Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsIncome Tax Assessment Act 1997

1 Section 418 - 1

Repeal the section, substitute:

418 - 1 What this Division is about

Generally , you are entitled to a tax offset for an income year for exploration credits issued to you for the income year.

A greenfields minerals explorer can create exploration credits for an income year. Before creating exploration credits, the explorer must obtain an allocation of exploration credits from the Commissioner for the year.

The exploration credits created for an income year cannot exceed an amount based on the explorer's greenfields minerals expenditure or tax loss for the year. If the explorer's exploration credits allocation for the year is smaller than that amount, the amount of exploration credits that the explorer can create will be reduced to sit within the allocation. However, any unused allocation of exploration credits from the preceding year would be carried over and so would increase the amount of exploration credits that the explo rer can create.

An exploration credit created by a greenfields minerals explorer can be issued to you if you have invested in the explorer. While the tax offset you receive for the exploration credit issued to you for an income year will apply to that income year, the investment that gives rise to that offset may have been made in that or the preceding income year.

There are rules to ensure that exploration credits are not streamed to some investors rather than others. There are also rules to ensure that the total of the exploration credits you receive because of an investment (whether those credits are issued to you for the year in which you invest or the subsequent year) do not exceed the corporate tax that might be paid by the greenfields minerals explorer on that investment.

The explorer is liable to pay excess exploration credit tax if the explorer issues exploration credits in breach of these rules.

There is a cap on total allocations made by the Commissioner for each income year, but if part of the cap from the preceding year is unallocated it will be carried over. Allocations are made in the order in which applications for an allocation are made.

If an exploration credit is issued to a corporate tax entity, it will give rise to a franking credit (rather than a tax offset).

Note: Excess exploration credit tax is imposed by the Excess Exploration Credit Tax Act 2015 , and the amount of the tax is set out in that Act.

2 Subdivisions 418 - D and 418 - E

Repeal the Subdivisions, substitute:

Subdivision 418 - D -- Creating exploration credits

Table of sections

418 - 70 Entities that may create exploration credits

418 - 75 Meaning of greenfields minerals explorer

418 - 80 Meaning of greenfields minerals expenditure

418 - 81 Meaning of exploration credits allocation for an income year

418 - 82 When does an entity have an unused allocation of exploration credits from an income year

418 - 85 Exploration credits must not exceed maximum exploration credit amount

418 - 95 Effect on tax losses of creating exploration credits

418 - 70 Entities that may create exploration credits

(1) An entity may create exploration credits for an income year if:

(a) the entity was a * greenfields minerals explorer in the income year; and

(b) the entity has an * exploration credits allocation for the income year or an * unused allocation of exploration credits from the immediately preceding income year.

(2 ) The entity cannot create * exploration credits for an income year before income tax is assessed for the entity for the year.

(3 ) The entity cannot create * exploration credits for the 2021 - 22 income year or a later income year.

(4 ) A failure to comply with subsection ( 1) or ( 2 ) does not invalidate the creation of an * exploration credit.

(5 ) An * exploration credit is to be expressed as an amount.

(6 ) The entity cannot make more than one decision to create * exploration credits for an income year, and the decision is final and irrevocable.

418 - 75 Meaning of greenfields minerals explorer

(1) An entity is a greenfields minerals explorer in an income year if:

(a) the entity has * greenfields minerals expenditure for the income year; and

(b) during the income year, the entity is a disclosing entity (within the meaning of section 111AC of the Corporations Act 2001 ); and

(c) during the income year, the entity is a * constitutional corporation; and

(d) during the income year, and during the immediately preceding income year, neither:

(i) the entity; nor

(ii) any other entity that is * connected with or is an * affiliate of the entity;

carried on any mining operations on a mining property for extracting * minerals (except * petroleum) from their natural site, for the * purpose of producing assessable income.

(2) However, an entity is not a greenfields minerals explorer in an income year in which either or both of the following happens, or in any subsequent income year:

(a) the entity fails to comply with a request of the Commissioner under subsection 418 - 80(5);

(b) a determination under section 418 - 185 has effect.

