Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPerson not member of a couple

(1) If:

(a) a person is eligible for a compensation affected pension; and

(b) the person is not a member of a couple; and

(c) the person receives compensation in the form of a lump sum (whether before or after the person became eligible for the pension);

the pension is not payable to the person for any day or days in the lump sum preclusion period.

Note 1: For compensation affected pension see subsection 5NB(1).

Note 2: For lump sum preclusion period see subsections (3) to (7).

Person member of a couple (lump sum received before 20 March 1997)

(2) If:

(a) a person is eligible for a compensation affected pension; and

(b) the person is a member of a couple; and

(c) before 20 March 1997, the person, or the person's partner, receives compensation in the form of a lump sum (whether before or after the person became eligible for the pension);

the following provisions have effect:

(d) the pension is not payable to the person for any day or days in the lump sum preclusion period;

(e) if the person's partner is eligible for a compensation affected pension--that pension is not payable to the partner for any day or days in the lump sum preclusion period.

Note 1: For compensation affected pension see subsection 5NB(1).

Note 2: For lump sum preclusion period see subsections (3) to (7).

Person member of a couple (lump sum received on or after 20 March 1997)

(2A) If:

(a) a person is eligible for a compensation affected pension; and

(b) the person is a member of a couple; and

(c) on or after 20 March 1997, the person receives compensation in the form of a lump sum (whether before or after the person became eligible for the pension);

the pension is not payable to the person for any day or days in the lump sum preclusion period.

Note 1: For compensation affected pension see subsection 5NB(1).

Note 2: For lump sum preclusion period see subsections (3) to (7).

(3) If a person receives both periodic compensation payments and compensation in the form of a lump sum in respect of lost earnings or lost earning capacity, the lump sum preclusion period is the period that:

(a) begins on the day following the last day of the periodic payments period or, if there is more than one periodic payments period, the day after the last day of the last periodic payments period; and

(b) ends after the number of weeks specified in subsection (7).

Note: For periodic payments period see subsection 5NB(1).

(4) If a person chooses to receive part of an entitlement to periodic compensation payments in the form of a lump sum, the lump sum preclusion period is the period that:

(a) begins on the first day on which the person's periodic compensation payment is a reduced payment because of that choice; and

(b) ends after the number of weeks specified in subsection (7).

(6) If neither subsection (3) nor (4) applies, the lump sum preclusion period is the period that:

(a) begins on the day on which the loss of earnings or loss of earning capacity began; and

(b) ends after the number of weeks specified in subsection (7).

(7) The number of weeks in the lump sum preclusion period in relation to a person is:

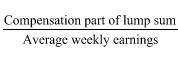

(a) if the person or the person's partner receives the lump sum compensation payment before 20 March 1997--the number worked out by using the formula:

or

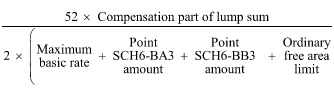

(b) if the person receives the lump sum compensation payment on or after 20 March 1997--the number worked out by using the formula:

where:

maximum basic rate means the amount specified in column 3 of item 1 in Table B - 1 in point SCH6 - B1 of Schedule 6.

ordinary free area limit means the amount specified in column 3 of item 1 in Table E - 1 in point SCH6 - E6 of Schedule 6.

point SCH6 - BA3 amount means the pension supplement amount worked out under point SCH6 - BA3 of Schedule 6 for a person who is not a member of a couple (whether or not the person for whom the lump sum preclusion period is being worked out is a member of a couple and whether or not that point applies to the person for whom the lump sum preclusion period is being worked out).

point SCH6 - BB3 amount means the energy supplement worked out under point SCH6 - BB3 of Schedule 6 for a person who is not a member of a couple (whether or not the person for whom the lump sum preclusion period is being worked out is a member of a couple and whether or not that point applies to the person for whom the lump sum preclusion period is being worked out).

Note: For compensation part of lump sum and average weekly earnings see section 5NB.

(8) If the number worked out under subsection (7) is not a whole number, the number is to be rounded down to the nearest whole number.