Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) The GST payable by you on a * taxable supply, the input tax credit to which you are entitled for a * creditable acquisition, or an * adjustment that you have, is attributable to a particular tax period (the transition tax period ), and not to any other tax period, if:

(a) at the start of the transition tax period, you cease to * account on a cash basis; and

(b) the GST on the supply, the input tax credit on the acquisition, or the adjustment, was not attributable, to any extent, to a previous tax period during which you accounted on a cash basis; and

(c) it would have been attributable to that previous tax period had you not accounted on a cash basis during that period.

For accounting on a cash basis, see Subdivision 29 - B.

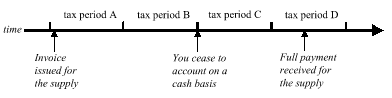

Example: In tax period A in the following diagram, you issue an invoice for a supply that you made, but you receive no payment for the supply until tax period D. However, you cease to account on a cash basis at the start of tax period C (which is therefore the transition tax period).

Under section 29 - 5, the supply was not attributable to tax period A (because at the time you were accounting on a cash basis), but it would have been attributable to that period if you had not been accounting on a cash basis (because you issued the invoice in that period). Therefore the supply is attributable to tax period C (the transition tax period).

(2) This section has effect despite sections 29 - 5, 29 - 10 and 29 - 20 (which are about attributing GST on supplies, input tax credits on acquisitions, and adjustments) and any other provisions of this Chapter.