Note 1: Under subsection 418 - 80(5), the Commissioner may request a report on an area in relation to which an entity has greenfields minerals expenditure.

Note 2: Under section 418 - 185, the Commissioner may determine that an entity that is, or has been, liable to excess exploration credit tax is not to be treated as a greenfields minerals explorer.

418 - 80 Meaning of greenfields minerals expenditure

(1) An entity's greenfields minerals expenditure for an income year is the sum of:

(a) the amounts of any deductions to which the entity is entitled under section 40 - 25 for that income year in relation to declines in value that:

(i) are declines in value of * depreciating assets used for * exploration or prospecting for * minerals in an area to which subsection ( 3) of this section applies; and

(ii) are worked out under subsection 40 - 80(1); and

(b) the amounts of any deductions for that income year to which the entity is entitled in relation to expenditure:

(i) that is of a kind referred to in subsection 40 - 730(1); and

(ii) in relation to which the entity satisfies one or more of paragraphs 40 - 730(1)(a) to (c); and

(iii) that is expenditure on exploration or prospecting for minerals in an area to which subsection ( 3) of this section applies.

(2) For the purposes of subsection ( 1), disregard a deduction to the extent that it relates to:

(a) matters other than:

(i) declines in value of * depreciating assets used for; or

(ii) expenditure on;

* exploration or prospecting for * minerals in an area to which subsection ( 3) of this section applies; or

(b) exploration or prospecting for * petroleum or oil shale; or

(c) activities (such as feasibility studies) undertaken to identify the viability of a mineral resource rather than its existence.

(3) This subsection applies to an area:

(a) that is in Australia; and

(b) in relation to which the entity * holds a * mining, quarrying or prospecting right at the time of incurring the expenditure , or is the transferee under a * farm - in farm - out arrangement ; and

(c) that has not been identified as containing a mineral resource that is at least inferred in a report prepared in accordance with the requirements of:

(i) unless subparagraph ( ii) applies--the document that is known as the Australasian Code for Reporting of Exploration Results, Minerals Resources and Ore Reserves and that took effect on 20 December 2012; or

Note: This document is commonly referred to as the JORC Code (2012 Edition).

(ii) such other document as the regulations prescribe; and

(d) that is not, and is not in, any of the following:

(i) the coastal sea of Australia (within the meaning of subsection 15B(4) of the Acts Interpretation Act 1901 );

(ii) an area referred to in subsection 960 - 505(2).

(4) For the purposes of paragraph ( 3)(c), disregard any mineral resource, identified in a report of a kind referred to in that paragraph, that does not include * minerals the * exploration or prospecting for which involved:

(a) use of assets referred to in paragraph ( 1)(a); or

(b) expenditure referred to in paragraph ( 1)(b).

(5) The Commissioner may request an entity that is a * greenfields minerals explorer in an income year to prepare, within the period specified in the request, a report that:

(a) is of the kind referred to in paragraph ( 3)(c); and

(b) relates to an area in relation to which the entity has * greenfields minerals expenditure for the income year.

The request may specify the manner in which, and the form in which, the report is to be prepared.

418 - 81 Meaning of exploration credits allocation for an income year

(1) An entity has an exploration credits allocation for an income year if the Commissioner makes a determination under section 418 - 101 allocating the entity * exploration credits for the income year.

(2) The amount of the entity's exploration credits allocation for the income year is the amount of * exploration credits allocated to the entity under the determination.

(3) If no determination is made allocating * exploration credits to the entity for the income year, the amount of the entity's exploration credits allocation for the year is nil.

418 - 82 When does an entity have an unused allocation of exploration credits from an income year

(1) An entity has an unused allocation of exploration credits from an income year if each of the following:

(a) the entity's * exploration credits allocation for the income year;

(b) the total credits issue for investment in the entity for the income year;

exceeds the total amount of all * exploration credits created by the entity for the income year.

(2) The amount of the unused allocation of exploration credits from the income year is the lesser of:

(a) the amount by which the amount mentioned in paragraph ( 1)(a) exceeds the total amount of all * exploration credits created by the entity for the income year; and

(b) the amount by which the amount mentioned in paragraph ( 1)(b) exceeds the total amount of all * exploration credits created by the entity for the income year.

