Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsNote: See subsection 58(1).

Part 1 -- Overall rate calculation process

1 Overall rate calculation process

(1) To work out an individual's annual rate of family tax benefit, add:

(a) the individual's Part A rate calculated under Part 2 (clauses 3 to 24S), Part 3 (clauses 25 to 28) or Part 3A (clause 28A); and

(b) the individual's Part B rate calculated under Part 4 (clauses 28B to 33).

(2) To work out the individual's Part A rate:

(a) use Part 2 (clauses 3 to 24S) if the individual has at least one FTB child and:

(i) the individual's adjusted taxable income does not exceed the individual's higher income free area; or

(ii) the individual, or the individual's partner, is receiving a social security pension, a social security benefit, a service pension, income support supplement or a veteran payment; and

(b) use Part 3 (clauses 25 to 28) if the individual has at least one FTB child and:

(i) the individual's adjusted taxable income exceeds the individual's higher income free area; and

(ii) neither the individual, nor the individual's partner, is receiving a social security pension, a social security benefit, a service pension, income support supplement or a veteran payment; and

(c) use Part 3A (clause 28A) if the individual has no FTB children.

Use Schedule 3 to work out the individual's adjusted taxable income. Use clause 2 to work out the individual's higher income free area.

For the purposes of this Part, an individual's higher income free area is the basic amount in column 1 of the following table.

Higher income free area | |

| Column 1 Basic amount |

1 | $98,988 |

Part 2 -- Part A rate (Method 1)

Division 1 -- Overall rate calculation process

3 Method of calculating Part A rate

Subject to the operation of clauses 5, 6A, 38J and 38K, if the individual's Part A rate is to be calculated using this Part, it is calculated as follows:

Method statement

Step 1. Add the following amounts:

(a) the individual's standard rate under Division 2 of this Part (clauses 7 to 11);

(ba) the individual's newborn supplement (if any) under Division 1A of Part 5 (clauses 35A and 35B);

(c) the individual's multiple birth allowance (if any) under Division 2 of Part 5 (clauses 36 to 38);

(ca) the individual's FTB Part A supplement under Division 2A of Part 5 (clause 38A);

(cb) the individual's energy supplement (Part A) under Subdivision A of Division 2AA of Part 5 (clause 38AA);

(d) the individual's rent assistance (if any) under Subdivision A of Division 2B of Part 5 (clauses 38B to 38H).

The result is the individual's maximum rate .

Note: Paragraph (cb) does not apply to certain individuals: see clause 6A.

Step 2. Apply the income test in Division 2C of Part 5 (clauses 38L to 38N) to work out any reduction for adjusted taxable income. Take any reduction away from the individual's maximum rate: the result is the individual's income tested rate .

Step 3. Apply the maintenance income test in Division 5 of this Part (clauses 20 to 24) to work out any reduction for maintenance income. Take any reduction away from the individual's income tested rate: the result is the individual's income and maintenance tested rate .

Step 4. The individual's Part A rate is:

(a) the individual's income and maintenance tested rate if it is equal to or greater than the individual's base rate (see clause 4); or

(b) the individual's base rate (see clause 4) if it is more than the individual's income and maintenance tested rate.

The individual's base rate is the rate that would be the individual's Method 2 base rate under clause 25 if the individual's Part A rate were worked out using Part 3.

5 Family tax benefit advance to individual

(1) If:

(a) an individual is entitled to be paid family tax benefit by instalment; and

(b) the individual is paid a family tax benefit advance; and

(c) the individual has not repaid the whole of the advance; and

(d) the amount of unrepaid family tax benefit advance is not an FTB advance debt;

then, subject to clauses 44 and 49, the individual's Part A rate (as reduced (if at all) under clauses 38J and 38K) is to be reduced in accordance with Division 4 of Part 5 (clauses 40 to 51).

(2) If an individual satisfies paragraphs (1)(a) to (d) for more than one family tax benefit advance, the individual's Part A rate is to be reduced under subclause (1) for each of those advances.

6 Components of Part A rates under this Part

The Minister may, by legislative instrument, determine a method for working out the extent to which Part A rates under this Part are attributable to the amounts referred to in step 1 of the method statement in clause 3.

(1) Paragraph (cb) of step 1 of the method statement in clause 3 does not apply to an individual on or after the commencement of this clause unless:

(a) the individual was entitled to be paid family tax benefit in respect of 19 September 2016; and

(b) the individual's Part A rate of family tax benefit in respect of 19 September 2016 was not worked out under Part 3A of this Schedule.

(2) However, if:

(a) the individual ceases to be entitled to be paid family tax benefit in respect of a day (the applicable day ) on or after 20 September 2016; or

(b) the individual's Part A rate of family tax benefit is worked out under Part 3A of this Schedule in respect of a day (the applicable day ) on or after 20 September 2016;

then paragraph (cb) of step 1 of the method statement in clause 3 does not apply, and never again applies, to the individual from:

(c) if the applicable day is before the commencement of this clause--the start of the day this clause commences; or

(d) if the applicable day is on or after the commencement of this clause--the start of the applicable day.

(1) Subject to subclauses (2) and (3) and clauses 8 to 11, an individual's standard rate is worked out using the following table. Work out which category applies to each FTB child of the individual. The FTB child rate is the corresponding amount in column 2. The standard rate is the sum of the FTB child rates.

FTB child rates (Part A--Method 1) | ||

| Column 1 Category of FTB child | Column 2 FTB child rate |

1 | FTB child who is under 13 years of age | $4,292.40 |

2 | FTB child who has reached 13 years of age | $5,580.85 |

Reduction during reduction period for failing to have health check or meet immunisation requirements

(2) If either or both section 61A and subparagraph 61B(1)(b)(ii) apply in relation to an individual and an FTB child of the individual, the annual FTB child rate in relation to the child is reduced by $737.30 for each day in the FTB child rate reduction period (except any day in a past period to which subclause (3) applies).

Reduction of past period claims for failing to meet immunisation requirements

(3) The annual FTB child rate in relation to an FTB child of an individual is reduced by $737.30 if subparagraph 61B(1)(b)(i) applies in relation to the individual and the child.

For the purposes of this Division, the base FTB child rate for an FTB child of an individual is the rate that would be the FTB child rate under subclause 26(2) if:

(a) the individual's Part A rate were being worked out under Part 3; and

(b) clause 27 did not apply.

9 FTB child rate--recipient of other periodic payments

The FTB child rate for an FTB child of an individual is the base FTB child rate (see clause 8) if:

(a) the individual or the individual's partner is receiving a periodic payment under a law of the Commonwealth and the law provides for an increase in the rate of payment by reference to an FTB child of the individual; or

(b) the individual or the individual's partner is receiving a periodic payment under a scheme administered by the Commonwealth and the scheme provides for an increase in the rate of payment by reference to an FTB child of the individual.

10 Effect of certain maintenance rights

(1) The FTB child rate for an FTB child of an individual is the base FTB child rate (see clause 8) if:

(a) the individual or the individual's partner is entitled to claim or apply for maintenance for the child; and

(b) the Secretary considers that it is reasonable for the individual or partner to take action to obtain maintenance; and

(c) the individual or partner does not take action that the Secretary considers reasonable to obtain maintenance.

(2) Subclause (1) does not apply to maintenance that is:

(a) a liability under an administrative assessment (within the meaning of the Child Support (Assessment) Act 1989 ); and

(b) not an enforceable maintenance liability (within the meaning of the Child Support (Registration and Collection) Act 1988 ).

11 Sharing family tax benefit (shared care percentages)

If an individual has a shared care percentage for an FTB child of the individual, the FTB child rate for the child, in working out the individual's standard rate, is the individual's shared care percentage of the FTB child rate that would otherwise apply to the child.

Division 5 -- Maintenance income test

Subdivision A -- Maintenance income test

19A Extended meaning of receiving maintenance income

In this Division, if the FTB child of an individual receives maintenance income, the individual is taken to have received the maintenance income.

