Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsIncome Tax Assessment Act 1997

1 S ection 301 - 125

After "20H(2), (2AA), (2A) or (3)", insert ", 20QF(2)" .

2 Paragraph 301 - 225 (2)(b)

Repeal the paragraph, substitute:

(b) the benefit is paid to you:

(i) under subsection 20QF(2) of the Superannuation (Unclaimed Money and Lost Members) Act 1999 in a case covered by paragraph ( d) of that subsection; or

(ii) under subsection 24G(2) of that Act in a case covered by paragraph ( d) of that subsection; and

3 Subsection 307 - 5(1) (table item 5, column 2)

After "or 20H(2), (2AA) or (2A),", insert "section 20QD or subsection 20QF(2) or (5),".

4 Subsection 307 - 5(1) (table item 5, column 3)

After "20H(2), (2AA), (2A) or (3)", insert ", 20QF(2), (5) or (6)".

5 Paragraph 307 - 120(2)(e)

After "20H(2), (2AA), (2A) or (3)", insert ", 20QF(2), (5) or (6)".

6 Subsection 307 - 142(1)

After "20H(2), (2AA), (2A) or (3)", insert ", 20QF(2), (5) or (6)".

7 Subsection 307 - 142 (2) (method statement, step 1, note)

After:

A payment under subsection 20H(2) or (3) of that Act may be attributable to more than one unclaimed amount.

in sert:

A payment under subsection 20QF(2) of that Act is attributable to a single unclaimed amount set out in item 3A of the table.

8 Subsection 307 - 142(3) (after table item 3)

Insert:

3A | an amount paid to the Commissioner under section 20QD of the Superannuation (Unclaimed Money and Lost Members) Act 1999 in respect of the person | a * superannuation benefit paid from a * superannuation plan | the * tax free component of that superannuation benefit |

9 Paragraph 307 - 142(3A)(a)

After "20JA", insert ", 20QH".

10 Subsection 307 - 142(3B)

After "20H(2AA)", insert ", 20QF(5) or (6)".

11 Subsection 307 - 300(1)

After "20H(2), (2AA), (2A) or (3)", insert ", 20QF(2)".

12 Subsection 307 - 300(2) (method statement, step 1, note)

After:

A payment under subsection 20H(2) or (3) of that Act may be attributable to more than one unclaimed amount.

i nsert:

A payment under subsection 20QF(2) of that Act is attributable to a single unclaimed amount set out in item 3A of the table.

13 Subsection 307 - 300(3) (after table item 3)

Insert:

3A | an amount paid to the Commissioner under section 20QD of the Superannuation (Unclaimed Money and Lost Members) Act 1999 in respect of the person | a * superannuation benefit paid from a * superannuation plan | the * element taxed in the fund of the * taxable component of that superannuation benefit |

14 Subsection 307 - 300(3A) (note)

After "17(2AB) or (2AC)", insert ", 20QF(5) or (6)".

15 Subsection 307 - 350(2B)

After "20H(2), (2AA), (2A) and (3)", insert ", 20QF(2)".

Superannuation (Unclaimed Money and Lost Members) Act 1999

16 After paragraph 6(d)

Insert:

(da) the matching of benefits of inactive low - balance account members and persons entitled to them; and

17 At the end of paragraph 6(e)

Add:

(iv) certain amounts relating to superannuation of inactive low - balance account members; and

18 After paragraph 6(ea)

Insert:

(eb) the payment of:

(i) unclaimed money; and

(ii) certain amounts relating to superannuation of lost members; and

(iii) certain amounts relating to superannuation of inactive low - balance account members;

into funds in which the member is active; and

19 Section 7

After:

Superannuation providers must pay to the Commissioner of Taxation the value of any such accounts. Later, the Commissioner must, if satisfied that it is possible to do so, pay an amount he or she has received in respect of a person:

(a) to a fund identified by the person; or

(b) if the person has reached eligibility age or the amount is less than $200--to the person; or

(c) if the person has died--to the person's death beneficiaries or legal personal representative.

insert:

Superannuation of inactive low - balance members

At times determined by the Commissioner, superannuation providers must give the Commissioner of Taxation details relating to inactive low - balance accounts.

