Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

A New Tax System (Goods and Services Tax) Act 1999

1 Section 9 - 39 (after table item 3)

Insert:

3A | Compulsory third party schemes | Division 79 |

2 Section 9 - 39 (after table item 8A)

Insert:

8B | Settlement sharing arrangements | Division 80 |

3 Section 9 - 99 (after table item 2)

Insert:

2A | Compulsory third party schemes | Division 79 |

4 Section 11 - 99 (after table item 2)

Insert:

2A | Compulsory third party schemes | Division 79 |

5 Section 11 - 99 (after table item 14)

Insert:

15 | Settlement sharing arrangements | Division 80 |

6 Section 17 - 99 (after table item 4)

Insert:

4AA | Compulsory third party schemes | Division 79 |

7 Section 17 - 99 (after table item 12)

Insert:

12AA | Settlement sharing arrangements | Division 80 |

8 Section 19 - 99 (before table item 1A)

Insert:

1AA | Compulsory third party schemes | Division 79 |

9 Section 19 - 99 (after table item 2)

Insert:

3 | Settlement sharing arrangements | Division 80 |

10 Section 37 - 1 (after table item 8)

Insert:

8A | Compulsory third party schemes | Division 79 |

11 Section 37 - 1 (after table item 29)

Insert:

29AA | Settlement sharing arrangements | Division 80 |

12 At the end of subsection 72 - 5(3)

Add "or by an entity (other than an * operator) settling a claim under a * compulsory third party scheme".

13 At the end of subsection 72 - 40(3)

Add "or by an * operator settling a claim under a * compulsory third party scheme".

14 At the end of section 78 - 1

Add:

Note: Payments and supplies under compulsory third party schemes are dealt with in some cases under this Division and in others under Division 79 or 80.

15 After paragraph 78 - 50(1)(c)

Insert:

; and (d) the insurance policy was not issued under a * compulsory third party scheme.

16 At the end of section 78 - 105

Add:

; but does not include a * compulsory third party scheme.

Note: Divisions 79 and 80 deal with compulsory third party schemes.

17 Saving of existing regulations

The amendment of section 78 - 105 of the A New Tax System (Goods and Services Tax) Act 1999 by this Schedule does not affect the validity of regulations made for the purposes of that section, to the extent that the regulations do not relate to compulsory third party schemes.

18 After Division 78

Insert:

Division 79 -- Compulsory third party schemes

79 - 1 What this Division is about

Operators of compulsory third party schemes have adjustments which enable the net GST on the schemes to reflect correctly their margins after settlements of claims and other payments and supplies under the schemes are taken into account.

The normal application of Division 78 to some insurance policy payments and supplies under the schemes is modified (see Subdivision 79 - A). That Division is also extended so that it applies in a modified form to payments and supplies connected with, but not under, insurance policies (see Subdivision 79 - B). For other settlements, and payments, provisions similar to Division 78 apply (see Subdivision 79 - C). Certain adjustments are worked out using an "applicable average input tax credit fraction" (see Subdivision 79 - D).

Note: Division 80 deals with use of settlement sharing arrangements by the operators of compulsory third party schemes.

Table of Subdivisions

79 - A Modified application of Division 78 to certain compulsory third party scheme payments and supplies under insurance policies

79 - B Extension of Division 78 to cover certain compulsory third party scheme payments and supplies connected with, but not under, insurance policies

79 - C Other payments and supplies under compulsory third party schemes

79 - D Compulsory third party scheme decreasing adjustments worked out using applicable average input tax credit fraction

(1) This section applies to a payment or supply if:

(a) it is a payment or supply made under a * compulsory third party scheme; and

(b) the payment or supply is made in settlement of a claim under an * insurance policy; and

(c) the * premium selection test is satisfied; and

(d) the payment or supply is not a payment or supply to which section 79 - 15 (about sole operator elections) applies.

Premium selection test

(2) The premium selection test is satisfied if the amount of the premium or premiums for the policy resulted from:

(a) an * operator of the * compulsory third party scheme offering a number of different premium amounts to the entity liable to pay the premium or premiums; and

(b) that entity selecting a premium amount:

(i) that was offered on the basis that there would be an entitlement to an input tax credit for some or all of the amount; or

(ii) that was offered on the basis that there would be no entitlement to an input tax credit for any of the amount.

Input tax credit entitlement

(3) If subparagraph (2)(b)(i) applies, then, for the purposes of sections 78 - 10 and 78 - 15:

(a) there is taken to be an entitlement to an input tax credit for the premium paid in relation to the period during which the event giving rise to the claim happened; and

(b) if the supply of the insurance policy was solely or partly a * taxable supply--the amount of the input tax credit is taken to equal the GST payable by the * operator for the taxable supply.

No input tax credit entitlement

(4) If subparagraph (2)(b)(ii) applies, then, for the purposes of sections 78 - 10 and 78 - 15, there is taken to be no entitlement to an input tax credit for the premium paid in relation to the period during which the event giving rise to the claim happened.

