Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsNote: See Division 6 of Part 4A.

Part 1 -- Amount of child care subsidy

1 Amount of child care subsidy

If an individual is eligible for CCS for at least one session of care provided by an approved child care service to a child in a week, work out the amount of child care subsidy for the individual for the week, for sessions of care provided by the service to the child, using the following method statement.

Method statement

Step 1. Work out the individual's activity test result, in relation to the child, for the CCS fortnight that includes the week (see clause 11 of this Schedule).

If the activity test result is zero, the amount of child care subsidy for the individual for the week, for the sessions of care provided by the service to the child, is nil.

Otherwise, go to step 3.

Step 3. Identify all the sessions of care:

(a) provided by the service to the child in the week; and

(b) for which the individual is eligible for CCS.

Step 4. Work out the hourly rate of CCS for the individual for each of those sessions of care (see clause 2).

If the applicable percentage is 0% for each of those sessions of care, the amount of child care subsidy for the individual for the week, for those sessions, is nil.

Otherwise, go to step 5.

Step 5. Work out:

(a) the activity - tested amount of CCS for those sessions of care (see clause 4); and

(b) if at least one of those sessions of care is a session of care to which clause 4A applies--the adjusted activity - tested amount of CCS for those sessions of care (see clause 4A).

If paragraph (b) applies, go to step 7.

Otherwise, go to step 6.

Step 6. The amount of CCS for the individual for the week, for the sessions of care identified in step 3, is the activity - tested amount.

Step 7. If at least one of the sessions of care identified in step 3 is a session of care to which clause 4A applies, the amount of CCS for the individual for the week, for the sessions of care, is the adjusted activity - tested amount.

Note: An individual who is receiving CCS by fee reduction might have a lower amount passed on than the amount worked out under this method statement, because of a withholding amount in relation to the payment. See sections 67EB and 201A of the Family Assistance Administration Act.

(1) For the purposes of step 4 of the method statement in clause 1, the hourly rate of CCS for the individual, for a session of care provided by the service to the child in the week, is the individual's applicable percentage (see clauses 3 and 3A) of the lower of:

(a) the hourly session fee for the individual; and

(b) the CCS hourly rate cap for the session;

rounded to the nearest cent (rounding 0.5 cents upwards).

Note: If the applicable percentage for a session of care is 0%, the hourly rate of CCS for the individual for the session of care is nil.

(2) The hourly session fee for an individual, for a session of care provided to a child, is the amount the individual or the individual's partner is liable to pay, or would, disregarding any discount allowed under section 201BA or 201BB of the Family Assistance Administration Act, have been liable to pay, for the session of care:

(a) divided by the number of hours in the session of care; and

(b) reduced by:

(i) the hourly rate of any payment (other than a payment mentioned in subclause (2A)) which the individual benefits from in respect of that session; and

(ii) the amount per hour of any reimbursement fringe benefit in respect of the session of care (see subclause (5)).

Note: A discount allowed under section 201BA of the Family Assistance Administration Act may not attract fringe benefits tax in some circumstances: see subsection 47(2) of the Fringe Benefits Tax Assessment Act 1986 .

(2A) Subparagraph 2(2)(b)(i) does not apply to the following payments:

(a) CCS;

(b) ACCS;

(c) a payment prescribed by the Minister's rules.

(3) Work out the CCS hourly rate cap for a session of care using the following table.

CCS hourly rate cap | ||

Item | If the session of care is provided by: | the CCS hourly rate cap is: |

1 | a centre - based day care service | $11.98 |

2 | a family day care service | $11.10 |

3 | an outside school hours care service | $10.48 |

4 | an in home care service | $32.58 |

5 | a type of service prescribed by the Minister's rules | the dollar amount prescribed by the Minister's rules |

Note: The dollar amounts referred to in the table are indexed under Schedule 4 and reflect the indexation applied on 1 July 2019.