19AA References to applying for maintenance income

A reference in this Division to an individual being, or not being, entitled to apply for maintenance income includes an individual who is, or is not, entitled to so apply under the Child Support (Assessment) Act 1989 or the Family Law Act 1975 .

If the individual, or the individual's partner, is:

(a) permanently blind; and

(b) receiving:

(i) an age pension (under Part 2.2 of the Social Security Act 1991 ); or

(ii) a disability support pension (under Part 2.3 of the Social Security Act 1991 ); or

(iii) a service pension; or

(iv) income support supplement (under Part IIIA of the Veterans' Entitlements Act 1986 ); or

(v) a veteran payment;

then:

(c) the individual's maintenance income excess is nil; and

(d) the individual's income and maintenance tested rate is the same as the individual's income tested rate.

20 Effect of maintenance income on family tax benefit rate

(1) This is how to work out an individual's reduction for maintenance income if clause 19B does not apply:

Method statement

Step 1. Work out the annualised amount of the individual's maintenance income . In doing so:

(a) disregard any maintenance income for an FTB child for whom the FTB child rate under clause 7 does not exceed the base FTB child rate (see clause 8); and

(b) disregard the operation of clause 11 (sharing of family tax benefit) in applying paragraph (a); and

(c) disregard any amount that, for the income year for which the individual's reduction for maintenance income is being worked out, is required under clause 24E to be depleted from a maintenance income credit balance of the individual and, if the individual is a member of a couple, from a maintenance income credit balance of the individual's partner; and

(d) disregard any maintenance income that is received by the individual, or the individual's partner, from another individual if the income is over the maintenance income ceiling for the income (see Subdivisions C and D).

Step 2. Work out the individual's maintenance income free area using clauses 22 and 23.

Step 3. Work out whether the individual's maintenance income exceeds the individual's maintenance income free area.

Step 4. If the individual's maintenance income does not exceed the individual's maintenance income free area, the individual's maintenance income excess is nil and there is no reduction for maintenance income.

Step 5. If the individual's maintenance income exceeds the individual's maintenance income free area, the individual's maintenance income excess is the individual's maintenance income less the individual's maintenance income free area.

Step 6. The individual's reduction for maintenance income is half the maintenance income excess.

(2) Paragraph (c) of step 1 of the method statement in subclause (1) does not apply unless and until the individual has satisfied the FTB reconciliation conditions in section 32B of the Family Assistance Administration Act for all of the same - rate benefit periods (within the meaning of that section) that are included in the income year for which the individual's reduction for maintenance income is being worked out.

20A Annualised amount of maintenance income

Object of clause

(1) The object of this clause is to annualise the maintenance income (other than capitalised maintenance income) ( CMI ) of an individual during an income year.

Annualisation of maintenance income other than CMI

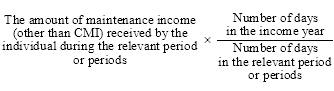

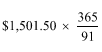

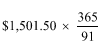

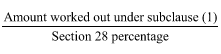

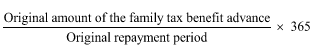

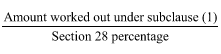

(2) If an individual receives maintenance income (other than CMI) from another individual during any period or periods (the relevant period or periods ) in an income year, the annualised amount of the maintenance income of the individual is worked out using the following formula:

Commencement of relevant period

(3) If:

(a) an individual ( payee ) receives maintenance income (other than CMI) from another individual ( payer ) in an income year under a maintenance liability; and

(b) subsection (4) does not apply;

the relevant period in respect of the maintenance income commences:

(c) in the case where the maintenance liability arises after 1 July of the income year in which the maintenance income is received--on the day that the maintenance liability arises; or

(d) in the case where the maintenance liability exists on 1 July of the income year in which the maintenance income is received--1 July.

(4) If:

(a) a payee receives maintenance income (other than CMI) from a payer in an income year under a maintenance liability; and

(b) the payee has received maintenance income (other than CMI) from that payer previously during a period in the income year, but not under a maintenance liability; and

(c) in between the time the payee receives maintenance income under paragraph (a) and the end of the period referred to in paragraph (b):

(i) the payee and the payer were not members of the same couple; and

(ii) the payee was entitled to claim, or apply for, maintenance from the payer;

the relevant period in respect of the maintenance income commences:

(d) on the day the payee first received the previously received maintenance income in the income year; or

(e) on such earlier day in respect of the previously received maintenance income that the Secretary determines.

(5) If a payee receives maintenance income (other than CMI) from a payer during a period in an income year but not under a maintenance liability, the relevant period, in respect of the maintenance income, commences:

(a) on the day that the payee first received the maintenance income during that period; or

(b) on such earlier day that the Secretary determines.

End of relevant period

(6) A relevant period, in respect of maintenance income (other than CMI) received under a maintenance liability in an income year, ends either when the maintenance liability ceases (if it ceases before the end of the income year) or on 30 June of the income year.

(7) If:

(a) a payee receives maintenance income (other than CMI) in an income year; and

(b) the maintenance income is not received under a maintenance liability;

the relevant period ends in respect of the payee either:

(c) unless subclause (8) applies--when the payee ceases to receive the maintenance income (if the payee ceases to receive the income before the end of the income year); or

(d) on 30 June of the income year.

(8) If:

(a) a payee receives maintenance income (other than CMI) from a payer in an income year under a maintenance liability; and

(b) the payee has received maintenance income (other than CMI) from that payer previously during a period in the income year, but not under a maintenance liability; and

(c) in between the time the payee receives maintenance income under paragraph (a) and the end of the period referred to in paragraph (b):

(i) the payee and the payer were not members of the same couple; and

(ii) the payee was entitled to claim, or apply for, maintenance from the payer;

the relevant period ends either when the maintenance liability ceases (if it ceases before the end of the income year) or on 30 June of the income year.

Relevant period where payee elects to end an assessment

(9) If:

(a) a payee receives maintenance income (other than CMI) in an income year from a payer under a maintenance liability which is an assessment under Part 5 of the Child Support (Assessment) Act 1989 ; and

(b) the payee and payer become members of the same couple; and

(c) the payee elects under the Child Support (Assessment) Act 1989 to end the assessment from a specified day before the day the payee and payer became members of the same couple;

for the purpose of determining the commencement or end of the relevant period, the assessment is taken to end from the day the payee and the payer became a member of the same couple or from such earlier day as the Secretary determines (not being a day earlier than the specified day).

Meaning of maintenance liability

(10) In this clause, maintenance liability means a liability to provide:

(a) child support; or

(b) maintenance (other than child support) that arises as a result of:

(i) the order of a court; or

(ii) a maintenance agreement (within the meaning of the Family Law Act 1975 ) that has been registered in, or approved by, a court in Australia or an external Territory; or

(iii) a financial agreement, or Part VIIIAB financial agreement, within the meaning of that Act; or

(iv) any other agreement with respect to the maintenance of a person that has been registered in, or approved by, a court in Australia or an external Territory.

Day a maintenance liability arises

(11) The day a maintenance liability arises is:

(a) if the liability is to provide child support, the day that the liability arises under the Child Support (Assessment) Act 1989 ; or

(b) if the liability is to provide maintenance that arises as set out in paragraph (10)(b), the day that the order of the court or the agreement has effect from.

20B Working out amounts of child maintenance using notional assessments

(1) If:

(a) an individual receives child maintenance for an FTB child of the individual under a child support agreement or court order; and

(b) there is, in relation to the agreement or order, a notional assessment of the annual rate of child support that would be payable to the individual for the child for a particular day in a child support period if that annual rate were payable under Part 5 of the Child Support (Assessment) Act 1989 instead of under the agreement or order;

then the amount of child maintenance that the individual is taken to have received in an income year under the agreement or order for the child for a period is worked out in accordance with this clause.

