Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) The GST payable by you on a * taxable supply, the input tax credit to which you are entitled for a * creditable acquisition, or an * adjustment that you have, is attributable to a particular tax period (the transition tax period ), and not to any other tax period, if:

(a) at the start of the transition tax period, you cease to * account on a cash basis; and

(b) the GST on the supply, the input tax credit on the acquisition, or the adjustment, was only to some extent attributable to a previous tax period during which you accounted on a cash basis; and

(c) it would have been attributable solely to that previous tax period had you not accounted on a cash basis during that period.

(2) However, the GST on the supply, the input tax credit on the acquisition, or the adjustment, is attributable to the transition tax period only to the extent that it has not been previously attributed to one or more of those previous tax periods.

For accounting on a cash basis, see Subdivision 29 - B.

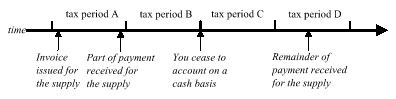

Example: Take the example in section 159 - 5 as changed in the following diagram so that you receive part of the payment for the supply in tax period A. The transition tax period is still tax period C.

Under section 29 - 5, the supply was to some extent attributable to tax period A, but it would have been attributable only to that tax period if you had not been accounting on a cash basis. Therefore the supply is attributable to tax period C (the transition tax period), but only to the extent that it is not attributable to tax period A.

(3) This section has effect despite sections 29 - 5, 29 - 10 and 29 - 20 (which are about attributing GST on supplies, input tax credits on acquisitions, and adjustments) and any other provisions of this Chapter.