(3) If neither the amount mentioned in paragraph ( 1)(a) nor (1)(b) exceeds the total amount of all * exploration credits created by the entity for the income year, there is no unused allocation of exploration credits from the income year, and the amount of any unused allocation of exploration credits from the income year is nil.

(4) In this section:

"total credits issue" for investment in the entity (the minerals explorer ) for an income year means the total of all * exploration credits that may be issued by the minerals explorer to all other entities in relation to * exploration investment made by those other entities in the minerals explorer in the income year if section 418 - 120 is complied with.

418 - 85 Exploration credits must not exceed maximum exploration credit amount

(1) An entity must not create * exploration credits for an income year of a total amount that exceeds the entity's * maximum exploration credit amount for the income year.

(2) An entity's maximum exploration credit amount for an income year (the credit year ) is the smallest of the following amounts :

(a) the entity's * greenfields minerals expenditure for the credit year multiplied by the entity's * corporate tax rate for the credit year;

(b) the entity's * tax loss for the credit year multiplied by the entity's corporate tax rate for the credit year;

(c) the sum of :

(i) the entity's * exploration credits allocation for the credit year; and

(ii) the entity's * unused allocation of exploration credits from the income year immediately preceding the credit year.

( 3 ) In working out the entity's * greenfields minerals expenditure for the credit year for the purposes of paragraph ( 2) (a) , reduce that greenfields minerals expenditure by the sum of:

(a) all * recoupments that the entity receives in relation to the entity's greenfields minerals expenditure for the credit year; and

(b) if:

(i) an amount has been included in the entity's assessable income because a * balancing adjustment event occurs for a * depreciating asset; and

(ii) all or part of the amount of the deduction to which the entity is entitled under section 40 - 25 for the credit year in relation to the decline in value of the asset is included in the entity's greenfields minerals expenditure for that year;

so much of the amount of that deduction as was included in that greenfields minerals expenditure.

(4) In working out the entity's * tax loss for the credit year for the purposes of paragraph ( 2)(b), reduce that tax loss by the sum of:

(a) all * recoupments that the entity receives in relation to the entity's * greenfields minerals expenditure for the credit year; and

(b) any part of the entity's tax loss for the credit year that would not be deductible in the income year immediately following the credit year; and

(c) if:

(i) an amount has been included in the entity's assessable income because a * balancing adjustment event occurs for a * depreciating asset; and

(ii) all or part of the amount of the deduction to which the entity is entitled under section 40 - 25 for the credit year in relation to the decline in value of the asset is included in the entity's greenfields minerals expenditure for that year;

so much of the amount of that deduction as was included in that greenfields minerals expenditure.

(5) For the purposes of paragraph ( 4)(b), assume that the entity's assessable income for the income year immediately following the credit year is sufficient to allow the entity to utilise the whole of that * tax loss in relation to the credit year.

(6) A failure to comply with this section does not invalidate the creation of an * exploration credit.

418 - 95 Effect on tax losses of creating exploration credits

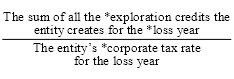

(1) If an entity creates any * exploration credits for a * loss year, the amount of the entity's * tax loss for the loss year is reduced by the amount worked out as follows:

(2) However, if the amount worked out under subsection ( 1) equals or exceeds what would (apart from this section) be the entity's * tax loss for the * loss year, that tax loss is taken to be nil.

Subdivision 418DA -- Exploration credits allocation

Table of sections

418 - 100 Applying for an exploration credits allocation

418 - 101 Determination by the Commissioner

418 - 102 General allocation rules

418 - 103 Meaning of annual exploration cap

418 - 104 Failure to comply with this Subdivision does not affect allocation

418 - 100 Applying for an exploration credits allocation

(1) An entity may apply to the Commissioner for a determination under section 418 - 101 allocating * exploration credits to the entity for an income year.

(2) The application must be made within 1 month before the start of the * financial year corresponding to the income year for which the allocation is sought.

