Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

A New Tax System (Bonuses for Older Australians) Act 1999

1 Section 19

Repeal the section, substitute:

19 Application of social security law

(1) Except to the extent the provision is made in this Part, the social security law applies to:

(a) the making of a determination about whether to grant a proper claim for a bonus payment under this Part; and

(b) the making of any payment as a result of such a determination; and

(c) any other matter relating to such a determination or payment;

in the same way as that law applies in the making of determinations about, and payments of, pension bonus under that law.

(2) For this purposes of so applying the social security law:

(a) references in that law to that law itself are taken to include references to this Act; and

(b) any modifications of that law that are prescribed by the regulations for the purposes of this section apply.

(3) For the purposes of this section:

"social security law" means:

(a) the Social Security Act 1991 ; and

(b) the Social Security (Administration) Act 1999 ; and

(c) the Social Security (International Agreements) Act 1999 ; and

(d) any other Act that is expressed to form part of the social security law.

Note: This section means that the provisions of the social security law dealing with matters such as the following will apply:

Child Support (Assessment) Act 1989

2 Paragraph 39(2)(b) (definition of base FTB rate )

After "means the base FTB child rate", insert "for the child".

3 Paragraph 39(2)(b) (definition of standard FTB rate )

Omit "standard rate", substitute "FTB child rate for the child".

4 Paragraph 89(4)(b)

Omit "at a rate", substitute "at a Part A rate".

5 Paragraph 91A(1)(b)

Omit "at a rate", substitute "at a Part A rate".

6 Subsection 91A(3)

Repeal the subsection, substitute:

(3) The Secretary must decide if the eligible person has taken reasonable action to obtain maintenance for the child by applying clause 10 of Schedule 1 to the Family Assistance Act as if:

(a) the Registrar had accepted the agreement; and

(b) if the eligible person is a claimant for family tax benefit for the child--the eligible person was entitled to be paid the benefit.

For the purposes of this Act and of the A New Tax System (Family Assistance) (Administration) Act 1999 , the Secretary is said to make an adverse decision under this subsection if the Secretary decides under clause 10 of Schedule 1 to the Family Assistance Act that the FTB child rate for the child is the base FTB child rate for the child.

7 Paragraph 92(4)(a)

Omit "at a rate", substitute "at a Part A rate".

8 Subsection 151(4)

Repeal the subsection, substitute:

(4) If:

(a) a carer makes an election under subsection (1) in respect of a child; and

(b) the carer is entitled to be paid, or is a claimant for, family tax benefit for the child, the Part A rate of which is higher than the base rate for the carer under clause 4 of Schedule 1 to the Family Assistance Act;

the election has no effect unless and until the Secretary approves the election under section 151A.

9 Subsections 151A(2), (3) and (4)

Repeal the subsections, substitute:

(2) The Secretary must, by applying clause 10 of Schedule 1 to the Family Assistance Act, decide whether the carer has taken reasonable action to obtain maintenance for the child if it were assumed that:

(a) the election were to take effect; and

(b) if the carer is a claimant for family tax benefit for the child--the carer were entitled to be paid the benefit.

(3) The Secretary is taken to approve the election if the Secretary decides that the carer has taken reasonable action to obtain maintenance for the child.

(4) The Secretary is taken not to approve the election if the Secretary decides that the carer has not taken reasonable action to obtain maintenance for the child.

Note: The heading to section 151A is altered by omitting " more than the minimum rate of family allowance " and substituting " more than the base rate of family tax benefit Part A ".

10 Paragraph 5EAA(b)

Repeal the paragraph, substitute:

(b) the person's daily rate of family tax benefit consists of, or includes, a Part A rate that is worked out using Part 2 of Schedule 1 to the Family Assistance Act; and

(c) the person's income excess under Division 4 of Part 2 of that Schedule is nil.

Income Tax Assessment Act 1936

11 Sub - subparagraph 23AB(7)(a)(ii)(AA)

Omit "subsection 159L(3A)", substitute "subsections 159L(3A), (5A) and (5B)".

12 Sub - subparagraph 23AB(7)(a)(ii)(BA)

Omit "subsection 159J(1AA)", substitute "subsections 159J(1AA), (3AA) and (3AB)".

13 Sub - subparagraph 23AB(7)(a)(ii)(D)

Omit "subsection 159J(1AA)", substitute "subsections 159J(1AA), (3AA) and (3AB)".

14 Subsection 23AB(7) (note 1)

Omit "if the taxpayer is eligible for family tax benefit", substitute "if the taxpayer or the taxpayer's spouse is eligible for family tax benefit at the Part B rate".