(4) The Minister's rules may prescribe criteria for determining by which of the types of service mentioned in the table in subclause (3) any particular session of care is provided.

(5) A reimbursement fringe benefit in respect of a session of care is the amount by which an individual or the individual's partner is reimbursed by a person in respect of the individual's or partner's liability to pay for the session of care, if the reimbursement:

(a) is a fringe benefit within the meaning of the Fringe Benefits Tax Assessment Act 1986 ; or

(b) would be such a fringe benefit but for paragraph (g) of the definition of fringe benefit in subsection 136(1) of that Act.

3 Applicable percentage--basic case

(1) An individual's applicable percentage for a session of care provided to a child in a CCS fortnight is determined by the following table (unless that percentage is determined in accordance with clause 3A).

Applicable percentage | ||

Item | If the individual's adjusted taxable income for the income year in which the CCS fortnight starts is: | Then the applicable percentage for the individual is: |

1 | equal to or below the lower income (base rate) threshold | 90% |

2 | above the lower income (base rate) threshold and below the upper income (base rate) threshold | see subclause (2) |

3 | equal to or above the upper income (base rate) threshold | 0% |

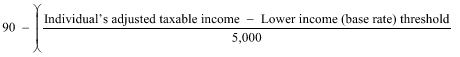

(2) If table item 2 applies, work out the individual's applicable percentage for the session of care using the following formula and rounding the result to 2 decimal places:

(4) In this Act:

"lower income (base rate) threshold" means $80,000.

Note: This amount is indexed annually in line with CPI increases (see Schedule 4). However, the amount will not be indexed in 2023 (see subclause 3(9) of Schedule 4).

"upper income (base rate) threshold" means the lower income (base rate) threshold plus $450,000.

3A Applicable percentage--other cases

When applicable percentage determined in accordance with this clause

(1) Subject to subclause (2), an individual's applicable percentage for a session of care provided to a child in a CCS fortnight is determined in accordance with this clause if:

(a) the child is a higher rate child in relation to the individual for the session of care; and

(b) the session of care is not provided by an in home care service; and

(c) the individual's adjusted taxable income for the income year in which the CCS fortnight starts is below the upper income (other rate) threshold.

Note: If the individual's adjusted taxable income for the income year in which the CCS fortnight starts is equal to or above the upper income (other rate) threshold, the individual's applicable percentage for the session of care is determined in accordance with clause 3.

(2) If the individual's applicable percentage for the session of care would be a higher percentage if it were determined in accordance with clause 3 than the percentage determined in accordance with this clause, the individual's applicable percentage for the session of care is that percentage determined in accordance with clause 3.

What is the applicable percentage?

(3) If this clause applies in relation to the individual for the session of care, the individual's applicable percentage for the session of care is determined by the following table.

Applicable percentage | ||

Item | If the individual's adjusted taxable income for the income year in which the CCS fortnight starts is: | Then the applicable percentage for the individual is: |

1 | equal to or below the lower income (other rate) threshold | 95% |

2 | above the lower income (other rate) threshold and below the second income (other rate) threshold | see subclause (4) |

3 | equal to or above the second income (other rate) threshold and below the third income (other rate) threshold | 80% |

4 | equal to or above the third income (other rate) threshold and below the fourth income (other rate) threshold | see subclause (5) |

5 | equal to or above the fourth income (other rate) threshold and below the upper income (other rate) threshold | 50% |

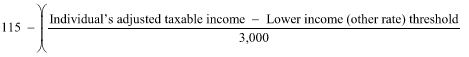

(4) If table item 2 applies, the individual's applicable percentage for the session of care is the lesser of:

(a) 95%; and

(b) the percentage worked out using the following formula and rounding the result to 2 decimal places:

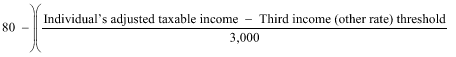

(5) If table item 4 applies, the individual's applicable percentage for the session of care is the percentage worked out using the following formula and rounding the result to 2 decimal places:

(6) In this Act:

"fourth income (other rate) threshold" means the lower income (other rate) threshold plus $274,290.

