Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

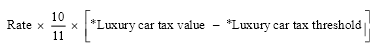

Commonwealth Consolidated Acts(1) The amount of luxury car tax payable on a * taxable importation of a luxury car is as follows:

where:

"luxury car tax value" of the * car is the sum of:

(a) the customs value (for the purposes of Division 2 of Part VIII of the Customs Act 1901 ) of the car and of any * car parts, accessories or attachments covered by subsection 7 - 10(2); and

(b) the amount paid or payable:

(i) for the * international transport of the car and any car parts, accessories or attachments covered by subsection 7 - 10(2) to their * place of consignment in the indirect tax zone ; and

(ii) to insure the car and any car parts, accessories or attachments covered by subsection 7 - 10(2) for that transport;

to the extent that the amount is not already included under paragraph ( a); and

(c) any * customs duty payable in respect of the * importation of the car and of any car parts, accessories or attachments covered by subsection 7 - 10(2); and

(d) any * GST payable in respect of the importation of the car and of any car parts, accessories or attachments covered by subsection 7 - 10(2); and

(e) if the * importation of the car is * GST - free (to an extent) because of paragraph 13 - 10(b) of the * GST Act in conjunction with Subdivision 38 - P of that Act--an amount equal to the amount of * GST that was not payable because of paragraph 13 - 10(b) and Subdivision 38 - P.

"rate" is the rate applicable under:

(a) the A New Tax System (Luxury Car Tax Imposition--General) Act 1999 ; or

(b) the A New Tax System (Luxury Car Tax Imposition--Customs) Act 1999 ; or

(c) the A New Tax System (Luxury Car Tax Imposition--Excise) Act 1999 .

(2) The Commissioner may, in writing:

(a) determine the way in which the amount paid or payable for a specified kind of transport or insurance is to be worked out for the purposes of paragraph ( b) of the definition of luxury car tax value in subsection ( 1); and

(b) in relation to importations of a specified kind or importations to which specified circumstances apply, determine that the amount paid or payable for a specified kind of transport or insurance is taken, for the purposes of that paragraph, to be zero.