Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) Subsection 200B(1) does not apply to a benefit if:

(a) the benefit is a payment in connection with a person's retirement from an office or position in a company or a related body corporate; and

(b) the payment is for past services the person rendered to:

(i) the company; or

(ii) a related body corporate; or

(iii) a body that was a related body corporate of the company when the past services were rendered; and

(c) the value of the benefit, when added to the value of all other benefits (if any) already given in connection with the person's retirement from offices or positions in the company and related bodies corporate does not exceed the amount worked out under whichever of subsections (2) and (3) is applicable.

In applying paragraph (c), disregard any pensions or lump sums that section 200F applies to.

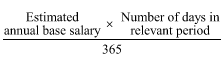

(2) This subsection applies if the relevant period for the person is less than 1 year. The amount worked out under this subsection is:

where:

"estimated annual base salary" is a reasonable estimate of the base salary that the person would have received from the company and related bodies corporate during the relevant period if the relevant period had been 1 year.

Note: The relevant period for the person is defined in subsection (6).

(3) This subsection applies in every other case. The amount worked out under this subsection is:

(a) if the relevant period is 1 year--the base salary that the person received from the company and related bodies corporate during the relevant period; or

(b) if the relevant period is more than 1 year but less than 2 years--the average annual base salary that the person received from the company and related bodies corporate during the relevant period, worked out as if:

(i) the relevant period were 2 years; and

(ii) the person's annual base salary for the second year were a reasonable estimate of what the person would have received as base salary after the first year of the relevant period had the relevant period been 2 years; or

(c) if the relevant period is 2 years--the average annual base salary that the person received from the company and related bodies corporate during the relevant period; or

(d) if the relevant period is more than 2 years but less than 3 years--the average annual base salary that the person received from the company and related bodies corporate during the relevant period, worked out as if:

(i) the relevant period were 3 years; and

(ii) the person's annual base salary for the third year were a reasonable estimate of what the person would have received as base salary after the second year of the relevant period had the relevant period been 3 years; or

(e) if the relevant period is 3 years or more--the average annual base salary that the person received from the company and related bodies corporate during the last 3 years of the relevant period.

(4) In determining for the purposes of paragraph (1)(c) the value of a pension or lump sum payment, disregard any part of the pension or lump sum payment that is attributable to:

(a) a contribution made by the person; or

(b) a contribution made by a person other than:

(i) the company; or

(ii) a body corporate (a relevant body corporate ) that is a related body corporate of the company, or that was, when the contribution was made, such a related body corporate; or

(iii) an associate of the company, or of a relevant body corporate, in respect of:

(A) the payment of the pension, or the making of the lump sum payment, as the case may be; or

(B) the making of the contribution.

(6) In this section:

"payment" means a payment by way of pension or lump sum and includes a superannuation, retiring allowance, superannuation gratuity or similar payment.

"relevant period" : if a person has held a managerial or executive office in the company or a related body corporate:

(a) throughout a period; or

(b) throughout a number of periods;

the relevant period for that person is that period or the period consisting of those periods.