(3) The application must:

(a) be * lodged electronically; and

(b ) be in the * approved form; and

(c ) include an estimate of:

(i) the entity's * greenfields minerals expenditure for the income year; and

(ii) the entity's * tax loss for the income year; and

(iii) the entity's * corporate tax rate for the income year.

(4) The Commissioner must give the entity:

(a) if the Commissioner makes a determination under section 418 - 101-- a copy of the determination; or

(b) if the Commissioner decides to refuse the application--notice of that decision.

418 - 101 Determination by the Commissioner

Determination allocating exploration credits

(1) The Commissioner may make a written determination allocating * exploration credits of an amount specified in the determination to an entity for an income year.

Circumstances in which the Commissioner must not make a determination

(2) The Commissioner must not make a determination allocating * exploration credits to an entity for an income year if the Commissioner is not satisfied that:

(a) there is a reasonable possib ility that the entity will have:

(i) * greenfields minerals expenditure of the amount estimated by the entity in the application, or greater; and

(ii) a * tax loss of the amount estimated by the entity in the application, or greater; and

(iii) the * c orporate tax rate estimated by the entity in the application; and

(b) the entity meets any other requirement prescribed under the regulations.

A mount of the exploration credits allocated

(3) The amount of the * exploration credits specified in the determination must be the smallest of the following amounts:

(a) the entity's estimated * greenfields minerals expenditure for the income year multiplied by the entity's estimated * corporate tax rate for the income year;

(b) the entity's estimated * tax loss for the income year multiplied by the entity's estimated corporate tax rate for the income year;

(c) either:

(i) 5 % of an amount equal to the * annual expl oration cap for the income year; or

(ii) if another amount, or a method for working out another amount, is prescribed--th e other amount .

Determination not a legislative instrument

(4) A determination made under subsection ( 1) is not a legislative instrument.

418 - 102 General allocation rules

(1) The total amount of * exploration credits allocated to entities for an income year by the Commissioner must not exceed the * annual exploration cap for the year.

(2) The Commissioner must consider applications for * exploration credits from entities for an income year in the order in which the Commissioner receives the applications.

(3) If the Commissioner receives more than one application at the same time, the Commissioner may decide the order in which the Commissioner considers the applications.

(4) If the Commissioner would contravene this section by allocating * exploration credits to an entity for an income year of an amount worked out under subsection 418 - 101(3) then, despite that subsection, the amount of exploration credits allocated to that entity for the income year is to be the difference between the * annual exploration cap for the year and the total amount of exploration credits already allocated to other entities for the year.

418 - 103 Meaning of annual exploration cap

(1) The annual exploration cap for an income year is the following amount:

(a) for the 2017 - 18 income year--$15 million;

(b) for the 2018 - 19 income year--$25 million, plus the * exploration credits remainder for the immediately preceding income year;

(c) for the 2019 - 20 income year--$30 million, plus the exploration credits remainder for the immediately preceding income year and any other amount prescribed for the purposes of this paragraph ;

(d) for the 2020 - 21 income year--$30 million, plus the exploration credits remainder for the immediately preceding income year and any other amount prescribed for the purposes of this paragraph .

(2) If the total amount of * exploration credits allocated by the Commissioner for an income year is less than the * annual exploration cap for the year, the difference is the exploration credits remainder for the income year.

418 - 104 Failure to comply with this Subdivision does not affect allocation

A failure by the Commissioner to comply with this Subdivision does not invalidate a determination allocating * exploration credits to an entity for an income year.

Subdivision 418 - E -- Issuing exploration credits

Table of sections

418 - 110 Issuing exploration credits

418 - 111 Working out whether an exploration investment has been made in an income year

418 - 115 Who may receive an exploration credit and what is the pool from which the credit may be issued

418 - 116 Exploration credits issued must be in proportion to exploration investment

418 - 120 The total of all exploration credits issued in relation to exploration investment

418 - 125 Expiry of exploration credits

418 - 130 Notifying the Commissioner of issuing or expiry of exploration credits

418 - 110 Issuing exploration credits

(1) An entity that has created * exploration credits for an income year (the minerals explorer ) may issue an exploration credit for that income year to another entity (the investor ).