Note: The amount worked out in accordance with this clause is annualised under clause 20A.

Individual taken to have received notional assessed amount

(2) For the purposes of this Act, the amount of child maintenance that the individual is taken to have received under the agreement or order for the child for the period is, subject to this clause, the amount (the notional assessed amount ) that the individual would have received if the individual had received the annual rate of child support for the child for the period that is included in the notional assessment, disregarding so much of that rate as is attributable to the individual receiving disability expenses maintenance.

Underpayments

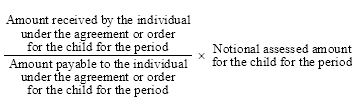

(3) If the amount received in an income year by the individual under the agreement or order for the child for the period is less than the amount that is payable to the individual under the agreement or order for the child for the period (such that a debt arises for the period under the agreement or order), then, for the purposes of this Act, the amount of child maintenance that the individual is taken to have received under the agreement or order for the child for the period is the following amount (the notional amount paid ):

Note: This subclause only applies in respect of enforceable maintenance liabilities (see subclause (7)).

Underpayments--non - periodic payments and lump sum payments

(3A) For the purposes of the formula in subclause (3), the amount received by the individual under the agreement or order, for the child for the period, is taken to include:

(a) if the agreement or order is a non - periodic payments agreement or order--the amount by which the annual rate of child support payable for the child is reduced for the period under the agreement or order; and

(b) if the agreement or order is a lump sum payments agreement or order--the total amount of the lump sum payment that is credited for each day in the period under section 69A of the Child Support (Registration and Collection) Act 1988 against the amount payable under the liability under the agreement or order.

(3B) If the agreement or order is a non - periodic payments agreement or order, for the purposes of the formula in subclause (3), the amount payable to the individual under the agreement or order for the child for the period is taken to include the amount by which the annual rate of child support payable for the child is reduced for the period under the agreement or order.

Arrears

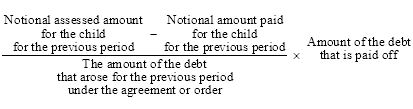

(4) If the amount received in an income year by the individual under the agreement or order for the child for the period exceeds the amount that is payable to the individual under the agreement or order for the child for the period, then, for the purposes of this Act, the amount of child maintenance that the individual is taken to have received under the agreement or order for the child for the period is:

Note: This subclause only applies in respect of enforceable maintenance liabilities (see subclause (7)).

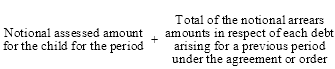

(5) The notional arrears amount , in respect of a debt arising for a previous period under the agreement or order, is:

(6) For the purposes of subclause (5), if:

(a) an individual has more than one debt that arose under an agreement or order for previous periods; and

(b) the amount received in an income year by the individual under the agreement or order for a child for a period exceeds the amount that is payable to the individual under the agreement or order for the child for the period;

then:

(c) the individual is taken to have received the excess to pay off each debt in the order in which the debts arose; and

(d) each debt is reduced by the amount of the debt that is paid off.

(7) Subclauses (3) and (4) only apply in respect of enforceable maintenance liabilities (within the meaning of the Child Support (Registration and Collection) Act 1988 ).

(8) In this clause:

"lump sum payments agreement or order" means:

(a) an agreement containing lump sum payment provisions (within the meaning of the Child Support (Assessment) Act 1989 ); or

(b) a court order made under section 123A of that Act.

"non-periodic payments agreement or order" means:

(a) an agreement containing non - periodic payment provisions (within the meaning of the Child Support (Assessment) Act 1989 ); or

(b) a court order made under section 124 of that Act that includes a statement made under section 125 of that Act that the annual rate of child support payable by a liable parent under an administrative assessment is to be reduced.

20C Working out amounts of child maintenance in relation to lump sum payments

(1) This clause applies if an individual receives in an income year child maintenance for an FTB child of the individual under:

(a) a child support agreement, containing lump sum payment provisions (within the meaning of paragraph 84(1)(e) of the Child Support (Assessment) Act 1989 ), to which clause 20B does not apply; or

(b) a court order made under section 123A of that Act;

in the form of a lump sum payment that is to be credited under section 69A of the Child Support (Registration and Collection) Act 1988 against the amount payable under a liability under an administrative assessment.

(2) For the purposes of this Act, the amount of child maintenance that the individual is taken to have received in an income year under the agreement or order for the child for a period is the amount that is credited under section 69A of the Child Support (Registration and Collection) Act 1988 against the amount payable under the liability under the administrative assessment for the child for the period.

Note: The amount worked out under this clause is annualised under clause 20A.

(3) Subclause (2) does not apply in relation to the individual and the child for a period if subclause 20B(2), (3) or (4) or 20D(2) has applied in relation to the individual and the child for that period.

20D Working out amounts of child maintenance for administrative assessments privately collected

(1) This clause applies if, during a period in an income year:

(a) an individual is entitled to receive an amount of child maintenance for an FTB child of the individual under a liability under an administrative assessment (within the meaning of the Child Support (Assessment) Act 1989 ); and

(b) the liability is not an enforceable maintenance liability (within the meaning of the Child Support (Registration and Collection) Act 1988 ); and

(c) the child maintenance is not maintenance to which clause 20B applies; and

(d) the Secretary considers that it is reasonable for the individual to take action to obtain the amount.

Individual taken to have received full entitlement

(2) For the purposes of this Act, the individual is taken to have received, for the period in the income year, the amount of child maintenance for the child that the individual is entitled to receive under the liability, disregarding so much of that amount as is attributable to the individual receiving disability expenses maintenance.

21 Maintenance income of members of couple to be added

The annualised amount of the maintenance income of an individual who is a member of a couple is the sum of the amounts that, apart from this clause, would be the respective annualised amounts of each of the members of the couple.

22 How to calculate an individual's maintenance income free area

An individual's maintenance income free area is worked out using the following table. Work out which family situation in the table applies to the individual. The maintenance income free area is the corresponding amount in column 2 plus an additional corresponding amount in column 3 for each FTB child after the first, disregarding any child:

(a) for whom maintenance income is disregarded under paragraph (a) of step 1 of the method statement in clause 20; or

(b) in respect of whom neither the individual, nor the individual's partner, is entitled to apply for maintenance income.

Maintenance income free area (Part A--Method 1) | |||

| Column 1 Individual's family situation | Column 2 Basic amount | Column 3 Additional amount |

1 | Not a member of a couple | $952.65 | $317.55 |

2 | Partnered (both the individual and the partner have an annualised amount of maintenance income) | $1,905.30 | $317.55 |

3 | Partnered (only one has an annualised amount of maintenance income) | $952.65 | $317.55 |

23 Only maintenance actually received taken into account in applying clause 22

In determining whether or not item 2 or 3 of the table in clause 22 applies to an individual, clause 21 is to be disregarded. This has the effect of taking into account only maintenance income that the individual actually receives rather than any maintenance income that the individual is taken to receive because of maintenance income received by the individual's partner.

24 Apportionment of capitalised maintenance income

(1) The object of this clause is to spread capitalised maintenance income so that it is taken into account over the whole of the period in respect of which it is received.

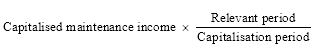

(2) If an individual receives capitalised maintenance income, the maintenance income of the individual that is attributable to the capitalised maintenance income during any period (the relevant period ) in the capitalisation period is the amount worked out using the formula:

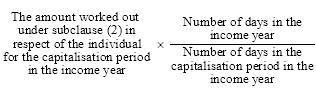

(2A) For the capitalisation period in an income year, the annualised amount of an individual's capitalised maintenance income is worked out using the following formula:

Capitalisation period--court order or agreement

(3) If:

(a) the capitalised maintenance income is received under or as a result of:

(i) the order of a court; or

(ii) a maintenance agreement (within the meaning of the Family Law Act 1975 ) that has been registered in, or approved by, a court in Australia or an external Territory; or

(iii) a financial agreement, or Part VIIIAB financial agreement, within the meaning of that Act; or

(iv) any other agreement with respect to the maintenance of a person that has been registered in, or approved by, a court in Australia or an external Territory; and

(b) the order or agreement specified the period in relation to which the capitalised maintenance income was to be provided; and

(c) the length of the period could be ascertained with reasonable certainty when the order was made or the agreement was so registered or approved;

the capitalisation period is, subject to subclause (6), the period specified in the order or agreement.