Decreasing adjustment

(1) If:

(a) subsection 79 - 5(3) applies to a payment or supply; and

(b) after the * premium selection test was satisfied, the * operator became or becomes aware that there was actually no entitlement to an input tax credit for any of the amount of the premium or premiums paid in relation to the period during which the event giving rise to the claim happened; and

(c) if subsection 79 - 5(4) had applied, the operator would have been entitled to a * decreasing adjustment (the notional decreasing adjustment );

then:

(d) the operator has a decreasing adjustment whose amount is, subject to paragraph (e), equal to the notional decreasing adjustment; and

(e) if one or more * increasing adjustments (each being a notional section 78 - 40 increasing adjustment ) would have arisen, before the decreasing adjustment under paragraph (d) arose, under Division 19 because of section 78 - 40 applying in relation to the notional decreasing adjustment, the amount of the decreasing adjustment under paragraph (d) is reduced by the sum of the notional section 78 - 40 increasing adjustments; and

(f) for the purposes of applying section 78 - 40 after the decreasing adjustment arises under this subsection, that decreasing adjustment is taken to arise under Division 78.

Increasing adjustment

(2) If:

(a) subsection 79 - 5(4) applies to a payment or supply; and

(b) as a result, the * operator has a * decreasing adjustment (the original decreasing adjustment); and

(c) after the * premium selection test was satisfied, the operator becomes aware that there actually was an entitlement to an input tax credit for some or all of the amount of the premium or premiums paid in relation to the period during which the event giving rise to the claim happened;

then:

(d) the operator has an increasing adjustment whose amount is, subject to paragraph (e), equal to the original decreasing adjustment; and

(e) if one or more * increasing adjustments (each being a section 78 - 40 increasing adjustment ) arose, before the increasing adjustment under paragraph (d) arose, under Division 19 because of section 78 - 40 applying in relation to the original decreasing adjustment, the amount of the increasing adjustment under paragraph (d) is reduced by the sum of the section 78 - 40 increasing adjustments; and

(f) after the increasing adjustment arises under paragraph (d), no adjustment arises under Division 19 because of section 78 - 40 applying in relation to the original decreasing adjustment.

(1) This section applies to a payment or supply if:

(a) it is a payment or supply made under a * compulsory third party scheme; and

(b) the payment or supply is made in settlement of a claim under an * insurance policy; and

(c) there is only one * operator who issues insurance policies under the scheme; and

(d) assuming the requirements of paragraph 78 - 10(2)(b) were satisfied, the operator would have a * decreasing adjustment under section 78 - 10 in respect of the payment or supply; and

(e) an election under subsection (4) is in force during the * financial year in which the payment or supply is made.

(2) For the purposes of section 78 - 10, the * operator has a * decreasing adjustment under that section in relation to the payment or supply.

(3) Section 78 - 15 does not apply to the * decreasing adjustment, but its amount is instead worked out using the applicable * average input tax credit fraction (see section 79 - 95).

(4) The * operator may, in writing, elect that, from the start of a specified * financial year, any * decreasing adjustment in relation to the payment or supply is to be worked out using the applicable * average input tax credit fraction.

(5) Subject to subsection (6), the election must be made before the start of the specified * financial year.

(6) Subsection (5) does not apply if the election specifies the * financial year beginning on 1 July 2003 and is made before the end of 30 days after the day on which this section commences.

(7) The election is in force during the specified * financial year and every later financial year, other than one that begins after a financial year in which the election is revoked.

Payments or supplies in settlement of claims

(1) For the purposes of sections 78 - 35, 78 - 40 and 78 - 75, a reference in those sections to a payment or supply made by an entity in settlement of a claim by an insurer in exercising the insurer's rights of subrogation in respect of an * insurance policy includes a reference to a payment or supply that satisfies the following requirements:

(a) the payment or supply is made by an entity in settlement of a claim by an * operator of a * compulsory third party scheme;

(b) the claim was made by the operator in exercise of the operator's rights to recover in respect of a payment or supply made under the compulsory third party scheme;

(c) the claim was not made under an * insurance policy that is a policy of reinsurance.

Payments or supplies in compliance with court judgments etc. relating to claims

(2) For the purposes of section 78 - 110, a reference in that section to a payment or supply made by an entity in compliance with a judgment or order of a court relating to a claim made by an insurer in exercising the insurer's rights of subrogation in respect of an * insurance policy includes a reference to a payment or supply that satisfies the following requirements:

(a) the payment or supply is made by an entity in compliance with a judgment or order of a court relating to a claim made by an * operator of a * compulsory third party scheme;

(b) the claim was made by the * operator in exercise of the operator's rights to recover a payment or supply made under the * compulsory third party scheme;

(c) the claim was not made under an insurance policy that is a policy of reinsurance.

79 - 25 Meaning of CTP hybrid payment or supply

(1) Subject to this section, a payment or supply is a CTP hybrid payment or supply if:

(a) it is made in settlement of a claim for compensation under a * compulsory third party scheme; and

(b) the claim would not have been made but for an * insurance policy issued under the scheme; and

(c) the claim was not made under the insurance policy.

(2) A payment or supply is not a CTP hybrid payment or supply if:

(a) when the payment or supply is made, the entity that paid the premium for the * insurance policy cannot be located; and

(b) that entity did not, at or before the time the * operator making the payment or supply was first made aware of the circumstances to which the payment or supply relates, inform the operator of the entitlement to an input tax credit for the CTP premium it paid; and

(c) the * premium selection test was not satisfied in relation to the insurance policy.

(3) A payment or supply is not a CTP hybrid payment or supply if the * operator making the payment or supply was required to do so by law because of the bankruptcy or insolvency of another operator who is an insurer.

79 - 30 Application of Division 78

(1) Division 78 (other than section 78 - 100), as modified by Subdivision 79 - A, applies in relation to a * CTP hybrid payment or supply as if it were a payment or supply made in settlement of a claim under the * insurance policy mentioned in paragraph 79 - 25(1)(b).