"lower income (other rate) threshold" means $72,466.

Note: This amount is indexed annually in line with CPI increases (see Schedule 4).

"second income (other rate) threshold" means the lower income (other rate) threshold plus $105,000.

"third income (other rate) threshold" means the lower income (other rate) threshold plus $184,290.

"upper income (other rate) threshold" means the lower income (other rate) threshold plus $284,290.

Higher rate child

(1) A child (the relevant child ) is a higher rate child in relation to an individual for a session of care provided to the relevant child in a CCS fortnight if:

(a) the relevant child satisfies the conditions in subclause (2) in relation to the individual and the CCS fortnight; and

(b) another child (the other child ) satisfies the conditions in subclause (2) or (3) in relation to the individual and the CCS fortnight; and

(c) one of the following conditions is satisfied:

(i) if the relevant child and the other child were born on different days--the other child is older than the relevant child;

(ii) if the relevant child and the other child were born on the same day--the other child is ranked above the relevant child for the CCS fortnight by a determination under subclause (5).

Note: There may be several children each of whom is a higher rate child in relation to the same individual for sessions of care provided in a CCS fortnight.

(2) A child satisfies the conditions in this subclause in relation to an individual and a CCS fortnight if:

(a) the child is under 6 years of age on the first Monday of the CCS fortnight; and

(b) a determination under paragraph 67CC(1)(a) of the Family Assistance Administration Act determines that the individual is eligible for CCS by fee reduction for the child; and

(c) that determination is in effect in relation to the first Monday of the CCS fortnight.

(3) A child satisfies the conditions in this subclause in relation to an individual and a CCS fortnight if:

(a) the child is under 6 years of age on the first Monday of the CCS fortnight; and

(b) a determination under paragraph 67CC(1)(a) of the Family Assistance Administration Act determines that a person who is a partner of the individual on the first Monday of the CCS fortnight is eligible for CCS by fee reduction for the child; and

(c) that determination is in effect in relation to the first Monday of the CCS fortnight.

Determinations ranking children born on same day

(4) Subclause (5) applies if:

(a) there is a group of 2 or more children who were all born on the same day; and

(b) at least one child in the group satisfies the conditions in subclause (2) in relation to an individual and a CCS fortnight; and

(c) every child in the group satisfies the conditions in subclause (2) or (3) in relation to that individual and that CCS fortnight.

(5) The Secretary must determine, in writing, that one of the children in the group is ranked above the other child or children in the group for the CCS fortnight.

(6) When making a determination under subclause (5), the Secretary must apply the Minister's rules (if any) prescribed for the purposes of this subclause.

(7) A determination under subclause (5) is not a legislative instrument.

4 Activity - tested amount of CCS

(1) For the purposes of step 5 of the method statement in clause 1, the activity - tested amount of CCS, for the sessions of care identified in step 3 of the method statement, is the amount worked out by:

(a) for each session of care--multiplying the hourly rate of CCS for the session by the number of hours in the session, up to the lower of:

(i) the balance of the activity test result worked out under subclause (2) in relation to the session; and

(ii) if the Secretary is satisfied that it is appropriate, for the CCS fortnight, to have regard to an election (if any) made under subclause (3)--the number determined in accordance with the election; and

(b) adding the results together.

(2) The balance of the activity test result, in relation to a particular session of care, is the individual's activity test result in relation to the child for the CCS fortnight, reduced (but not below zero) by:

(a) the number of hours (if any) for which either of the following is entitled to be paid CCS or ACCS for sessions of care provided to the child in the CCS fortnight:

(i) the individual;

(ii) if the individual was a member of a couple on each day in the CCS fortnight--the individual's partner; and

(b) the number of hours in any earlier sessions of care identified in step 3 of the method statement.