Capitalisation period--FTB child under 18

(4) If:

(a) the capitalised maintenance income relates to the maintenance of an FTB child of the individual; and

(b) the child has not turned 18 on the day on which the income is received; and

(c) subclause (3) does not apply to the capitalised maintenance income;

the capitalisation period is, subject to subclause (6), the period that starts on the day on which the income is received and ends on the day immediately before the day on which the child turns 18.

Capitalisation period--partner under 65

(5) If:

(a) the capitalised maintenance income relates to the maintenance of the individual by the individual's partner or former partner; and

(b) the individual has not turned 65 on the day on which the income is received; and

(c) subclause (3) does not apply to the capitalised maintenance income;

the capitalisation period is, subject to subclause (6), the period that starts on the day on which the income is received and ends on the day immediately before the day on which the individual turns 65.

Capitalisation period--other cases

(6) If:

(a) the Secretary considers:

(i) in a case falling within subclause (3) where the period referred to in that subclause was specified in an order of a court that was made by consent or in an agreement referred to in subparagraph (3)(a)(ii), (iii) or (iv)--that the period is not appropriate in the circumstances of the case; or

(ii) in a case falling within subclause (4) or (5)--that the period referred to in that subclause is not appropriate in the circumstances of the case; or

(b) no capitalisation period is applicable in relation to the capitalised maintenance income under subclause (3), (4) or (5);

the capitalisation period is such period as the Secretary considers appropriate in the circumstances of the case.

Subdivision B -- Maintenance income credit balances

24A Maintenance income credit balances

(1) A maintenance income credit balance , for a registered entitlement of an individual, is, at any particular time, the balance at that time of the accruals under clause 24B and the depletions under clause 24E in relation to that entitlement.

(2) Despite subclause (1), a maintenance income credit balance for a registered entitlement, at the end of an income year, cannot exceed the total arrears owing from that registered entitlement, at that time, for all income years for which the entitlement has existed.

(3) If:

(a) but for the condition in subclause 24B(3) not being met in relation to an income year, there would be an accrual to a maintenance income credit balance of an individual for a day in that income year; and

(b) after there has been an accrual under clause 24C for a day in a later income year or a depletion under clause 24E for a later income year, that condition is met in relation to the earlier income year;

the maintenance income credit balance is recalculated, taking into account the accrual for the day in the earlier income year before taking into account the accrual or depletion mentioned in paragraph (b).

(4) This Subdivision continues to apply in relation to a maintenance income credit balance of an individual whether or not the individual or the individual's partner continues to be eligible for family tax benefit.

24B Accruals to a maintenance income credit balance

Accrual if conditions are satisfied

(1) There is an accrual to a maintenance income credit balance for a registered entitlement of an individual, for a day in an income year, of the amount worked out under clause 24C for that day, if all the conditions in this clause are satisfied.

Conditions that must be satisfied

(2) Either or both of the following must apply:

(a) the individual is eligible for family tax benefit for the day;

(b) if the individual is a member of a couple on the day--the individual's partner is eligible for family tax benefit for the day.

(3) The eligible person must have satisfied the FTB reconciliation conditions in section 32B of the Family Assistance Administration Act for all of the same - rate benefit periods (within the meaning of that section) that are included in the income year.

(4) The annualised amount of the maintenance income of the eligible person for the day must be less than the maintenance income free area that applied to the eligible person for that day.

(5) The maintenance income that the individual received in the income year from the registered entitlement must be less than the amount due in the income year from the registered entitlement.

24C Amount of accrual to a maintenance income credit balance

(1) This is how to work out the amount of the accrual under clause 24B, for a day in an income year, to a maintenance income credit balance for a registered entitlement of an individual who is, or is the partner of, an eligible person under subclause 24B(2):

Method statement

Step 1. Work out the global maintenance entitlement of the eligible person for the day using clause 24D.

Step 2. Identify the lower of:

(a) that global maintenance entitlement; and

(b) the maintenance income free area that applied to the eligible person for the day.

Step 3. Subtract from the lower amount identified in step 2 the annualised amount of the maintenance income of the eligible person for the day.

Step 4. Divide the result of step 3 by 365 and round the result of the division to the nearest cent (rounding 0.5 cents upwards).

Step 5. Unless subclause (2) applies to the individual, the amount that accrues to the maintenance income credit balance of the individual for the day is the amount worked out under step 4.

If subclause (2) applies to the individual, take the amount worked out under step 4 and apply the method statement in subclause (2).

(2) If either or both of the following apply:

(a) the individual has more than one registered entitlement for the day in respect of which the condition in subclause 24B(5) is met;

(b) if the individual is a member of a couple on the day--the individual's partner has one or more registered entitlements for the day in respect of which the condition in subclause 24B(5) is met;

this is how to work out the amount of the accrual under clause 24B, for a day in an income year, to each of the maintenance income credit balances (the relevant balances ) for those entitlements:

Method statement

Step 1. Work out the daily cap for each relevant balance as follows:

(a) work out the annualised amount mentioned in paragraph 24D(1)(a) that is due in the income year from the registered entitlement to which the balance relates, and any related private collection entitlement;

(b) work out under subclause (4) the annualised amount of maintenance income received in the income year from that registered entitlement, and any related private collection entitlement;

(c) the daily cap is the excess of the amount mentioned in paragraph (a) over the amount mentioned in paragraph (b), divided by 365 and rounded to the nearest cent (rounding 0.5 cents upwards).

Step 2. Distribute the amount worked out under step 4 of the method statement in subclause (1) equally among each relevant balance, up to the amount of the daily cap for the relevant balance.

Step 3. Distribute any remaining amount equally among each relevant balance for which the daily cap has not been reached, up to the amount of the daily cap for the relevant balance.

Step 4. Reapply step 3 to any remaining amount until:

(a) there is no remaining amount to distribute; or

(b) the daily cap for each relevant balance is reached.

Step 5. The amount that accrues to each of the relevant balances for the day is the sum of the amount distributed under step 2 and any additional amounts distributed under steps 3 and 4, with that sum rounded to the nearest cent (rounding 0.5 cents upwards).

(3) To avoid doubt, clauses 24B and 24C apply only once for a day in relation to any relevant balance.

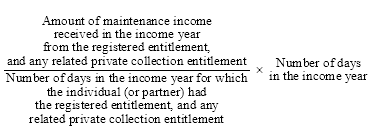

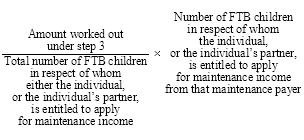

(4) For the purposes of step 1 of the method statement in subclause (2), the annualised amount of maintenance income received in an income year from a registered entitlement, and any related private collection entitlement, of an individual (or an individual's partner) is the amount worked out by using this formula:

(5) In this clause:

"related private collection entitlement" , in relation to a registered entitlement, has the same meaning as in clause 24D.

24D Global maintenance entitlement of an eligible person

(1) For the purposes of step 1 of the method statement in subclause 24C(1), the global maintenance entitlement of the eligible person under subclause 24B(2) for the day is the sum of:

(a) the annualised amounts worked out using the formula in subclause (2) for:

(i) each registered entitlement for the day, and any related private collection entitlement, of the eligible person; and

(ii) if the eligible person is a member of a couple on the day--each registered entitlement for the day, and any related private collection entitlement, of the eligible person's partner; and

(b) any amounts worked out under subclause (3); and

(c) the annualised amount of any capitalised maintenance income of the eligible person and, if the eligible person is a member of a couple on the day, of the eligible person's partner, for the day; and

(d) the annualised amount of any maintenance income of the eligible person and, if the eligible person is a member of a couple on the day, of the eligible person's partner, for the day:

(i) that is not from a registered entitlement; and

(ii) that is not capitalised maintenance income.