(2) The * exploration credit issued to the investor for the income year may relate to:

(a) * exploration investment made by the investor in the minerals explorer in the income year; or

(b) exploration investment made by the investor in the minerals explorer in the immediately preceding income year.

However, this rule is subject to the limitations imposed under sections 418 - 115, 418 - 116 and 418 - 120.

(3) An * exploration credit is issued to an entity by giving the entity a statement in the * approved form.

418 - 111 Working out whether an exploration investment has been made in an income year

(1) An entity (the investor ) makes an exploration investment in another entity (the minerals explorer ) in an income year if:

(a) * shares in the minerals explorer are issued to the investor by the minerals explorer:

(i) on or after the day on which the Commissioner makes a determination under section 418 - 101 allocating * exploration credits to the minerals explorer for the income year; and

(ii) before the end of the income year; and

(b) those shares are * equity interests.

(2) The amount of the exploration investment made by the investor in the minerals explorer in the income year is equal to the total amount paid up by the investor on the shares during the period mentioned in paragraph ( 1)(a).

(1) If * exploration credits are to be issued by an entity (the minerals explorer ) for an income year (the credit year ), work out each of the following by identifying whether scenario 1, 2 or 3 applies, and applying the rules for that scenario :

(a) whether the minerals explorer can issue an exploration credit to another entity in relation to * exploration investment made by the other entity in the minerals explorer in the credit year;

(b) whether the minerals explorer can issue an exploration credit to another entity in relation to exploration investment made by the other entity in the minerals explorer in the income year immediately preceding the credit year (the preceding year );

(c) the pool of exploration credits from which an exploration credit may be issued to another entity in relation to exploration investment made by the other entity in the minerals explorer in the credit year (this is called the issue pool for exploration investment made in the minerals e xplorer in the credit year);

(d) the pool of exploration credits from which an exploration credit may be issued to another entity in relation to exploration investment made by the other entity in the minerals explorer in the preceding year (this is called the issue pool for exploration investment made in the minerals explorer in the preceding year).

Scenario 1--no unused allocation of exploration credits from the preceding year

(2) If there is no * unused allocation of exploration credits from the preceding year:

(a) * exploration credits can be issued to another entity in relation to * exploration investment made by the other entity in the minerals explorer in the credit year; and

(b) no exploration credits can be issued to another entity in relation to exploration investment made by the other entity in the minerals explorer in the preceding year.

(3) In this scenario:

(a) the issue pool for * exploration investment made in the minerals explorer in the credit year is equal to the total amount of * exploration credits created by the minerals explorer for the credit year; and

(b) the issue pool for exploration investment made in the minerals explorer in the preceding year is nil.

Scenario 2--exploration credits for the credit year exceed unused allocation of exploration credits from the preceding year

(4) If the amount of the * exploration credits created by the minerals explorer for the credit year is more than the * unused allocation of exploration credits from the preceding year:

(a) exploration credits can be issued to another entity in relation to * exploration investment made by the other entity in the minerals explorer in the credit year; and

(b) exploration credits can be issued to another entity in relation to exploration investment made by the other entity in the minerals explorer in the preceding year.

(5) In this scenario:

(a) the issue pool for * exploration investment ma de in the minerals explorer in the credit year is equal to the difference between the * unused allocation of exploration credits from the preceding year and the total amount of * exploration credits created by the minerals explorer for the credit year; and

(b) the issue pool for exploration investment made in the minerals explorer in the preceding year is equal to the unused allocation of exploration credits fro m the preceding year.

(6) However, no * exploration credit can be issued to another entity in relation to * exploration investment made by the entity in the minerals explorer in the credit year unless the * issue pool for exploration investment in the preceding year is exhausted.

Scenario 3--exploration credits for the credit year are equal to or less than the unused allocation of exploration credits from the preceding year

(7) If the amount of the * exploration credits created by the minerals explorer for the credit year is equal to or less than the * unused allocation of exploration credits from the preceding year:

(a) no exploration credits can be issued to another entity in relation to * exploration investment made by the enti ty in the minerals explorer in the credit year; and

(b) exploration credits can be issued to another entity in relation to exploration investment made by the other entity in the minerals explorer in the preceding year.

