Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsNote: See section 3.

1 Adjusted taxable income relevant to family tax benefit, schoolkids bonus and child care subsidy

An individual's adjusted taxable income is relevant to eligibility for, and the rate or amount of, family tax benefit, schoolkids bonus and child care subsidy.

(1) For the purposes of this Act and subject to subclause (2), an individual's adjusted taxable income for a particular income year is the sum of the following amounts ( income components ):

(a) the individual's taxable income for that year, disregarding the individual's assessable FHSS released amount (within the meaning of the Income Tax Assessment Act 1997 ) for that year;

(b) the individual's adjusted fringe benefits total for that year;

(c) the individual's target foreign income for that year;

(d) the individual's total net investment loss (within the meaning of the Income Tax Assessment Act 1997 ) for that year;

(e) the individual's tax free pension or benefit for that year;

(f) the individual's reportable superannuation contributions (within the meaning of the Income Tax Assessment Act 1997 ) for that year;

less the amount of the individual's deductible child maintenance expenditure for that year.

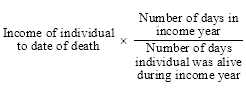

(2) If an individual dies before the end of a particular income year, the individual's adjusted taxable income for that year is to be calculated in accordance with the following formula:

where:

"income of individual to date of death" means the amount that would, but for the operation of this subclause, have been the amount of adjusted taxable income of the individual for the particular income year in which the individual died if, so far as that particular individual is concerned, that year had comprised only those days preceding the individual's death.

3 Adjusted taxable income of members of a couple--family tax benefit and schoolkids bonus

(1A) This clause applies in relation to working out eligibility for, and the rate of, family tax benefit and schoolkids bonus.

(1) For the purposes of this Act (other than Part 4 of Schedule 1), if an individual is a member of a couple, the individual's adjusted taxable income for an income year includes the adjusted taxable income for that year of the individual's partner.

(2) For the purposes of Part 4 of Schedule 1, if an individual is a member of a couple, the individual's adjusted taxable income for an income year is:

(a) for the purposes of Subdivision AA of Division 1 of Part 4 of Schedule 1:

(i) the individual's adjusted taxable income for that year; or

(ii) the adjusted taxable income for that year of the individual's partner if it is more than the individual's adjusted taxable income for that year; and

(b) for the purposes of the other provisions of Part 4 of Schedule 1:

(i) the individual's adjusted taxable income for that year; or

(ii) the adjusted taxable income for that year of the individual's partner if it is less than the individual's adjusted taxable income for that year.

3AA Adjusted taxable income of members of a couple--child care subsidy

(1) This clause applies in relation to working out eligibility for, and the rate of, child care subsidy for the purposes of this Act in relation to a child care decision.

(2) If an individual is a member of a couple with a TFN determination person on the first Monday (an applicable Monday ) of any CCS fortnight in an income year, the individual's adjusted taxable income for that year is taken to include:

(a) if the individual is a member of the same couple on all applicable Mondays in the year--the TFN determination person's adjusted taxable income for that year; or

(b) in any other case--an amount equal to the percentage of the TFN determination person's adjusted taxable income for that year that corresponds to the percentage of applicable Mondays in that year:

(i) on which the TFN determination person was a member of that couple; and

(ii) that was included in a week for which a determination under section 67CD of the Family Assistance Administration Act about the individual's entitlement to be paid CCS or ACCS was made.

(3) This clause is subject to clause 3A.

