Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Tax cost setting for certain depreciating assets

Income Tax Assessment Act 1997

1 Paragraph 701 - 55(2)(d)

Omit "section 40 - 95 (other than subsections (2) and (5))", substitute "subsections 40 - 95(1) and (3)".

Part 2 -- Cost base and reduced cost base of pre - CGT assets

Income Tax Assessment Act 1997

2 Subsection 126 - 60(3) (note)

Omit "Note", substitute "Note 1".

3 At the end of subsection 126 - 60(3)

Add:

Note 2: Under section 716 - 855, where there have been certain roll - overs, the cost base and reduced cost base of pre - CGT assets for the purposes of Part 3 - 90 (Consolidated groups) are worked out by applying subsection (2), rather than subsection (3), of this section.

4 At the end of subsection 705 - 65(1)

Add:

Note: Under section 716 - 855, if membership interests are pre - CGT assets that have been subject to certain roll - overs, the cost base and reduced cost base are worked out in the same way as if they were post - CGT assets.

5 After section 716 - 850

Insert:

If:

(a) it is necessary for the purposes of this Part to work out the * cost base or * reduced cost base of a * pre - CGT asset owned at a particular time; and

(b) before that time:

(i) the owner was the recipient company involved in a roll - over under Subdivision 126 - B in relation to a * CGT event that happened in relation to the CGT asset; or

(ii) the owner was the transferee in relation to a disposal of the CGT asset to which section 160ZZO of the Income Tax Assessment Act 1936 applied;

the cost base or reduced cost base is worked out as if, in applying Subdivision 126 - B or section 160ZZO in relation to the CGT event or the disposal, the provisions of that Subdivision or section applying to CGT assets * acquired on or after 20 September 1985 replaced those that applied to CGT assets acquired on or before that date.

Note: The effect is that the owner's cost base or reduced cost base will be the same as that of the originating company or transferor, as is the case with post - CGT assets.

Income Tax (Transitional Provisions) Act 1997

6 After section 701 - 5

Insert:

Section 716 - 855 applies for the purposes of this Division in the same way as that section applies for the purposes of Part 3 - 90 of the Income Tax Assessment Act 1997 .

Part 3 -- CGT event in respect of reduction in tax cost setting amounts for reset cost base assets

Income Tax Assessment Act 1997

7 Section 104 - 5 (at the end of the table)

Add:

L8 Reduction in tax cost setting amount for reset cost base assets on joining cannot be allocated [See section 104 - 535] | Just after entity becomes subsidiary member | no capital gain | amount of reduction that cannot be allocated |

8 At the end of Subdivision 104 - L

Add:

(1) CGT event L8 happens if:

(a) an entity becomes a * subsidiary member of a * consolidated group or a * MEC group; and

(b) the * tax cost setting amount for a reset cost base asset of the entity is reduced under subsection 705 - 40(1) (including in its application in accordance with Subdivisions 705 - B to 705 - D); and

(c) some or all (the unallocated amount ) of the reduction cannot be allocated as mentioned in subsection 705 - 40(2).

(2) The time of the event is just after the entity becomes a * subsidiary member of the group.

(3) For the head company core purposes mentioned in subsection 701 - 1(2), the * head company makes a capital loss equal to the unallocated amount.

9 Section 110 - 10 (at the end of the table)

Add:

L8 | Reduction in tax cost setting amount for reset cost base assets on joining cannot be allocated | 104 - 535 |

10 Subsection 705 - 40(2) (at the end of the note)

Add ": see CGT event L8".

Part 4 -- Replacement of continuity of ownership test for retention of accelerated depreciation

Income Tax Assessment Act 1997

11 Subsection 701 - 80(3)

Repeal the subsection, substitute:

Section applies to certain depreciating assets

(3) This section applies if:

(a) a * depreciating asset to which Division 40 applies becomes that of the * head company because subsection 701 - 1(1) (the single entity rule) applies when the entity becomes a * subsidiary member of the group; and

(b) just before the entity became a subsidiary member, subsection 40 - 10(3) or 40 - 12(3) of the Income Tax (Transitional Provisions) Act 1997 applied for the purpose of the entity working out the asset's decline in value under Division 40; and

Note: The effect of those subsections was to preserve an entitlement to accelerated depreciation.

(c) the * tax cost setting amount that applies in relation to the asset for the purposes of section 701 - 10 when it becomes an asset of the head company is not more than the entity's * terminating value for the asset.