(8) In this scenario:

(a) the issue pool for * exploration investment made in the minerals explorer in the credit year is nil; and

(b) the issue pool for exploration investment made in the minerals explorer in the preceding year is equal to the total amount of * exploration credits created by the minerals explorer for the credit year.

418 - 116 Exploration credits issued must be in proportion to exploration investment

If an * exploration credit is issued by an entity (the minerals explorer ) for an income year to another entity (the investor ) in relation to * exploration investment made by the investor in the minerals explorer in an income year (the investment year ):

(a) the proportion of the * issue pool for exploration investment made in the minerals explorer in the investment year that is issued to the investor as an exploration credit must be the same as the proportion of the total exploration investment in the minerals explorer in the investment year that is represented by the investor 's exploration investment in the minerals explorer in the investment year; and

(b) the minerals explorer must issue an exploration credit to every entity who made an exploration investment in the minerals e xplorer in the investment year.

418 - 120 The total of all exploration credits issued in relation to exploration investment

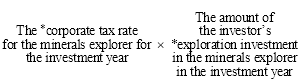

The total amount of all * exploration credits issued by an entity (the minerals explorer ) to another entity (the investor ) in relation to * exploration investment made by the investor in the minerals explorer in an income year (the investment year ) must not exceed the amount worked out using the following formula:

418 - 125 Expiry of exploration credits

An * exploration credit created by an entity for an income year (the credit year ) expires if the entity does not issue the credit under this Subdivision on or before 30 June in the financial year that corresponds to the income year that immediately follows the credit year.

418 - 130 Notifying the Commissioner of issuing or expiry of exploration credits

(1) An entity that has created * exploration credits for an income year (the credit year ) must notify the Commissioner of the issuing or expiry of the credits.

(2) The notice must:

(a) be in the * approved form; and

(b) be given to the Commissioner on or before the due date:

(i) if the entity is an * investment body for * Part VA investments--for giving to the Commissioner an * annual investment income report in respect of the * financial year corresponding to the year immediately following the credit year; or

(ii) otherwise--for the entity to lodge its * income tax return for the income year that immediately follows the credit year.

3 Section 418 - 150

Omit "the entity's * maximum exploration credit amount for the income year.", substitute "the amount worked out under section 418 - 151 for the income year (the complying exploration credit amount ) . ".

4 After section 418 - 150

Insert:

418 - 151 Complying exploration credit amount

(1) T he complying exploration credit amount (which may be nil) for an income year is worked out by:

(a) starting with the sum of the * exploration credits the entity issues for the income year; and

(b) subtracting from the result of paragraph ( a) the sum of any of those exploration credits covered by subsection ( 2); and

(c) if the result of paragraph ( b) exceeds the entity's * maximum exploration credit amount for the income year--subtracting from that result the amount of the excess.

Note: The complying exploration credit amount is the sum of issued exploration credits that were issued (and created) in compliance with this Division. A liability arises under section 418 - 150 if the sum of all issued exploration credits exceeds this amount.

(2) This subsection cover s an * exploration credit to the extent to which either or both of the following apply to the credit :

( a ) the credit was issued in contravention of a requirement in this Division;

(b) the credit was created in contravention of a requirement in Subdivision 41 8 - D (other than section 418 - 85).

Note: Because the maximum exploration credit amount from section 418 - 85 is taken into account in paragraph ( 1)(c) of this section , it is disregarded here .

5 Section 418 - 160

Repeal the section, substitute:

An entity that is liable to pay * excess exploration credit tax for an income year (the credit year ) must give the Commissioner a return relating to excess exploration credit tax, in the * approved form, within 21 days after the end of the * financial year corresponding to the income year that immediately follows the credit year.

