Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Amendments commencing 1 July 2016

Income Tax Assessment Act 1997

1 Subsection 36 - 55(2) (method statement, step 2)

Omit "the * standard corporate tax rate", substitute "the entity's * corporate tax rate for imputation purposes for that year".

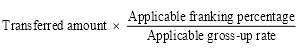

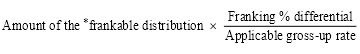

2 Subsection 197 - 45(2) (formula)

Repeal the formula, substitute:

3 Subsection 197 - 45(2)

Insert:

"applicable gross-up rate" means the company's * corporate tax gross - up rate for the income year in which the franking debit arises.

4 Subsection 197 - 60(3) ( paragraph ( a) of the definition of applicable tax rate )

Omit "the * standard corporate tax rate", substitute "the company's * corporate tax rate for imputation purposes for the income year in which the choice is made".

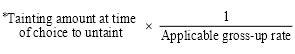

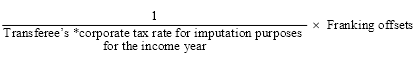

5 Subsection 197 - 60(4) (formula)

Repeal the formula, substitute:

6 At the end of subsection 197 - 60(4)

Add:

where:

"applicable gross-up rate" means the company's * corporate tax gross - up rate for the income year in which the choice is made.

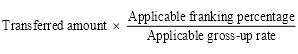

7 Subsection 197 - 65(3) (formula)

Repeal the formula, substitute:

8 Subsection 197 - 65(3)

Insert:

"applicable gross-up rate" means the company's * corporate tax gross - up rate for the income year in which the franking debit arise s .

9 Subsection 200 - 25(1)

Omit "the standard corporate tax rate", substitute "the entity's corporate tax rate for imputation purposes for the income year in which the distribution is made".

10 Section 202 - 55

Omit "the current standard corporate tax rate", substitute "the entity's corporate tax rate for imputation purposes for the income year in which the distribution is made".

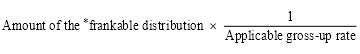

11 Subsection 202 - 60(2) (formula)

Repeal the formula, substitute:

12 At the end of subsection 202 - 60(2)

Add:

where:

"applicable gross-up rate" means the * corporate tax gross - up rate of the entity making the distribution for the income year in which the distribution is made.

13 Subsection 203 - 50(2) (formula)

Repeal the formula, substitute:

14 Subsection 203 - 50(2)

Insert:

"applicable gross-up rate" means the * corporate tax gross - up rate of the entity making the distribution for the income year in which the distribution is made.

15 Subsection 215 - 20(2) (formula)

Repeal the formula, substitute:

![]()

16 At the end of subsection 215 - 20(2)

Add:

where:

"applicable gross-up rate" means the * corporate tax gross - up rate of the entity making the distribution for the income year in which the distribution is made.

17 Subsection 705 - 90(3) (formula)

Repeal the formula, substitute:

![]()

18 At the end of subsection 705 - 90(3)

Add:

where:

"applicable gross-up rate" means the joining entity's * corporate tax gross - up rate for the income year that ends, or, if section 701 - 30 applies, for the income year that is taken by subsection ( 3) of that section to end, at the joining time.

19 Paragraph 707 - 310(3A)(c) (formula)

Repeal the formula, substitute:

20 Section 976 - 1 (formula)

Repeal the formula, substitute:

![]()

21 At the end of section 976 - 1

Add:

where:

"applicable gross-up rate" means the * corporate tax gross - up rate of the entity making the distribution for the income year in which the distribution is made.

22 Section 976 - 10 (formula)

Repeal the formula, substitute:

![]()

23 At the end of section 976 - 10

Add:

where:

"applicable gross-up rate" means the * corporate tax gross - up rate of the entity making the distribution for the income year in which the distribution is made.

24 Section 976 - 15 (formula)

Repeal the formula, substitute:

![]()

25 At the end of section 976 - 15

Add:

where:

"applicable gross-up rate" means the * corporate tax gross - up rate of the entity making the distribution for the income year in which the distribution is made.

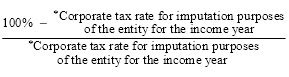

26 Subsection 995 - 1(1) (definition of corporate tax gross - up rate )

Repeal the definition, substitute:

"corporate tax gross-up rate" , of an entity for an income year, means the amount worked out using the following formula:

27 Subsection 995 - 1(1) (definition of corporate tax rate )

Repeal the definition, substitute:

"corporate tax rate" :

(a) in relation to a company to which paragraph 23(2)(a) of the Income Tax Rates Act 1986 applies--means the rate of tax in respect of the taxable income of a company covered by that paragraph; or

(b) in relation to another entity--means the rate of tax in respect of the taxable income of a company covered by paragraph 23(2)(b) of that Act.

28 Subsection 995 - 1(1)

Insert:

"corporate tax rate for imputation purposes" , of an entity for an income year, means:

(a) unless paragraph ( b) applies--the entity's * corporate tax rate for the income year, worked out on the assumption that the entity's * aggregated turnover for the income year is equal to its aggregated turnover for the previous income year; or

(b) if the entity did not exist in the previous income year--the rate of tax in respect of the taxable income of a company covered by paragraph 23(2)(a) of the Income Tax Rates Act 1986 .

29 Subsection 995 - 1(1) (definition of standard corporate tax rate )

Repeal the definition.

Part 3 -- Application of amendments

The amendments made by Part 1 of this Schedule apply to the 2016 - 17 income year and later income years.