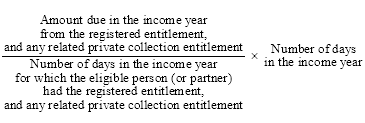

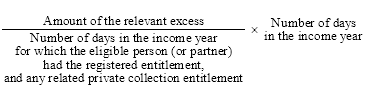

(2) For the purposes of paragraph (1)(a), the formula is:

(3) If:

(a) in respect of:

(i) a registered entitlement for the day, and any related private collection entitlement, of the eligible person; or

(ii) if the eligible person is a member of a couple on the day--a registered entitlement for the day, and any related private collection entitlement, of the eligible person's partner;

the maintenance income received by the eligible person or partner for the income year exceeds the amount due in the income year from the registered entitlement, and any related private collection entitlement; and

(b) that excess, or any part of it (the relevant excess ), is not disregarded for the purposes of paragraph (c) of step 1 of the method statement in clause 20;

an amount for the purposes of paragraph (1)(b) is worked out by using this formula:

(4) For the purposes of this clause, an individual's private collection entitlement is related to the individual's registered entitlement if the private collection entitlement and registered entitlement relate to the same registrable maintenance liability, within the meaning of the Child Support (Registration and Collection) Act 1988 .

(5) In this clause:

"private collection entitlement" , of an individual, means the individual's entitlement to receive maintenance income from a particular payer, if the payer's liability to pay that maintenance income is a registrable maintenance liability that is not an enforceable maintenance liability, within the meaning of the Child Support (Registration and Collection) Act 1988 .

24E Depletions from a maintenance income credit balance

(1) There is a depletion from the maintenance income credit balance for a registered entitlement of an individual, for an income year, of the amount worked out under subclause (2), if:

(a) the income year has ended; and

(b) the maintenance income that the individual received in the income year from the entitlement is more than the amount due in the income year from the entitlement.

(2) The amount by which the maintenance income credit balance is depleted is the lower of:

(a) the excess of the maintenance income that the individual received in the income year from the entitlement over the amount due in the income year from the entitlement; and

(b) the amount of the maintenance income credit balance.

(3) For the purposes of paragraphs (1)(b) and (2)(a), in working out the maintenance income received in an income year or the amount of maintenance income due in an income year:

(a) disregard any maintenance income received or due for an FTB child for whom the FTB child rate under clause 7 does not exceed the base FTB child rate (see clause 8); and

(b) disregard the operation of clause 11 (sharing of family tax benefit) in applying paragraph (a).

24EA Amounts due under notional assessments

(1) This clause applies if:

(a) an individual receives child maintenance for an FTB child of the individual under a child support agreement or court order; and

(b) there is, in relation to the agreement or order, a notional assessment of the annual rate of child support that would be payable to the individual for the child for a particular day in a child support period if that annual rate were payable under Part 5 of the Child Support (Assessment) Act 1989 instead of under the agreement or order; and

(c) the child maintenance is received, wholly or in part, from a registered entitlement.

(2) For the purposes of this Subdivision, the amount of child maintenance that is taken to be due to the individual under the agreement or order (whether from the registered entitlement or from a related private collection entitlement within the meaning of clause 24D), for the child for a period, is the amount that would have been due if the amount due to the individual had been the annual rate of child support for the child for the period that is included in the notional assessment.

(3) To avoid doubt, subclause (2) does not apply in relation to the total arrears owing from a registered entitlement, as mentioned in subclause 24A(2).

Subdivision C -- Maintenance income ceiling for Method 1

24F Subdivision not always to apply

This Subdivision does not apply to an individual if:

(a) the individual, and the individual's partner, between them are entitled to apply for maintenance income:

(i) from only one other individual; and

(ii) in respect of all of the FTB children of the individual; and

(b) the individual has no regular care children who are rent assistance children.

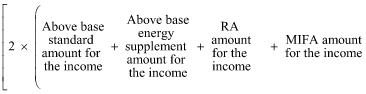

24G Overall method for working out maintenance income ceiling for Method 1

For the purposes of paragraph (d) of step 1 of the method statement in clause 20, this is how to work out an individual's maintenance income ceiling for maintenance income received by the individual, or the individual's partner, from another individual (the maintenance payer ) if the individual's Part A rate is worked out using this Part (Method 1):

Method statement

Step 1. Work out the individual's above base standard amount for the maintenance income using clause 24H.

Step 1A. Work out the individual's above base energy supplement amount for the maintenance income using clause 24HA.

Step 2. Work out the individual's RA amount for the maintenance income using clause 24J.

Step 3. Work out the individual's MIFA amount for the maintenance income using clause 24K.

Step 4. Work out the individual's maintenance income ceiling for the maintenance income using clause 24L.

24H How to work out an individual's above base standard amount

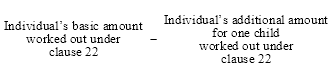

The individual's above base standard amount for the maintenance income is the difference between:

(a) the individual's standard rate under Division 2 of this Part (clauses 7 to 11) for the FTB children of the individual in respect of whom the individual, or the individual's partner, is entitled to apply for maintenance income from the maintenance payer; and

(b) the individual's standard rate under Division 2 of Part 3 (clauses 26 and 27) for those children (assuming that the individual's Part A rate were calculated under Part 3).

24HA How to work out an individual's above base energy supplement amount

(1) The individual's above base energy supplement amount for the maintenance income is the difference between:

(a) the individual's energy supplement (Part A) under Subdivision A of Division 2AA of Part 5 (clause 38AA) for the FTB children of the individual in respect of whom the individual, or the individual's partner, is entitled to apply for maintenance income from the maintenance payer; and

(b) the individual's energy supplement (Part A) under Subdivision B of Division 2AA of Part 5 (clause 38AF) for those children (assuming that the individual's Part A rate were calculated under Part 3).

(2) However, the individual's above base energy supplement amount for the maintenance income is nil if paragraph (cb) of step 1 of the method statement in clause 3 does not apply to the individual because of clause 6A.

24J How to work out an individual's RA (rent assistance) amount

This is how to work out the individual's RA amount for the maintenance income:

Method statement

Step 1. Work out the individual's rent assistance (if any) under Subdivision A of Division 2B of Part 5.

Step 2. Work out the amount that would be the individual's rent assistance (if any) under that Subdivision if rent assistance were paid for only those children in respect of whom neither the individual, nor the individual's partner, is entitled to apply for maintenance income.

Step 3. If the individual, and the individual's partner, between them are entitled to apply for maintenance income from only one maintenance payer, the difference between the amount worked out under step 1 and the amount worked out under step 2 is the individual's RA amount for the maintenance income.

Step 4. If the individual, and the individual's partner, between them are entitled to apply for maintenance income from more than one maintenance payer, the individual's RA amount for maintenance income received from a particular maintenance payer is worked out using the formula:

24K How to work out an individual's MIFA (maintenance income free area) amount

(1) If the individual, and the individual's partner, between them are entitled to apply for maintenance income from only one maintenance payer, then the individual's MIFA amount for the maintenance income is the amount of the individual's maintenance income free area.