12 Paragraph 705 - 45(a)

Repeal the paragraph, substitute:

(a) an asset of the joining entity is a * depreciating asset to which Division 40 applies; and

(aa) just before the entity became a subsidiary member, subsection 40 - 10(3) or 40 - 12(3) of the Income Tax (Transitional Provisions) Act 1997 applied for the purposes of the joining entity working out the asset's decline in value under Division 40; and

Note: The effect of those subsections was to preserve an entitlement to accelerated depreciation.

Income Tax (Transitional Provisions) Act 1997

13 Subsection 701 - 30(3)

Repeal the subsection, substitute:

Creation of, or increase in, tax deferral amount

(3) For the purposes of applying section 705 - 50 (reduction in tax cost setting amount for over - depreciated assets) of the Income Tax Assessment Act 1997 in relation to an asset of the transitional entity that becomes that of the head company under subsection 701 - 1(1) of that Act when the transitional group comes into existence:

(a) if, before the transitional group came into existence, the transitional entity paid any dividends to which paragraph 705 - 50(2)(b) of that Act applies--the tax deferral amount in relation to the dividends under subsection 705 - 50(3) of that Act is increased by the amount worked out under subsection (4) of this section; and

(b) if paragraph (a) does not apply--the transitional entity is taken to have paid dividends to which paragraph 705 - 50(2)(b) of that Act applies and there is taken to be a tax deferral amount in relation to the dividends under subsection 705 - 50(3) of that Act whose amount is worked out under subsection (4) of this section.

14 Subsection 701 - 30(4)

Omit "The increase", substitute "The amount for the purposes of paragraphs (3)(a) and (b)".

Note: The heading to subsection 701 - 30(4) is replaced by the heading " Amount for purposes of paragraphs (3)(a) and (b) ".

Part 6 -- Adjustments for errors etc.

Taxation Administration Act 1953

15 Subsection 8W(1C)

Omit ", so far as they were made in a statement made as mentioned in subsection 705 - 230(2) of that Act", substitute "that were made in a statement that was made before the Commissioner became aware of the errors".

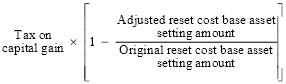

16 Subsection 8W(1C) (formula)

Repeal the formula, substitute:

17 Subsection 8W(1C) (definition of capital gain )

Repeal the definition.

18 Subsection 8W(1C)

Insert:

"tax on capital gain" means the product of:

(a) the * capital gain that the * head company makes as a result of * CGT event L6 happening as mentioned in section 104 - 525 of the Income Tax Assessment Act 1997 ; and

(b) the * corporate tax rate in respect of taxable income for the income year in which that CGT event happens.

19 Paragraph 284 - 80(2)(b) in Schedule 1

Omit "the income tax return mentioned in subsection 705 - 230(2) of that Act", substitute "it and it was made before the Commissioner became aware of the errors".

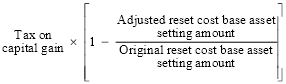

20 Subsection 284 - 80(2) in Schedule 1 (formula)

Repeal the formula, substitute:

21 Subsection 284 - 80(2) in Schedule 1 (definition of capital gain )

Repeal the definition.

22 Subsection 284 - 80(2) in Schedule 1

Insert:

"tax on capital gain" means the product of:

(a) the * capital gain that the * head company makes as a result of * CGT event L6 happening as mentioned in section 104 - 525 of the Income Tax Assessment Act 1997 ; and

(b) the * corporate tax rate in respect of taxable income for the income year in which that CGT event happens.

23 Subsection 284 - 150(3) in Schedule 1

Omit "in an income tax return as mentioned in subsection 705 - 230(2) of the Income Tax Assessment Act 1997 ", substitute "mentioned in section 705 - 315 of the Income Tax Assessment Act 1997 that were made in a statement that was made before the Commissioner became aware of the errors".

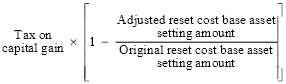

24 Subsection 284 - 150(3) in Schedule 1 (formula)

Repeal the formula, substitute:

25 Subsection 284 - 150(3) in Schedule 1 (definition of capital gain )

Repeal the definition.

26 Subsection 284 - 150(3) in Schedule 1

Insert:

"tax on capital gain" means the product of:

(a) the * capital gain that the * head company makes as a result of * CGT event L6 happening as mentioned in section 104 - 525 of the Income Tax Assessment Act 1997 ; and

(b) the * corporate tax rate in respect of taxable income for the income year in which that CGT event happens.