Superannuation providers must pay to the Commissioner of Taxation the value of any such accounts. Later, the Commissioner must, if satisfied that it is possible to do so, pay an amount the Commissioner has received in respect of a person:

(a) to a fund identified by the person; or

(b) if the person has reached eligibility age or the amount is less than $200--to the person; or

(c) if the person has died--to the person's death beneficiaries or legal personal representative.

Reunification of amounts held by the Commissioner

If, having taken the steps required in relation to unclaimed amounts, or amounts held by the Commissioner for lost members or inactive low - balance members, the Commissioner still holds an amount, the Commissioner must pay that amount to a fund in which the member for whom the Commissioner holds the amount is active, or in accordance with the regulations.

20 Section 8 (definition of account )

Repeal the definition, substitute:

"account" , in a fund that is an RSA, means:

(a) if the RSA is an account--that account; or

(b) if the RSA is a policy (within the meaning of the RSA Act)-- t hat policy.

21 Section 8

Insert:

"choice product" has the same meaning as in the SIS Act.

"inactive low-balance account" : see subsections 20QA(1) and (1A).

"inactive low-balance member" has the meaning given by subsection 20QA(2).

"inactive low-balance product" has the meaning given by subsection 20QA(3).

"MySuper product" has the same meaning as in the SIS Act.

22 Section 8 ( paragraph ( a) of the definition of scheduled statement day )

Omit "or 4A", substitute ", 3B or 4A".

23 Paragraph 15A(a)

Omit "Part 4A", substitute "Parts 3B and 4A".

24 Paragraph 15A(b)

Omit "Part 4A", substitute "Part 3B or 4A".

25 After paragraph 19(1)(d)

Insert:

(da) amounts paid to the Commissioner under section 20QD (amounts from inactive low - balance accounts); and

(db) each person in respect of whom there is an amount referred to in paragraph ( da) of this subsection; and

26 After subparagraph 20H(1)(b)(ii)

Insert:

(iiaa) the amounts (if any) paid to the Commissioner under section 20QD in respect of the person; and

27 After subparagraph 20H(1)(b)(v)

Insert:

(va) the amounts (if any) paid by the Commissioner under subsection 20QF(2) in respect of the person; and

28 Paragraph 20H(2B)(a)

After "subsection 17(1) or (2),", insert "section 20QD or subsection 20QF(2), or".

29 Subsection 20H(3)

After " subparagraphs ( 1)(b)(i), (ii)", insert ", (iiaa)".

30 After Part 3A

Insert:

Part 3B -- Payment of low balances in inactive accounts to the Commissioner

The object of this Part is to set up a procedure for dealing with inactive low - balance accounts.

(1) An account in a fund is taken to be an inactive low - balance account if:

(a ) for a fund that is a regulated superannuation fund:

(i) the fund has 5 or more members; and

(ii) the account is held on behalf of a member of the fund; and

(iii) the account relates, in whole or in part, to a MySuper product or choice product held by th at member; and

( iv ) the superannuation provider has not received an amount in respect of the member for crediting to that product within the last 1 6 months; and

( v ) the balance of the account that relates to that product is less than $6,000; and

(v i) the member has not satisfied any of the conditions of release of benefits specified in a standard made under paragraph 31(2)(h) of the SIS Act that are prescribed for th e purposes of this subparagraph; and

( vii ) the account does not support or relate to a defined benefit interest (within the meaning of section 291 - 175 of the Income Tax Assessment Act 1997 ) ; and

(viii) no benefit that despite section 68AAA of the SIS Act could, because of the application of sub section 68AAA(7) or (8) of that Act, be provided to, or in respect of, the member under the product by taking out or maintaining insurance is provided in that way; and

(b) for a fund that is an RSA or approved deposit fund:

(i) the account is held on behalf of a member of the fund; and

(ii) the superannuation provider has not received an amount in respect of the member within the last 1 6 months; and

(iii) the balance of the account is less than $6,000; and

(iv) the member has not satisfied any of the conditions of release of benefits specified in a standard made under paragraph 38(2)(f) of the Retirement Savings Accounts Act 1997 (for an RSA), or paragraph 32(2)(c) of the SIS Act (for an approved deposit fund), that are prescribed for the purposes of this paragraph; and

( v) the account does not support or relate to a defined benefit interest (within the meaning of section 291 - 175 of the Income Tax Assessment Act 1997 ).