15 Subsection 79A(4) (paragraph (aa) of the definition of relevant rebate amount )

Omit "subsection 159L(3A)", substitute "subsections 159L(3A), (5A) and (5B)".

16 Subsection 79A(4) (paragraph (ba) of the definition of relevant rebate amount )

Omit "subsection 159J(1AA)", substitute "subsections 159J(1AA), (3AA) and (3AB)".

17 Subsection 79A(4) (paragraph (d) of the definition of relevant rebate amount )

Omit "subsection 159J(1AA)", substitute "subsections 159J(1AA), (3AA) and (3AB)".

18 Subsection 79A(4) (definition of relevant rebate amount , note 1)

Omit "if the taxpayer is eligible for family tax benefit", substitute "if the taxpayer or the taxpayer's spouse is eligible for family tax benefit at the Part B rate".

19 Subsection 79B(6) (paragraph (aa) of the definition of concessional rebate amount )

Omit "subsection 159L(3A)", substitute "subsections 159L(3A), (5A) and (5B)".

20 Subsection 79B(6) (paragraph (ba) of the definition of concessional rebate amount )

Omit "subsection 159J(1AA)", substitute "subsections 159J(1AA), (3AA) and (3AB)".

21 Subsection 79B(6) (paragraph (d) of the definition of concessional rebate amount )

Omit "subsection 159J(1AA)", substitute "subsections 159J(1AA), (3AA) and (3AB)".

22 Subsection 79B(6) (definition of concessional rebate amount , note 1)

Omit "if the taxpayer is eligible for family tax benefit", substitute "if the taxpayer or the taxpayer's spouse is eligible for family tax benefit at the Part B rate".

23 Subsection 159J(1AA)

Repeal the subsection, substitute:

(1AA) A taxpayer is not entitled, in his or her assessment in respect of a year of income, to a rebate under this section in respect of a dependant included in class 1 or 2 in the table in subsection (2), if, during the whole of that year of income:

(a) the taxpayer, or the taxpayer's spouse while being the taxpayer's partner as defined in the A New Tax System (Family Assistance) Act 1999 , was eligible for family tax benefit at the Part B rate within the meaning of that Act; and

(b) clause 31 of Schedule 1 to that Act did not apply to the Part B rate.

24 Paragraphs 159J(3)(e) and (f)

Repeal the paragraphs, substitute:

(e) a dependant, being a child included in class 3 in the table in subsection (2), a student or an invalid relative, is such a dependant during part only of the year of income;

25 After subsection 159J(3)

Insert:

(3AA) If:

(a) but for this subsection, a taxpayer would be entitled, in his or her assessment in respect of a year of income, to a rebate under this section in respect of a dependant included in class 1 or 2 in the table in subsection (2); and

(b) during part only of that year of income:

(i) the taxpayer, or the taxpayer's spouse while being the taxpayer's partner as defined in the A New Tax System (Family Assistance) Act 1999 , was eligible for family tax benefit at the Part B rate within the meaning of that Act; and

(ii) clause 31 of Schedule 1 to that Act did not apply in respect of the Part B rate;

then:

(c) the taxpayer has no entitlement to a rebate under this section in respect of that dependant for that part of the year of income; and

(d) the rebate allowable to the taxpayer in respect of that dependant for the remainder of that year of income is, subject to the operation of subsection (3AB), such part of the relevant rebate amount specified in column 3 of the table in subsection (2) as, in the opinion of the Commissioner, is reasonable in the circumstances.

(3AB) If:

(a) but for this subsection, a taxpayer would be entitled, in his or her assessment in respect of a year of income, to a rebate under this section in respect of a dependant included in class 1 or 2 of the table in subsection (2); and

(b) during the whole or a part of the year of income concerned:

(i) the taxpayer, or the taxpayer's spouse while being the taxpayer's partner as defined in the A New Tax System (Family Assistance) Act 1999 , was eligible for family tax benefit at the Part B rate within the meaning of that Act; and

(ii) clause 31 of Schedule 1 to that Act applied in respect of that Part B rate because of the determination of a particular specified percentage under subsection 59(1) of that Act;

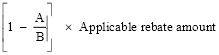

the rebate allowable to the taxpayer for the year of income, or that part of the year of income, (the shared care period ) is to be worked out using the formula:

where:

"A" is the standard rate in respect of the taxpayer or the taxpayer's spouse worked out under clause 31 of Schedule 1 to the A New Tax System (Family Assistance) Act 1999 .

"applicable rebate amount" is the amount of rebate that would have been allowable under this section in respect of the shared care period but for the application of this subsection.