(2) This section does not prevent Division 78 applying to a payment or supply under a * compulsory third party scheme if the payment or supply is made in settlement of a claim under an * insurance policy.

Subdivision 79 - C -- Other payments and supplies under compulsory third party schemes

79 - 35 Meaning of CTP compensation or ancillary payment or supply etc.

Meaning of CTP compensation or ancillary payment or supply

(1) A payment or supply is a CTP compensation or ancillary payment or supply if it is a * CTP compensation payment or supply or a * CTP ancillary payment or supply.

Meaning of CTP compensation payment or supply

(2) A payment or supply is a CTP compensation payment or supply if

(a) it is a payment or supply made under a * compulsory third party scheme; and

(b) it is a payment or supply made in settlement of a claim for compensation under the scheme; and

(c) it is not the case that the * operator making the payment or supply was required to do so by law because of the bankruptcy or insolvency of another operator who is an insurer; and

(d) Division 78 does not apply in relation to the payment or supply; and

(e) the payment or supply is not a * CTP dual premium or election payment or supply or a * CTP hybrid payment or supply.

Meaning of CTP ancillary payment or supply

(3) A payment or supply is a CTP ancillary payment or supply if:

(a) the payment or supply is made under a * compulsory third party scheme; and

(b) the payment or supply is of a kind specified in the regulations; and

(c) it is not the case that the * operator making the payment or supply was required to do so by law because of the bankruptcy or insolvency of another operator who is an insurer; and

(d) Division 78 does not apply in relation to the payment or supply; and

(e) the payment or supply is not a * CTP dual premium or election payment or supply or a * CTP hybrid payment or supply; and

(f) the payment or supply is not made in settlement of a claim for compensation under the scheme; and

(g) the payment or supply is not * consideration for a * creditable acquisition.

79 - 40 GST on CTP premiums is exclusive of stamp duty

(1) The * value of a * taxable supply for which the * consideration includes an amount of * CTP premium is worked out as if the * price of the supply were reduced by the amount of any stamp duty payable under a * State law or * Territory law in respect of the supply.

(2) This section has effect despite section 9 - 75 (which is about the value of taxable supplies).

79 - 45 Exclusion of certain compulsory third party schemes

This Subdivision (other than section 79 - 40) does not apply to a * compulsory third party scheme under which * CTP compensation or ancillary payments or supplies are made, or to a * CTP compensation or ancillary payment or supply, if the compulsory third party scheme is of a kind specified in the regulations.

79 - 50 Decreasing adjustments for CTP compensation or ancillary payments or supplies

(1) An * operator of a * compulsory third party scheme has a decreasing adjustment if the operator makes a * CTP compensation or ancillary payment or supply under the scheme.

(2) However, this section only applies if:

(a) the payments of * CTP premium that have been or are required to be made under the scheme are, or would be, * consideration for a * taxable supply; and

(b) the * operator is * registered or * required to be registered.

(3) The * decreasing adjustment in relation to the payment or supply is worked out using the applicable * average input tax credit fraction (see section 79 - 95).

79 - 55 Increasing adjustments for payments of excess etc. under compulsory third party schemes

(1) An * operator of a * compulsory third party scheme has an increasing adjustment if:

(a) there is a payment of an excess to the operator under the scheme; and

(b) the payment relates to a * CTP compensation payment or supply that the operator makes or has made; and

(c) the operator makes, or has made, * creditable acquisitions or * creditable importations directly for the purpose of making the CTP compensation payment or supply.

(2) The amount of the increasing adjustment is 1 / 11 of the amount that represents the extent to which the payment of excess relates to * creditable acquisitions or * creditable importations made by the * operator directly for the purpose of making the * CTP compensation payment or supply.

(3) An * operator of a * compulsory third party scheme has an increasing adjustment if:

(a) there is a payment of an excess to the operator under the scheme; and

(b) the operator makes, or has made, * creditable acquisitions or * creditable importations directly for the purpose of making a * CTP compensation payment or supply to which the payment of excess would relate; and

(c) the operator has not made any CTP compensation payment or supply to which the payment of excess relates.

The amount of the increasing adjustment is 1 / 11 of the amount of the payment of excess.

79 - 60 Effect of settlements and payments under compulsory third party schemes

(1) If an * operator of a * compulsory third party scheme makes a payment under the scheme, it is not treated as * consideration:

(a) for an acquisition made by the operator; or

(b) for a supply made to the operator by the entity to whom the payment was made;

to the extent that the payment is a * CTP compensation or ancillary payment or supply.

(2) If an * operator of a * compulsory third party scheme makes a supply under the scheme:

(a) it is not a * taxable supply; and

(b) it is not treated as * consideration for an acquisition made by the operator; and

(c) it is not treated as * consideration for a supply made to the operator by the entity to whom the supply was made;

to the extent that the supply is a * CTP compensation or ancillary payment or supply.

(3) This section has effect despite section 9 - 5 (which is about what are taxable supplies), section 9 - 15 (which is about consideration) and section 11 - 5 (which is about what is a creditable acquisition).

79 - 65 Taxable supplies relating to recovery by operators of compulsory third party schemes

(1) If:

(a) an * operator of a * compulsory third party scheme has made a claim in relation to a * CTP compensation or ancillary payment or supply; and

(b) the operator's claim is made in exercising rights to recover in respect of that payment or supply; and

(c) an entity:

(i) makes a payment of * money; or

(ii) makes a supply; or

(iii) makes both a payment of money and a supply;

in settlement of the operator's claim;

the payment or supply mentioned in paragraph (c) is not treated as * consideration for a supply made by the operator (whether or not the payment or supply is made to the operator), or for an acquisition made by the entity making the payment or supply (or payment and supply).