Note: The balance of an account does not reflect any earnings, fees or charges that have not yet been credited to, or debited from, the account.

(1A) However, an account in a fund that is a regulated superannuation fund is taken not to be an inactive low - balance account if:

(a) the account is held on behalf of a member of the fund; and

(b) any of the following occurred in relation to the member in the last 16 months:

(i) the member changed the member's investment options under the fund;

(ii) the member made changes in relation to the member's insurance coverage under the fund;

(iii) the member made or amended a binding beneficiary nomination;

(iv) the member, by written notice given to the Commissioner, declared that the member was not a member of an inactive low - balance account;

(v) the superannuation provider was owed an amount in respect of the member.

(2) A person on whose behalf a superannuation provider holds an inactive low - balance account is an inactive low - balance member .

(3) In a regulated superannuation fund, e ach MySuper product or choice product to which an inactive low - balance account relates in whole or in part, and in r elation to which subparagraphs ( 1) (a)(iv), (v) and (viii) are satisfied , is an inactive low - balance product in the inactive low - balance account.

Division 2 -- Statements on inactive low - balance accounts

20QB Statements on inactive low - balance accounts

Superannuation provider must give statement to the Commissioner

(1) A superannuation provider must, for each unclaimed money day, give the Commissioner a statement, in the approved form, of information relevant to either or both of the following:

(a) each inactive low - balance account as at the end of the day;

(b) the administration of any of the following in connection with each inactive low - balance account:

(i) this Part;

(ii) the Superannuation (Departing Australia Superannuation Payments Tax) Act 2007 ;

(iii) the Income Tax Assessment Act 1997 , Part 3AA of this Act, and Chapters 2 and 4 in Schedule 1 to the Taxation Administration Act 1953 , so far as they relate to this Part or the Superannuation (Departing Australia Superannuation Payments Tax) Act 2007 .

Note 1: For State or Territory public sector superannuation schemes, see sections 20QG and 20QH.

Note 2: The Taxation Administration Act 1953 provides for offences and administrative penalties if the statement required under subsection ( 1) includes false or misleading information: see sections 8K, 8M, 8N and 8R of that Act and Division 284 in Schedule 1 to that Act.

Note 3: The approved form may also require the statement to include certain tax file numbers: see subsection 25(2B) of this Act.

(2) If, at the end of the unclaimed money day, there are no balances held in inactive low - balance accounts, the statement must say so.

(3) The statement must also contain information, required by the approved form, relevant to any account that ceases to be an inactive low - balance account during the period that:

(a) starts on the unclaimed money day; and

(b) ends on the day on which the statement is given to the Commissioner.

(4) This section does not apply if, at the end of the unclaimed money day:

(a) the fund is a regulated superannuation fund that has fewer than 5 members; and

(b) there are no inactive low - balance accounts.

When statement must be given

( 5 ) The superannuation provider must give the Commissioner the statement by the end of the scheduled statement day for the unclaimed money day.

Note 1: The Commissioner may defer the time for giving the statement: see section 388 - 55 in Schedule 1 to the Taxation Administration Act 1953 .

Note 2: The Taxation Administration Act 1953 provides for offences and administrative penalties if the statement is not given when it must be: see sections 8C and 8E of that Act and Division 286 in Schedule 1 to that Act.

Relationship to rest of Act

( 6 ) This section does not apply in relation to:

(a) an amount that is unclaimed money at the end of the unclaimed money day; or

(b) amounts payable to a person identified in a notice the Commissioner has given the superannuation provider under section 20C; or

(c) an amount payable to the Commissioner in respect of a lost member under section 24E.

Note 1: Section 16 requires the superannuation provider to give the Commissioner a statement about unclaimed money.

Note 2: Section 20E requires the superannuation provider to give the Commissioner a statement about the superannuation interest of a person identified in a notice given to the provider under section 20C (which is about notices identifying former temporary residents).

Note 3: Section 24C requires the superannuation provider to give the Commissioner statements about lost member accounts.

