Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) Subsection 200B(1) does not apply to:

(a) a benefit that is a payment made in respect of leave of absence to which the person is entitled under an industrial instrument; or

(aa) a benefit given under an order of a court; or

(b) a benefit given in prescribed circumstances.

(2) Subsection 200B(1) does not apply to a benefit given in connection with a person's retirement from an office or position in relation to a company if:

(a) the benefit is:

(i) a genuine payment by way of damages for breach of contract; or

(ii) given to the person under an agreement made between the company and the person before the person became the holder of the office or position as the consideration, or part of the consideration, for the person agreeing to hold the office or position; and

(b) the value of the benefit, when added to the value of all other benefits (if any) already given in connection with the person's retirement from offices or positions in the company and related bodies corporate, does not exceed the amount worked out under whichever of subsections (3) and (4) is applicable.

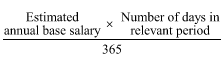

(3) This subsection applies if the relevant period for the person is less than 1 year. The amount worked out under this subsection is:

where:

"estimated annual base salary" is a reasonable estimate of the base salary that the person would have received from the company and related bodies corporate during the relevant period if the relevant period had been 1 year.

Note: The relevant period for the person is defined in subsection (5).

(4) This subsection applies in every other case. The amount worked out under this subsection is:

(a) if the relevant period is 1 year--the base salary that the person received from the company and related bodies corporate during the relevant period; or

(b) if the relevant period is more than 1 year but less than 2 years--the average annual base salary that the person received from the company and related bodies corporate during the relevant period, worked out as if:

(i) the relevant period were 2 years; and

(ii) the person's annual base salary for the second year were a reasonable estimate of what the person would have received as base salary after the first year of the relevant period had the relevant period been 2 years; or

(c) if the relevant period is 2 years--the average annual base salary that the person received from the company and related bodies corporate during the relevant period; or

(d) if the relevant period is more than 2 years but less than 3 years--the average annual base salary that the person received from the company and related bodies corporate during the relevant period, worked out as if:

(i) the relevant period were 3 years; and

(ii) the person's annual base salary for the third year were a reasonable estimate of what the person would have received as base salary after the second year of the relevant period had the relevant period been 3 years; or

(e) if the relevant period is 3 years or more--the average annual base salary that the person received from the company and related bodies corporate during the last 3 years of the relevant period.

(5) For the purposes of this section, if a person has held a managerial or executive office in relation to a company:

(a) throughout a period; or

(b) throughout a number of periods;

the relevant period for that person is that period or the period consisting of those periods.