(2) This section has effect despite section 9 - 15 (which is about consideration) and section 11 - 5 (which is about what is a creditable acquisition).

Division 19 applies in relation to a * decreasing adjustment that an * operator of a * compulsory third party scheme has under section 79 - 50 as if:

(a) the adjustment were an input tax credit; and

(b) either:

(i) if the adjustment relates to a * CTP compensation payment or supply--the settlement of the claim to which the adjustment relates were a * creditable acquisition that the operator made; or

(ii) if the adjustment relates to a * CTP ancillary payment or supply--the operator had made a creditable acquisition for which the payment or supply was the * consideration; and

(c) any payment or supply made by another entity, in settlement of a claim made by the operator in exercising rights to recover from the other entity in respect of the settlement mentioned in subparagraph (b)(i) or the payment or supply mentioned in subparagraph (b)(ii), were a reduction in the consideration for the acquisition.

79 - 75 Adjustment events relating to increasing adjustments under section 79 - 55

Division 19 applies in relation to an * increasing adjustment that an * operator of a * compulsory third party scheme has under section 79 - 55 as if:

(a) payments of excess to which the adjustment relates were * consideration for a * taxable supply that the operator made; and

(b) the adjustment were the GST payable on the taxable supply; and

(c) any refunds made by the operator of any of those payments of excess were reductions in the consideration for the supply.

79 - 80 Payments of excess under compulsory third party schemes are not consideration for supplies

(1) The making of any payment by an entity is not treated as * consideration for a supply, to the entity or any other entity, to the extent that the payment is the payment of an excess to an * operator of a * compulsory third party scheme.

(2) This section has effect despite section 9 - 15 (which is about consideration).

79 - 85 Supplies of goods to operators in the course of settling claims

(1) A supply of goods is not a * taxable supply if it is solely a supply made under a * compulsory third party scheme to an * operator of the scheme in the course of settling a claim for compensation made under the scheme.

(2) In working out the value of a * taxable supply that is partly a supply of goods made under a * compulsory third party scheme to an * operator of the scheme in the course of settling a claim for compensation made under the scheme, disregard the * consideration to the extent that it relates to the supply of those goods.

(3) This section has effect despite section 9 - 5 (which is about what are taxable supplies) and section 9 - 75 (which is about the value of taxable supplies).

79 - 90 Effect of judgments and court orders

If:

(a) in compliance with a judgment or order of a court relating to:

(i) a claim for compensation under a * compulsory third party scheme; or

(ii) a claim by an * operator of a compulsory third party scheme, exercising rights to recover from another entity in respect of a settlement made under the scheme;

an entity makes a payment of * money, makes a supply, or makes both a payment of money and a supply; and

(b) had the payment or supply been made in the absence of such a judgment or order, it would have been a * CTP compensation payment or supply or a CTP ancillary payment or supply;

the payment or supply is treated as having been a CTP compensation payment or supply or a CTP ancillary payment or supply.

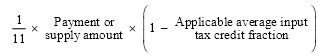

(1) If an * operator of a * compulsory third party scheme has a * decreasing adjustment in relation to a payment or supply that is to be worked out using the applicable * average input tax credit fraction, the amount of the * decreasing adjustment is as follows.

(2) The amount is worked out using the formula:

where:

"applicable average input tax credit fraction" is the * average input tax credit fraction for the * compulsory third party scheme concerned for the * financial year in which:

(a) if the payment or supply is a * CTP compensation payment or supply--the accident or other incident to which the claim relates happened; or

(b) if the payment or supply is a * CTP ancillary payment or supply--the payment or supply was made.

"payment or supply amount" is the amount worked out in accordance with subsection (3).

Payment or supply amount

(3) The payment or supply amount mentioned in subsection (2) is worked out using this method statement.

Method statement

Step 1. Add together:

(a) the sum of the payments of * money (if any) that are included in the payment or supply; and

(b) the * GST inclusive market value of the supplies (if any) made by the * operator that are included in the payment or supply (other than supplies that would have been * taxable supplies but for section 78 - 25 or 79 - 60).

Step 2. If, in relation to the payment or supply, any payments of an excess were made to the * operator, subtract from the step 1 amount the sum of all those payments (except to the extent that they are payments of excess to which section 78 - 18 or 79 - 55 applies).

Step 3. Except where the payment or supply is a * CTP ancillary payment or supply, multiply the step 1 amount, or (if step 2 applies) the step 2 amount, by the following:

![]()

where:

applicable average input tax credit fraction has the meaning given by subsection (2).

Reduction for non - creditable insurance events

(4) The amount of the * decreasing adjustment under subsection (1) is reduced to the extent (if any) that the payment or supply relates to one or more * non - creditable insurance events.

79 - 100 Meaning of average input tax credit fraction

(1) Except where subsection (7) applies, the average input tax credit fraction for a * compulsory third party scheme for a * financial year is:

(a) for the financial year beginning on 1 July 2000, 1 July 2001 or 1 July 2002--nil; and

(b) for the financial year beginning on 1 July 2003, 1 July 2004, 1 July 2005 or 1 July 2006--the business vehicle use fraction for the scheme determined by the Treasurer under subsection (2); and

(c) for any later financial year:

(i) if subparagraph (ii) does not apply--the same fraction as the average input tax credit fraction for the scheme for the preceding financial year; or

(ii) if, under subsection (3), the Treasurer determines the average input tax credit fraction for the scheme for the financial year--that fraction.

