until this section is complied with.

16D After subsection 222AOC(1)

Insert:

(1A) If section 222AOBAA is not complied with before the end of the payment day, each person who is a director of the company on the payment day is liable to pay to the Commissioner, by way of penalty, an amount equal to the unpaid amount or amounts that the company is required to pay under section 13 - 5 in Schedule 1 to the Taxation Administration Act 1953 in respect of the payment or payments relating to the payment day.

16E After subsection 222AOD(1)

Insert:

(1A) If:

(a) after the payment day, a person becomes, or again becomes, a director of the company at a time when section 222AOBAA has not yet been complied with in relation to the payment or payments relating to the payment day; and

(b) at the end of 14 days after the person becomes a director, that section has still not been complied with in relation to that payment or those payments;

the person is liable to pay to the Commissioner, by way of penalty, an amount equal to the unpaid amount of the liability referred to in subsection 222AOC(1A).

16F Paragraph 222AOE(a)

Omit "subsection 222AOC(1) or (2)", substitute "subsection 222AOC(1), (1A) or (2)".

16G Paragraph 222AOG(b)

After "section 222AOB", insert ", 222AOBAA".

Note: The heading to section 222AOG is altered by inserting " , 222AOBAA " after " 222AOB ".

16H Paragraph 222AOH(1)(b)

Omit "subsection 222AOC(1) or (2)", substitute "subsection 222AOC(1), (1A) or (2)".

16J Paragraph 222AOJ(2)(b)

After "subsection 222AOB(1)", insert "or 222AOBAA(1)".

16K Paragraph 222AOJ(3)(a)

After "subsection 222AOB(1)", insert ", 222AOBAA(1)".

Income Tax Assessment Act 1997

16L At the end of section 85 - 20

Add:

(3) An amount or payment that you cannot deduct because of this section is neither assessable income nor * exempt income of your * associate.

16M Subsection 86 - 20(2) (step 1 of the method statement)

After "maintenance deductions", insert "or deductions for amounts of salary or wages paid to you".

16N At the end of subsection 86 - 35(2)

Add "or entitled to receive it".

17 Sections 87 - 1 and 87 - 5

Repeal the sections, substitute:

87 - 1 What this Division is about

Divisions 85 and 86 do not apply to personal services income that is income from conducting a personal services business.

It is not intended that the Divisions apply to independent contractors.

A personal services business exists if there is a personal services business determination or if one or more of 4 tests for what is a personal services business are met.

Regardless of how much of your personal services income is paid from one source, you can self - assess against the results test to determine whether you are an independent contractor. The results test is based on the traditional tests for determining independent contractors and it is intended that it apply accordingly.

However, you cannot "self - assess" whether you meet any of the other 3 tests if 80% or more of your personal services income is from one source. In these cases, you need a personal services business determination in order to be treated as conducting a personal services business.

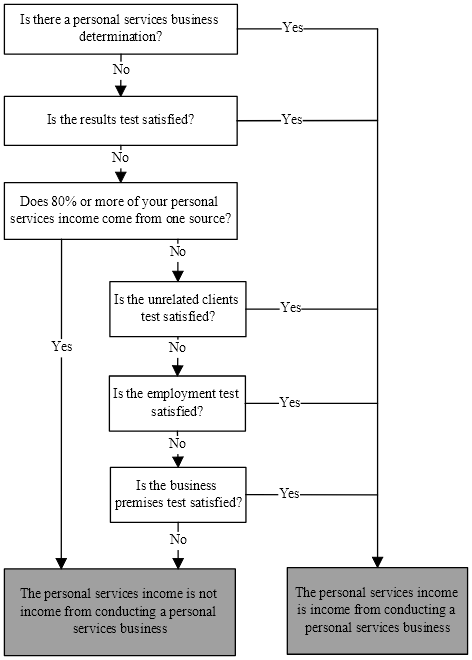

87 - 5 Diagram showing the operation of this Division

This diagram shows how this Division operates to ascertain whether personal services income is income from conducting a personal services business.

Taxation Administration Act 1953

18 Subsection 13 - 15(3) in Schedule 1

Omit all the words after "if", substitute:

it is reasonable to expect that:

(a) the entity will receive at least 80% of that income from the same entity (or one entity and its * associates) ; and

(b) the entity will not meet the results test under section 87 - 18 of the Income Tax Assessment Act 1997 .

18A Paragraph 45 - 120(3)(b) in Schedule 1

Omit " * amounts", substitute "amounts".

19 Application

(1) The amendments made by this Schedule (other than items 4A, 4B, 16C to 16J, 16L, 18 and 18A) apply, and are taken to have applied, to assessments for the 2000 - 2001 income year and later income years.

(2) However, a declaration made under subitem 26(2) of Schedule 1 to the New Business Tax System (Alienation of Personal Services Income) Act 2000 has effect, and is taken to have had effect, in relation to the amendments made by this Schedule in the same way that it has, and had, effect in relation to the amendments made by Part 1 of that Schedule.

(2A) The amendments made by items 4A, 4B, 4C and 16M apply to assessments for the 2002 - 2003 income year and later income years.

(2B) The amendments made by items 16C to 16K apply on and after the day on which this Act receives the Royal Assent.

(3) Item 18 applies, and is taken to have applied, to an amount received, or a non - cash benefit provided, on or after 1 July 2000.

(4) Item 18A applies to an amount received, or a non - cash benefit provided, on or after 1 July 2002.

Notes to the Taxation Laws Amendment Act (No. 6) 2001

Note 1

The Taxation Laws Amendment Act (No. 6) 2001 as shown in this compilation comprises Act No. 169, 2001 amended as indicated in the Tables below.

Table of Acts

Act | Number | Date | Date of commencement | Application, saving or transitional provisions |

Taxation Laws Amendment Act (No. 6) 2001 | 169, 2001 | 1 Oct 2001 | See s. 2 |

|

Taxation Laws Amendment Act (No. 2) 2002 | 57, 2002 | 3 July 2002 | Schedule 12 (items 57 -59 ): (a) | -- |

Tax Laws Amendment (2010 Measures No. 2) Act 2010 | 75, 2010 | 28 June 2010 | Schedule 6 (item 92): 29 June 2010 | -- |

(a) Subsection 2(1) (items 57 and 58) of the Taxation Laws Amendment Act (No. 2) 2002 provides as follows:

(1) Each provision of this Act specified in column 1 of the table commences, or is taken to have commenced, on the day or at the time specified in column 2 of the table.

Commencement information | ||

Column 1 | Column 2 | Column 3 |

Provision(s) | Commencement | Date/Details |

57. Schedule 12, item 57 | Immediately after the time specified in the Taxation Laws Amendment Act (No. 6) 2001 for the commencement of item 11 of Schedule 5 to that Act | 1 October 2001 |

58. Schedule 12, items 58 and 59 | Immediately after the time specified in the Taxation Laws Amendment Act (No. 6) 2001 for the commencement of item 16L of Schedule 6 to that Act | 1 October 2001 |

Table of Amendments

ad. = added or inserted am. = amended rep. = repealed rs. = repealed and substituted | |

Provision affected | How affected |

S. 4 .................... | rep. No. 75, 2010 |

Schedule 5 |

|

Item 11 ................. | am. No. 57, 2002 |

Schedule 6 |

|

Heading before item 16L ..... | ad . No. 57, 2002 |

Heading before item 17 ...... | rep. No. 57, 2002 |