Apportioning the maintenance income free area

(2) If the individual, and the individual's partner, between them are entitled to apply for maintenance income from more than one maintenance payer, the individual's MIFA amount for maintenance income received from a particular maintenance payer is worked out using the following formula:

where:

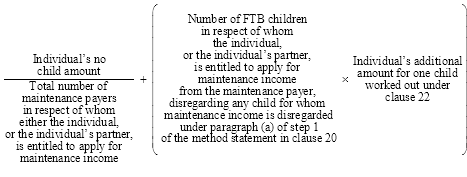

"individual's no child amount" is the amount worked out using the following formula:

24L How to work out an individual's maintenance income ceiling

The individual's maintenance income ceiling for the maintenance income is worked out using the following formula:

Subdivision D -- Maintenance income ceiling for purposes of comparison for Method 2

24M Subdivision not always to apply

This Subdivision does not apply to an individual if:

(a) the individual, and the individual's partner, between them are entitled to apply for maintenance income:

(i) from only one other individual; and

(ii) in respect of all of the FTB children of the individual; and

(b) the individual has no regular care children who are rent assistance children.

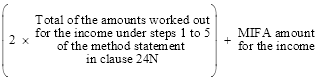

For the purposes of the comparison in step 4 of the method statement in clause 25, this is how to work out an individual's maintenance income ceiling for maintenance income received by the individual, or the individual's partner, from another individual (the maintenance payer ) if the individual's Part A rate is worked out using Part 3 of this Schedule (Method 2):

Method statement

Step 1. Work out the individual's standard amount for the maintenance income using clause 24P.

Step 2A. Work out the individual's newborn supplement (if any) under Division 1A of Part 5 (clauses 35A and 35B) for FTB children of the individual in respect of whom the individual, or the individual's partner, is entitled to apply for maintenance income from the maintenance payer.

Step 3. Work out the individual's multiple birth allowance (if any) under Division 2 of Part 5 (clauses 36 to 38) for FTB children of the individual in respect of whom the individual, or the individual's partner, is entitled to apply for maintenance income from the maintenance payer.

Step 4. Work out the individual's supplement amount for the maintenance income using clause 24R.

Step 4A. Work out the individual's energy supplement amount for the maintenance income using clause 24RA.

Step 5. Work out the individual's RA amount for the maintenance income using clause 24J.

Step 6. Work out the individual's MIFA amount for the maintenance income using clause 24K.

Step 7. Work out the individual's maintenance income ceiling for the maintenance income using clause 24S.

24P How to work out an individual's standard amount

The individual's standard amount for the maintenance income is the individual's standard rate under Division 2 of this Part (clauses 7 to 11) for the FTB children of the individual in respect of whom the individual, or the individual's partner, is entitled to apply for maintenance income from the maintenance payer.

24R How to work out an individual's supplement amount

The individual's supplement amount for the maintenance income is the individual's FTB Part A supplement under Division 2A of Part 5 (clause 38A) for the FTB children of the individual in respect of whom the individual, or the individual's partner, is entitled to apply for maintenance income from the maintenance payer.

24RA How to work out an individual's energy supplement amount

(1) The individual's energy supplement amount for the maintenance income is the individual's energy supplement (Part A) under Subdivision A of Division 2AA of Part 5 (clause 38AA) for the FTB children of the individual in respect of whom the individual, or the individual's partner, is entitled to apply for maintenance income from the maintenance payer.

(2) However, the individual's energy supplement amount for the maintenance income is nil if paragraph (e) of step 1 of the method statement in clause 25 does not apply to the individual because of clause 25C.

24S How to work out an individual's maintenance income ceiling

The individual's maintenance income ceiling for the maintenance income is worked out using the following formula:

Part 3 -- Part A rate (Method 2)

Division 1 -- Overall rate calculation process

25 Method of calculating Part A rate

Subject to the operation of clauses 25A, 25C and 25D, if the individual's Part A rate is to be calculated using this Part, it is calculated as follows:

Method statement

Step 1. Add the following amounts:

(a) the individual's standard rate under Division 2 of this Part (clauses 26 and 27);

(ba) the individual's newborn supplement (if any) under Division 1A of Part 5 (clauses 35A and 35B);

(c) the individual's multiple birth allowance (if any) under Division 2 of Part 5 (clauses 36 to 38);

(d) the individual's FTB Part A supplement under Division 2A of Part 5 (clause 38A);

(e) the individual's energy supplement (Part A) under Subdivision B of Division 2AA of Part 5 (clause 38AF).

The result is the individual's Method 2 base rate .

Note: Paragraph (e) does not apply to certain individuals: see clause 25C.

Step 2. Apply the income test in Division 3 of this Part (clause 28) to work out any reduction for adjusted taxable income. Take any reduction away from the individual's Method 2 base rate: the result is the individual's provisional Part A rate .

Step 3. Work out the rate that would be the individual's income and maintenance tested rate under step 3 of the method statement in clause 3 if the individual's Part A rate were to be calculated using Part 2 (but disregarding clause 24G): the result is the individual's Method 2 income and maintenance tested rate .

Note: Clause 25D modifies the application of this step.

Step 4. The individual's Part A rate is:

(a) the individual's provisional Part A rate if it is equal to or greater than the individual's Method 2 income and maintenance tested rate; or

(b) the individual's Method 2 income and maintenance tested rate if it is greater than the individual's provisional Part A rate.

25A Family tax benefit advance to individual

(1) If:

(a) an individual is entitled to be paid family tax benefit by instalment; and

(b) the individual is paid a family tax benefit advance; and

(c) the individual has not repaid the whole of the advance; and

(d) the amount of unrepaid family tax benefit advance is not an FTB advance debt;

then, subject to clauses 44 and 49, the individual's Part A rate is to be reduced in accordance with Division 4 of Part 5 (clauses 40 to 51).

(2) If an individual satisfies paragraphs (1)(a) to (d) for more than one family tax benefit advance, the individual's Part A rate is to be reduced under subclause (1) for each of those advances.

25B Components of Part A rates under this Part

The Minister may, by legislative instrument, determine a method for working out the extent to which Part A rates under this Part are attributable to the amounts referred to in step 1 of the method statement in clause 25.

(1) Paragraph (e) of step 1 of the method statement in clause 25 does not apply to an individual on or after the commencement of this clause unless:

(a) the individual was entitled to be paid family tax benefit in respect of 19 September 2016; and

(b) the individual's Part A rate of family tax benefit in respect of 19 September 2016 was not worked out under Part 3A of this Schedule.

(2) However, if:

(a) the individual ceases to be entitled to be paid family tax benefit in respect of a day (the applicable day ) on or after 20 September 2016; or

(b) the individual's Part A rate of family tax benefit is worked out under Part 3A of this Schedule in respect of a day (the applicable day ) on or after 20 September 2016;

then paragraph (e) of step 1 of the method statement in clause 25 does not apply, and never again applies, to the individual from:

(c) if the applicable day is before the commencement of this clause--the start of the day this clause commences; or

(d) if the applicable day is on or after the commencement of this clause--the start of the applicable day.

25D Working out the Method 2 income and maintenance tested rate

In applying step 3 of the method statement in clause 25, step 2 of the method statement in clause 3 is taken to be replaced with the following:

Step 2. Subtract the individual's income free area (worked out under clause 38N) from the individual's higher income free area (worked out under clause 2).

Step 2A. Work out 20% of the amount at step 2.

Step 2B. Subtract the individual's higher income free area (worked out under clause 2) from the individual's adjusted taxable income.

Step 2C. Work out 30% of the amount at step 2B.

Step 2D. The individual's reduction for adjusted taxable income is the sum of the amounts at steps 2A and 2C. Take that reduction away from the individual's maximum rate: the result is the individual's income tested rate .

(1) Subject to subclauses (3) and (4) and clause 27, an individual's standard rate is the total obtained by adding the FTB child rates for each of the individual's FTB children.

(2) The FTB child rate for the purpose of subclause (1) is $1,416.20.

Reduction during reduction period for failing to have health check or meet immunisation requirements

(3) If either or both section 61A and subparagraph 61B(1)(b)(ii) apply in relation to an individual and an FTB child of the individual, the annual FTB child rate in relation to the child is reduced by $737.30 for each day in the FTB child rate reduction period (except any day in a past period to which subclause (4) applies).