Treasurer to determine business vehicle use fraction for 2003 - 4 to 2006 - 7 financial years using statistical information

(2) As soon as practicable after the commencement of this section, the Treasurer must, in writing, determine the business vehicle use fraction (see subsection (4)) for each * compulsory third party scheme, using statistical information that:

(a) relates to business and total use of vehicles in the State or Territory in which the scheme operates; and

(b) was published on 27 June 2001 by the Australian Bureau of Statistics in respect of the period 1 November 1999 to 31 October 2000.

Treasurer to use later statistical information to determine whether average input tax credit fraction to be varied for later financial years

(3) As soon as practicable after the beginning of each of the following * financial years (a determination year ):

(a) the financial year that begins on 1 July 2006;

(b) the financial years that begin on each 1 July that occurs 3 years, or a multiple of 3 years, after 1 July 2006;

the Treasurer must, for each * compulsory third party scheme:

(c) work out business vehicle use fractions (see subsection (4)) using each set of statistical information, relating to business and total use of vehicles in the State or Territory in which the scheme operates, published by the Australian Bureau of Statistics during the 3 financial years before the determination year; and

(d) work out the average of those fractions (the new fraction ); and

(e) if the Treasurer considers the new fraction is significantly different from the average input tax credit fraction that would, disregarding this subsection, apply under subparagraph (1)(c)(i) for the scheme for the financial year (the operative year ) following the determination year--in writing, determine that the new fraction is to be the average input tax credit fraction for the scheme for the operative year.

Business vehicle use fraction

(4) The business vehicle use fraction is the fraction of total vehicle use, in the State or Territory in which the * compulsory third party scheme operates, represented by business vehicle use.

Publication of revised statistical information

(5) To avoid doubt, if, after publishing statistical information relating to business and total use of vehicles in a State or Territory, the Australian Bureau of Statistics publishes a revised or replacement version of that statistical information, that revision or replacement is to be disregarded for the purposes of this section.

Gazettal of determinations

(6) The Treasurer must arrange for a copy of any determination that he or she makes under subsection (2) or (3) to be published in the Gazette .

Exception

(7) If:

(a) this section is being applied in working out the amount of a * decreasing adjustment that arises under section 79 - 15 (about sole operator elections); and

(b) the cover under the * insurance policy concerned commenced before 1 July 2003;

the average input tax credit fraction for the * compulsory third party scheme concerned is nil for all * financial years beginning on or after 1 July 2000.

Division 80 -- Settlement sharing arrangements

80 - 1 What this Division is about

A series of adjustments arise if, under an arrangement, an operator of a compulsory third party scheme settles a claim, arising from one or more accidents or other incidents, covered by the arrangement and other operators are obliged to contribute payments to that operator in respect of the settlement.

Table of Subdivisions

80 - A Insurance policy settlement sharing arrangements

80 - B Nominal defendant settlement sharing arrangements

80 - C Hybrid settlement sharing arrangements

Subdivision 80 - A -- Insurance policy settlement sharing arrangements

80 - 5 Meaning of insurance policy settlement sharing arrangement etc.

Meaning of insurance policy settlement sharing arrangement

(1) An insurance policy settlement sharing arrangement is an arrangement:

(a) that relates to an accident or other incident or 2 or more related accidents or other incidents; and

(b) to which the parties are the * operators of a * compulsory third party scheme or schemes who have issued * insurance policies to owners or drivers involved in the accidents or incidents; and

(c) under which:

(i) one party (the managing operator ) is to make one or more payments or supplies in settlement of a claim, under the compulsory third party scheme or one of the compulsory third party schemes, relating to the accidents or incidents; and

(ii) each other party (a contributing operator ) is to make a payment to the * managing operator in respect of that operator settling the claim.

Meaning of managing operator's payment or supply

(2) If a payment or supply mentioned in subparagraph (1)(c)(i) is not a * CTP ancillary payment or supply, it is a managing operator's payment or supply .

Meaning of contributing operator's payment

(3) A payment mentioned in subparagraph (1)(c)(ii), to the extent that it is not a fee to the * managing operator for managing the process of making settlements under the arrangement, is a contributing operator's payment .

(1) An * operator of a * compulsory third party scheme does not make a * taxable supply by:

(a) entering into, or becoming a party to, an * insurance policy settlement sharing arrangement; or

(b) becoming a party to a deed created by or under a * State law or a * Territory law establishing a * compulsory third party scheme, that provides for an insurance policy settlement sharing arrangement.

(2) This section has effect despite section 9 - 5 (which is about what are taxable supplies).

80 - 15 Effect of contributing operator's payment

(1) A * contributing operator's payment is not treated as * consideration for a supply by the * managing operator, or for an acquisition by the * contributing operator.

(2) This section has effect despite section 9 - 15 (which is about consideration) and section 11 - 5 (which is about what is a creditable acquisition).

80 - 20 Managing operator's payments or supplies

(1) For the purposes of Divisions 78 and 79, a * managing operator's payment or supply is treated as follows.

(2) If the * managing operator is a party to the * insurance policy settlement sharing arrangement because it issued only one * insurance policy, the * managing operator's payment or supply is treated as a payment or supply, made by the managing operator, in settlement of a claim relating to the accidents or incidents, under that insurance policy.