20QC Error or omission in statement

Scope

(1) This section applies if:

(a) a superannuation provider gives the Commissioner a statement under section 20QB; and

(b) the superannuation provider becomes aware of a material error, or material omission, in any information in the statement.

Superannuation provider must give information

(2) The superannuation provider must, in the approved form, give the Commissioner the corrected or omitted information.

(3) Information required by subsection ( 2) must be given no later than 30 days after the superannuation provider becomes aware of the error or omission.

Note 1: The Commissioner may defer the time for giving the information: see section 388 - 55 in Schedule 1 to the Taxation Administration Act 1953 .

Note 2: The Taxation Administration Act 1953 provides for offences and administrative penalties if the information is not given when it must be: see sections 8C and 8E of that Act and Division 286 in Schedule 1 to that Act.

Division 3 -- Payment in respect of inactive low - balance accounts

20QD Payment in respect of inactive low - balance accounts

Provider must pay Commissioner

(1) A superannuation provider must pay the Commissioner (for the Commonwealth) the amount worked out under subsection ( 2) in respect of a person if:

(a) an account is an inactive low - balance account as at the end of an unclaimed money day; and

(b) the account is held by the provider on behalf of the person; and

(c) the account is still an inactive low - balance account at the time (the calculation time ) immediately before the earlier of:

(i) the time (if any) the payment is made; and

(ii) the time at which the payment is due and payable (assuming tha t the payment must be made).

The amount is due and payable at the end of the scheduled statement day for the unclaimed money day.

Note 1: For State or Territory public sector superannuation schemes, see sections 20QG and 20QH.

Note 2: Subsection 20QE(2) makes it an offence not to comply with a requirement under this subsection.

Note 3: The amount the superannuation provider must pay the Commissioner is a tax - related liability for the purposes of the Taxation Administration Act 1953 . Division 255 in Schedule 1 to that Act deals with payment and recovery of tax - related liabilities. Division 284 in that Schedule provides for administrative penalties connected with such liabilities.

Note 4: The Commissioner may defer the time at which the amount is due and payable: see section 255 - 10 in Schedule 1 to the Taxation Administration Act 1953 .

Note 5: Section 20QJ provides for refunds of overpayments by the superannuation provider to the Commissioner.

(2) The amount payable in respect of the person is the amount that would have been payable by the superannuation provider if:

(a) for a fund that is a regulated superannuation fund-- the person had requested that the balance held in respect of each inactive low - balance product in the account be rolled over or transferred to a complying superannuation fund (wit hin the meaning of the SIS Act); and

(b) for a fund that is an RSA or approved deposit fund--the person had requested that the balance held in the account be rolled over or transferred to a complying superannuation fund (within the meaning of the SIS Act).

(3) For the purposes of subsection ( 2):

(a) work out the amount that would have been payable at the calculation time; and

(b) assume that the request were made before the calculation time; and

(c) assume that the inactive low - balance member had not died before the calculation time.

Family Law payment splits

(4) If, as a result of a payment split that applies in relation to the account, the non - member spouse (or his or her legal personal representative if he or she has died) is, or could in the future be, entitled to be paid an amount, then:

(a) for the purposes of subsection ( 2), take account only of the inactive low - balance member's entitlement to payment remaining after any reduction by the payment split (disregarding subsection 90MB(3) of the Family Law Act 1975 ); and

(b) the superannuation provider must also pay an amount (the non - member spouse amount ) to the Commissioner in respect of the non - member spouse; and

(c) the non - member spouse amount is due and payable at the same time as the amount payable under subsection ( 1); and

(d) the amount of the non - member spouse amount is the amount of the reduction mentioned in paragraph ( a).

Note 1: Part VIIIB of the Family Law Act 1975 is about splitting amounts payable in respect of a superannuation interest between the parties to a marriage. Subsection 90MB(3) of that Act provides that the Part has effect subject to this Act.

Note 2: Subsection 20QE(2) of this Act makes it an offence not to comply with a requirement under this subsection.

Miscellaneous

(5) This section does not require the superannuation provider to pay the Commissioner:

(a) an amount that is unclaimed money at the end of the unclaimed money day; or

(b) an amount payable to a person identified in a notice the Commissioner has given the provider under section 20C; or

(c) an amount payable to the Commissioner in respect of a lost member under section 24E.