6 Paragraph 4 18 - 185(2)(a)

Repeal the paragraph , substitute:

(a) if, at the time the notice is given, the entity has not issued any * exploration credits for the income year (the credit year ) immediately preceding the income year in which the notice is given--the credit year; or

6A At the end of Division 418

Add:

Subdivision 418 - G -- Other matters

Table of sections

418 - 190 Annual impact assessments of this Division

418 - 190 Annual impact assessments of this Division

(1) As soon as practicable after the end of each income year referred to in subsection ( 2), the Minister must cause to be conducted an impact assessment of the operation of this Division during that income year. The objective of the impact assessment should be to measure the additional * exploration or prospecting attributable to the Division.

(2) The income years are as follows:

(a) the 2017 - 2018 income year;

(b) the 2018 - 2019 income year;

(c) the 2019 - 2020 income year;

(d) the 2020 - 2021 income year.

(3) Each impact assessment must make provision for public consultation, including consultation with the industry.

(4) The Minister must cause to be prepared a report of each impact assessment. The report must include any information made publicly available by the Commissioner under section 3F of the Taxation Administration Act 1953 in relation to * exploration credits allocated for the income year.

(5) The Minister must cause a copy of a report of an impact assessment to be published on the Australian Taxation Office website as soon as practicable after the completion of the preparation of the report.

Income Tax Assessment Act 1936

7 Subsection 6(1) (definition of exploration development incentive tax offset )

Repeal the definition.

8 Subsection 6(1)

Insert:

"junior" minerals exploration incentive tax offset means a tax offset under Subdivision 418 - B of the Income Tax Assessment Act 1997 .

9 Subparagraph 1 77F(1)(e)(i)

Omit "an exploration development incentive", substitute "a junior minerals exploration incentive".

10 Subparagraphs 177F(3)(e)(i) and (ii)

Omit "an exploration development incentive" (wherever occurring), substitute "a junior minerals exploration incentive".

Income Tax Assessment Act 1997

11 Section 13 - 1 (table item headed "exploration for minerals")

Omit "exploration development incentive", substitute "junior minerals exploration incentive".

12 Section 67 - 23 (table item 27)

Omit "exploration development incentive", substitute "junior minerals exploration incentive".

13 After section 112 - 77

Insert:

112 - 78 Exploration investments

Exploration investments | |||

Item | In this situation: | Element affected: | See section: |

1 | An exploration investment in the form of a share is disposed of | The total reduced cost base | 130 - 110 |

14 Section 130 - 1

Omit:

substitute:

15 At the end of Division 130

Add:

Subdivision 130 - F -- Exploration investments

130 - 110 Reducing the reduced cost base before disposal

(1) This section applies if:

(a) an entity (the minerals explorer ) issue s a * share in the minerals explorer to another entity (the investor ) during the 2017 - 18, 2018 - 19, 2019 - 20 or 2020 - 21 income year; and

(b) the Commissioner ma kes a determination under section 418 - 101 allocating exploration credits to the minerals explorer for the income year in which the share is issued ; and

(c) the share is issued to the investor on or after the day on which the Commissioner's determination is made ; and

( d ) the share is an * equity interest .

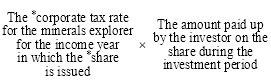

(2) The * reduced cost base of the * share is to be reduced immediately before the disposal of the share by the amount worked out as follows:

where:

"investment period" means the period, within the income year in which the * share is issued to the investor, that:

(a) begins on the day on which the Commissioner makes the determination mentioned in paragraph ( 1)(b); and

(b) ends at the end of the income year.

16 Subdivision 418 - B (heading)

Repeal the heading, substitute:

Subdivision 418 - B -- Junior minerals exploration incentive tax offset

17 Group heading before section 418 - 10

Repeal the heading, substitute:

Entitlement to junior minerals exploration incentive tax offset

18 Group heading before section 418 - 25

Repeal the heading, substitute:

Amount of junior minerals exploration incentive tax offset

19 Subdivision 418 - C (heading)

Repeal the heading, substitute:

Subdivision 418 - C -- Junior minerals exploration incentive franking credit

20 Section 418 - 50 (heading)

Repeal the heading, substitute:

418 - 50 Junior minerals explora tion incentive franking credit-- ordinary case

21 Section 418 - 55 (heading)

Repeal the heading, substitute:

418 - 55 Junior minerals exploration incentive franking credit--life insurance company

22 Subsection 995 - 1(1)

Insert:

"annual exploration cap" for an income year has the meaning given by subsection 418 - 103(1).