(3) If the * managing operator is a party to the * insurance policy settlement sharing arrangement because it issued 2 or more * insurance policies, the * managing operator's payment or supply is treated as a payment or supply made by the managing operator, in settlement of a claim relating to the accidents or incidents, under the insurance policies, and for that purpose is divided among the policies in equal proportions.

Example: 3 vehicles are involved in an accident, 2 of which are covered by insurance policies issued by the managing operator and the other by a policy issued by a contributing operator. The managing operator makes a payment in settlement of a claim by an insured person in respect of the accident.

For the purposes of Division 78 or 79, half of the payment will be treated as being made under each of the policies issued by the managing operator.

80 - 25 Contributing operator's payment

(1) For the purposes of Divisions 78 and 79, a * contributing operator's payment is treated as follows.

(2) If the * contributing operator is a party to the * insurance policy settlement sharing arrangement because it issued only one * insurance policy, the * contributing operator's payment is treated as a payment or supply, made by the contributing operator, in settlement of a claim relating to the accidents or incidents, under that insurance policy.

Example: Assume the same facts as in the example in section 80 - 20. The contributing operator who issued 1 of the 3 policies covering the vehicles in the accident makes a payment to the managing operator.

For the purposes of Division 78 or 79, the payment (except to the extent that it represents a managing operator's fee) will be treated as being made by the contributing operator under the insurance policy that it issued.

(3) If the * contributing operator is a party to the * insurance policy settlement sharing arrangement because it issued 2 or more * insurance policies, the * contributing operator's payment is treated as a payment or supply, made by the contributing operator, in settlement of a claim relating to the accidents or incidents, under the insurance policies, and for that purpose is divided among the policies in equal proportions.

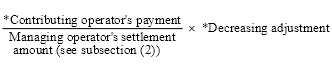

80 - 30 Managing operator's increasing adjustment where contributing operator's payment

(1) If:

(a) a * contributing operator's payment is made; and

(b) as a result of section 80 - 20, there was a * decreasing adjustment for the * managing operator under Division 78 or 79 in relation to the * managing operator's payment or supply;

there is an increasing adjustment for the managing operator of the following amount:

Managing operator's settlement amount

(2) The managing operator's settlement amount mentioned in subsection (1) is worked out using this method statement.

Method statement

Step 1. Add together:

(a) the sum of the payments of * money (if any) that are included in the * managing operator's payment or supply; and

(b) the * GST inclusive market value of the supplies (if any) that are included in the * managing operator's payment or supply (other than supplies that would have been * taxable supplies but for section 78 - 25 or 79 - 60).

Step 2. If, in relation to the * managing operator's payment or supply, any payments of an excess were made to the * managing operator, subtract from the step 1 amount the sum of all those payments (except to the extent that they are payments of excess to which section 78 - 18 or 79 - 55 applies).

Example: Assume the same facts as in the examples in sections 80 - 20 and 80 - 25. Assume also that, as a result of section 80 - 20, there was a decreasing adjustment under Division 78 or 79 for the managing operator's payment or supply.

The managing operator has an increasing adjustment. It equals the part of the decreasing adjustment that is attributable to the managing operator's payment or supply that was repaid by the contributing operator's contribution.

80 - 35 Adjustment events relating to managing operator's payment or supply

Division 19 applies in relation to an * increasing adjustment that the * managing operator has under section 80 - 30 as a result of the making of a * managing operator's payment or supply as if:

(a) the * contributing operator's payment were * consideration for a * taxable supply made by the managing operator; and

(b) the adjustment were the GST payable on the taxable supply; and

(c) any changes made to those payments were a change in the consideration for the supply.

Subdivision 80 - B -- Nominal defendant settlement sharing arrangements

80 - 40 Meaning of nominal defendant settlement sharing arrangement etc.

Meaning of nominal defendant settlement sharing arrangement

(1) A nominal defendant settlement sharing arrangement is an arrangement:

(a) that relates to an accident or other incident or 2 or more related accidents or other incidents; and

(b) to which the parties are * operators of a * compulsory third party scheme, where they are parties because the driver involved in the accidents or incidents was not covered under an * insurance policy; and

(c) under which:

(i) one party (the managing operator ) is to make one or more payments or supplies in settlement of a claim, under the compulsory third party scheme, relating to the accidents or incidents; and

(ii) the other party, or one or more of the other parties, (each being a contributing operator ) is to make a payment to the * managing operator in respect of that operator settling the claim.

Meaning of managing operator's payment or supply

(2) If a payment or supply mentioned in subparagraph (1)(c)(i) is not a * CTP ancillary payment or supply, it is a managing operator's payment or supply .

Meaning of contributing operator's payment

(3) A payment mentioned in subparagraph (1)(c)(ii), to the extent that it is not a fee to the * managing operator for managing the process of making settlements under the arrangement, is a contributing operator's payment .

80 - 45 Nominal defendant settlement sharing arrangements to which this Subdivision applies

This Subdivision applies to a * nominal defendant settlement sharing arrangement if its * managing operator is not a party to a * hybrid settlement sharing arrangement relating to the same accidents or incidents.

(1) An * operator of a * compulsory third party scheme does not make a * taxable supply by:

(a) entering into, or becoming a party to, a * nominal defendant settlement sharing arrangement to which this Subdivision applies; or

(b) becoming a party to a deed created by or under a * State law or a * Territory law establishing a compulsory third party scheme, that provides for a nominal defendant settlement sharing arrangement to which this Subdivision applies.

(2) This section has effect despite section 9 - 5 (which is about what are taxable supplies).