Reduction of past period claims for failing to meet immunisation requirements

(4) The annual FTB child rate in relation to an FTB child of an individual is reduced by $737.30 if subparagraph 61B(1)(b)(i) applies in relation to the individual and the child.

27 Sharing family tax benefit (shared care percentages)

If an individual has a shared care percentage for an FTB child of the individual, the FTB child rate for the child, in working out the individual's standard rate under clause 26, is the individual's shared care percentage of the FTB child rate that would otherwise apply to the child.

This is how to work out an individual's reduction for adjusted taxable income:

Method statement

Step 1. Work out the individual's higher income free area using clause 2.

Step 2. Work out whether the individual's adjusted taxable income exceeds the individual's higher income free area.

Step 3. If the individual's adjusted taxable income does not exceed the individual's higher income free area, the individual's income excess is nil.

Step 4. If the individual's adjusted taxable income exceeds the individual's higher income free area, the individual's income excess is the individual's adjusted taxable income less the individual's higher income free area.

Step 5. The individual's reduction for income is 30% of the income excess.

Part 3A -- Part A rate (Method 3)

28A Method of calculating Part A rate

Subject to the operation of clauses 38J and 38K, if the individual's Part A rate is to be calculated using this Part, it is calculated as follows:

Method statement

Step 1. Work out the individual's rent assistance (if any) under Subdivision A of Division 2B of Part 5 (clauses 38B to 38H). The result is the individual's maximum rate .

Step 2. Apply the income test in Division 2C of Part 5 (clauses 38L to 38N) to work out any reduction for adjusted taxable income. Take any reduction away from the individual's maximum rate: the result is the individual's income tested rate .

Step 3. The individual's Part A rate is the individual's income tested rate.

Division 1 -- Overall rate calculation process

Subdivision AA -- When Part B rate is nil

28B Adjusted taxable income exceeding $100,000

(1) Despite Subdivisions A and B, an individual's Part B rate is nil if the individual's adjusted taxable income is more than $100,000.

Note: If the individual is a member of a couple, the individual's adjusted taxable income is the higher of the individual's adjusted taxable income and the adjusted taxable income of the individual's partner: see clause 3 of Schedule 3.

(2) However, subclause (1) does not apply while the individual, or the individual's partner, is receiving a social security pension, a social security benefit, a service pension, income support supplement or a veteran payment.

Despite Subdivisions A and B, the Part B rate that an individual is eligible for in respect of a day is nil if the day is a day for which parental leave pay is payable to the individual, or the individual's partner.

28D Member of a couple whose youngest FTB child has turned 13

(1) Despite Subdivisions A and B, an individual's Part B rate is nil if:

(a) the individual is a member of a couple; and

(b) the youngest FTB child of the individual has turned 13 years of age.

(2) Subclause (1) does not apply if the individual is a grandparent or great - grandparent of that FTB child.

(3) In determining, for the purposes of this clause, whether an individual is a grandparent or great - grandparent of another person, treat the following relationships as if they were biological child - parent relationships:

(a) the relationship between an adopted child and his or her adoptive parent;

(b) the relationship between a step - child and his or her step - parent;

(c) the relationship between a relationship child and his or her relationship parent.

(4) In this clause:

"adoptive parent" , of a person (the child ), means the person who adopted the child under a law of any place (whether in Australia or not) relating to the adoption of children.

"step-parent" , of a person (the child ), means the person who:

(a) is the current or former partner of the biological parent, adoptive parent or relationship parent of the child; and

(b) is not the biological parent, adoptive parent or relationship parent of the child.

Subdivision A -- General method of calculating Part B rate

29 General method of calculating Part B rate

(1) Subject to clause 29AA, the individual's Part B rate is the amount worked out by adding the following amounts if the individual is not a member of a couple:

(a) the individual's standard rate under Division 2 (clauses 30 and 31);

(b) the individual's FTB Part B supplement under Division 2A (clause 31A);

(c) the individual's energy supplement (Part B) under Division 2B (clause 31B).

Note: Paragraph (c) does not apply to certain individuals: see clause 29AA.

(2) The individual's Part B rate is worked out using the following method statement if the individual is a member of a couple:

Method statement

Step 1. Add the following amounts:

(a) the individual's standard rate under Division 2 (clauses 30 and 31);

(b) the individual's FTB Part B supplement under Division 2A (clause 31A);

(c) the individual's energy supplement (Part B) under Division 2B (clause 31B).

The result is the individual's maximum rate .

Note: Paragraph (c) does not apply to certain individuals: see clause 29AA.

Step 2. Work out the individual's reduction for adjusted taxable income using Division 3 (clauses 32 and 33).

Step 3. The individual's Part B rate is the maximum rate less the reduction for adjusted taxable income.

Note: An individual who is a member of a couple works out his or her Part B rate under Subdivision B if the secondary earner of the couple returns to paid work after the birth of a child etc.

(2A) The Minister may, by legislative instrument, determine a method for working out the extent to which Part B rates under subclause (2) are attributable to the amounts referred to in step 1 of the method statement in subclause (2).

(3) In applying this Part to an individual, disregard an FTB child who has turned 16 years of age unless the FTB child is a senior secondary school child. If disregarding the FTB child means that neither item 1 nor item 2 in the table in clause 30 applies to the individual, the individual's Part B rate is nil.

(1) Paragraph 29(1)(c) of this Schedule, or paragraph (c) of step 1 of the method statement in subclause 29(2) of this Schedule, does not apply to an individual on or after the commencement of this clause unless:

(a) the individual was entitled to be paid family tax benefit in respect of 19 September 2016; and

(b) the individual's Part A rate of family tax benefit in respect of 19 September 2016 was not worked out under Part 3A of this Schedule.

(2) However, if:

(a) the individual ceases to be entitled to be paid family tax benefit in respect of a day (the applicable day ) on or after 20 September 2016; or

(b) the individual's Part A rate of family tax benefit is worked out under Part 3A of this Schedule in respect of a day (the applicable day ) on or after 20 September 2016;

then paragraph 29(1)(c) of this Schedule, or paragraph (c) of step 1 of the method statement in subclause 29(2) of this Schedule, does not apply, and never again applies, to the individual from:

(c) if the applicable day is before the commencement of this clause--the start of the day this clause commences; or

(d) if the applicable day is on or after the commencement of this clause--the start of the applicable day.

Application of clause

(1) The Part B rate that an individual is eligible for in respect of a day in an income year is worked out under subclause (2) if:

(a) the individual is a member of a couple on the day; and

(b) the conditions in subclauses (3) to (8) of this clause are met; and

(c) the conditions in clause 29C are met in respect of the day.

Method of calculating Part B rate

(2) Subject to clause 29D, the Part B rate that the individual is eligible for in respect of the day is the amount worked out by adding the following amounts:

(a) the individual's standard rate under Division 2 in respect of the day (clauses 30 and 31);

(b) the individual's FTB Part B supplement under Division 2A in respect of the day (clause 31A);

(c) the individual's energy supplement (Part B) under Division 2B in respect of the day (clause 31B).

Note: Paragraph (c) does not apply to certain individuals: see clause 29D.

Conditions

(3) During a period during the income year in which the day occurs, the secondary earner of the couple (who might be the individual mentioned in subclause (1)):

(a) is not engaging in paid work; and

(b) is not receiving passive employment income in respect of that period.

(4) Later during that income year, the secondary earner returns to paid work for the first time since a child became an FTB child of the secondary earner.

(4A) If, in different income years, more than one secondary earner returns to paid work for the first time in respect of the same child, the Part B rate of the individual is not calculated under this clause in respect of a return to paid work that is not the earliest return to paid work.

(4B) If, in the same income year, more than one secondary earner returns to paid work for the first time in respect of the same child, the Part B rate of the individual is not calculated under this clause in respect of a secondary earner for whom the period mentioned under paragraph 29C(1)(a) does not begin first.

(5) The conditions in clause 29B are met in respect of that child.