Note 1: Unclaimed money is payable to the Commissioner under subsection 17(1).

Note 2: An amount mentioned in paragraph ( 5)(b) is payable to the Commissioner under section 20F.

(6) Upon payment to the Commissioner of an amount as required under this section, the superannuation provider is discharged from further liability in respect of that amount.

(7) For the purposes of this section, ignore accounts with nil balances, or balances below nil, as at the calculation time mentioned in subsection ( 1).

20QE Payment in respect of inactive low - balance accounts--late payments

General interest charge on late payment

(1) If any of the amount a superannuation provider must pay under section 20QD remains unpaid after it is due and payable, the superannuation provider is liable to pay general interest charge on the unpaid amount for each day in the period that:

(a) starts at the time it is due and payable; and

(b) ends at the end of the last day on which either of the following remains unpaid:

(i) the amount unpaid when it is due and payable;

(ii) general interest charge on any of the amount.

Offence of failing to make payment to Commissioner

(2) A person commits an offence if:

(a) the person is subject to a requirement under subsection 20QD(1) or (4); and

(b) the person engages in conduct; and

(c) the person's conduct breaches the requirement.

Penalty for an offence against subsection ( 2): 100 penalty units.

20QF Payment by Commissioner in respect of person for whom an amount has been paid to Commissioner

(1) This section applies in relation to a person if:

(a) a superannuation provider paid an amount to the Commissioner under section 20QD in respect of the person; and

(b) the Commissioner is satisfied, on application in the approved form or on the Commissioner's own initiative, that it is possible for the Commissioner to pay the amount in accordance with subsection ( 2).

(2) The Commissioner must pay the amount:

(a) to a single fund if:

(i) the person has not died; and

(ii) the person directs the Commissioner to pay to the fund; and

(iii) the fund is a complying superannuation plan (within the meaning of the Income Tax Assessment Act 1997 ); or

(b) in accordance with subsection ( 4) if:

(i) the person has died; and

(ii) the Commissioner is satisfied that, if the superannuation provider had not paid the amount to the Commissioner, the provider would have been required to pay an amount or amounts (death benefits) to one or more other persons (death beneficiaries) because of the deceased person's death; or

(c) to the person's legal personal representative if the person has died but subparagraph ( b)(ii) does not apply; or

(d) to the person if this paragraph applies (see subsection ( 3)).

Note: Money for payments under subsection ( 2) is appropriated by section 16 of the Taxation Administration Act 1953 .

(3) Paragraph ( 2)(d) applies if:

(a) subparagraph ( 2)(a)(ii) does not apply; and

(b) any of the following subparagraphs apply:

(i) the person has reached the eligibility age;

(ii) the amount is less than $200;

(iii) a terminal medical condition (within the meaning of the Income Tax Assessment Act 1997 ) exists in relation to the person; and

(c) the person has not died.

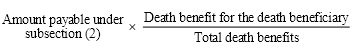

(4) In a case covered by paragraph ( 2)(b), the Commissioner must pay t he amount under subsection ( 2) by paying to each death beneficiary the amount worked out using the following formula:

Note: If there is only one death beneficiary, the whole of the amount is payable to that beneficiary.

(5) If:

(a) the Commissioner makes a payment under subsection ( 2) to a fund, a legal personal representative or a person; and

(b) the payment is in accordance with paragraph ( 2)(a), (c) or (d);

the Commissioner must also pay to the fund, legal personal representative or person the amount of interest (if any) worked out in accordance with the regulations.

Note: Money for payments under subsection ( 5) is appropriated by section 16 of the Taxation Administration Act 1953 .

(6) If:

(a) the Commissioner makes a payment under subsection ( 2) to a death beneficiary; and

(b) the payment is in accordance with paragraph ( 2)(b);

the Commissioner must also pay to the death beneficiary the amount of interest (if any) worked out in accordance with the regulations.

Note: Money for payments under subsection ( 6) is appropriated by section 16 of the Taxation Administration Act 1953 .

(7) Regulations made for the purposes of subsection ( 5) or (6) may prescribe different rates for different periods over which the interest accrues. For this purpose, rate includes a nil rate.