(3) If a circumstance prescribed by the Minister's rules exists in relation to an individual, the individual may, in a form and manner approved by the Secretary, give the Secretary a written election for the purposes of subparagraph (1)(a)(ii).

4A Adjusted activity - tested amount of CCS

(1) This clause applies in relation to a session of care if the amount (the actual fee ) the individual or the individual's partner is liable to pay for the session of care is less than the sum of:

(a) the activity - tested amount of CCS for the individual for the session; and

(b) the amount of a payment prescribed by the Minister's rules for the purposes of paragraph 2(2A)(c) which the individual benefits from in respect of the session.

(2) For the purposes of step 5 of the method statement in clause 1, the adjusted activity - tested amount of CCS, for the sessions of care identified in step 3 of the method statement, is the sum of:

(a) for each session of care to which this clause applies--the amount worked out by reducing the activity - tested amount of CCS for the session by the excess amount; and

(b) for each session of care to which this clause does not apply--the activity - tested amount of CCS for the session.

(3) For the purposes of paragraph (2)(a), the excess amount , in relation to a session of care, is:

(a) an amount equal to the difference between:

(i) the sum of the amounts mentioned in paragraphs (1)(a) and (b) for the session; and

(ii) the actual fee for the session; or

(b) if another method for working out the amount is prescribed by the Minister's rules--an amount worked out in accordance with that method.

If an individual is eligible for ACCS (child wellbeing), ACCS (temporary financial hardship) or ACCS (grandparent) for at least one session of care provided by an approved child care service to a child in a week, work out the amount of ACCS for the individual for the week, for sessions of care provided by the service to the child, using the method statement in clause 1 with the following modifications:

(a) read references to CCS as references to the kind of ACCS the individual is eligible for (except in subclause 4(2));

(c) at steps 4 and 5, use the hourly rate of ACCS (see clause 6) instead of the hourly rate of CCS.

6 Hourly rate of ACCS (child wellbeing), ACCS (temporary financial hardship) or ACCS (grandparent)

(1) For the purposes of paragraph 5(c), the hourly rate of ACCS for the individual, for a session of care provided by the service to the child in the week, is 100% of the lower of:

(a) the hourly session fee for the individual (see subclause 2(2)); and

(b) the ACCS hourly rate cap for the session.

(2) The ACCS hourly rate cap for a session of care provided by a service to a child is the following percentage of the CCS hourly rate cap (see subclause 2(3)) for the session:

(a) 120%;

(b) if a higher percentage applies under the Secretary's rules and paragraph (c) does not apply--that higher percentage;

(c) if the Secretary is satisfied that exceptional circumstances exist in relation to an individual or the individual's partner, or the service, and makes a written determination to that effect that applies to the session--the higher percentage specified in the determination.

(3) A determination made under paragraph (2)(c) is not a legislative instrument.

Part 3 -- Amount of ACCS (transition to work)

7 Amount of ACCS (transition to work)

If an individual is eligible for ACCS (transition to work) for at least one session of care provided by an approved child care service to a child in a week, work out the amount of ACCS (transition to work) for the individual for the week, for sessions of care provided by the service to the child, using the method statement in clause 1 with the following modifications:

(a) read references to CCS as references to ACCS (transition to work) (except in subclause 4(2));

(c) at step 4, work out the hourly rate of CCS for the individual using 95% instead of the applicable percentage in clause 3 or 3A (whichever applies).

Part 4 -- Amount of ACCS (child wellbeing) for an approved provider

8 Amount of ACCS (child wellbeing) for an approved provider

If an approved provider is eligible for ACCS (child wellbeing) for at least one session of care provided by an approved child care service of the provider to a child in a week, work out the amount of ACCS (child wellbeing) for the provider for the week, for sessions of care provided by the service to the child, using the following method statement.

Method statement

Step 1. Work out the provider's deemed activity test result for the child and service for the CCS fortnight that includes the week (see clause 16).