80 - 55 Effect of contributing operator's payment

(1) A * contributing operator's payment is not treated as * consideration for a supply by the * managing operator, or for an acquisition by the * contributing operator.

(2) This section has effect despite section 9 - 15 (which is about consideration) and section 11 - 5 (which is about what is a creditable acquisition).

80 - 60 Managing operator's payment or supply

For the purposes of Division 79, a * managing operator's payment or supply is treated as a * CTP compensation payment or supply.

80 - 65 Contributing operator's payment

For the purposes of Division 79, a * contributing operator's payment is treated as a * CTP compensation payment or supply.

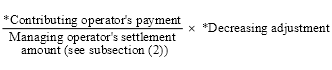

80 - 70 Managing operator's increasing adjustment where contributing operator's payment

(1) If:

(a) a * contributing operator's payment is made; and

(b) as a result of section 80 - 60, there was a * decreasing adjustment for the * managing operator under Division 79 in relation to the * managing operator's payment or supply;

there is an increasing adjustment for the managing operator of the following amount:

Managing operator's settlement amount

(2) The managing operator's settlement amount mentioned in subsection (1) is worked out using this method statement.

Method statement

Step 1. Add together:

(a) the sum of the payments of * money (if any) that are included in the * managing operator's payment or supply; and

(b) the * GST inclusive market value of the supplies (if any) that are included in the * managing operator's payment or supply (other than supplies that would have been * taxable supplies but for section 78 - 25 or 79 - 60).

Step 2. If, in relation to the * managing operator's payment or supply, any payments of an excess were made to the * managing operator, subtract from the step 1 amount the sum of all those payments (except to the extent that they are payments of excess to which section 78 - 18 or 79 - 55 applies).

80 - 75 Adjustment events relating to managing operator's payment or supply

Division 19 applies in relation to an * increasing adjustment that the * managing operator has under section 80 - 70 as a result of the making of a * managing operator's payment or supply as if:

(a) the * contributing operator's payment were * consideration for a * taxable supply made by the managing operator; and

(b) the adjustment were the GST payable on the taxable supply; and

(c) any changes made to those payments were a change in the consideration for the supply.

Subdivision 80 - C -- Hybrid settlement sharing arrangements

80 - 80 Meaning of hybrid settlement sharing arrangement etc.

Meaning of hybrid settlement sharing arrangement

(1) A hybrid settlement sharing arrangement is an arrangement:

(a) that relates to an accident or other incident or 2 or more related accidents or other incidents; and

(b) to which the parties are:

(i) an entity that is the * managing operator of a * nominal defendant settlement sharing arrangement, or entities that are managing operators of nominal defendant settlement sharing arrangements, that relate to the accidents or incidents; and

(ii) an * operator or operators of a * compulsory third party scheme or schemes who have issued * insurance policies to owners or drivers involved in the accidents or incidents; and

(c) under which:

(i) one party (the managing operator ) is to make one or more payments or supplies in settlement of a claim, under the compulsory third party scheme or one of the compulsory third party schemes involved, relating to the accidents or incidents; and

(ii) each other party (a contributing operator ) is to make a payment to the * managing operator in respect of that operator settling the claim.

Meaning of managing operator's payment or supply

(2) If a payment or supply mentioned in subparagraph (1)(c)(i) is not a * CTP ancillary payment or supply, it is a managing operator's payment or supply .

Meaning of contributing operator's payment

(3) A payment mentioned in subparagraph (1)(c)(ii), to the extent that it is not a fee to the * managing operator for managing the process of making settlements under the arrangement, is a contributing operator's payment .

80 - 85 Subdivision 80 - A to apply to hybrid settlement sharing arrangement, subject to exceptions

In addition to its operation apart from this Subdivision, Subdivision 80 - A has effect, subject to sections 80 - 90 and 80 - 95, as if a * hybrid settlement sharing arrangement were an * insurance policy settlement sharing arrangement.

If:

(a) the entity that is the * managing operator of the * hybrid settlement sharing arrangement is a party to that arrangement because it is also the managing operator of a * nominal defendant settlement arrangement; and

(b) the entity makes a payment or supply that, as a result of section 80 - 85, is a * managing operator's payment or supply under the hybrid settlement sharing arrangement;

then:

(c) Subdivision 80 - A does not have any other effect in relation to the payment or supply in accordance with section 80 - 85; but

(d) Subdivision 80 - B (other than section 80 - 45) applies in relation to the payment or supply as if it were a managing operator's payment or supply under the nominal defendant settlement sharing arrangement and the entity were not party to the hybrid settlement sharing arrangement.

If:

(a) an entity that is a * contributing operator of the * hybrid settlement sharing arrangement is a party to that arrangement because it is also the * managing operator of a * nominal defendant settlement arrangement; and

(b) the entity makes a payment that, as a result of section 80 - 85, is a * contributing operator's payment under the hybrid settlement sharing arrangement;

then:

(c) Subdivision 80 - A does not have any other effect in relation to the payment or supply in accordance with section 80 - 85; but

(d) Subdivision 80 - B (other than section 80 - 45) applies in relation to the payment as if it were a * managing operator's payment or supply under the nominal defendant settlement sharing arrangement and the entity were not party to the hybrid settlement sharing arrangement.

19 After paragraph 188 - 22(a)

Insert:

(aa) is a * CTP dual premium or election payment or supply, a * CTP hybrid payment or supply or a * CTP compensation or ancillary payment or supply; or

20 Section 195 - 1

Insert:

"average input tax credit fraction" has the meaning given by section 79 - 100.