(8) This section does not apply to an amount that is to be, is or has been, taken into account in determining whether the Commissioner must make a payment under subsection 20H(2) or (3).

Note: Subsections 20H(2) and (3) provide for payment by the Commissioner of amounts equal to amounts paid to the Commissioner under subsections 17(1), 20F(1), 20QD(1) and 24E(1) in respect of a person who:

(a) is identified in a notice under section 20C; or

(b) used to be the holder of a temporary visa.

Division 4 -- Various rules for special cases

20QG State or Territory public sector superannuation schemes

Subject to section 20QH, sections 20QB and 20QD do not apply to a superannuation provider in relation to an unclaimed money day if, because of section 18, the superannuation provider does not have to comply with subsection 16(1) or 17(1) in relation to the unclaimed money day.

20QH Prescribed public sector superannuation schemes

(1) Section 6, subsections 19(1) to (3), this Part (other than sections 20QE and 20QG) and subsection 25(2B) apply as if:

(a) a public sector superannuation scheme that:

(i) is prescribed for the purposes of this section; and

(ii) in the case of a Commonwealth public sector superannuation scheme--is not a fund;

were a fund; and

Note: The reg u lations may prescribe a scheme by reference to a class of schemes: see subsection 13(3) of the Legislation Act 2003 .

(b) the trustee of the scheme were the superannuation provider; and

(c) a member of the scheme were a member of the fund.

(2) Despite subsection ( 1), in the case of a State or Territory public sector superannuation scheme:

(a) section 20QB (statements on inactive low - balance accounts):

(i) permits, rather than requires, the trustee to give a statement to the Commissioner; and

(ii) does not permit the trustee to give a statement to the Commissioner if the governing rules of the scheme prohibit the trustee from giving the statement to the Commissioner; and

(b) section 20QD (payment of balances from inactive low - balance accounts):

(i) does not apply in relation to an unclaimed money day if the trustee does not give a statement in relation to the unclaimed money day to the Commissioner under section 20QB; and

(ii) permits, rather than requires, the trustee to pay an amount to the Commissioner; and

(iii) does not apply to an amount to the extent that the governing rules of the scheme prohibit the trustee from paying the amount to the Commissioner.

(3) Subparagraphs ( 2)(a)(i) and (b)(ii) do not apply in relation to an unclaimed money day if, disregarding this section:

(a) the public sector superannuation scheme is a fund; and

(b) the superannuation provider has to comply with subsections 16(1) and 17(1) in relation to the unclaimed money day.

20QJ Refund of overpayment made by superannuation provider

(1) This section applies if:

(a) a superannuation provider for a fund (the first fund ) has made a payment to the Commissioner under section 20QD in respect of a person; and

(b) the Commissioner is satisfied that the amount paid exceeded the amount (if any) that was payable under that section in respect of the person.

(2) The Commissioner must pay the excess:

(a) to the superannuation provider; or

(b) to a superannuation provider for another fund if the Commissioner is satisfied that:

(i) the first fund no longer exists; and

(ii) the other fund provides rights relating to the person equivalent to those provided by the first fund.

Note: Money for payments under subsection ( 2) is appropriated by section 16 of the Taxation Administration Act 1953 .

20QK Commissioner may recover overpayment

(1) This section applies if:

(a) the Commissioner makes a payment in respect of a person under, or purportedly under, this Part; and

(b) the amount paid exceeds the amount (if any) properly payable under this Part in respect of the person.

(2) The Commissioner may recover all or part of the excess from a person (the debtor ) described in subsection ( 3) as a debt due by the debtor to the Commonwealth if the conditions specified in subsection ( 4) are met.

(3) The persons from whom the Commissioner may recover are as follows:

(a) the person to whom the payment was made (whether the payment was made to the person in his or her own right or as the legal personal representative of someone else who had died);

(b) the superannuation provider for the fund to which the payment was made;

(c) if the payment, or an amount wholly or partly attributable to that payment, was transferred to another fund--the superannuation provider for that other fund.

(4) The conditions for recovery are that:

(a) the Commissioner gave the debtor written notice, as prescribed by the regulations, of the proposed recovery and the amount to be recovered; and

(b) at least 28 days have passed since the notice was given; and

(c) the amount recovered is not more than the amount specified in the notice.