Step 2. Identify all the sessions of care:

(a) provided by the service to the child in the week; and

(b) for which the provider is eligible for ACCS (child wellbeing).

Step 3. Work out the hourly rate of ACCS for the provider for each of those sessions of care (see clause 9).

Step 4. Work out the activity - tested amount of ACCS for those sessions of care (see clause 10).

Step 5. The amount of ACCS (child wellbeing) for the provider for the week, for the sessions of care identified in step 2, is the activity - tested amount.

9 Hourly rate of ACCS for a provider

(1) For the purposes of step 3 of the method statement in clause 8, the hourly rate of ACCS for the provider, for a session of care provided to a child in a week, is 100% of the lower of:

(a) the hourly session fee for the provider; and

(b) the ACCS hourly rate cap for the session (see subclause 6(2)).

(2) The hourly session fee for a provider, for a session of care provided to a child, is the amount the provider would ordinarily charge an individual who is eligible for CCS for the session of care:

(a) divided by the number of hours in the session of care; and

(b) reduced by the hourly rate of any payment (other than CCS or ACCS) which the provider benefits or would have benefitted from in respect of that session.

10 Activity - tested amount of ACCS for an approved provider

(1) For the purposes of step 4 of the method statement in clause 8, the activity - tested amount of ACCS, for the sessions of care identified in step 2 of the method statement, is the amount worked out by:

(a) for each session of care--multiplying the hourly rate of ACCS for the session by the number of hours in the session up to the balance of the deemed activity test result worked out under subclause (2) in relation to the session; and

(b) adding the results together.

(2) The balance of the deemed activity test result, in relation to a particular session of care, is the provider's deemed activity test result for the child and the service for the CCS fortnight, reduced (but not below zero) by:

(a) the number of hours (if any) for which the provider is entitled to be paid ACCS for sessions of care provided to the child by the service in the CCS fortnight; and

(b) the number of hours in any earlier sessions of care identified in step 2 of the method statement.

Division 1 -- Individual's activity test result

11 Individual's activity test result

(1) For the purposes of working out an amount of CCS or ACCS for an individual in relation to sessions of care provided to a child, an individual's activity test result , in relation to the child, for a CCS fortnight is:

(a) the highest of:

(i) the result specified in item 1 of the following table for the amount; and

(ii) any other result specified in any other table item for the amount that applies to the individual in relation to the child; or

(b) if the individual is a member of a couple on the first day of the CCS fortnight--the lower of the following:

(i) the result worked out in accordance with paragraph (a) for the individual in relation to the child;

(ii) the result worked out in accordance with paragraph (a) for the individual's partner in relation to the child, assuming that any estimate of adjusted taxable income that applies for the individual also applies for the partner for the purposes of the low income result in clause 13.

Individual's activity test result | |||

Item | Results for amount of CCS | Results for amount of ACCS (child wellbeing), ACCS (temporary financial hardship) or ACCS (grandparent) | Results for amount of ACCS (transition to work) |

1 | recognised activity result in clause 12 | 100 | recognised activity result in clause 12 |

2 | low income result in clause 13 |

|

|

3 | Minister's rules result in clause 14 | Minister's rules result in clause 14 | Minister's rules result in clause 14 |

4 | child wellbeing result in clause 15 |

| child wellbeing result in clause 15 |

5 | exceptional circumstances result in this clause | exceptional circumstances result in this clause | exceptional circumstances result in this clause |

6 | Aboriginal or Torres Strait Islander child result in clause 15A |

| Aboriginal or Torres Strait Islander child result in clause 15A |

Note: See subclause (5) for an individual eligible for both CCS and ACCS in the same CCS fortnight.

Exceptional circumstances result

(2) The exceptional circumstances result is the result specified in a determination made under paragraph (3)(b).