21 Section 195 - 1

Insert:

"compulsory third party scheme" is a scheme or arrangement:

(a) that is established by an * Australian law; and

(b) that is specified in the regulations, or that is of a kind specified in the regulations, made for the purposes of this definition.

22 Section 195 - 1 (definition of consideration )

After "78 - 70,", insert "79 - 60, 79 - 65, 79 - 80, 80 - 15, 80 - 55,".

23 Section 195 - 1

Insert:

"contributing operator" has the meaning given by subparagraph 80 - 5(1)(c)(ii), 80 - 40(1)(c)(ii) or 80 - 80(1)(c)(ii).

24 Section 195 - 1

Insert:

"contributing operator's payment" has the meaning given by subsection 80 - 5(3), 80 - 40(3) or 80 - 80(3).

25 Section 195 - 1

Insert:

"CTP ancillary payment or supply" has the meaning given by subsection 79 - 35(3).

Note: Section 79 - 90 also treats certain payments or supplies as CTP ancillary payments or supplies.

26 Section 195 - 1

Insert:

"CTP compensation or ancillary payment or supply" has the meaning given by subsection 79 - 35(1).

27 Section 195 - 1

Insert:

"CTP compensation payment or supply" has the meaning given by subsection 79 - 35(2).

Note: Section 79 - 90 also treats certain payments or supplies as CTP compensation payments or supplies.

28 Section 195 - 1

Insert:

"CTP dual premium or election payment or supply" means a payment or supply to which section 79 - 5 or 79 - 15 applies.

29 Section 195 - 1

Insert:

"CTP hybrid payment or supply" has the meaning given by section 79 - 25.

30 Section 195 - 1

Insert:

"CTP premium" , in relation to a * compulsory third party scheme, means:

(a) a payment of a premium, contribution or similar payment under the scheme; or

(b) a payment of levy in connection with the scheme.

31 Section 195 - 1

Insert:

"hybrid settlement sharing arrangement" has the meaning given by subsection 80 - 80(1).

32 Section 195 - 1 (table item 4A of the definition of decreasing adjustment )

Repeal the table item, substitute:

4A | Section 78 - 10 (including as it applies in accordance with Subdivision 79 - A or 79 - B or Division 80) | Payments or supplies in settlement of insurance claims or under * compulsory third party schemes |

4B | Subsection 79 - 10(1) (including as it applies in accordance with Division 80) | * Decreasing adjustments under * compulsory third party schemes |

4C | Section 79 - 50 (including as it applies in accordance with Division 80) | * Decreasing adjustments under * compulsory third party schemes |

33 Section 195 - 1 (table item 4AA of the definition of increasing adjustment )

Repeal the table item, substitute:

4AA | Section 78 - 18 (including as it applies in accordance with Subdivision 79 - B or Division 80) | Payments of excess etc. under insurance policies or * compulsory third party schemes |

4AB | Subsection 79 - 10(2) (including as it applies in accordance with Division 80) | * Increasing adjustments under * compulsory third party schemes |

4AC | Section 79 - 55 (including as it applies in accordance with Division 80) | * Increasing adjustments under * compulsory third party schemes |

4AD | Section 80 - 30 | * Increasing adjustments under * insurance policy settlement sharing arrangements |

4AE | Section 80 - 70 | * Increasing adjustments under * nominal defendant settlement sharing arrangements |

34 Section 195 - 1

Insert:

"insurance policy settlement sharing arrangement" has the meaning given by subsection 80 - 5(1).

35 Section 195 - 1

Insert:

"managing operator" has the meaning given by subparagraph 80 - 5(1)(c)(i), 80 - 40(1)(c)(i) or 80 - 80(1)(c)(i).

36 Section 195 - 1

Insert:

"managing operator's payment or supply" has the meaning given by subsection 80 - 5(2), 80 - 40(2) or 80 - 80(2).

37 Section 195 - 1

Insert:

"nominal defendant settlement sharing arrangement" has the meaning given by subsection 80 - 40(1).

38 Section 195 - 1

Insert:

"operator" of a * compulsory third party scheme means an entity that is required to make payments or supplies in settlement of claims under the scheme.

39 Section 195 - 1

Insert:

"premium selection test is satisfied" has the meaning given by subsection 79 - 5(2).

40 Section 195 - 1 (note to definition of taxable supply )

After "78 - 70,", insert "79 - 60, 79 - 85, 80 - 10, 80 - 50,".

41 Section 195 - 1 (paragraph (b) of the definition of value )

After "78 - 95,", insert "79 - 40, 79 - 85,".

A New Tax System (Goods and Services Tax Transition) Act 1999

42 At the end of section 22

Add:

(3) The settlement of a claim for compensation does not give rise to any adjustment, and is not a taxable supply, under Division 79 or 80 of the GST Act to the extent that the event giving rise to the claim happened before 1 July 2000.

(4) However, if:

(a) the claim is one mentioned in section 79 - 25 of the GST Act and the insurance policy concerned covers a period that started before 1 July 2000 and ends after that day; and

(b) it cannot be ascertained whether the event giving rise to the claim happened before 1 July 2000;

subsection (3) does not apply and the settlement does not give rise to any adjustment, and is not a taxable supply, under Division 79 or 80 of the GST Act if the claim was made before 1 July 2000.

Note: The heading to section 22 is replaced by the heading " Event before 1 July 2000 giving rise to claim ".

43 Application

The amendments made by this Schedule apply, and are taken to have applied, in relation to net amounts for tax periods starting on or after 1 July 2000.