Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

1 Subsection 17(1) (definition of income cut-out amount )

Repeal the definition, substitute:

"income cut-out amount" is the amount worked out using the formula in subsection (8).

2 At the end of section 17

Add:

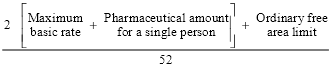

(8) For the purposes of the definition of income cut-out amount in subsection (1), the formula is as follows:

where:

"maximum basic rate" means the sum of the amount specified in column 3 of item 1 in Table B in point 1064-B1 and the amount of pension supplement worked out under point 1064-BA2 for a person who is not a member of a couple.

Note: Point 1064-BA2 refers to maximum basic rate . Maximum basic rate depends on a person's family situation. The rate used here is the rate for a person who is not a member of a couple.

"ordinary free area limit" means the amount specified in column 3 of item 1 in Table E - 1 in point 1064 - E4.

"pharmaceutical amount for a single person" means the amount specified in column 3 of item 1 in the Pharmaceutical Allowance Amount Table in point 1064 - C8.

3 Subsection 20(2)

Repeal the subsection.

4 Subsection 23(1) (paragraph (c) of the definition of family assistance law )

Repeal the paragraph, substitute:

(c) regulations under the Family Assistance Administration Act;

(d) Schedules 5 and 6 to the A New Tax System (Family Assistance and Related Measures) Act 2000 .

5 Subsection 23(1) (paragraph (a) of the definition of payday )

Repeal the paragraph, substitute:

(a) if the person is receiving a social security pension, a social security benefit, a carer allowance, a double orphan pension or a pensioner education supplement--a day on which an instalment of the pension, benefit, supplement or allowance is, or would normally be, paid to the person; or

6 At the end of subsection 999(1)

Add:

; and (d) the person:

(i) is an Australian resident; or

(ii) meets the requirements set out in subparagraph 729(2)(f)(ii), (iii), (iv) or (v) of this Act and is in Australia .

7 Subsection 1061PZG(1)

Omit "$30.00", substitute "$31.20".

8 Point 1068B - A2 (method statement, step 7)

After "plus", insert ", except where the person is a CDEP Scheme participant in respect of the whole or part of the period for which the rate of payment is being worked out,".

9 Point 1068B - A3 (method statement, step 7)

After "plus", insert ", except where the person is a CDEP Scheme participant in respect of the whole or part of the period for which the rate of payment is being worked out,".

10 Point 1068B - C2 (first sentence)

Repeal the sentence, substitute:

If a person is not a CDEP Scheme participant in respect of the whole or part of the period for which the rate of payment is being worked out, the person's maximum basic rate is worked out using Table C.

11 Subsection 1188D(5)

Omit "$20", substitute "$20.80".

12 Subsection 1188F(10)

Omit "$20", substitute "$20.80".

13 Section 1206GA (table item 1, column 2)

Omit "subsection 967(1)", substitute "subsection 974(2)".

14 Section 1206GA (table item 1, column 3)

Omit "child disability allowance", substitute "carer allowance".

15 At the end of Schedule 1A

Add:

If:

(a) a person was, before 1 July 2000 , subject to a seasonal work non - benefit period under this Act; and

(b) but for the amendments of this Act taking effect on that day, the seasonal work non - benefit period would have extended for a period (the residual period ) starting on 1 July 2000 and ending at the end of that seasonal work non - benefit period;

then, for the purposes of this Act as in force on and after that day, the residual period is to be treated as if it were a seasonal work preclusion period.

Social Security (Administration) Act 1999

Repeal the subsection, substitute:

(5) To the extent that a provision of this Act relates to a double orphan pension, a reference in the provision to a person includes a reference to an approved care organisation.

17 Subsection 10(5)

Repeal the subsection.

18 Paragraphs 15(5)(e), (f), (g) and (h)

Repeal the paragraphs.

19 Sections 19 and 27

Repeal the sections.

20 Paragraphs 31(1)(b), (c), (d) and (e)

Repeal the paragraphs.

21 Subsection 39(1)

Omit "subsections (2) and", substitute "subsection".

22 Subsection 39(2)

Repeal the subsection.

23 Paragraphs 47(1)(g) and (h)

Repeal the paragraphs.

24 Section 71

Repeal the section.

25 Paragraph 72(3)(e)

Repeal the paragraph.

26 Subsection 72(4)

Omit "(other than a notice under section 71)".