"B" is the rate that would be the standard rate in respect of the taxpayer or the taxpayer's spouse under clause 30 of Schedule 1 to that Act had clause 31 of that Schedule not applied and had the FTB child in respect of whom the standard rate was determined under clause 31 been the only FTB child of the taxpayer or the taxpayer's spouse, as the case requires.

26 Subsection 159L(3A)

Repeal the subsection, substitute:

(3A) A taxpayer is not entitled, in his or her assessment in respect of a year of income, to a rebate under this section in respect of a person wholly engaged in keeping house in Australia for the taxpayer if, during the whole of that year of income:

(a) the taxpayer, or the taxpayer's spouse while being the taxpayer's partner as defined in the A New Tax System (Family Assistance) Act 1999 , was eligible for family tax benefit at the Part B rate within the meaning of that Act; and

(b) clause 31 of Schedule 1 to that Act did not apply to the Part B rate; and

(c) the taxpayer did not contribute to the maintenance of a dependant specified in paragraph (1)(c).

27 After subsection 159L(5)

Insert:

(5A) If:

(a) but for this subsection, a taxpayer would be entitled, in his or her assessment in respect of a year of income, to a rebate under this section in respect of a person wholly engaged in keeping house in Australia for the taxpayer; and

(b) during part only of that year of income:

(i) the taxpayer, or the taxpayer's spouse while being the taxpayer's partner as defined in the A New Tax System (Family Assistance) Act 1999 , was eligible for family tax benefit at the Part B rate within the meaning of that Act; and

(ii) clause 31 of Schedule 1 to that Act did not apply in respect of the Part B rate; and

(iii) the taxpayer did not contribute to the maintenance of a dependant specified in paragraph (1)(c);

then:

(c) the taxpayer has no entitlement to a rebate under this section for that part of the year of income; and

(d) the rebate allowable to the taxpayer for the remainder of that year of income is, subject to the operation of subsection (5B), such part of the rebate specified in subsection (2) in relation to the taxpayer as, in the opinion of the Commissioner, is reasonable in the circumstances.

(5B) If:

(a) but for this subsection, a taxpayer would be entitled, in his or her assessment in respect of a year of income, to a rebate under this section in respect of a person wholly engaged in keeping house in Australia for the taxpayer; and

(b) during the whole or a part of the year of income concerned:

(i) the taxpayer, or the taxpayer's spouse while being the taxpayer's partner as defined in the A New Tax System (Family Assistance) Act 1999 , was eligible for family tax benefit at the Part B rate within the meaning of that Act; and

(ii) clause 31 of Schedule 1 to that Act applied in respect of that Part B rate because of the determination of a particular specified percentage under subsection 59(1) of that Act; and

(iii) the taxpayer did not contribute to the maintenance of a dependant specified in paragraph (1)(c);

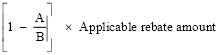

the rebate allowable to the taxpayer for the year of income, or that part of the year of income, (the shared care period ) is to be worked out using the formula:

where:

"A" is the standard rate in respect of the taxpayer or the taxpayer's spouse worked out under clause 31 of Schedule 1 to the A New Tax System (Family Assistance) Act 1999 .

"applicable rebate amount" is the amount of rebate that would have been allowable under this section in respect of the shared care period but for the application of this subsection.

"B" is the rate that would be the standard rate in respect of the taxpayer or the taxpayer's spouse under clause 30 of Schedule 1 to that Act had clause 31 of that Schedule not applied and had the FTB child in respect of whom the standard rate was determined under clause 31 been the only FTB child of the taxpayer or the taxpayer's spouse, as the case requires.

28 Subsection 251R(5)

Repeal the subsection, substitute:

(5) If, in relation to a period, being the whole or a part of a year of income:

(a) the parents of a child referred to in paragraph (3)(b) lived separately and apart from each other; and

(b) the child would, but for this subsection, be taken, for the purposes of this Part, to be a dependant of each of his or her parents in respect of that period; and

(c) both of the parents or their spouses, being partners as defined in the A New Tax System (Family Assistance) Act 1999 , are eligible for family tax benefit at the Part A rate under that Act for that child in respect of the period; and

(d) the Secretary of the Department whose Minister administers that Act has determined, under subsection 59(1) of that Act, that each parent is entitled to a specified percentage of that family tax benefit;

the child is to be taken to be a dependant of each parent for the purposes of Part VIIB of this Act, for so much only of that period as represents that percentage of the period.

29 Application

The amendments of the Income Tax Assessment Act 1936 made by this Schedule apply to assessments in relation to the 2000 - 2001 year of income and later years of income.