Part 7 -- Extension of certain consolidation provisions to cover MEC groups

Income Tax Assessment Act 1997

27 Section 102 - 30 (table item 7A)

After "consolidated group" (twice occurring), insert "or a MEC group".

28 Section 104 - 5 (table row relating to event number L1)

After "consolidated group", insert "or MEC group".

29 Subdivision 104 - L (heading)

Repeal the heading, substitute:

Subdivision 104 - L -- Consolidated groups and MEC groups

30 Subsection 104 - 500(1)

After " * consolidated group", insert "or a * MEC group".

31 Paragraphs 104 - 505(1)(a), 104 - 510(1)(a), 104 - 515(1)(a), 104 - 520(1)(a) and 104 - 525(1)(a)

After " * consolidated group", insert "or a * MEC group".

32 Subsection 104 - 525(6) (definition of current asset setting amount )

After " * consolidated group", insert "or the * MEC group".

33 Subsection 104 - 530(1)

After " * consolidated group", insert "or a * MEC group".

34 Section 110 - 10 (table rows relating to event numbers L1 and L6)

After "consolidated group", insert "or MEC group".

Income Tax (Transitional Provisions) Act 1997

35 Paragraph 701B - 1(1)(b)

After "consolidated group", insert "or the MEC group".

36 Subsection 719 - 2(1)

After "than", insert "Division 701B,".

37 Subsection 719 - 160(2)

After "Divisions 701", insert ", 701A".

Part 8 -- Excess franking deficit tax offsets

Income Tax Assessment Act 1997

38 At the end of section 701 - 30

Add:

Excess franking deficit tax offset for the income year

(10) For the purposes of applying section 205 - 70 in relation to an income year after the income year (the current income year ) to which this section applies, the entity has an excess mentioned in paragraph 205 - 70(1)(c) (about excess franking deficit tax offsets) for the current income year only if it has such an excess for the non - membership period (if any) ending at the end of the current income year. The amount of the excess for the current income year is the amount of the excess for the non - membership period.

39 At the end of Division 709

Add:

709 - 180 What this Subdivision is about

This Subdivision provides that any excess in the tax offset arising from a franking deficit tax liability of an entity that becomes a subsidiary member of a consolidated group is transferred to the head company of the group.

Table of sections

709 - 185 Joining entity's excess franking deficit tax offsets transferred to head company

709 - 190 Exit history rule not to treat leaving entity as having a franking deficit tax offset excess

709 - 185 Joining entity's excess franking deficit tax offsets transferred to head company

(1) This section operates if:

(a) an entity (the joining entity ) becomes a * subsidiary member of a * consolidated group at a time (the joining time ); and

(b) the joining entity is entitled to a * tax offset under section 205 - 70 for the income year that ends or, if subsection 701 - 30(3) applies, that is taken by subsection (3) of that section to end, at the joining time; and

(c) the offset exceeds (the excess being the joining entity's excess ) the amount that would have been the joining entity's income tax liability for that income year if it did not have that offset (but had all its other tax offsets).

Transfer of excess to head company

(2) For the purpose of applying subsection 205 - 70(1) to the * head company of the * consolidated group for the income year in which the joining time occurs:

(a) if the head company does not, after taking into account any application of this section to any other entity that became a * subsidiary member of the group before the joining time, have an excess mentioned in paragraph 205 - 70(1)(c) for the previous income year--the head company is taken to have an excess mentioned in that paragraph for the previous income year equal to the joining entity's excess; and

(b) if the head company does have such an excess--that excess is taken to be increased by the amount of the joining entity's excess.

Joining entity prevented from utilising excess in later income years

(3) For the purpose of applying subsection 205 - 70(1) to the joining entity for any income year after that in which the joining time occurs, the joining entity's excess is disregarded.

To avoid doubt, if:

(a) the * head company of a * consolidated group is entitled to a * tax offset under section 205 - 70 for an income year; and

(b) the offset exceeds the amount that would have been the head company's income tax liability for that income year if it did not have that offset (but had all its other tax offsets); and

(c) an entity ceases to be a * subsidiary member of the group in the income year;

the entity is not taken because of section 701 - 40 (the exit history rule):

(d) to have the excess mentioned in paragraph (b); or

(e) to have another excess of that kind because of the circumstances that caused the head company to have the excess.

40 Application

The amendments made by this Schedule apply on and after 1 July 2002.