If:

(a) an individual is a member of a couple with another individual ( partner A ) for a period or periods during an income year but not at the end of the income year; and

(b) for any period during the income year while the individual was a member of that couple, the Secretary had determined the individual's entitlement to family assistance by way of family tax benefit or child care subsidy on the basis that a particular amount was the individual's adjusted taxable income (the current ATI amount ); and

(c) that amount differs from the amount of the individual's adjusted taxable income as finally determined in respect of the income year by the Secretary (the final ATI amount ); and

(d) the individual's entitlement to family assistance of that kind, for the total period, or for the total of the periods, that the individual was a member of that couple, would be less if worked out using the final ATI amount than if worked out using the current ATI amount as determined from time to time; and

(e) if the current ATI amount at any time was based on an estimate provided by the individual and is less than the final ATI amount:

(i) at the time when the estimate was provided--the individual did not know, and had no reason to suspect, that the estimate was incorrect; and

(ii) if, after the estimate was provided and before ceasing to be a member of the couple, the individual knew or had reason to suspect that the estimate was incorrect--the individual provided a revised estimate as soon as practicable after knowing or suspecting that the estimate was incorrect;

then, despite the final determination of that adjusted taxable income by the Secretary, the individual's adjusted taxable income during any period during the income year:

(f) that the individual and partner A were a couple; and

(g) that a particular current ATI amount applied;

is to be taken to be that particular current ATI amount.

4 Adjusted fringe benefits total

An individual's adjusted fringe benefits total for an income year is the amount worked out using the formula:

![]()

where:

"other employer fringe benefits total" is the amount that is the sum of the following:

(a) each of the individual's reportable fringe benefits amounts for the income year under section 135P of the Fringe Benefits Tax Assessment Act 1986 ;

(b) each of the individual's reportable fringe benefits amounts for the income year under section 135Q of the Fringe Benefits Tax Assessment Act 1986 , to the extent that section relates to the individual's employment by an employer described in section 58 of that Act.

"section 57A employer fringe benefits total" is the amount that is the sum of each of the individual's individual quasi - fringe benefits amounts for the income year under section 135Q of the Fringe Benefits Tax Assessment Act 1986 , to the extent that section relates to the individual's employment by an employer described in section 57A of that Act.

(1) An individual's target foreign income for an income year is:

(a) the amount of the individual's foreign income (as defined in section 10A of the Social Security Act 1991 ) for the income year that is neither:

(i) taxable income; nor

(ii) received in the form of a fringe benefit (as defined in the Fringe Benefits Tax Assessment Act 1986 , as it applies of its own force or because of the Fringe Benefits Tax (Application to the Commonwealth) Act 1986 ) in relation to the individual as an employee (as defined in the Fringe Benefits Tax Assessment Act 1986 ) and a year of tax; and

(b) any amount of income that is not covered by paragraph (a) that is exempt from tax under section 23AF or 23AG of the Income Tax Assessment Act 1936 , reduced (but not below nil) by the total amount of losses and outgoings (except capital losses and outgoings) incurred by the individual in deriving that exempt income.

(2) If it is necessary, for the purposes of this Act, to work out an amount of foreign income expressed in a foreign currency received in an income year, the amount in Australian currency is to be worked out using the market exchange rate for 1 July in that income year.

(3) If there is no market exchange rate for 1 July in the income year (for example, because of a national public holiday), the market exchange rate to be used is the market exchange rate that applied on the last working day immediately before that 1 July.

(4) For the purposes of this clause, the appropriate market exchange rate on a particular day for a foreign currency is:

(a) if there is an on - demand airmail buying rate for the currency available at the Commonwealth Bank of Australia at the start of business in Sydney on that day and the Secretary determines that it is appropriate to use that rate--that rate; or

(b) in any other case:

(i) if there is another rate of exchange for the currency, or there are other rates of exchange for the currency, available at the Commonwealth Bank of Australia at the start of business in Sydney on that day and the Secretary determines that it is appropriate to use the other rate or one of the other rates--the rate so determined; or

(ii) otherwise--a rate of exchange for the currency available from another source at the start of business in Sydney on that day that the Secretary determines it is appropriate to use.