(3) The exceptional circumstances result applies to an individual for a CCS fortnight, in relation to a particular child, if the Secretary:

(a) is satisfied that exceptional circumstances exist in relation to the individual, the individual's partner or the child; and

(b) makes a written determination to that effect that applies to the child.

(4) A determination made under paragraph (3)(b) is not a legislative instrument.

Individual eligible for CCS and ACCS in same CCS fortnight

(5) If an individual is eligible for an amount of:

(a) CCS or ACCS (transition to work) for sessions of care provided to a child in a week of a CCS fortnight; and

(b) ACCS (child wellbeing) or ACCS (temporary financial hardship) for sessions of care provided to the child in the other week (whether the first or second week) of the CCS fortnight;

the individual's activity test result for the CCS fortnight, in relation to the child, is the activity test result for the amount referred to in paragraph (b).

(1) The recognised activity result for an individual for a CCS fortnight, in relation to any child, is the result specified in the following table for the individual's circumstances in the CCS fortnight.

Recognised activity result | ||

Item | If an individual engages in this many hours of recognised activity in the CCS fortnight: | The result is: |

1 | fewer than 8 | 0 |

2 | at least 8 and no more than 16 | 36 |

3 | more than 16 and no more than 48 | 72 |

4 | more than 48 | 100 |

Note: The number of hours of recognised activity for an individual to be counted towards the recognised activity result may be affected by Minister's rules made for the purposes of subclause (4), or a Secretary's determination made under subclause (5).

What is recognised activity

(2) An individual engages in recognised activity if the individual engages in any one or more of the following:

(a) paid work (whether or not as an employee);

(b) a training course for the purpose of improving the individual's work skills or employment prospects, or both;

(c) an approved course of education or study;

(d) an activity prescribed by the Minister's rules, in circumstances (if any) prescribed by those rules;

(e) an activity determined for the individual by the Secretary under subclause (5), in circumstances (if any) specified in the determination.

Note 1: The definition of paid work in section 3B does not apply in relation to paragraph (2)(a) of this clause. For the purposes of that paragraph, paid work has its ordinary meaning.

Note 2: For approved course of education or study , see subsection 541B(5) of the Social Security Act 1991 and subsection 3(1) of this Act.

Associated activities

(3) An individual who engages in recognised activity mentioned in any of paragraphs (2)(a) to (d) is taken also to engage in recognised activity of that kind while:

(a) engaging in other activity prescribed by the Minister's rules as being associated with recognised activity of that kind; or

(b) taking leave or another break from, or otherwise not performing, recognised activity of that kind in circumstances prescribed by the Minister's rules (whether or not the individual has engaged in recognised activity of that kind during the CCS fortnight).

Hours during which activities are engaged in

(4) For the purposes of working out the recognised activity result for an individual who engages in recognised activity mentioned in any of paragraphs (2)(a) to (d) during a CCS fortnight, the Minister's rules may prescribe either or both of the following:

(a) how to work out a number of hours of recognised activity of that kind that is taken to be counted towards the activity in that fortnight (which may be more or less than the actual number of hours during which the individual engaged in the activity during the fortnight);

(b) a maximum number of hours that are to be counted towards the activity in that fortnight (including a maximum number of hours taken to be so counted by the operation of rules made for the purposes of paragraph (a)).

Secretary's determination

(5) The Secretary may, in writing, make a determination for an individual for the purposes of paragraph (2)(e). The determination may also provide for any matter covered by Minister's rules that may be made for the purposes of subclause (3) or (4) in relation to the individual.

(6) A determination made under subclause (5) is not a legislative instrument.

Changes in the number of hours of recognised activity

(7) In working out the recognised activity result, a change in the number of hours of recognised activity in which an individual engages in a CCS fortnight is to be disregarded until the CCS fortnight immediately after the CCS fortnight in which the change occurs.

(1) The low income result is 24.