(6) The individual mentioned in subclause (1) has satisfied the FTB reconciliation conditions under section 32B of the Family Assistance Administration Act for all of the same - rate benefit periods in that income year.

(7) If subclause (8) does not apply--either or both of the following apply:

(a) the individual notifies the Secretary of the secondary earner's return to paid work before the end of the income year following the income year in which the secondary earner returns to paid work;

(b) the Secretary becomes aware of the secondary earner's return to paid work before the end of the income year following the income year in which the secondary earner returns to paid work.

(8) If, during the second income year following a particular income year, a claim is made under the Family Assistance Administration Act for payment of family tax benefit for a past period that occurs in the particular income year, the Secretary is notified in the claim that the secondary earner returned to paid work during the particular income year.

29B Conditions to be met in respect of an FTB child

(1) For the purpose of subclause 29A(5), the conditions in this clause are met in respect of a child if the conditions in subclauses (2) and (3) of this clause are met in respect of the child on any single day that meets the conditions in clause 29C.

Conditions in respect of FTB child

(2) Of all the FTB children of the secondary earner, either:

(a) the child most recently became an FTB child of the secondary earner; or

(b) if all of the children became FTB children of the secondary earner at the same time--the child is the youngest FTB child of the secondary earner.

Generally, only one individual calculates Part B rate under clause 29A

(3) No other individual's Part B rate has been calculated under clause 29A as a result of the conditions in this clause being met in respect of the child.

Exception--section 59 determination (shared care)

(4) If another individual's Part B rate has been calculated as mentioned in subclause (3), the condition in that subclause is taken to be met in respect of the child if:

(a) on the day on which the other individual or his or her partner returns to paid work, the other individual has a shared care percentage for the child; and

(b) the secondary earner is not a member of the same couple as the other individual on either:

(i) the day mentioned in paragraph (a); or

(ii) the day on which the secondary earner returns to paid work.

Exception--section 28 and 29 determinations (members of a couple in a blended family or members of a separated couple) etc.

(5) If another individual's Part B rate has been calculated as mentioned in subclause (3), the condition in that subclause is taken to be met in respect of the child if:

(a) at some time during the income year, the other individual is the partner of:

(i) the secondary earner; or

(ii) the individual mentioned in subclause 29A(1) (if he or she is not the secondary earner); and

(b) the other individual's Part B rate has been calculated under clause 29A in respect of the same return to paid work, and the same FTB child, of the secondary earner.

29C Conditions to be met in respect of a day

(1) For the purposes of paragraph 29A(1)(c) and clause 29B, the conditions in this clause are met in respect of a day in an income year if:

(a) the day falls in the period that starts on the latest of the following days:

(i) 1 July of the income year;

(ii) the day after the secondary earner stops paid work;

(iii) the day after the secondary earner stops receiving passive employment income in respect of a period;

and ends immediately before the day on which the secondary earner returns to paid work; and

(b) the secondary earner is not receiving passive employment income in respect of the day.

(2) For the purpose of subclause (1), the day on which an individual returns to paid work is:

(a) if the individual returns to paid work because of subsection 3B(2)--the first day of the 4 week period mentioned in that subsection on which the individual is engaging in paid work; and

(b) if the individual returns to paid work because of subsection 3B(3)--the first day on which the individual is engaging in paid work.

(3) To avoid doubt, the first and last days of the period mentioned in paragraph (1)(a) fall in that period.

(1) Paragraph 29A(2)(c) of this Schedule does not apply to an individual on or after the commencement of this clause unless:

(a) the individual was entitled to be paid family tax benefit in respect of 19 September 2016; and

(b) the individual's Part A rate of family tax benefit in respect of 19 September 2016 was not worked out under Part 3A of this Schedule.

(2) However, if:

(a) the individual ceases to be entitled to be paid family tax benefit in respect of a day (the applicable day ) on or after 20 September 2016; or

(b) the individual's Part A rate of family tax benefit is worked out under Part 3A of this Schedule in respect of a day (the applicable day ) on or after 20 September 2016;

then paragraph 29A(2)(c) of this Schedule does not apply, and never again applies, to the individual from:

(c) if the applicable day is before the commencement of this clause--the start of the day this clause commences; or

(d) if the applicable day is on or after the commencement of this clause--the start of the applicable day.

Subject to clause 31, an individual's standard rate is worked out using the following table. Work out which family situation applies to the individual. The standard rate is the corresponding amount in column 2.

Standard

rates | ||

| Column 1 Family situation | Column 2 Standard rate |

1 | youngest FTB child is under 5 years of age | $2,569.60 |

2 | youngest FTB child is 5 years of age or over | $1,781.20 |

31 Sharing family tax benefit (shared care percentages)

(1) If:

(a) an individual has a shared care percentage for an FTB child of the individual; and

(b) the child is the individual's only FTB child;

the individual's standard rate is the individual's shared care percentage of the standard rate that would otherwise apply.

(2) If:

(a) an individual has a shared care percentage for an FTB child of the individual; and

(b) the child is not the individual's only FTB child;

the individual's standard rate is to be worked out as follows:

(c) for each of the individual's FTB children for whom the individual does not have a shared care percentage, work out the rate that would be the individual's standard rate under clause 30 if that child were the individual's only FTB child;

(d) for each of the individual's FTB children for whom the individual has a shared care percentage, work out the rate that would be the individual's standard rate under clause 30 if:

(i) that child were the individual's only FTB child; and

(ii) subclause (1) of this clause applied to the child;

(e) the individual's standard rate is the highest of the rates obtained under paragraphs (c) and (d).

Division 2A -- FTB Part B supplement

31A Rate of FTB Part B supplement

(1) The amount of the FTB Part B supplement to be added in working out an individual's Part B rate under clause 29 or 29A is:

(a) if the individual has one FTB child, or more than one FTB child, and the individual does not have a shared care percentage for that child, or for at least one of those children--the FTB (B) gross supplement amount; or

(b) if the individual has only one FTB child and the individual has a shared care percentage for the child--the shared care percentage of the FTB (B) gross supplement amount; or

(c) if the individual has more than one FTB child and the individual has a shared care percentage for each of those children--the highest of those percentages of the FTB (B) gross supplement amount.

(2) For the purposes of subclause (1), the FTB (B) gross supplement amount is $302.95.

(3) To avoid doubt, when the FTB (B) gross supplement amount is indexed on a 1 July under Part 2 of Schedule 4, the amount, as it stood before that indexation, continues to apply in working out an individual's Part B rate under clause 29 or 29A for the income year ending just before that 1 July.

Division 2B -- Energy supplement (Part B)

31B Energy supplement (Part B)

(1) Subject to clause 31C, the amount of the energy supplement (Part B) to be added in working out an individual's Part B rate under clause 29 or 29A is worked out using the following table.

Energy supplement (Part B) | ||

Item | Individual's family situation | Amount of energy supplement (Part B) |

1 | Youngest FTB child is under 5 years of age | $73.00 |

2 | Youngest FTB child is 5 years of age or over | $51.10 |

Note: For certain individuals, energy supplement (Part B) is not to be added in working out the Part B rate: see clauses 29AA and 29D.

(3) This clause does not apply in relation to a day if an election made by the individual under subsection 58A(1) is in force on that day.

Note: If that election is in force on one or more days in a quarter, then the Secretary must review the instalment determination taking into account this Division: see section 105B of the Family Assistance Administration Act.

31C Sharing family tax benefit (shared care percentages)

(1) If:

(a) an individual has a shared care percentage for an FTB child of the individual; and

(b) the child is the individual's only FTB child;

the individual's energy supplement (Part B) is the individual's shared care percentage of the energy supplement (Part B) that would otherwise apply.

(2) If:

(a) an individual has a shared care percentage for an FTB child of the individual; and

(b) the child is not the individual's only FTB child;

the individual's energy supplement (Part B) is to be worked out as follows: