Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsNote: See section 85.

This Schedule provides for:

(a) the indexation, in line with CPI (Consumer Price Index) increases, of the amounts in column 1 of the table at the end of clause 3; and

(c) the adjustment of other amounts in line with the increases in the amounts indexed under the Social Security Act 1991 .

2 Indexed and adjusted amounts

The following table sets out:

(a) each monetary amount that is to be indexed or adjusted under this Schedule; and

(b) the abbreviation used in this Schedule for referring to that amount; and

(c) the provision or provisions in which that amount is to be found.

Indexed and adjusted amounts | |||

| Column 1 Description of amount | Column 2 Abbreviation | Column 3 Provisions in which amount specified |

FTB child rate (Part A--Method 1) | FTB child rate (A1) | [Schedule 1--subclause 7(1)--table--column 2--all amounts] | |

2 | Reduction in FTB child rate (Part A--Method 1) | Reduction in FTB child rate (A1) | [Schedule 1--subclauses 7(2) and (3)--all amounts] |

4 | Rent threshold rate for rent assistance for family tax benefit (Part A--Methods 1 and 3) | FTB RA rent threshold (A1 and A3) | [Schedule 1--subparagraphs 38C(1)(f)(i), (ii), (iii) and (iv)] [Schedule 1--subparagraphs 38C(1)(fa)(i), (ii), (iii) and (iv)] [Schedule 1--clause 38D--table--column 2--all amounts] [Schedule 1--clause 38E--table--column 2--all amounts] |

5 | Maximum rent assistance for family tax benefit (Part A--Methods 1 and 3) | FTB RA maximum (A1 and A3) | [Schedule 1--clause 38D--table--column 3--all amounts] [Schedule 1--clause 38E--table--column 3--all amounts] |

6 | FTB child rate (Part A--Method 2) | FTB child rate (A2) | [Schedule 1--subclause 26(2)] |

7 | Reduction in FTB child rate (Part A--Method 2) | Reduction in FTB child rate (A2) | [Schedule 1--subclauses 26(3) and (4)--all amounts] |

7A | Newborn supplement for family tax benefit (Part A) | newborn supplement | [Schedule 1--paragraphs 35B(1)(a), (b), (c) and (d) and subclauses 35B(2), (3) and (4)--the dollar amount in the formula] |

7B | Upfront payment of family tax benefit | newborn upfront payment | subsections 58AA(1) and (1A) |

Multiple birth allowance for family tax benefit (Part A) | FTB MBA (A) | [Schedule 1--clause 37--paragraphs (a) and (b)] | |

8A | FTB gross supplement amount for family tax benefit (Part A) | FTB gross supplement amount (A) | [Schedule 1--subclause 38A(3)] |

Standard rate of family tax benefit (Part B) | FTB standard rate (B) | [Schedule 1--clause 30--table--column 2--all amounts] | |

9A | FTB (B) gross supplement amount for family tax benefit (Part B) | FTB gross supplement amount (B) | [Schedule 1--subclause 31A(2)] |

10 | Standard rate of family tax benefit payable to an approved care organisation | FTB standard ACO rate | [subsection 58(2A)] |

Basic higher income free area for family tax benefit (Part A) | FTB basic HIFA (A) | [Schedule 1--clause 2--table--column 1] | |

13 | Income free area for family tax benefit (Part A--Methods 1 and 3) | FTB free area (A1 and A3) | [Schedule 1--clause 38N] |

14 | Income free area for family tax benefit (Part B) | FTB free area (B) | [Schedule 1--clause 33] |

Standard basic maintenance income free area for family tax benefit (Part A--Method 1) | FTB basic MIFA (A1) | [Schedule 1--clause 22--table--column 2--items 1 and 3] | |

16 | Double basic maintenance income free area for family tax benefit (Part A--Method 1) | FTB double basic MIFA (A1) | [Schedule 1--clause 22--table--column 2--item 2] |

17 | Additional maintenance income free area for family tax benefit (Part A--Method 1) | FTB additional MIFA (A1) | [Schedule 1--clause 22--table--column 3--all amounts] |

17AA | Income limit for family tax benefit (Part B) | FTB income limit (B) | [Schedule 1--subclause 28B(1)] |

Income limit for stillborn baby payment | stillborn baby payment income limit | [paragraph 36(1)(e)] | |

18 | Lower income (base rate) threshold for CCS | CCS lower income (base rate) threshold | subclause 3(4) of Schedule 2 definition of lower income (base rate) threshold |

18A | Lower income (other rate) threshold for CCS | CCS lower income (other rate) threshold | subclause 3A(6) of Schedule 2 definition of lower income (other rate) threshold |

19 | CCS hourly rate cap | CCS hourly rate cap | subclause 2(3) of Schedule 2 |

(1) An amount referred to in the following table is to be indexed under this Part on each indexation day for the amount, using the reference quarter and base quarter for the amount and indexation day and rounding off to the nearest multiple of the rounding amount:

CPI indexation | |||||

| Column 1 Amount | Column 2 Indexation day(s) | Column 3 Reference quarter (most recent before indexation day) | Column 4 Base quarter | Column 5 Rounding base |

1 | FTB child rate (A1) and reduction in FTB child rate (A1) | 1 July | December | highest December quarter before reference quarter (but not earlier than December quarter 1999) | $3.65 |

FTB RA maximum (A1 and A3) | (a) 20 March (b) 20 September | (a) December (b) June | highest June or December quarter before reference quarter (but not earlier than June quarter 1979) | $3.65 | |

5 | FTB RA rent threshold (A1 and A3) | (a) 20 March (b) 20 September | (a) December (b) June | highest June or December quarter before reference quarter (but not earlier than June quarter 1979) | $3.65 |

6 | FTB child rate (A2) and reduction in FTB child rate (A2) | 1 July | December | highest December quarter before reference quarter (but not earlier than December quarter 1999) | $3.65 |

newborn supplement | 1 July | December | highest December quarter before reference quarter (but not earlier than December quarter 2012) | $0.91 | |

7B | newborn upfront payment | 1 July | December | highest December quarter before reference quarter (but not earlier than December quarter 2012) | $1.00 |

FTB MBA (A) | 1 July | December | highest December quarter before reference quarter (but not earlier than December quarter 1999) | $3.65 | |

8A | FTB gross supplement amount (A) | 1 July | December | highest December quarter before reference quarter (but not earlier than December quarter 2002) | $3.65 |

FTB standard rate (B) | 1 July | December | highest December quarter before reference quarter (but not earlier than December quarter 1999) | $3.65 | |

9A | FTB gross supplement amount (B) | 1 July | December | highest December quarter before reference quarter (but not earlier than December quarter 2004) | $3.65 |

FTB standard ACO rate | 1 July | December | highest December quarter before reference quarter (but not earlier than December quarter 1999) | $3.65 | |

11 | FTB basic HIFA (A) | 1 July | December | highest December quarter before reference quarter (but not earlier than December quarter 1999) | $73.00 |

FTB free area (A1 and A3) | 1 July | December | highest December quarter before reference quarter (but not earlier than December quarter 2005) | $73.00 | |

14 | FTB free area (B) | 1 July | December | highest December quarter before reference quarter (but not earlier than December quarter 2003) | $73.00 |

FTB basic MIFA (A1) | 1 July | December | highest December quarter before reference quarter (but not earlier than December quarter 1999) | $10.95 | |

16 | FTB double basic MIFA (A1) | 1 July | December | highest December quarter before reference quarter (but not earlier than December quarter 1999) | $21.90 |

FTB additional MIFA (A1) | 1 July | December | highest December quarter before reference quarter (but not earlier than December quarter 1999) | $3.65 | |

FTB income limit (B) | 1 July | December | highest December quarter before reference quarter (but not earlier than December quarter 2007) | $1.00 | |

stillborn baby payment income limit | 1 July | December | highest December quarter before reference quarter (but not earlier than December quarter 2015) | $1.00 | |

18 | CCS lower income (base rate) threshold | first day of first CCS fortnight of income year | December | highest December quarter before reference quarter (but not earlier than December quarter 2015) | $1.00 |

18A | CCS lower income (other rate) threshold | first day of first CCS fortnight of income year | December | highest December quarter before reference quarter (but not earlier than December quarter 2015) | $1.00 |

19 | CCS hourly rate cap | first day of first CCS fortnight of income year | December | highest December quarter before reference quarter (but not earlier than December quarter 2015) | $0.01 |

(2) A reference in the table in subclause (1) to the highest of a group of quarters is a reference to the quarter in that group that has the highest index number.

No indexation of certain FTB rates and reductions on 1 July 2017 and 1 July 2018

(3) The FTB child rate (A1), the FTB child rate (A2), the reduction to those rates, the FTB standard rate (B) and the FTB standard ACO rate are not to be indexed on 1 July 2017 and 1 July 2018.

First indexation of stillborn baby payment income limit

(4A) The first indexation under subclause (1) of the stillborn baby payment income limit is to take place on 1 July 2017.

Indexation rules for certain income limits for certain years

(7) The FTB basic HIFA (A) is not to be indexed on 1 July 2019 and 1 July 2020.

(7A) For the purposes of working out the indexed amount for the FTB basic HIFA (A) on 1 July 2021, the current figure for the FTB basic HIFA (A) immediately before that day is taken to be $98,988.

(7B) The FTB income limit (B) is not to be indexed on 1 July 2019 and 1 July 2020.

No indexation of FTB gross supplement amount (A) and (B) for certain years

(8) The FTB gross supplement amount (A) and the FTB gross supplement amount (B) are not to be indexed on 1 July 2011, 1 July 2012, 1 July 2013, 1 July 2014, 1 July 2015 and 1 July 2016.

No indexation for CCS lower income (base rate) threshold in 2023

(9) The CCS lower income (base rate) threshold is not to be indexed on the first day of the first CCS fortnight of the income year starting on 1 July 2023.

3A One - off 6 - month indexation of FTB gross supplement amount (B) for 2005 - 2006 income year

The FTB gross supplement amount (B) is to be indexed under this Part on the indexation day, using the reference quarter, base quarter and indexation day and rounding off to the nearest multiple of the rounding base, where:

"base quarter" means June quarter 2004.

"indexation day" means 1 July 2005.

"reference quarter" means December quarter 2004.

"rounding base" means $3.65.

(1) If an amount is to be indexed under this Part on an indexation day, this Act has effect as if the indexed amount were substituted for that amount on that day.

(2) This is how to work out the indexed amount for an amount that is to be indexed under this Part on an indexation day:

Method statement

Step 1. Use clause 5 to work out the indexation factor for the amount on the indexation day.

Step 2. Work out the current figure for the amount immediately before the indexation day.

Step 3. Multiply the current figure by the indexation factor: the result is the provisional indexed amount .

Step 4 . Use clause 6 to round off the provisional indexed amount: the result is the indexed amount.

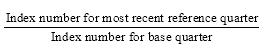

(1) Subject to subclauses (2) and (3) and clauses 10 and 11, the indexation factor for an amount that is to be indexed under this Part on an indexation day is:

worked out to 3 decimal places.

(2) If an indexation factor worked out under subclause (1) would, if it were worked out to 4 decimal places, end in a number that is greater than 4, the indexation factor is to be increased by 0.001.

(3) If an indexation factor worked out under subclauses (1) and (2) would be less than 1, the indexation factor is to be increased to 1.

(4) Subject to subclause (5), if at any time (whether before or after the commencement of this clause), the Australian Statistician publishes an index number for a quarter in substitution for an index number previously published by the Australian Statistician for that quarter, the publication of the later index number is to be disregarded for the purposes of this clause.

(5) If at any time (whether before or after the commencement of this clause) the Australian Statistician changes the index reference period for the Consumer Price Index, regard is to be had, for the purposes of applying this clause after the change takes place, only to index numbers published in terms of the new index reference period.

6 Rounding off indexed amounts

(1) If a provisional indexed amount is a multiple of the rounding base, the provisional indexed amount becomes the indexed amount.

(2) If a provisional indexed amount is not a multiple of the rounding base, the indexed amount is the provisional indexed amount rounded up or down to the nearest multiple of the rounding base.

(3) If a provisional indexed amount is not a multiple of the rounding base but is a multiple of half the rounding base, the indexed amount is the provisional indexed amount rounded up to the nearest multiple of the rounding base.