27 Subsection 72(5)

Repeal the subsection.

28 Subsection 72(7)

Omit ", 68 or 71", substitute "or 68".

29 Subsections 81(3), (4), (5) and (6)

Repeal the subsections.

30 Subsections 110(6), (7), (8) and (12)

Repeal the subsections.

31 Section 113

Repeal the section.

32 Subsection 114(1)

Omit ", section 110 nor 113", substitute "nor 110".

33 Paragraph 118(1)(a)

Repeal the paragraph.

34 Section 119

Repeal the section.

35 Paragraph 126(1)(b)

Repeal the paragraph.

36 Paragraph 129(1)(b)

Repeal the paragraph

37 Subsection 129(2)

Repeal the subsection

38 Section 136

Repeal the section, substitute:

136 Notice of decision on review

If a person makes a decision under subsection 135(1), the person must give the applicant written notice of the decision.

39 Paragraph 140(1)(e)

Repeal the paragraph.

40 Subsection 142(3)

Repeal the subsection.

41 Paragraph 144(r)

Repeal the paragraph.

42 Subsection 156(5)

Repeal the subsection.

43 Subsection 160(4)

Repeal the subsection.

44 Paragraph 175(1)(a)

Omit ", the Farm Household Support Act 1992 or subsection 91A(3) of the Child Support (Assessment) Act 1989 ", substitute "or under the Farm Household Support Act 1992 ".

45 Paragraph 175(5)(c)

Repeal the paragraph

46 Paragraph 178(1)(a)

Omit ", the Farm Household Support Act 1992 or subsection 91A(3) of the Child Support (Assessment) Act 1989 ", substitute "or under the Farm Household Support Act 1992 ".

47 Subsection 179(5)

Repeal the subsection.

48 Sections 202 and 207

Omit ", the Child Care Payments Act 1997 " (wherever occurring).

49 Paragraph 208(1)(a)

Omit ", the Child Care Payments Act 1997 ".

50 Clause 1 of Schedule 1 (paragraphs (d), (e) and (h) of the definition of social security periodic payment )

Repeal the paragraphs.

51 Paragraph 4(2)(b) of Schedule 2

Repeal the paragraph, substitute:

(b) parenting payment is not a relevant social security payment in the case of a person who becomes qualified for the payment because of the birth of a child.

52 Clauses 20 to 27 (inclusive) of Schedule 2

Repeal the clauses.

53 Clause 36 of Schedule 2

Omit "family allowance", substitute "family tax benefit".

Note: The heading to clause 36 of Schedule 2 is altered by omitting " family allowance " and substituting " family tax benefit ".

54 Subclauses 19(2), (3), (5) and (7) of Schedule 3

Omit "the Student and Youth Assistance Act 1973 or the Child Care Payments Act 1997 " (wherever occurring), substitute "the family assistance law or the Student Assistance Act 1973 ".

55 Clause 20 of Schedule 3

Omit "the Student and Youth Assistance Act 1973 , the Child Care Payments Act 1997 ", substitute "the family assistance law, the Student Assistance Act 1973 ".

Social Security (International Agreements) Act 1999

56 Paragraphs 13(e), (f) and (g)

Repeal the paragraphs, substitute:

(e) if the person's notional agreement pension rate is not nil, add the additional child amount or amounts (that are applicable in accordance with section 14A) to the person's notional agreement pension rate. This new amount is the person's total notional rate ;

(f) multiply the person's total notional rate by the person's residence factor: the result is the person's international agreement portability rate .

57 After section 14

Insert:

(1) For the purpose of the step in the calculation of a person's international agreement portability rate that is described in paragraph 13(e), the additional child amounts that may be applicable are set out in the following table. They are annual amounts. The amount in item 3 is only applicable if an amount in item 1 or 2 is to be paid to a person without a partner.

Additional child amounts | ||

Item | Family situation | Additional child amount |

1 | For each dependent child under 13 years of age | $1,957.80 |

2 | For each dependent child who has reached 13, but is under 15, years of age | $2,732.60 |

3 | For a person without a partner | $962.00 |

(2) If, for the purposes of subsection (1), the Secretary determines in writing a higher amount in substitution for an amount set out in the table, the higher amount is taken, from the commencement of subsection (1), to be substituted for the amount so set out.

(3) A determination under subsection (2) is a disallowable instrument for the purposes of section 46A of the Acts Interpretation Act 1901 .