(5) Despite subsections ( 2) and (3), if the Commissioner gives a notice described in paragraph ( 4)(a) to a superannuation provider for a fund, and the fund does not hold an amount attributable to the payment, the Commissioner cannot recover from the superannuation provider.

(6) The Commissioner may revoke a notice described in paragraph ( 4)(a).

(7) The total of the amounts recovered from different debtors in relation to the same excess must not be more than the excess.

(8) A notice described in paragraph ( 4)(a) is not a legislative instrument.

20QL Superannuation provider to return payment from Commissioner that cannot be credited

Scope

(1) This section applies if:

(a) a payment (the Commissioner's payment ) is made to a fund under subsection 20QF(2) or (5) in accordance with a person's direction; and

(b) the superannuation provider for the fund has not credited the payment to an account for the benefit of the person by the time (the repayment time ) that is the end of the 28th day after the day on which the Commissioner's payment was made.

Repayment

(2) The superannuation provider is liable to repay the Commissioner's payment to the Commonwealth. The repayment is due and payable at the repayment time.

Note: The amount the superannuation provider is liable to repay is a tax - related liability for the purposes of the Taxation Administration Act 1953 . Division 255 in Schedule 1 to that Act deals with payment and recovery of tax - related liabilities.

(3) The superannuation provider must give the Commissioner, in the approved form, information relating to the Commissioner's payment when repaying it.

Note: The Taxation Administration Act 1953 provides for offences and administrative penalties if the form is not given when it must be or includes false or misleading information: see sections 8C, 8K and 8N of that Act and Divisions 284 and 286 in Schedule 1 to that Act.

General interest charge

(4) If any of the amount the superannuation provider is liable to repay under subsection ( 2) remains unpaid by the superannuation provider after the repayment time, the superannuation provider is liable to pay general interest charge on the unpaid amount for each day in the period that:

(a) starts at the repayment time; and

(b) ends at the end of the last day on which either of the following remains unpaid:

(i) the amount unpaid at the repayment time;

(ii) general interest charge on any of the amount.

20QM Compensation for acquisition of property

(1) If the operation of this Part would result in an acquisition of property from a person otherwise than on just terms, the Commonwealth is liable to pay a reasonable amount of compensation to the person.

(2) If the Commonwealth and the person do not agree on the amount of the compensation, the person may institute proceedings in a court of competent jurisdiction for the recovery from the Commonwealth of such reasonable amount of compensation as the court determines.

(3) In this section:

"acquisition of property" has the same meaning as in paragraph 51(xxxi) of the Constitution.

"just terms" has the same meaning as in paragraph 51(xxxi) of the Constitution.

31 Subsection 24B(3)

Repeal the subsection.

32 After Part 4A

Insert:

Part 4B -- Reunification of superannuation balances

The object of this Part is to set out a procedure for transferring amounts received by the Commissioner under Parts 3, 3B and 4A in respect of a person into a single active account held by a superannuation provider in respect of the person.

Division 2 -- Transferring balances to an active account

24NA Transferring balances to an active account

(1) This section applies in relation to a person if:

(a) the Commissioner is satisfied that:

(i) a superannuation provider has paid an amount to the Commissioner under subsection 17(1) (unclaimed money) and, after applying Part 3 and section 20H, the Commissioner holds an amount under that Part in respect of the person (a superannuation amount ); or

(ii) a superannuation provider has paid an amount to the Commissioner under section 20QD (an amount from an inactive low - balance account) and, after applying Part 3B and section 20H, the Commissioner holds an amount under that Part in respect of the person (a superannuation amount ); or

(iii) a superannuation provider has paid an amount to the Commissioner under section 24E (an amount from a lost member account) and, after applying Part 4A and section 20H, the Commissioner holds an amount under that Part in respect of the person (a superannuation amount ); and

(b ) the Commissioner is satisfied, on application in the approved form or on the Commissioner's own initiative, that it is possible for the Commissioner to pay the superannuation amount in accordance with subsection ( 2).

(1A) The Commissioner must pay the superannuation amount in accordance with subsection ( 2) within 28 days after the Commissioner is satisfied it is possible to pay that amount in accordance with that subsection.