23 Subsection 995 - 1(1) (definition of exploration credit )

After "created", insert ", or to be created".

24 Subsection 995 - 1 (1)

Insert:

"exploration credits allocation" for an entity for an income y ear has the meaning given by section 418 - 8 1 .

"exploration credits remainder" for an income year has the meaning given by subsection 418 - 103(2).

"exploration investment" has the meaning given by section 418 - 111 .

"issue pool" , for exploration investment made in an entity in an income year, has the meaning given by section 418 - 115.

25 Subsection 995 - 1(1) (definition of maximum exploration credit amount )

Repeal the definition, substitute:

"maximum exploration credit amount" for an income year has the meaning given by subsection 418 - 85(2).

26 Subsection 995 - 1(1)

Insert:

"unused allocation of exploration credits" from an income year has the meaning given by section 418 - 8 2.

Taxation Administration Act 1953

26A At the end of Part IA

Add:

3F Reporting of information about junior minerals exploration incentive offset

(1) This section applies if the Commissioner makes a determination under section 418 - 101 of the Income Tax Assessment Act 1997 allocating exploration credits to an entity for an income year.

(2) The Commissioner must, as soon as practicable after making the determination, make publicly available:

(a) the ABN and name of the entity; and

(b) the amount of the entity's exploration credits allocation for the income year.

(3) An expression used in this section that is also used in the Income Tax Assessment Act 1997 has the same meaning as in that Act.

27 Section 45 - 340 in Schedule 1 (method statement, step 1, paragraph ( h))

Omit "exploration development incentive", substitute "junior minerals exploration incentive".

28 Section 45 - 375 in Schedule 1 (method statement, step 1, paragraph ( g))

Omit "exploration development incentive", substitute "junior minerals exploration incentive".

Part 4 -- Application, transitional and saving provisions

Division 1--Application and transitional provisions

65 Application of amendments

The amendments made by Parts 1 and 2 of this Schedule apply in relation to :

(a) the creation and issuing of exploration credits by an entity in relation to exploration investment made in the entity in the 2017 - 18, 2018 - 19, 2019 - 20 and 2020 - 21 income years ; and

(b) the consequences of creating or issuing exploration credits for the 2017 - 18, 2018 - 19, 2019 - 20 and 2020 - 21 income years.

66 Transitional provisions relating to the 2017 - 18 income year

(1) Despite subsection 418 - 100(2) of the Income Tax Assessment Act 1997 , as inserted by item 2 of this Schedule, an application to the Commissioner for a determination allocating exploration credits to an entity for the 2017 - 18 income year must be made during the period of one month starting on the later of:

(a) the eleventh business day after the day on which this Act receives the Royal Assent; and

(b) the day on which this item commences.

(2 ) Nothing in subitem ( 1 ) affects the rules in sub section 418 - 102 (2) or (3) of the Income Tax Assessment Act 1997 , as inserted by item 2 of this Schedule.

(3 ) To avoid doubt:

(a) there can be no allocation of exploration credits for the 2016 - 17 income year by the Commissioner under section 418 - 101 of the Income Tax Assessment Act 1997 , as inserted by item 2 of this Schedule; and

(b) there can be no unused allocation of exploration credits from the 2016 - 17 income year for the purposes of that Act, a s amended by this Schedule.

67 Continued application of the old law in relation to entities that were greenfields minerals explorers in the 2016 - 17 income year

To avoid doubt, the taxation law continues to apply in relation to the 2017 - 18 income year as if the amendments in Parts 1 and 2 of this Schedule had not been made, to the extent that the law relates to:

(a) the creation and issuing of exploration credits on the basis that the entity that creates and issues the credits is a greenfields minerals explorer in the 2016 - 17 income year; and

(b) the consequences of creating or issuing exploration credits in those circumstances.