Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsGiving a debt agreement proposal

(1) A debtor who is insolvent may give the Official Receiver a written proposal for a debt agreement.

Requirements for a debt agreement proposal

(2) A debt agreement proposal must:

(aa) be in the approved form; and

(a) identify the debtor's property that is to be dealt with under the agreement; and

(b) specify how the property is to be dealt with; and

(c) authorise a specified person (being a person who is the Official Trustee, a registered trustee or a registered debt agreement administrator and who is not the debtor) to deal with the identified property in the way specified; and

(d) provide that:

(i) all provable debts in relation to the agreement rank equally; and

(ii) if the total amount paid by the debtor under the agreement in respect of those provable debts is insufficient to meet those provable debts in full, those provable debts are to be paid proportionately; and

(e) provide that a creditor is not entitled to receive, in respect of a provable debt, more than the amount of the debt; and

(f) provide that the amount of a provable debt in relation to the agreement is to be ascertained as at the time when the acceptance of the proposal for processing is recorded on the National Personal Insolvency Index; and

(g) if a creditor is a secured creditor--provide that, if the creditor does not realise the creditor's security while the agreement is in force, the creditor is taken, for the purposes of working out the amount payable to the creditor under the agreement, to be a creditor only to the extent (if any) by which the amount of the provable debt exceeds the value of the creditor's security; and

(h) if a creditor is a secured creditor--provide that, if the creditor realises the creditor's security while the agreement is in force, the creditor is taken, for the purposes of working out the amount payable to the creditor under the agreement, to be a creditor only to the extent of any balance due to the creditor after deducting the net amount realised; and

(i) be signed by the debtor; and

(j) specify the date on which the debtor signed the proposal.

(2AA) A debt agreement proposal must not provide for the debtor to make payments under the agreement, in respect of provable debts in relation to the agreement, after:

(a) 3 years beginning on the day the agreement is made; or

(b) if subsection (2AB) applies to the debtor--5 years beginning on the day the agreement is made.

Note: Section 185H deals with when a debt agreement is made.

(2AB) This subsection applies to the debtor if at the time the debtor gives the debt agreement proposal to the Official Receiver the debtor has an interest in real property in Australia that is a dwelling and is the debtor's principal place of residence, being an interest:

(a) that is an interest under a long - term lease; or

(b) that is any other legal or equitable estate or interest, except:

(i) an interest under a lease (other than a long - term lease); or

(ii) an interest under a licence; or

(iii) a life interest; or

(iv) an interest in an easement; or

(v) an interest held on trust for another person; or

(vi) an interest of a kind determined in an instrument under subsection (2AD) for the purposes of this subparagraph.

(2AC) If, in accordance with subsections (2AA) and (2AB), a debt agreement proposal provides for the debtor to make payments under the agreement, in respect of provable debts in relation to the agreement, after 3, but not after 5, years beginning on the day the agreement is made, the property identified under paragraph (2)(a) must not include any interest covered by subsection (2AB).

(2AD) The Minister may, by legislative instrument, determine a kind of interest for the purposes of subparagraph (2AB)(b)(vi).

(2A) A debt agreement proposal must not provide for the transfer of property (other than money) to a creditor.

(2B) A debt agreement proposal given to the Official Receiver must be accompanied by an explanatory statement in the approved form containing such information as the form requires.

(2C) The debtor's subsection (2B) statement may be set out in the same document as the debtor's debt agreement proposal.

(2D) The debt agreement proposal given to the Official Receiver must be accompanied by a certificate signed by the proposed administrator:

(a) stating that the proposed administrator consents to being specified under paragraph (2)(c); and

(b) stating that the proposed administrator has given the debtor the information prescribed by the regulations; and

(c) if subsection (4C) does not apply to the debtor--stating that, having regard to:

(i) the circumstances in existence at the time when the debtor's statement of affairs was signed by the debtor; and

(ii) any other relevant matters;

the proposed administrator has reasonable grounds to believe that the debtor is likely to be able to discharge the obligations created by the agreement as and when they fall due; and

(d) stating that the proposed administrator has reasonable grounds to believe that all information required to be set out in the debtor's statement of affairs has been set out in that statement; and

(e) stating that the proposed administrator has reasonable grounds to believe that all information required to be set out in the debtor's subsection (2B) statement has been set out in that statement; and

(f) if a person (the broker ) referred the debtor to the proposed administrator--setting out details of the relationship between the broker and the proposed administrator and details of any payments made, or to be made, to the broker by the proposed administrator in connection with that referral; and

(g) if, at the time a person became an affected creditor, the person was a related entity of the proposed administrator--specifying the name of the affected creditor and the nature of the relationship between the affected creditor and the proposed administrator.

(2DA) If subsection (4C) applies to the debtor, the debt agreement proposal given to the Official Receiver must also be accompanied by the certificate under paragraph (4C)(b).