(2) The Commissioner must pay each superannuation amount in respect of the person to a single fund if:

(a) the person has not died; and

(b) the superannuation provider for the fund holds an account on behalf of the person in the fund; and

(c) the superannuation provider for the fund has received an amount in respect of the person during the prescribed period ; and

(d) the balance of the account will be equal to or greater than $6,000 if all of the superannuation amounts in respect of the person are paid into the account; and

(e) under the terms of the fund, and under the law of the Commonwealth, the fund can accept payment of the superannuation amount in respect of the person.

(3) If there is more than one fund in relation to which paragraphs ( 2)(b), (c), (d) and (e) are satisfied in respect of a person, then despite subsection ( 2), the Commissioner must pay each superannuation amount in respect of the person in accordance with the regulations.

24NB Superannuation provider to return payment from Commissioner that cannot be credited

Scope

(1) This section applies if:

(a) a payment (the Commissioner's payment ) is made to a fund under subsection 24NA(2) or regulations made for the purposes of subsection 24NA(3); and

(b) the superannuation provider for the fund has not credited the payment to an account to which the payment relates for the benefit of the person by the time (the repayment time ) that is the end of the 28th day after the day on which the Commissioner's payment was made.

Repayment

(2) The superannuation provider is liable to repay the Commissioner's payment to the Commonwealth. The repayment is due and payable at the repayment time.

Note: The amount the superannuation provider is liable to repay is a tax - related liability for the purposes of the Taxation Administration Act 1953 . Division 255 in Schedule 1 to that Act deals with payment and recovery of tax - related liabilities.

(3) The superannuation provider must give the Commissioner, in the approved form, information relating to the Commissioner's payment when repaying it.

Note: The Taxation Administration Act 1953 provides for offences and administrative penalties if the form is not given when it must be or includes false or misleading information: see sections 8C, 8K and 8N of that Act and Divisions 284 and 286 in Schedule 1 to that Act.

General interest charge

(4) If any of the amount the superannuation provider is liable to repay under subsection ( 2) remains unpaid by the superannuation provider after the repayment time, the superannuation provider is liable to pay general interest charge on the unpaid amount for each day in the period that:

(a) starts at the repayment time; and

(b) ends at the end of the last day on which either of the following remains unpaid:

(i) the amount unpaid at the repayment time;

(ii) general interest charge on any of the amount.

33 After subsection 25(2A)

Insert:

Statement about inactive low - balance accounts

(2B) The approved form of statement by a superannuation provider for the purposes of section 20QB may require the statement to contain the tax file number of:

(a) the superannuation provider; and

(b) the fund; and

(c) a member of the fund if:

(i) the statement relates to an account, in the fund, held on behalf of the member; and

(ii) the member has quoted his or her tax file number to the superannuation provider.

Taxation Administration Act 1953

34 Subsection 8AAB(4) (after table item 33)

Insert:

33A | 20QE | payment in respect of inactive low - balance accounts | |

33B | 20QL | repayment of Commissioner's payment in respect of inactive low - balance accounts that cannot be credited to an account |

35 Subsection 8AAB(4) (after table item 35)

Insert:

35A | 24NB | repayment of Commissioner's payment for inactive low - balance accounts that cannot be credited to an active account |

36 Subsection 250 - 10(2) in Schedule 1 (after table item 69)

Insert:

69AA | payment of value of inactive low - balance accounts to the Commissioner | 20QD | |

69AB | payment from Commissioner that cannot be credited | 20QL |

37 Subsection 250 - 10(2) in Schedule 1 (after table item 69B)

Insert:

69BA | payment from Commissioner that cannot be credited | 24NB |

Part 2 -- Application and transitional provisions

38 Application of this Schedule

(1) The amendments made by this Schedule apply in relation to unclaimed money days that occur on or after 30 June 2019.

(2) However, a period during which a member's account in a fund is inactive is to be taken into account for the purposes of paragraphs 20QA(1)(a) and (b) and subsection ( 1A) of the Superannuation (Unclaimed Money and Lost Members) Act 1999 , as inserted by item 30 of this Schedule, even if the period begins before 30 June 2019.