Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

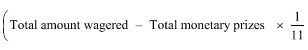

Commonwealth Consolidated Acts(1) Your global GST amount for a tax period is as follows:

where:

"total amounts wagered" is the sum of the * consideration for all of your * gambling supplies that are attributable to that tax period.

"total monetary prizes" is the sum of:

(a) the * monetary prizes you are liable to pay, during the tax period, on the outcome of gambling events (whether or not any of those gambling events, or the * gambling supplies to which the monetary prizes relate, take place during the tax period); and

(b) any amounts of * money or * digital currency you are liable to pay, during the tax period, under agreements between you and * recipients of your gambling supplies, to repay to them a proportion of their losses relating to those supplies (whether or not the supplies take place during the tax period).

For the basic rules on what is attributable to a particular period, see Division 29.

(2) However, your global GST amount is zero for any tax period in which total monetary prizes exceeds total amounts wagered.

(3) In working out the total monetary prizes for a tax period, disregard any * monetary prizes you are liable to pay, during the tax period, that relate to supplies that are * GST - free.

(4) Your global GST amount for a tax period may be affected by sections 126 - 15 and 126 - 20.