(2) The low income result applies to an individual for a CCS fortnight, in relation to any child, if, on the first day of the CCS fortnight:

(a) there is an estimate of adjusted taxable income that, under section 67DB of the Family Assistance Administration Act, the Secretary is permitted to use for the purposes of making a determination under Division 3 of Part 3A of that Act for the individual; and

(b) the estimate is equal to or below the lower income (base rate) threshold.

Note: The meaning of this provision for members of couples is affected by section 67DE of the Family Assistance Administration Act.

(1) The Minister's rules result is the result prescribed by, or worked out by a method prescribed by, the Minister's rules.

(2) The Minister's rules result applies to an individual for a CCS fortnight, in relation to:

(a) a particular child--if a circumstance prescribed by the rules exists and the application of the rules in the circumstance is limited to the particular child; and

(b) any child--if a circumstance prescribed by the rules exists and the application of the rules in the circumstance is not limited to a particular child.

(3) Minister's rules made for the purposes of subclause (2) may prescribe circumstances in relation to any or all of the following:

(a) individuals;

(b) individuals' partners;

(c) children.

(1) The child wellbeing result is 100.

(2) The child wellbeing result applies to an individual for a CCS fortnight, in relation to a particular child, if:

(a) the individual is eligible for CCS for a session of care provided to the child in a CCS fortnight; and

(b) on the first day of the CCS fortnight, it has been less than 18 months since an extended child wellbeing period for the child ended.

(3) An extended child wellbeing period for a child is a period of at least 6 months during which instruments of either or both of the following kinds were continuously in effect in relation to the child:

(a) a certificate given by an approved provider under section 85CB;

(b) a determination made by the Secretary under section 85CE.

15A Aboriginal or Torres Strait Islander child result

(1) The Aboriginal or Torres Strait Islander child result is 36.

(2) The Aboriginal or Torres Strait Islander child result applies to an individual for a CCS fortnight, in relation to a child, if:

(a) the individual is eligible for CCS for a session of care provided to the child in the CCS fortnight; and

(b) the child is an Aboriginal or Torres Strait Islander child; and

(c) the Secretary has been notified, in a manner approved by the Secretary, that the child is an Aboriginal or Torres Strait Islander child.

Meaning of Aboriginal or Torres Strait Islander child

(3) A child is an Aboriginal or Torres Strait Islander child if:

(a) all of the following apply:

(i) the child is of Aboriginal descent or of Torres Strait Islander descent (or both);

(ii) the child identifies as a person of that descent;

(iii) the child is accepted by the community in which the child lives as being of that descent; or

(b) the child is biologically related to an Aboriginal or Torres Strait Islander person; or

(c) the child is a member of a class prescribed by the Minister's rules.

Meaning of Aboriginal or Torres Strait Islander person

(4) A person is an Aboriginal or Torres Strait Islander person if:

(a) the person is of Aboriginal descent or of Torres Strait Islander descent (or both); and

(b) the person identifies as a person of that descent; and

(c) the person is accepted by the community in which the person lives as being of that descent.

Division 2 -- Provider's deemed activity test result

16 Provider's deemed activity test result

(1) For the purposes of working out an amount of ACCS (child wellbeing) under Part 4 of this Schedule for sessions of care provided to a child by an approved child care service, the provider's deemed activity test result , for the child and the service, for a CCS fortnight, is the highest of the following:

(a) 100;

(b) if a circumstance prescribed by the Minister's rules exists in relation to the child, the provider or the service and paragraph (c) does not apply--the result prescribed by, or worked out by a method prescribed by, the Minister's rules;

(c) if the Secretary is satisfied that exceptional circumstances exist in relation to the child, the provider or the service and makes a written determination to that effect that applies to the session--the result specified in the determination.

(2) Minister's rules made for the purposes of paragraph (1)(b) may prescribe circumstances in relation to any or all of the following:

(a) children;

(b) approved providers;

(c) approved child care services.

(3) A determination made under paragraph (1)(c) is not a legislative instrument.