For the purposes of this Schedule, the following payments received in an income year are tax free pensions or benefits for that year:

(a) a disability support pension under Part 2.3 of the Social Security Act 1991 ;

(c) a carer payment under Part 2.5 of the Social Security Act 1991 ;

(d) a pension under Part II of the Veterans' Entitlements Act 1986 payable to a veteran;

(da) a pension under Part IV of the Veterans' Entitlements Act 1986 payable to a member of the Forces or a member of a Peacekeeping Force;

(e) an invalidity service pension under Division 4 of Part III of the Veterans' Entitlements Act 1986 ;

(f) a partner service pension under Division 5 of Part III of the Veterans' Entitlements Act 1986 ;

(g) a pension under Part II of the Veterans' Entitlements Act 1986 payable to the widow or widower of a deceased veteran;

(ga) a pension under Part IV of the Veterans' Entitlements Act 1986 payable to the widow or widower of a deceased member of the Forces or the widow or widower of a deceased member of a Peacekeeping Force;

(h) income support supplement under Part IIIA of the Veterans' Entitlements Act 1986 ;

(haaa) a veteran payment under an instrument made under Part IIIAA of the Veterans' Entitlements Act 1986 ;

(ha) a Special Rate Disability Pension under Part 6 of Chapter 4 of the Military Rehabilitation and Compensation Act 2004 ;

(hb) a payment of compensation under section 68, 71 or 75 of the Military Rehabilitation and Compensation Act 2004 ;

(hc) a payment of the weekly amount mentioned in paragraph 234(1)(b) of the Military Rehabilitation and Compensation Act 2004 (including a reduced weekly amount because of a choice under section 236 of that Act) or of a lump sum mentioned in subsection 236(5) of that Act;

to the extent to which the payment:

(i) is exempt from income tax; and

(j) is not a payment by way of bereavement payment, pharmaceutical allowance, rent assistance, language, literacy and numeracy supplement, remote area allowance or energy supplement; and

(k) if the payment is a payment under the Social Security Act 1991 --does not include tax - exempt pension supplement (within the meaning of subsection 20A(6) of that Act); and

(l) if the payment is a payment under the Veterans' Entitlements Act 1986 --does not include tax - exempt pension supplement (within the meaning of subsection 5GA(5) of that Act).

8 Deductible child maintenance expenditure

Deductible child maintenance expenditure

(1) For the purposes of this Schedule, if an individual incurs an amount of child maintenance expenditure during an income year, 100% of the amount of the expenditure is the individual's deductible child maintenance expenditure in respect of that year.

Child maintenance expenditure

(2) For the purposes of this clause, an individual incurs child maintenance expenditure if:

(a) the individual (the payer ) pays a payment (either one - off or periodic) or provides benefits; and

(b) the payment or benefits are paid or provided in respect of the payer's natural, adopted or relationship child; and

(c) the payment or benefits are paid or provided to another individual other than the payer's partner (if any) for the maintenance of the child.

Amount of child maintenance expenditure

(3) For the purposes of this clause, if an individual incurs child maintenance expenditure, the amount of the child maintenance expenditure incurred by the individual is the amount of the payment paid or the value of the benefits to the individual who provided them.

Value of a benefit provided

(4) For the purposes of subclause (3), the value of a benefit , in relation to the individual providing the benefit, has the meaning set out in subclauses (5) and (6).

Value of benefit where provider is a party to a child support agreement

(5) If:

(a) an individual providing a benefit is a party to a child support agreement under the Child Support (Assessment) Act 1989 ; and

(b) the agreement contains:

(i) non - periodic payment provisions (within the meaning of that Act) under which the individual is providing child support to another individual for a child; and

(ii) a statement that the annual rate of child support payable under any relevant administrative assessment is to be reduced by a specified amount that represents an annual value of the child support to be provided; and

(c) the individual provides the support;

the value of the benefit provided by the individual is the specified amount.

Value of benefit where provider is not a party to a child support agreement

(6) If an individual providing a benefit is not a party to a child support agreement under the Child Support (Assessment) Act 1989 , the value of the benefit provided by the individual is the cost of the benefit to the individual.