(2E) A debt agreement proposal must not be given jointly by 2 or more debtors.

(2F) If a debt agreement proposal is expressed to be subject to the occurrence of a specified event within a specified period after the debt agreement proposal is accepted, the specified period must not be longer than 7 days.

What a debt agreement proposal may include

(3) A debt agreement proposal may provide for any matter relating to the debtor's financial affairs.

If the proposed administrator is not the Official Trustee, the proposal may also provide for the remuneration of the proposed administrator.

Remuneration of administrator

(3A) If a debt agreement proposal provides for the remuneration of the proposed administrator, the debt agreement proposal must:

(a) provide that the total remuneration of the proposed administrator is an amount equal to a specified percentage (the overall remuneration percentage ) of the total amount payable by the debtor under the agreement in respect of provable debts; and

(b) provide that, if the debtor pays an amount (the individual debt repayment amount ) under the agreement in respect of those provable debts:

(i) the debtor must also pay to the proposed administrator an amount (the individual remuneration amount ) ascertained in accordance with the agreement; and

(ii) the individual remuneration amount must not exceed the overall remuneration percentage of the individual debt repayment amount; and

(iii) the proposed administrator must apply the individual remuneration amount towards the discharge of the proposed administrator's entitlement to remuneration under the agreement.

Reimbursement of expenses

(3B) A debt agreement proposal may also provide for the proposed administrator to be reimbursed expenses of a kind specified in the proposal that are incurred by the proposed administrator in administering any debt agreement resulting from the acceptance of the proposal.

When a debtor cannot give a debt agreement proposal

(4) A debtor cannot give the Official Receiver a debt agreement proposal at a particular time (the proposal time ) if:

(a) at any time in the 10 years immediately before the proposal time the debtor:

(i) has been a bankrupt; or

(ii) has been a party (as debtor) to a debt agreement; or

(iii) has given an authority under section 188; or

(b) at the proposal time the debtor's unsecured debts total more than:

(i) the threshold amount; or

(ii) if the regulations prescribe a greater amount for this purpose--the amount prescribed; or

(c) at the proposal time, the value of the debtor's property that would be divisible among creditors if the debtor were bankrupt is more than twice the threshold amount; or

(d) the debtor's after tax income (see subsection (5)) in the year beginning at the proposal time is likely to exceed three - quarters of the threshold amount; or

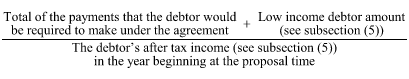

(e) if subsection (2AB) does not apply to the debtor--the

amount worked out using the following formula (expressed as a percentage)

exceeds the percentage determined in an instrument under subsection

(4B) (unless subsection (4C) applies to the debtor):

(4A) Subparagraph (4)(a)(i) does not apply in relation to a bankruptcy that has been annulled under section 153B.

(4B) The Minister may, by legislative instrument, determine the following:

(a) a percentage for the purposes of paragraph (4)(e) (which may exceed 100%);

(b) an amount for the purposes of the definition of low income debtor amount in subsection (5).

(4C) This subsection applies to the debtor if:

(a) the amount worked out using the formula under paragraph (4)(e) (expressed as a percentage) exceeds the percentage determined in an instrument under subsection (4B); and

(b) the proposed administrator gives to the debtor a certificate signed by the proposed administrator stating that, having regard to:

(i) the circumstances in existence at the time when the debtor's statement of affairs was signed by the debtor; and

(ii) any other relevant matters;

the proposed administrator is satisfied that the debtor is likely to be able to discharge the obligations created by the agreement as and when they fall due.

(4D) A person commits an offence of strict liability if:

(a) the person gives a certificate under paragraph (4C)(b); and

(b) before giving the certificate, the person did not:

(i) make reasonable inquiries about the debtor's financial situation; or

(ii) take reasonable steps to verify the debtor's financial situation.

Note: See also section 277B (about infringement notices).

(5) In this section:

"after tax income" , in relation to a debtor and a year, means the amount that is likely to be the taxable income of the debtor for the year less the income tax and the medicare levy imposed on that taxable income (worked out treating the year as a year of income if it is not actually a year of income).

Note: For the purposes of this definition, taxable income , income tax and year of income have the same meanings as in the Income Tax Assessment Act 1936 , and medicare levy means the levy imposed by the Medicare Levy Act 1986 .

"lease" includes a sublease.

"long-term lease" means a lease granted by the Commonwealth, a State or a Territory for a term (including any extension or renewal) that is reasonably likely, at the time the lease is granted, to exceed 20 years.

"low income debtor amount" means the amount determined in an instrument under subsection (4B) for the purposes of this definition.

"threshold amount" , in relation to a particular time, means 7 times the amount that, at that time, is specified in column 3, item 2, Table B, point 1064 - B1, Pension Rate Calculator A, in the Social Security Act 1991 .

"unsecured debt" includes the amount by which the value of a debt exceeds the value of a security given for the debt.